Global Standards Collaboration GSC 14 DOCUMENT GSC 14

Global Standards Collaboration (GSC) 14 DOCUMENT #: GSC 14 -GRSC-012 FOR: Presentation SOURCE: Huawei Technologies Co. , LTD AGENDA ITEM: GRSC-7 4. 1 CONTACT(S): Wang. xuemin@huawei. com Mobile network technology trends CCSA-Huawei technologies Co. , LTD Geneva, 13 -16 July 2009 Fostering worldwide interoperability

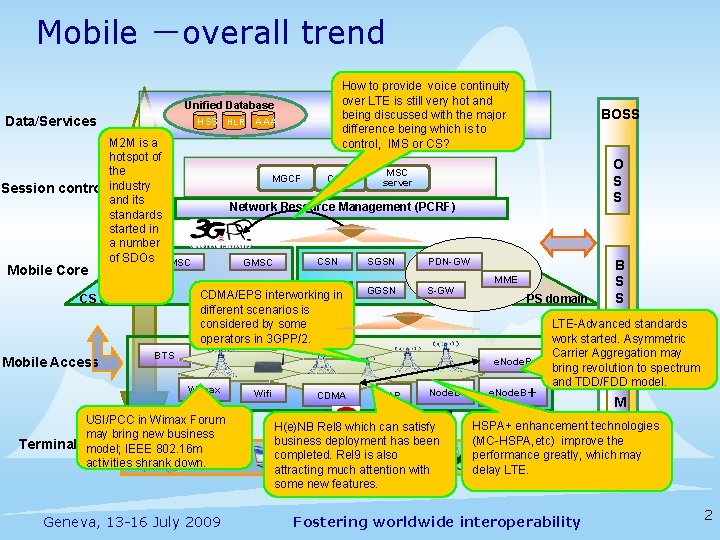

Mobile -overall trend How to provide voice continuity over LTE is still very hot and being discussed with the major Services & Applications difference being which is to control, IMS or CS? Unified Database Data/Services HSS HLR M 2 M is a hotspot of the Q Session control industry and its O standards started in S a number of SDOs MSC MGCF CSCF GMSC CSN MGW PDSN CDMA/EPS interworking in different scenarios is considered by some operators in 3 GPP/2. CS domain BOSS O S S MSC server Network Resource Management (PCRF) Mobile Core Mobile Access AAA SGSN GGSN PDN-GW S-GW BTS MME PS domain e. Node. B Wimax USI/PCC in Wimax Forum may bring new business Terminal model; IEEE 802. 16 m activities shrank down. Geneva, 13 -16 July 2009 Wifi CDMA AP Node. B H(e)NB Rel 8 which can satisfy business deployment has been completed. Rel 9 is also attracting much attention with some new features. e. Node. B+ B S S LTE-Advanced standards work started. Asymmetric Carrier Aggregation may bring revolution C to spectrum and TDD/FDD R model. M HSPA+ enhancement technologies (MC-HSPA, etc) improve the performance greatly, which may delay LTE. Fostering worldwide interoperability 2

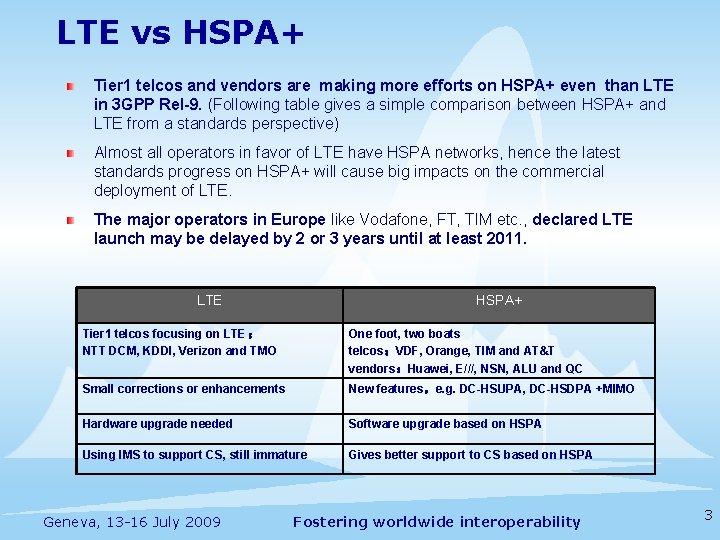

LTE vs HSPA+ Tier 1 telcos and vendors are making more efforts on HSPA+ even than LTE in 3 GPP Rel-9. (Following table gives a simple comparison between HSPA+ and LTE from a standards perspective) Almost all operators in favor of LTE have HSPA networks, hence the latest standards progress on HSPA+ will cause big impacts on the commercial deployment of LTE. The major operators in Europe like Vodafone, FT, TIM etc. , declared LTE launch may be delayed by 2 or 3 years until at least 2011. LTE HSPA+ Tier 1 telcos focusing on LTE: NTT DCM, KDDI, Verizon and TMO One foot, two boats telcos:VDF, Orange, TIM and AT&T vendors:Huawei, E///, NSN, ALU and QC Small corrections or enhancements New features,e. g. DC-HSUPA, DC-HSDPA +MIMO Hardware upgrade needed Software upgrade based on HSPA Using IMS to support CS, still immature Gives better support to CS based on HSPA Geneva, 13 -16 July 2009 Fostering worldwide interoperability 3

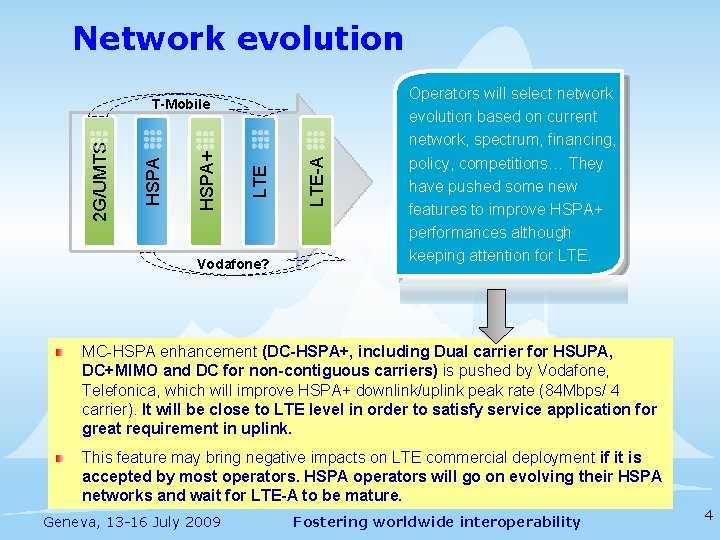

Network evolution Vodafone? LTE-A LTE HSPA+ HSPA 2 G/UMTS T-Mobile Operators will select network evolution based on current network, spectrum, financing, policy, competitions… They have pushed some new features to improve HSPA+ performances although keeping attention for LTE. MC-HSPA enhancement (DC-HSPA+, including Dual carrier for HSUPA, DC+MIMO and DC for non-contiguous carriers) is pushed by Vodafone, Telefonica, which will improve HSPA+ downlink/uplink peak rate (84 Mbps/ 4 carrier). It will be close to LTE level in order to satisfy service application for great requirement in uplink. This feature may bring negative impacts on LTE commercial deployment if it is accepted by most operators. HSPA operators will go on evolving their HSPA networks and wait for LTE-A to be mature. Geneva, 13 -16 July 2009 Fostering worldwide interoperability 4

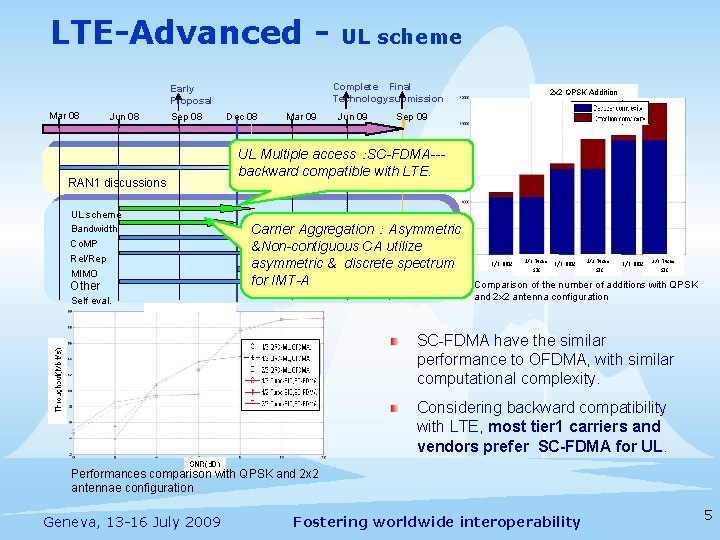

LTE-Advanced - Complete Final Technologysubmission Early Proposal Mar 08 Jun 08 Sep 08 RAN 1 discussions UL scheme Bandwidth Co. MP Rel/Rep MIMO Other UL scheme Dec 08 Mar 09 Jun 09 2 x 2 QPSK Addition Sep 09 TR v 1. 0. 0 access TR v 9. 1. 0 TR v 9. 0. 0 UL Multiple :SC-FDMA--for information for approval to update capture backward compatible withand LTE. evaluation results Carrier Aggregation : Asymmetric &Non-contiguous CA utilize asymmetric & discrete spectrum for IMT-A Self eval. 1/3 QRM 1/3 Turbo 1/2 QRM SIC 1/2 Turbo SIC 2/3 QRM 2/3 Turbo SIC Comparison of the number of additions with QPSK and 2 x 2 antenna configuration SC-FDMA have the similar performance to OFDMA, with similar computational complexity. Considering backward compatibility with LTE, most tier 1 carriers and vendors prefer SC-FDMA for UL. Performances comparison with QPSK and 2 x 2 antennae configuration Geneva, 13 -16 July 2009 Fostering worldwide interoperability 5

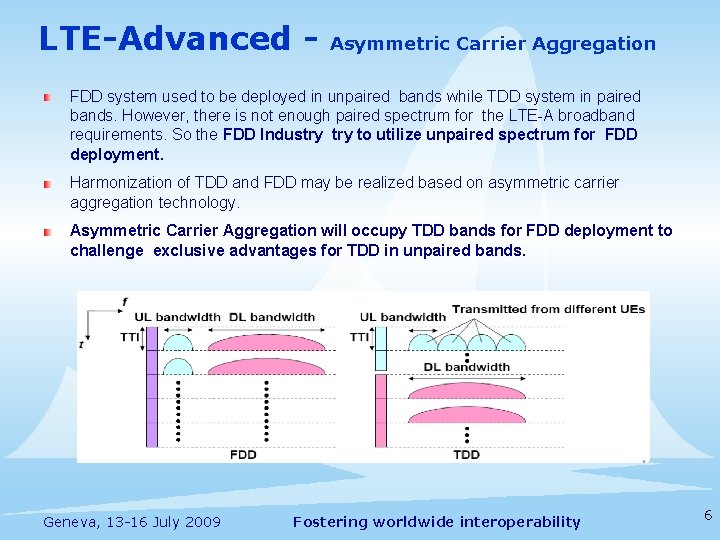

LTE-Advanced - Asymmetric Carrier Aggregation FDD system used to be deployed in unpaired bands while TDD system in paired bands. However, there is not enough paired spectrum for the LTE-A broadband requirements. So the FDD Industry to utilize unpaired spectrum for FDD deployment. Harmonization of TDD and FDD may be realized based on asymmetric carrier aggregation technology. Asymmetric Carrier Aggregation will occupy TDD bands for FDD deployment to challenge exclusive advantages for TDD in unpaired bands. Geneva, 13 -16 July 2009 Fostering worldwide interoperability 6

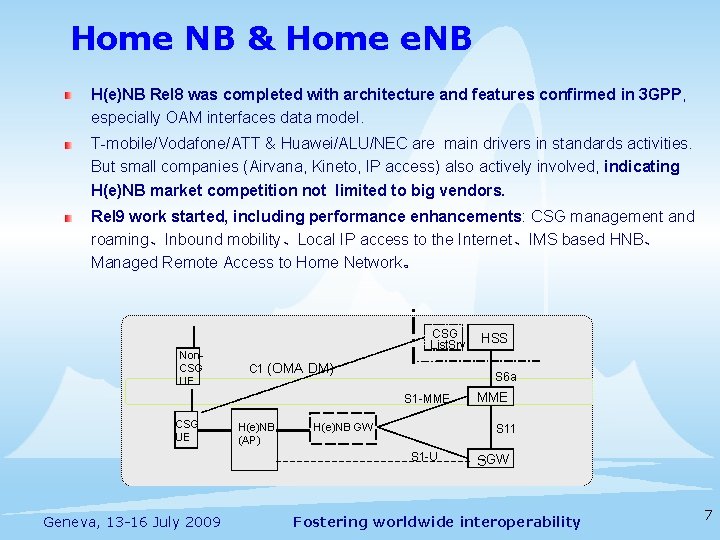

Home NB & Home e. NB H(e)NB Rel 8 was completed with architecture and features confirmed in 3 GPP, especially OAM interfaces data model. T-mobile/Vodafone/ATT & Huawei/ALU/NEC are main drivers in standards activities. But small companies (Airvana, Kineto, IP access) also actively involved, indicating H(e)NB market competition not limited to big vendors. Rel 9 work started, including performance enhancements: CSG management and roaming、Inbound mobility、Local IP access to the Internet、IMS based HNB、 Managed Remote Access to Home Network。 Non. CSG UE CSG List. Srv C 1 (OMA DM) S 6 a S 1 -MME CSG UE H(e)NB (AP) H(e)NB GW MME S 11 S 1 -U Geneva, 13 -16 July 2009 HSS S-GW Fostering worldwide interoperability 7

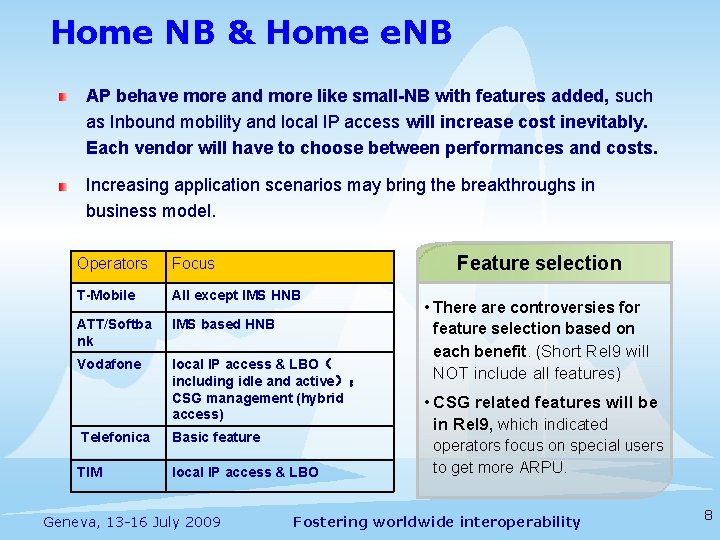

Home NB & Home e. NB AP behave more and more like small-NB with features added, such as Inbound mobility and local IP access will increase cost inevitably. Each vendor will have to choose between performances and costs. Increasing application scenarios may bring the breakthroughs in business model. Feature selection Operators Focus T-Mobile All except IMS HNB ATT/Softba nk IMS based HNB Vodafone local IP access & LBO( including idle and active); CSG management (hybrid access) Telefonica Basic feature TIM local IP access & LBO Geneva, 13 -16 July 2009 • There are controversies for feature selection based on each benefit. (Short Rel 9 will NOT include all features) • CSG related features will be in Rel 9, which indicated operators focus on special users to get more ARPU. Fostering worldwide interoperability 8

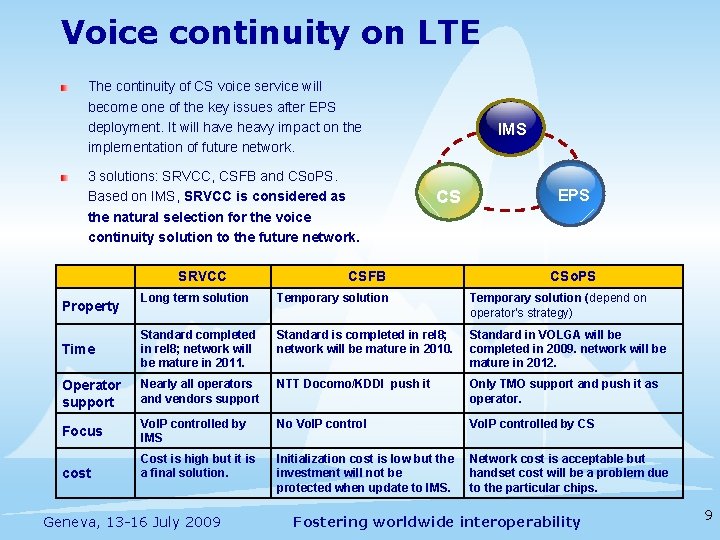

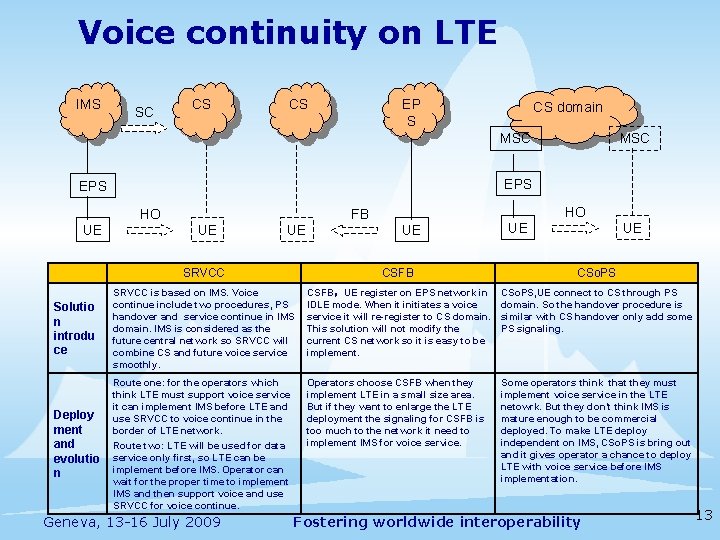

Voice continuity on LTE The continuity of CS voice service will become one of the key issues after EPS deployment. It will have heavy impact on the implementation of future network. 3 solutions: SRVCC, CSFB and CSo. PS. Based on IMS, SRVCC is considered as the natural selection for the voice continuity solution to the future network. SRVCC IMS CS CSFB EPS CSo. PS Long term solution Temporary solution (depend on operator’s strategy) Time Standard completed in rel 8; network will be mature in 2011. Standard is completed in rel 8; network will be mature in 2010. Standard in VOLGA will be completed in 2009. network will be mature in 2012. Operator support Nearly all operators and vendors support NTT Docomo/KDDI push it Only TMO support and push it as operator. Focus Vo. IP controlled by IMS No Vo. IP controlled by CS Cost is high but it is a final solution. Initialization cost is low but the investment will not be protected when update to IMS. Network cost is acceptable but handset cost will be a problem due to the particular chips. Property cost Geneva, 13 -16 July 2009 Fostering worldwide interoperability 9

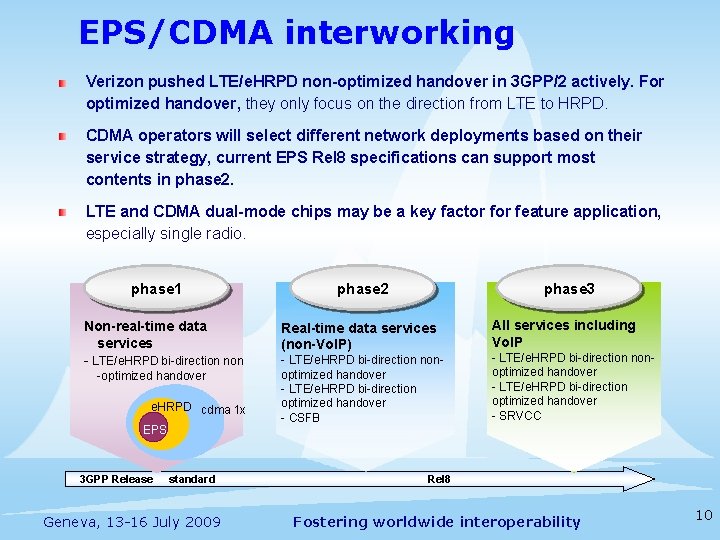

EPS/CDMA interworking Verizon pushed LTE/e. HRPD non-optimized handover in 3 GPP/2 actively. For optimized handover, they only focus on the direction from LTE to HRPD. CDMA operators will select different network deployments based on their service strategy, current EPS Rel 8 specifications can support most contents in phase 2. LTE and CDMA dual-mode chips may be a key factor feature application, especially single radio. phase 1 Non-real-time data services - LTE/e. HRPD bi-direction non -optimized handover e. HRPD cdma 1 x EPS 3 GPP Release standard Geneva, 13 -16 July 2009 phase 2 phase 3 Real-time data services (non-Vo. IP) - LTE/e. HRPD bi-direction nonoptimized handover - LTE/e. HRPD bi-direction optimized handover - CSFB All services including Vo. IP - LTE/e. HRPD bi-direction nonoptimized handover - LTE/e. HRPD bi-direction optimized handover - SRVCC Rel 8 Fostering worldwide interoperability 10

Supplementary Slides Geneva, 13 -16 July 2009 Fostering worldwide interoperability 11

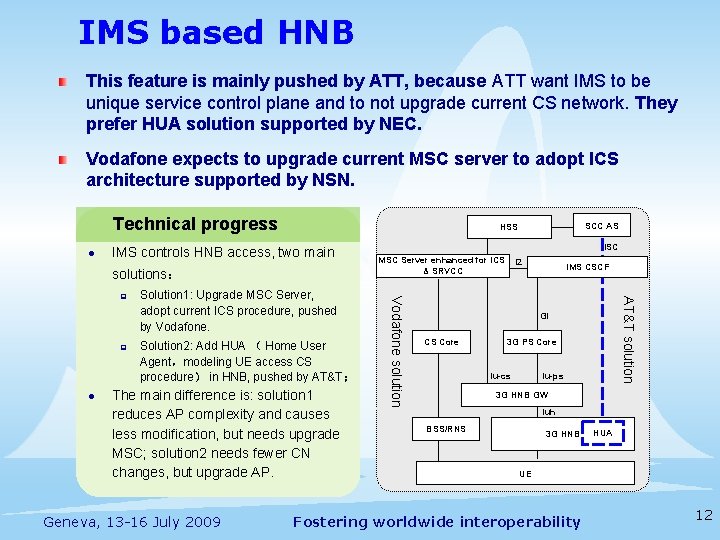

IMS based HNB This feature is mainly pushed by ATT, because ATT want IMS to be unique service control plane and to not upgrade current CS network. They prefer HUA solution supported by NEC. Vodafone expects to upgrade current MSC server to adopt ICS architecture supported by NSN. Technical progress l IMS controls HNB access, two main solutions: l Solution 2: Add HUA ( Home User Agent,modeling UE access CS procedure) in HNB, pushed by AT&T; The main difference is: solution 1 reduces AP complexity and causes less modification, but needs upgrade MSC; solution 2 needs fewer CN changes, but upgrade AP. Geneva, 13 -16 July 2009 I 2 IMS CSCF AT&T solution p Solution 1: Upgrade MSC Server, adopt current ICS procedure, pushed by Vodafone. ISC MSC Server enhanced for ICS & SRVCC Vodafone solution p SCC AS HSS Gi CS Core 3 G PS Core Iu-cs Iu-ps 3 G HNB GW Iuh BSS/RNS 3 G HNB HUA UE Fostering worldwide interoperability 12

Voice continuity on LTE IMS SC CS CS EP S CS domain MSC EPS HO UE MSC HO FB UE UE UE SRVCC CSFB CSo. PS Solutio n introdu ce SRVCC is based on IMS. Voice continue include two procedures, PS handover and service continue in IMS domain. IMS is considered as the future central network so SRVCC will combine CS and future voice service smoothly. CSFB:UE register on EPS network in IDLE mode. When it initiates a voice service it will re-register to CS domain. This solution will not modify the current CS network so it is easy to be implement. CSo. PS, UE connect to CS through PS domain. So the handover procedure is similar with CS handover only add some PS signaling. Deploy ment and evolutio n Route one: for the operators which think LTE must support voice service it can implement IMS before LTE and use SRVCC to voice continue in the border of LTE network. Route two: LTE will be used for data service only first, so LTE can be implement before IMS. Operator can wait for the proper time to implement IMS and then support voice and use SRVCC for voice continue. Operators choose CSFB when they implement LTE in a small size area. But if they want to enlarge the LTE deployment the signaling for CSFB is too much to the network it need to implement IMS for voice service. Some operators think that they must implement voice service in the LTE netowrk. But they don’t think IMS is mature enough to be commercial deployed. To make LTE deploy independent on IMS, CSo. PS is bring out and it gives operator a chance to deploy LTE with voice service before IMS implementation. Geneva, 13 -16 July 2009 Fostering worldwide interoperability 13

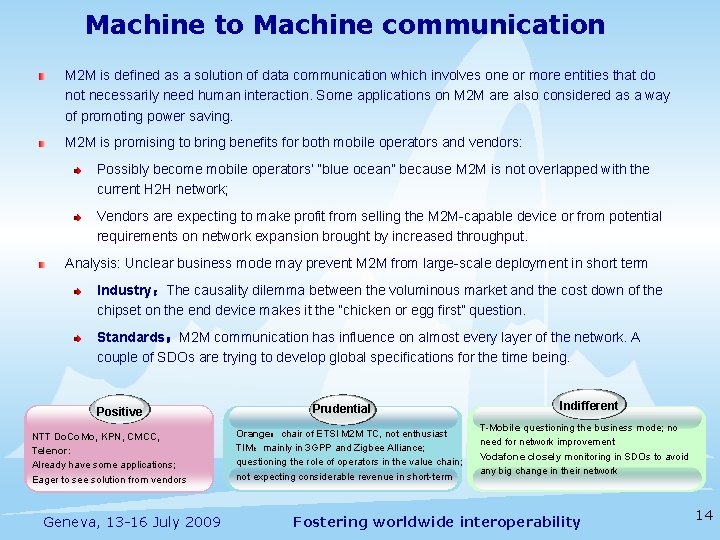

Machine to Machine communication M 2 M is defined as a solution of data communication which involves one or more entities that do not necessarily need human interaction. Some applications on M 2 M are also considered as a way of promoting power saving. M 2 M is promising to bring benefits for both mobile operators and vendors: Possibly become mobile operators’ “blue ocean” because M 2 M is not overlapped with the current H 2 H network; Vendors are expecting to make profit from selling the M 2 M-capable device or from potential requirements on network expansion brought by increased throughput. Analysis: Unclear business mode may prevent M 2 M from large-scale deployment in short term Industry:The causality dilemma between the voluminous market and the cost down of the chipset on the end device makes it the “chicken or egg first” question. Standards:M 2 M communication has influence on almost every layer of the network. A couple of SDOs are trying to develop global specifications for the time being. Positive NTT Do. Co. Mo, KPN, CMCC, Telenor: Already have some applications; Eager to see solution from vendors Geneva, 13 -16 July 2009 Prudential Orange:chair of ETSI M 2 M TC, not enthusiast TIM:mainly in 3 GPP and Zigbee Alliance; questioning the role of operators in the value chain; not expecting considerable revenue in short-term Indifferent T-Mobile questioning the business mode; no need for network improvement Vodafone closely monitoring in SDOs to avoid any big change in their network Fostering worldwide interoperability 14

- Slides: 14