Finance Management End Next Finance Management Introduction We

- Slides: 11

Finance Management End Next

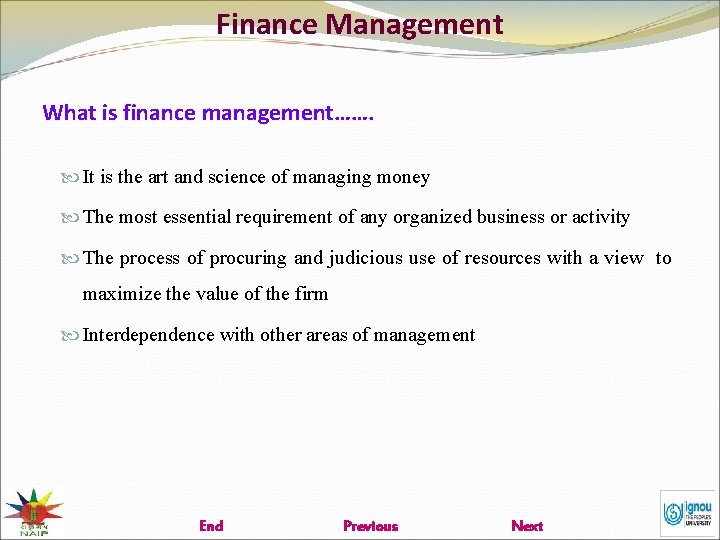

Finance Management Introduction We need to assemble five ‘M’ Money is most vital which also affect the arrangement other 4 ‘M’. 5 M Money Material Men Methods Machines This learning object will emphasize the importance and management of money which also known as finance. End Previous Next

Finance Management What is finance management……. It is the art and science of managing money The most essential requirement of any organized business or activity The process of procuring and judicious use of resources with a view to maximize the value of the firm Interdependence with other areas of management End Previous Next

Finance Management Types of Capital Fixed capital It is required to meet the expenses on fixed assets, like land, building, machinery, etc. Long term finance is to be arranged to meet the fixed capital requirement. It may be arranged from owned capital as well as from long term loans. The Working capital is required to meet the day-by-day expenditure of an enterprise e. g. expenditure on row material, labour, transportation, etc. Short term finance arranged to meet the working capital requirement. The short term finance is generally required for less than two years End Previous Next

Finance Management Budget An important instrument of the financial management used as aid in planning, programming and control A budget may be defined as a financial and quantitative statement, prepared and approved prior to defined period of time, of the policy to be pursued during that period for the purpose of achieving the given objective. End Previous Next

Finance Management Budget: advantages It is a tool for a) Quantitative expression of the planning b) Evaluation of financial performance in accordance with plans c) Controlling costs d) Optimizing the use of resources e) Directing the total efforts in to the most profitable channels End Previous Next

Finance Management Accounting An art of recording , classifying and summarizing data in a significant manner and interpreting the results Data may be in form of money transactions and events which are, in part at least , of a financial character End Previous Next

Finance Management Sources of Finance Owned capital: Entrepreneurs used owned funds, personal or family resources and property, etc to start business activities. Friends and relatives: Friend and relatives helps in establishment and management of an enterprise by proving money to entrepreneur at no or very low interest Commercial banks: The Commercial banks are most important source of credits to set up large varieties of business enterprise, big and small. The commercial banks provide short and long term loans to priority sectors. National level financial institutions: Industrial Development Bank of India (IDBI), Small Industries Development Bank of India (SIDBI), Industrial Finance Corporation of India (IFCI), National Bank for Agricultural and Rural Development (NABARD), etc. provide the financial assistance on term basis to establish the business projects. They also provide promotional, technical and managerial support to various new and existing business concerns. End Previous Next

Finance Management Sources of Finance (Contd…) Regional Rural Banks (RRB): In order to support the agricultural and enterprise activities in rural area, RRBs were established under commercial banks. The RRBs provides all types to credits in rural areas. Cooperatives credit societies: Cooperatives societies are formed by the farmers, artisans, industrial workers, etc. They provide credits at reasonably low interest rate to user members. Indigenous banks: Entrepreneur can get the loan from private individuals known as money lender. The rate of interest is very high. End Previous Next

Finance Management Selection of source of finance Rate of interest, repayment period, margin money requirement, processing charges and time period involved in sanctioning of loan, are very important point should be kept in view while selecting source of finance. The banker / intuition should charge the lowest rate of interest, provide larger repayment period, require minimum contribution as margin from the entrepreneur, charge lowest processing fee and take minimum time in sanctioning the loan. End Previous Next

Finance Management Let Us Sum Up A business entrepreneur needs to arrange the finance to set up a new enterprise or to modernise and expand the already set up unit. Owned capital can be contributed out of personal family deposit and property. The borrowed captain can be arranged from various commercial banks, cooperative banks, indigenous lender, friends and relatives, special financial institutions like IDBI, SIDBI, etc. The financial required can be divided into two types namely short term and long term credits. Short term credits are required to meet the working capital requirement and the long term loan are required to meet the capital investment. The source of finance should be selected properly after considering the rate of interest; margin requirement; repayment period; processing charges; and time and documents requirements in sanctioning the loan End Previous