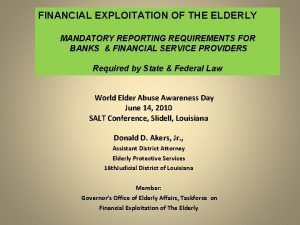

FINANCIAL EXPLOITATION OF THE ELDERLY MANDATORY REPORTING REQUIREMENTS

- Slides: 17

FINANCIAL EXPLOITATION OF THE ELDERLY MANDATORY REPORTING REQUIREMENTS FOR BANKS & FINANCIAL SERVICE PROVIDERS Required by State & Federal Law World Elder Abuse Awareness Day June 14, 2010 SALT Conference, Slidell, Louisiana Donald D. Akers, Jr. , Assistant District Attorney Elderly Protective Services 16 th. Judicial District of Louisiana Member: Governor’s Office of Elderly Affairs, Taskforce on Financial Exploitation of The Elderly • .

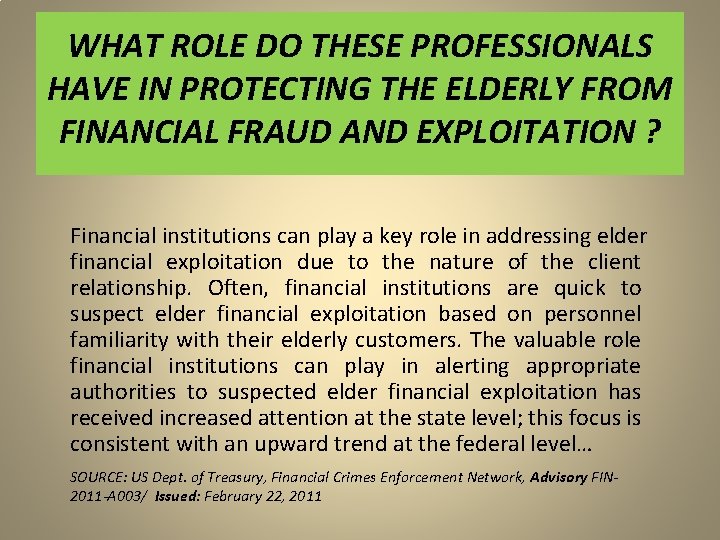

WHAT ROLE DO THESE PROFESSIONALS HAVE IN PROTECTING THE ELDERLY FROM FINANCIAL FRAUD AND EXPLOITATION ? Financial institutions can play a key role in addressing elder financial exploitation due to the nature of the client relationship. Often, financial institutions are quick to suspect elder financial exploitation based on personnel familiarity with their elderly customers. The valuable role financial institutions can play in alerting appropriate authorities to suspected elder financial exploitation has received increased attention at the state level; this focus is consistent with an upward trend at the federal level… SOURCE: US Dept. of Treasury, Financial Crimes Enforcement Network, Advisory FIN 2011 -A 003/ Issued: February 22, 2011

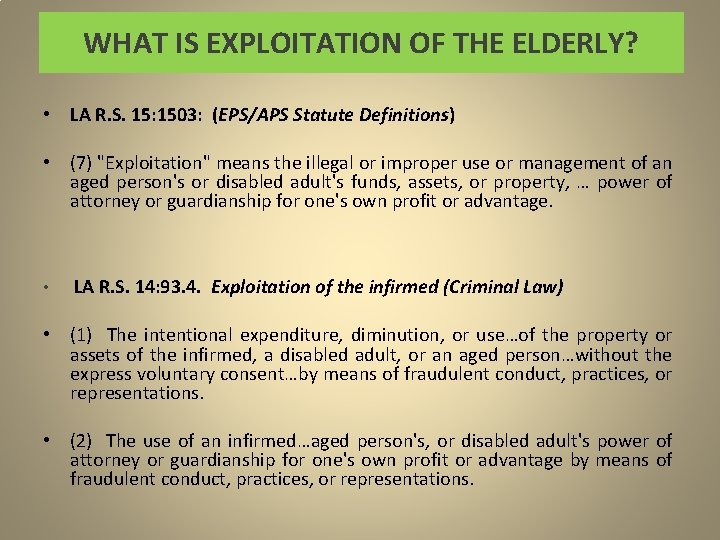

WHAT IS EXPLOITATION OF THE ELDERLY? • LA R. S. 15: 1503: (EPS/APS Statute Definitions) • (7) "Exploitation" means the illegal or improper use or management of an aged person's or disabled adult's funds, assets, or property, … power of attorney or guardianship for one's own profit or advantage. • LA R. S. 14: 93. 4. Exploitation of the infirmed (Criminal Law) • (1) The intentional expenditure, diminution, or use…of the property or assets of the infirmed, a disabled adult, or an aged person…without the express voluntary consent…by means of fraudulent conduct, practices, or representations. • (2) The use of an infirmed…aged person's, or disabled adult's power of attorney or guardianship for one's own profit or advantage by means of fraudulent conduct, practices, or representations.

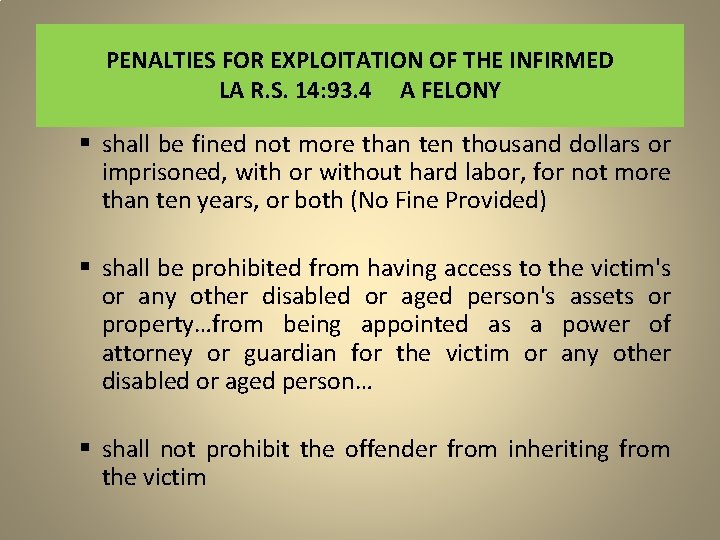

PENALTIES FOR EXPLOITATION OF THE INFIRMED LA R. S. 14: 93. 4 A FELONY § shall be fined not more than ten thousand dollars or imprisoned, with or without hard labor, for not more than ten years, or both (No Fine Provided) § shall be prohibited from having access to the victim's or any other disabled or aged person's assets or property…from being appointed as a power of attorney or guardian for the victim or any other disabled or aged person… § shall not prohibit the offender from inheriting from the victim

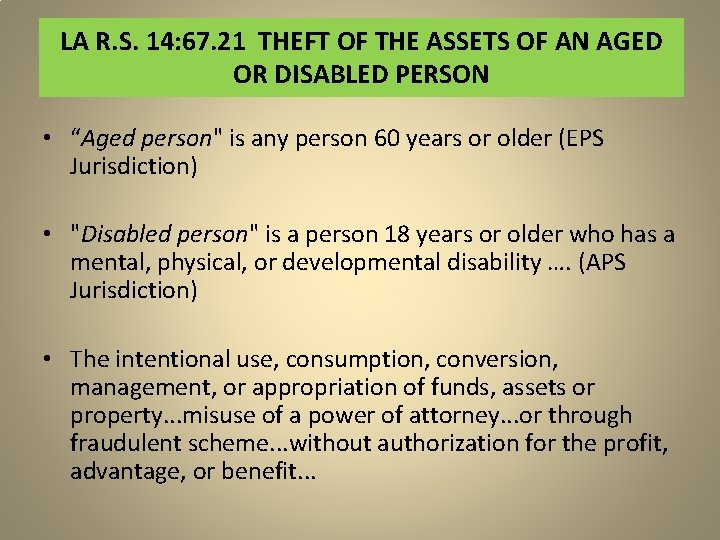

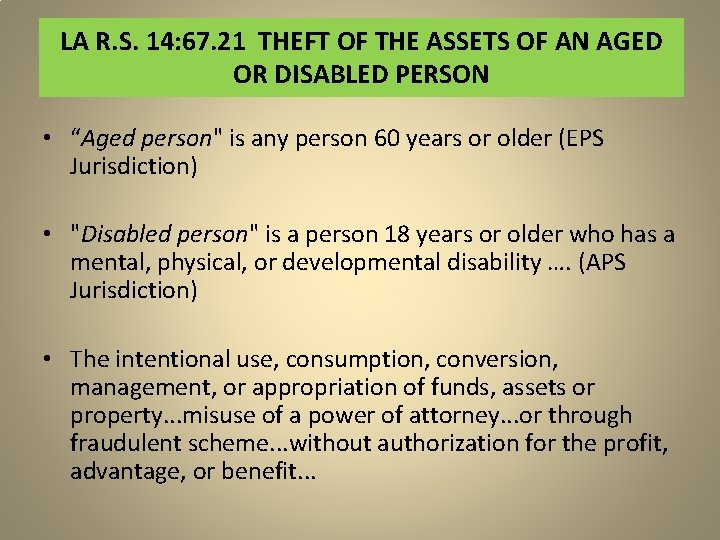

LA R. S. 14: 67. 21 THEFT OF THE ASSETS OF AN AGED OR DISABLED PERSON • “Aged person" is any person 60 years or older (EPS Jurisdiction) • "Disabled person" is a person 18 years or older who has a mental, physical, or developmental disability …. (APS Jurisdiction) • The intentional use, consumption, conversion, management, or appropriation of funds, assets or property. . . misuse of a power of attorney. . . or through fraudulent scheme. . . without authorization for the profit, advantage, or benefit. . .

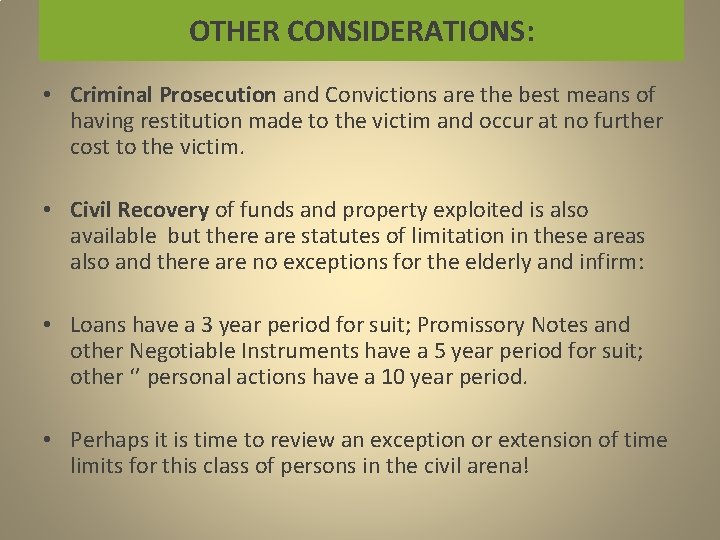

OTHER CONSIDERATIONS: • Criminal Prosecution and Convictions are the best means of having restitution made to the victim and occur at no further cost to the victim. • Civil Recovery of funds and property exploited is also available but there are statutes of limitation in these areas also and there are no exceptions for the elderly and infirm: • Loans have a 3 year period for suit; Promissory Notes and other Negotiable Instruments have a 5 year period for suit; other ‘’ personal actions have a 10 year period. • Perhaps it is time to review an exception or extension of time limits for this class of persons in the civil arena!

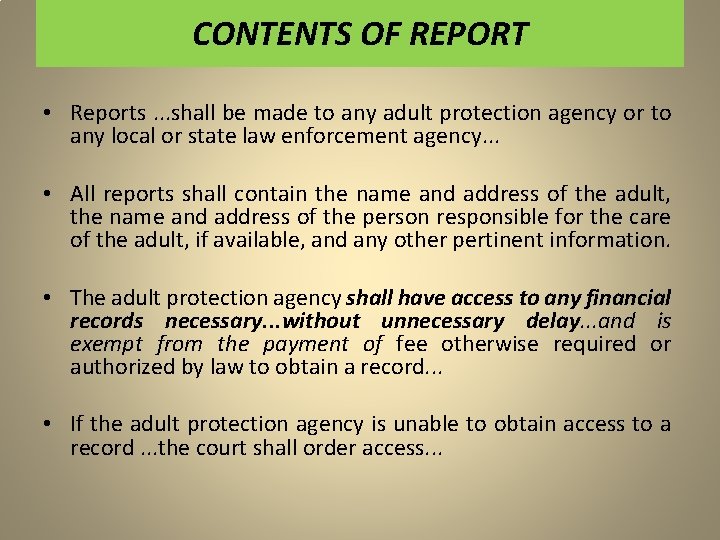

CONTENTS OF REPORT • Reports. . . shall be made to any adult protection agency or to any local or state law enforcement agency. . . • All reports shall contain the name and address of the adult, the name and address of the person responsible for the care of the adult, if available, and any other pertinent information. • The adult protection agency shall have access to any financial records necessary. . . without unnecessary delay. . . and is exempt from the payment of fee otherwise required or authorized by law to obtain a record. . . • If the adult protection agency is unable to obtain access to a record. . . the court shall order access. . .

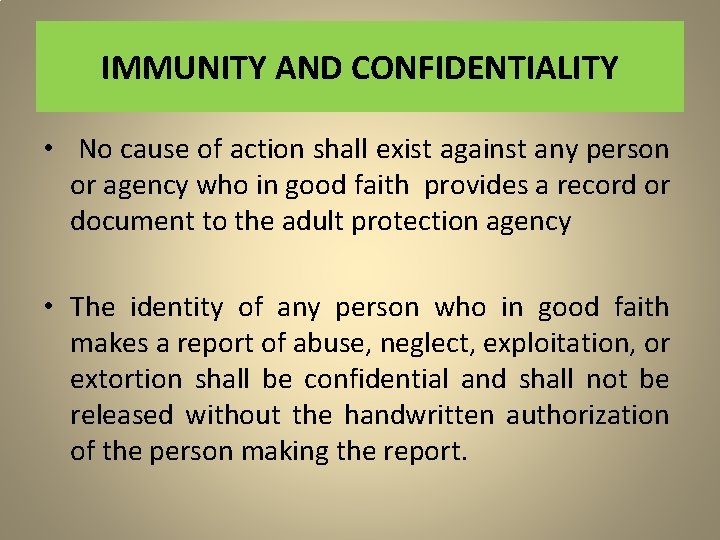

IMMUNITY AND CONFIDENTIALITY • No cause of action shall exist against any person or agency who in good faith provides a record or document to the adult protection agency • The identity of any person who in good faith makes a report of abuse, neglect, exploitation, or extortion shall be confidential and shall not be released without the handwritten authorization of the person making the report.

CONSEQUENCES OF FAILURE TO REPORT • Further, a person who knowingly fails to report abuse may be liable for fines and/or imprisonment. • It is everyone's responsibility to report abuse or neglect of an elder.

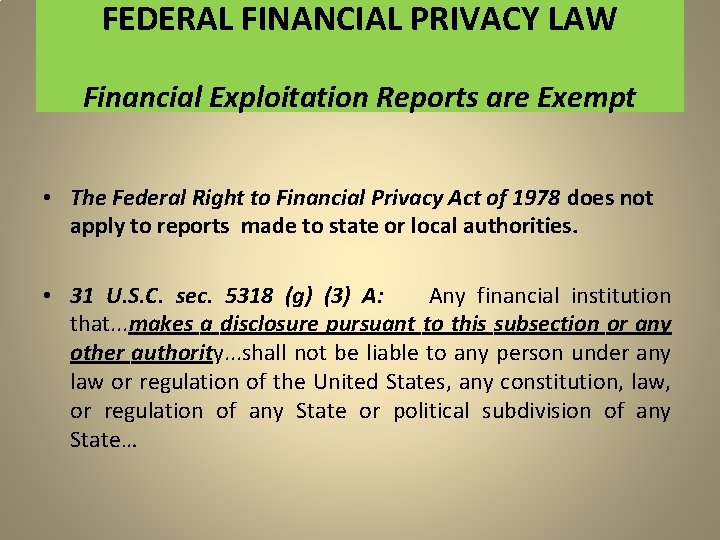

FEDERAL FINANCIAL PRIVACY LAW Financial Exploitation Reports are Exempt • The Federal Right to Financial Privacy Act of 1978 does not apply to reports made to state or local authorities. • 31 U. S. C. sec. 5318 (g) (3) A: Any financial institution that. . . makes a disclosure pursuant to this subsection or any other authority. . . shall not be liable to any person under any law or regulation of the United States, any constitution, law, or regulation of any State or political subdivision of any State…

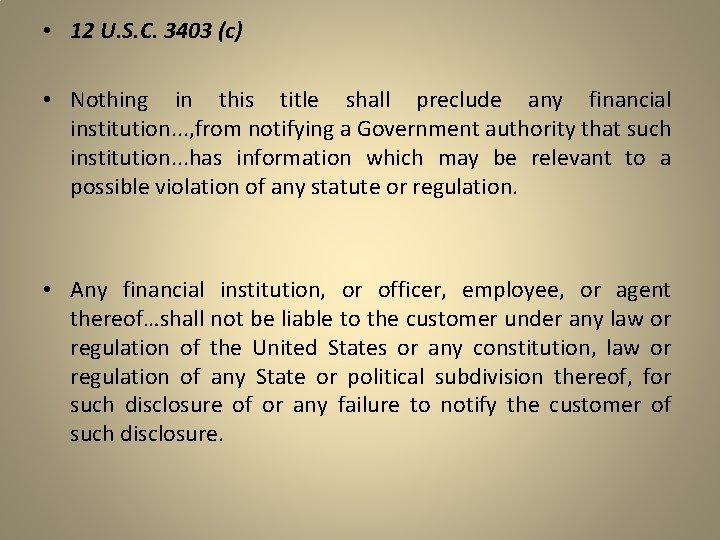

• 12 U. S. C. 3403 (c) • Nothing in this title shall preclude any financial institution. . . , from notifying a Government authority that such institution. . . has information which may be relevant to a possible violation of any statute or regulation. • Any financial institution, or officer, employee, or agent thereof…shall not be liable to the customer under any law or regulation of the United States or any constitution, law or regulation of any State or political subdivision thereof, for such disclosure of or any failure to notify the customer of such disclosure.

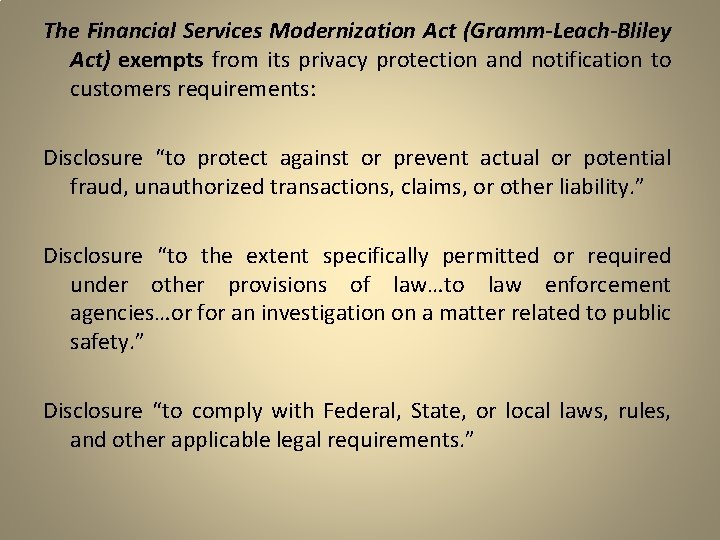

The Financial Services Modernization Act (Gramm-Leach-Bliley Act) exempts from its privacy protection and notification to customers requirements: Disclosure “to protect against or prevent actual or potential fraud, unauthorized transactions, claims, or other liability. ” Disclosure “to the extent specifically permitted or required under other provisions of law…to law enforcement agencies…or for an investigation on a matter related to public safety. ” Disclosure “to comply with Federal, State, or local laws, rules, and other applicable legal requirements. ”

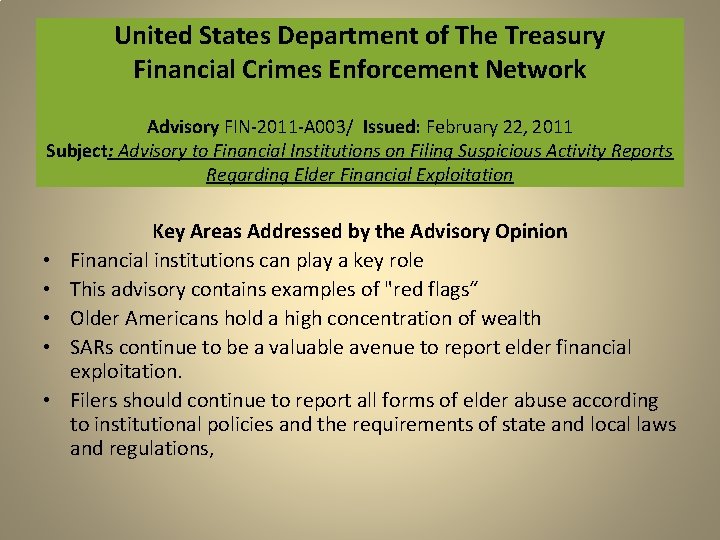

United States Department of The Treasury Financial Crimes Enforcement Network Advisory FIN-2011 -A 003/ Issued: February 22, 2011 Subject: Advisory to Financial Institutions on Filing Suspicious Activity Reports Regarding Elder Financial Exploitation • • • Key Areas Addressed by the Advisory Opinion Financial institutions can play a key role This advisory contains examples of "red flags“ Older Americans hold a high concentration of wealth SARs continue to be a valuable avenue to report elder financial exploitation. Filers should continue to report all forms of elder abuse according to institutional policies and the requirements of state and local laws and regulations,

HOW CAN BANKERS AND FINANCIAL SERVICE PROVIDERS HELP ? • Train and sensitize employees about financial exploitation so that they recognize and report it • Designate a staff person whom employees must notify when questionable or illegal financial transactions are occurring • Develop a protocol for reporting suspected financial exploitation to law enforcement or Adult Protective Services • Train customer service specialists in interview techniques of elder customers • Educate customers about how to recognize the signs of exploitation

SIGNS OF FINANCIAL EXPLOITATION OF AN ELDERLY PERSON • A relative or caregiver with no means of support who is suddenly interested in the elder's finances • The elderly person's bills are not being paid • A relative or caregiver who isolates the elder • The elder is unaware of or unable to explain their finances • Bank and credit card statements are sent to the relative or caregiver • The elder is concerned about missing money • Suspicious signatures on checks • A legal document, such as a will or power of attorney, is drafted without the elder fully appreciating its implications

METHODS OF FINANCIAL EXPLOITATION • Taking or giving the victim's money, property, or valuables without permission • Borrowing money and not paying it back • Misusing ATM or credit cards • Joint Bank Accounts where the offender's name is added to the victim's account • Deed or Title Transfer: Transferring property to the offender, possibly as a result of force or intimidation • Power of Attorney: Misusing the power of attorney by forcing the victim to agree to it or using the power for other unintended purposes • Living Trusts and Wills: Having himself named manager of the victim's trust or as a beneficiary

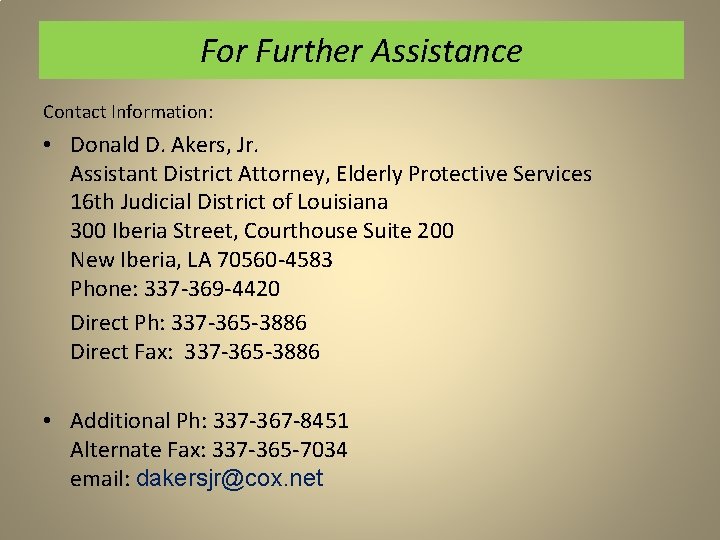

For Further Assistance Contact Information: • Donald D. Akers, Jr. Assistant District Attorney, Elderly Protective Services 16 th Judicial District of Louisiana 300 Iberia Street, Courthouse Suite 200 New Iberia, LA 70560 -4583 Phone: 337 -369 -4420 Direct Ph: 337 -365 -3886 Direct Fax: 337 -365 -3886 • Additional Ph: 337 -367 -8451 Alternate Fax: 337 -365 -7034 email: dakersjr@cox. net

Financial accounting standards

Financial accounting standards Accounting and auditing board of ethiopia proclamation

Accounting and auditing board of ethiopia proclamation Mandated reporter training massachusetts

Mandated reporter training massachusetts Mandatory reporting arizona

Mandatory reporting arizona Mandatory reporting alabama

Mandatory reporting alabama Tn mandatory reporting laws

Tn mandatory reporting laws Virginia mandatory reporting law domestic violence

Virginia mandatory reporting law domestic violence Mandatory reporting

Mandatory reporting California aca reporting requirements

California aca reporting requirements Spill reporting requirements by state

Spill reporting requirements by state Project reporting requirements

Project reporting requirements Fisma reporting requirements

Fisma reporting requirements Exploitation plan meaning

Exploitation plan meaning Child exploitation and obscenity section

Child exploitation and obscenity section Heap exploitation techniques

Heap exploitation techniques Exploitation competition

Exploitation competition Windows heap exploitation

Windows heap exploitation Exploitation of the infirmed

Exploitation of the infirmed