Fundamentals of Microfinance Presentation by Maria Kristina S

Fundamentals of Microfinance Presentation by: Maria Kristina S. Galvez Project Manager – Social Enterprise Unit Punla sa Tao Foundation

Presentation Outline Where Did It All Began: The Grameen Bank The Philippine Financial System Philippine Microfinance Profile Process and Procedure: How Does Microfinance Work? Impact Assessment: Does Microfinance Really Work? Microfinance and the Financial Crisis

Why the poor cannot borrow from other formal financial institutions? Can the poor really pay or save?

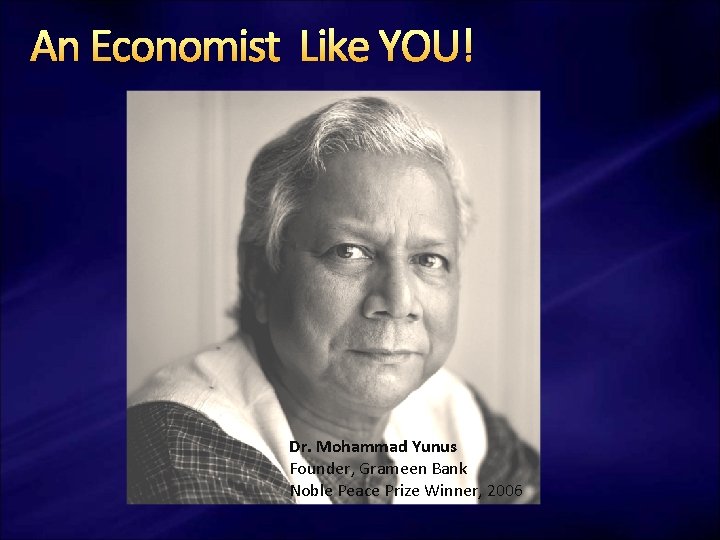

An Economist Like YOU! Dr. Mohammad Yunus Founder, Grameen Bank Noble Peace Prize Winner, 2006

Yunus and the Grameen Bank Grameen means “village” – thus, Village Banking Envisioned as the “biggest development wonder” Extended banking facilities to poor men and women Aimed to create opportunities for selfemployment in rural Bangladesh

Grameen Framework From “low income, low saving & low investment“ into "low income, injection of credit, investment, more income, more savings, more investment, more income".

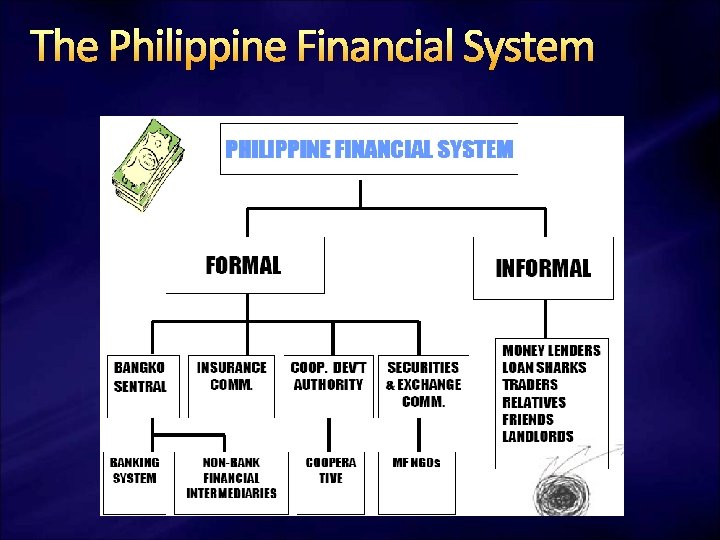

The Philippine Financial System

Microfinance 101 Defined as provision of financial services, savings and credit to the poor on a sustainable basis. Credit Savings Other Financial Services (ex. Insurance)

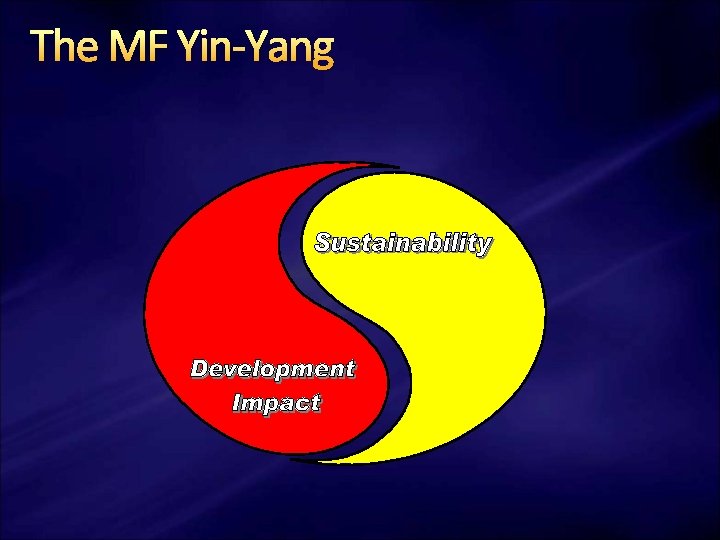

Dual Objectives of Microfinance Serve the poor or reduce poverty while at the same time Pursue the business to maximize return on investments

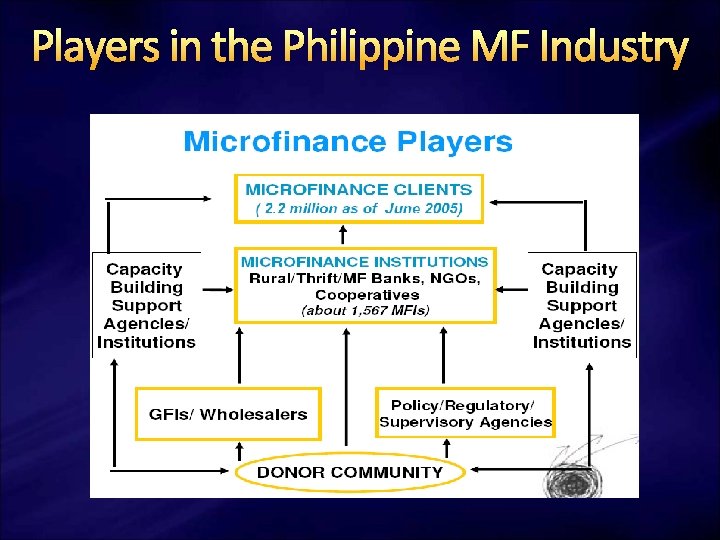

Players in the Philippine MF Industry

Major Providers of MF Services NGOs – 500 Rural Banks – 195 Savings and Credit Cooperatives – 4, 579 Source: GTZ-Phil. Health Orientation for Microfinance

Who Are the Clients of MF? Near Poor Entrepreneurial Poor or “e-poor” E-Poor Laboring Ultra. Poor

Status of Microfinance in the Philippines 17 million people still do not have access to financing services Source: National Anti-Poverty Commission, 2005

Preparing for Microfinance Process, Approach and Methodologies

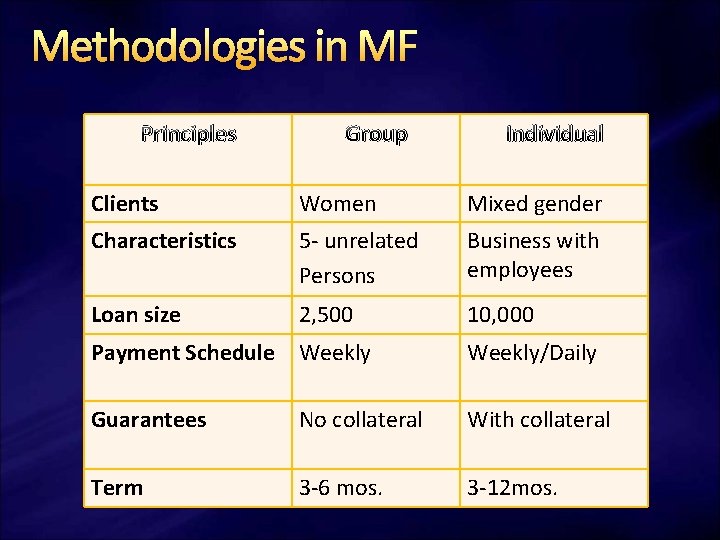

Methodologies in MF Group Lending Around 5 -30 members per group Members guarantee each other’s loan Example: Grameen methodology

Methodologies in MF Individual Lending Loans are given based on the capacity to pay (Household or Business Cash Flow) With collateral or co-maker Clients are screened for credit checks or character references Loan size are tailored to business needs.

Methodologies in MF Principles Group Individual Clients Women Mixed gender Characteristics 5 - unrelated Persons Business with employees Loan size 2, 500 10, 000 Payment Schedule Weekly/Daily Guarantees No collateral With collateral Term 3 -6 mos. 3 -12 mos.

Microfinance Products and Services Credit Savings Compulsory Savings Voluntary Savings Insurance Death Insurance Health Insurance Payment Services Agricultural Microfinance

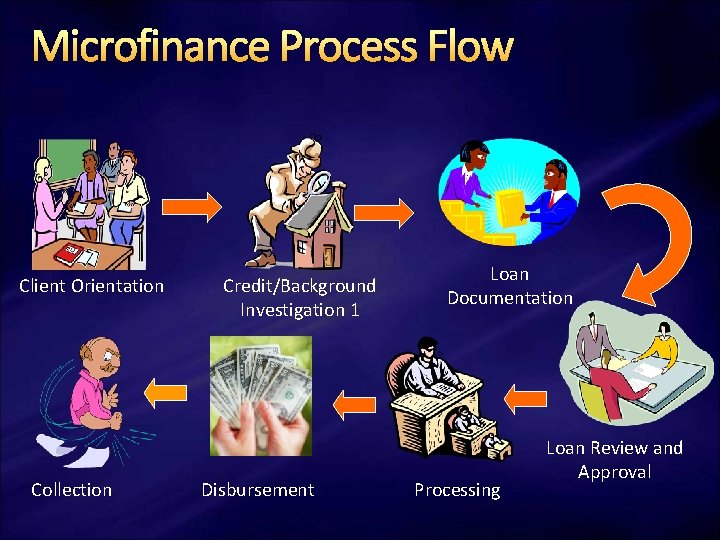

Microfinance Process Flow Client Orientation Collection Credit/Background Investigation 1 Disbursement Loan Documentation Processing Loan Review and Approval

Understanding the MF Loan Small loans granted to borrowers based on cash flow Given to increase income levels, for small enterprises

Understanding the MF Loan Amount starts from Php 2, 000 to Php 5, 000 and maximum principal amount pegged at Php 150, 000 Equivalent to the maximum capitalization of a microenterprise (under RA 8425) Source: Bangko Sentral ng Pilipinas

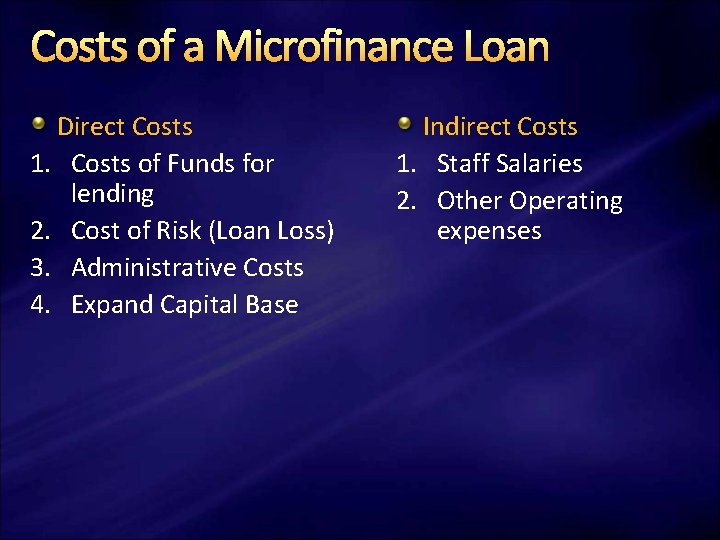

Costs of a Microfinance Loan Direct Costs 1. Costs of Funds for lending 2. Cost of Risk (Loan Loss) 3. Administrative Costs 4. Expand Capital Base Indirect Costs 1. Staff Salaries 2. Other Operating expenses

Interest on Microfinance Loans Old Approach – subsidized interest rates New Approach – market-based interest rates The new approach permits the microfinance institution to cover the costs in lending a loan, thus making it sustainable. Interests at MFIs are currently at 2% - 3% per month

Commercial Banks vs. MFIs Commercial banks deal with large loans therefore their transaction costs are lower. Government-owned MFIs are also lower because of political considerations. Some MFIs charge very low rates (ex. 20% per annum), but incur losses. Losses are recovered through subsidies.

Lower Interest Rates, Healthier Credit Environment A “win-win” proposition: more microcredit lent and gross returns to lenders.

What Should the Government Do? Government should continually seek consultation with MFIs to understand better the infrastructure bottlenecks they face. The government should not lend, rather make an enabling environment for lending.

Does Microfinance Really Work? Studies and Evidences

The MF Yin-Yang

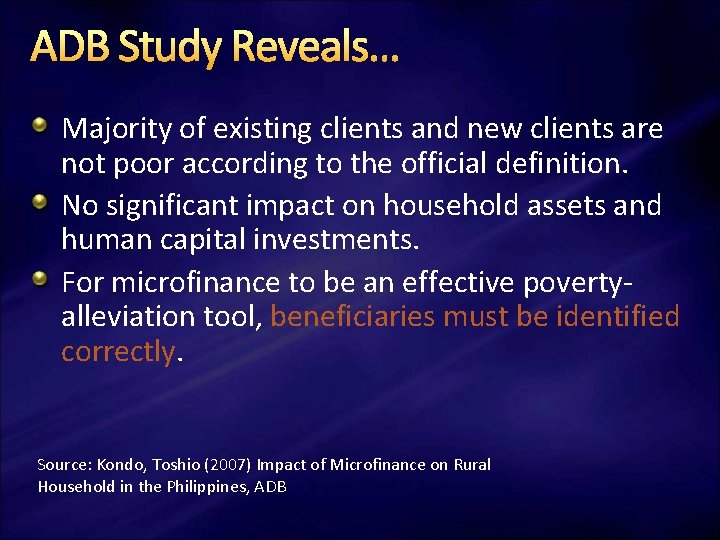

ADB Study Reveals… Majority of existing clients and new clients are not poor according to the official definition. No significant impact on household assets and human capital investments. For microfinance to be an effective povertyalleviation tool, beneficiaries must be identified correctly. Source: Kondo, Toshio (2007) Impact of Microfinance on Rural Household in the Philippines, ADB

Is MF spared from the Financial Crisis? Asian Financial Crisis : Banking and currency crises had little relevance to subsistence-based economies in closed ecosystem markets Money will become more scarce, more conservative, and more costly. Financial pressures on families may lead to less savings and more withdrawals.

For MF to Shield Itself… Risk Management, Good Governance and Shift to More Enterprising Environment for Clients!

Thoughts to Ponder in Microfinance Maybe necessary, but not sufficient as a poverty-alleviation tool. Microfinance should pay for itself to reach more poor people. The role of the government is to enable financial services, not to provide them.

Solidarity in Microfinance

- Slides: 33