Free Cash Flow Valuation Intro to Free Cash

- Slides: 15

Free Cash Flow Valuation

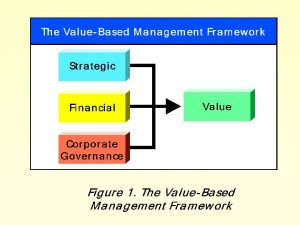

Intro to Free Cash Flows Ø Dividends are the cash flows actually paid to stockholders Ø Free cash flows are the cash flows available for distribution. Ø Applied to dividends, the DCF model is the discounted dividend approach or dividend discount model (DDM). This chapter extends DCF analysis to value a firm and the firm’s equity securities by valuing its free cash flow to the firm (FCFF) and free cash flow to equity (FCFE).

Intro to Free Cash Flows Ø Analysts like to use free cash flow valuation models (FCFF or FCFE) whenever one or more of the following conditions are present: • the firm is not dividend paying, • the firm is dividend paying but dividends differ significantly from the firm’s capacity to pay dividends, • free cash flows align with profitability within a reasonable forecast period with which the analyst is comfortable, or • the investor takes a control perspective.

Intro to Free Cash Flows Ø Common equity can be valued by either • directly using FCFE or • indirectly by first computing the value of the firm using a FCFF model and subtracting the value of non-common stock capital (usually debt and preferred stock) to arrive at the value of equity.

Defining Free Cash Flow Ø Free cash flow to equity (FCFE) is the cash flow available to the firm’s common equity holders after all operating expenses, interest and principal payments have been paid, and necessary investments in working and fixed capital have been made. • FCFE is the cash flow from operations minus capital expenditures minus payments to (and plus receipts from) debtholders.

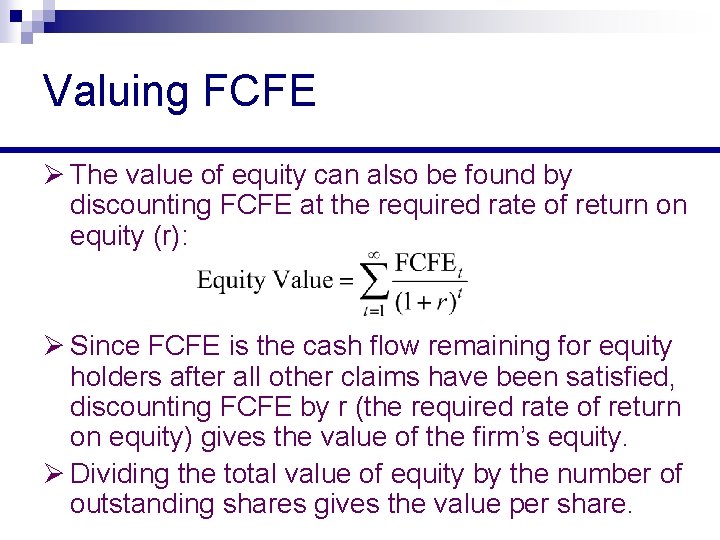

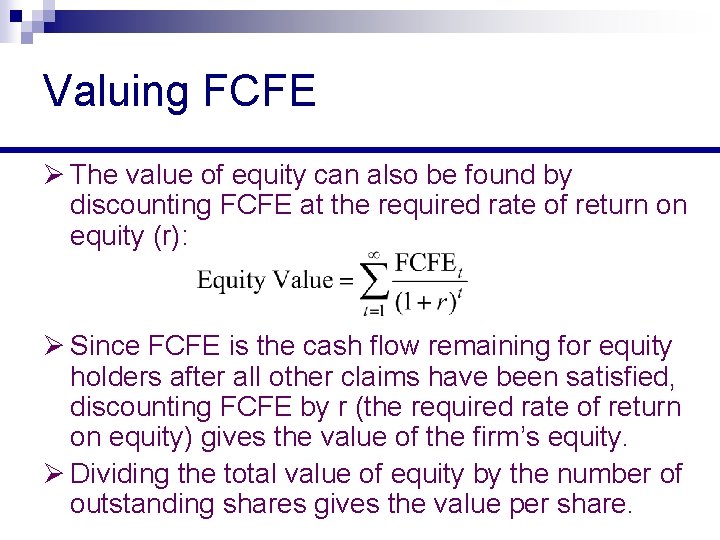

Valuing FCFE Ø The value of equity can also be found by discounting FCFE at the required rate of return on equity (r): Ø Since FCFE is the cash flow remaining for equity holders after all other claims have been satisfied, discounting FCFE by r (the required rate of return on equity) gives the value of the firm’s equity. Ø Dividing the total value of equity by the number of outstanding shares gives the value per share.

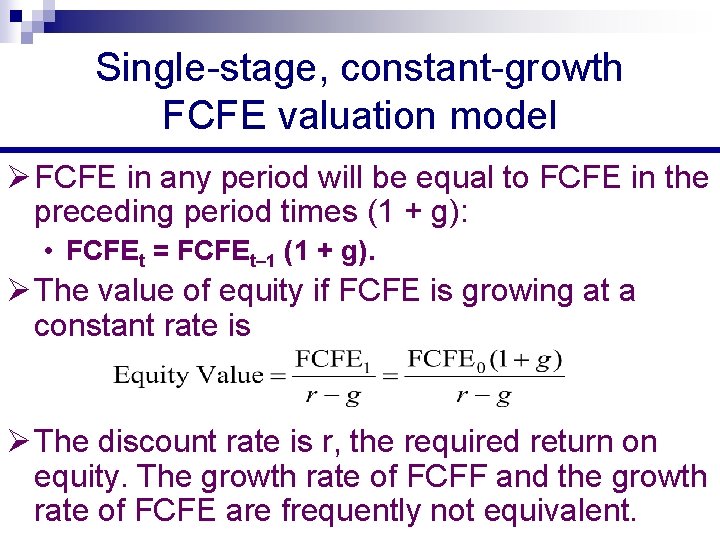

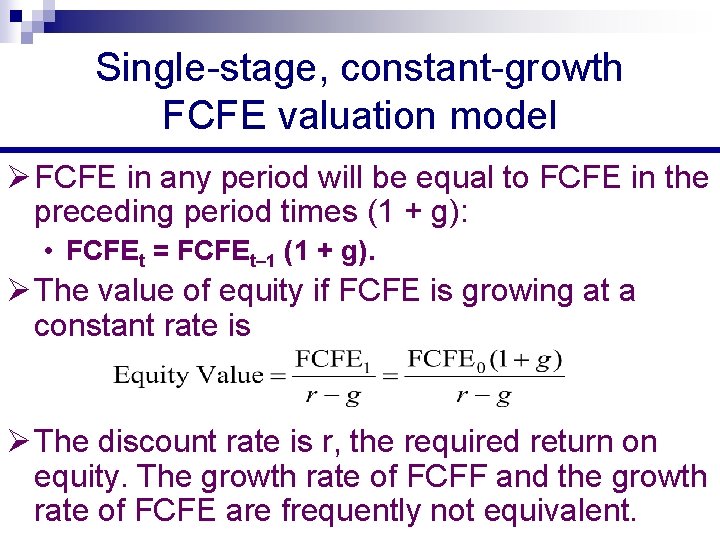

Single-stage, constant-growth FCFE valuation model Ø FCFE in any period will be equal to FCFE in the preceding period times (1 + g): • FCFEt = FCFEt– 1 (1 + g). Ø The value of equity if FCFE is growing at a constant rate is Ø The discount rate is r, the required return on equity. The growth rate of FCFF and the growth rate of FCFE are frequently not equivalent.

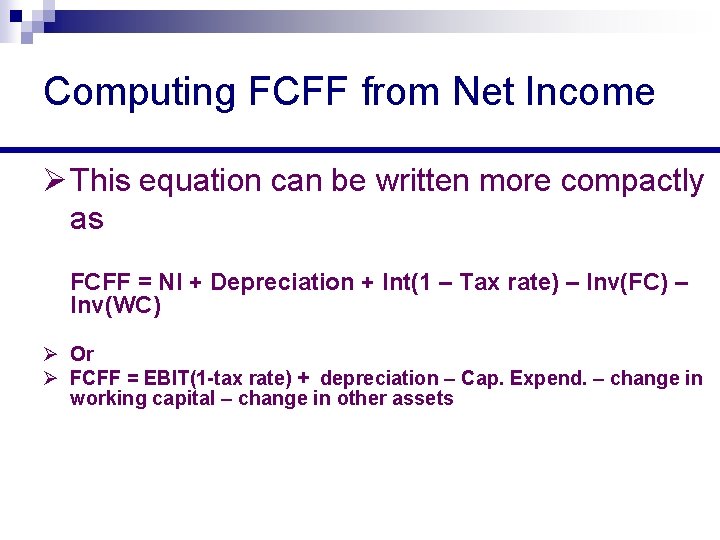

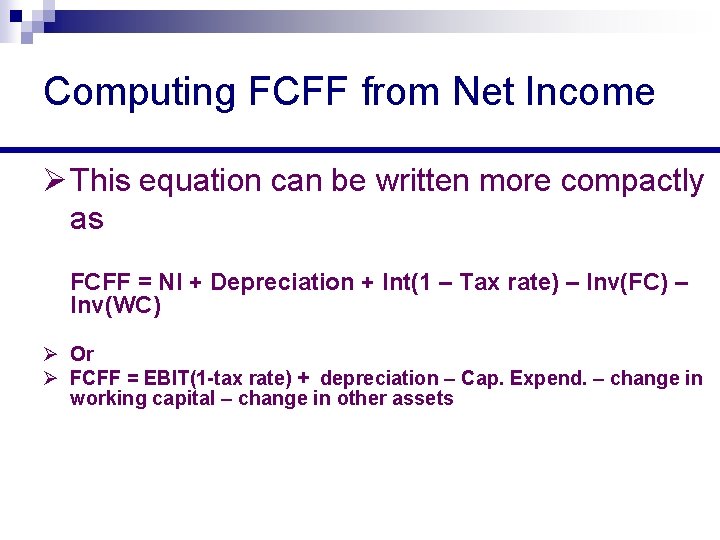

Computing FCFF from Net Income Ø This equation can be written more compactly as FCFF = NI + Depreciation + Int(1 – Tax rate) – Inv(FC) – Inv(WC) Ø Or Ø FCFF = EBIT(1 -tax rate) + depreciation – Cap. Expend. – change in working capital – change in other assets

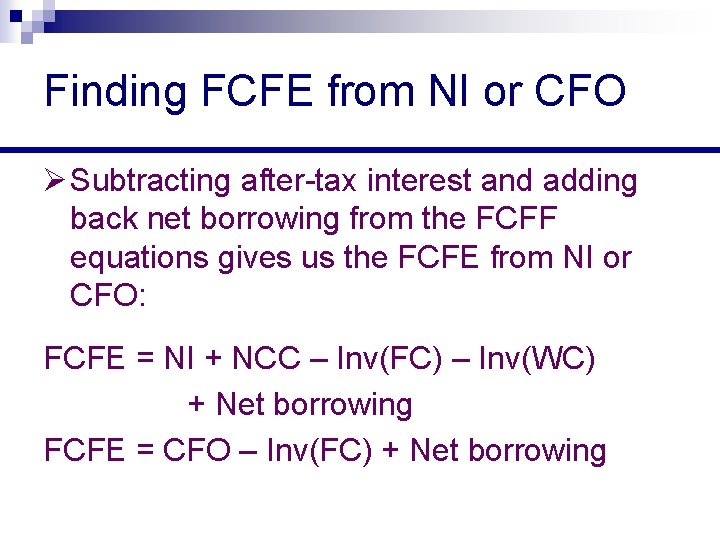

Finding FCFE from NI or CFO Ø Subtracting after-tax interest and adding back net borrowing from the FCFF equations gives us the FCFE from NI or CFO: FCFE = NI + NCC – Inv(FC) – Inv(WC) + Net borrowing FCFE = CFO – Inv(FC) + Net borrowing

Forecasting free cash flows Ø Computing FCFF and FCFE based upon historical accounting data is straightforward. Often times, this data is then used directly in a single-stage DCF valuation model. Ø On other occasions, the analyst desires to forecast future FCFF or FCFE directly. In this case, the analyst must forecast the individual components of free cash flow. This section extends our previous presentation on computing FCFF and FCFE to the more complex task of forecasting FCFF and FCFE. We present FCFF and FCFE valuation models in the next section.

Forecasting free cash flows Ø Given that we have a variety of ways in which to derive free cash flow on a historical basis, it should come as no surprise that there are several methods of forecasting free cash flow. Ø One approach is to compute historical free cash flow and apply some constant growth rate. This approach would be appropriate if free cash flow for the firm tended to grow at a constant rate and if historical relationships between free cash flow and fundamental factors were expected to be maintained.

Forecasting FCFE Ø If the firm finances a fixed percentage of its capital spending and investments in working capital with debt, the calculation of FCFE is simplified. Let DR be the debt ratio, debt as a percentage of assets. In this case, FCFE can be written as Ø FCFE = NI – (1 – DR)(Capital Spending – Depreciation) – (1 – DR)Inv(WC) Ø When building FCFE valuation models, the logic, that debt financing is used to finance a constant fraction of investments, is very useful. This equation is pretty common.

Preferred stock in the capital structure Ø When we are calculating FCFE starting with Net income available to common, if Preferred dividends were already subtracted when arriving at Net income available to common, no further adjustment for Preferred dividends is required. However, issuing (redeeming) preferred stock increases (decreases) the cash flow available to common stockholders, so this term would be added in. Ø In many respects, the existence of preferred stock in the capital structure has many of the same effects as the existence of debt, except that preferred stock dividends paid are not tax deductible unlike interest payments on debt.

Nonoperating assets and firm value Ø When calculating FCFF or FCFE, investments in working capital do not include any investments in cash and marketable securities. The value of cash and marketable securities should be added to the value of the firm’s operating assets to find the total firm value. Ø Some companies have substantial non-current investments in stocks and bonds that are not operating subsidiaries but financial investments. These should be reflected at their current market value. Based on accounting conventions, those securities reported at book values should be revalued to market values.

Nonoperating assets and firm value Ø Finally, many corporations have overfunded or underfunded pension plans. The excess pension fund assets should be added to the value of the firm’s operating assets. Likewise, an underfunded pension plan should result in an appropriate subtraction from the value of operating assets.

Chapter 6 discounted cash flow valuation

Chapter 6 discounted cash flow valuation Valuation theories of fixed income securities

Valuation theories of fixed income securities Apv finance

Apv finance Free cash flow to firm

Free cash flow to firm Fcf fcff fcfe

Fcf fcff fcfe Positive free cash flow

Positive free cash flow Sony free cash flow

Sony free cash flow Dcf investopedia

Dcf investopedia Cash cab intro

Cash cab intro Cash to cash cycle time

Cash to cash cycle time Cash to cash cycle time

Cash to cash cycle time What is cash in and cash out

What is cash in and cash out Budgeted income statement

Budgeted income statement Paid cash to establish a petty cash fund

Paid cash to establish a petty cash fund An endorsement indicating a new owner of a check

An endorsement indicating a new owner of a check Residual cash flow

Residual cash flow