Financial Statements 1 The Four Primary Financial Statements

- Slides: 52

Financial Statements 1

The Four Primary Financial Statements • The Income Statement • The Balance Sheet • Statement of Retained Earnings • Statement of Cash Flows 2

Balance Sheet The balance sheet presents a summary of a firm’s financial position at a given point in time. Assets indicate what the firm owns, equity represents the owners’ investment, and liabilities indicate what the firm has borrowed. 3

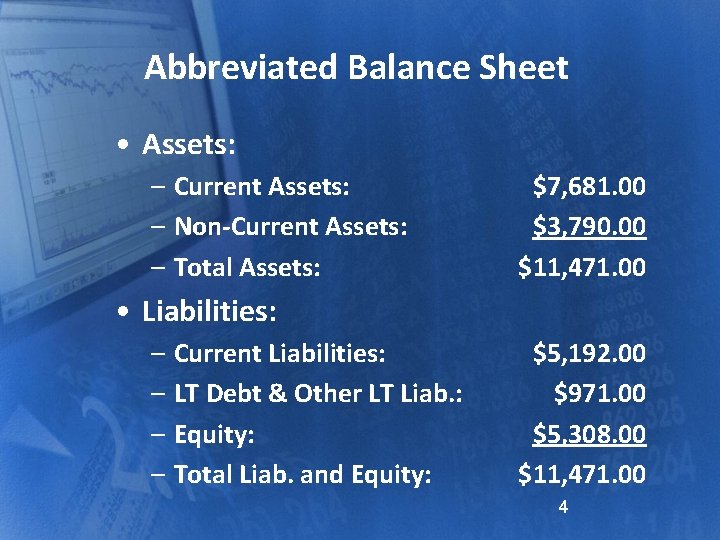

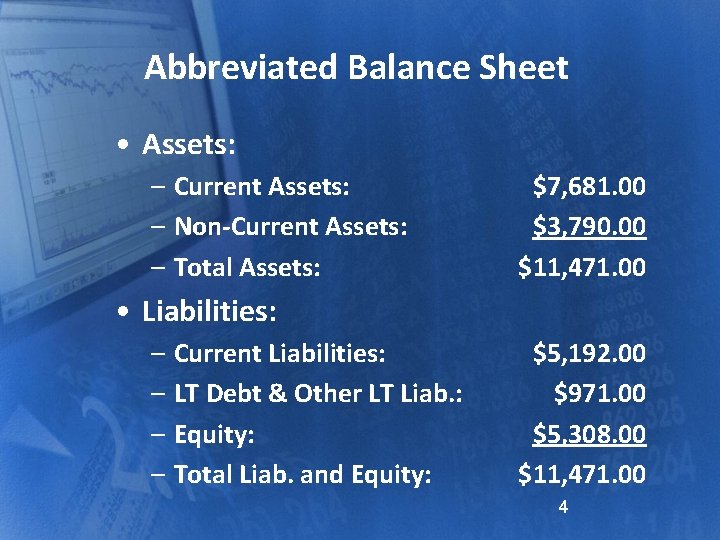

Abbreviated Balance Sheet • Assets: – Current Assets: – Non-Current Assets: – Total Assets: $7, 681. 00 $3, 790. 00 $11, 471. 00 • Liabilities: – Current Liabilities: – LT Debt & Other LT Liab. : – Equity: – Total Liab. and Equity: $5, 192. 00 $971. 00 $5, 308. 00 $11, 471. 00 4

Analysis • Assets the firm owns total more that $11 billion, more short-term assets than long-term assets like plant and equipment. • Those assets were purchased with money that came mainly from equity and short-term borrowing. Relatively little long-term debt. 5

Income Statement The income statement provides a financial summary of a company’s operating results during a specified period. Although they are prepared annually for reporting purposes, they are generally computed monthly by management and quarterly for tax purposes. 6

Statement of Retained Earnings Income the firm earned in the past that was “retained” and reinvested in assets 7

Statement of Cash Flows • Provides a summary of the cash flows over the fiscal year. • Gives insight into a company’s investment, financing and operating activities • Ties together the income statement and previous and current balance sheets. 8

Statement of Cash Flows • Income versus cash flows—revenues and expenses are recognized when incurred, not when cash is received or paid • Non-cash items—some non-cash items appear on the income statement, such as depreciation • Accounting profit—net income, or the “bottom line” on the income statement; net income and cash flows generally are highly correlated • Operating cash flows—cash flows generated from the normal operating activities of the firm 9

What is Free Cash Flow (FCF)? • FCF is the amount of cash available from operations for distribution to all investors (including stockholders and debtholders) after meeting all operating expenses. • A company’s value depends upon the amount of FCF it can generate. 10

Five uses of FCF 1. Pay interest on debt. 2. Pay back principal on debt. 3. Pay dividends. 4. Buy back stock. 5. Buy non-operating assets (e. g. , marketable securities, investments in other companies, etc. ) 11

Financial Ratios 12

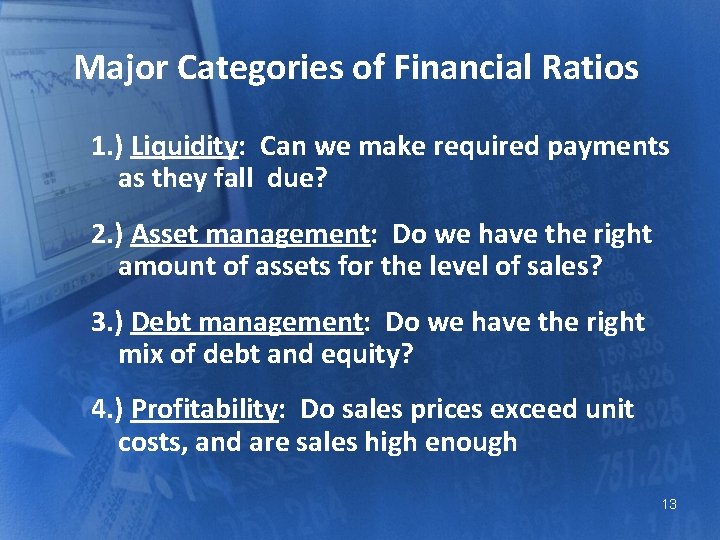

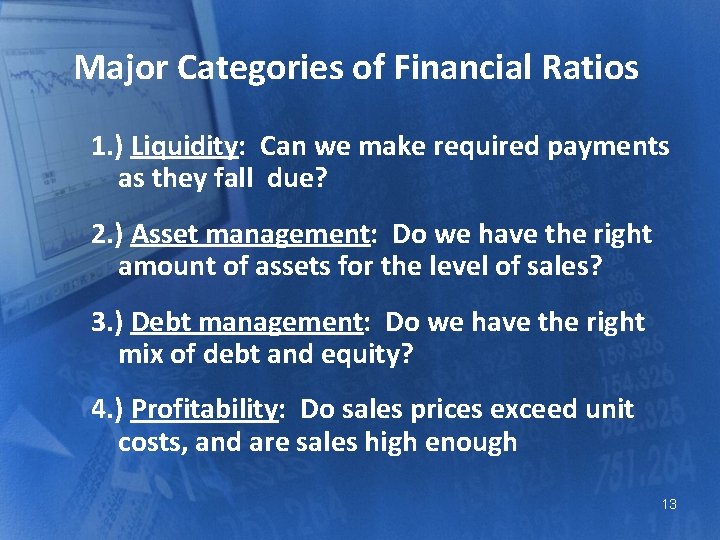

Major Categories of Financial Ratios 1. ) Liquidity: Can we make required payments as they fall due? 2. ) Asset management: Do we have the right amount of assets for the level of sales? 3. ) Debt management: Do we have the right mix of debt and equity? 4. ) Profitability: Do sales prices exceed unit costs, and are sales high enough 13

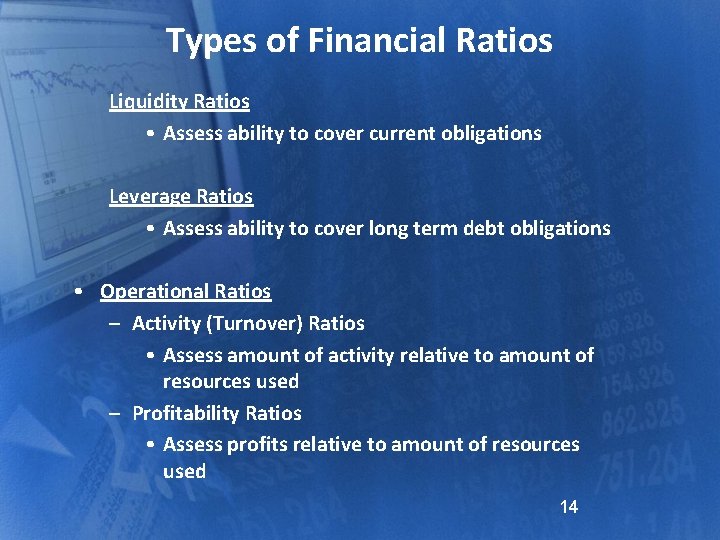

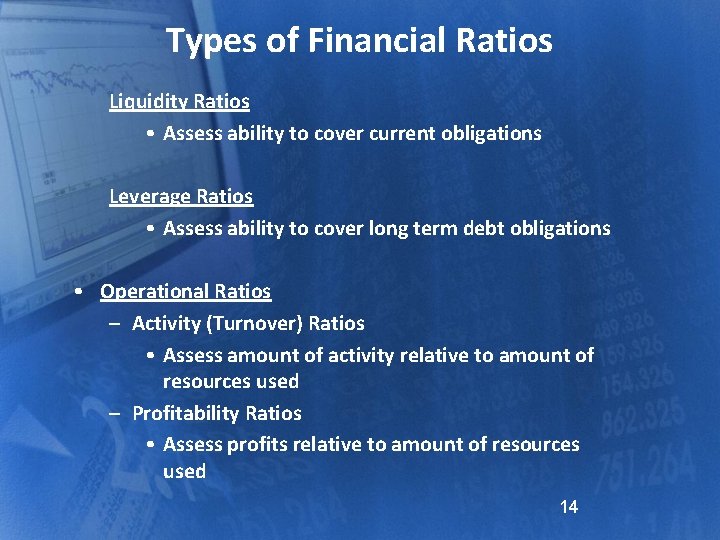

Types of Financial Ratios Liquidity Ratios • Assess ability to cover current obligations Leverage Ratios • Assess ability to cover long term debt obligations • Operational Ratios – Activity (Turnover) Ratios • Assess amount of activity relative to amount of resources used – Profitability Ratios • Assess profits relative to amount of resources used 14

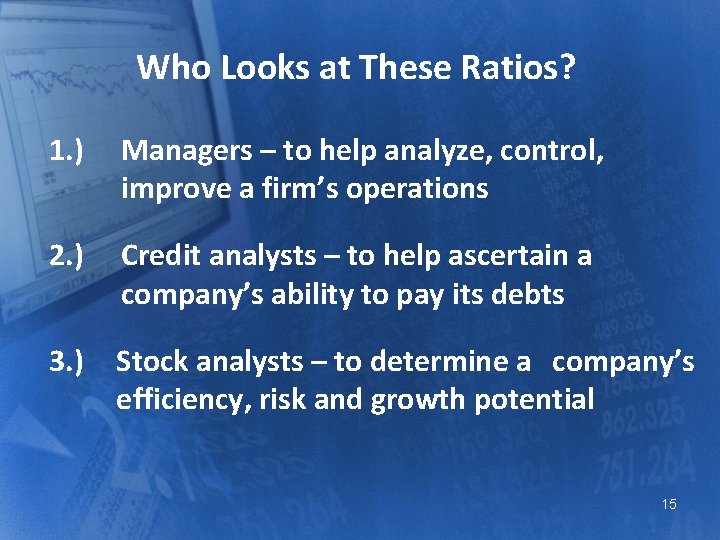

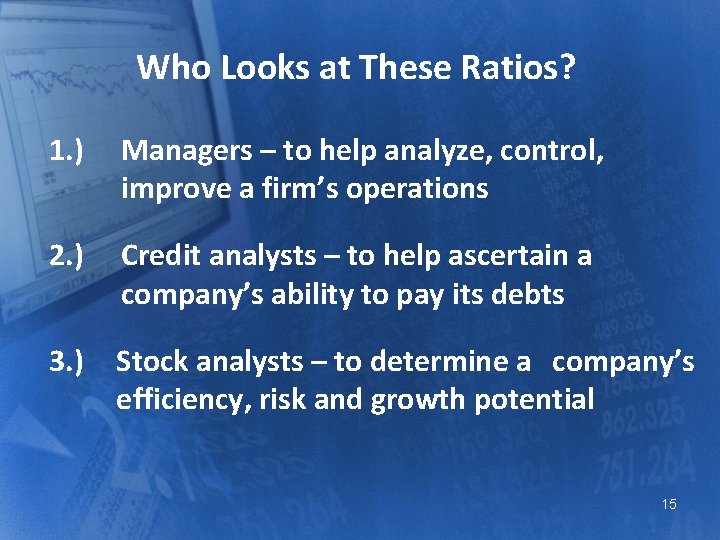

Who Looks at These Ratios? 1. ) Managers – to help analyze, control, improve a firm’s operations 2. ) Credit analysts – to help ascertain a company’s ability to pay its debts 3. ) Stock analysts – to determine a company’s efficiency, risk and growth potential 15

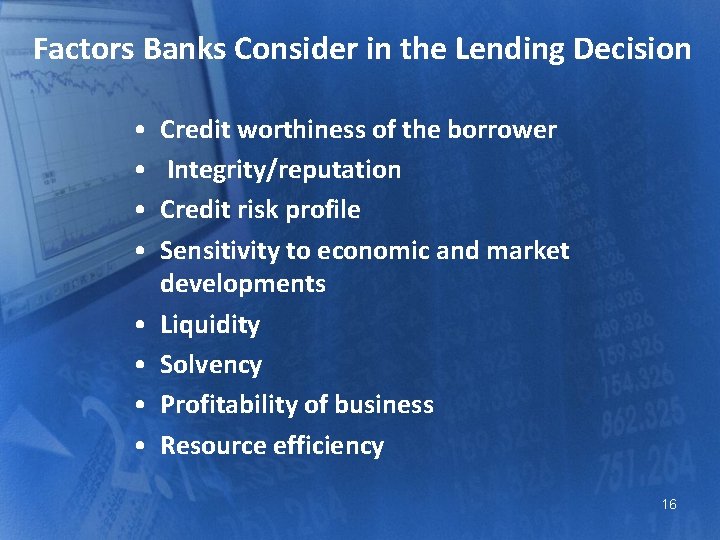

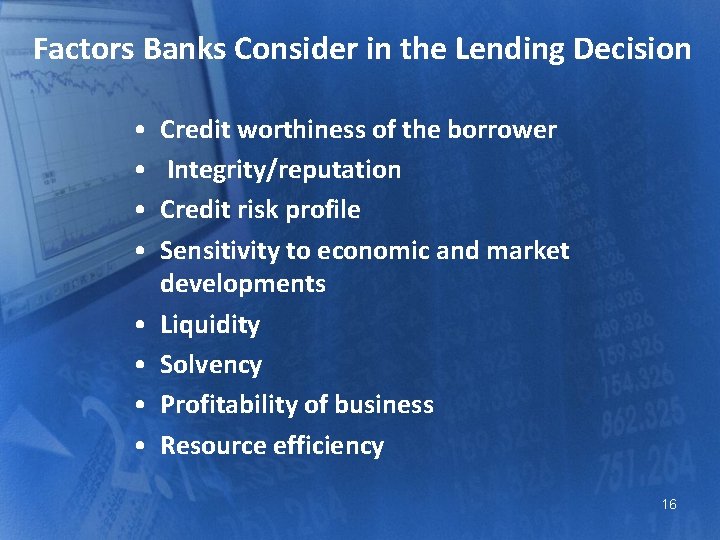

Factors Banks Consider in the Lending Decision • • Credit worthiness of the borrower Integrity/reputation Credit risk profile Sensitivity to economic and market developments Liquidity Solvency Profitability of business Resource efficiency 16

Liquidity Ratios Provide an indication of how well the firm can meet its current obligations • Helps measure the liquidity position of the firm – too little liquidity—suggests the firm will have problems paying its current obligations in the future – too much liquidity—might suggest the firm is not investing its funds wisely 17

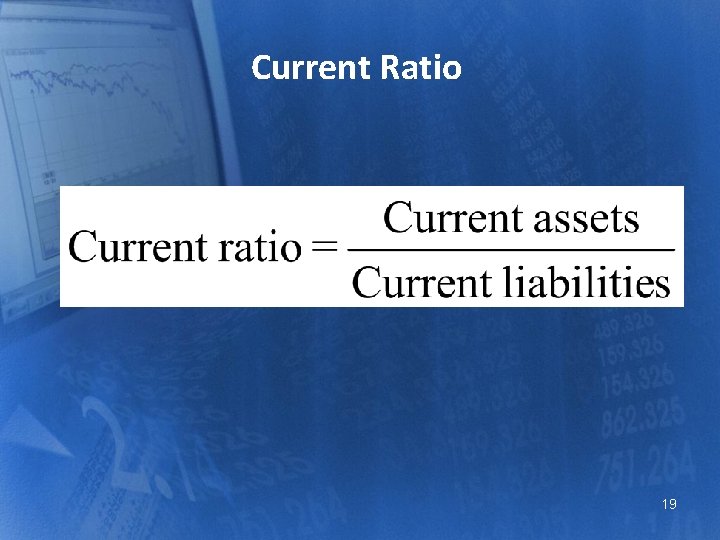

Current Ratio • Ideal level – approx 1. 5 : 1 • Need enough current assets to cover current liabilities • If its too high means too many current assets e. g. might have too much stock, could use the money tied up in current assets more effectively • If its too low you run the risk of not being able to meet current liabilities and you could have liquidity problems (may face working capital problems) 18

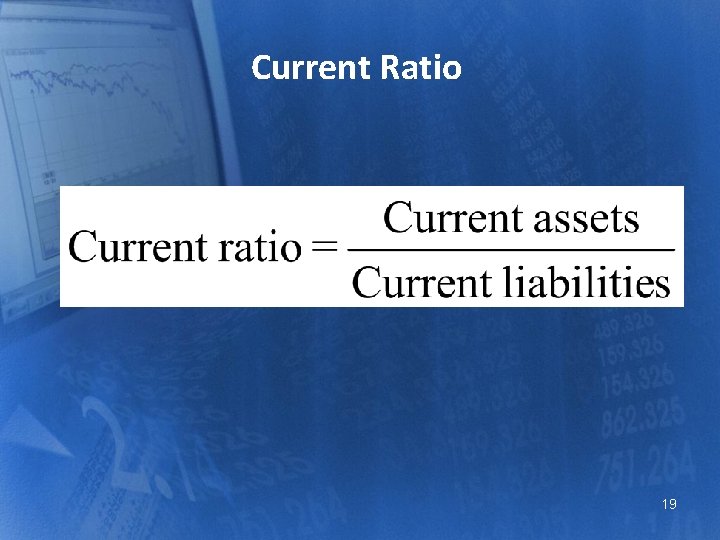

Current Ratio 19

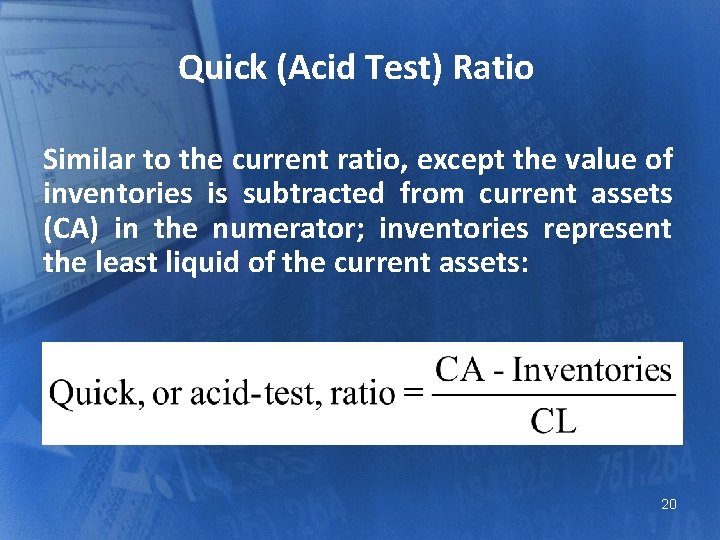

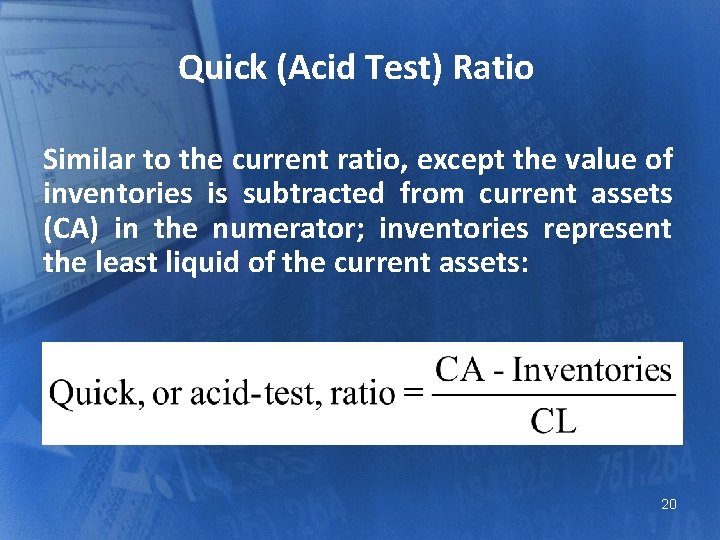

Quick (Acid Test) Ratio Similar to the current ratio, except the value of inventories is subtracted from current assets (CA) in the numerator; inventories represent the least liquid of the current assets: 20

Quick Ratio • 1: 1 seen as ideal • Some types of business need more cash than others so quick ratio is expected to be higher 21

Asset Management (Activity) Ratios Provides an indication of how well the firm manages its assets (efficiency) • Shows how often the firm is “turning over” its assets to generate cash • Generally, when assets are not turned over quickly enough, it is because sales have slowed or current assets, such as inventory and receivables, are too high • If assets are turned over too quickly, it could mean that the firm is under-producing. 22

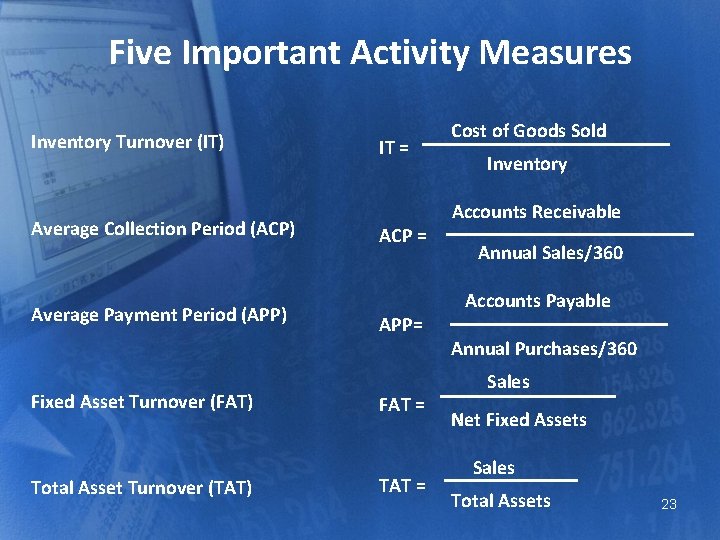

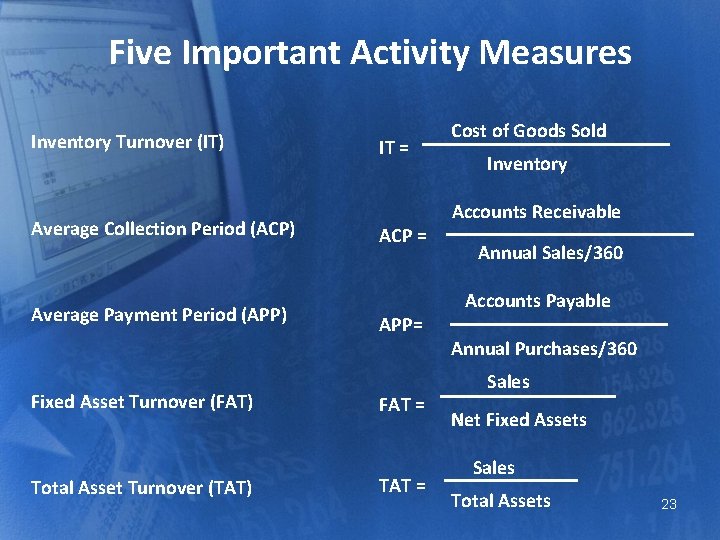

Five Important Activity Measures Cost of Goods Sold Inventory Turnover (IT) IT = Average Collection Period (ACP) Accounts Receivable ACP = Annual Sales/360 Average Payment Period (APP) Fixed Asset Turnover (FAT) Total Asset Turnover (TAT) Inventory Accounts Payable APP= Annual Purchases/360 Sales FAT = Net Fixed Assets Sales TAT = Total Assets 23

Asset Turnover Ratios The value will vary with the type of business: – Businesses with a high value of assets who have few sales will have a low asset turnover ratio – If a business has a high sales and a low value of assets it will have a high asset turnover ratio – Businesses can improve this by either increasing sales performance or getting rid of any additional assets 24

Inventory Turnover Shows how many times during a period— for example, one year—the amount of average inventory is turned over due to sales activities. 25

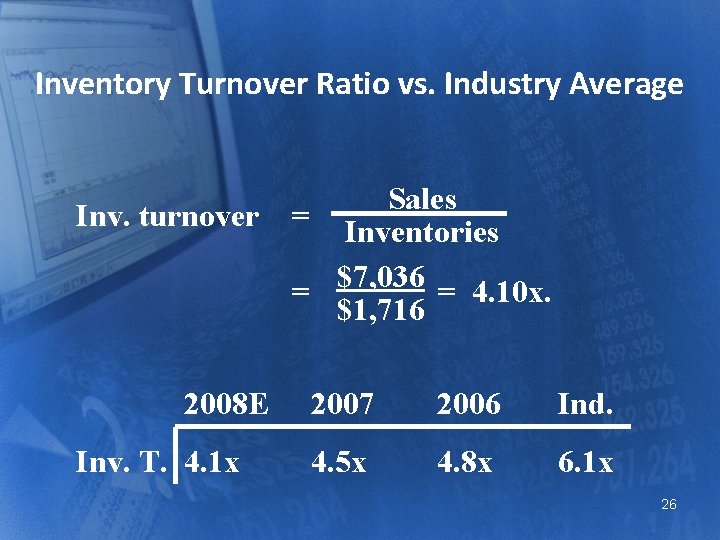

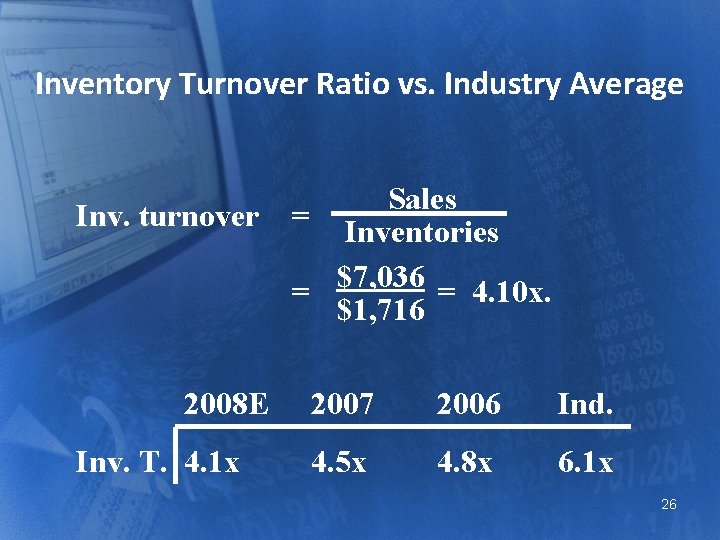

Inventory Turnover Ratio vs. Industry Average Inv. turnover 2008 E Inv. T. 4. 1 x Sales = Inventories $7, 036 = = 4. 10 x. $1, 716 2007 2006 Ind. 4. 5 x 4. 8 x 6. 1 x 26

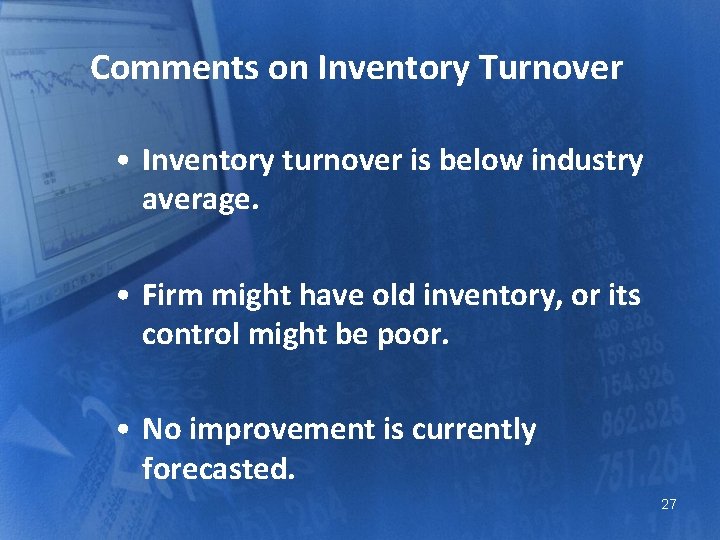

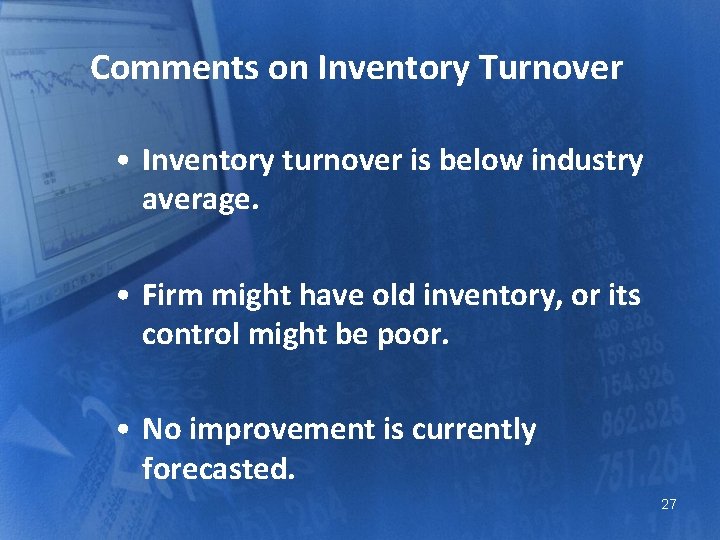

Comments on Inventory Turnover • Inventory turnover is below industry average. • Firm might have old inventory, or its control might be poor. • No improvement is currently forecasted. 27

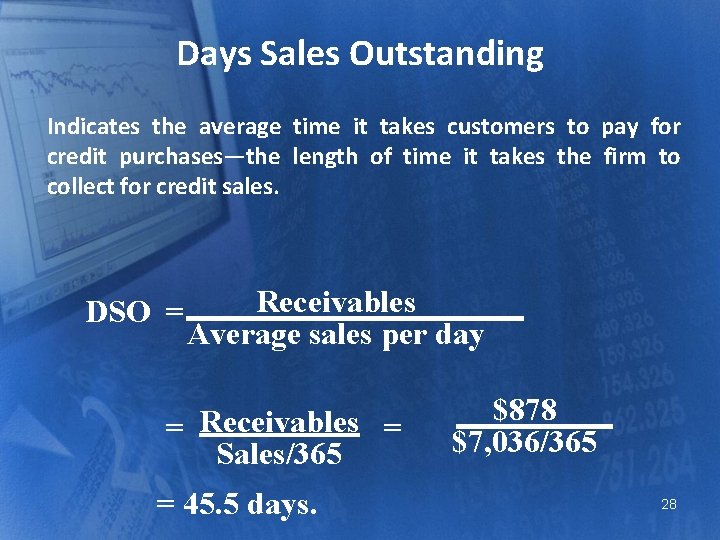

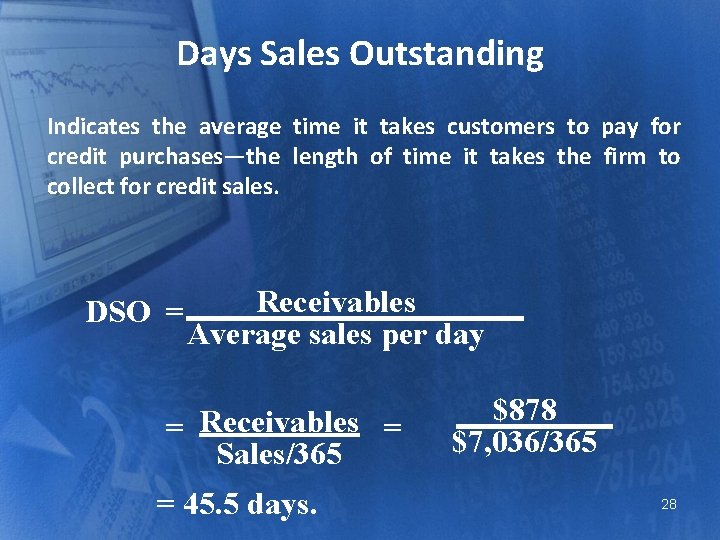

Days Sales Outstanding Indicates the average time it takes customers to pay for credit purchases—the length of time it takes the firm to collect for credit sales. DSO = Receivables Average sales per day = Receivables = Sales/365 = 45. 5 days. $878 $7, 036/365 28

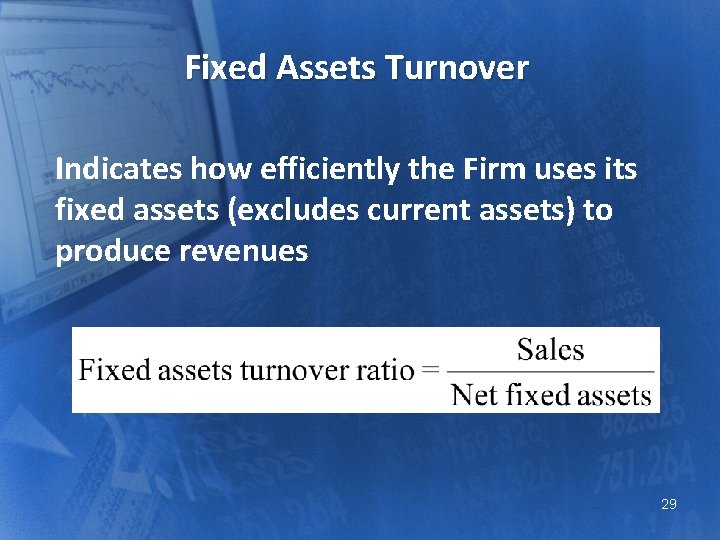

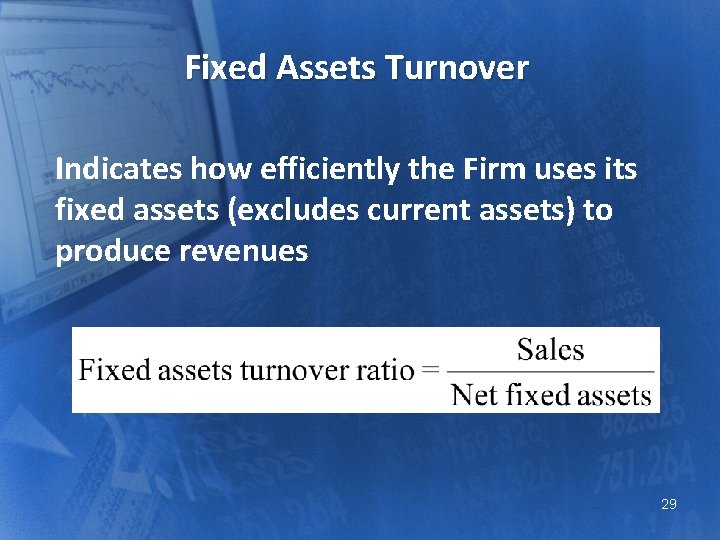

Fixed Assets Turnover Indicates how efficiently the Firm uses its fixed assets (excludes current assets) to produce revenues 29

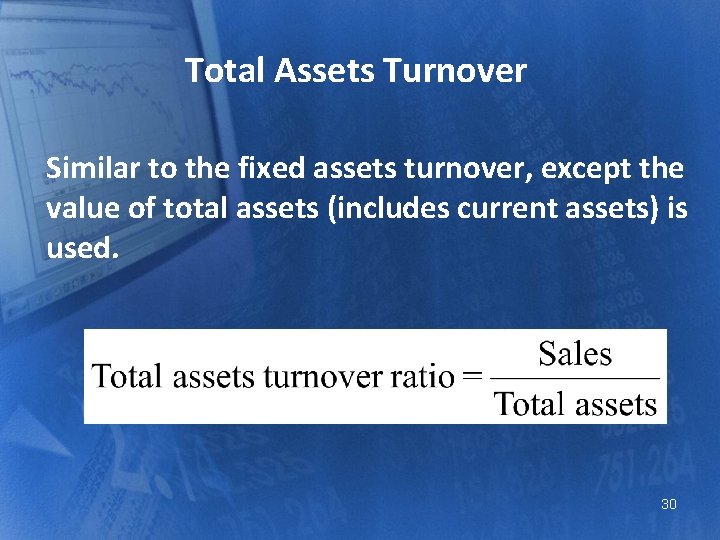

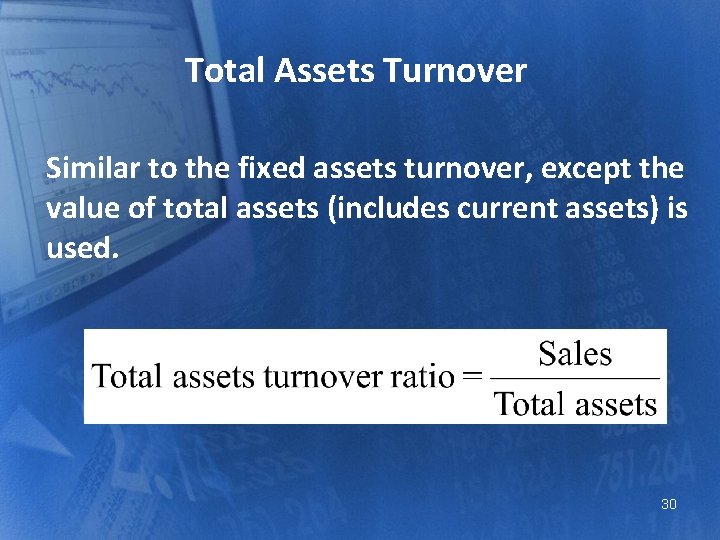

Total Assets Turnover Similar to the fixed assets turnover, except the value of total assets (includes current assets) is used. 30

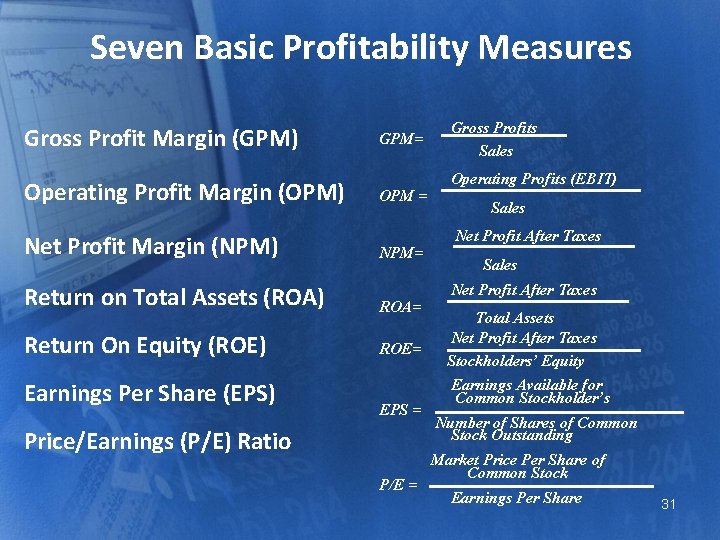

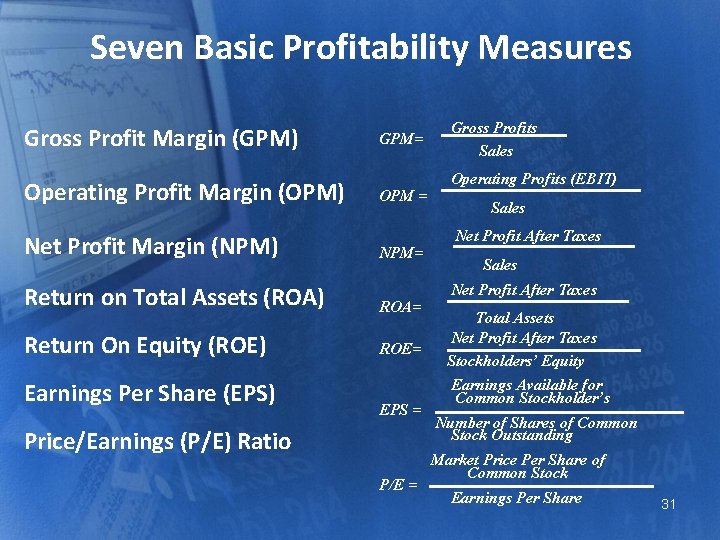

Seven Basic Profitability Measures Gross Profit Margin (GPM) Operating Profit Margin (OPM) Net Profit Margin (NPM) GPM= OPM = NPM= Return on Total Assets (ROA) ROA= Return On Equity (ROE) ROE= Earnings Per Share (EPS) EPS = Price/Earnings (P/E) Ratio P/E = Gross Profits Sales Operating Profits (EBIT) Sales Net Profit After Taxes Total Assets Net Profit After Taxes Stockholders’ Equity Earnings Available for Common Stockholder’s Number of Shares of Common Stock Outstanding Market Price Per Share of Common Stock Earnings Per Share 31

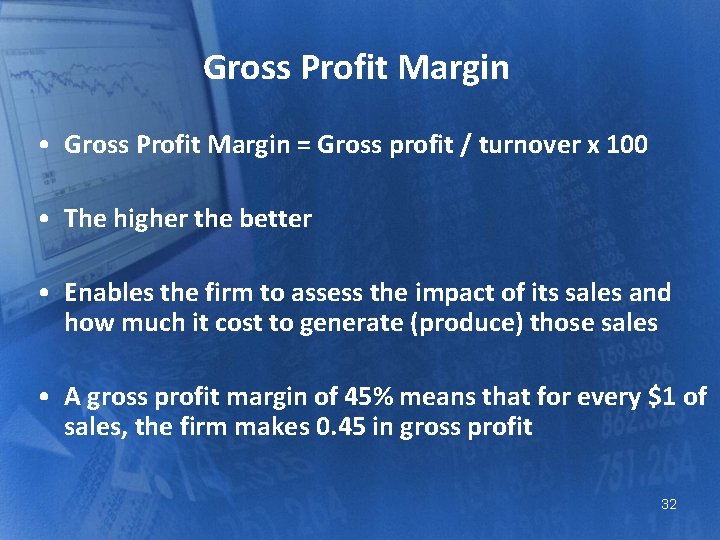

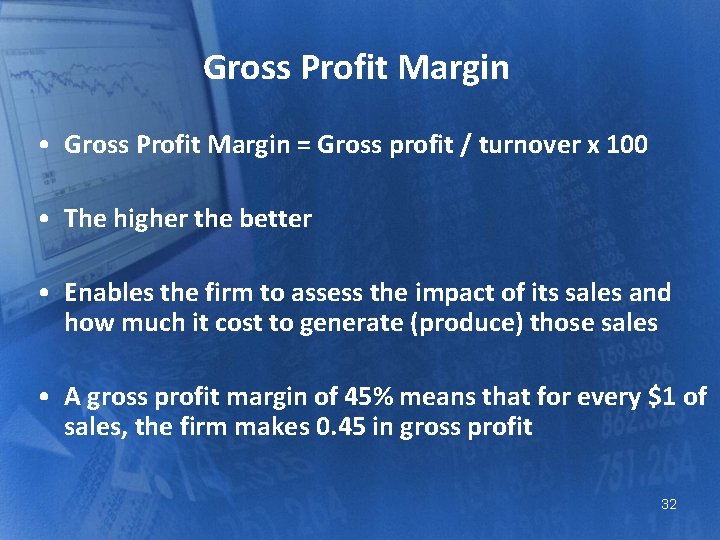

Gross Profit Margin • Gross Profit Margin = Gross profit / turnover x 100 • The higher the better • Enables the firm to assess the impact of its sales and how much it cost to generate (produce) those sales • A gross profit margin of 45% means that for every $1 of sales, the firm makes 0. 45 in gross profit 32

Net Profit Margin • Net profit looks at how much of the sales revenue is left as net profit • Net Profit Margin = Net Profit / Turnover x 100 • Includes overheads / fixed costs • Net profit is more important than gross profit for a business as all costs are included • A business would like to see that this ratio has improved over time 33

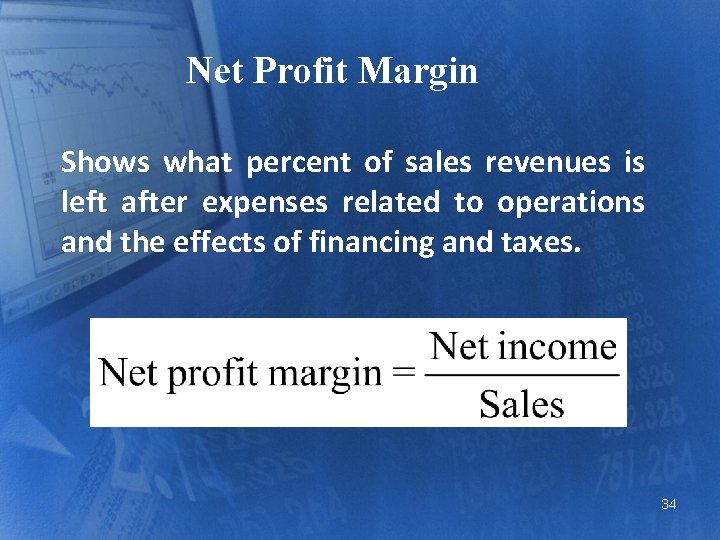

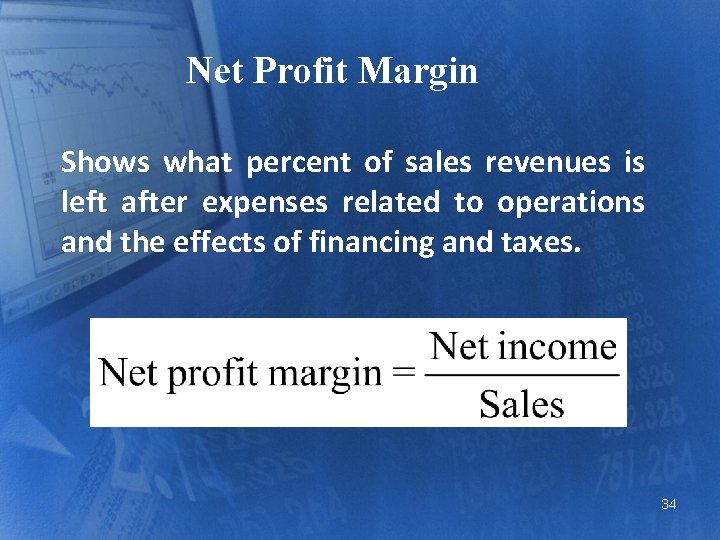

Net Profit Margin Shows what percent of sales revenues is left after expenses related to operations and the effects of financing and taxes. 34

• Profit Margin measures the firm’s ability to control expenses. • An 8% profit margin says out of each dollar of sales, the Company spent 92 cents on expenses. 35

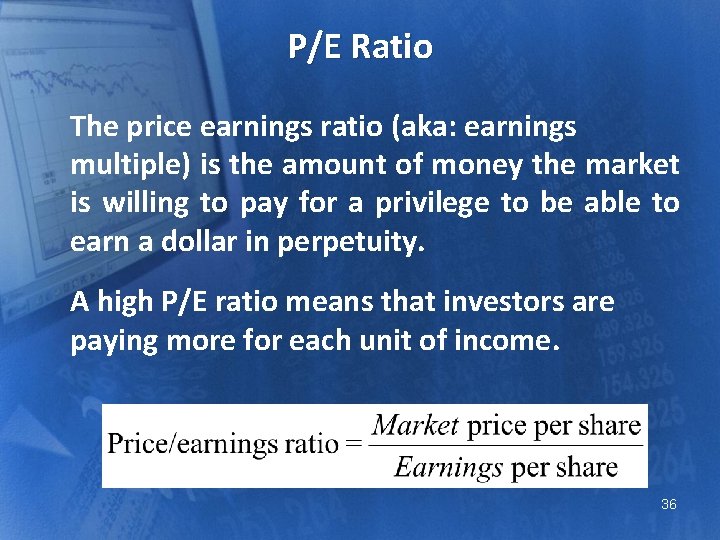

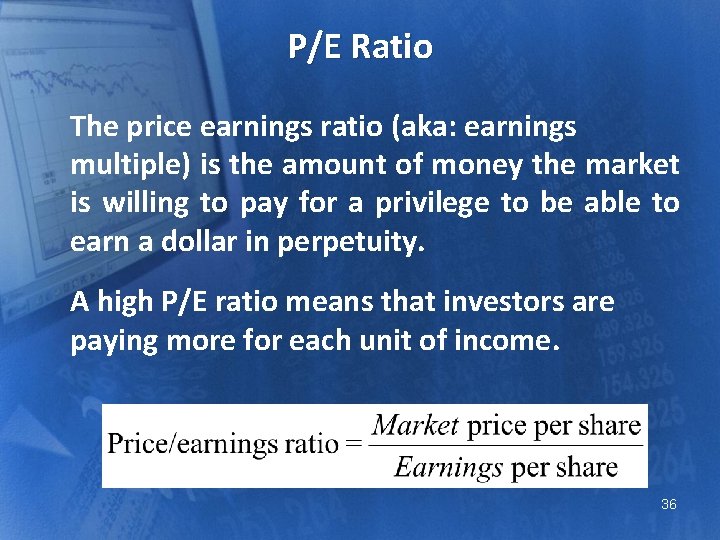

P/E Ratio The price earnings ratio (aka: earnings multiple) is the amount of money the market is willing to pay for a privilege to be able to earn a dollar in perpetuity. A high P/E ratio means that investors are paying more for each unit of income. 36

Price/Earnings Ratio A P/E ratio of 20 suggests that investors in the stock are willing to pay $20 for every $1 of earnings that the company generates. 37

Interpreting the P/E Ratio N/A: The company has no earnings—undefined P/E ratio. Companies with losses (negative earnings) are usually treated as having an undefined P/E ratio. 0– 10: Either the stock is undervalued or the company's earnings are thought to be in decline. 10– 17: This is usually considered fair value. 17– 25: Either the stock is overvalued or the company's earnings have increased since the last earnings figure was published. The stock may also be a growth stock with earnings expected to increase substantially in the future. 25+: A company whose shares have a very high P/E may have high expected future growth in earnings or the stock may be the 38 subject of a speculative bubble.

Analyzing the P/E Ratio Is the stock cheap or expensive—take two factors into account: • Rate of Growth: How fast has the company been growing in the past, and is it expected to continue in the future? Something isn't right if a company has only grown at 5% in the past and still has a high P/E. • Industry: Utility companies have low P/E ratios—technology companies have high P/E ratios. 39

Points to Remember: • Historically, the average P/E ratio in the market has been around 15 -25. • The P/E ratio is a much better indicator of a stock's value than the market price alone. • In general, it's difficult to say whether a particular P/E is high or low without taking into account growth rates and the industry. • P/E ratios are generally lower during times of high inflation. 40

Debt Ratio Analysis A company’s debt position is a measure of how much of the firm’s profits are generated using money borrowed from other companies or individuals. 41

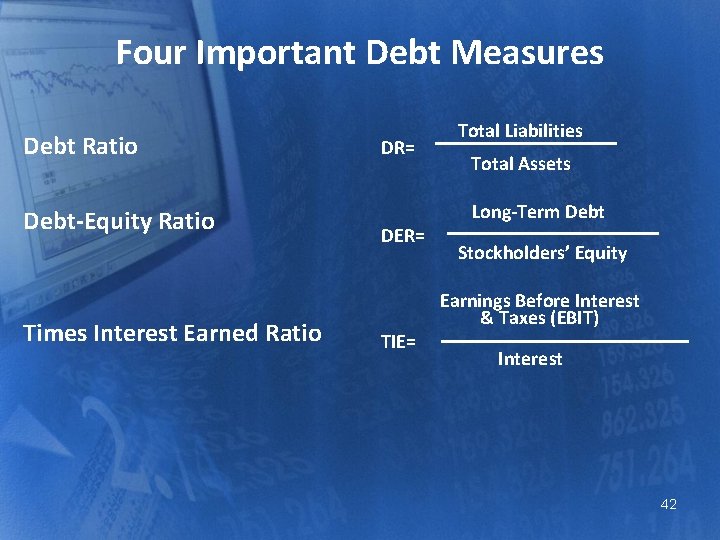

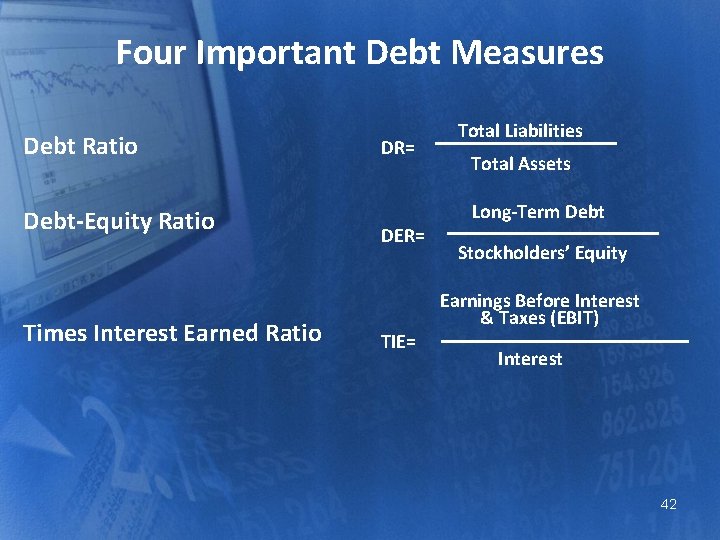

Four Important Debt Measures Total Liabilities Debt Ratio DR= Debt-Equity Ratio Long-Term Debt DER= Stockholders’ Equity Times Interest Earned Ratio Total Assets Earnings Before Interest & Taxes (EBIT) TIE= Interest 42

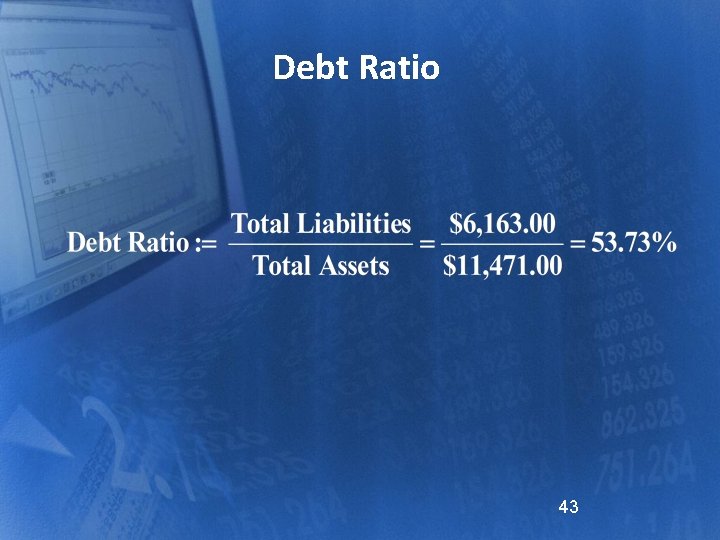

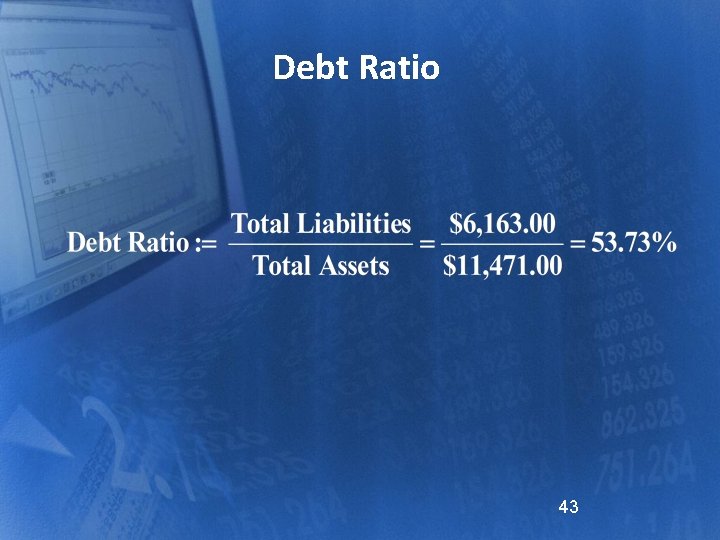

Debt Ratio 43

Implication of a High Debt Ratio • Good in good years because the common shareholders capture all profits over what is needed to service the debt. • This bad in poor years because the debt has to be serviced whether or not the common shareholders make a profit. 44

Debt Collection Period • This is another efficiency ratio • This looks at how long it takes for the business to get back money it is owed • Debtors collection ratio = debtors x 365 / turnover • The lower the figure the better as get cash more quickly • However sometimes need to offer credit terms to customers so this may increase it • Need to ensure keep track of any changes in credit terms as these should impact this ratio 45

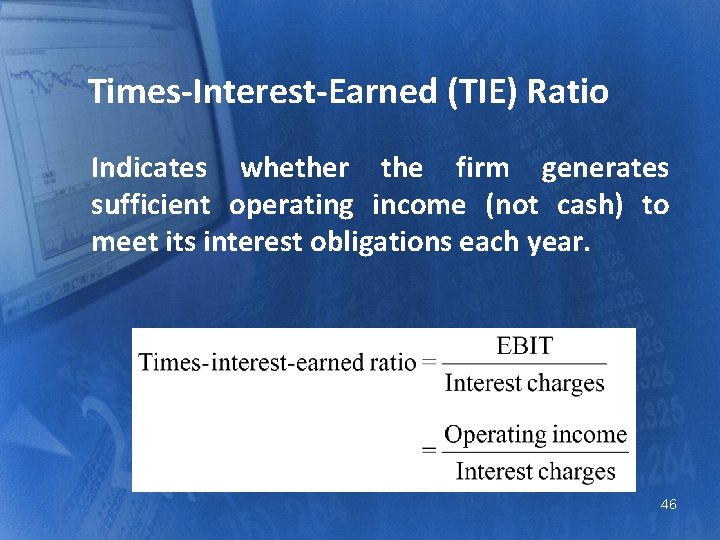

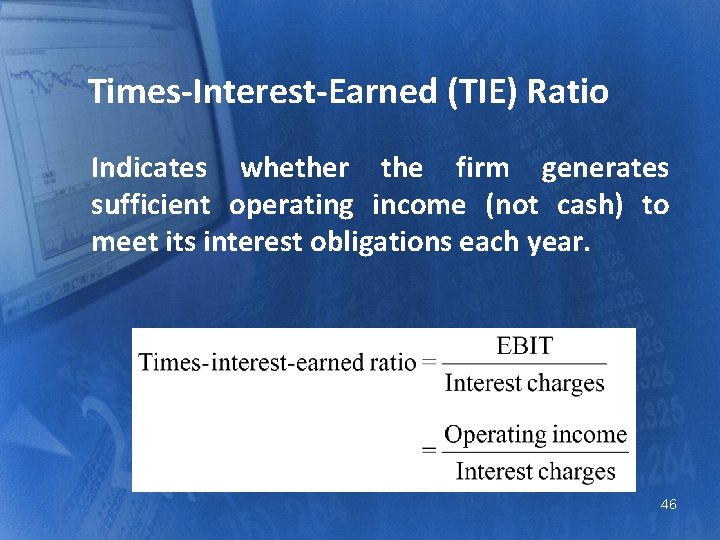

Times-Interest-Earned (TIE) Ratio Indicates whether the firm generates sufficient operating income (not cash) to meet its interest obligations each year. 46

Analysis of Risk Factors that affect risk of a firm – Economy-wide factors such as inflation – Industry-wide factors such as competition – Firm-specific factors such as potential for a labor strike • Questions or issues a. Can the firm pay short-term obligations like workers’ wages? That is, what are measures of short term risk? b. Can the firm pay long-term obligations like debt? That is, what are long-term measures of risk? 47

Measures of Short-Term Risk • Measures of short-term liquidity risk • Current ratio – = (current assets)/(current liabilities) – Measure of ability of the firm to pay short-term liabilities on time • Quick ratio – = (current highly liquid assets)/(current liabilities) – Current highly liquid assets are assets that are quickly and easily converted into cash – This includes bank accounts but not inventories 48

Measures of Short-Term Risk Cash flow from operations to current liabilities ratio = (cash flow from operations)/(current liabilities) – Measures the ability of the firm to pay current liabilities without borrowing or additional investments. 49

Measures of Long-Term Risk Debt-to-equity ratio = (total liabilities)/(total equities) – Percentage of total financing provided by debtors or creditors. – A firm is said to be highly leveraged when this ratio is large. • Cash from operations to total liabilities ratio – Measures the ability of the firm to pay all liabilities from cash without new debt or additional investment. 50

Measures of Long-Term Risk Interest coverage ratio (Earnings before interest and income tax) (interest expense) • Number of times interest is covered by income • Indicates the relative protection that operating profitability provides to debtors 51

Limitations of Ratio Analysis 1. Ratios based on financial data share the same problems of financial data (such as timeliness). 2. Changes in many ratios correlate with other ratios so a direct interpretation of a change in a ratio is not always apparent. 3. Comparing ratios over time is complicated by the fact that economic conditions may change also. 4. Comparing ratios between two firms is complicated by the fact that the firms may have different economic environments or production technologies even though they produce the same product. 52