Government Finance Government Finance Decisions governments make affect

- Slides: 92

Government Finance

Government Finance � Decisions governments make affect the economy as a whole by changing incentives

Government Finance � Decisions governments make affect the economy as a whole by changing incentives � Heavily taxed activities, products, localities, industries or people react accordingly… move elsewhere, convert money to alternate uses, not work as hard, illegal behavior (avoiding taxes)

Government Finance � Decisions governments make affect the economy as a whole by changing incentives � Heavily taxed activities, products, localities, industries or people react accordingly… move elsewhere, convert money to alternate uses, not work as hard, illegal behavior (avoiding taxes) � In short, people change their behavior in response to governmental financial operations

How does government get its money?

How does government get its money? � Taxes, bonds, sale of goods and services and the good old printing press

How does government get its money? � Taxes, bonds, sale of goods and services and the good old printing press � Each of which has its own consequences, no matter what the intent

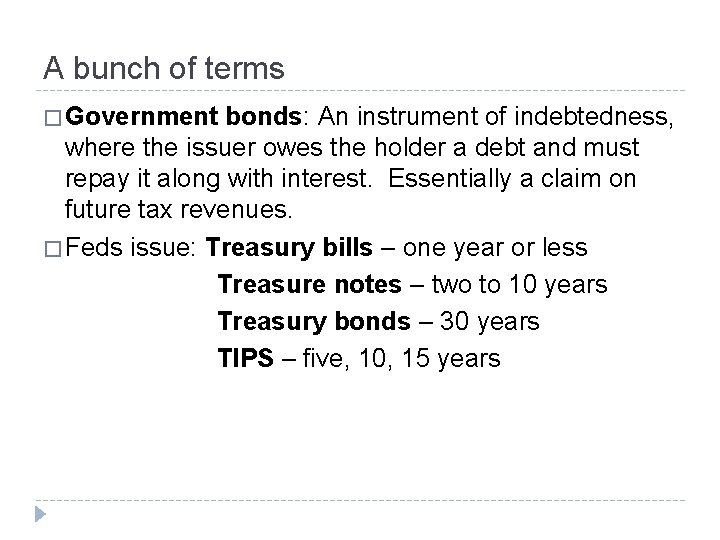

A bunch of terms � Government bonds: An instrument of indebtedness, where the issuer owes the holder a debt and must repay it along with interest. Essentially a claim on future tax revenues.

A bunch of terms � Government bonds: An instrument of indebtedness, where the issuer owes the holder a debt and must repay it along with interest. Essentially a claim on future tax revenues. � Feds issue: Treasury bills – one year or less Treasure notes – two to 10 years Treasury bonds – 30 years TIPS – five, 10, 15 years

Bonds � Corporations also issue bonds to expand business, fund innovation and acquire new companies. These bonds create wealth

Bonds � Corporations also issue bonds to expand business, fund innovation and acquire new companies. These bonds create wealth � Government bonds create no wealth… in fact, they pull money that could be productive out of the system, thus negatively affecting wealth creation

A bunch of terms � Balanced budget:

A bunch of terms � Balanced budget: if all current government spending is paid for with money received from taxes and other revenues. Most states have balancedbudget laws.

A bunch of terms � Balanced budget: if all current government spending is paid for with money received from taxes and other revenues. Most states have balancedbudget laws. � Budget surplus:

A bunch of terms � Balanced budget: if all current government spending is paid for with money received from taxes and other revenues. Most states have balancedbudget laws. � Budget surplus: when current tax receipts exceed current spending

A bunch of terms � Balanced budget: if all current government spending is paid for with money received from taxes and other revenues. Most states have balancedbudget laws. � Budget surplus: when current tax receipts exceed current spending � Last true federal budget surplus was in 1969, although thanks to accounting schemes, President Clinton is credited with it three times in his terms

Couple more terms � Deficit:

Couple more terms � Deficit: the preferred way to govern whereby tax receipts don’t even come close to covering current expenses so gap is closed by bonds and printing press

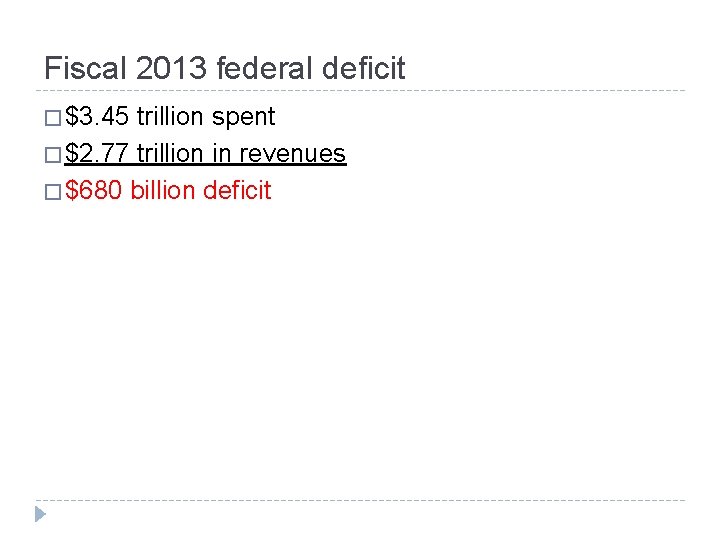

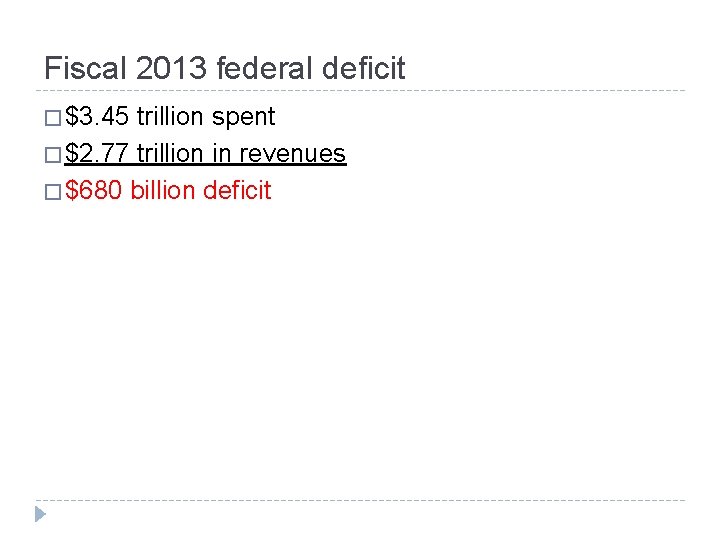

Fiscal 2013 federal deficit � $3. 45 trillion spent � $2. 77 trillion in revenues � $680 billion deficit

Couple more terms � Deficit: the preferred way to govern whereby tax receipts don’t even come close to covering current expenses so gap is closed by bonds and printing press � National debt:

Couple more terms � Deficit: the preferred way to govern whereby tax receipts don’t even come close to covering current expenses so gap is closed by bonds and printing press � National debt: the accumulation of those deficits over time, or the total amount owed by the national government. How big is U. S. debt?

$17. 5 trillion

$17. 5 trillion � Debt person: $55, 280 � Debt per taxpayer $151, 950 � Debt is increasing about $2 billion per day

National debt � Two pieces � Public debt, that held by the public, foreigners, corporations. 71% of debt � Intra-government holdings, or debt held by government accounts: 29%

Taxes

What is a tax?

What is a tax? � “A sum of money demanded by a government for its support or for specific facilities or services, levied upon incomes, property, sales, etc. ” � From the Latin “taxo” � It "is not a voluntary payment or donation, but an enforced contribution, exacted pursuant to legislative authority”

Taxes � All that governments control is tax rates

Taxes � All that governments control is tax rates � Increases in tax rates don’t necessarily translate to increased taxes

Taxes � All that governments control is tax rates � Increases in tax rates don’t necessarily translate to increased taxes � Meet the Laffer Curve

The Laffer Curve � Relationship revenue between tax rates and government

The Laffer Curve � Relationship between tax rates and government revenue � Taxable-income elasticity: income will change in response to tax rates

The Laffer Curve � Relationship between tax rates and government revenue � Taxable-income elasticity: income will change in response to tax rates � Raising tax rates beyond a certain point will result in less tax revenues

The Laffer Curve � Relationship between tax rates and government revenue � Taxable-income elasticity: income will change in response to tax rates � Raising tax rates beyond a certain point will result in less tax revenues � Cutting taxes can result in more revenue

Laffer on the Dutch � Cut top marginal rate from 70% to 28% � Cut corporate tax rate from 46% to 34% � Tax brackets “pushed out” � Cut pages in Federal Registry from 80, 000 to 48, 000 � Ended price controls on oil and gas � Created 21 million jobs � Increased tax revenues 60%

More Laffer “The true lessons to be learned from Reagan presidency is that good economics isn’t Republican or Democrat, right wing or left wing, liberal or conservative. It’s simply good economics. President Obama should take heed and not limit his vision while seeking a workable solution to America’s tragically high unemployment rate. ”

Taxes � All that governments control is tax rates � Increases in tax rates don’t necessarily translate to increased taxes � Meet the Laffer Curve � CBO has been very wrong about impacts of tax increases and decreases

Taxes � All that governments control is tax rates � Increases in tax rates don’t necessarily translate to increased taxes � Meet the Laffer Curve � CBO has been very wrong about impacts of tax increases and decreases � Key point: tax rates change behavior

Couple more terms � Regressive tax:

Couple more terms � Regressive tax: one that affects lower-income people disproportionally

Couple more terms � Regressive tax: one that affects lower-income people disproportionally � Example?

Couple more terms � Regressive tax: one that affects lower-income people disproportionally � Example? � Sales tax get a higher percentage of income from low-income people. � Social Security tax also is regressive because the 7. 65% tax stops after $117, 000 earned (selfemployed SS tax is 15. 3%)

Still more terms � Progressive tax:

Still more terms � Progressive tax: a tax that hits the higher-income people disproportionally

Still more terms � Progressive tax: a tax that hits the higher-income people disproportionally � Examples: income tax with higher marginal rates

2013 federal income tax rates 2013 Tax Brackets Single Married Filing Jointly 10% Bracket $0–$8, 925 $0–$17, 850 15% Bracket $8, 926 –$36, 250 $17, 850–$72, 500 25% Bracket $36, 250–$87, 850 $72, 500–$146, 400 28% Bracket $87, 850–$183, 250 $146, 400–$223, 050 33% Bracket $183, 250–$398, 350 $223, 050–$398, 350 35% Bracket $398, 350–$400, 000 $398, 350–$450, 000 39. 6% Bracket $400, 000+ $450, 000+

One more term � Hypocrite: a politician who loves taxing and spending but is greedy with their own money

One more term � Hypocrite: a politician who loves taxing and spending but is greedy with their own money � President Obama: 2003 income of $238, 000… contributions to charity/religious organizations, $3, 400 (1. 4%)

One more term � Hypocrite: a politician who loves taxing and spending but is greedy with their own � President Obama: 2003 income of $238, 000… contributions to charity/religious organizations, $3, 400 (1. 4%) � Vice President Biden: 2007 income of $319, 853… contributions $995 (0. 0000001%) � Joe since increased it to 1. 5% of income � Tithe: 10% of your first-fruits to God

Other taxes � Most states (all but Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming) and many cities also tax your income

Other taxes � Most states (all but Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming) and many cities also tax your income � Least tax-friendly states: New York, New Jersey, California, Vermont, Rhode Island, Minnesota, North Carolina, Wisconsin, Maryland

What? ? Another term? ? � VAT:

What? ? Another term? ? � VAT: value-added tax

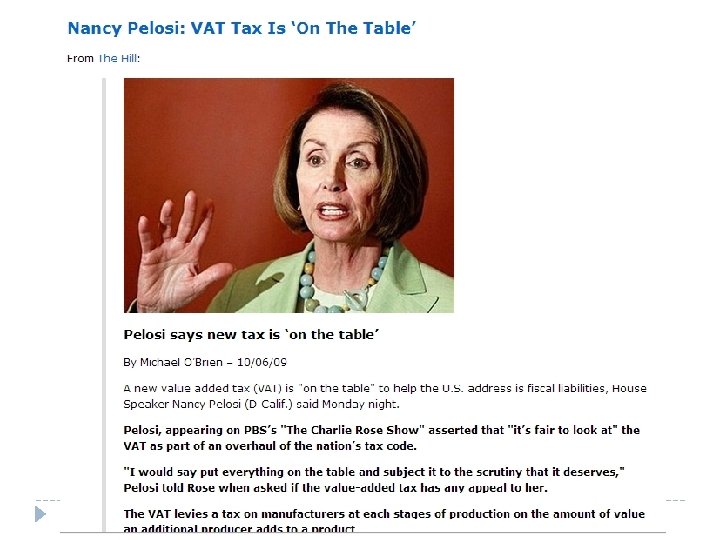

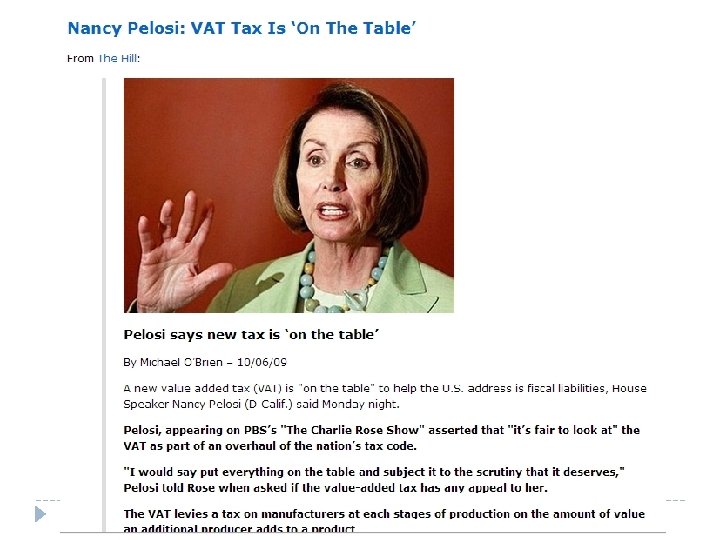

What? ? Another term? ? � VAT: value-added tax � Big in Europe: a tax imposed on things as they move through the supply chain; an indirect tax in that consumers don’t see the impact of the tax when they make a purchase even though something has been hammered each step of the way

Dr. S. Theorem “The less visible a tax is, the more revenue that can be collected without resistance or electoral retribution…”

Our old buddies, government bonds � What’s a bond?

Our old buddies, government bonds �A bond is a legal obligation to pay a fixed amount of $ on a fixed date, a way for governments to borrow

Our old buddies, government bonds �A bond is a legal obligation to pay a fixed amount of $ on a fixed date, a way for governments to borrow � 47% of the U. S. public debt (bonds) is held by foreigners, primarily China and Japan

Our old buddies, government bonds �A bond is a legal obligation to pay a fixed amount of $ on a fixed date, a way for governments to borrow � 47% of the U. S. public debt (bonds) is held by foreigners, primarily China and Japan � “Future generations of Japanese or Chinese will be able to collect wealth from future generations of Americans…”

What might you look like when you’re my age?

Charges for goods & services � Mass transit:

Charges for goods & services � Mass transit: formerly run privately, now almost universally nationalized, i. e. , subsidized and run by highly compensated government employees

Charges for goods & services � Mass transit: formerly run privately, now almost universally nationalized, i. e. , subsidized and run by highly compensated government employees � Why so inefficient?

Charges for goods & services � Mass transit: formerly run privately, now almost universally nationalized, i. e. , subsidized and run by highly compensated government employees � Why so inefficient? Lack of incentives for government to be efficient

Stop with the terms!!!!! � Entitlements:

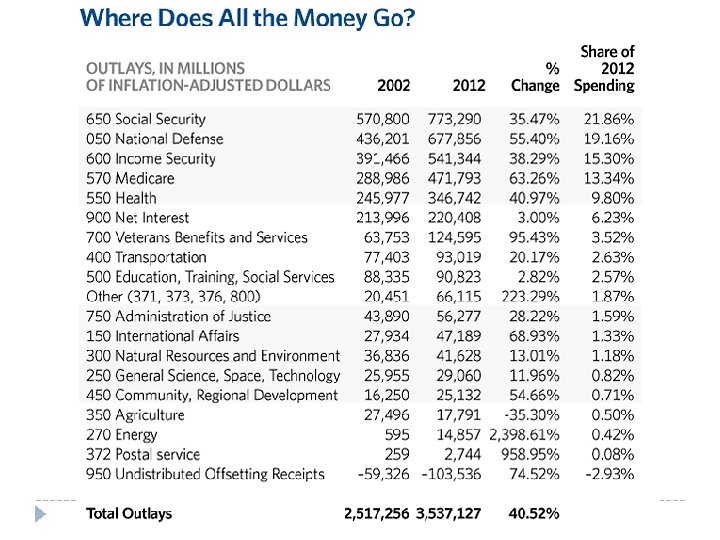

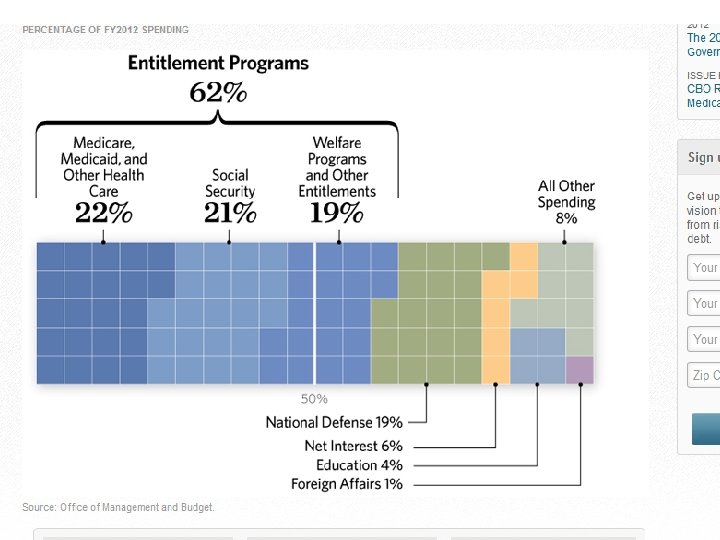

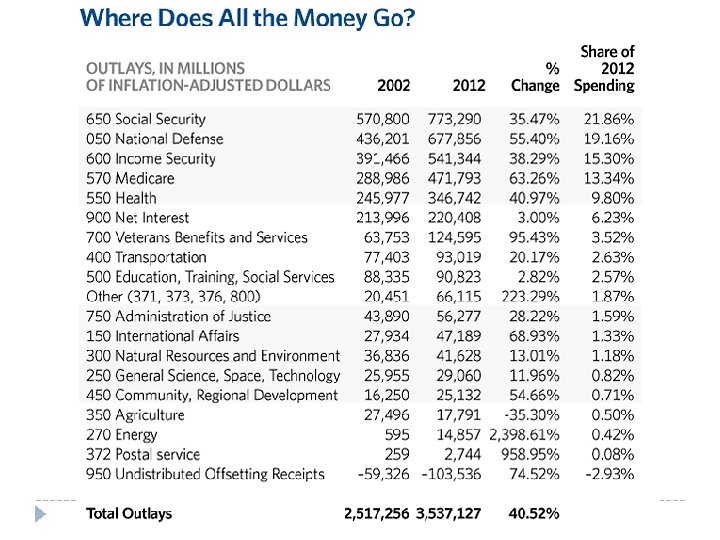

Stop with the terms!!!!! � Entitlements: spending that is beyond the control of government officials once it’s law… such as unemployment, government worker retirements, Social Security

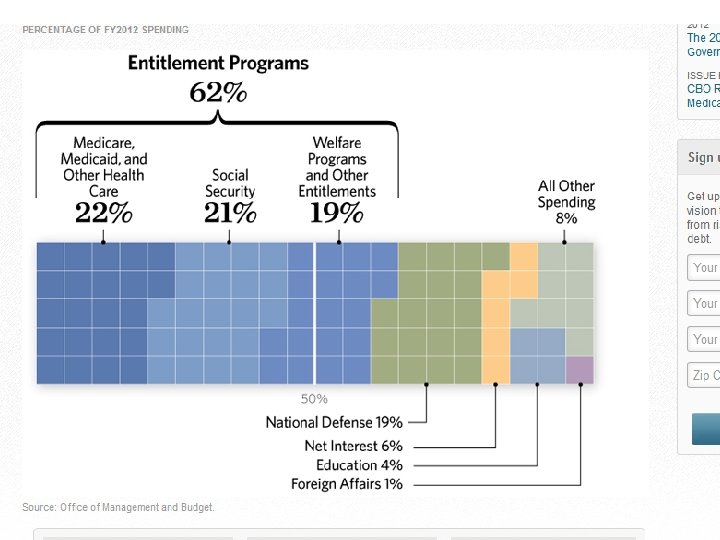

Stop with the terms!!!!! � Entitlements: spending that is beyond the control of government officials once it’s law… such as unemployment, government worker retirements, Social Security � More than 60% of the U. S. budget is for entitlement programs

Stop with the terms!!!!! � Entitlements: spending that is beyond the control of government officials once it’s law… such as unemployment, government worker retirements, Social Security � More than 60% of the U. S. budget is for entitlement programs � President Obama has vastly expanded entitlements, as did Bush 43

Cost vs Expenditures � Government programs are rarely discussed in terms of overall cost to economy

Cost vs Expenditures � Government programs are rarely discussed in terms of overall cost to economy � Good example: people complain about the cost of imprisoning people, but the cost of the criminals committing crimes would be a much great impact on the economy

Assignment for April 15 � Chapter 25: “The History of Economics”

Assignment for April 15 � Chapter 25: “The History of Economics” � Write a 350 -word essay: “Why I want to be (or don’t want to be) an economist. ” Have fun; this one is your opinion of what you think of econ as a course of study and profession. You are the “sez who!”

Image making meaning

Image making meaning Screening decisions and preference decisions

Screening decisions and preference decisions Factors that affect location decisions

Factors that affect location decisions People with political savvy make decisions that

People with political savvy make decisions that You make the decision - distribution decisions

You make the decision - distribution decisions Part 6: you make the decision - distribution decisions

Part 6: you make the decision - distribution decisions Marketing mix graphic organizer

Marketing mix graphic organizer To make place decisions marketers select the right

To make place decisions marketers select the right Mi'kmaq haudenosaunee and anishinabe

Mi'kmaq haudenosaunee and anishinabe Renew

Renew Different kind of governments

Different kind of governments Why do people create, structure, and change government?

Why do people create, structure, and change government? Two effects of allied bombing raids on japan.

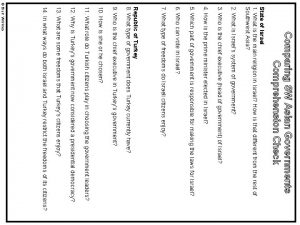

Two effects of allied bombing raids on japan. Comparing sw asian governments comprehension check

Comparing sw asian governments comprehension check Comparing sw asian governments answer key

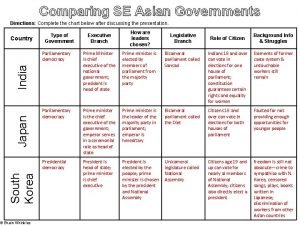

Comparing sw asian governments answer key Is japan a unitary state

Is japan a unitary state Comparing asian governments

Comparing asian governments Comparing asian governments

Comparing asian governments Centre region council of governments

Centre region council of governments Comparing african governments

Comparing african governments The formation of governments 1-2

The formation of governments 1-2 Are local governments tax exempt

Are local governments tax exempt Are city governments tax exempt

Are city governments tax exempt Comparing sw asian governments comprehension check

Comparing sw asian governments comprehension check How can governments ensure citizens are treated fairly

How can governments ensure citizens are treated fairly How do the governments of kenya and nigeria compare?

How do the governments of kenya and nigeria compare? Comparing sw asian governments

Comparing sw asian governments How are governments classified

How are governments classified The formation of governments 1-2

The formation of governments 1-2 Governments can sometimes improve market outcomes

Governments can sometimes improve market outcomes What are the three ways to classify governments

What are the three ways to classify governments Scog

Scog Liberals wanted governments to be based on

Liberals wanted governments to be based on Se asian economies comprehension check answer key

Se asian economies comprehension check answer key Is an anarchy limited or unlimited

Is an anarchy limited or unlimited Essential industry argument

Essential industry argument Make the lie big keep it simple

Make the lie big keep it simple Go make a difference we can make a difference

Go make a difference we can make a difference Make the lie big, make it simple

Make the lie big, make it simple Introduction to local government finance

Introduction to local government finance Cgfo exam study guide

Cgfo exam study guide Department of local government finance

Department of local government finance Georgia government finance officers association

Georgia government finance officers association Migration

Migration What are the three levels of government

What are the three levels of government International product decisions

International product decisions Business strategy game year 12 decisions

Business strategy game year 12 decisions Supply chain network design decisions include

Supply chain network design decisions include Product consistency example

Product consistency example Project charter introduction

Project charter introduction Product line decisions

Product line decisions Distribution channels and logistics

Distribution channels and logistics Pharmasim decisions

Pharmasim decisions Factors affecting transportation decisions

Factors affecting transportation decisions Operational decisions: bump up your bumper

Operational decisions: bump up your bumper Framework for network design decisions

Framework for network design decisions Message decision in advertising

Message decision in advertising Major decisions in advertising

Major decisions in advertising Channel objectives and constraints

Channel objectives and constraints Factors influencing pricing

Factors influencing pricing Factors influencing network design

Factors influencing network design Evaluating selection techniques and decisions

Evaluating selection techniques and decisions What is channel design in marketing

What is channel design in marketing Process specifications and structured decisions

Process specifications and structured decisions Basic warehousing decisions

Basic warehousing decisions Pricing and output decisions in perfect competition

Pricing and output decisions in perfect competition An organized method for making good buying decisions.

An organized method for making good buying decisions. An organized method for making good buying decisions

An organized method for making good buying decisions Chapter 4 financial decisions and planning

Chapter 4 financial decisions and planning Chapter 4 financial decisions and planning

Chapter 4 financial decisions and planning Process choice

Process choice Packaging decisions

Packaging decisions Facility location decisions in supply chain management

Facility location decisions in supply chain management Business analytics methods models and decisions

Business analytics methods models and decisions Paradigm of the channel design decision example

Paradigm of the channel design decision example Seemingly unimportant decisions examples

Seemingly unimportant decisions examples Components of facilities decisions

Components of facilities decisions Super decisions software

Super decisions software Statistics informed decisions using data 5th edition pdf

Statistics informed decisions using data 5th edition pdf Benefits of effective sourcing decisions

Benefits of effective sourcing decisions Making spatial decisions using gis

Making spatial decisions using gis Bcom marketing management

Bcom marketing management Layout decisions operations management

Layout decisions operations management What is goods service continuum

What is goods service continuum Retail marketing decisions

Retail marketing decisions Slidetodoc.com

Slidetodoc.com Optimal decisions in games in artificial intelligence

Optimal decisions in games in artificial intelligence How to calculate depreciation tax shield

How to calculate depreciation tax shield Optimal decisions in games in artificial intelligence

Optimal decisions in games in artificial intelligence Fundamental marcom decisions

Fundamental marcom decisions Nature and importance of warehousing

Nature and importance of warehousing Short run cost and output decisions

Short run cost and output decisions Business analytics methods models and decisions

Business analytics methods models and decisions