Financially Defined Credit is the granting of money

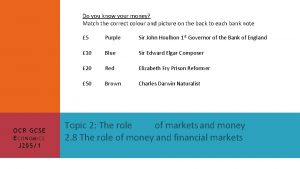

- Slides: 24

Financially Defined Credit is the granting of money or something else of value in exchange for a promise of future repayment.

We Use Credit

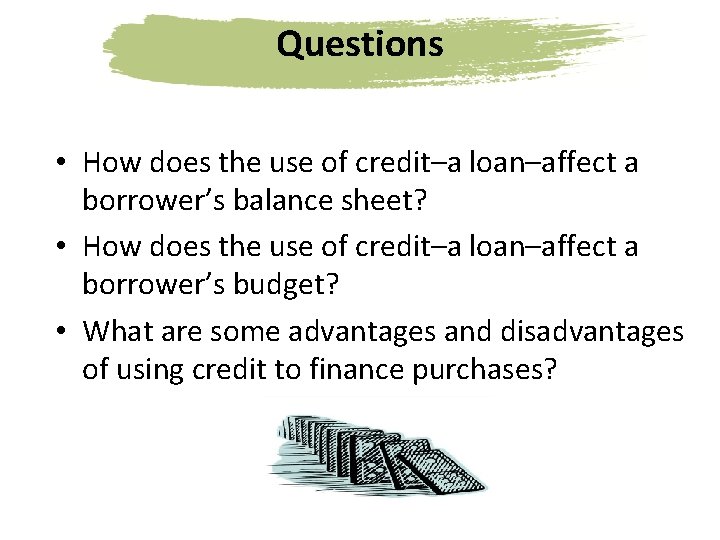

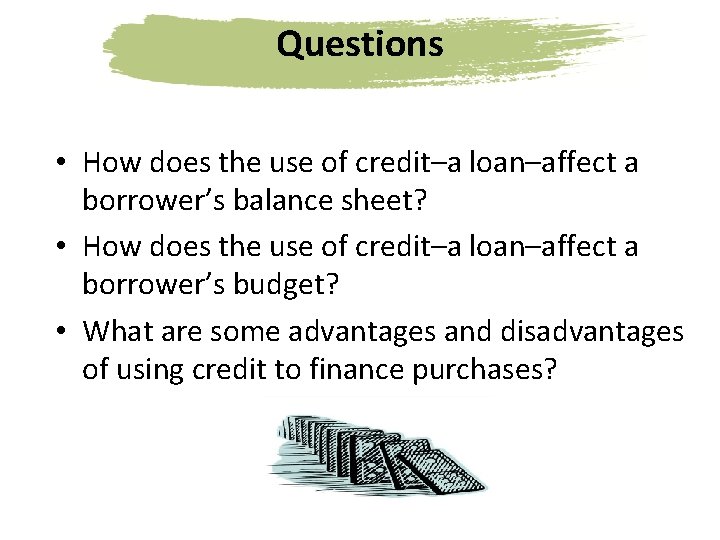

Questions • How does the use of credit–a loan–affect a borrower’s balance sheet? • How does the use of credit–a loan–affect a borrower’s budget? • What are some advantages and disadvantages of using credit to finance purchases?

Concepts • • • Assets Budget Credit Liabilities Net Worth

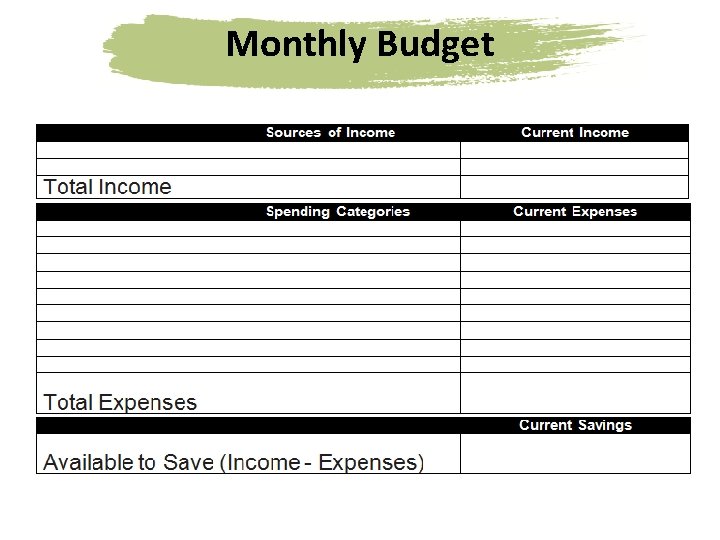

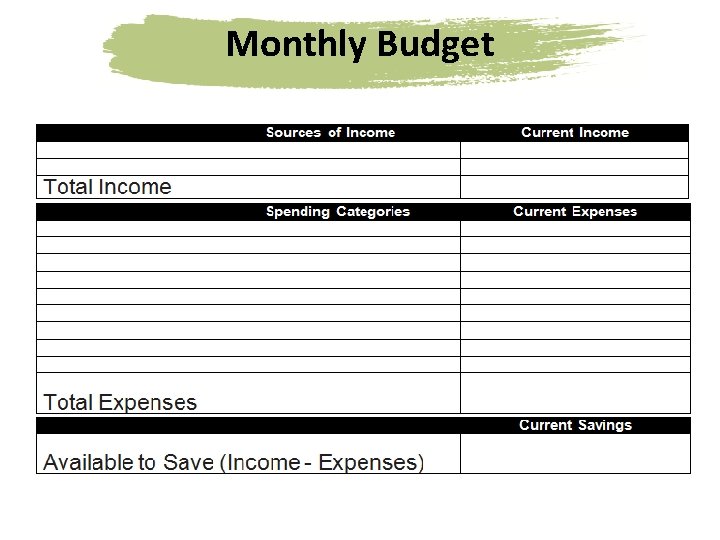

Concepts • Budget— An itemized summary of probable income and expenses for a given period. A budget is a plan for managing income, spending and saving during a given period of time.

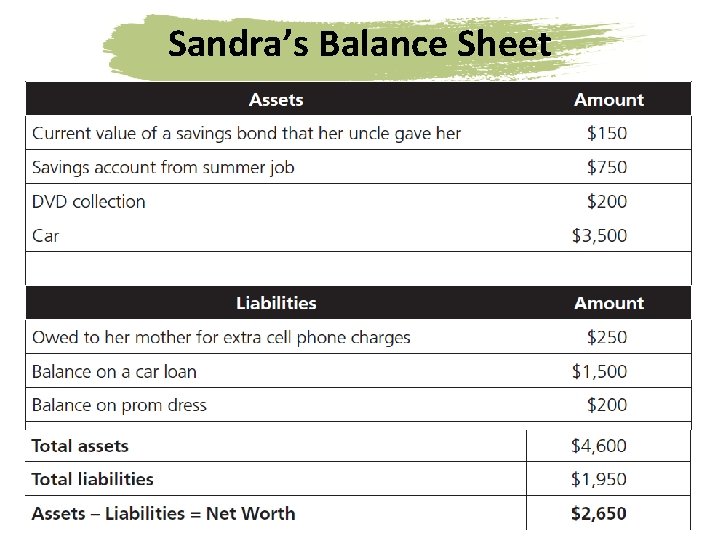

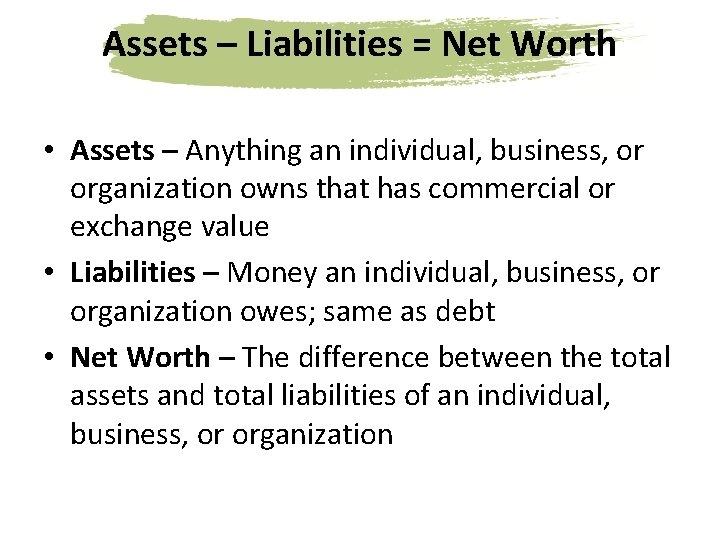

Assets – Liabilities = Net Worth • Assets – Anything an individual, business, or organization owns that has commercial or exchange value • Liabilities – Money an individual, business, or organization owes; same as debt • Net Worth – The difference between the total assets and total liabilities of an individual, business, or organization

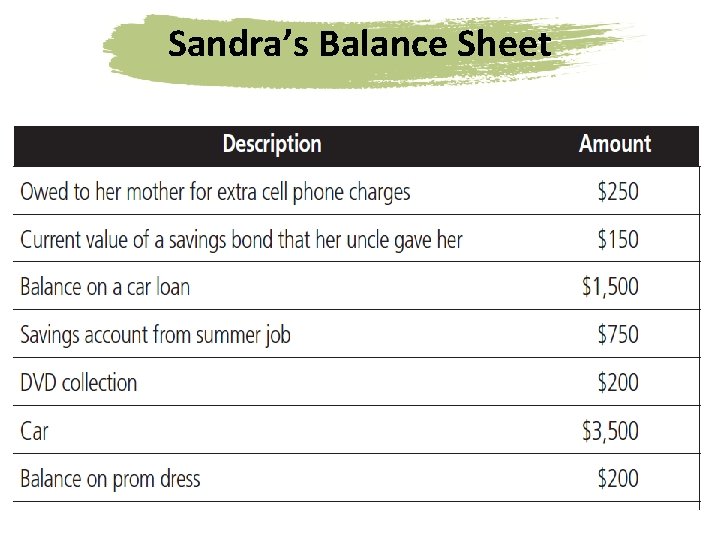

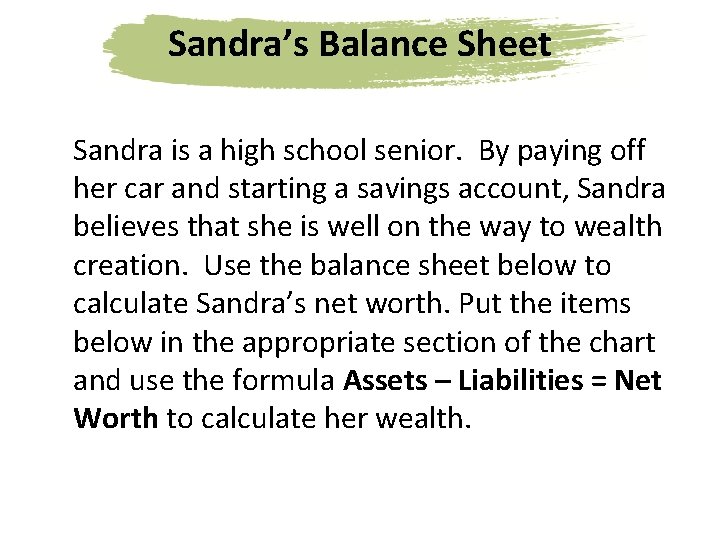

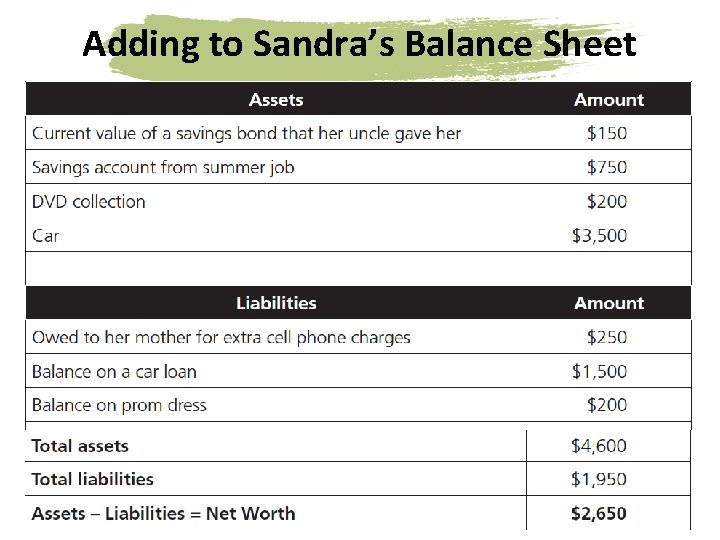

Sandra’s Balance Sheet Sandra is a high school senior. By paying off her car and starting a savings account, Sandra believes that she is well on the way to wealth creation. Use the balance sheet below to calculate Sandra’s net worth. Put the items below in the appropriate section of the chart and use the formula Assets – Liabilities = Net Worth to calculate her wealth.

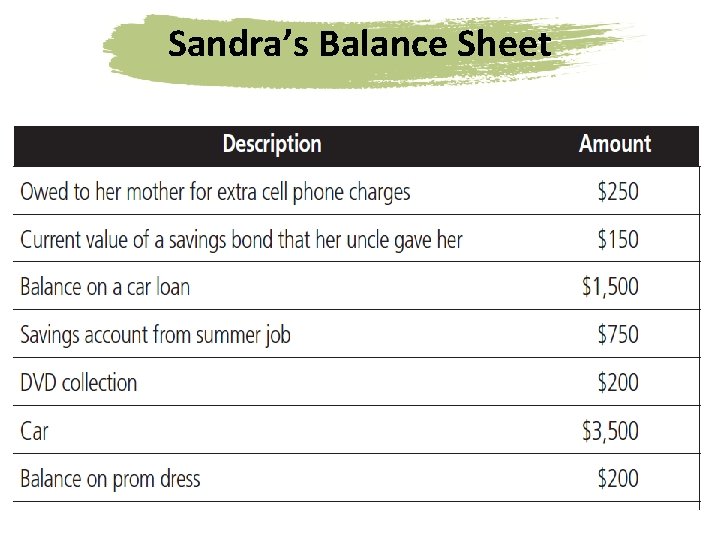

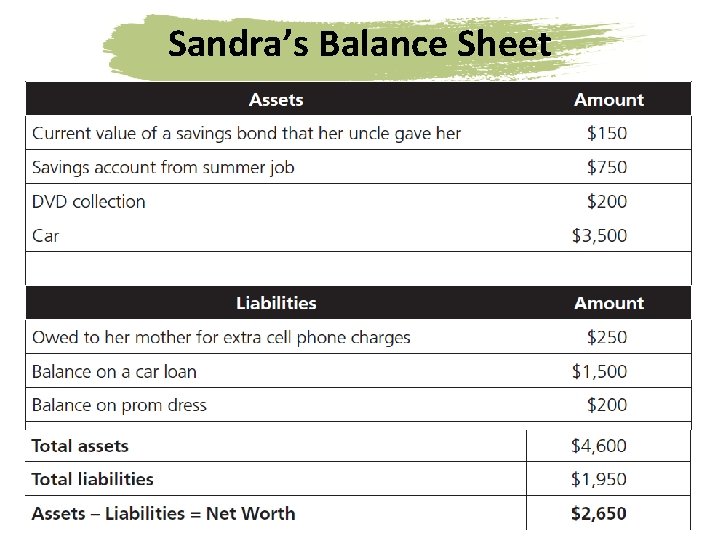

Sandra’s Balance Sheet

Sandra’s Balance Sheet

Sandra’s Balance Sheet

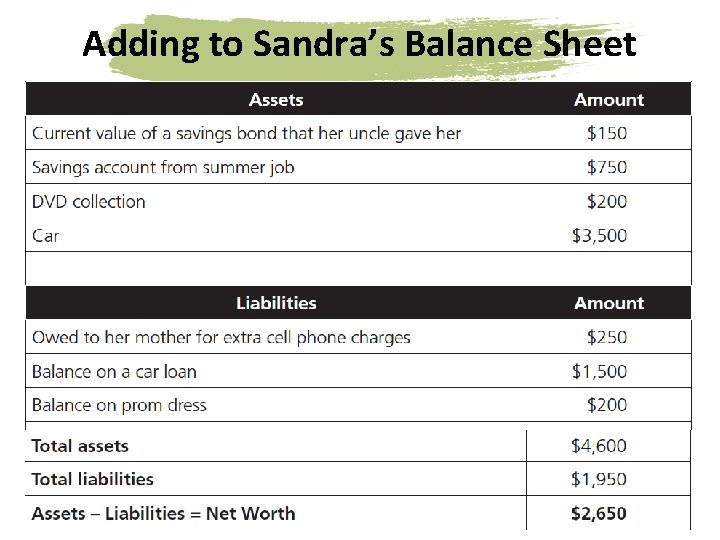

Adding to Sandra’s Balance Sheet

Monthly Budget

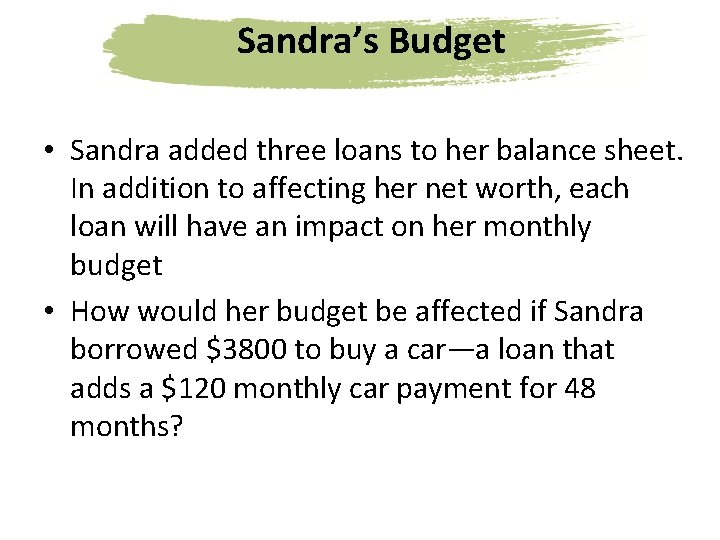

Sandra’s Budget • Sandra added three loans to her balance sheet. In addition to affecting her net worth, each loan will have an impact on her monthly budget • How would her budget be affected if Sandra borrowed $3800 to buy a car—a loan that adds a $120 monthly car payment for 48 months?

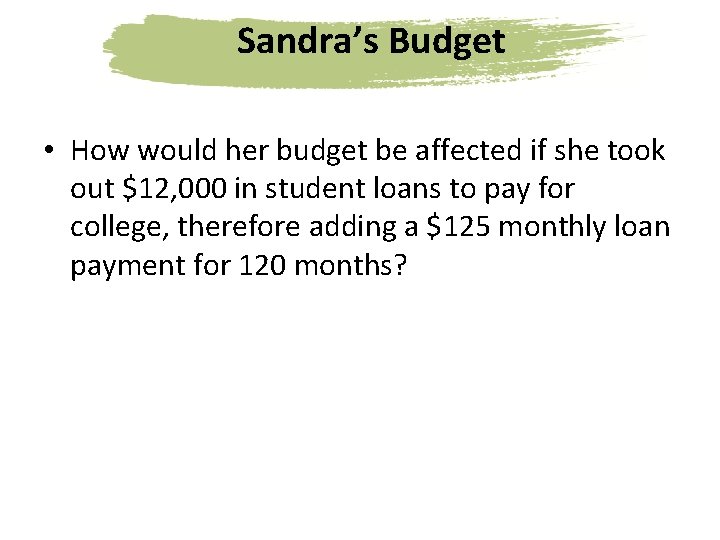

Sandra’s Budget • How would her budget be affected if she took out $12, 000 in student loans to pay for college, therefore adding a $125 monthly loan payment for 120 months?

Sandra’s Budget • How would her budget be affected if Sandra charged $450 on a credit card to pay for a spring break trip and pays off the balance in 10 months with a $50 monthly payment?

Use Credit Wisely

Use Credit Wisely Should Patrick borrow?

Use Credit Wisely Debra’s Degree Dilemma

Use Credit Wisely Carlos’ Comic Conundrum

Use Credit Wisely Veronica’s Vehicle Vexation

Questions • How does the use of credit–a loan–affect a borrower’s balance sheet? • How does the use of credit–a loan–affect a borrower’s budget? • What are some advantages and disadvantages of using credit to finance purchases?

Assessment

Questions

Cash flow in credit management

Cash flow in credit management Money money money team

Money money money team What is the name

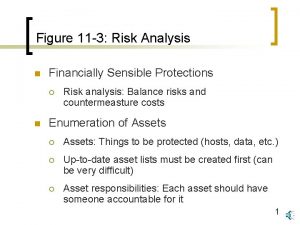

What is the name Financially sensible

Financially sensible Not well defined set examples

Not well defined set examples This can be avoided by giving credit where credit is due.

This can be avoided by giving credit where credit is due. Money supply and credit creation

Money supply and credit creation Money on money multiple

Money on money multiple Gatsby historical background

Gatsby historical background Gatsby

Gatsby Tom buchanan character traits

Tom buchanan character traits Money smart money match

Money smart money match Thẻ vin

Thẻ vin Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Cái miệng nó xinh thế

Cái miệng nó xinh thế Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Sơ đồ cơ thể người

Sơ đồ cơ thể người Diễn thế sinh thái là

Diễn thế sinh thái là Frameset trong html5

Frameset trong html5 Thứ tự các dấu thăng giáng ở hóa biểu

Thứ tự các dấu thăng giáng ở hóa biểu 101012 bằng

101012 bằng ưu thế lai là gì

ưu thế lai là gì Hát lên người ơi

Hát lên người ơi đại từ thay thế

đại từ thay thế Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra