Fundamentals of Real Estate Lecture 20 Spring 2002

- Slides: 13

Fundamentals of Real Estate Lecture 20 Spring, 2002 Copyright © Joseph A. Petry www. cba. uiuc. edu/jpetry/Fin_264_sp 02

Housekeeping Project Directions l Only necessary to do Before Tax Cash Flows Speakers l 2 ?

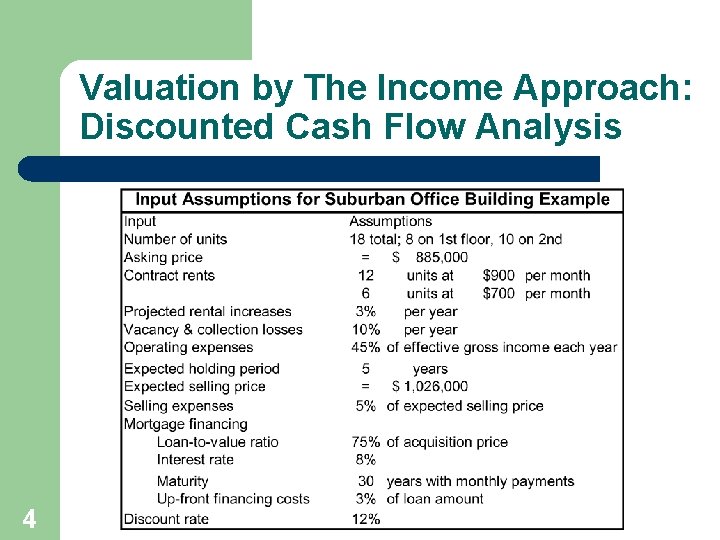

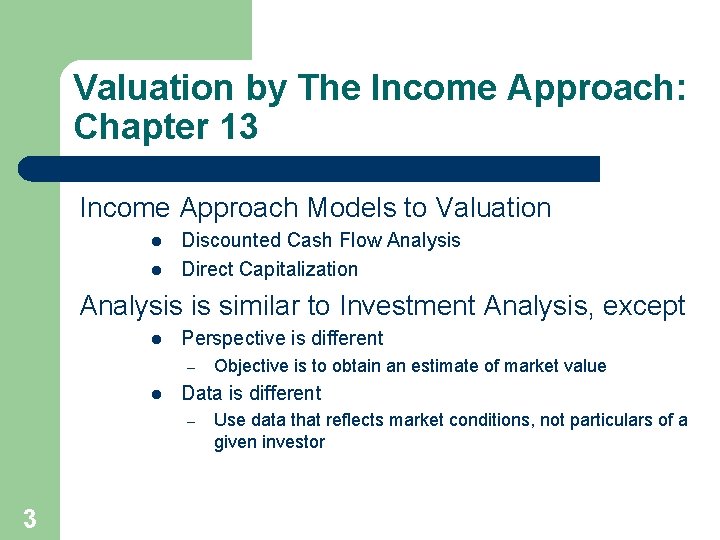

Valuation by The Income Approach: Chapter 13 Income Approach Models to Valuation l l Discounted Cash Flow Analysis Direct Capitalization Analysis is similar to Investment Analysis, except l Perspective is different – l Data is different – 3 Objective is to obtain an estimate of market value Use data that reflects market conditions, not particulars of a given investor

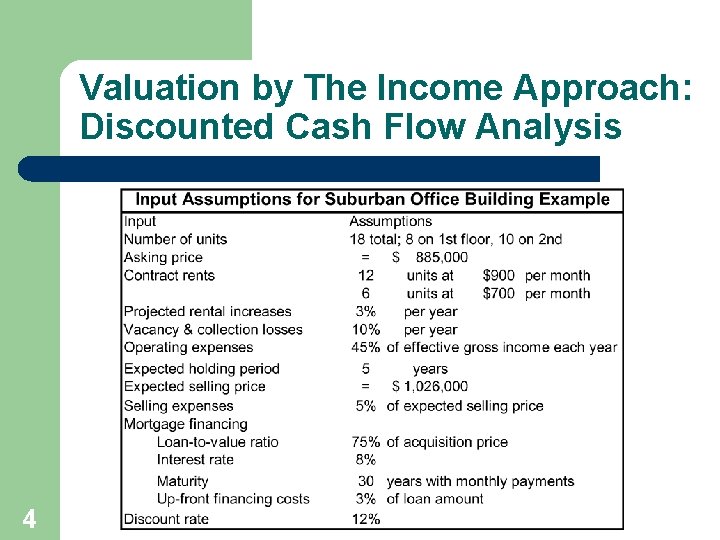

Valuation by The Income Approach: Discounted Cash Flow Analysis 4

Valuation by The Income Approach: Discounted Cash Flow Analysis 5

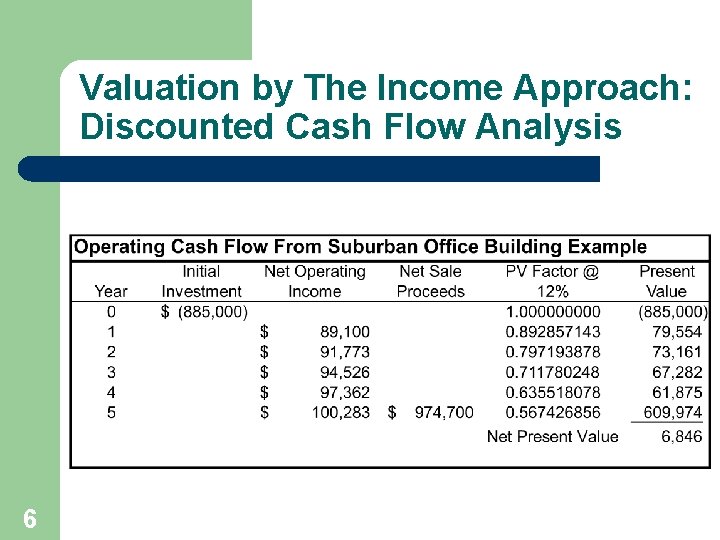

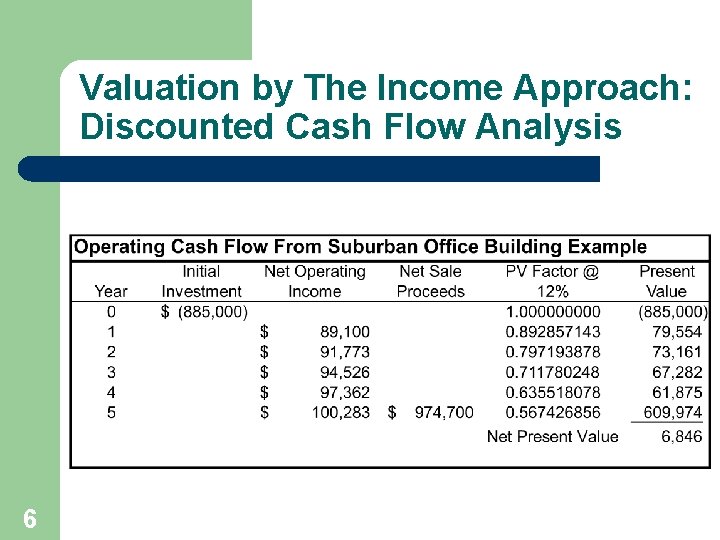

Valuation by The Income Approach: Discounted Cash Flow Analysis 6

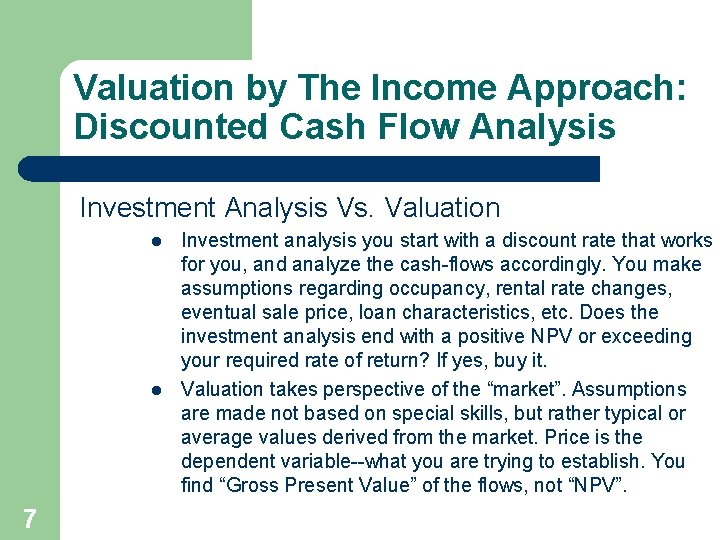

Valuation by The Income Approach: Discounted Cash Flow Analysis Investment Analysis Vs. Valuation l l 7 Investment analysis you start with a discount rate that works for you, and analyze the cash-flows accordingly. You make assumptions regarding occupancy, rental rate changes, eventual sale price, loan characteristics, etc. Does the investment analysis end with a positive NPV or exceeding your required rate of return? If yes, buy it. Valuation takes perspective of the “market”. Assumptions are made not based on special skills, but rather typical or average values derived from the market. Price is the dependent variable--what you are trying to establish. You find “Gross Present Value” of the flows, not “NPV”.

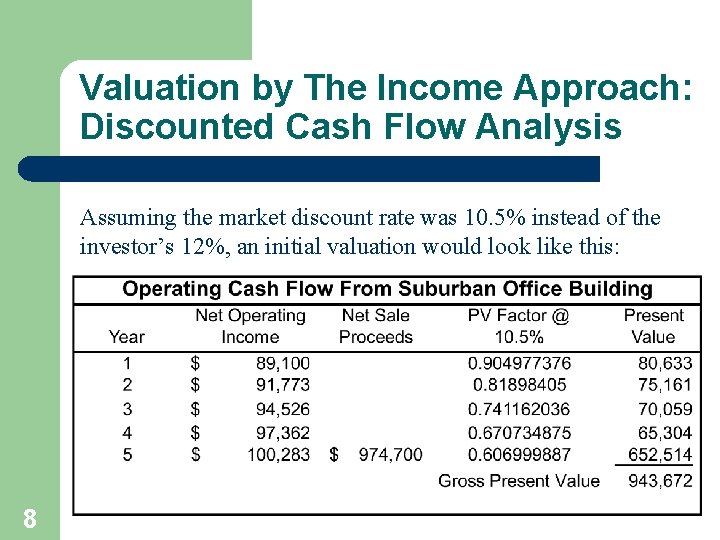

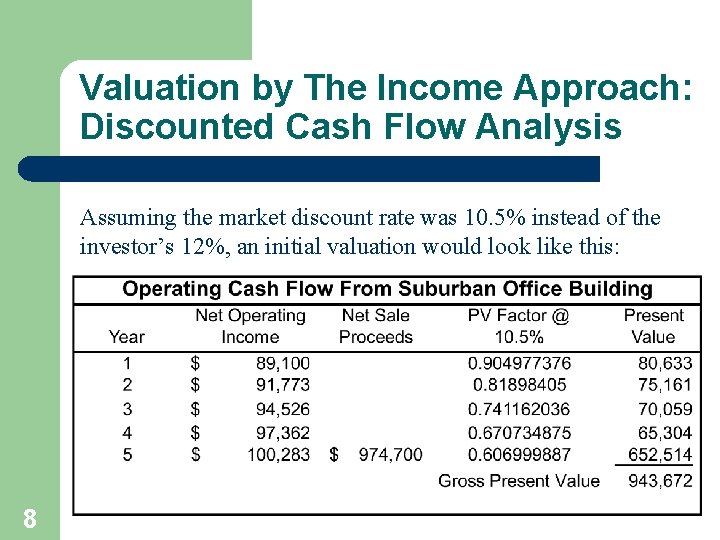

Valuation by The Income Approach: Discounted Cash Flow Analysis Assuming the market discount rate was 10. 5% instead of the investor’s 12%, an initial valuation would look like this: 8

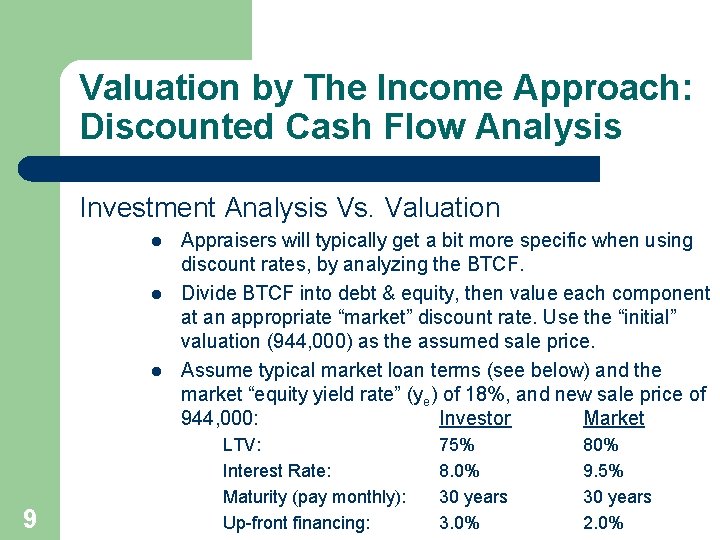

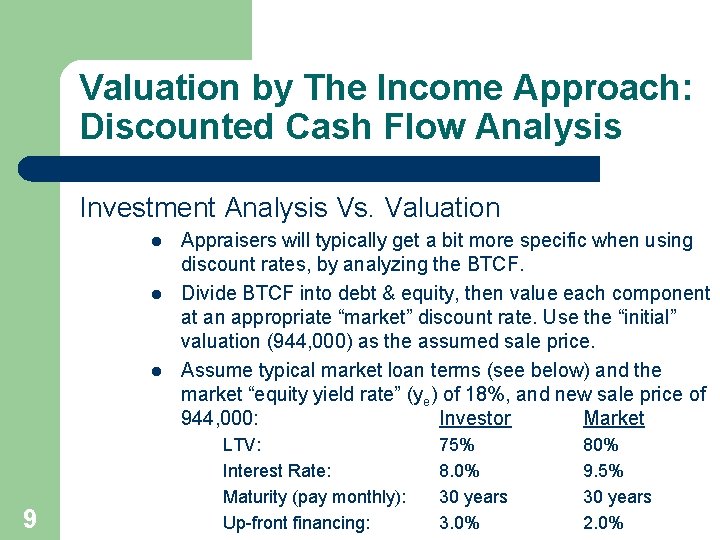

Valuation by The Income Approach: Discounted Cash Flow Analysis Investment Analysis Vs. Valuation l l l 9 Appraisers will typically get a bit more specific when using discount rates, by analyzing the BTCF. Divide BTCF into debt & equity, then value each component at an appropriate “market” discount rate. Use the “initial” valuation (944, 000) as the assumed sale price. Assume typical market loan terms (see below) and the market “equity yield rate” (ye) of 18%, and new sale price of 944, 000: Investor Market LTV: Interest Rate: Maturity (pay monthly): Up-front financing: 75% 8. 0% 30 years 3. 0% 80% 9. 5% 30 years 2. 0%

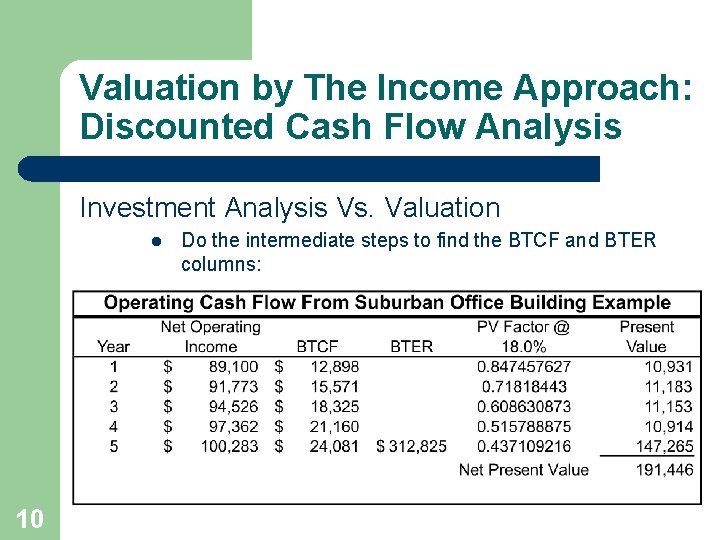

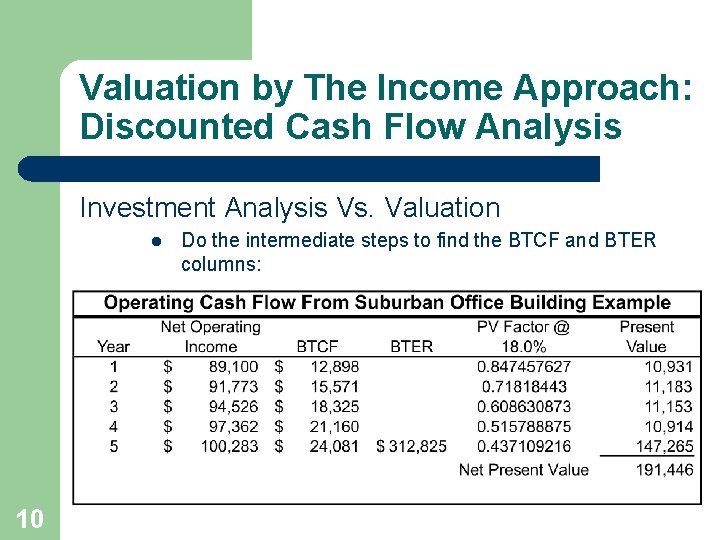

Valuation by The Income Approach: Discounted Cash Flow Analysis Investment Analysis Vs. Valuation l 10 Do the intermediate steps to find the BTCF and BTER columns:

Valuation by The Income Approach: Discounted Cash Flow Analysis Investment Analysis Vs. Valuation l l The value of the property is based upon the present value of the cash flows of debt, valued at the appropriate discount rate (the rate of interest of the loan), plus the present value of the return to equity, valued at the appropriate discount rate (equity yield rate). The appraised value of the property in this case is: V 0 = Ve + Vd V 0 = $191, 446 + $755, 200 = $946, 646 l 11 Using market discount rates, as well as breaking the analysis down further and applying separate discount rates on the debt and equity provided a significant improvement in estimate of market value.

Valuation by The Income Approach: Direct Capitalization is alternate, common approach l l l 12 Estimate a property’s value by dividing a one-year estimate of its income by a capitalization rate. Allows appraisers to rely on summary market evidence without having to project incomes and expenses years into the future. While the argument can be made that this relies on only one year’s cash flows, and hence is incomplete, there are two reasons why this is not such a problem for an appraiser 1. By using actual sales data to come up with a capitalization rate, future cash flows should be reflected provided that the purchasers did estimate future flows.

Valuation by The Income Approach: Direct Capitalization is alternate, common approach 2. 13 The capitalization rate used can be thought of as “an overall capitalization rate” and used in V=I/R: R 0 = y 0 – g 0 R 0 = Overall capitalization rate y 0 = discount rate, or yield for the overall property g 0 = Forecast compound annual growth rate of the NOI and property value for the remaining economic life or holding period. Assume NOI of a property is 200, 000, the investor required return is 12% and the estimate of NOI and appreciation is 2. 5% per year. What is the property worth? How much did incorporating the growth of NOI and property appreciation impact your estimate of value? What if you expect NOI and depreciation of 1% per year?

Fundamentals of analyzing real estate investments

Fundamentals of analyzing real estate investments Real estate finance fundamentals

Real estate finance fundamentals Real estate lecture

Real estate lecture Southpoint village apartments fishers indiana

Southpoint village apartments fishers indiana 01:640:244 lecture notes - lecture 15: plat, idah, farad

01:640:244 lecture notes - lecture 15: plat, idah, farad Spring, summer, fall, winter... and spring (2003)

Spring, summer, fall, winter... and spring (2003) Seasons spring summer fall winter

Seasons spring summer fall winter Elevator pitch for real estate agent

Elevator pitch for real estate agent What is a mofir

What is a mofir Real estate stakeholders

Real estate stakeholders Greek real estate market

Greek real estate market Sandy miller realtor

Sandy miller realtor Littoral vs riparian rights

Littoral vs riparian rights What are the 4 types of real estate

What are the 4 types of real estate