GEOGRAPHIC EXPANSION AND MA EUROLEASE FORUM 16 17

- Slides: 13

GEOGRAPHIC EXPANSION AND M&A EUROLEASE FORUM 16 -17 MAY 2013, MILAN

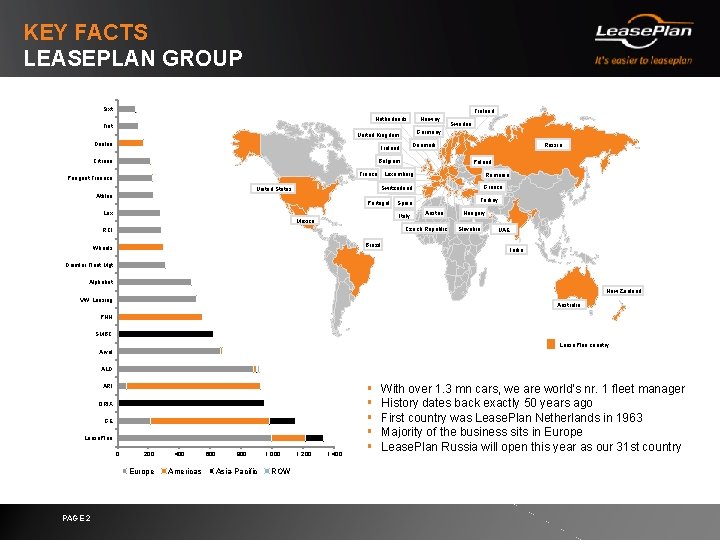

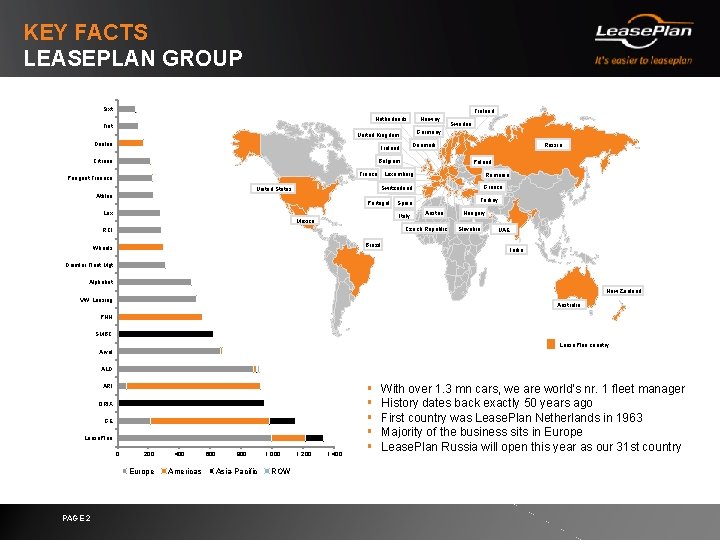

KEY FACTS LEASEPLAN GROUP Sixt Finland Netherlands Norway Fiat Germany United Kingdom Donlen Belgium France Peugeot Finance Poland Luxemburg Romania Greece Switzerland United States Athlon Russia Denmark Ireland Citroen Sweden Portugal Lex Italy Mexico Turkey Spain Austria Czech Republic RCI Brazil Wheels Hungary Slovakia UAE India Daimler Fleet Mgt Alphabet New Zealand VW Leasing Australia PHH SMBC Lease. Plan country Arval ALD ARI ORIX GE Lease. Plan 0 200 Europe PAGE 2 400 Americas 600 800 Asia-Pacific 1, 000 ROW 1, 200 1, 400 § § § With over 1. 3 mn cars, we are world’s nr. 1 fleet manager History dates back exactly 50 years ago First country was Lease. Plan Netherlands in 1963 Majority of the business sits in Europe Lease. Plan Russia will open this year as our 31 st country

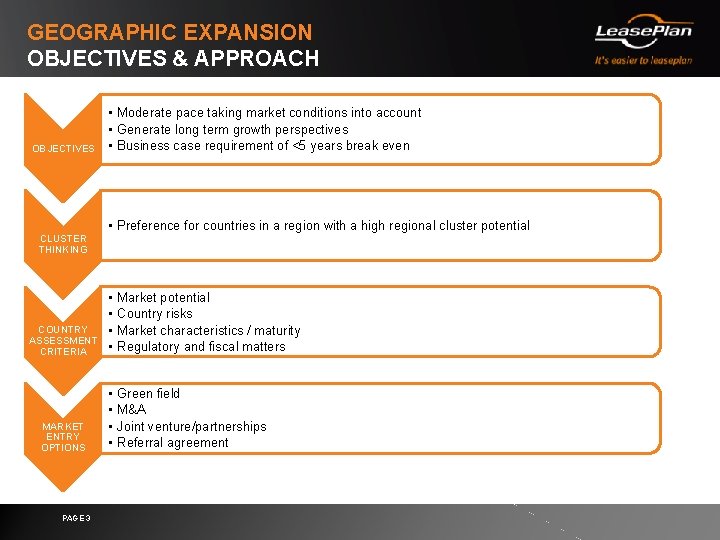

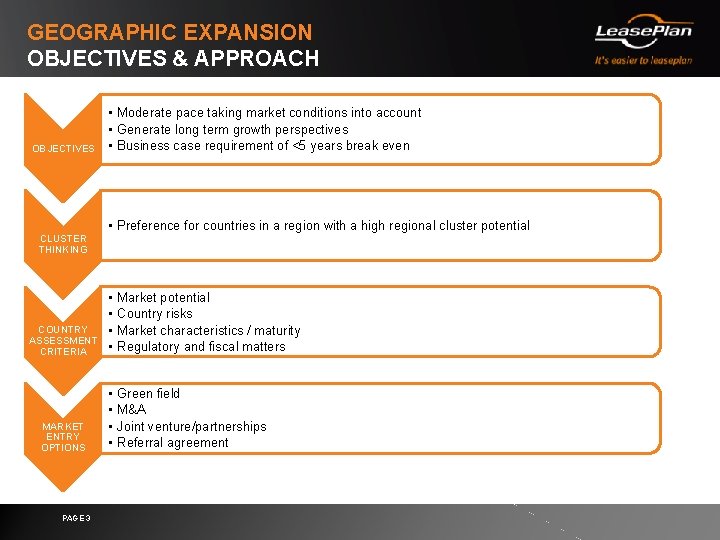

GEOGRAPHIC EXPANSION OBJECTIVES & APPROACH OBJECTIVES • Moderate pace taking market conditions into account • Generate long term growth perspectives • Business case requirement of <5 years break even • Preference for countries in a region with a high regional cluster potential CLUSTER THINKING COUNTRY ASSESSMENT CRITERIA • • Market potential Country risks Market characteristics / maturity Regulatory and fiscal matters MARKET ENTRY OPTIONS • • Green field M&A Joint venture/partnerships Referral agreement PAGE 3

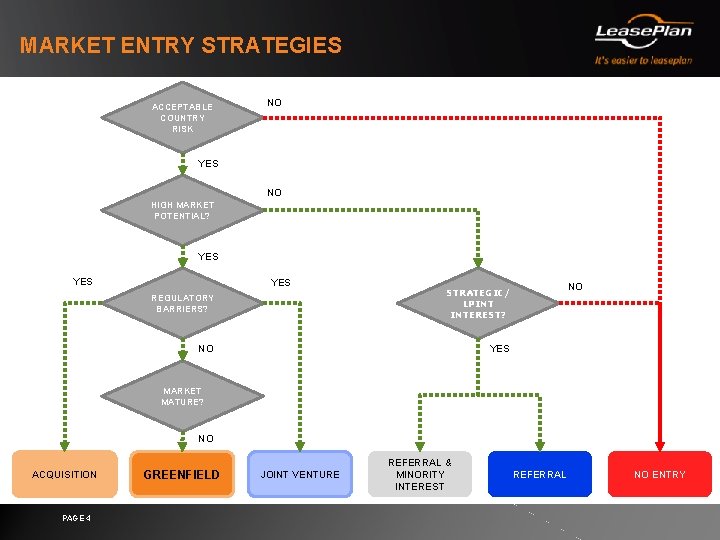

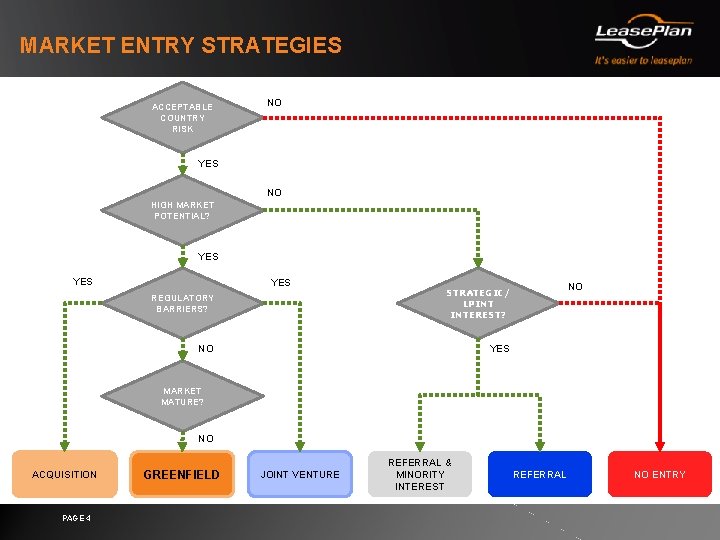

MARKET ENTRY STRATEGIES ACCEPTABLE COUNTRY RISK NO YES NO HIGH MARKET POTENTIAL? YES YES REGULATORY BARRIERS? STRATEGIC/ LPINT INTEREST? NO YES NO MARKET MATURE? NO ACQUISITION PAGE 4 GREENFIELD JOINT VENTURE REFERRAL & MINORITY INTEREST REFERRAL NO ENTRY

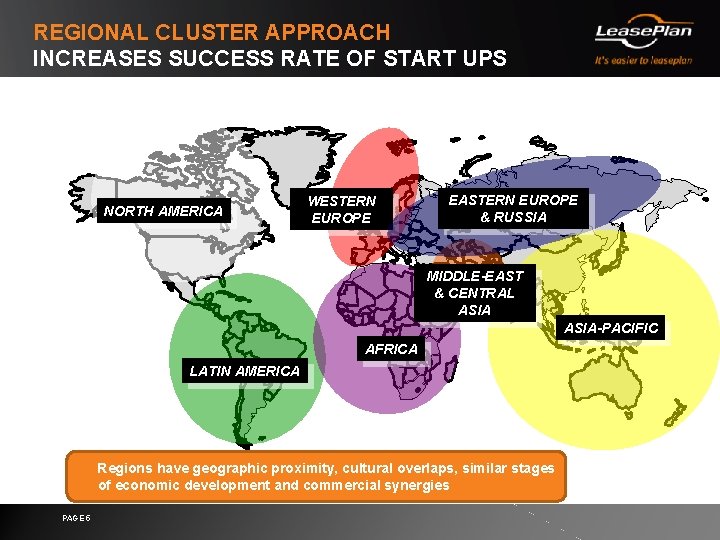

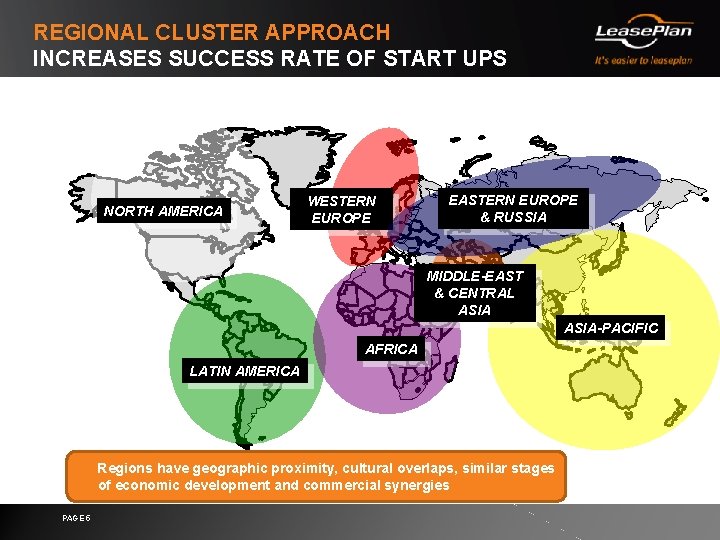

REGIONAL CLUSTER APPROACH INCREASES SUCCESS RATE OF START UPS NORTH AMERICA WESTERN EUROPE EASTERN EUROPE & RUSSIA MIDDLE-EAST & CENTRAL ASIA-PACIFIC AFRICA LATIN AMERICA Regions have geographic proximity, cultural overlaps, similar stages of economic development and commercial synergies PAGE 5

M&A 2012 FLASHBACK A CHALLENGING YEAR ECONOMIC ENVIRONMENT THAT HAS MADE M&A MORE DIFFICULT IN 2012 THEREFORE ONLY 2 • Lease. Plan acquiring BBVA Renting & BBVA Autorenting in Italy IMPORTANT DEALS HAVE BEEN COMPLETED LAST YEAR 20. 000 PAGE 6 • Still high price expectations by sellers • Funding availability still a key challenge for most buyers • General reluctance to significant exposures • Limited M&A mandates for several bank-related players • Business Lease acquiring KBC Autolease Polska in Poland 3. 000

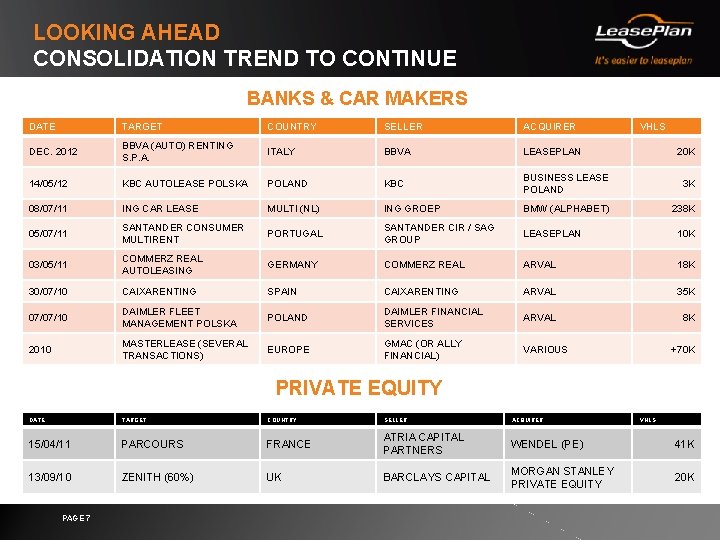

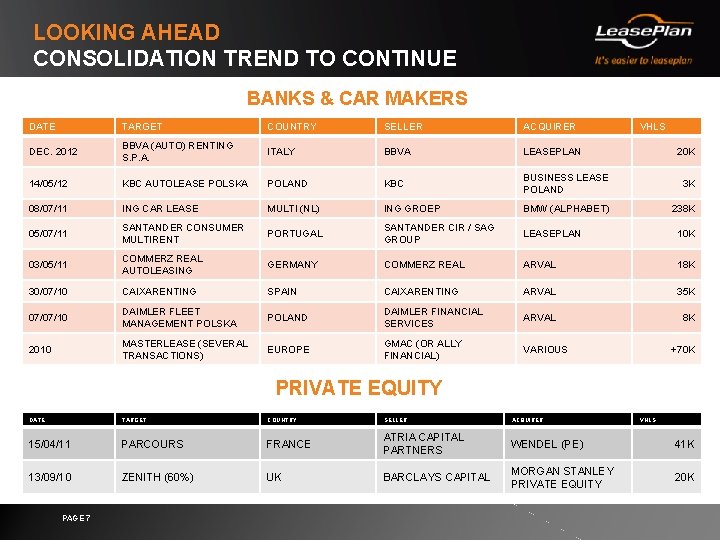

LOOKING AHEAD CONSOLIDATION TREND TO CONTINUE BANKS & CAR MAKERS DATE TARGET COUNTRY SELLER ACQUIRER DEC. 2012 BBVA (AUTO) RENTING S. P. A. ITALY BBVA LEASEPLAN 14/05/12 KBC AUTOLEASE POLSKA POLAND KBC BUSINESS LEASE POLAND 3 K 08/07/11 ING CAR LEASE MULTI (NL) ING GROEP BMW (ALPHABET) 238 K 05/07/11 SANTANDER CONSUMER MULTIRENT PORTUGAL SANTANDER CIR / SAG GROUP LEASEPLAN 10 K 03/05/11 COMMERZ REAL AUTOLEASING GERMANY COMMERZ REAL ARVAL 18 K 30/07/10 CAIXARENTING SPAIN CAIXARENTING ARVAL 35 K 07/07/10 DAIMLER FLEET MANAGEMENT POLSKA POLAND DAIMLER FINANCIAL SERVICES ARVAL 8 K MASTERLEASE (SEVERAL TRANSACTIONS) EUROPE GMAC (OR ALLY FINANCIAL) VARIOUS PRIVATE EQUITY 2010 VHLS 20 K +70 K PRIVATE EQUITY DATE TARGET COUNTRY SELLER ACQUIRER 15/04/11 PARCOURS FRANCE ATRIA CAPITAL PARTNERS WENDEL (PE) 41 K 13/09/10 ZENITH (60%) UK BARCLAYS CAPITAL MORGAN STANLEY PRIVATE EQUITY 20 K PAGE 7 VHLS

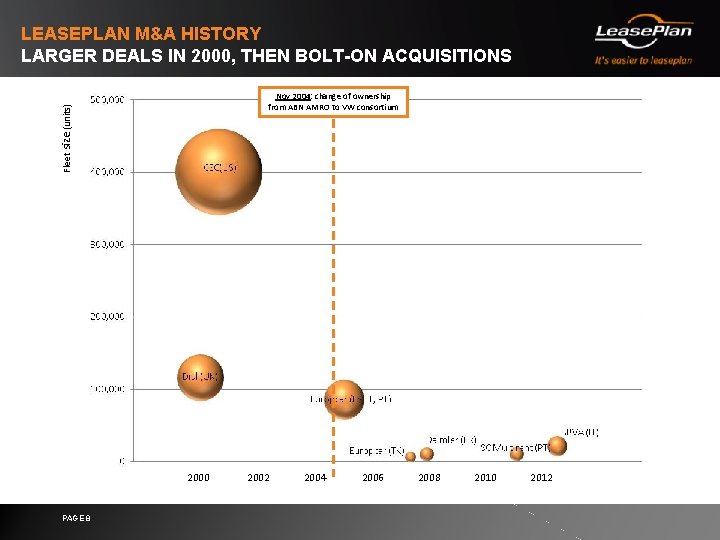

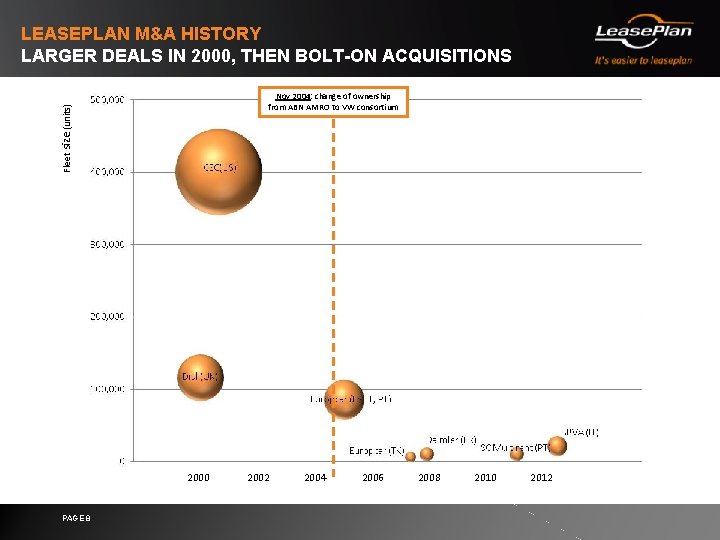

LEASEPLAN M&A HISTORY LARGER DEALS IN 2000, THEN BOLT-ON ACQUISITIONS Fleet size (units) Nov 2004: change of ownership from ABN AMRO to VW consortium 2000 PAGE 8 2002 2004 2006 2008 2010 2012

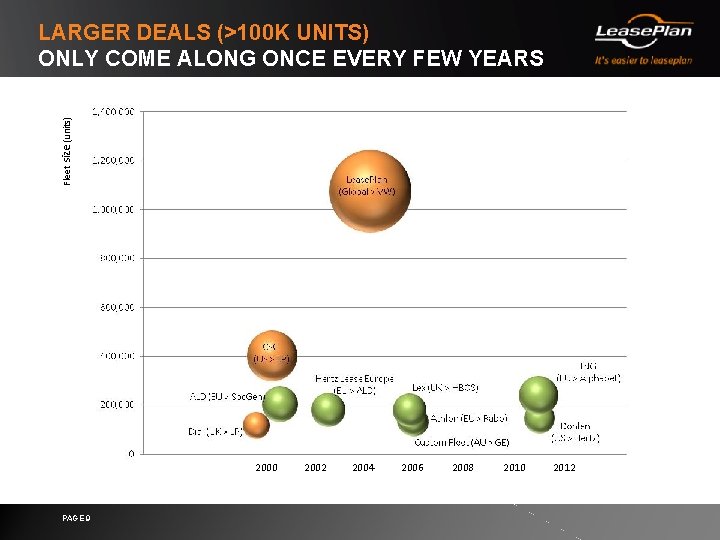

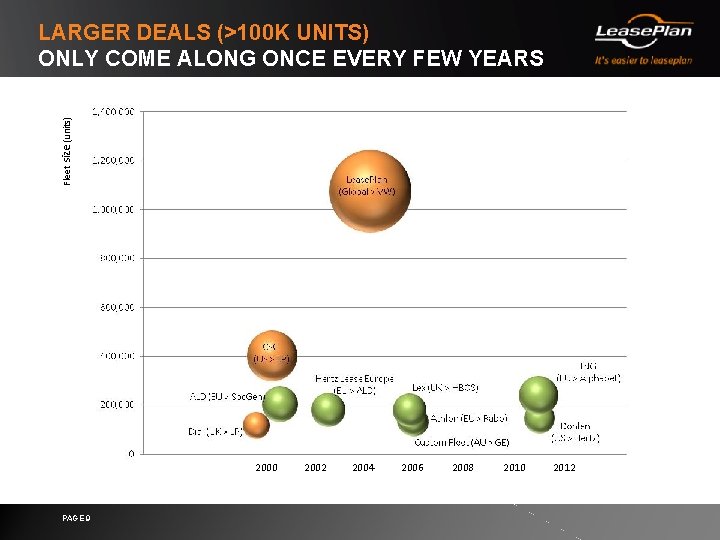

Fleet size (units) LARGER DEALS (>100 K UNITS) ONLY COME ALONG ONCE EVERY FEW YEARS 2000 PAGE 9 2002 2004 2006 2008 2010 2012

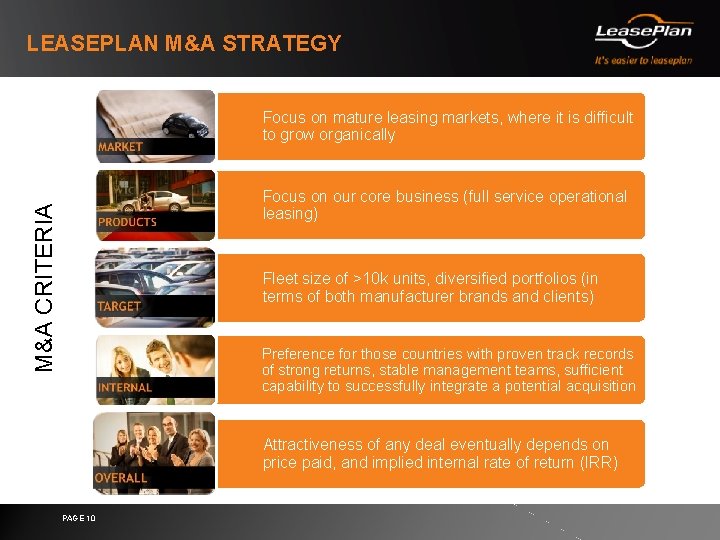

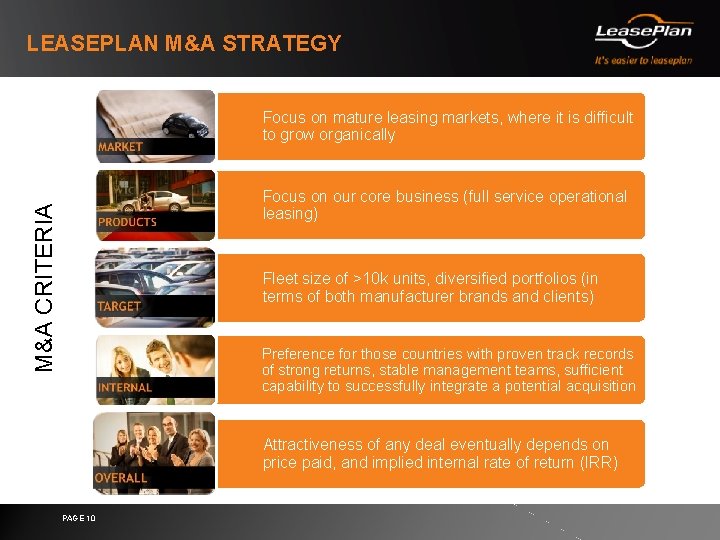

LEASEPLAN M&A STRATEGY Focus on mature leasing markets, where it is difficult to grow organically M&A CRITERIA Focus on our core business (full service operational leasing) Fleet size of >10 k units, diversified portfolios (in terms of both manufacturer brands and clients) Preference for those countries with proven track records of strong returns, stable management teams, sufficient capability to successfully integrate a potential acquisition Attractiveness of any deal eventually depends on price paid, and implied internal rate of return (IRR) PAGE 10

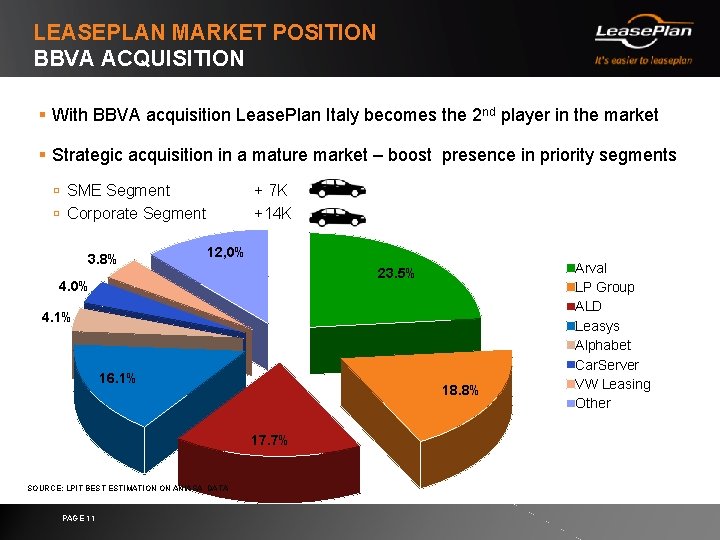

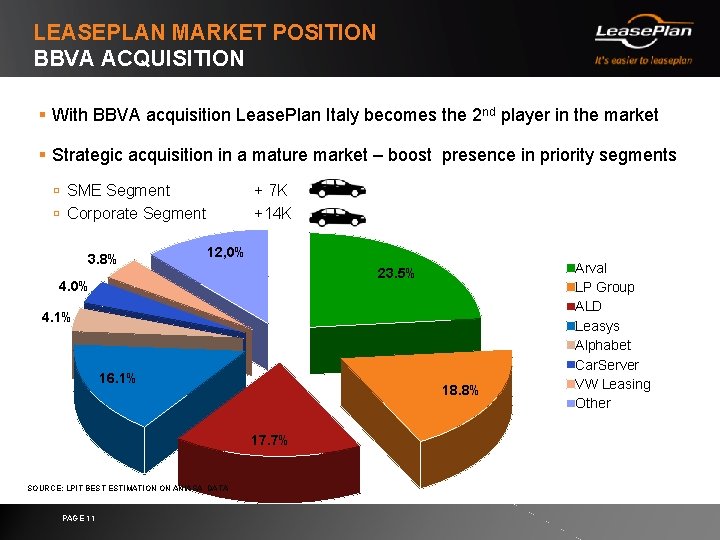

LEASEPLAN MARKET POSITION BBVA ACQUISITION § With BBVA acquisition Lease. Plan Italy becomes the 2 nd player in the market § Strategic acquisition in a mature market – boost presence in priority segments SME Segment Corporate Segment 3. 8% + 7 K +14 K 12, 0% 23. 5% 4. 0% 4. 1% 16. 1% 18. 8% 17. 7% SOURCE: LPIT BEST ESTIMATION ON ANIASA DATA PAGE 11 Arval LP Group ALD Leasys Alphabet Car. Server VW Leasing Other

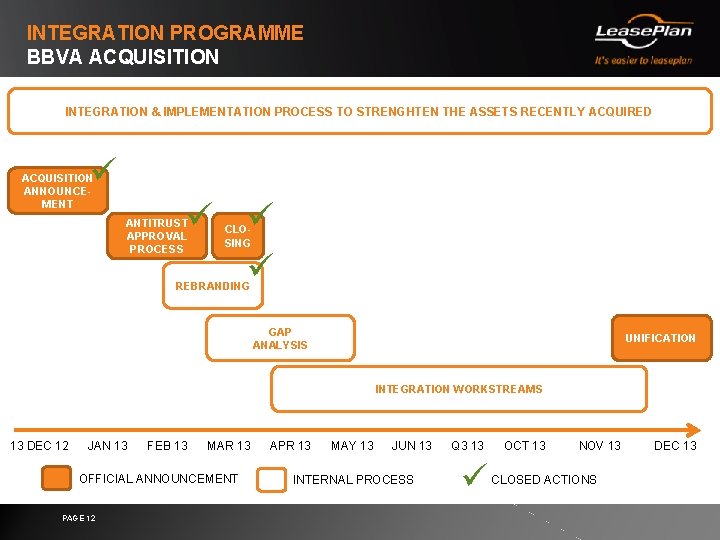

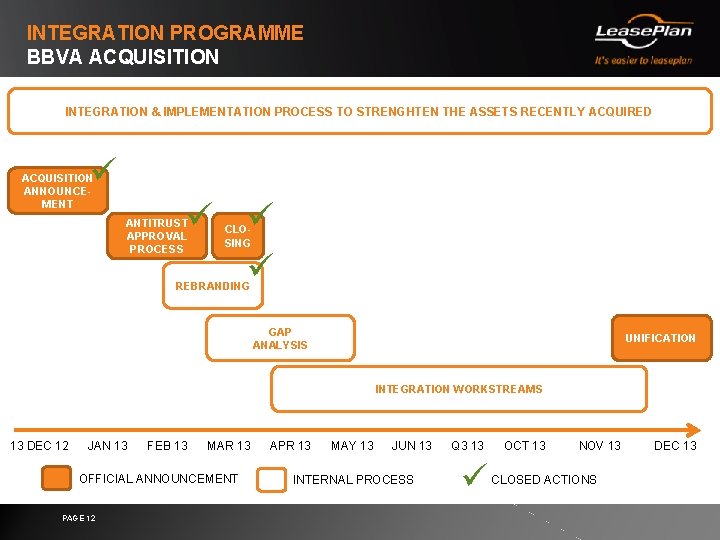

INTEGRATION PROGRAMME BBVA ACQUISITION INTEGRATION & IMPLEMENTATION PROCESS TO STRENGHTEN THE ASSETS RECENTLY ACQUIRED ACQUISITION ANNOUNCEMENT ANTITRUST APPROVAL PROCESS CLOSING REBRANDING GAP ANALYSIS UNIFICATION INTEGRATION WORKSTREAMS 13 DEC 12 JAN 13 FEB 13 MAR 13 OFFICIAL ANNOUNCEMENT PAGE 12 APR 13 MAY 13 JUN 13 INTERNAL PROCESS Q 3 13 OCT 13 NOV 13 CLOSED ACTIONS DEC 13

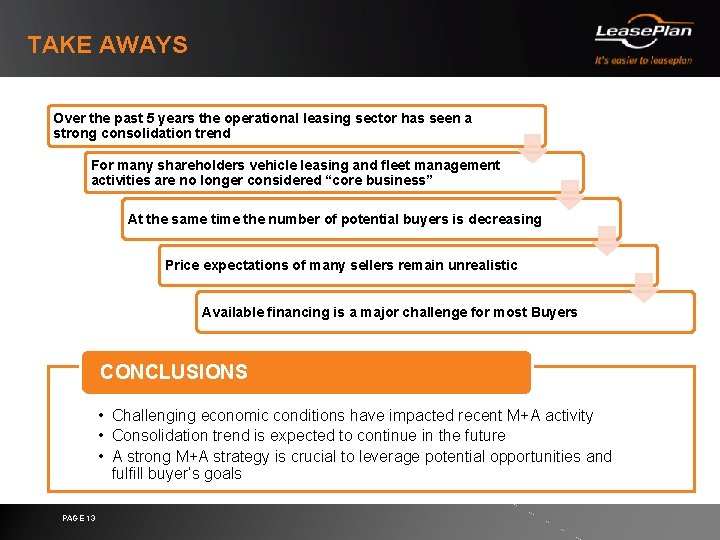

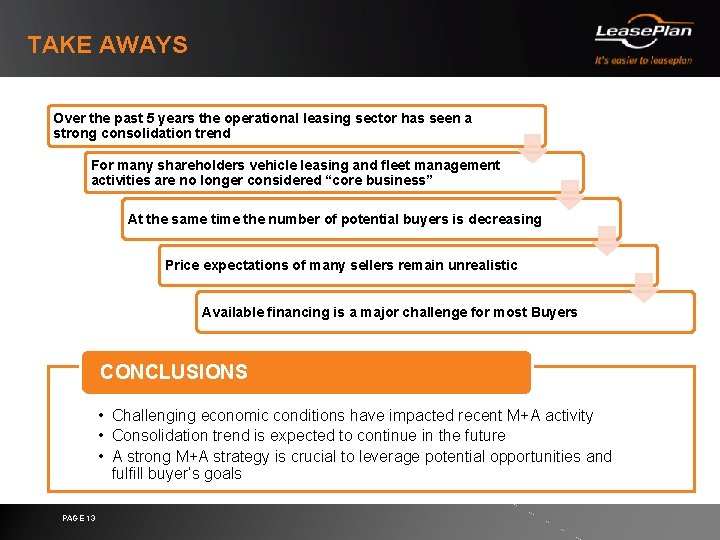

TAKE AWAYS Over the past 5 years the operational leasing sector has seen a strong consolidation trend For many shareholders vehicle leasing and fleet management activities are no longer considered “core business” At the same time the number of potential buyers is decreasing Price expectations of many sellers remain unrealistic Available financing is a major challenge for most Buyers CONCLUSIONS • Challenging economic conditions have impacted recent M+A activity • Consolidation trend is expected to continue in the future • A strong M+A strategy is crucial to leverage potential opportunities and fulfill buyer’s goals PAGE 13

Eurolease leasing

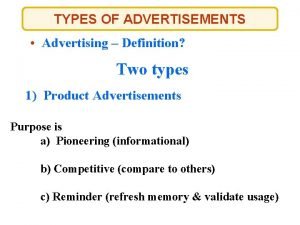

Eurolease leasing Disadvantages of magazines

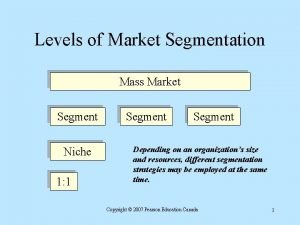

Disadvantages of magazines Mass market segment

Mass market segment Pros and cons of geographic segmentation

Pros and cons of geographic segmentation Market segmentation geographic demographic psychographic

Market segmentation geographic demographic psychographic Geographic coordinate system

Geographic coordinate system Weathering national geographic

Weathering national geographic What does a human embryo look like

What does a human embryo look like Ga geographic regions

Ga geographic regions Land regions of alabama

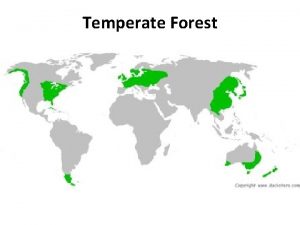

Land regions of alabama Temprate grasslands

Temprate grasslands There are _____ time zones on earth.

There are _____ time zones on earth. National geographic salem witch trials

National geographic salem witch trials Iceman national geographic

Iceman national geographic