Global Mobility Narendra Acharya Partner Employment Compensation Baker

Global Mobility Narendra Acharya, Partner, Employment & Compensation, Baker Mc. Kenzie

Agenda 1 Introduction 2 Overview – Global Equity Considerations 3 Taxation – Taxable Event and Sourcing 4 Taxation – Making the Case for Compliance 5 U. S. Specific Considerations 6 EU Specific Considerations 7 China Specific Considerations 8 Other Issues © 2018 Baker & Mc. Kenzie LLP 2

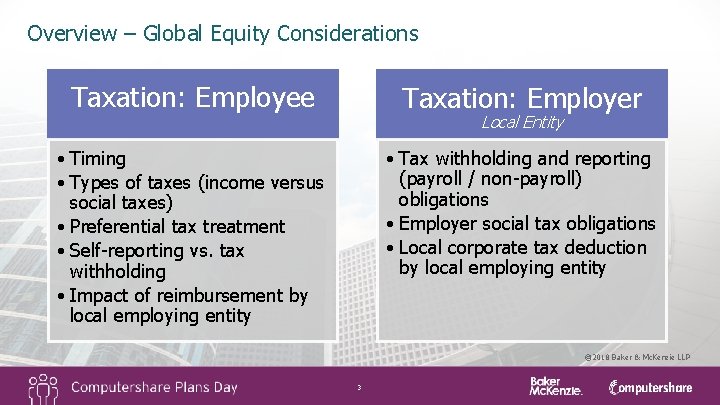

Overview – Global Equity Considerations Taxation: Employee Taxation: Employer • Timing • Types of taxes (income versus social taxes) • Preferential tax treatment • Self-reporting vs. tax withholding • Impact of reimbursement by local employing entity • Tax withholding and reporting (payroll / non-payroll) obligations • Employer social tax obligations • Local corporate tax deduction by local employing entity o Local Entity © 2018 Baker & Mc. Kenzie LLP 3

Overview – Global Equity Considerations Securities Laws Key Question: Is the award an “offering of securities”? Registration / prospectus requirements Disclosure / lodgment requirements Exemptions Labor & Employment Laws Acquired rights Termination indemnities Discrimination (Part-time workers / age / gender) Approval / consultation requirements with local works councils or trade unions © 2018 Baker & Mc. Kenzie LLP 4

Overview – Global Equity Considerations Foreign Currency / Exchange Controls / Reporting – Approval / registration requirements – Conversion of funds – Remittance of funds – “Foreign” Asset Reporting (many new rules recently enacted) – Holding of foreign company shares or even awards in some cases – Maintenance of foreign bank accounts Data Privacy – Collection, processing and transfer of employee data – Consent requirements – Registration requirements © 2018 Baker & Mc. Kenzie LLP 5

Residency versus Source Taxation Residence taxation Starting point – generally taxed on worldwide income if resident, but may be able to claim relief foreign taxes Recall that US citizens are always US tax residents regardless of geographic residence "Source" taxation - where income deemed earned If non-resident, for purposes of taxation If resident, for purposes of foreign tax credits and other relief Where did the employee work from grant to vest, grant to exercise, etc. © 2018 Baker & Mc. Kenzie LLP 6

QUESTION 1 a) b) c) d) e) What level of income sourcing for your mobile employees are you currently performing? f) Domestic Only International Only Business Travel Only Some Mix of the Above What is Income Sourcing? Not Yet Handling © 2018 Baker & Mc. Kenzie LLP 7

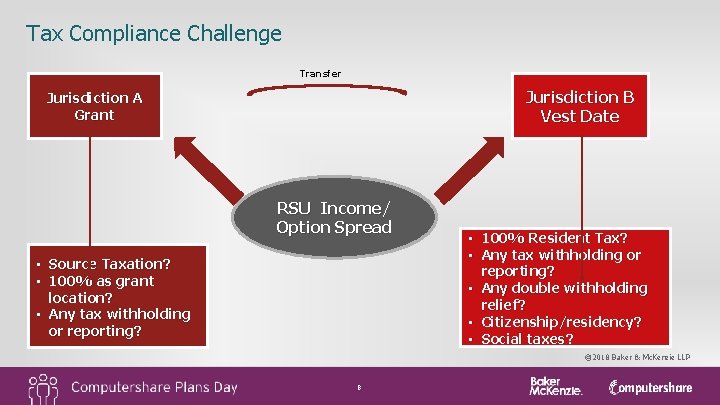

Tax Compliance Challenge Transfer Jurisdiction B Vest Date Jurisdiction A Grant RSU Income/ Option Spread • Source Taxation? • 100% as grant location? • Any tax withholding or reporting? • 100% Resident Tax? • Any tax withholding or reporting? • Any double withholding relief? • Citizenship/residency? • Social taxes? © 2018 Baker & Mc. Kenzie LLP 8

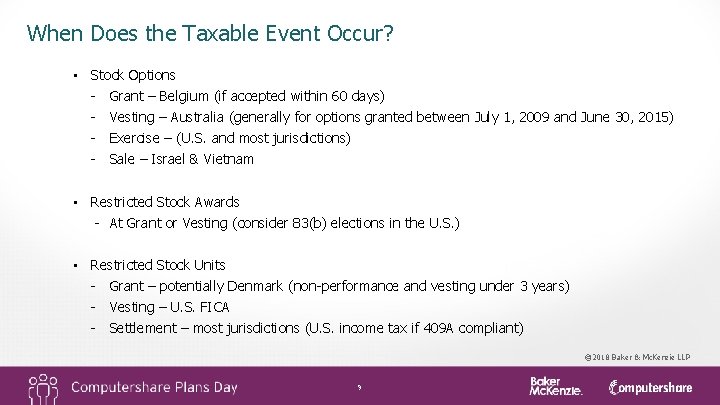

When Does the Taxable Event Occur? • Stock Options - Grant – Belgium (if accepted within 60 days) - Vesting – Australia (generally for options granted between July 1, 2009 and June 30, 2015) - Exercise – (U. S. and most jurisdictions) - Sale – Israel & Vietnam • Restricted Stock Awards - At Grant or Vesting (consider 83(b) elections in the U. S. ) • Restricted Stock Units - Grant – potentially Denmark (non-performance and vesting under 3 years) - Vesting – U. S. FICA - Settlement – most jurisdictions (U. S. income tax if 409 A compliant) © 2018 Baker & Mc. Kenzie LLP 9

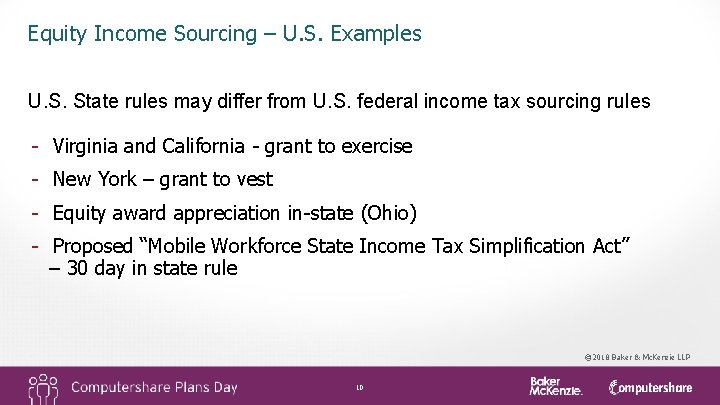

Equity Income Sourcing – U. S. Examples U. S. State rules may differ from U. S. federal income tax sourcing rules - Virginia and California - grant to exercise - New York – grant to vest - Equity award appreciation in-state (Ohio) - Proposed “Mobile Workforce State Income Tax Simplification Act” – 30 day in state rule © 2018 Baker & Mc. Kenzie LLP 10

QUESTION 2 a) Yes, by the CRA b) Yes, by the IRS or US state c) Yes, by other jurisdictions d) No /Not that I know of Has your company been audited for mobile employee income sourcing and tax compliance? © 2018 Baker & Mc. Kenzie LLP 11

Making the Case for Compliance • Increased scrutiny by tax authorities • Employer audit • Employee audit • Increasingly complex tax laws • Increased use of equity? Globally? • Increased mobility within company? • Employee relations and litigation re withholding errors • Corporate risk - reputational, penalties © 2018 Baker & Mc. Kenzie LLP 12

Conducting an Exposure Assessment Develop a high-level exposure assessment › Pick a sample timeframe and focus areas › Develop a methodology for determining reasonable estimates for employees and equity grants › Prepare range of hypothetical mobility exposure based on employees in each category and assumptions related to stock grants Prepare executive recommendations › Consider raising awareness if significant resource and/or budget constraints exist. › Consider potential future benefits (reduced processing time, greater accuracy) © 2018 Baker & Mc. Kenzie LLP 13

Managing Mobility Establish a Tracking System - Participant movement between countries over vesting or exercise period Number of days in each state or country and participant transfer dates - Length of temporary assignments (totalization agreement / 5 years) - Participant tax residency status - Employer at the time of key events (i. e. grant, exercise, vest) - Countries where tax event not at expected time (e. g. Belgium, Israel) - Countries with exit tax requirements (e. g. Singapore) © 2018 Baker & Mc. Kenzie LLP 14

Withholding and Reporting Requirements • Foreign requirements may depend upon involvement of local entity and whether costs are recharged locally • Employees are usually able to request tax refunds for double taxed amount at least between treaty countries - Refunds are difficult (if not impossible!) to obtain in some countries • Not always possible to fully alleviate double taxation • Keep in mind, non-payroll reporting requirements in Australia and the U. K. © 2018 Baker & Mc. Kenzie LLP 15

U. S. Withholding and Reporting Requirements • U. S. federal income requirements vary depending upon whethere is foreign withholding on the same income and a U. S. tax status - Mandatory foreign withholding exemption for U. S. citizens - If no foreign withholding, U. S. withholding likely applies for U. S. taxpayers, even where foreign taxes will eventually be paid on income • Inability to use Form W-4 exemptions while withholding at supplemental wage rate • All income for U. S. citizens and resident aliens must be reported on W-2 • Non-resident aliens are subject to withholding and reporting on their U. S. source income only © 2018 Baker & Mc. Kenzie LLP 16

Develop Assumptions that Fit Employees • Assume move is permanent or temporary? • Assume in first year of move still resident of departing country? • Assume income tax and social insurance treatment the same? • Assume U. S. state rules mirror federal? • Assume allocation over vesting period for all countries, even though a few allocate over exercise period? Note: Not technically correct but may be best that can be done © 2018 Baker & Mc. Kenzie LLP 17

Avoid the Audit Risk • A company may not be able to meet its legal and tax obligations if: - No records have been kept as to how, when and where the employee has worked for the company over the course of the vesting of the equity award - There is no understanding of the rules related to the taxation of the allocated income • Most companies are now making good faith attempts to track their employees and allocate income from equity awards © 2018 Baker & Mc. Kenzie LLP 18

Avoid the Audit Risk • Doing something is better than nothing (even it isn’t perfect!) - Get credit for doing something in a consistent fashion to illustrate good faith intention • Use a GLOBAL AGREEMENT - Country specific appendices (China exchange control issues, Israel) • Create and employ procedures for tax events in all pertinent locations • Review and update your compliance process annually (at a minimum) • Establish a tracking system that can be easily managed © 2018 Baker & Mc. Kenzie LLP 19

Phase the Approach › Start with a targeted group - International groups or domestic - By most complicated jurisdiction - By most high profile grant population › Considerations in decision making - What is your payroll team and system capable of? © 2018 Baker & Mc. Kenzie LLP 20

Canada Inbound Considerations Business Traveler Treaty Exemption – Waiver Process Salary Deferral Arrangement (“SDA”) rules for cash-settled awards Outbound Considerations Withholding on Trailing Tax Liability Broader Exit Tax Considerations © 2018 Baker & Mc. Kenzie LLP 21

U. S. Specific Considerations US Tax Considerations Section 409 A Section 457 A Foreign Asset Reporting Requirements US Securities Law Considerations State “Blue Sky” Requirements © 2018 Baker & Mc. Kenzie LLP 22

E. U. Specific Considerations Stock Purchase Plans EU Prospectus Directive Requirement if other exemptions are not applicable July 2019 Changes to Employee Share Plan Exemption Brexit? © 2018 Baker & Mc. Kenzie LLP › 23

China Specific Considerations China SAFE (Foreign Exchange) Approval China Notice 35 Tax Filings © 2018 Baker & Mc. Kenzie LLP 24

Other Issues Questions and Discussion © 2018 Baker & Mc. Kenzie LLP 25

Contact Narendra Acharya Baker & Mc. Kenzie LLP 300 East Randolph Street, Suite 5000 Chicago, Illinois, 60601 USA Tel: +1. 312. 861. 2840 narendra. acharya@bakermckenzie. com © 2018 Baker & Mc. Kenzie LLP 26

www. bakermckenzie. com Baker & Mc. Kenzie LLP is a member firm of Baker & Mc. Kenzie International, a global law firm with member law firms around the world. In accordance with the common terminology used in professional service organizations, reference to a "partner" means a person who is a partner, or equivalent, in such a law firm. Similarly, reference to an "office" means an office of any such law firm. This may qualify as “Attorney Advertising” requiring notice in some jurisdictions. Prior results do not guarantee a similar outcome. © 2018 Baker & Mc. Kenzie LLP 27

- Slides: 27