General Ledger and Reporting System Chapter 16 Copyright

- Slides: 11

General Ledger and Reporting System Chapter 16 Copyright © 2015 Pearson Education, Inc. 16 -1

Learning Objectives • Describe the information processing operations required to update the general ledger and to produce reports for internal and external users. • Identify the major threats in general ledger and reporting activities and evaluate the adequacy of various control procedures for dealing with them. • Understand the implications of new IT developments, such as XBRL, and changes in external reporting requirements, such as IFRS, for the design and operation of the general ledger and reporting system. • Discuss how tools like responsibility accounting, balanced scorecards, and graphs can be used to provide information managers need to effectively monitor performance. Copyright © 2015 Pearson Education, Inc. 16 -2

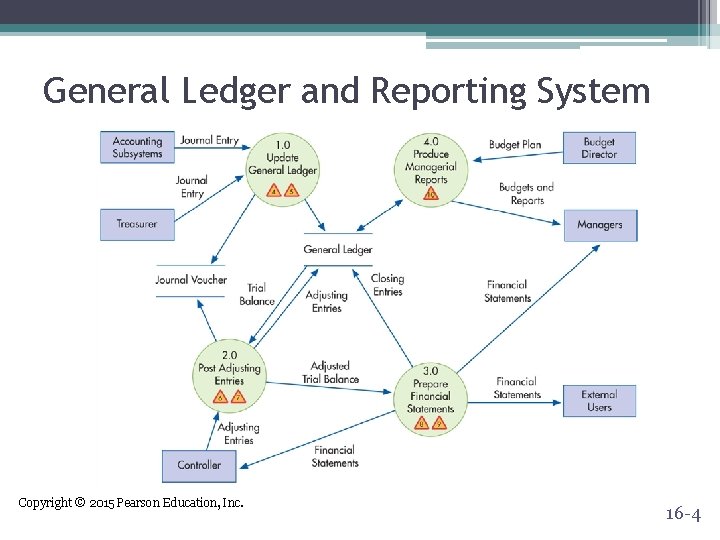

General Ledger and Reporting System Process • • Update general ledger Post adjusting entries Prepare financial statements Produce managerial reports Copyright © 2015 Pearson Education, Inc. 16 -3

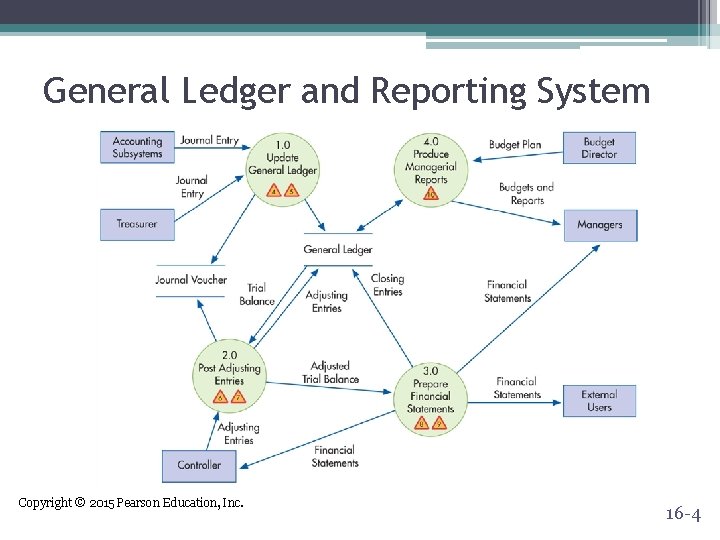

General Ledger and Reporting System Copyright © 2015 Pearson Education, Inc. 16 -4

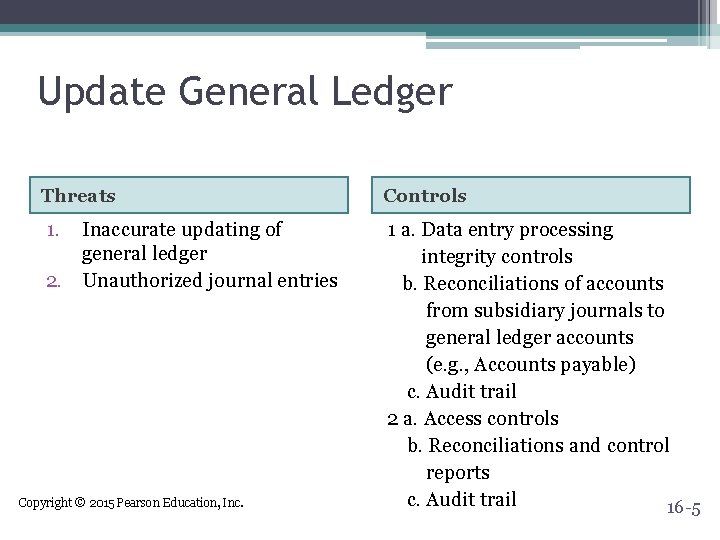

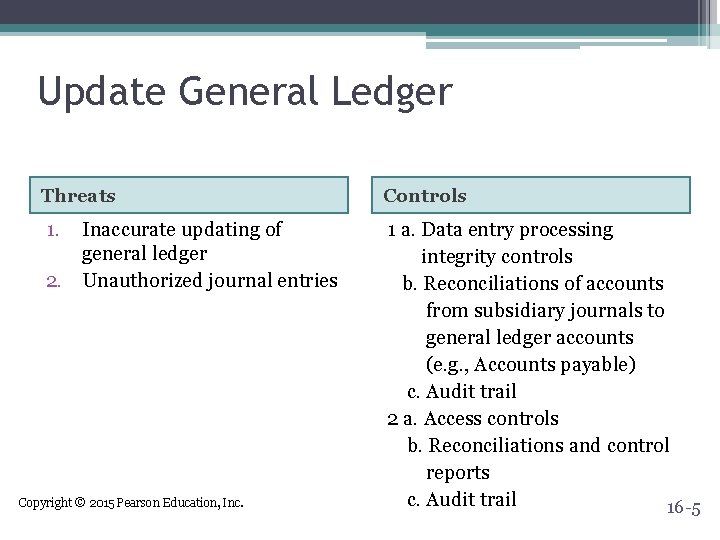

Update General Ledger Threats Controls 1. 1 a. Data entry processing integrity controls b. Reconciliations of accounts from subsidiary journals to general ledger accounts (e. g. , Accounts payable) c. Audit trail 2 a. Access controls b. Reconciliations and control reports c. Audit trail 16 -5 Inaccurate updating of general ledger 2. Unauthorized journal entries Copyright © 2015 Pearson Education, Inc.

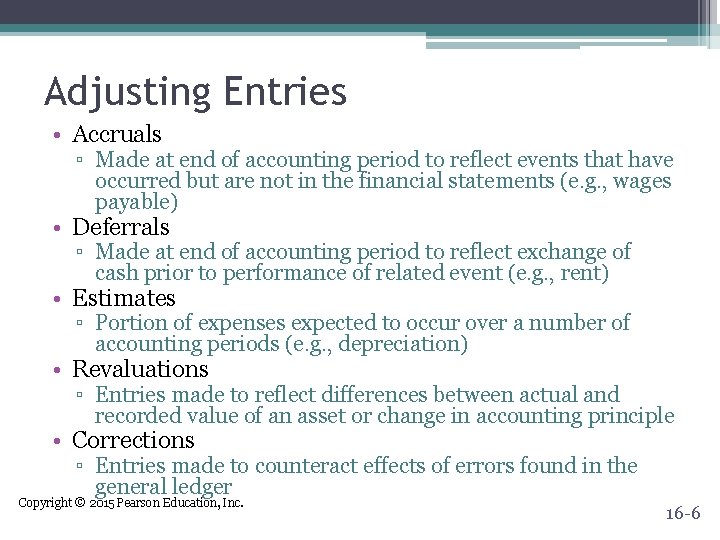

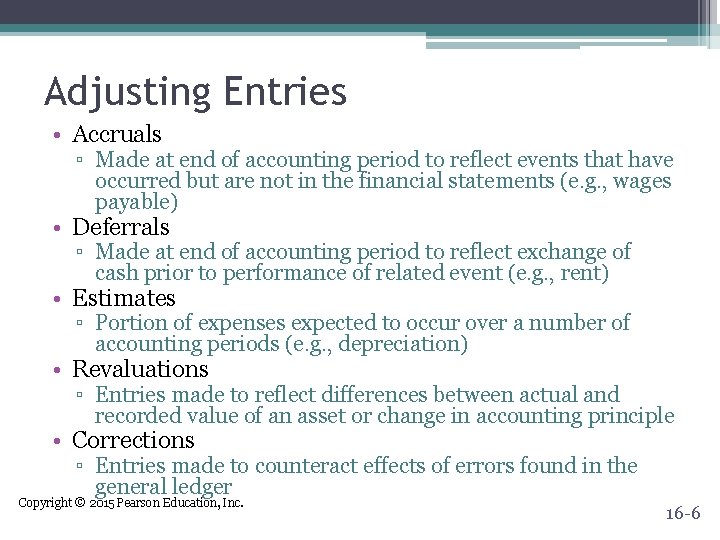

Adjusting Entries • Accruals ▫ Made at end of accounting period to reflect events that have occurred but are not in the financial statements (e. g. , wages payable) • Deferrals ▫ Made at end of accounting period to reflect exchange of cash prior to performance of related event (e. g. , rent) • Estimates ▫ Portion of expenses expected to occur over a number of accounting periods (e. g. , depreciation) • Revaluations ▫ Entries made to reflect differences between actual and recorded value of an asset or change in accounting principle • Corrections ▫ Entries made to counteract effects of errors found in the general ledger Copyright © 2015 Pearson Education, Inc. 16 -6

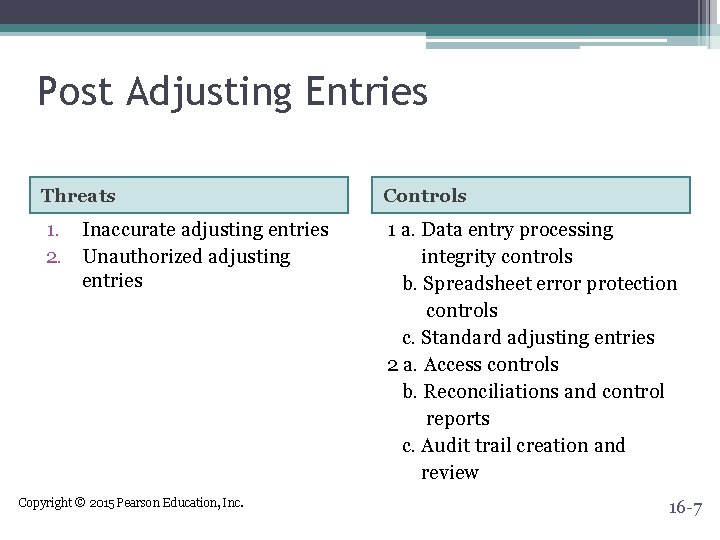

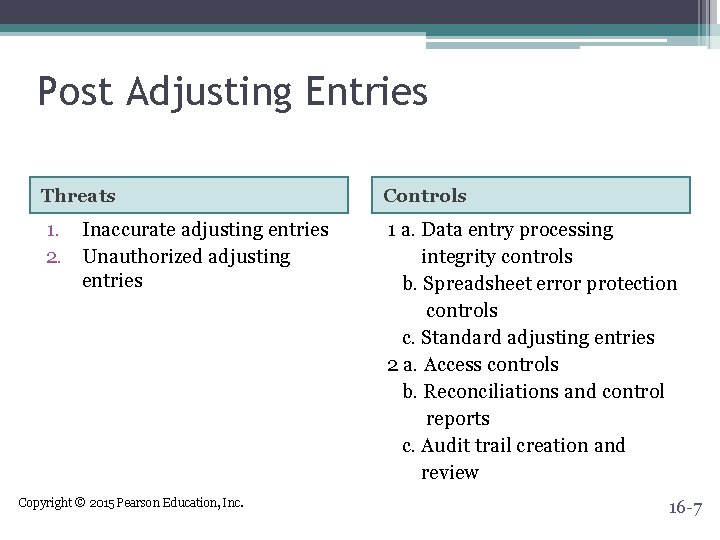

Post Adjusting Entries Threats Controls 1. Inaccurate adjusting entries 2. Unauthorized adjusting entries 1 a. Data entry processing integrity controls b. Spreadsheet error protection controls c. Standard adjusting entries 2 a. Access controls b. Reconciliations and control reports c. Audit trail creation and review Copyright © 2015 Pearson Education, Inc. 16 -7

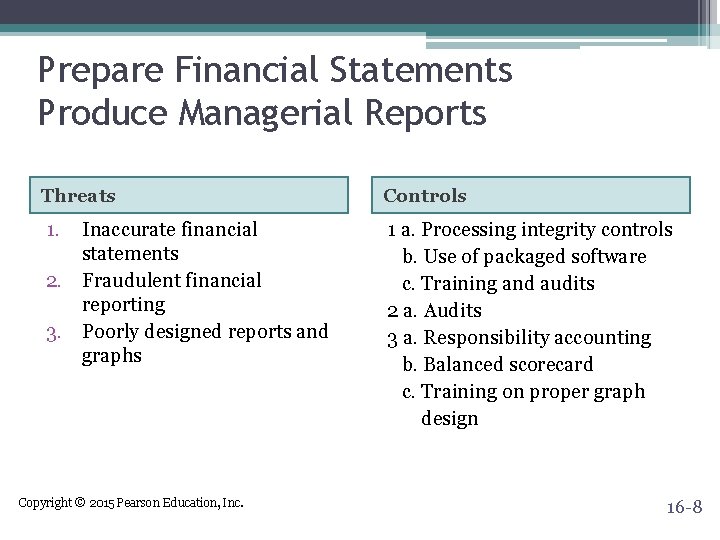

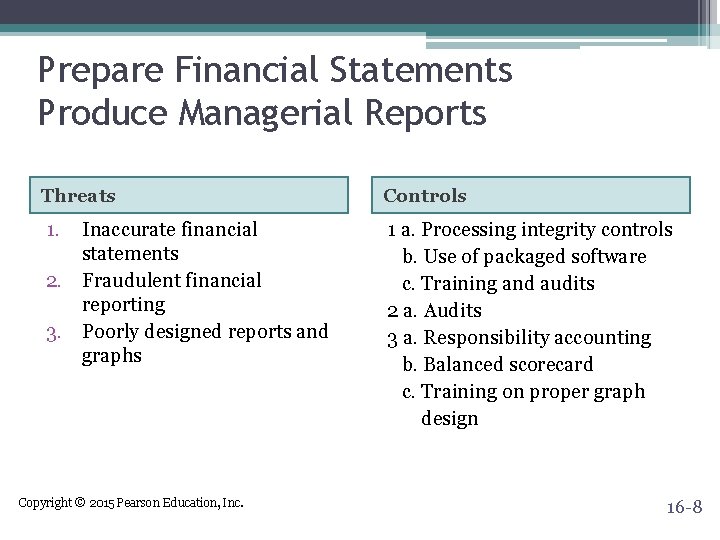

Prepare Financial Statements Produce Managerial Reports Threats Controls 1. 1 a. Processing integrity controls b. Use of packaged software c. Training and audits 2 a. Audits 3 a. Responsibility accounting b. Balanced scorecard c. Training on proper graph design Inaccurate financial statements 2. Fraudulent financial reporting 3. Poorly designed reports and graphs Copyright © 2015 Pearson Education, Inc. 16 -8

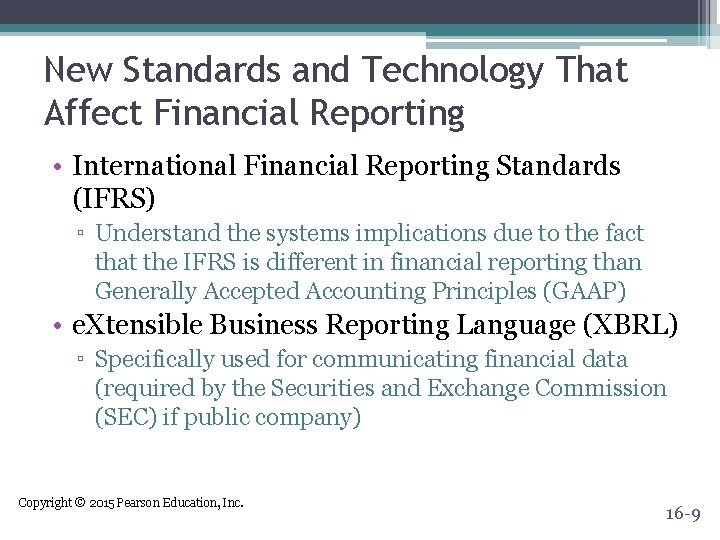

New Standards and Technology That Affect Financial Reporting • International Financial Reporting Standards (IFRS) ▫ Understand the systems implications due to the fact that the IFRS is different in financial reporting than Generally Accepted Accounting Principles (GAAP) • e. Xtensible Business Reporting Language (XBRL) ▫ Specifically used for communicating financial data (required by the Securities and Exchange Commission (SEC) if public company) Copyright © 2015 Pearson Education, Inc. 16 -9

Evaluating Performance • Responsibility accounting ▫ Reporting results based upon managerial responsibilities in an organization • Flexible budget ▫ Budget formula based upon level of activity (e. g. , production levels) • Balanced scorecard ▫ Measures financial and nonfinancial performance • Graphs ▫ Data visualization and proper graph design Copyright © 2015 Pearson Education, Inc. 16 -10

Key Terms • • Journal voucher file Trial balance Audit trail XBRL Instance document Element Taxonomy Copyright © 2015 Pearson Education, Inc. • • Schema Linkbases Style sheet Extension taxonomy Responsibility accounting Flexible budget Balanced scorecard 16 -11