Fluor Procurement Overview China Sourcing Petroleum Equipment Summit

- Slides: 21

Fluor Procurement Overview China Sourcing Petroleum Equipment Summit 2012 © 2012 Fluor Corporation. All Rights Reserved.

Fluor China Sourcing Petroleum Equipment Summit 2012 Global Petrochemical Project Execution Discussion Topics u. Fluor u. Petrochemical u. Procurement u. Fluor Project Sourcing Trends Execution Strategies Prospect Update 2

Fluor Corporation Executive Overview u One of the world’s leading publicly traded EPCM companies u Over 1, 000 projects annually, serving more than 600 clients in 66 different countries u More than 42, 000 employees – 1, 900 Procurement professionals u Offices in 28 countries on 6 continents u 100 years of experience 3

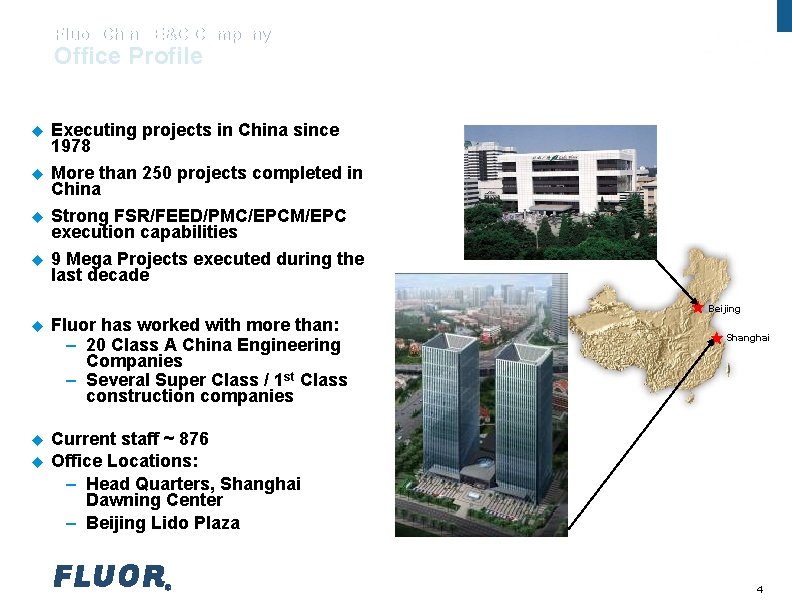

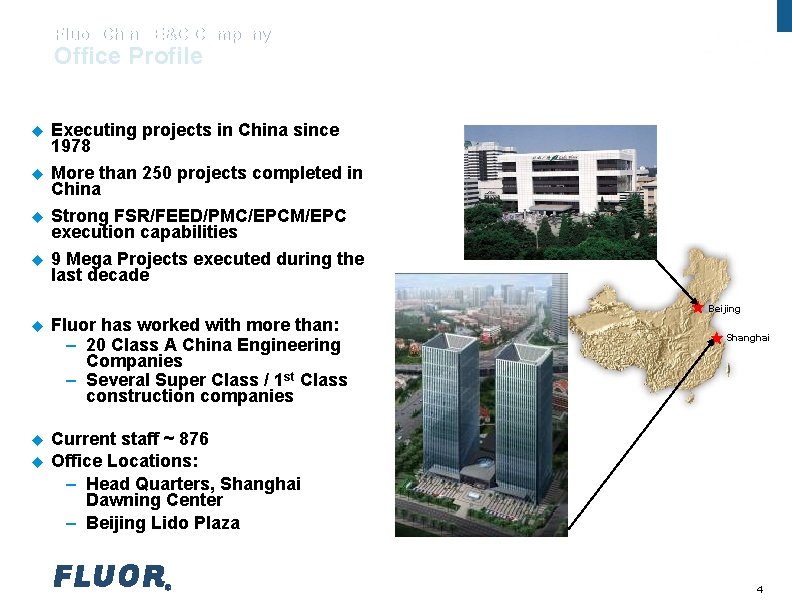

Fluor China E&C Company Office Profile u u Executing projects in China since 1978 More than 250 projects completed in China Strong FSR/FEED/PMC/EPCM/EPC execution capabilities 9 Mega Projects executed during the last decade Beijing u Fluor has worked with more than: – 20 Class A China Engineering Companies – Several Super Class / 1 st Class construction companies u Current staff ~ 876 Office Locations: – Head Quarters, Shanghai Dawning Center – Beijing Lido Plaza u Shanghai 4

Fluor China E&C Company Customer Value Proposition u Dependability and Reputation: Proven track record of successful project execution in China - minimizing clients’ risk exposure, worldclass reputation in project management, systems and tools. u Depth and capability of resources, including access to world wide expertise u Unmatched capability with very large projects but also with small and medium sized projects. u Full range of services from FSR, conceptual, self-perform design, procurement, construction, start-up, commissioning to O&M. u Our world class and leading track record in Safety in China u Class A Design and Pressure Piping QC and Class 1 Construction License u Large and highly capable China Sourcing center allowing customers to maximize China content whilst meeting safety and quality criteria u Extensive fabrication management experience – over US$ 1 billion in the last 3~4 years. 5

Fluor Procurement Sourcing and Procurement Trends Current Sourcing and Procurement Trends u. Capital Project Market u. Development u. Best of Local Supply Content Capabilities Country Sourcing (BCS) u. Modularization Execution Strategies 6

Fluor Procurement Current Sourcing and Procurement Trends Petrochemical Capital Project Market Impacts u Petrochemical Capital Project Markets – High Growth Markets - Asia and Middle East – Constrained Capital Project Funding s Driving more moderate design margins, industry specifications, High Value and best country sourcing trends – Increased Local Content and Social Regulatory Requirements – Remote Project Sites, Constrained Resource Base u Client Market Profile – Rise of National Oil Companies – Total Cost of Ownership Focus u Competitor Market Profile – Established Asian Competitor Base – Expanded Global Market Reach u Commercial Contracting Structures – Increased competition base – Increased Risk to Contractor – Lump Sum Turn Key Market – Execution Partnerships critical to pursuit and award opportunities 7

Fluor Procurement Current Sourcing and Procurement Trends Local Content Requirements u Local content is rising to the top of developing country political agendas impacting oil, gas, and mineral development capital projects u Local Content Requirements will be increasingly used as means to strategically develop national industries and generate employment – Countries will utilize procurement and contracting instruments to creatively build national competitiveness through capital investment, technology transfer, and skills development. u The regulations, compliance requirements, business development, project delivery, and social performance policies have to be formulated with great care and aligned to the domestic suppliers ability to win contracts on the basis of an international competitive tender – Instead of creating new jobs and filling local order books the result can be harmful impact on the country or region’s long term growth – Introduction of new risks and higher costs to investment projects – Reduce the volume or timeliness of government revenues from the project investments u Project Execution Risks and Opportunities – Capital Project Execution Framework Flexibility – Ability to optimize Local Labor and Supply Market Capability – Western and Local Supply Integration Programs (Craft Training, Supply Integration) 8

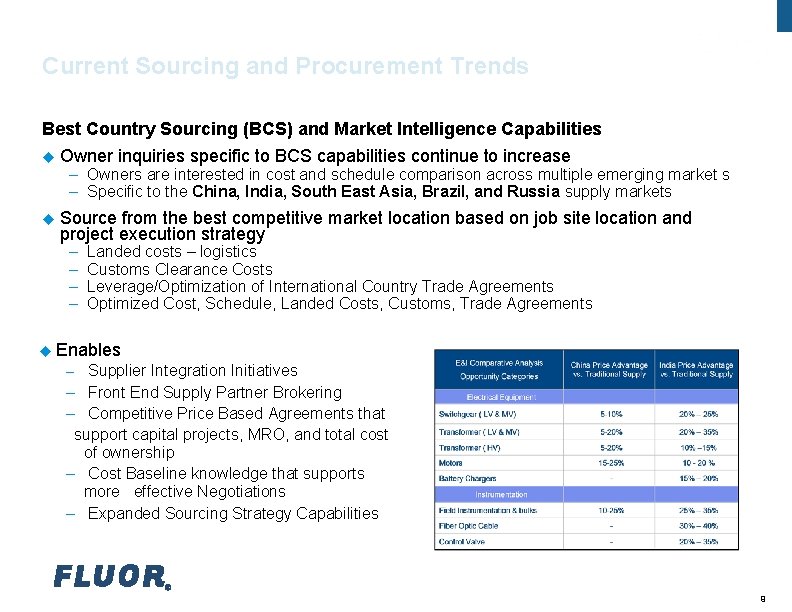

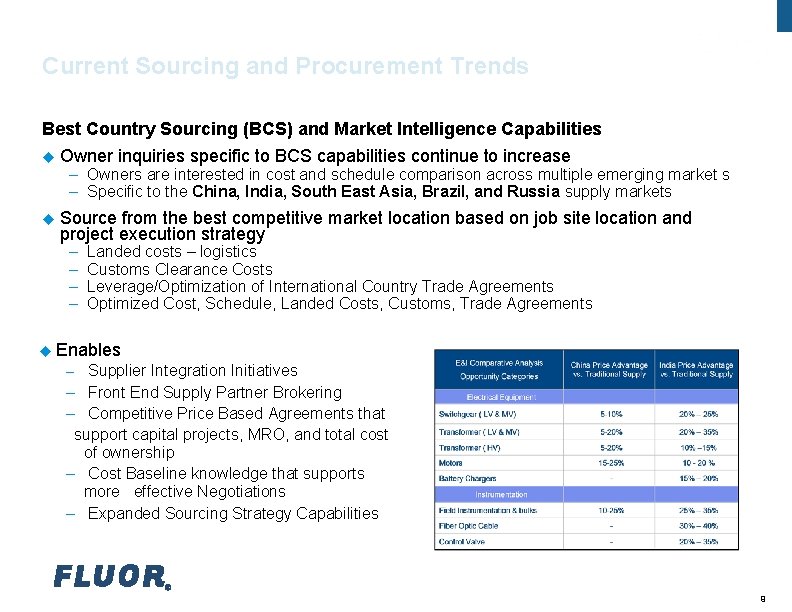

Fluor Procurement Current Sourcing and Procurement Trends Best Country Sourcing (BCS) and Market Intelligence Capabilities u Owner inquiries specific to BCS capabilities continue to increase – Owners are interested in cost and schedule comparison across multiple emerging market s – Specific to the China, India, South East Asia, Brazil, and Russia supply markets u Source from the best competitive market location based on job site location and project execution strategy – – u Landed costs – logistics Customs Clearance Costs Leverage/Optimization of International Country Trade Agreements Optimized Cost, Schedule, Landed Costs, Customs, Trade Agreements Enables – Supplier Integration Initiatives – Front End Supply Partner Brokering – Competitive Price Based Agreements that support capital projects, MRO, and total cost of ownership – Cost Baseline knowledge that supports more effective Negotiations – Expanded Sourcing Strategy Capabilities 9

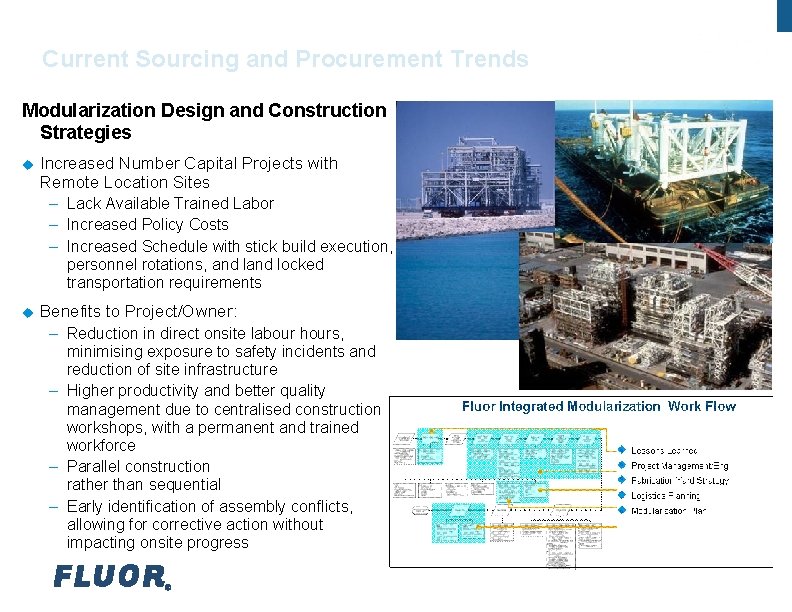

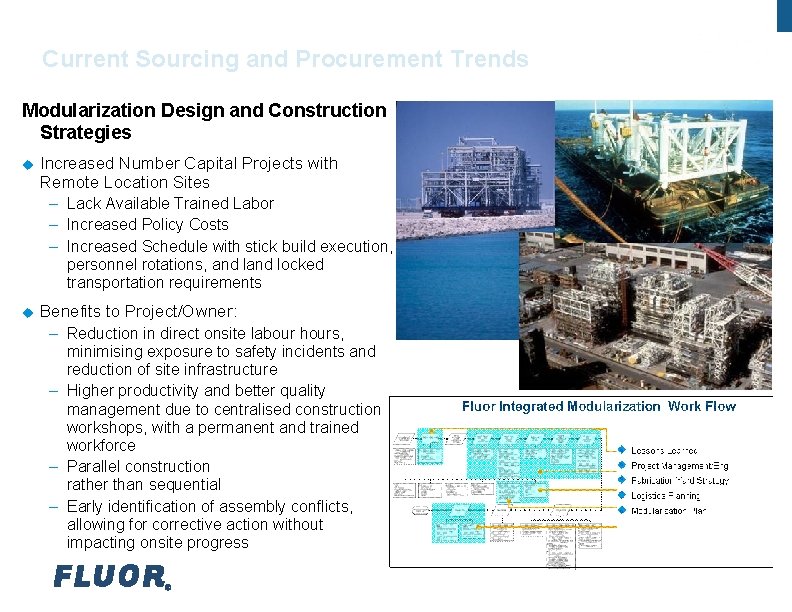

Fluor Procurement Current Sourcing and Procurement Trends Modularization Design and Construction Strategies u Increased Number Capital Projects with Remote Location Sites – Lack Available Trained Labor – Increased Policy Costs – Increased Schedule with stick build execution, personnel rotations, and locked transportation requirements u Benefits to Project/Owner: – Reduction in direct onsite labour hours, minimising exposure to safety incidents and reduction of site infrastructure – Higher productivity and better quality management due to centralised construction workshops, with a permanent and trained workforce – Parallel construction rather than sequential – Early identification of assembly conflicts, allowing for corrective action without impacting onsite progress

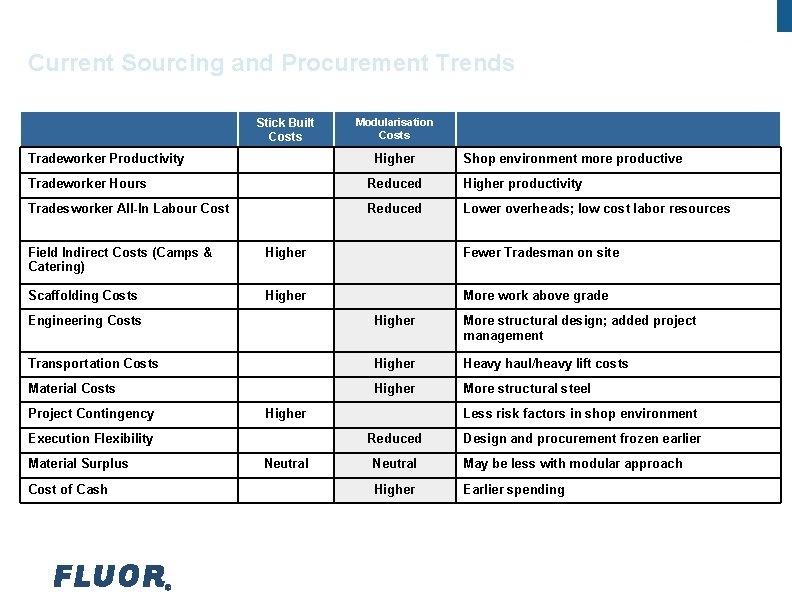

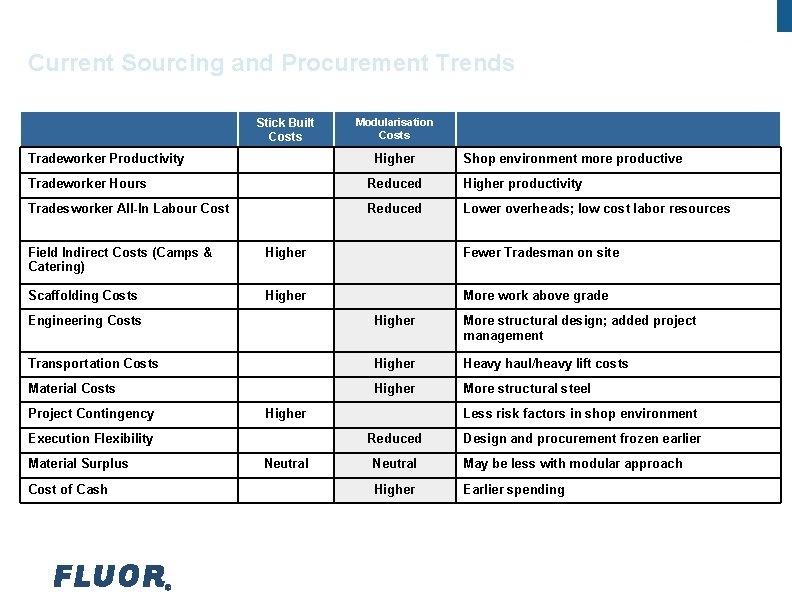

Fluor Procurement Current Sourcing and Procurement Trends Stick Built Costs Tradeworker Productivity Modularisation Costs Higher Shop environment more productive Tradeworker Hours Reduced Higher productivity Tradesworker All-In Labour Cost Reduced Lower overheads; low cost labor resources Field Indirect Costs (Camps & Catering) Higher Fewer Tradesman on site Scaffolding Costs Higher More work above grade Engineering Costs Higher More structural design; added project management Transportation Costs Higher Heavy haul/heavy lift costs Material Costs Higher More structural steel Project Contingency Higher Execution Flexibility Material Surplus Cost of Cash Less risk factors in shop environment Reduced Neutral Design and procurement frozen earlier Neutral May be less with modular approach Higher Earlier spending

Fluor Procurement Execution Strategies include the following which are being driven and fueled by Best Country Sourcing, Local Content, and modularization trends u. Sustainable Supply Chain Focus u. Procurement Outsoucing u. Procurement Offshoring 12

Fluor Procurement Current Sourcing and Procurement Trends Sustainable Global Supply Chains u Supply Chain disruptions can be devastating for capital project operations and client relationships. u Globalization has changed how companies manage the supply chain – Production of goods have shifted to developing and transitional economies s Cost and Schedule Advantages s Increased Capital Project Activities in developing markets (Mining, LNG, Petrochemical) s Local content requirements – This has brought new Challenges and Risks s Inconsistent or Poor Quality Equipment and Material s Supply Disruptions – Schedule Impacts s Cultural, legal, administrative, language, and political issues s Environmental – waste and emissions reduction, recycling, product design, recovery s Social Issues – child labor, working conditions, bribery, corruption u Companies that fail to manage these issues expose themselves to execution failures and reputational risks 13

Fluor Procurement Current Sourcing and Procurement Trends Sustainable Global Supply Chains Critical Success Factors for developing and maintaining sustainable supply chains in developing and emerging markets include – – – – – Identification and Qualification of top tier performers Relationship Management – Building / Maintaining China Commercial Terms and Conditions Continuous Alignment on technical, quality, and commercial requirements Procedures Development Assistance Production / Schedule Planning Support & Assistance QA/QC/Supplier Quality Surveillance Final Inspection for Release of shipment In-Country Presence 14

Fluor Procurement Execution Strategies Procurement Outsourcing/Offshore Execution Client Drivers include Capital Project Cost, Schedule, Funding, Total Cost of Ownership Focus, and lack of presence or expertise in high value supply locations. u Lack of Presence and capabilities in high value supply markets – China, SEA, India, Brazil, Russia – Cost and Effort to establish presence in cost competitive markets – Ability to implement sustainable supply chain critical success enablers in these markets u Asia and Middle East Capital Project Growth – Capital Project Funding – Local Content Requirements – High Value and Best Country Sourcing Drivers u Operations Cost – MRO Spend – Best Country Sourcing – Local Content Requirements – Supply Chain disruptions can impact project schedules, client relationships, plant operations 15

Market Prospect Update 16

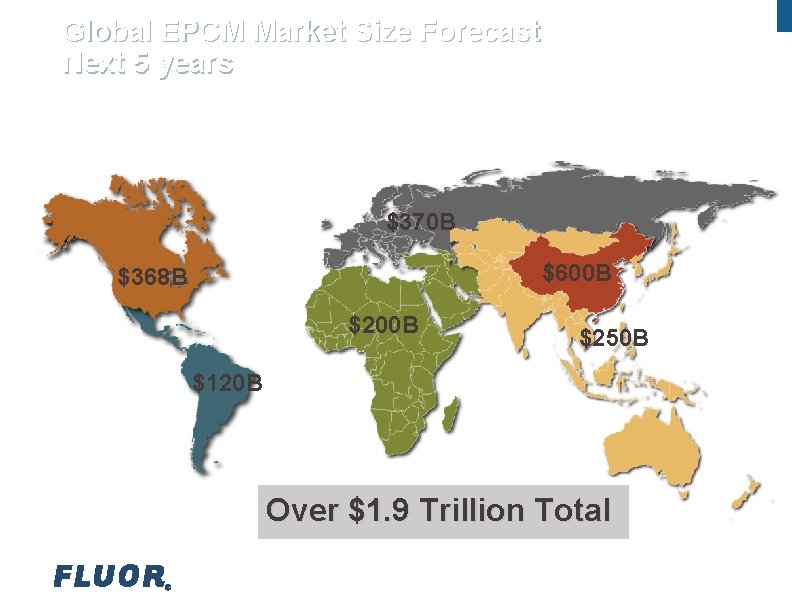

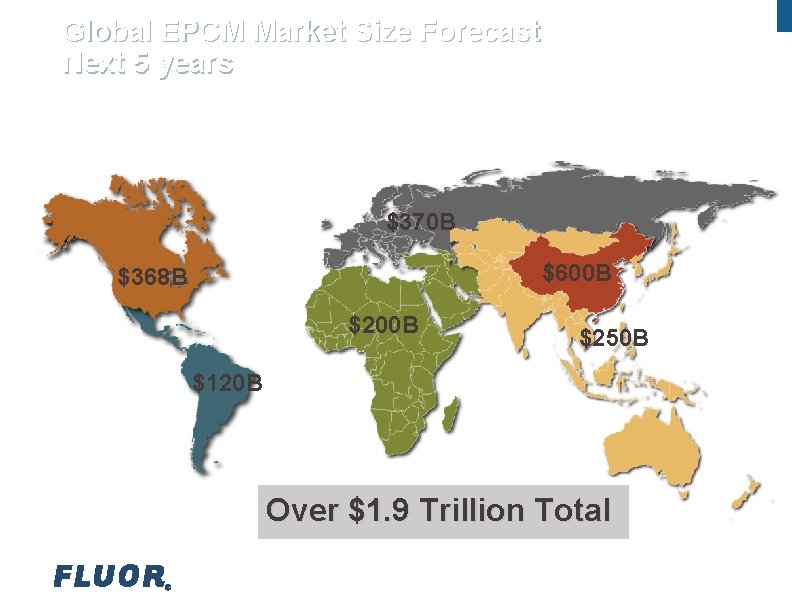

Global EPCM Market Size Forecast Next 5 years $370 B $600 B $368 B $200 B $250 B $120 B Over $1. 9 Trillion Total

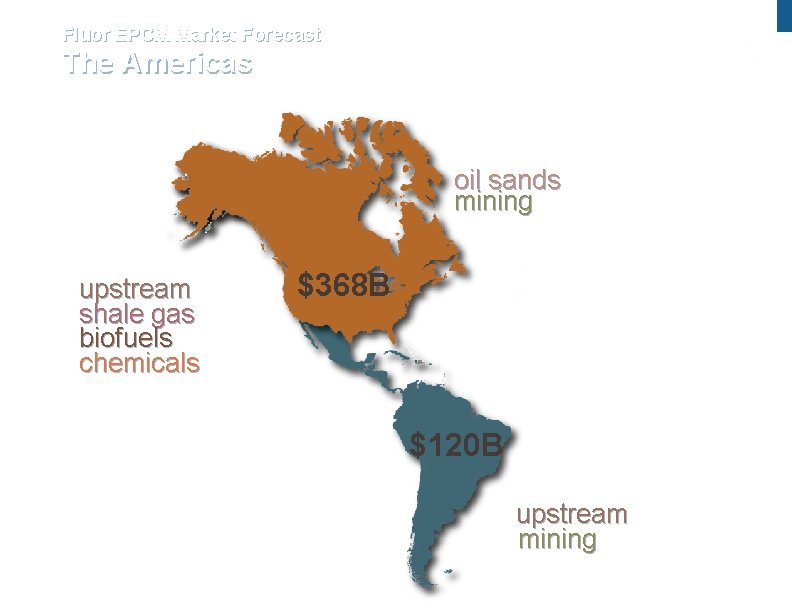

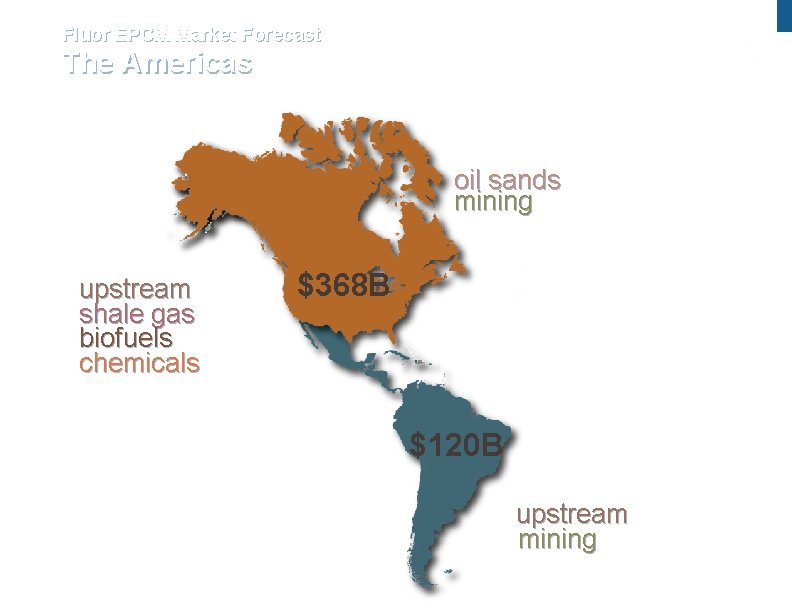

Fluor EPCM Market Forecast The Americas oil sands mining upstream shale gas biofuels chemicals $368 B $120 B upstream mining

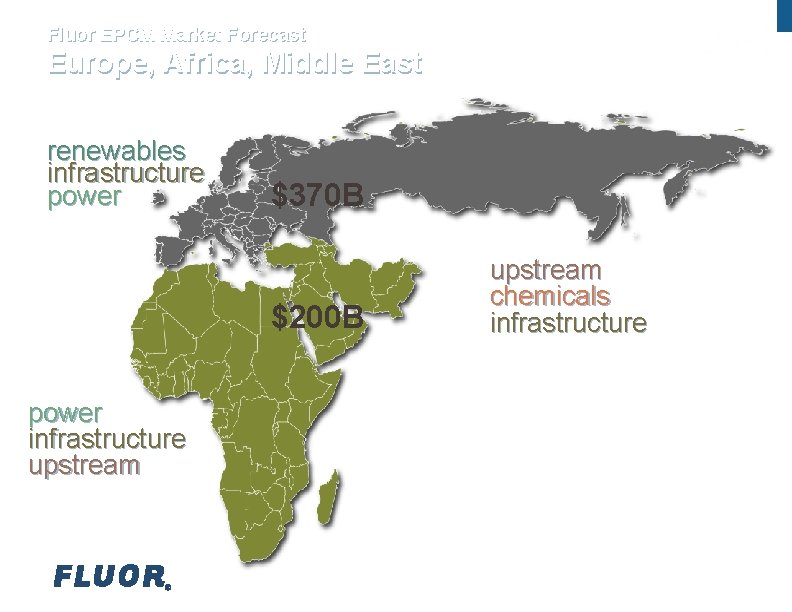

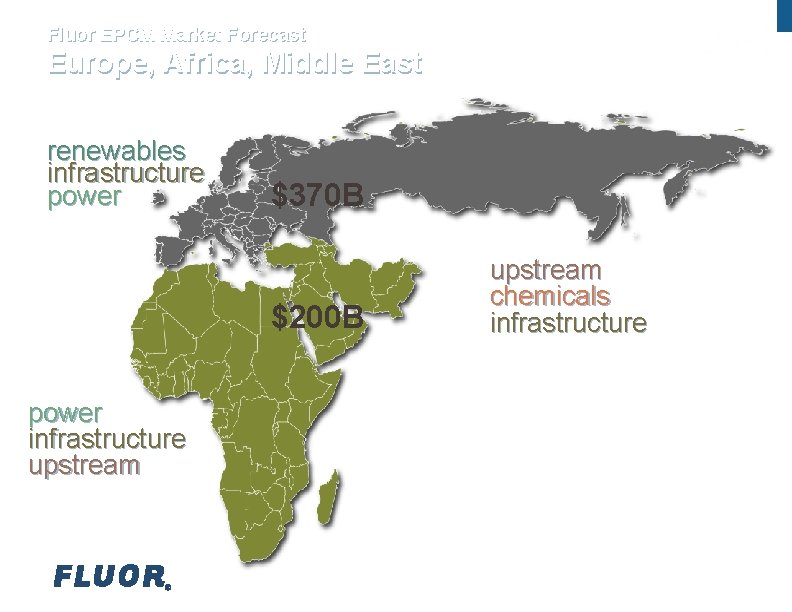

Fluor EPCM Market Forecast Europe, Africa, Middle East renewables infrastructure power $370 B $200 B power infrastructure upstream chemicals infrastructure

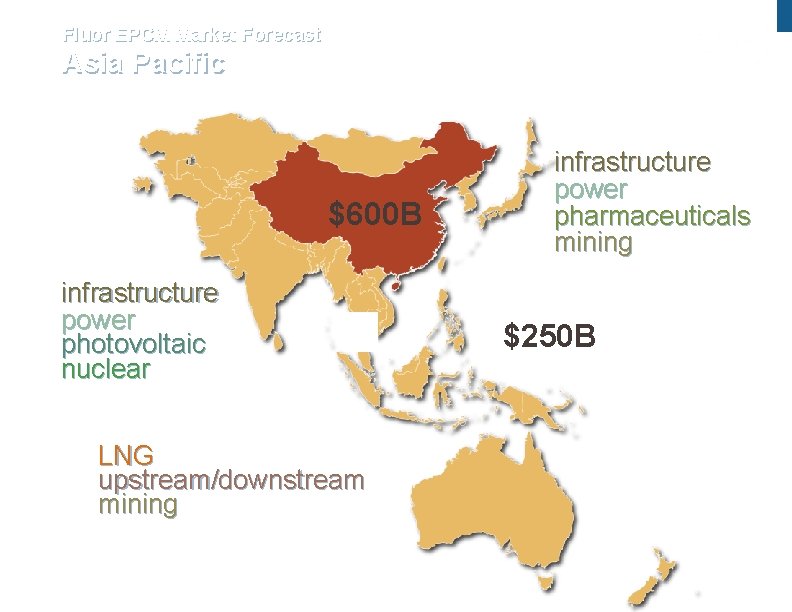

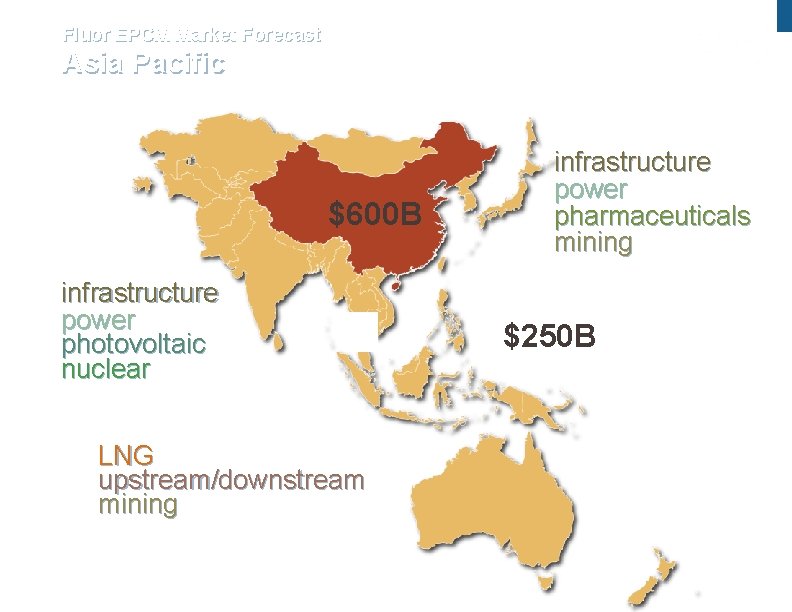

Fluor EPCM Market Forecast Asia Pacific $600 B infrastructure power photovoltaic nuclear LNG upstream/downstream mining infrastructure power pharmaceuticals mining $250 B

Q&A 21