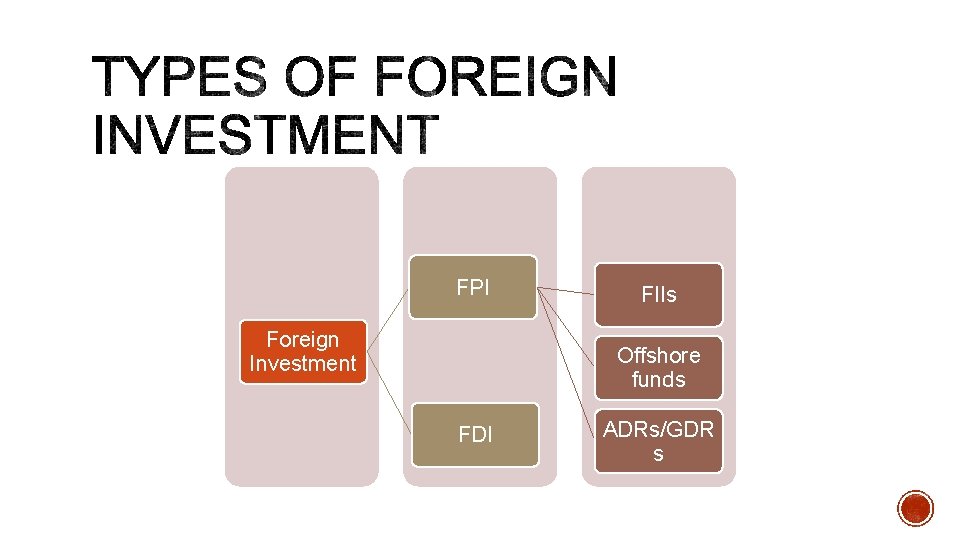

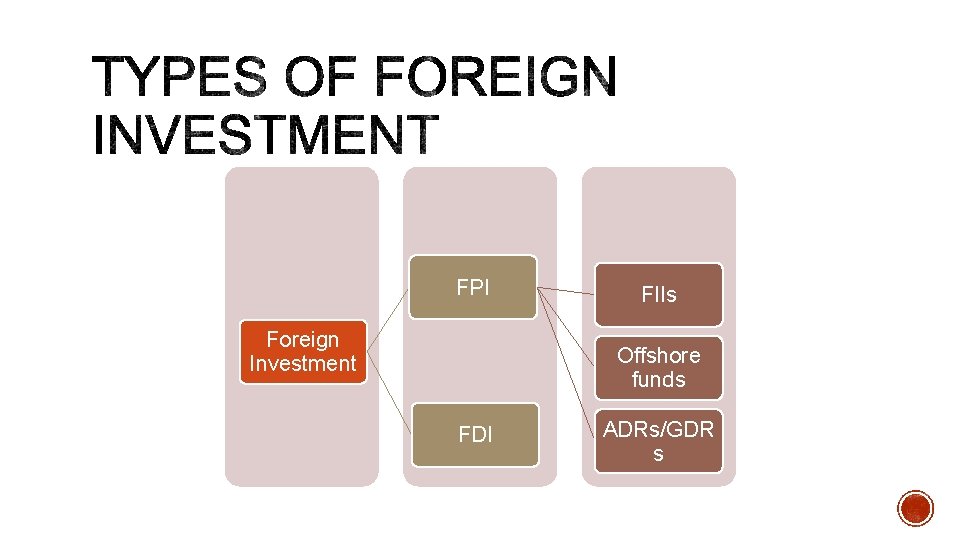

FPI Foreign Investment FIIs Offshore funds FDI ADRsGDR

- Slides: 14

FPI Foreign Investment FIIs Offshore funds FDI ADRs/GDR s

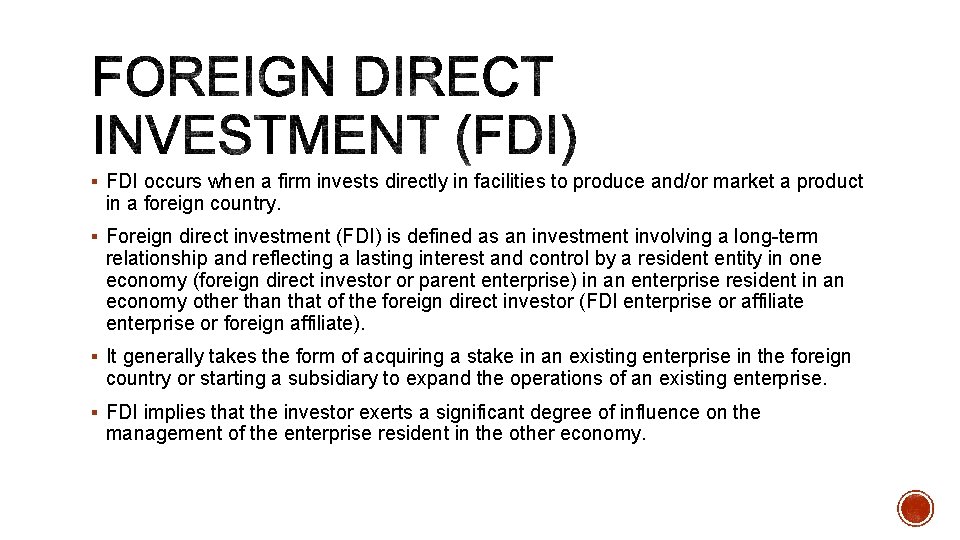

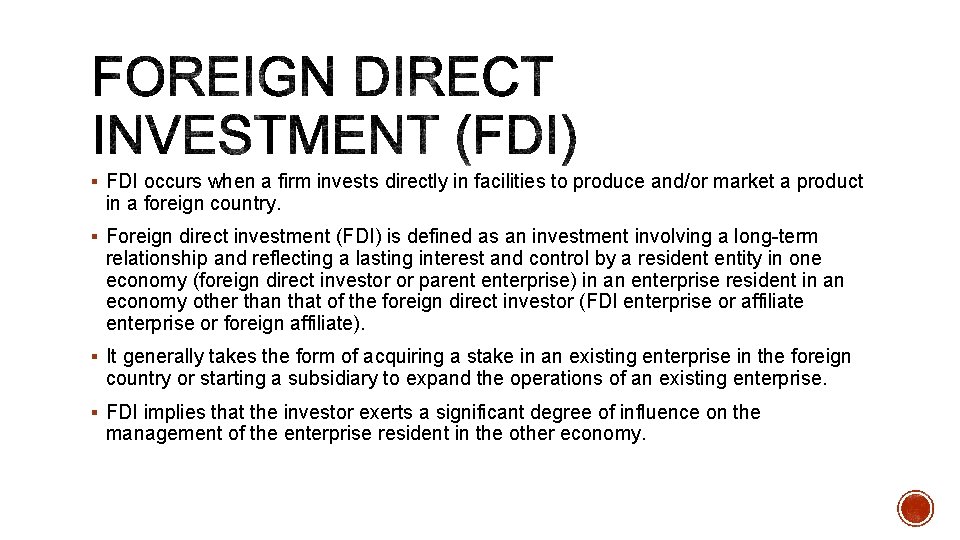

§ FDI occurs when a firm invests directly in facilities to produce and/or market a product in a foreign country. § Foreign direct investment (FDI) is defined as an investment involving a long-term relationship and reflecting a lasting interest and control by a resident entity in one economy (foreign direct investor or parent enterprise) in an enterprise resident in an economy other than that of the foreign direct investor (FDI enterprise or affiliate enterprise or foreign affiliate). § It generally takes the form of acquiring a stake in an existing enterprise in the foreign country or starting a subsidiary to expand the operations of an existing enterprise. § FDI implies that the investor exerts a significant degree of influence on the management of the enterprise resident in the other economy.

§ FPI involves investment in foreign financial assets like stocks, bonds, commodities etc. § This type of investment is not made with the intention of acquiring a controlling interest in the issuing company. § Typically, this type of investment is short term in nature and is made to take advantage of favorable changes in exchange rates or to earn short term profits on interest rate differences. § It provides the investor with an opportunity to diversify their portfolios and better manage the associated risk. §

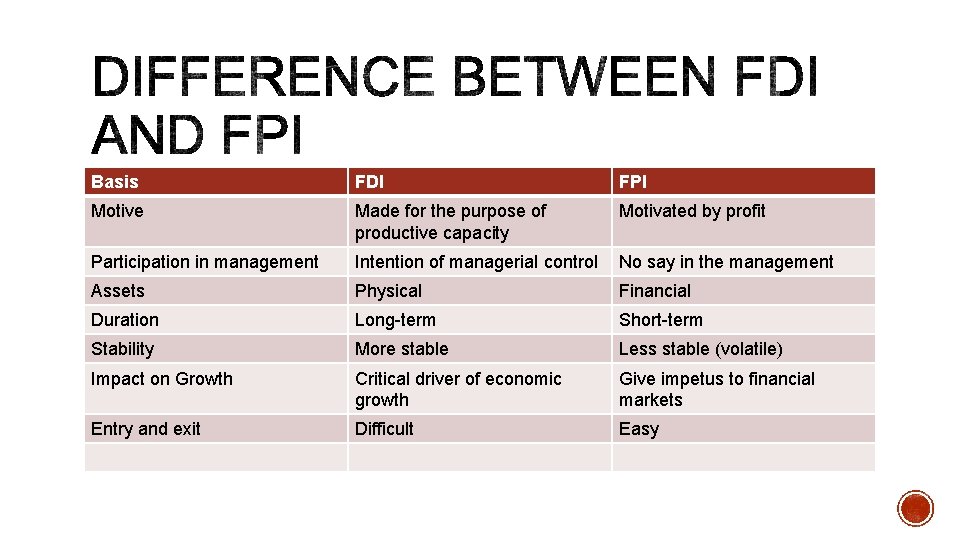

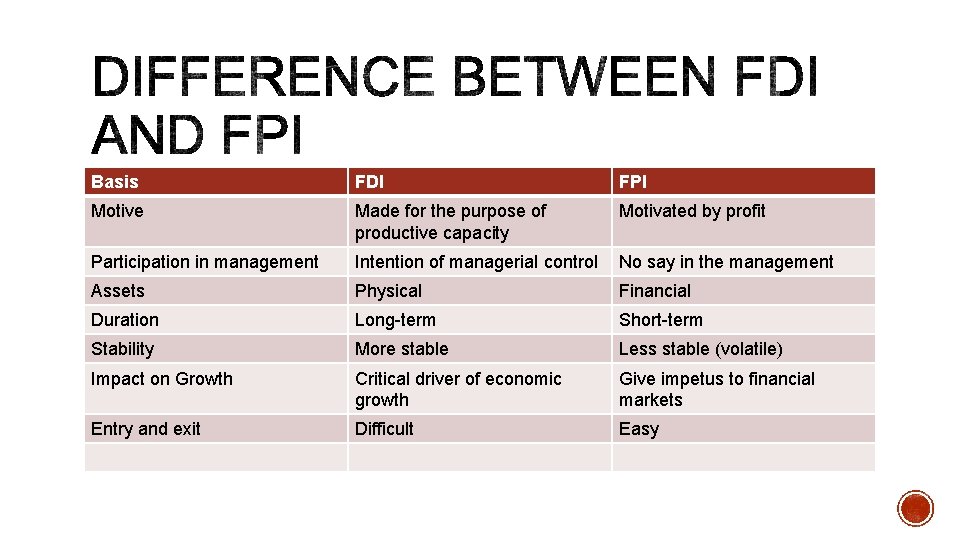

Basis FDI FPI Motive Made for the purpose of productive capacity Motivated by profit Participation in management Intention of managerial control No say in the management Assets Physical Financial Duration Long-term Short-term Stability More stable Less stable (volatile) Impact on Growth Critical driver of economic growth Give impetus to financial markets Entry and exit Difficult Easy

By Target/Assetbased view By Nature of Business Activity By Direction By Motive Basis Of Classification

§ On the basis of direction of flow of funds, FDI can be classified into two types. § INWARD FDI: Inward FDI takes place when foreign capital is invested in local resources. § OUTWARD FDI: Outward FDI takes place when local capital is invested in foreign resources.

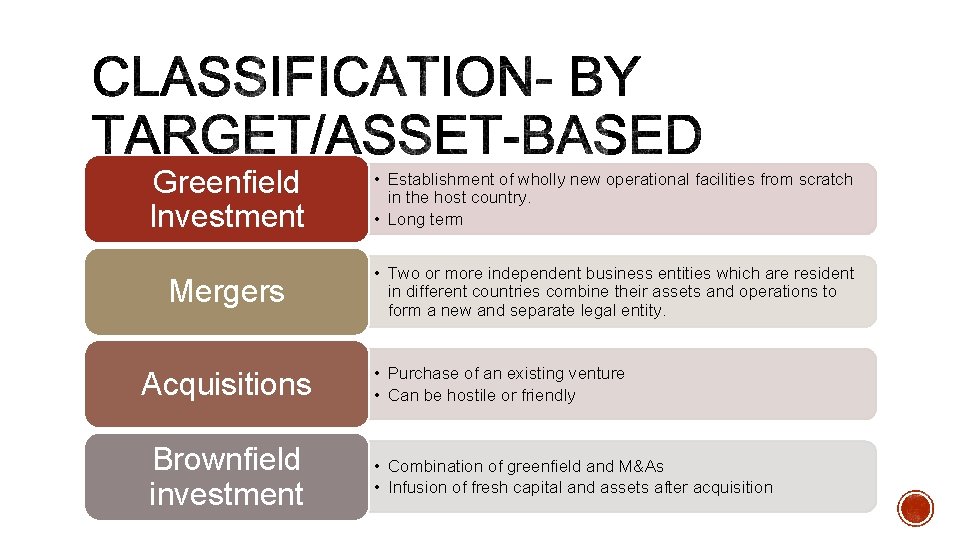

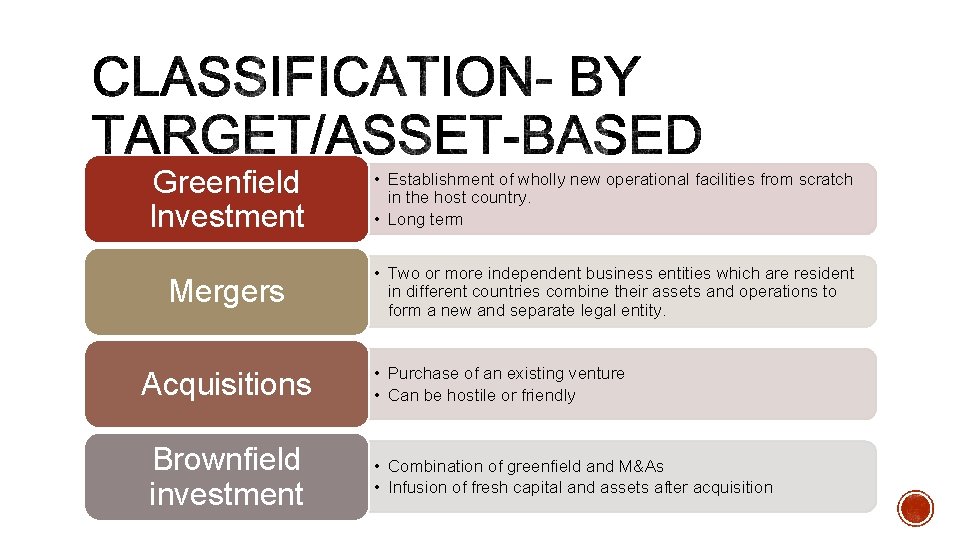

Greenfield Investment • Establishment of wholly new operational facilities from scratch in the host country. • Long term Mergers • Two or more independent business entities which are resident in different countries combine their assets and operations to form a new and separate legal entity. Acquisitions Brownfield investment • Purchase of an existing venture • Can be hostile or friendly • Combination of greenfield and M&As • Infusion of fresh capital and assets after acquisition

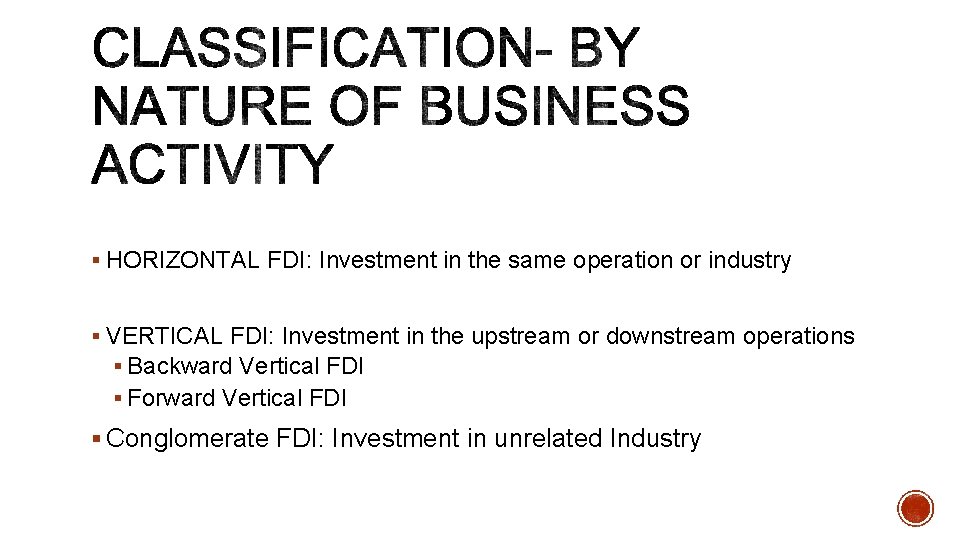

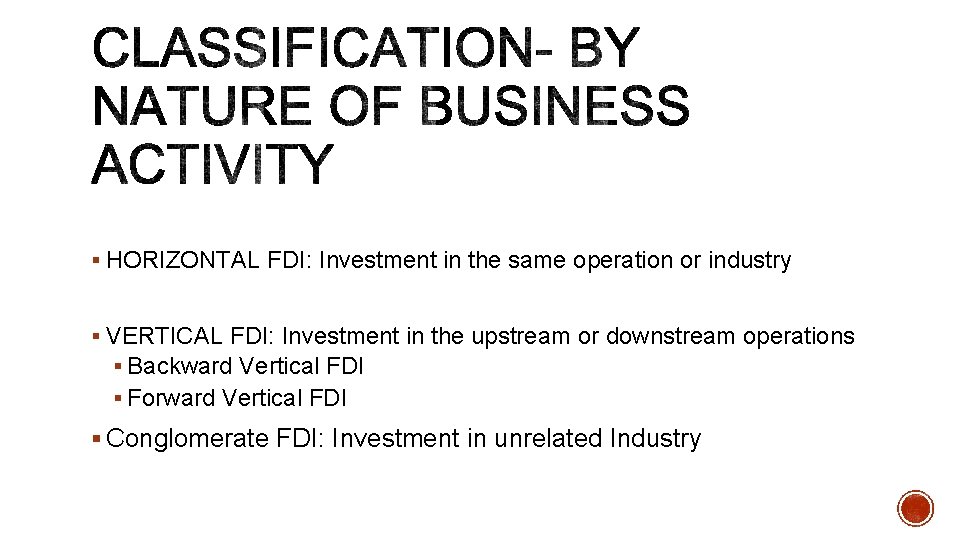

§ HORIZONTAL FDI: Investment in the same operation or industry § VERTICAL FDI: Investment in the upstream or downstream operations § Backward Vertical FDI § Forward Vertical FDI § Conglomerate FDI: Investment in unrelated Industry

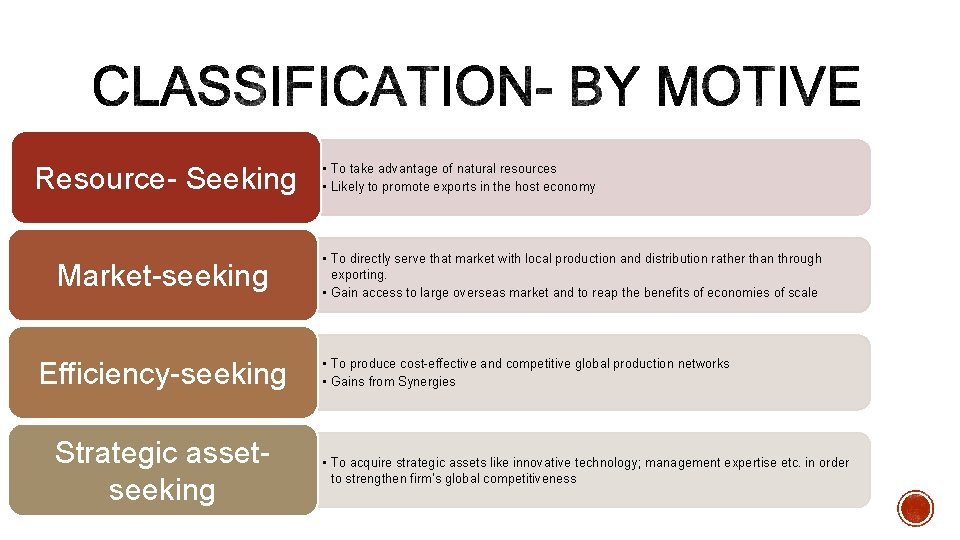

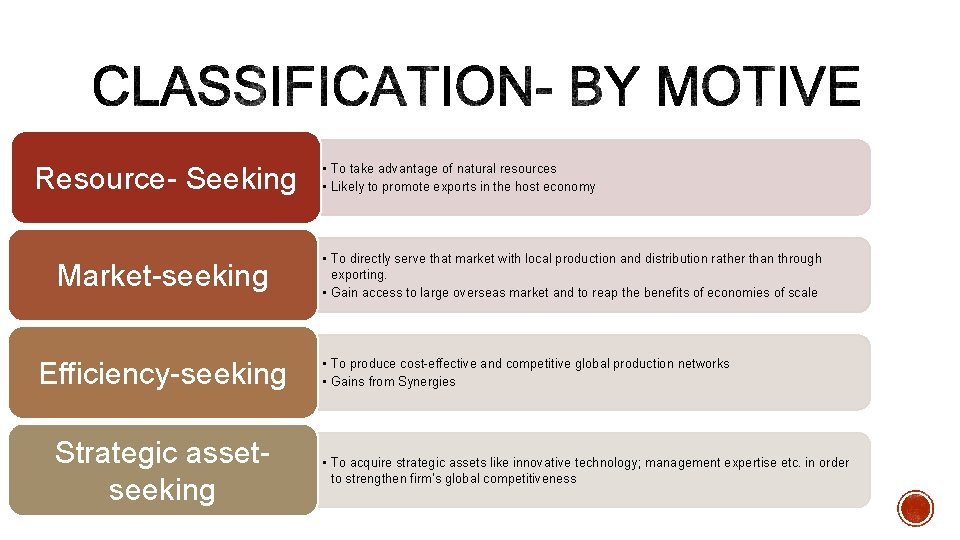

Resource- Seeking Market-seeking Efficiency-seeking Strategic assetseeking • To take advantage of natural resources • Likely to promote exports in the host economy • To directly serve that market with local production and distribution rather than through exporting. • Gain access to large overseas market and to reap the benefits of economies of scale • To produce cost-effective and competitive global production networks • Gains from Synergies • To acquire strategic assets like innovative technology; management expertise etc. in order to strengthen firm’s global competitiveness

§ Resource transfer effects § Employment effects § BOP effects § Effect on competition and Growth § Revenue to Government § Less volatility

§ Adverse effects on Competition § Adverse effects on BOP § National sovereignty and autonomy § Capital intensive technology

§ BOP benefits § Employment effects § Acquisition of skills

§ BOP effects in three ways: § Capital A/C- Initial capital outflow § Current A/C- More Imports § Current A/C- Less Exports § Employment Effects

Pendidikan jarak jauh ukm

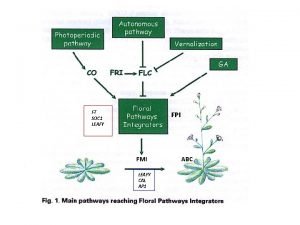

Pendidikan jarak jauh ukm Fca fpi

Fca fpi Fpi nowotwór

Fpi nowotwór Public funds investment act training

Public funds investment act training Agricultural investment funds for developing countries

Agricultural investment funds for developing countries Too foreign for home too foreign for here

Too foreign for home too foreign for here Direct investment definition

Direct investment definition Foreign direct investment in malay

Foreign direct investment in malay Foreign direct investment advantages and disadvantages

Foreign direct investment advantages and disadvantages Chapter 8 foreign direct investment

Chapter 8 foreign direct investment Starbucks foreign direct investment case study

Starbucks foreign direct investment case study Fdi in finland

Fdi in finland Foreign direct investment advantages and disadvantages

Foreign direct investment advantages and disadvantages Foreign indirect investment

Foreign indirect investment Fixed investment and inventory investment

Fixed investment and inventory investment