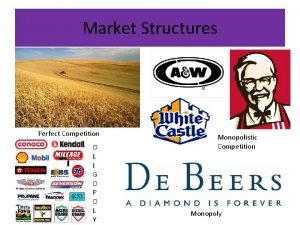

FOUR TYPES OF MARKETS Perfect Competition A market

![ECONOMIC PROFIT AND ACCOUNTING PROFIT Total Profit = [Price - Average cost] * Quantity ECONOMIC PROFIT AND ACCOUNTING PROFIT Total Profit = [Price - Average cost] * Quantity](https://slidetodoc.com/presentation_image_h2/548d769004c48d9272beb301ea1fab7e/image-15.jpg)

- Slides: 38

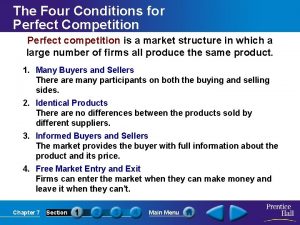

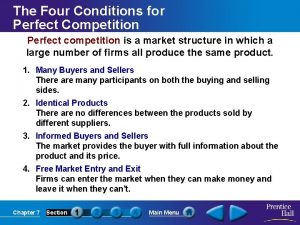

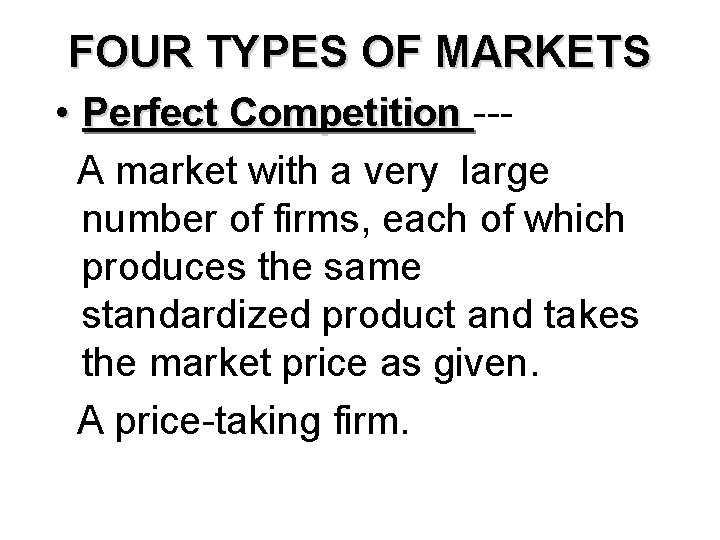

FOUR TYPES OF MARKETS • Perfect Competition --A market with a very large number of firms, each of which produces the same standardized product and takes the market price as given. A price-taking firm.

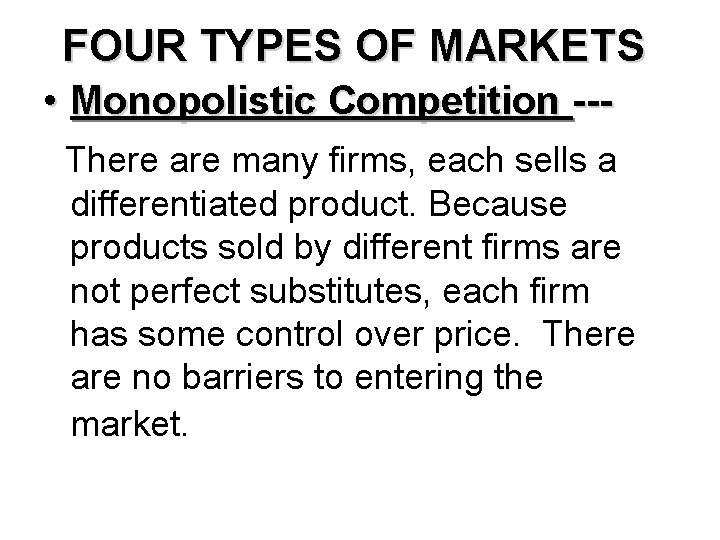

FOUR TYPES OF MARKETS • Monopolistic Competition --There are many firms, each sells a differentiated product. Because products sold by different firms are not perfect substitutes, each firm has some control over price. There are no barriers to entering the market.

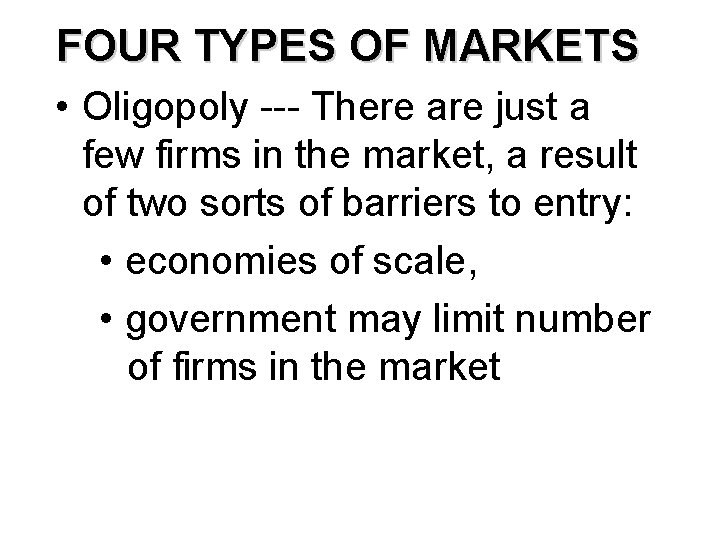

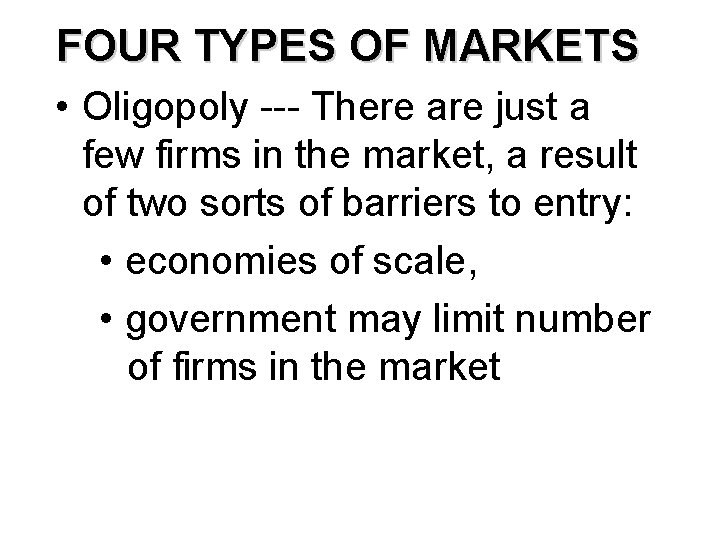

FOUR TYPES OF MARKETS • Oligopoly --- There are just a few firms in the market, a result of two sorts of barriers to entry: • economies of scale, • government may limit number of firms in the market

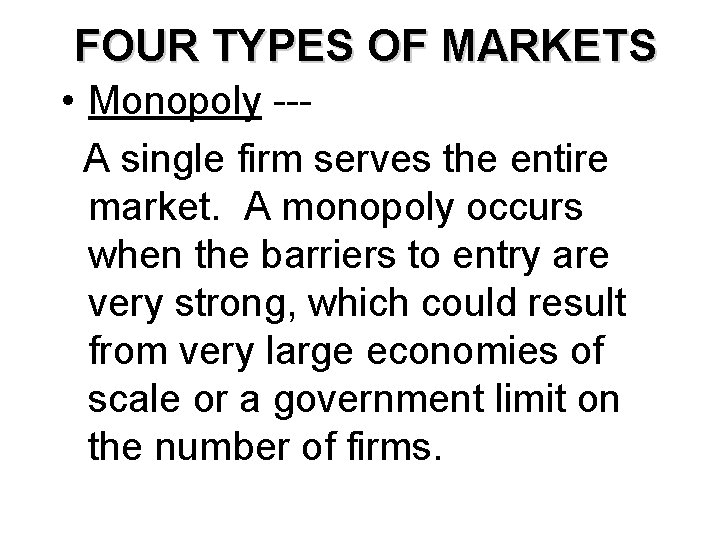

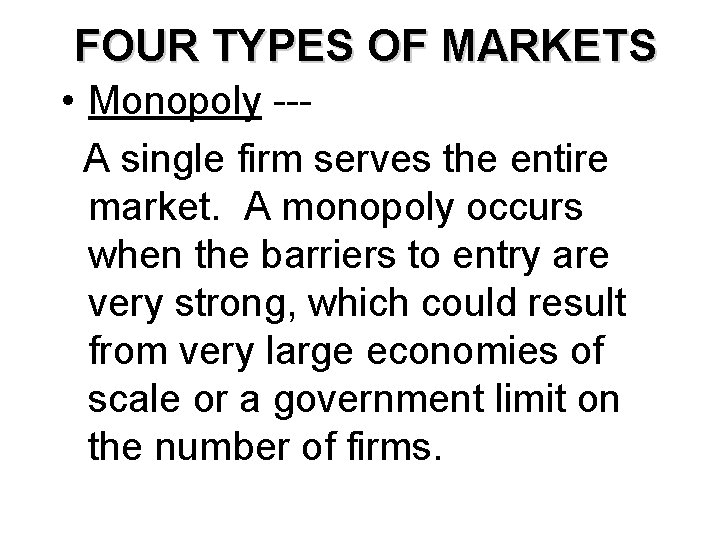

FOUR TYPES OF MARKETS • Monopoly --A single firm serves the entire market. A monopoly occurs when the barriers to entry are very strong, which could result from very large economies of scale or a government limit on the number of firms.

FOUR TYPES OF MARKETS • Monopoly --EXAMPLES large scale economies: • local phone service, • electric power generation, established by government policy: • drugs covered by patents, • concessions in National Parks

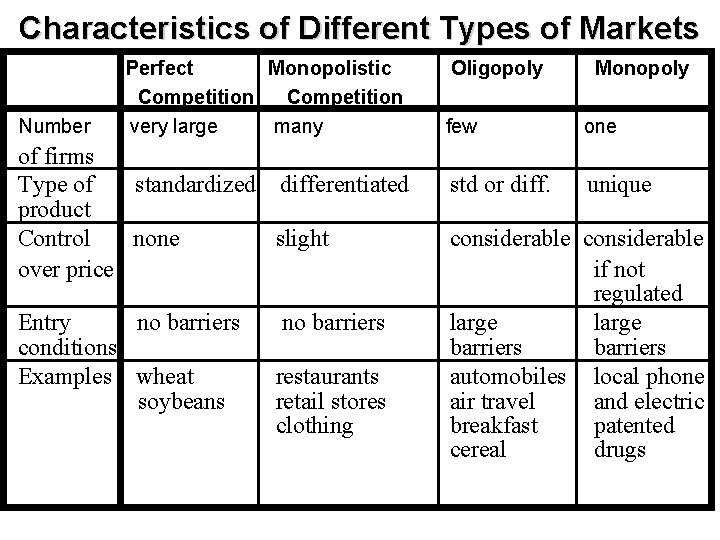

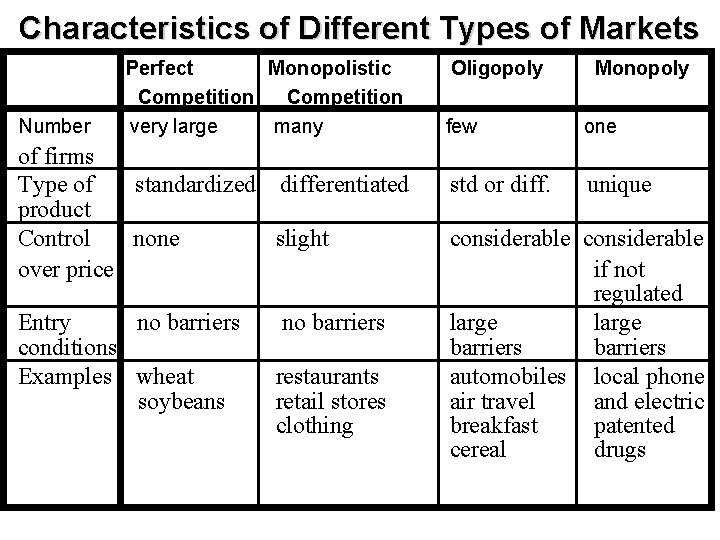

Characteristics of Different Types of Markets Number Perfect Monopolistic Competition very large many of firms Type of standardized differentiated product Control none slight over price Entry no barriers conditions Examples wheat soybeans no barriers restaurants retail stores clothing Oligopoly Monopoly few one std or diff. unique considerable if not regulated large barriers automobiles local phone air travel and electric breakfast patented cereal drugs

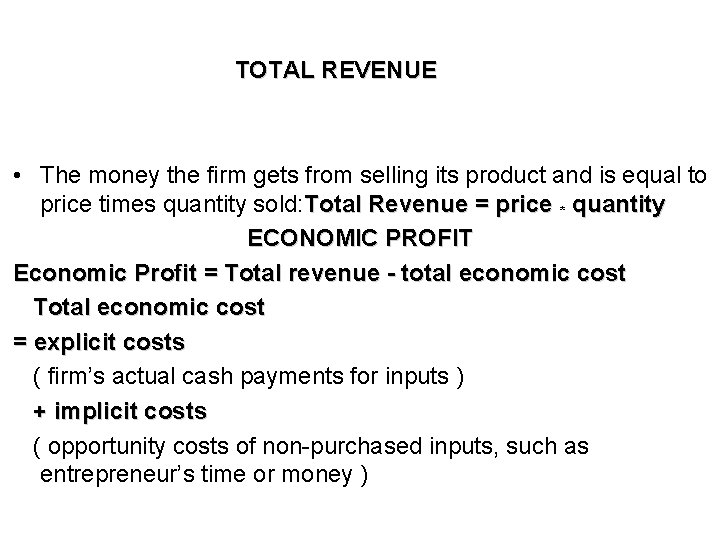

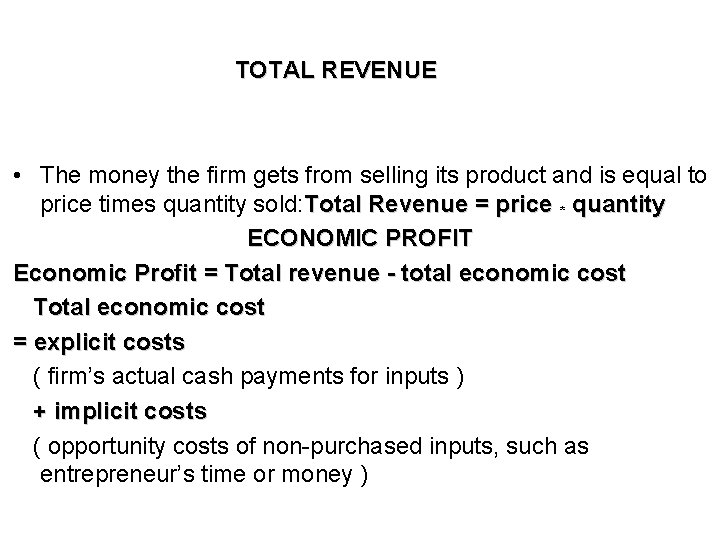

TOTAL REVENUE • The money the firm gets from selling its product and is equal to price times quantity sold: Total Revenue = price * quantity ECONOMIC PROFIT Economic Profit = Total revenue - total economic cost Total economic cost = explicit costs ( firm’s actual cash payments for inputs ) + implicit costs ( opportunity costs of non-purchased inputs, such as entrepreneur’s time or money )

ECONOMIC PROFIT Total revenue - total economic cost Total economic cost = explicit costs ( firm’s actual cash payments for inputs ) + implicit costs ( opportunity costs of non-purchased inputs, entrepreneur’s time or money ) such as

THE MARGINAL PRINCIPLE Increase the level of an activity if its marginal benefit exceeds its marginal cost, but reduce the level if the marginal cost exceeds the marginal benefit. If possible, pick the level at which the marginal benefit equals the marginal cost.

Marginal Benefit of Firm’s Activity Extra revenue earned by selling one more unit of output. Marginal Revenue The change in total revenue that results from selling one more unit of output. For a perfectly-competitive firm, marginal revenue equals market price. EXAMPLE Farmer sells 100 bushels of corn @ $200; Farmer sells 101 bushels of corn @ $202; Marginal revenue of 101 st bushel is $2 (i. e. , the same as price).

Applying Marginal Principle to Output Decision The marginal principle suggests that the firm should pick the quantity of output at which marginal revenue equals marginal cost: Marginal revenue = Marginal cost Continue to increase output as long as extra revenue from one unit of output exceeds extra cost. Applying Marginal Principle to Perfect Competition For a perfectly-competitive (price-taking) firm, marginal revenue equals the market price, so the firm should pick quantity of output at which price equals marginal cost: Price = Marginal Cost

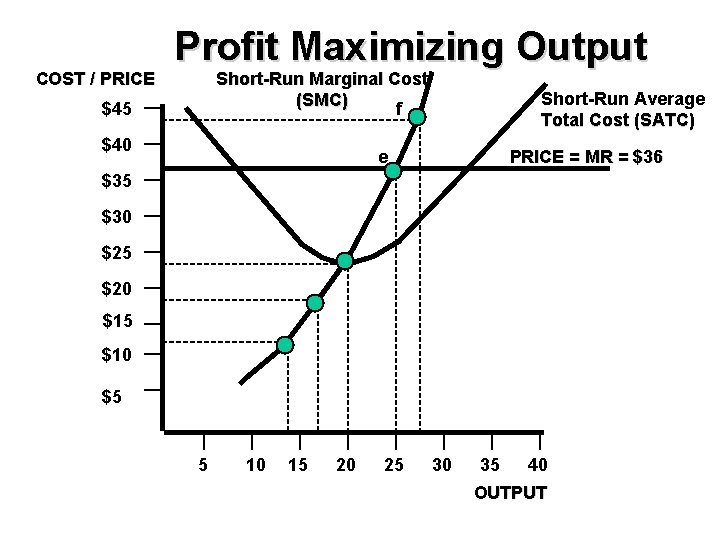

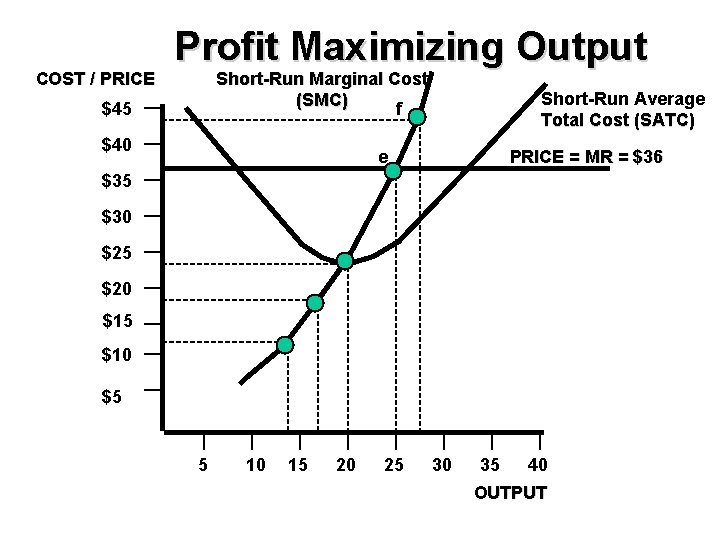

Picking the Profit-Maximizing Output Level Output 14 17 20 25 27 Marginal Revenue = Price $36 $36 $36 Marginal Cost $12 $18 $24 $36 $43

COST / PRICE Profit Maximizing Output Short-Run Marginal Cost (SMC) f $45 $40 Short-Run Average Total Cost (SATC) e PRICE = MR = $36 $35 $30 $25 $20 $15 $10 $5 5 10 15 20 25 30 35 40 OUTPUT

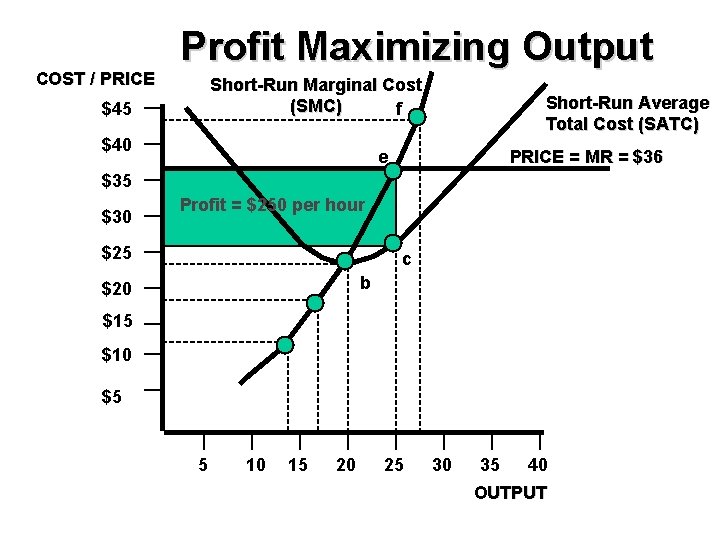

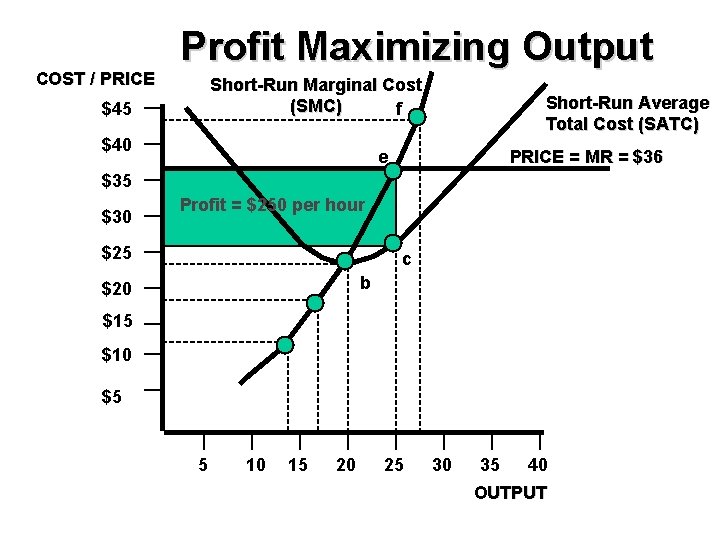

COST / PRICE Profit Maximizing Output Short-Run Marginal Cost (SMC) f $45 $40 Short-Run Average Total Cost (SATC) e PRICE = MR = $36 $35 $30 Profit = $250 per hour $25 c b $20 $15 $10 $5 5 10 15 20 25 30 35 40 OUTPUT

![ECONOMIC PROFIT AND ACCOUNTING PROFIT Total Profit Price Average cost Quantity ECONOMIC PROFIT AND ACCOUNTING PROFIT Total Profit = [Price - Average cost] * Quantity](https://slidetodoc.com/presentation_image_h2/548d769004c48d9272beb301ea1fab7e/image-15.jpg)

ECONOMIC PROFIT AND ACCOUNTING PROFIT Total Profit = [Price - Average cost] * Quantity If average cost of producing 25 chairs is $26: firm’s average profit = $36 - $26 = $10 firm’s total profit = $10 • 25 chairs = $250 firm’s total profit = [$36 - $26] • 25 = $250

COST / PRICE Profit Maximizing Output Short-Run Marginal Cost (SMC) f $45 $40 Short-Run Average Total Cost (SATC) e $35 $30 $25 PRICE = MR = $24 b $20 $15 $10 $5 5 10 15 20 25 30 35 40 OUTPUT

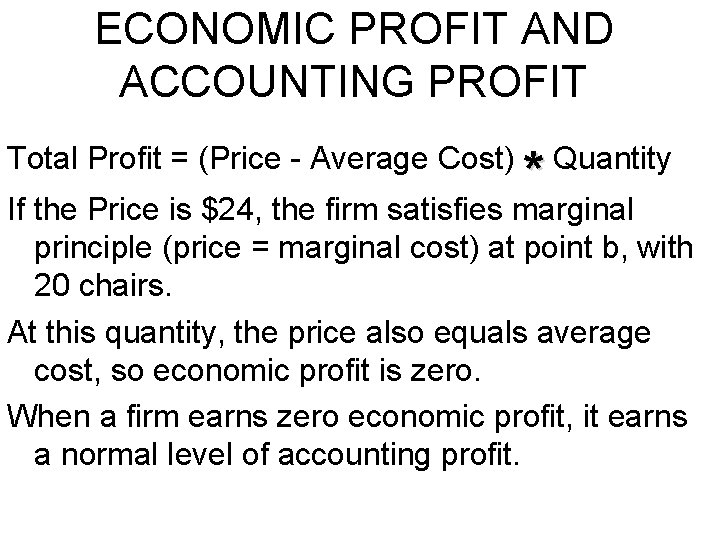

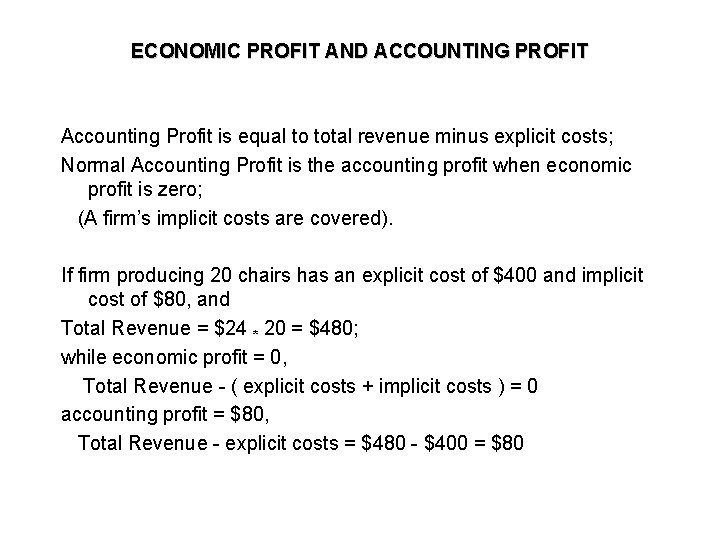

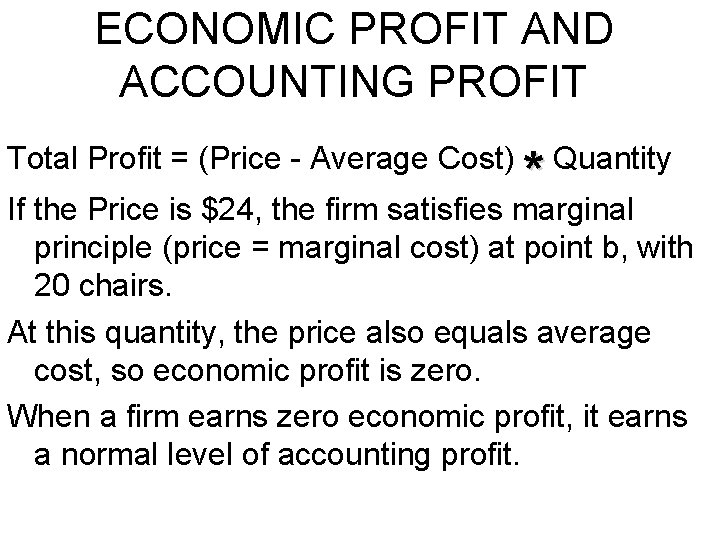

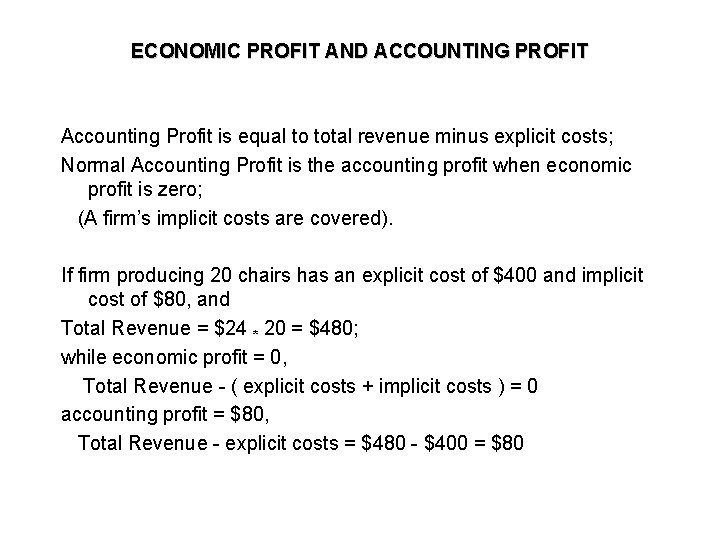

ECONOMIC PROFIT AND ACCOUNTING PROFIT Total Profit = (Price - Average Cost) * Quantity If the Price is $24, the firm satisfies marginal principle (price = marginal cost) at point b, with 20 chairs. At this quantity, the price also equals average cost, so economic profit is zero. When a firm earns zero economic profit, it earns a normal level of accounting profit.

ECONOMIC PROFIT AND ACCOUNTING PROFIT Accounting Profit is equal to total revenue minus explicit costs; Normal Accounting Profit is the accounting profit when economic profit is zero; (A firm’s implicit costs are covered). If firm producing 20 chairs has an explicit cost of $400 and implicit cost of $80, and Total Revenue = $24 * 20 = $480; while economic profit = 0, Total Revenue - ( explicit costs + implicit costs ) = 0 accounting profit = $80, Total Revenue - explicit costs = $480 - $400 = $80

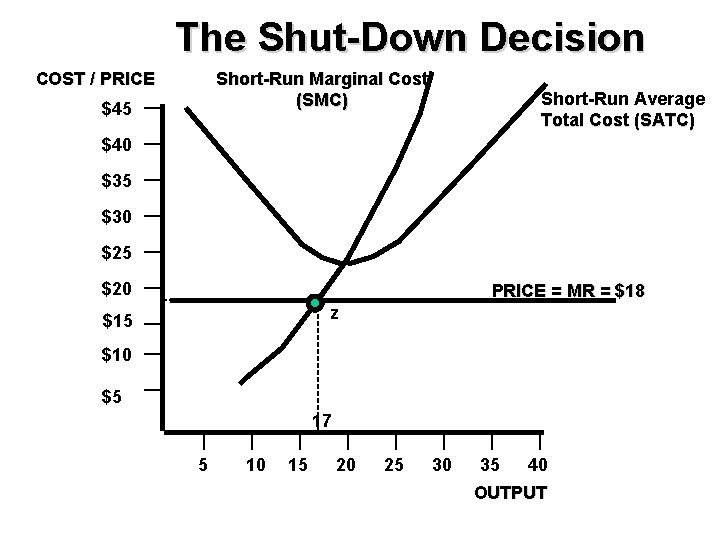

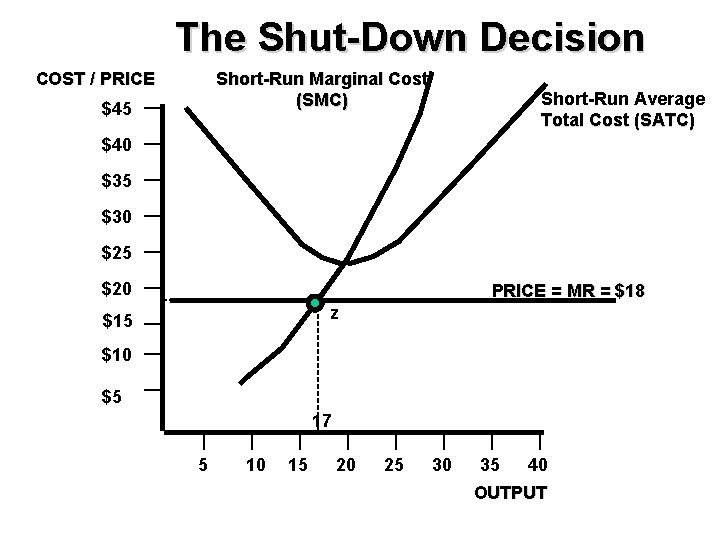

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 $30 $25 $20 PRICE = MR = $18 z $15 $10 $5 17 5 10 15 20 25 30 35 40 OUTPUT

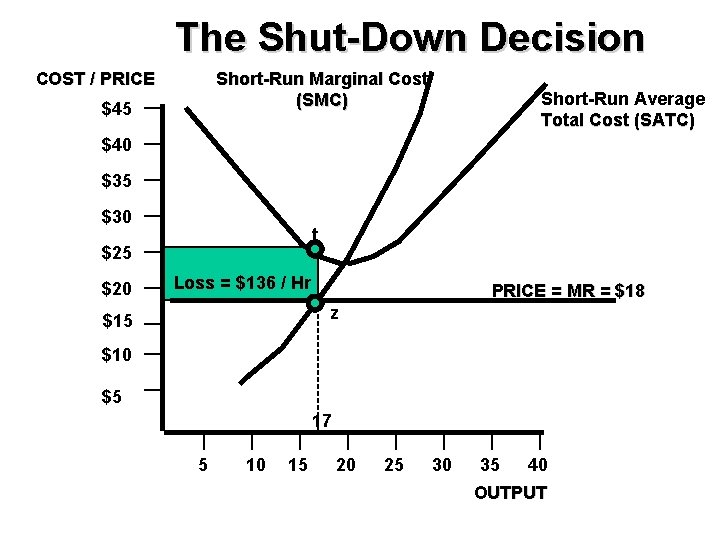

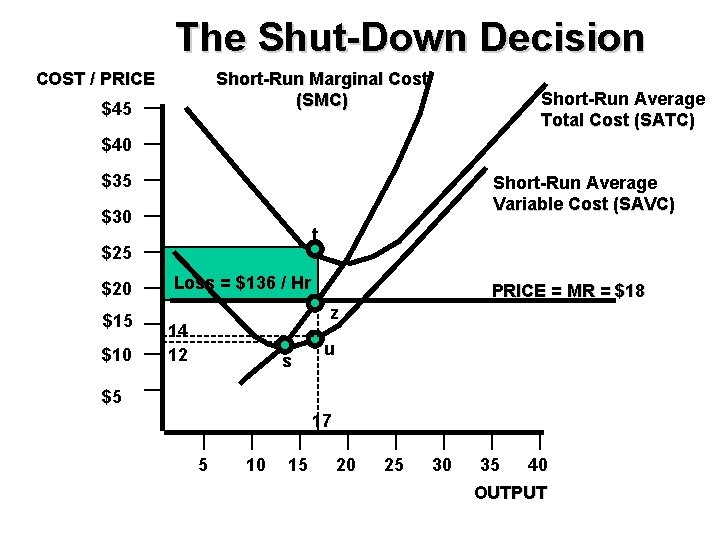

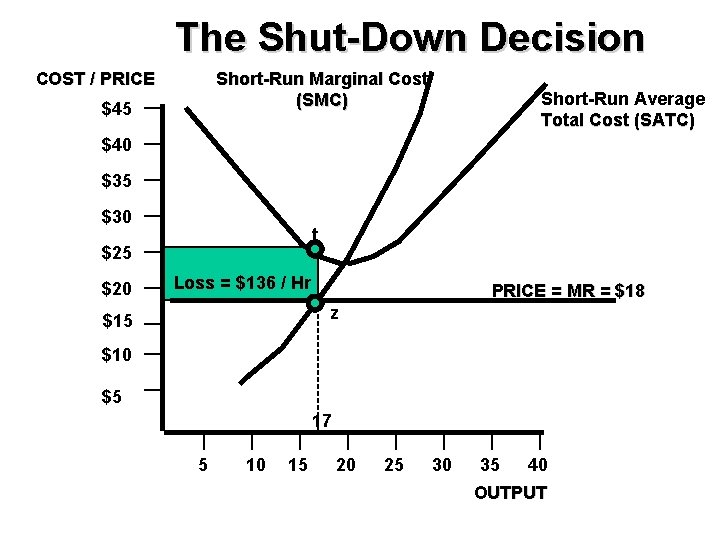

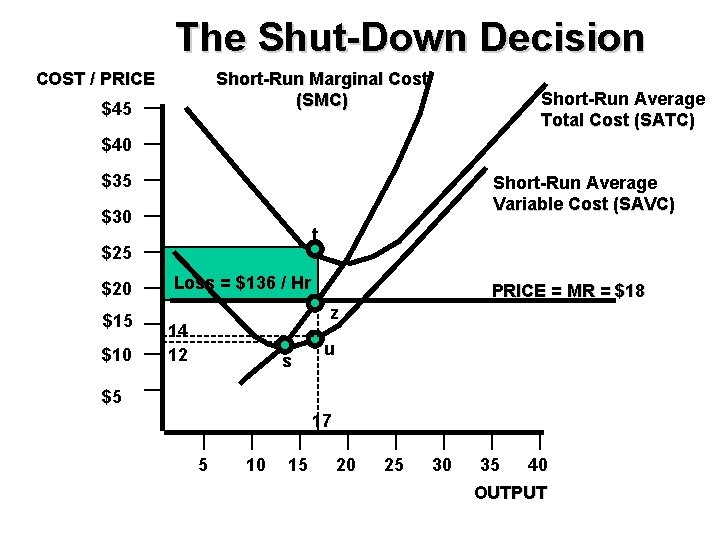

The Shut-Down Decision If market price of chairs drops to $18, the firm will produce 17 chairs per hour (point z).

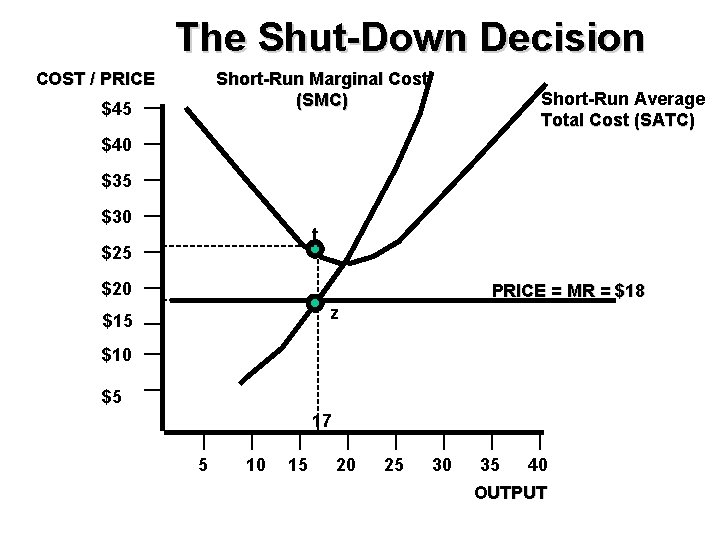

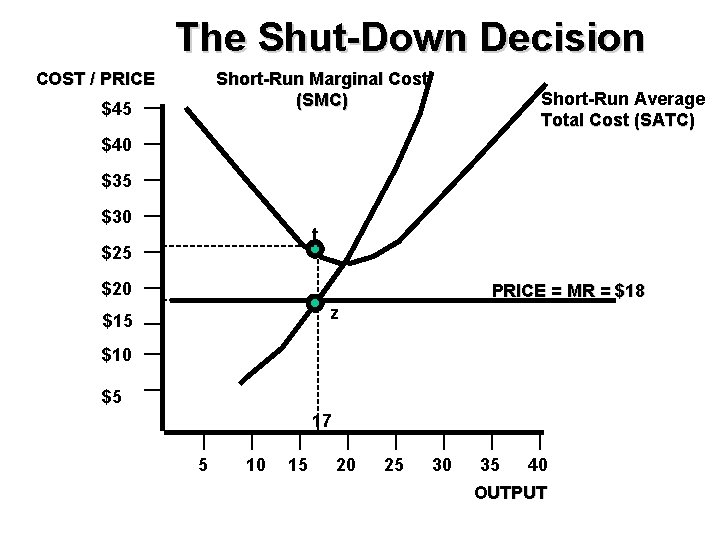

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 $30 t $25 $20 PRICE = MR = $18 z $15 $10 $5 17 5 10 15 20 25 30 35 40 OUTPUT

The Shut-Down Decision At an output of 17 chairs per hour, the average total cost becomes $26 (point t). Since the average cost exceeds the market price by $8, the firm will lose $136 per hour. $8 * 17 = $136 *

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 $30 t $25 $20 Loss = $136 / Hr PRICE = MR = $18 z $15 $10 $5 17 5 10 15 20 25 30 35 40 OUTPUT

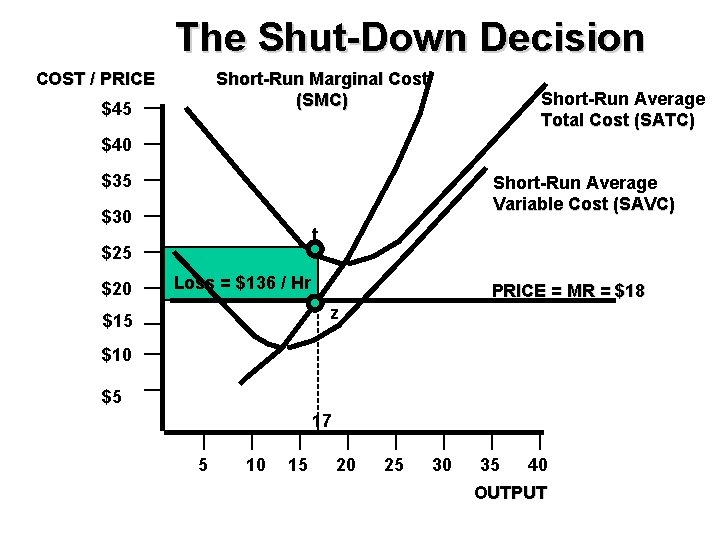

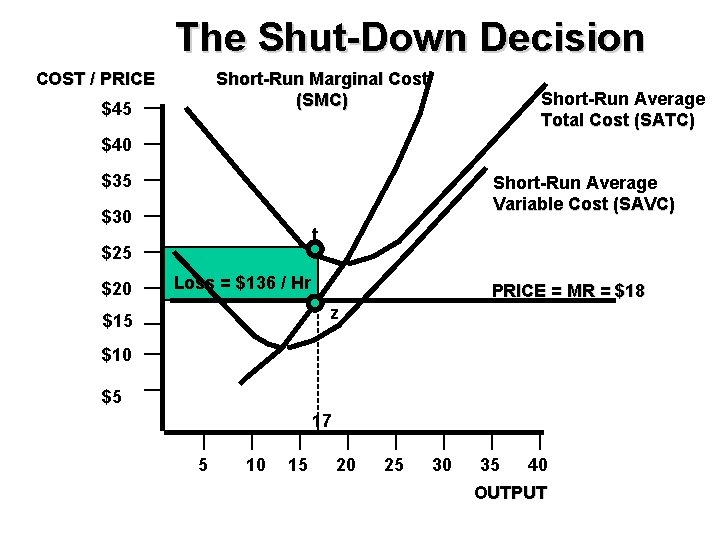

The Shut-Down Decision The firm should continue to operate an unprofitable facility if the benefit of operating the facility exceeds the cost.

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 Short-Run Average Variable Cost (SAVC) $30 t $25 $20 Loss = $136 / Hr PRICE = MR = $18 z $15 $10 $5 17 5 10 15 20 25 30 35 40 OUTPUT

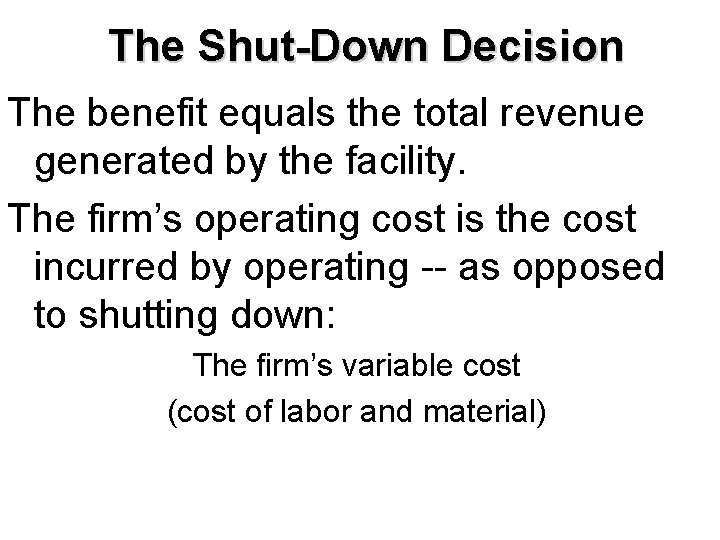

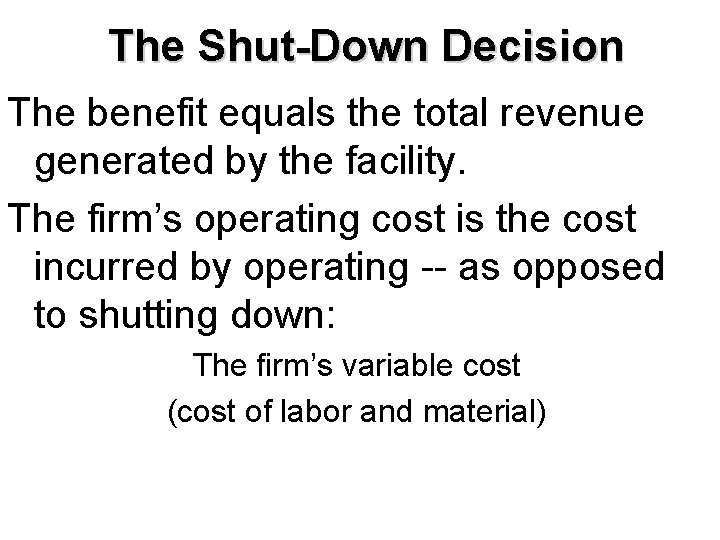

The Shut-Down Decision The benefit equals the total revenue generated by the facility. The firm’s operating cost is the cost incurred by operating -- as opposed to shutting down: The firm’s variable cost (cost of labor and material)

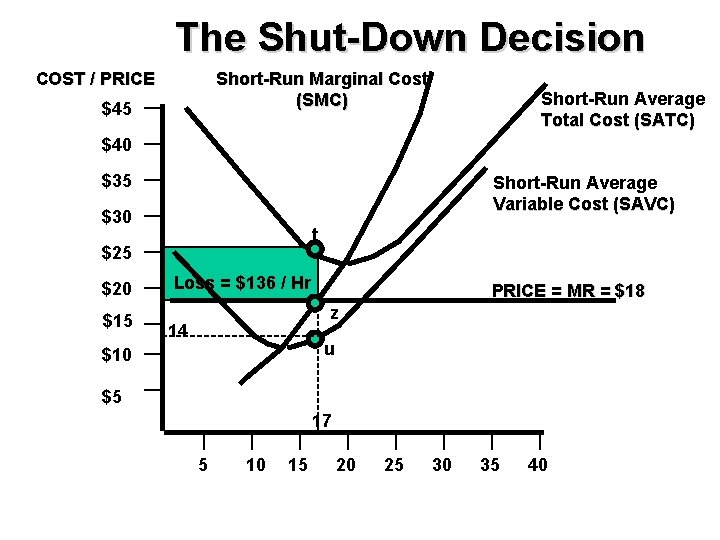

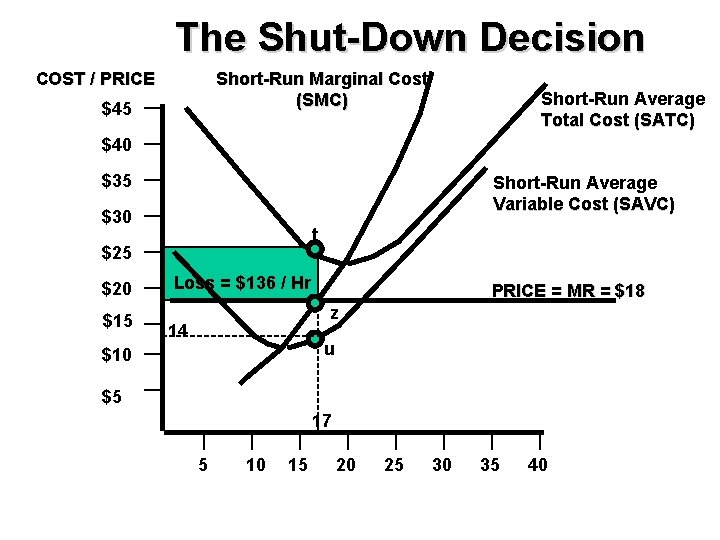

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 Short-Run Average Variable Cost (SAVC) $30 t $25 $20 $15 Loss = $136 / Hr PRICE = MR = $18 z 14 u $10 $5 17 5 10 15 20 25 30 35 40

The Shut-Down Decision The benefit = Total Revenue: Total Revenue = Price quantity sold * Total Revenue = $18 17 = $306 * The firm’s operating cost = variable cost: Total variable cost = average variable cost * quantity sold Total variable cost = $14 * 17 = $238 Since the benefit ($306) is greater than the operating cost ($238), continue to operate

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 Short-Run Average Variable Cost (SAVC) $30 t $25 $20 $15 $10 Loss = $136 / Hr PRICE = MR = $18 z 14 12 s u $5 17 5 10 15 20 25 30 35 40 OUTPUT

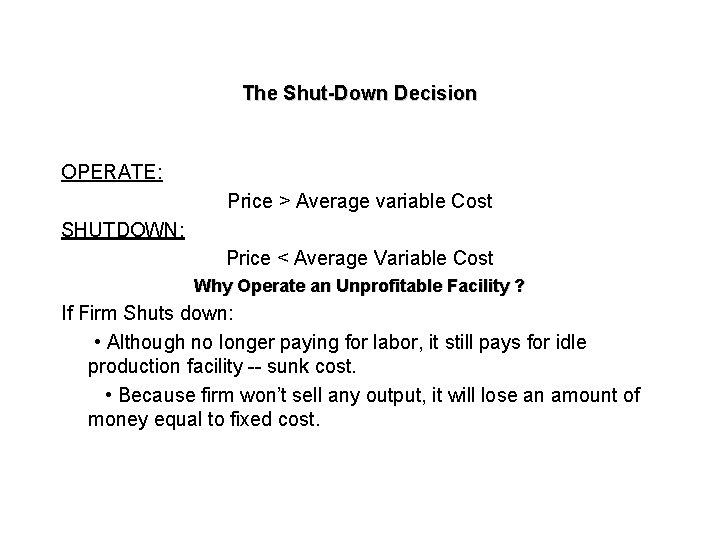

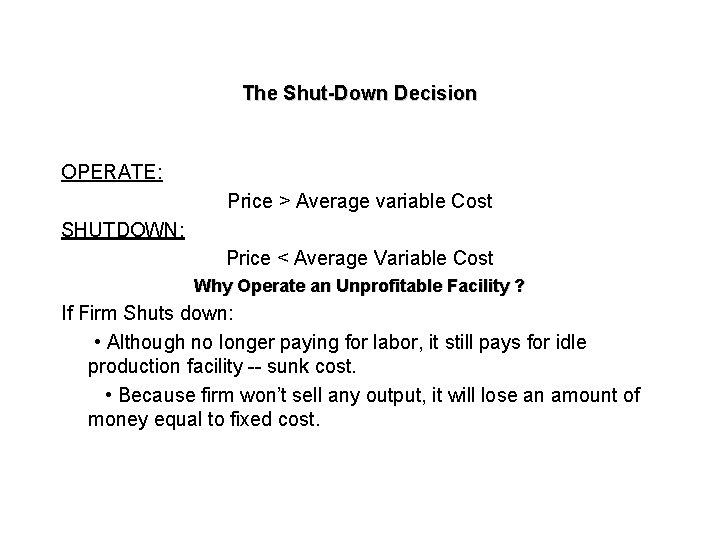

The Shut-Down Decision OPERATE: Price > Average variable Cost SHUTDOWN: Price < Average Variable Cost Why Operate an Unprofitable Facility ? If Firm Shuts down: • Although no longer paying for labor, it still pays for idle production facility -- sunk cost. • Because firm won’t sell any output, it will lose an amount of money equal to fixed cost.

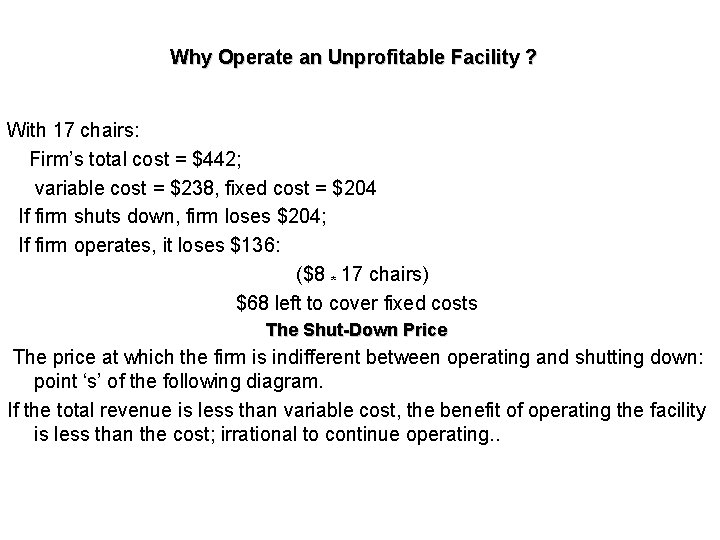

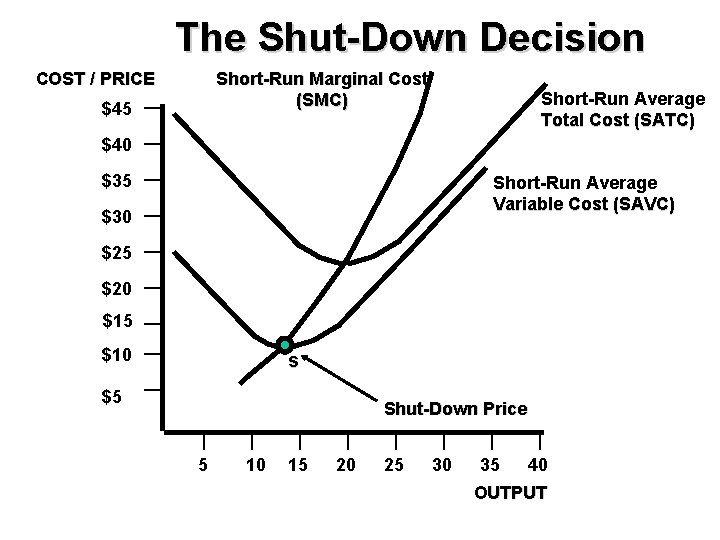

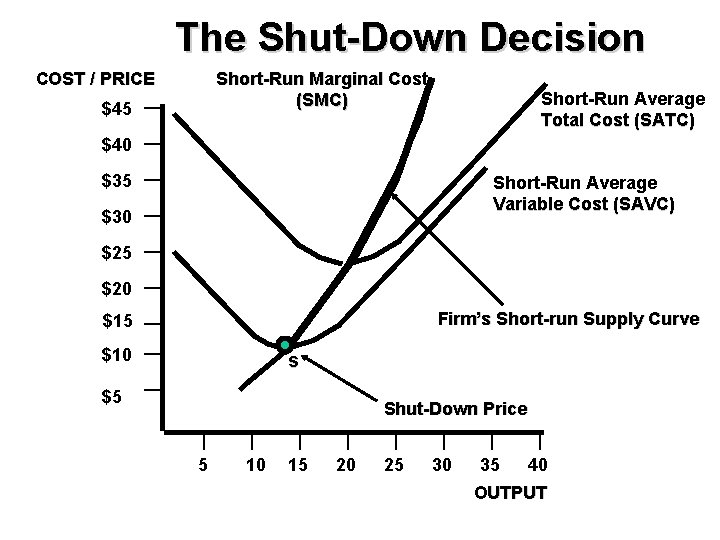

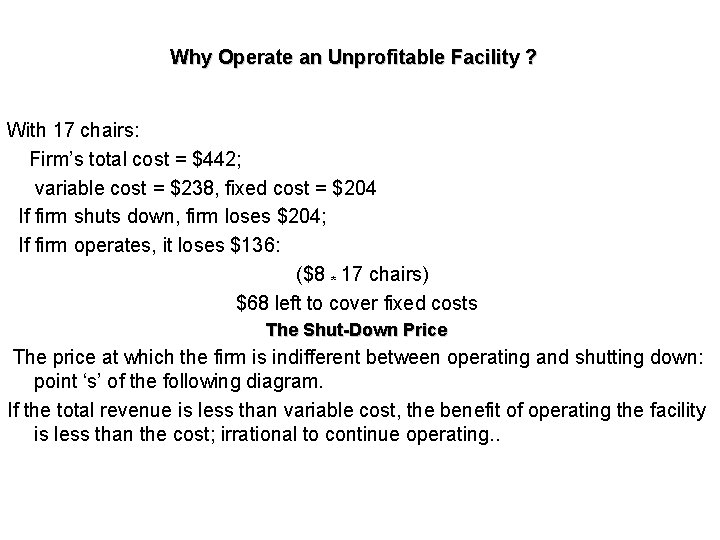

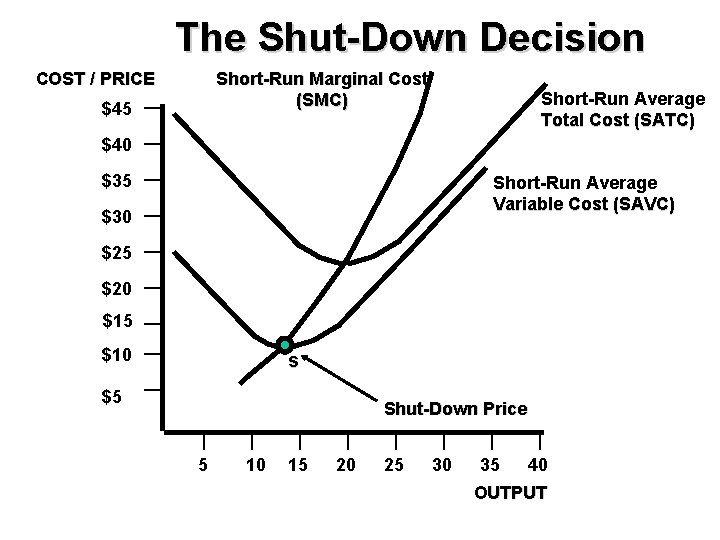

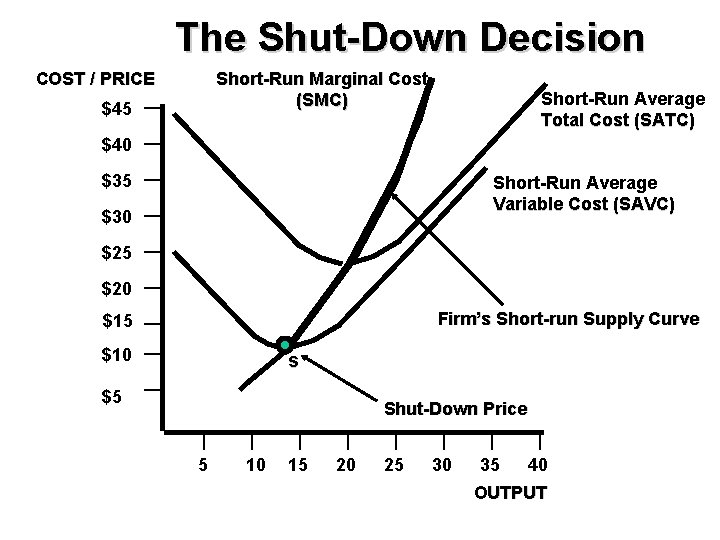

Why Operate an Unprofitable Facility ? With 17 chairs: Firm’s total cost = $442; variable cost = $238, fixed cost = $204 If firm shuts down, firm loses $204; If firm operates, it loses $136: ($8 * 17 chairs) $68 left to cover fixed costs The Shut-Down Price The price at which the firm is indifferent between operating and shutting down: point ‘s’ of the following diagram. If the total revenue is less than variable cost, the benefit of operating the facility is less than the cost; irrational to continue operating. .

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 Short-Run Average Variable Cost (SAVC) $30 $25 $20 $15 $10 s $5 Shut-Down Price 5 10 15 20 25 30 35 40 OUTPUT

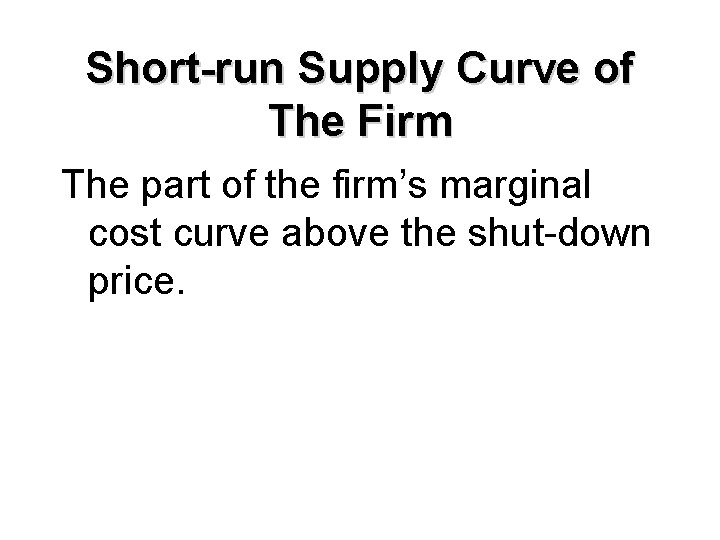

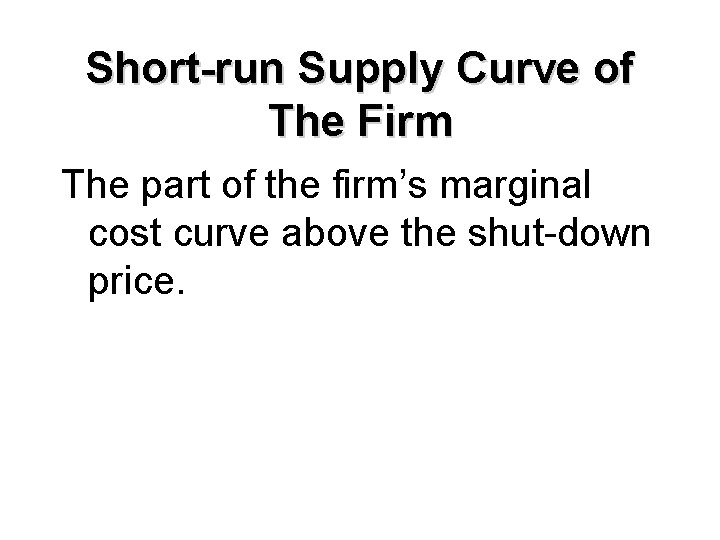

Short-run Supply Curve of The Firm The part of the firm’s marginal cost curve above the shut-down price.

The Shut-Down Decision COST / PRICE Short-Run Marginal Cost (SMC) $45 Short-Run Average Total Cost (SATC) $40 $35 Short-Run Average Variable Cost (SAVC) $30 $25 $20 Firm’s Short-run Supply Curve $15 $10 s $5 Shut-Down Price 5 10 15 20 25 30 35 40 OUTPUT

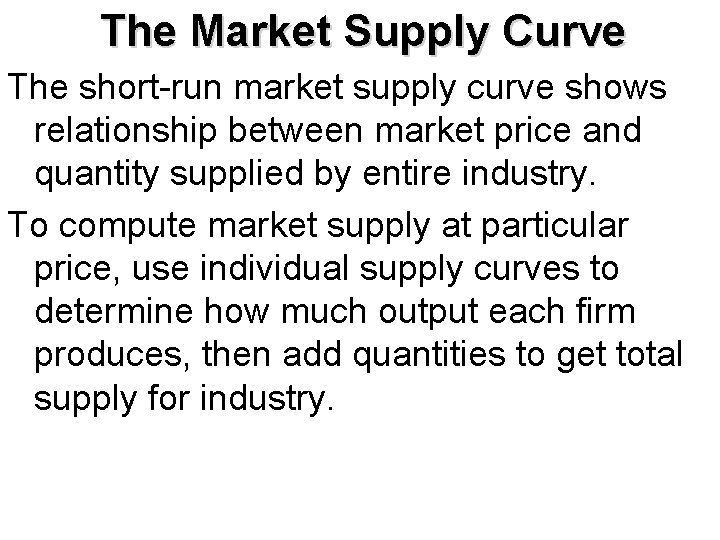

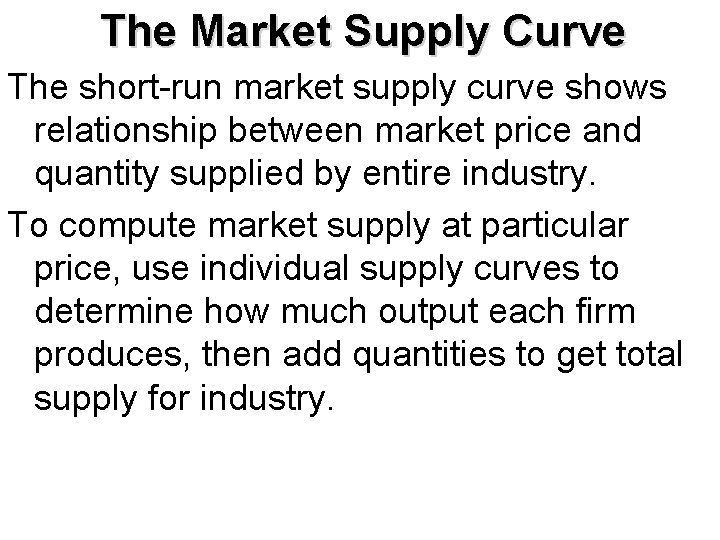

The Market Supply Curve The short-run market supply curve shows relationship between market price and quantity supplied by entire industry. To compute market supply at particular price, use individual supply curves to determine how much output each firm produces, then add quantities to get total supply for industry.

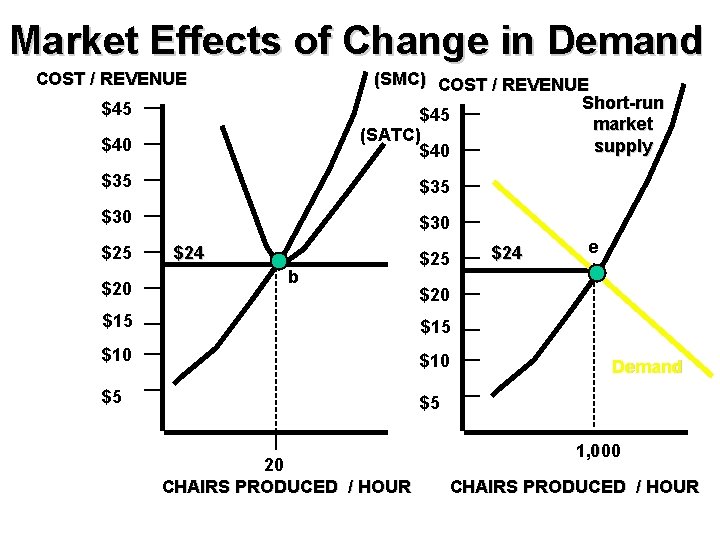

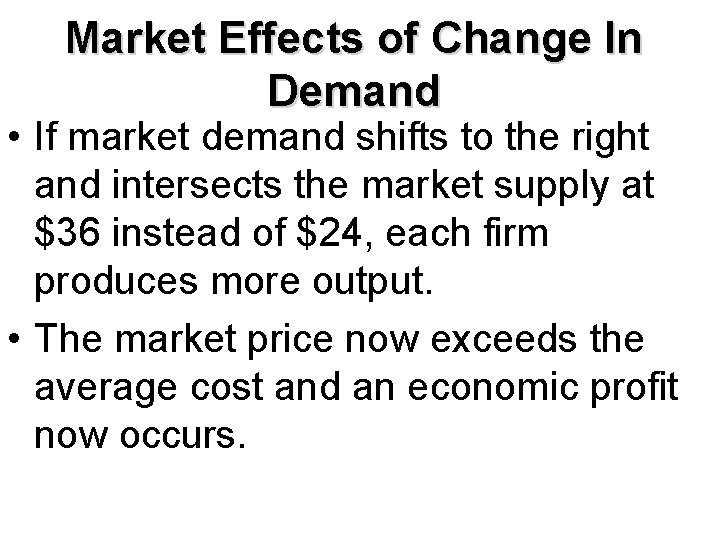

Market Effects of Change in Demand COST / REVENUE (SMC) COST / REVENUE Short-run $45 market (SATC) supply $40 $45 $40 $35 $30 $25 $20 $24 b $25 e $20 $15 $10 $5 $5 20 CHAIRS PRODUCED / HOUR $24 Demand 1, 000 CHAIRS PRODUCED / HOUR

Market Effects of Change In Demand • If market demand shifts to the right and intersects the market supply at $36 instead of $24, each firm produces more output. • The market price now exceeds the average cost and an economic profit now occurs.

Market Effects of Change in Demand COST / REVENUE $45 $40 $35 $30 $25 $20 $36 ECONOMIC PROFIT (SMC) COST / REVENUE $45 (SATC) $40 $36 $35 $24 b f $30 $25 $24 e New Demand $20 $15 $10 $5 $5 20 25 CHAIRS PRODUCED / HOUR Short-run market supply Original Demand 1, 000 1, 250 CHAIRS PRODUCED / HOUR

Lump sum subsidy

Lump sum subsidy Perfect competition vs monopolistic competition

Perfect competition vs monopolistic competition Competition refers to

Competition refers to Is milk a perfectly competitive market

Is milk a perfectly competitive market Oligopoly vs monopoly examples

Oligopoly vs monopoly examples Factor market perfect competition

Factor market perfect competition Difference between perfect competition and monopoly market

Difference between perfect competition and monopoly market Difference between perfect competition and monopoly market

Difference between perfect competition and monopoly market Example of pure competition

Example of pure competition Monopoly vs oligopoly venn diagram

Monopoly vs oligopoly venn diagram Market leader market challenger market follower

Market leader market challenger market follower Bases of market segmentation

Bases of market segmentation Perfect tenses

Perfect tenses Pure competition market

Pure competition market Perfect/pure competition definition

Perfect/pure competition definition Lesson quiz 7-1 market structures

Lesson quiz 7-1 market structures How does deregulation encourage competition in a market

How does deregulation encourage competition in a market Market structures graphic organizer

Market structures graphic organizer Perfect competition side by side graphs

Perfect competition side by side graphs Short run equilibrium under perfect competition

Short run equilibrium under perfect competition Supply curve under perfect competition

Supply curve under perfect competition Shut down point

Shut down point Barriers to entry for perfect competition

Barriers to entry for perfect competition Long run market supply curve

Long run market supply curve Disadvantages of perfect competition

Disadvantages of perfect competition Many buyers and sellers

Many buyers and sellers Shut down point in perfect competition

Shut down point in perfect competition Why is starbucks a monopolistic competition

Why is starbucks a monopolistic competition Barriers to entry for perfect competition

Barriers to entry for perfect competition Revenue maximisation point

Revenue maximisation point Pricing and output decisions in perfect competition

Pricing and output decisions in perfect competition Government monopoly

Government monopoly Difference between short run and long run economics

Difference between short run and long run economics Three characteristics of perfect competition

Three characteristics of perfect competition Price determination under perfect competition

Price determination under perfect competition Advantages of monopoly

Advantages of monopoly Supernormal profit in perfect competition

Supernormal profit in perfect competition P = mc

P = mc Graphing perfect competition

Graphing perfect competition