FINANCIAL REPORTING FOR GROUP ENTITIES UNDER IFRS IFRS

- Slides: 19

FINANCIAL REPORTING FOR GROUP ENTITIES UNDER IFRS - IFRS 3 Business Combinations Conf. univ. dr. Victor-Octavian Müller victor. muller@econ. ubbcluj. ro www. econ. ubbcluj. ro/~victor. muller

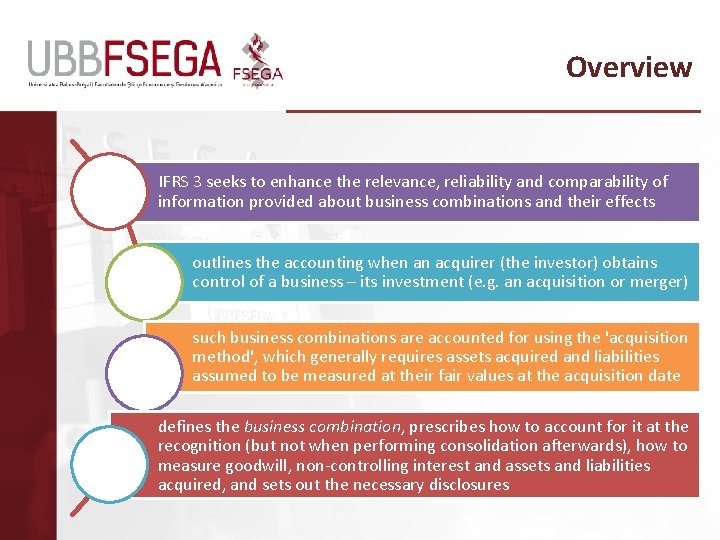

Overview IFRS 3 seeks to enhance the relevance, reliability and comparability of information provided about business combinations and their effects outlines the accounting when an acquirer (the investor) obtains control of a business – its investment (e. g. an acquisition or merger) such business combinations are accounted for using the 'acquisition method', which generally requires assets acquired and liabilities assumed to be measured at their fair values at the acquisition date defines the business combination, prescribes how to account for it at the recognition (but not when performing consolidation afterwards), how to measure goodwill, non controlling interest and assets and liabilities acquired, and sets out the necessary disclosures

Overview Definition of a business combination Measurement of NCI, assets & liabilities Recogniton of Goodwill Disclosures

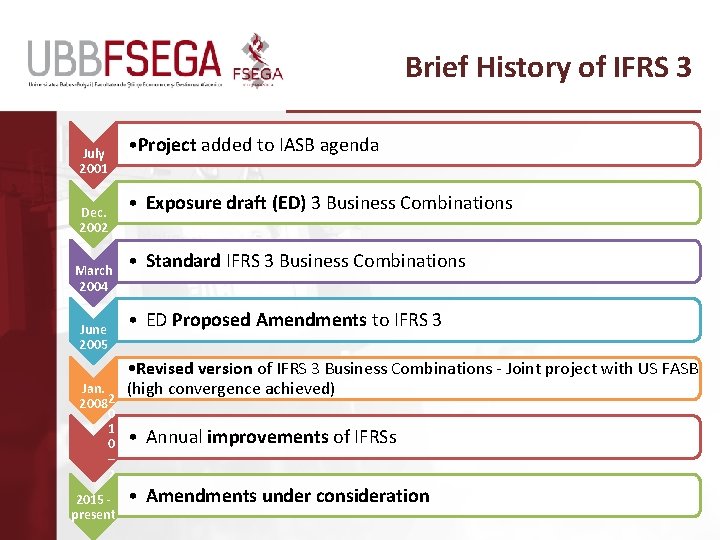

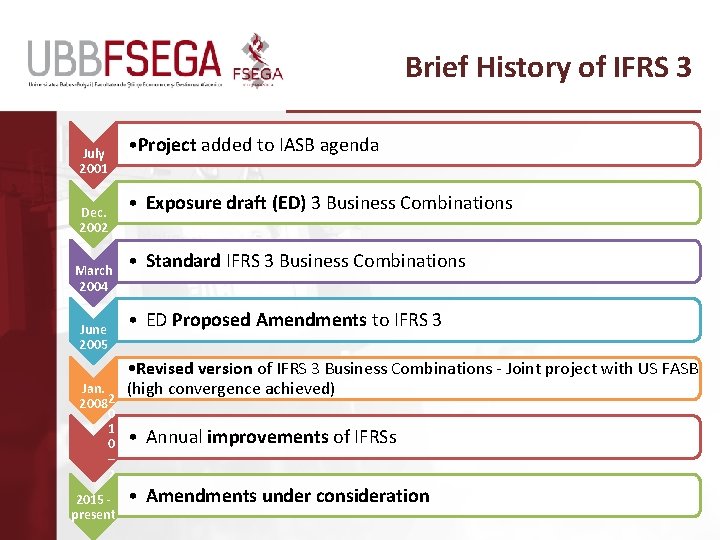

Brief History of IFRS 3 July 2001 Dec. 2002 March 2004 June 2005 Jan. 20082 0 1 0 – 2 0 2015 - 1 present 3 • Project added to IASB agenda • Exposure draft (ED) 3 Business Combinations • Standard IFRS 3 Business Combinations • ED Proposed Amendments to IFRS 3 • Revised version of IFRS 3 Business Combinations Joint project with US FASB (high convergence achieved) • Annual improvements of IFRSs • Amendments under consideration

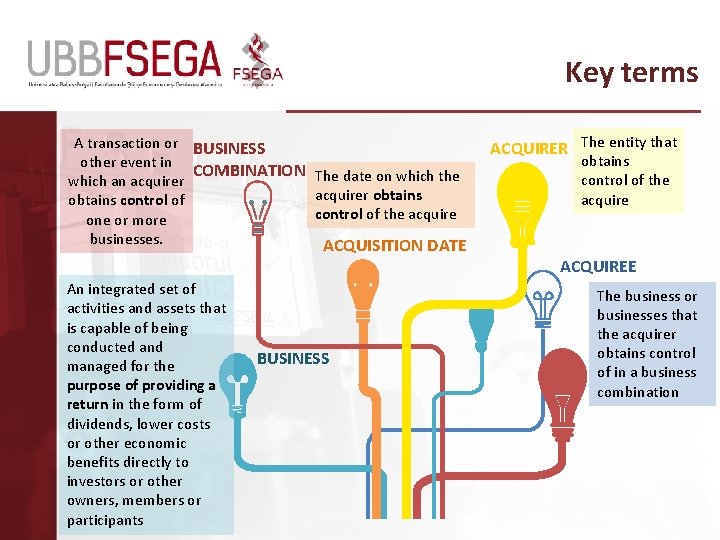

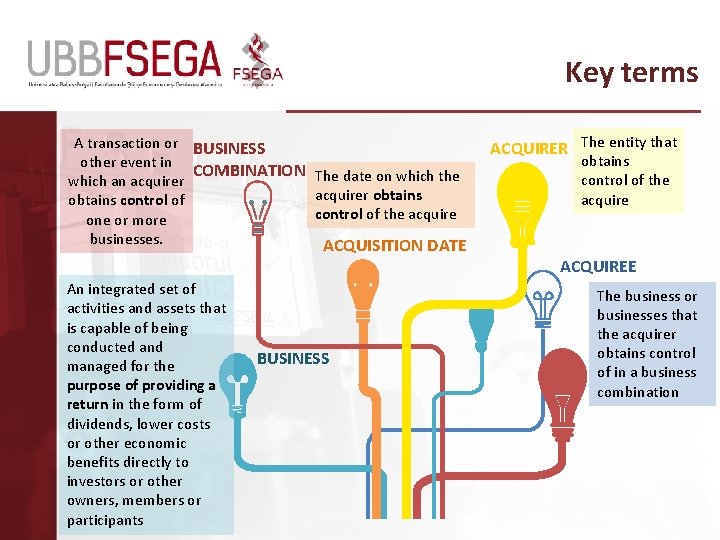

Key terms A transaction or BUSINESS other event in COMBINATION which an acquirer obtains control of one or more businesses. An integrated set of activities and assets that is capable of being conducted and managed for the purpose of providing a return in the form of dividends, lower costs or other economic benefits directly to investors or other owners, members or participants ACQUIRER The entity that The date on which the acquirer obtains control of the acquire n. ACQUISITION DATE BUSINESS obtains control of the acquire ACQUIREE The business or businesses that the acquirer obtains control of in a business combination

Determining whether a transaction is a business combination (1) ü Investors who acquire some investment have to determine whether the transaction or event is a business combination or not ü According to IFRS 3, assets and liabilities acquired must constitute a business, otherwise the transaction is not a business combination and the investor needs to account for it in line with other IFRS ü IFRS 3 provides guidance on determining whether a transaction meets the definition of a business combination ü Business combinations can occur in various ways, such as by transferring cash, incurring liabilities, issuing equity instruments (or any combination thereof), or by not issuing consider ation at all (i. e. by contract alone)

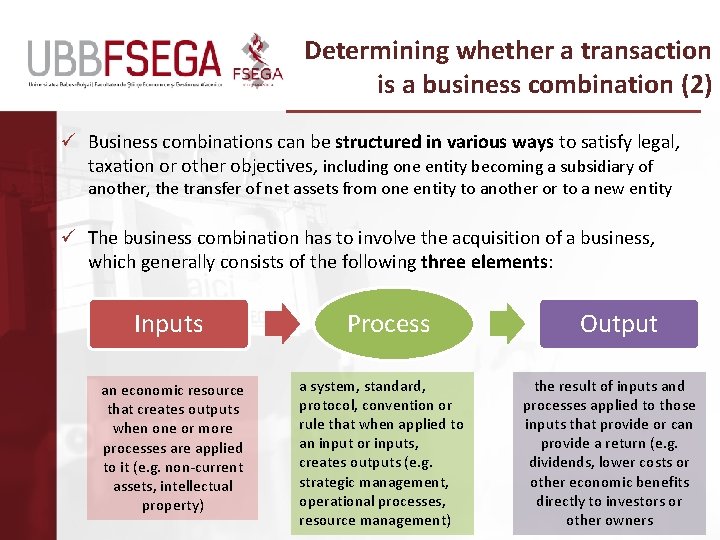

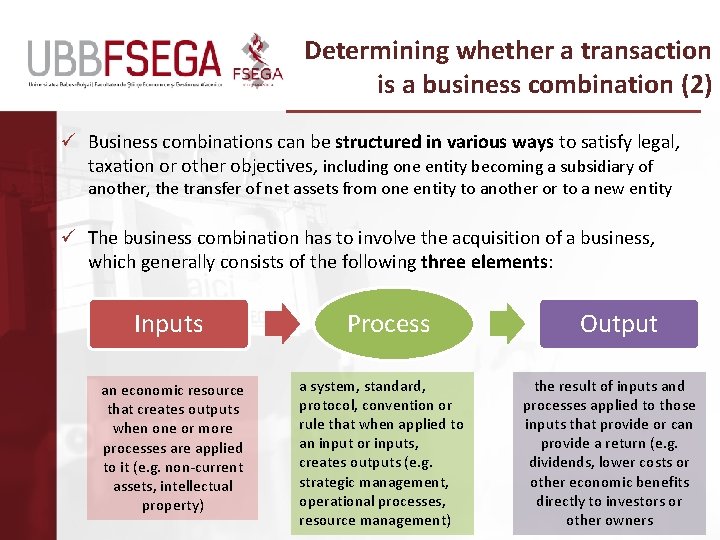

Determining whether a transaction is a business combination (2) ü Business combinations can be structured in various ways to satisfy legal, taxation or other objectives, including one entity becoming a subsidiary of another, the transfer of net assets from one entity to another or to a new entity ü The business combination has to involve the acquisition of a business, which generally consists of the following three elements: Inputs an economic resource that creates outputs when one or more processes are applied to it (e. g. non current assets, intellectual property) Process a system, standard, protocol, convention or rule that when applied to an input or inputs, creates outputs (e. g. strategic management, operational processes, resource management) Output the result of inputs and processes applied to those inputs that provide or can provide a return (e. g. dividends, lower costs or other economic benefits directly to investors or other owners

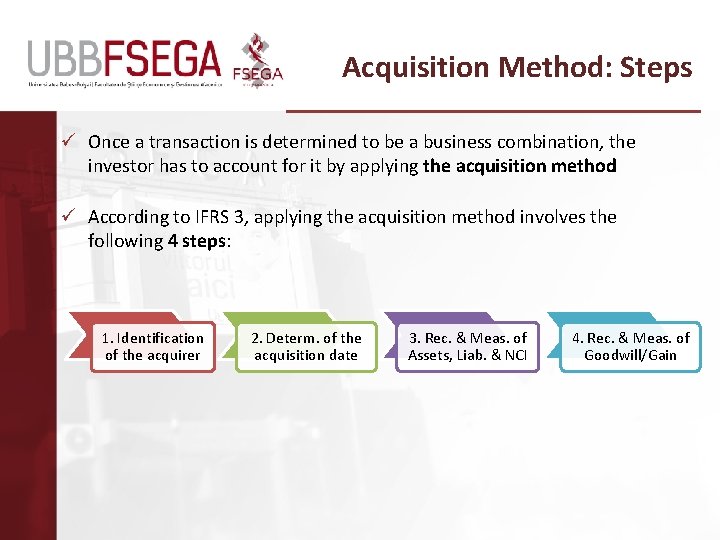

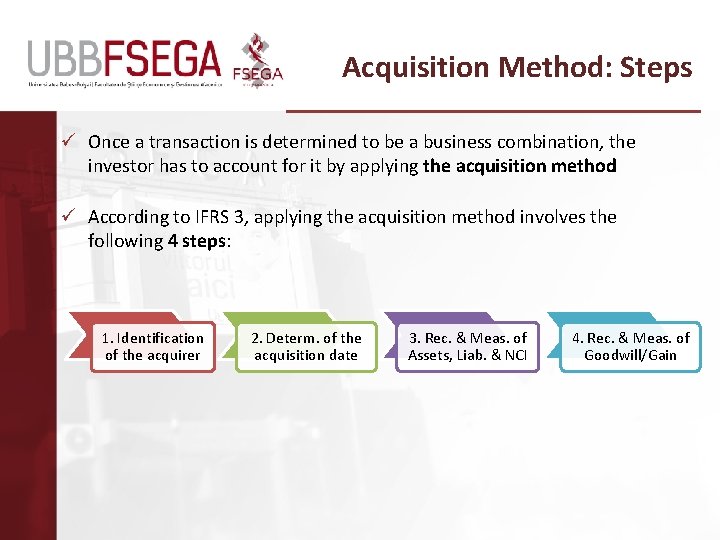

Acquisition Method: Steps ü Once a transaction is determined to be a business combination, the investor has to account for it by applying the acquisition method ü According to IFRS 3, applying the acquisition method involves the following 4 steps: 1. Identification of the acquirer 2. Determ. of the acquisition date 3. Rec. & Meas. of Assets, Liab. & NCI 4. Rec. & Meas. of Goodwill/Gain

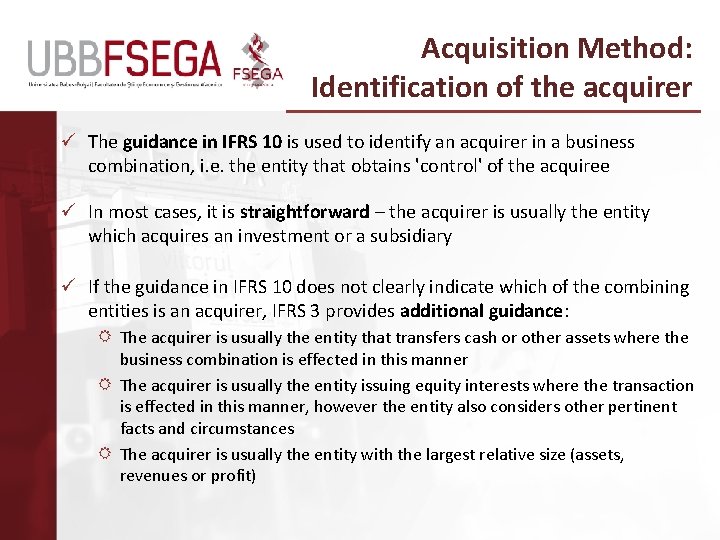

Acquisition Method: Identification of the acquirer ü The guidance in IFRS 10 is used to identify an acquirer in a business combination, i. e. the entity that obtains 'control' of the acquiree ü In most cases, it is straightforward – the acquirer is usually the entity which acquires an investment or a subsidiary ü If the guidance in IFRS 10 does not clearly indicate which of the combining entities is an acquirer, IFRS 3 provides additional guidance: The acquirer is usually the entity that transfers cash or other assets where the business combination is effected in this manner The acquirer is usually the entity issuing equity interests where the transaction is effected in this manner, however the entity also considers other pertinent facts and circumstances The acquirer is usually the entity with the largest relative size (assets, revenues or profit)

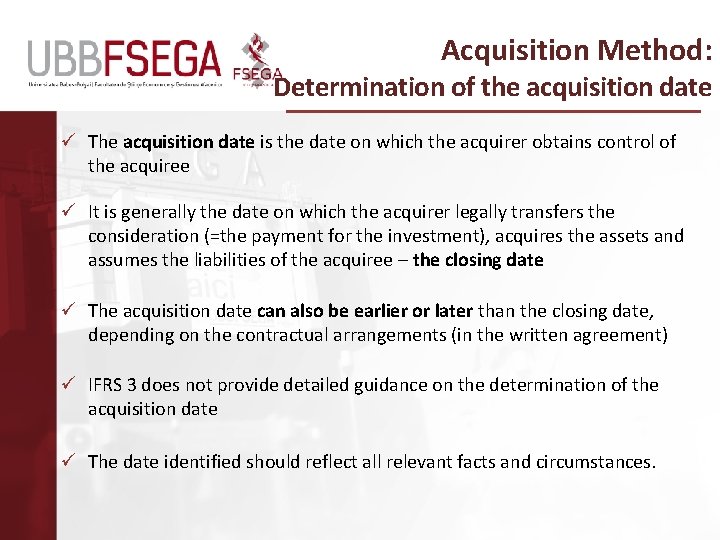

Acquisition Method: Determination of the acquisition date ü The acquisition date is the date on which the acquirer obtains control of the acquiree ü It is generally the date on which the acquirer legally transfers the consideration (=the payment for the investment), acquires the assets and assumes the liabilities of the acquiree – the closing date ü The acquisition date can also be earlier or later than the closing date, depending on the contractual arrangements (in the written agreement) ü IFRS 3 does not provide detailed guidance on the determination of the acquisition date ü The date identified should reflect all relevant facts and circumstances.

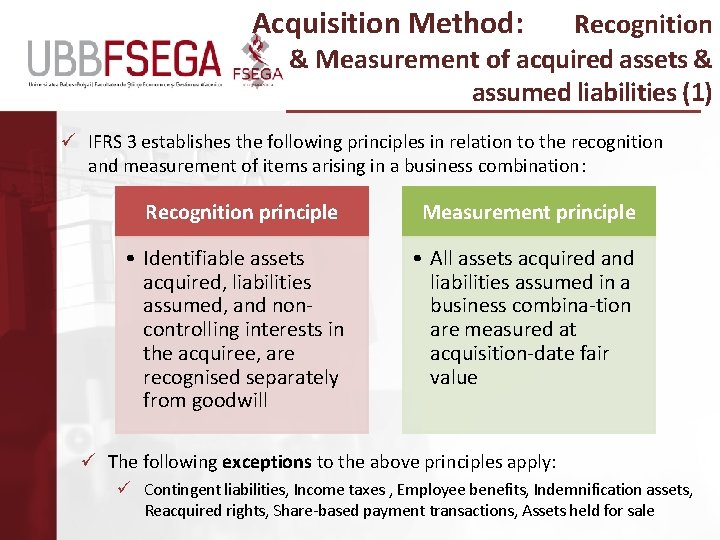

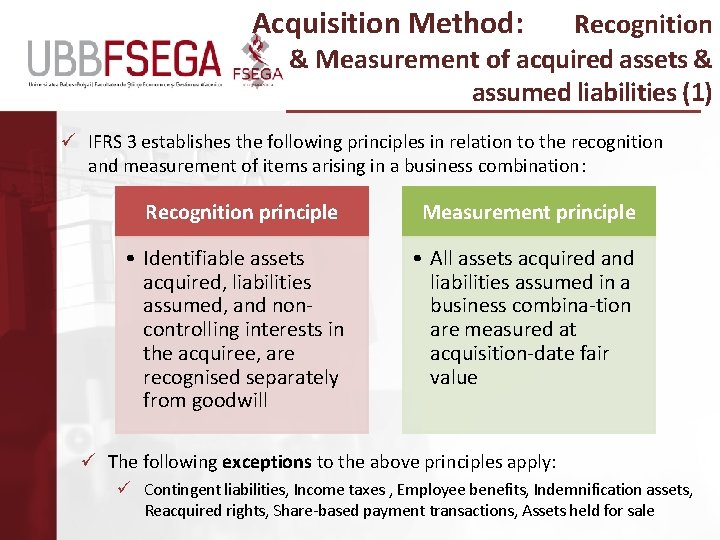

Acquisition Method: Recognition & Measurement of acquired assets & assumed liabilities (1) ü IFRS 3 establishes the following principles in relation to the recognition and measurement of items arising in a business combination: Recognition principle Measurement principle • Identifiable assets acquired, liabilities assumed, and non controlling interests in the acquiree, are recognised separately from goodwill • All assets acquired and liabilities assumed in a business combina tion are measured at acquisition date fair value ü The following exceptions to the above principles apply: ü Contingent liabilities, Income taxes , Employee benefits, Indemnification assets, Reacquired rights, Share based payment transactions, Assets held for sale

Acquisition Method: Recognition & Measurement of acquired assets & assumed liabilities (2) ü An acquirer classifies and designates assets acquired and liabilities assumed on the basis of the contractual terms, economic conditions, operating and accounting policies and other pertinent conditions existing at the acquisition date ü An acquired intangible asset must be recognised and measured at fair value if it is separable or arises from other contractual rights, irrespective of whether the acquiree had recognised the asset prior to the business combination: Unrecognised assets in an acquiree may exist, that an acquirer has to recognise if they meet the criteria for the recognition (e. g. an acquired entity can have unrecognized internally generated intangibles meeting separability criterion) ü Frequently “fair value adjustments” need to be performed at acquisition date, as assets and liabilities are often valued differently (e. g. at cost less accumulated depreciation, at amortized cost, etc. )

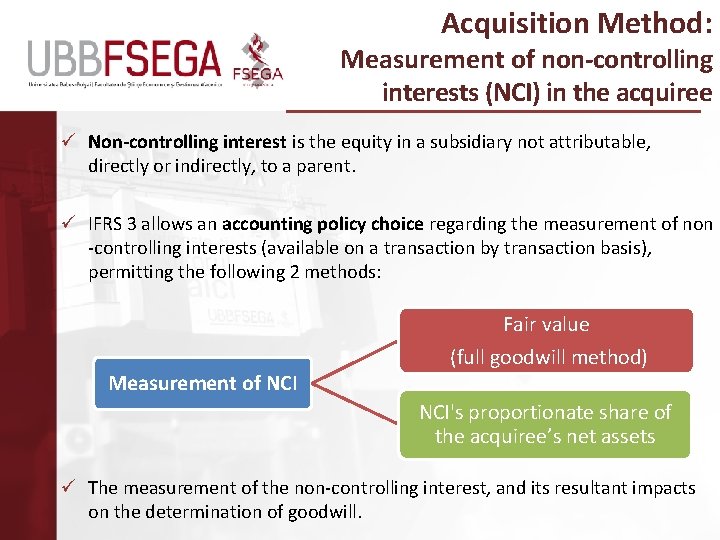

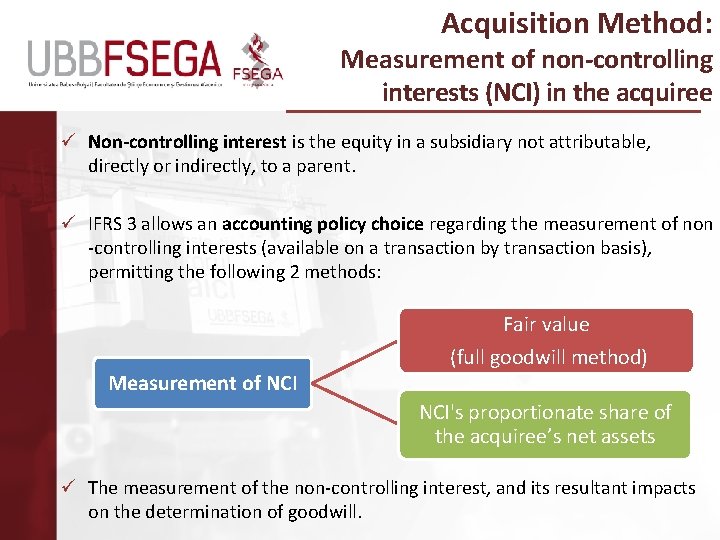

Acquisition Method: Measurement of non-controlling interests (NCI) in the acquiree ü Non-controlling interest is the equity in a subsidiary not attributable, directly or indirectly, to a parent. ü IFRS 3 allows an accounting policy choice regarding the measurement of non controlling interests (available on a transaction by transaction basis), permitting the following 2 methods: Fair value Measurement of NCI (full goodwill method) NCI's proportionate share of the acquiree’s net assets ü The measurement of the non controlling interest, and its resultant impacts on the determination of goodwill.

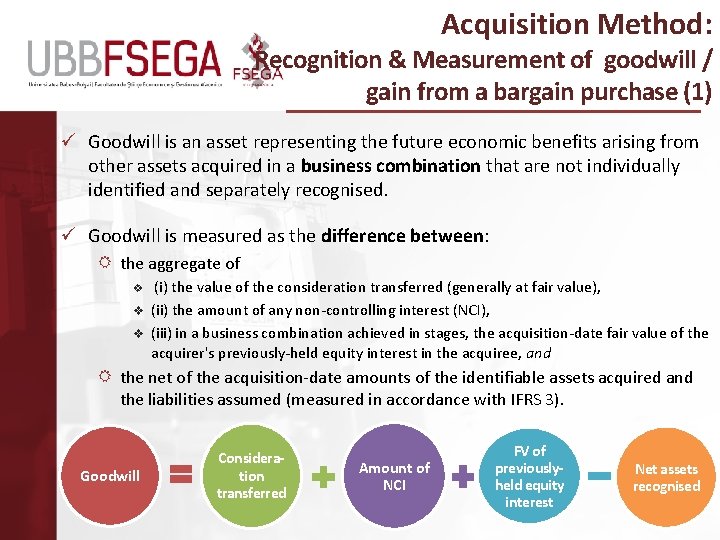

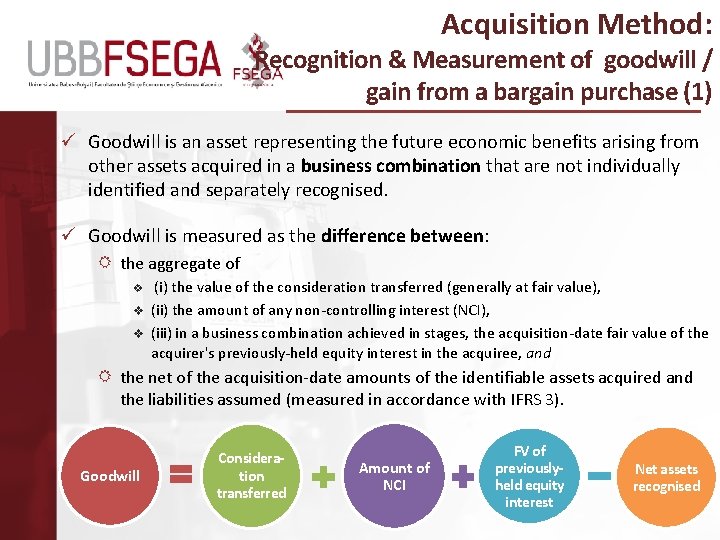

Acquisition Method: Recognition & Measurement of goodwill / gain from a bargain purchase (1) ü Goodwill is an asset representing the future economic benefits arising from other assets acquired in a business combination that are not individually identified and separately recognised. ü Goodwill is measured as the difference between: the aggregate of v (i) the value of the consideration transferred (generally at fair value), v (ii) the amount of any non controlling interest (NCI), (iii) in a business combination achieved in stages, the acquisition date fair value of the acquirer's previously held equity interest in the acquiree, and v the net of the acquisition date amounts of the identifiable assets acquired and the liabilities assumed (measured in accordance with IFRS 3). Goodwill Consideration transferred Amount of NCI FV of previouslyheld equity interest Net assets recognised

Acquisition Method: Recognition & Measurement of goodwill / gain from a bargain purchase (2) ü If the difference is negative, the resulting gain is a bargain purchase in profit or loss (may arise in circumstances such as a forced seller acting under compulsion). ü Before recognising a gain on a bargain purchase in profit or loss, the acquirer is required to undertake a review to ensure that: the identification of assets and liabilities is complete, and that measurements (of assets, liabilities, NCI and consideration transferred) appropriately take into consideration all available information. ü Consideration transferred is measured at fair value, calculated as: the sum of the acquisition date fair values of the assets transferred by the acquirer, the liabilities incurred by the acquirer to former owners of the acquiree and the equity interests issued by the acquirer. ü Potential forms of consideration include: cash, other assets, a business or a subsidiary of the acquirer, contingent consideration, ordinary or preference equity instruments, options, warrants etc.

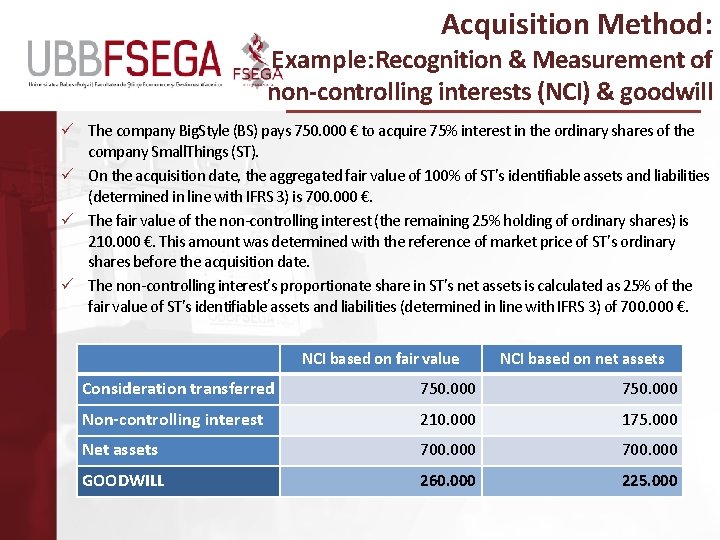

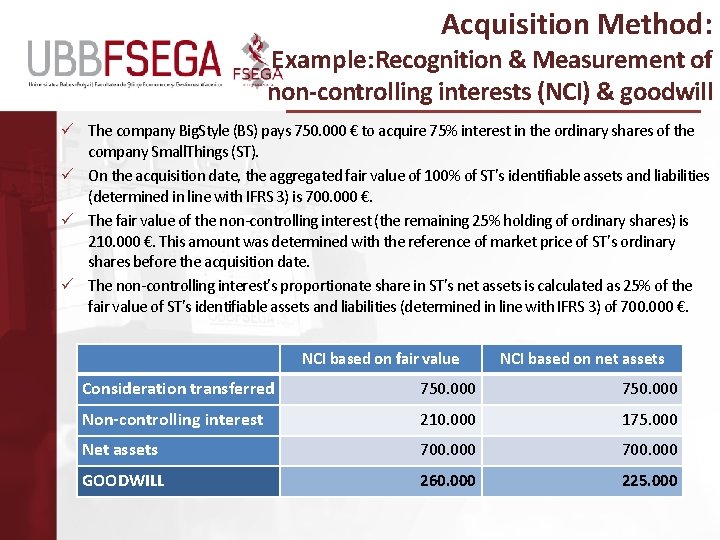

Acquisition Method: Example: Recognition & Measurement of non-controlling interests (NCI) & goodwill ü The company Big. Style (BS) pays 750. 000 € to acquire 75% interest in the ordinary shares of the company Small. Things (ST). ü On the acquisition date, the aggregated fair value of 100% of ST's identifiable assets and liabilities (determined in line with IFRS 3) is 700. 000 €. ü The fair value of the non controlling interest (the remaining 25% holding of ordinary shares) is 210. 000 €. This amount was determined with the reference of market price of ST’s ordinary shares before the acquisition date. ü The non controlling interest’s proportionate share in ST’s net assets is calculated as 25% of the fair value of ST's identifiable assets and liabilities (determined in line with IFRS 3) of 700. 000 €. NCI based on fair value NCI based on net assets Consideration transferred 750. 000 Non-controlling interest 210. 000 175. 000 Net assets 700. 000 GOODWILL 260. 000 225. 000

Acquisition Method: Particular types of business combinations ü A business combination achieved in stages (step acquisition): As part of accounting for the business combination, the acquirer has to remeasure any previously held equity interest in the acquiree at its acquisition date fair value and recognize the resulting gain or loss (if any) in profit or loss or other comprehensive income, as appropriate. All of the assets and liabilities of the acquiree are fully remeasured and the non controlling interest and the goodwill are determined at the acquisition date (when the acquirer obtains control of the acquiree) ü A business combination achieved without the transfer of consideration: An acquirer sometimes obtains control of an acquiree without transferring consideration (e. g. The acquiree repurchasing own shares; lapse of minority veto rights; business combination by contract alone) The acquisition method of accounting for a business combination applies to those combinations (achieved without the transfer of consideration)

Acquisition Method: Measurement period ü If the initial accounting for a business combination can be determined only provisionally by the end of the first reporting period in which the combination occurs, the business combination is accounted for using provisional amounts. ü Adjustments to provisional amounts, and the recognition of newly identified asset and liabilities, must be made within the 'measurement period' where they reflect new information obtained about facts and circumstances that were in existence at the acquisition date. ü The acquirer recognises an increase/decrease in the provisional amount recognised for an identifiable asset/liability by means of a decrease/increase in goodwill. ü The measurement period cannot exceed one year from the acquisition date and no adjustments are permitted after one year except to correct an error in accordance with IAS 8.

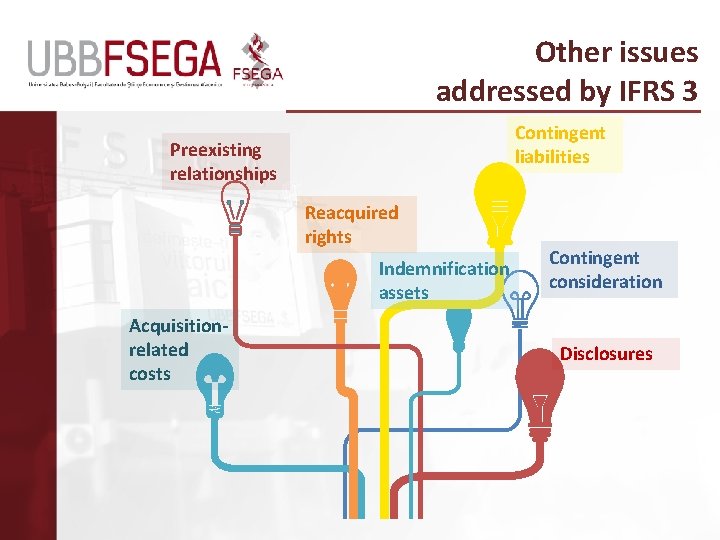

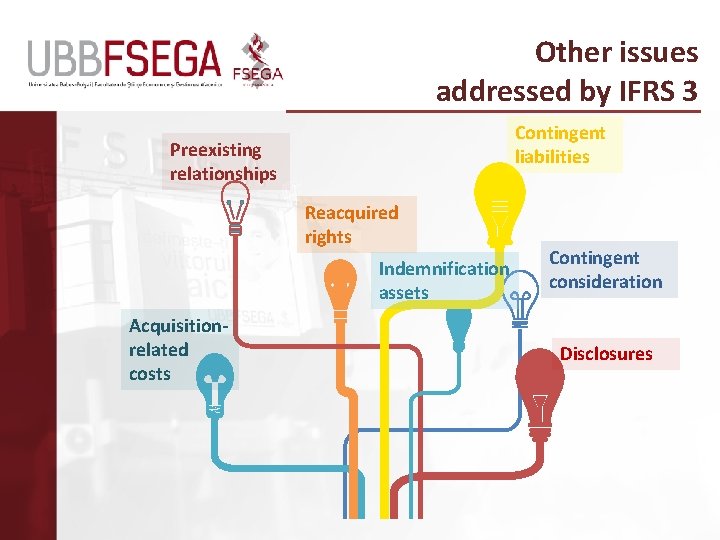

Other issues addressed by IFRS 3 Contingent liabilities Preexisting relationships Reacquired rights Indemnification assets Acquisitionrelated costs Contingent consideration Disclosures