FINAL ACCOUNTS With adjustments 1 FINAL ACCOUNTS Final

- Slides: 42

FINAL ACCOUNTS With adjustments , 1

FINAL ACCOUNTS • Final Accounts is the last step in the accounting process. Trial Balance is prepared at the end of all the accounting year to know the balances of all the accounts & to test the arithmetic accuracy of accounts. But the basic objective of accounting is to know about the profit or loss during the previous year & present financial position. This can be known only if Trading account and Profit & Loss account and Balance Sheet are prepared at the end pf year. These are also known as FINANCIAL STSTEMENTS which are prepared.

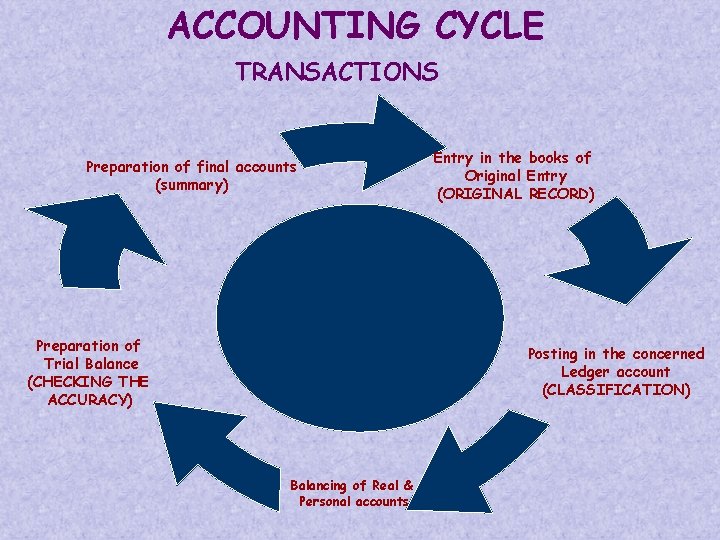

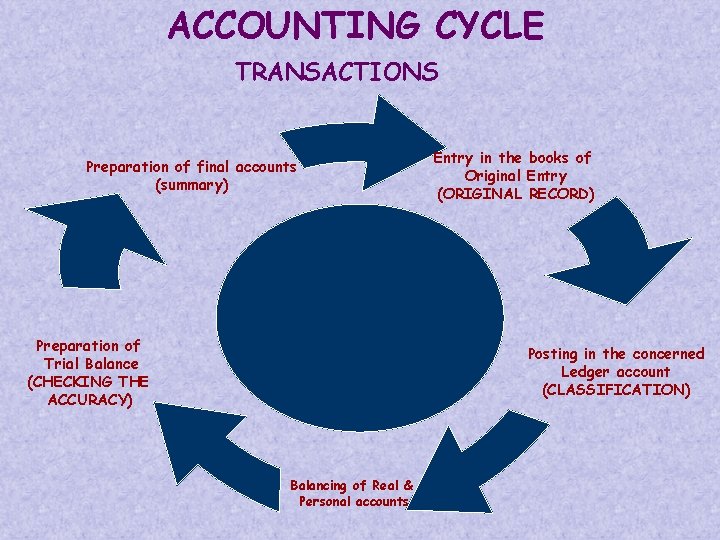

From Trial Balance. Final Accounts include the preparation of : 1) Trading and Profit & Loss account and 2) Balance Sheet as these two statements are prepared to give the final results of the business, both of these are collectively called as final accounts. Accounting cycle finally ends with these statements as shown in next slide:

ACCOUNTING CYCLE TRANSACTIONS Preparation of final accounts (summary) Preparation of Trial Balance (CHECKING THE ACCURACY) Entry in the books of Original Entry (ORIGINAL RECORD) Posting in the concerned Ledger account (CLASSIFICATION) Balancing of Real & Personal accounts

Types of Financial Statement Final accounts or financial statements can be divided in two parts: - 1) Trading and Profit & Loss Account 2) Balance Sheet

Trading Account Trading account is prepared by trading concerns i. e. , concerns which purchase and sell finished goods, to know the gross profit or gross loss incurred by them from buying and selling of goods during a particular period of time. Gross profit or gross loss is the difference between the cost of goods sold and the proceeds of their sale. If the sale proceeds exceed the cost of goods sold , gross profit is made. Otherwise, gross loss is made.

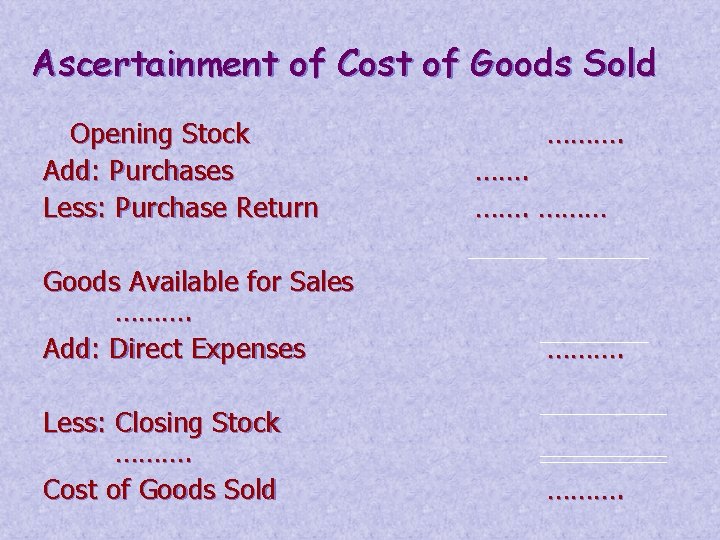

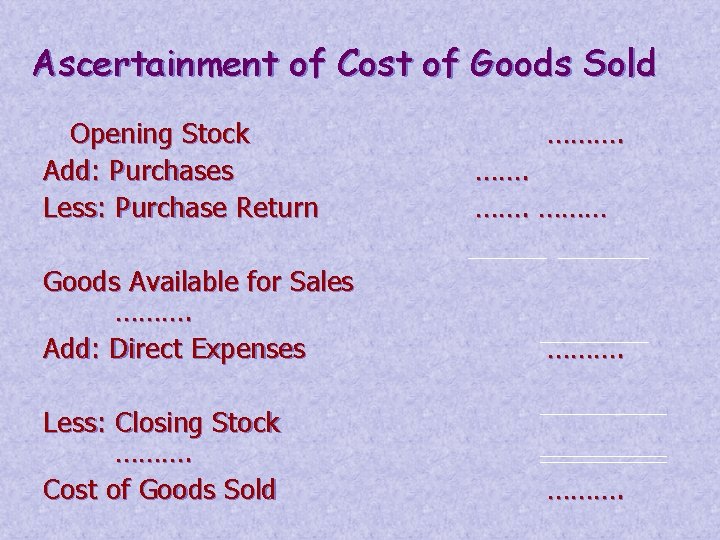

Ascertainment of Cost of Goods Sold Opening Stock Add: Purchases Less: Purchase Return ………. ……. ……… Goods Available for Sales ………. Add: Direct Expenses ………. Less: Closing Stock ………. Cost of Goods Sold ……….

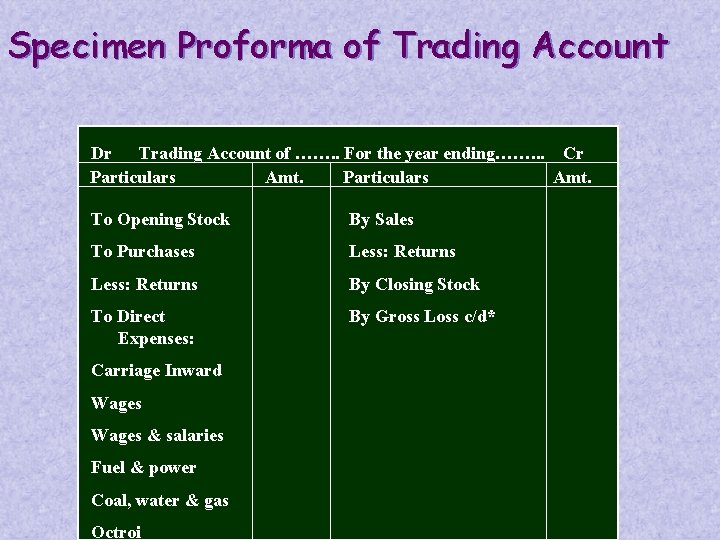

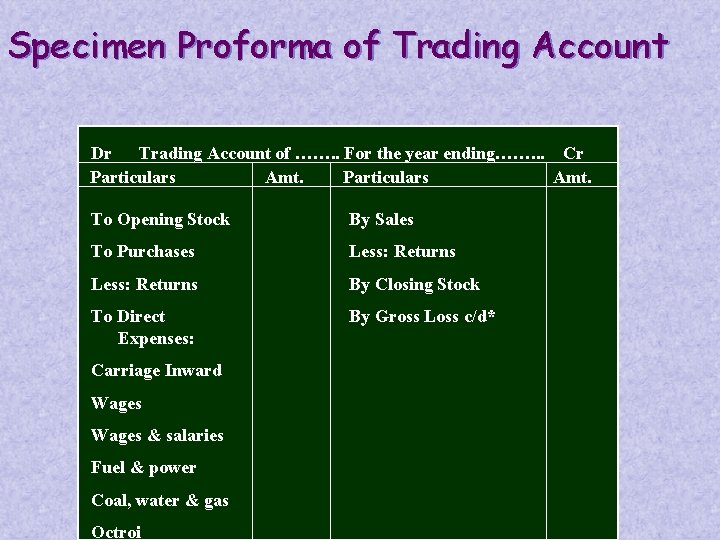

Specimen Proforma of Trading Account Dr Trading Account of ……. . For the year ending……. . . Cr Particulars Amt. To Opening Stock By Sales To Purchases Less: Returns By Closing Stock To Direct Expenses: By Gross Loss c/d* Carriage Inward Wages & salaries Fuel & power Coal, water & gas Octroi

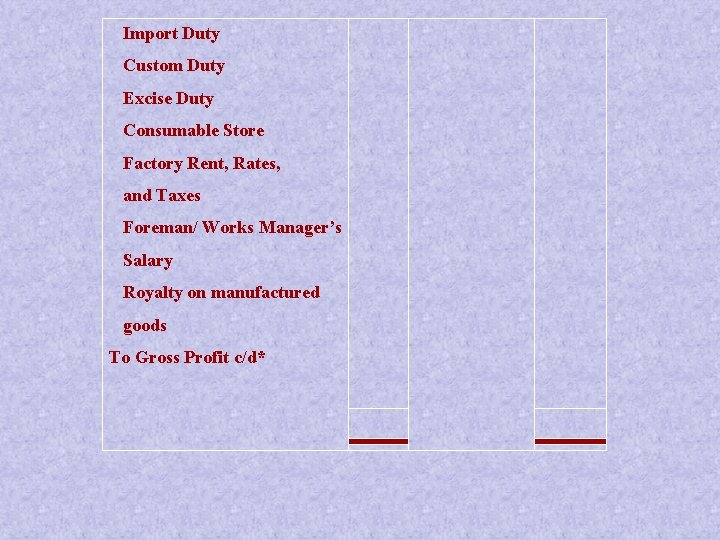

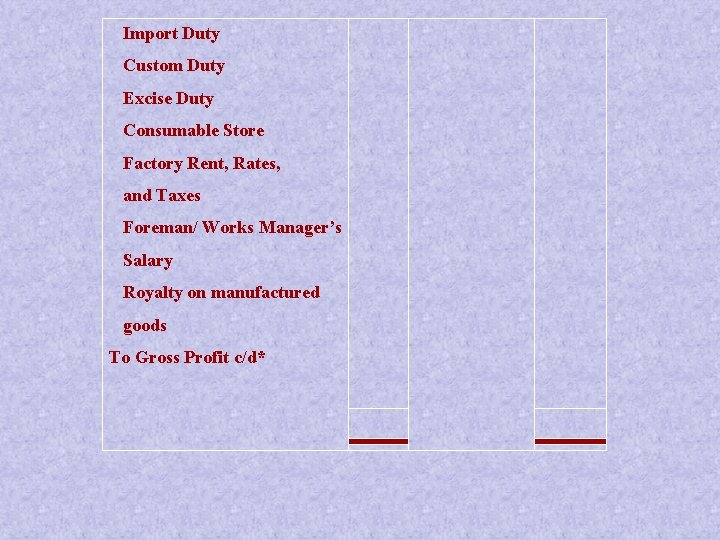

Import Duty Custom Duty Excise Duty Consumable Store Factory Rent, Rates, and Taxes Foreman/ Works Manager’s Salary Royalty on manufactured goods To Gross Profit c/d*

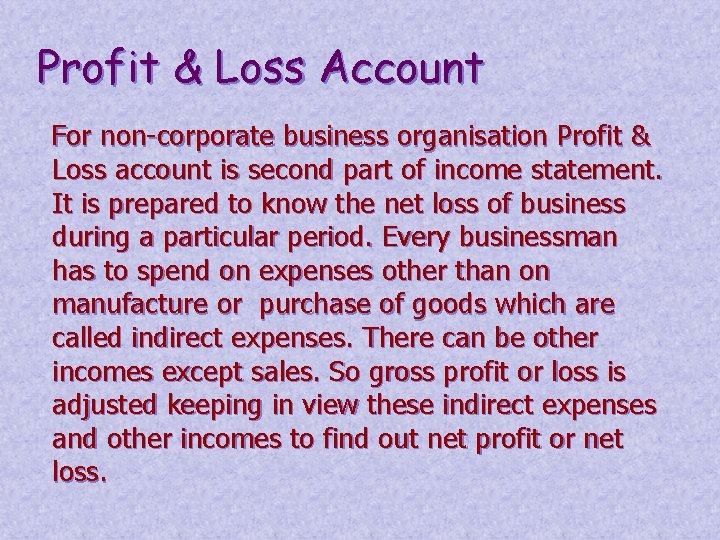

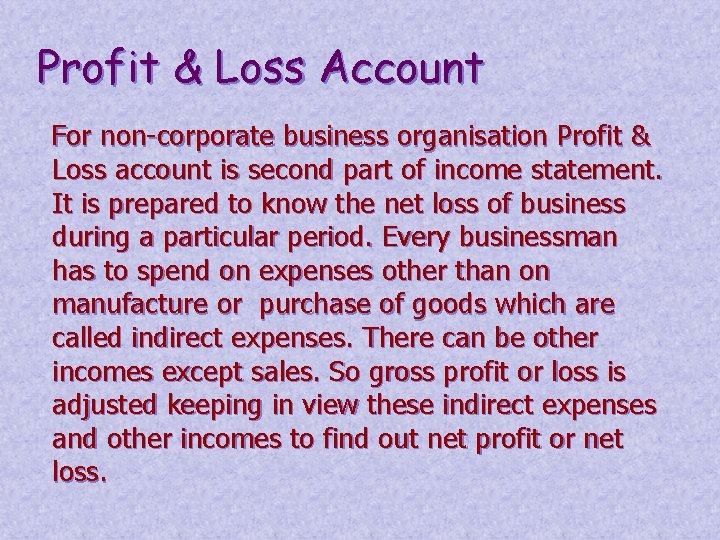

Profit & Loss Account For non-corporate business organisation Profit & Loss account is second part of income statement. It is prepared to know the net loss of business during a particular period. Every businessman has to spend on expenses other than on manufacture or purchase of goods which are called indirect expenses. There can be other incomes except sales. So gross profit or loss is adjusted keeping in view these indirect expenses and other incomes to find out net profit or net loss.

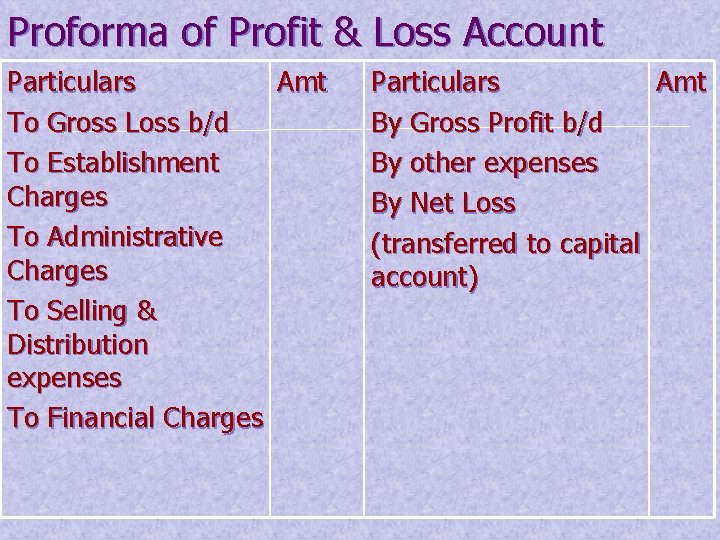

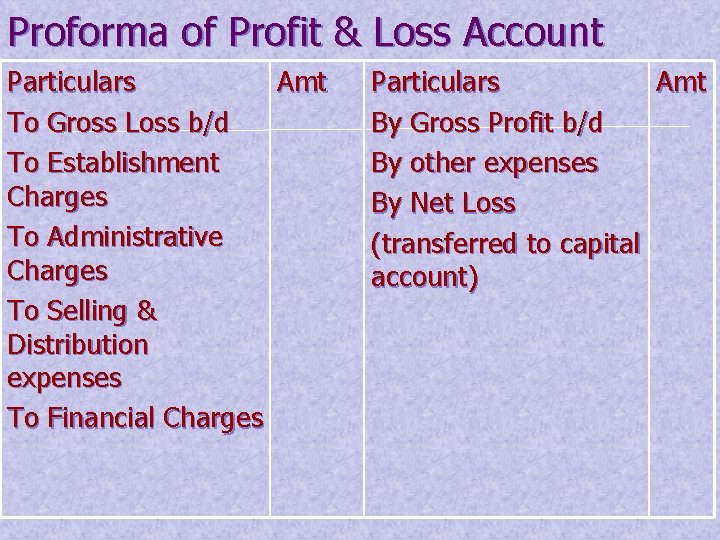

Proforma of Profit & Loss Account Particulars Amt To Gross Loss b/d To Establishment Charges To Administrative Charges To Selling & Distribution expenses To Financial Charges Particulars Amt By Gross Profit b/d By other expenses By Net Loss (transferred to capital account)

To Depreciation & Provisions To Abnormal Losses To Net Profit (transferred to Capital Account)

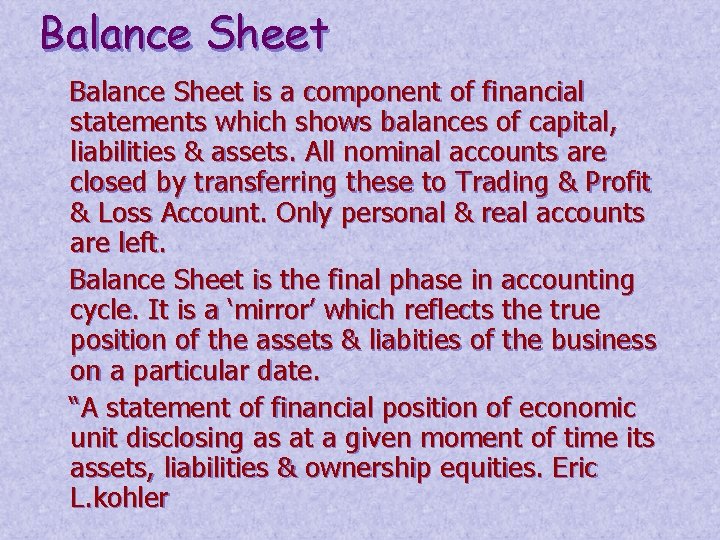

Balance Sheet is a component of financial statements which shows balances of capital, liabilities & assets. All nominal accounts are closed by transferring these to Trading & Profit & Loss Account. Only personal & real accounts are left. Balance Sheet is the final phase in accounting cycle. It is a ‘mirror’ which reflects the true position of the assets & liabities of the business on a particular date. “A statement of financial position of economic unit disclosing as at a given moment of time its assets, liabilities & ownership equities. Eric L. kohler

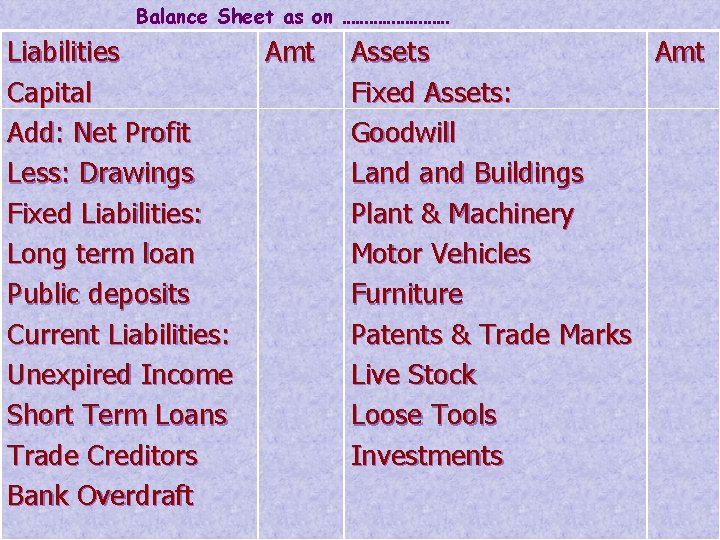

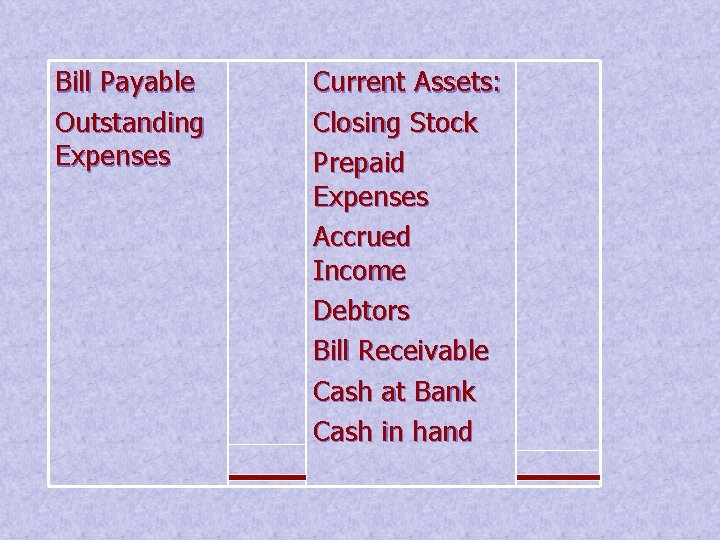

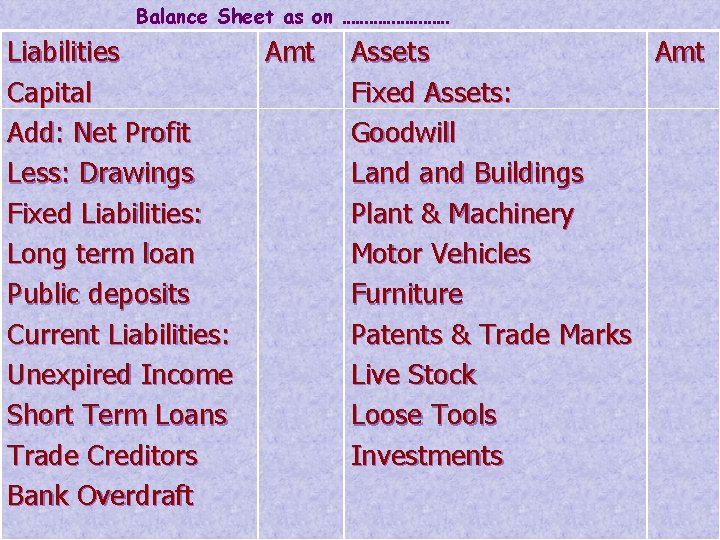

Balance Sheet as on ………… Liabilities Capital Add: Net Profit Less: Drawings Fixed Liabilities: Long term loan Public deposits Current Liabilities: Unexpired Income Short Term Loans Trade Creditors Bank Overdraft Amt Assets Amt Fixed Assets: Goodwill Land Buildings Plant & Machinery Motor Vehicles Furniture Patents & Trade Marks Live Stock Loose Tools Investments

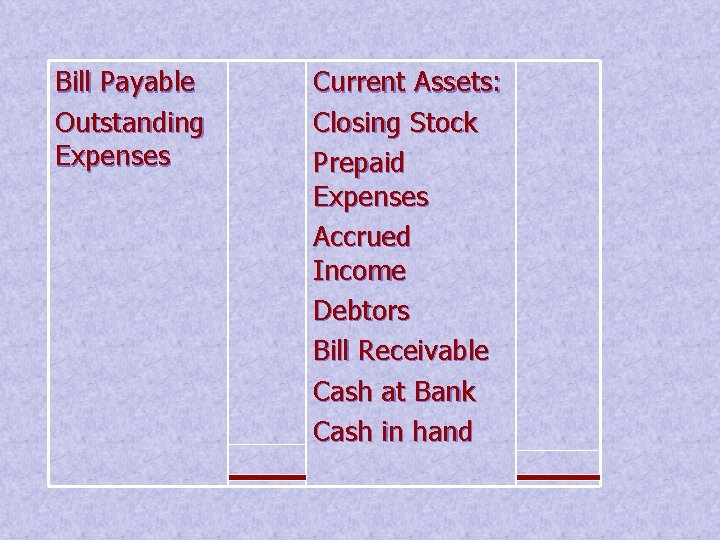

Bill Payable Outstanding Expenses Current Assets: Closing Stock Prepaid Expenses Accrued Income Debtors Bill Receivable Cash at Bank Cash in hand

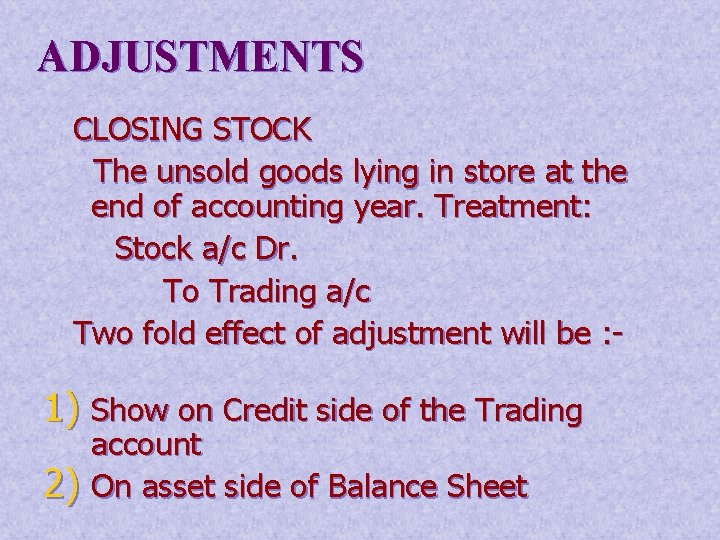

ADJUSTMENTS CLOSING STOCK The unsold goods lying in store at the end of accounting year. Treatment: Stock a/c Dr. To Trading a/c Two fold effect of adjustment will be : - 1) Show on Credit side of the Trading 2) account On asset side of Balance Sheet

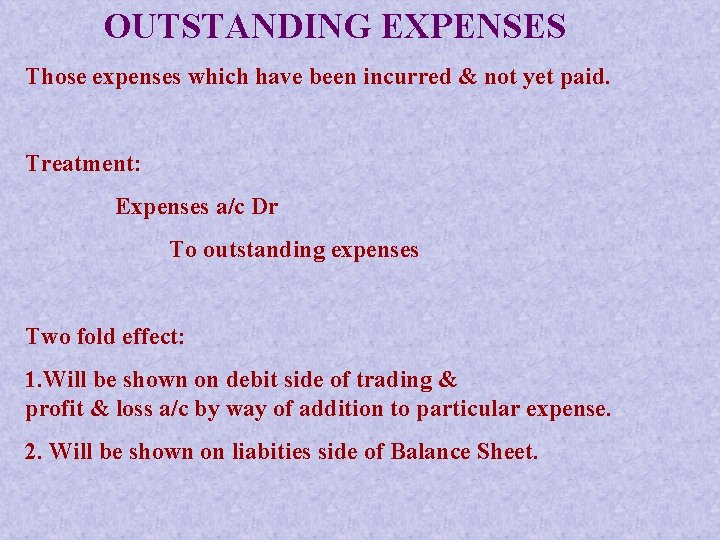

OUTSTANDING EXPENSES Those expenses which have been incurred & not yet paid. Treatment: Expenses a/c Dr To outstanding expenses Two fold effect: 1. Will be shown on debit side of trading & profit & loss a/c by way of addition to particular expense. 2. Will be shown on liabities side of Balance Sheet.

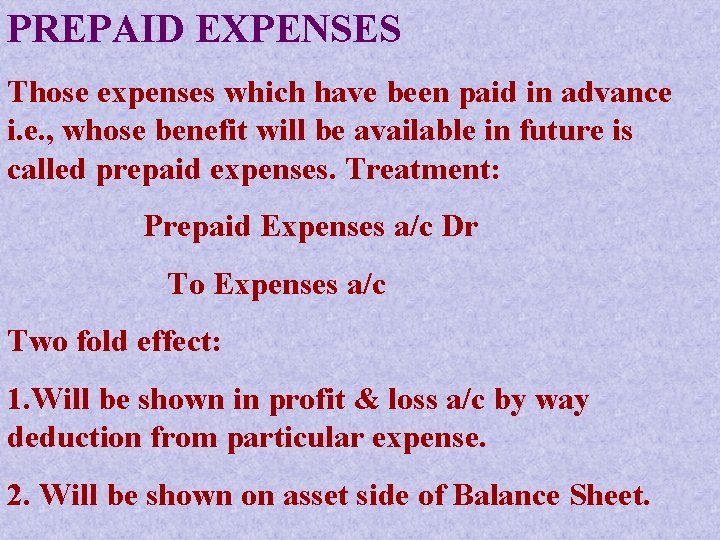

PREPAID EXPENSES Those expenses which have been paid in advance i. e. , whose benefit will be available in future is called prepaid expenses. Treatment: Prepaid Expenses a/c Dr To Expenses a/c Two fold effect: 1. Will be shown in profit & loss a/c by way deduction from particular expense. 2. Will be shown on asset side of Balance Sheet.

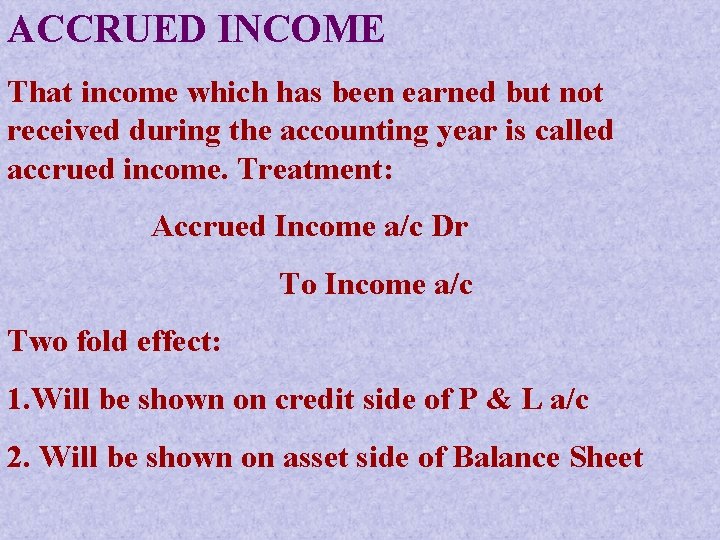

ACCRUED INCOME That income which has been earned but not received during the accounting year is called accrued income. Treatment: Accrued Income a/c Dr To Income a/c Two fold effect: 1. Will be shown on credit side of P & L a/c 2. Will be shown on asset side of Balance Sheet

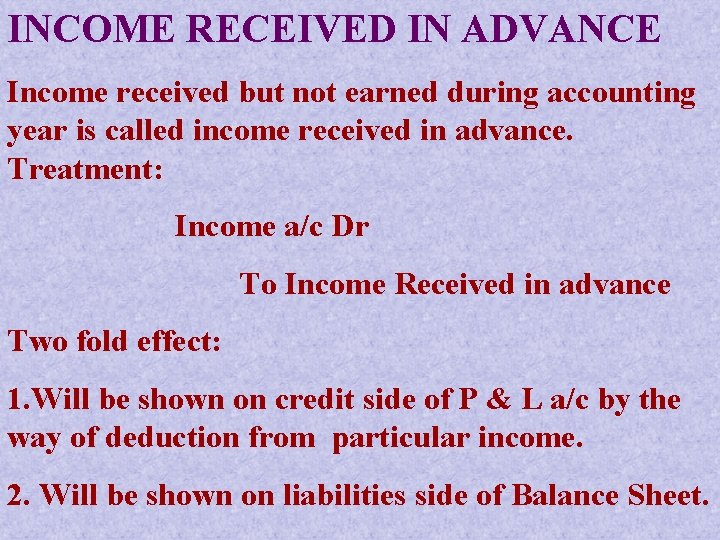

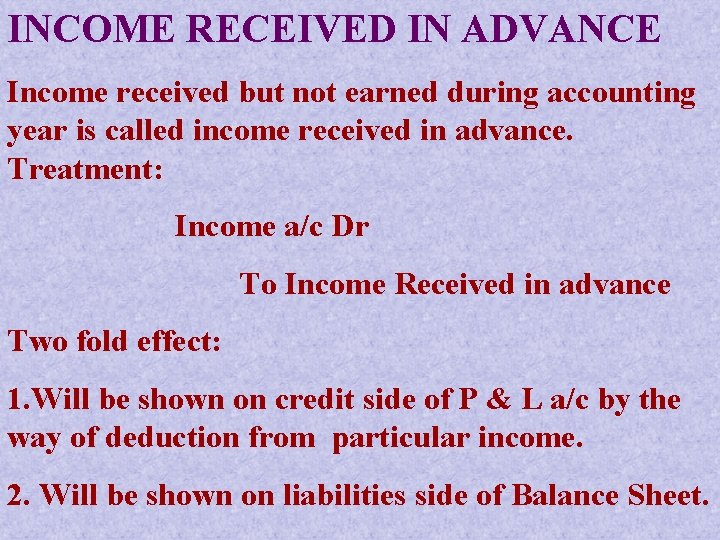

INCOME RECEIVED IN ADVANCE Income received but not earned during accounting year is called income received in advance. Treatment: Income a/c Dr To Income Received in advance Two fold effect: 1. Will be shown on credit side of P & L a/c by the way of deduction from particular income. 2. Will be shown on liabilities side of Balance Sheet.

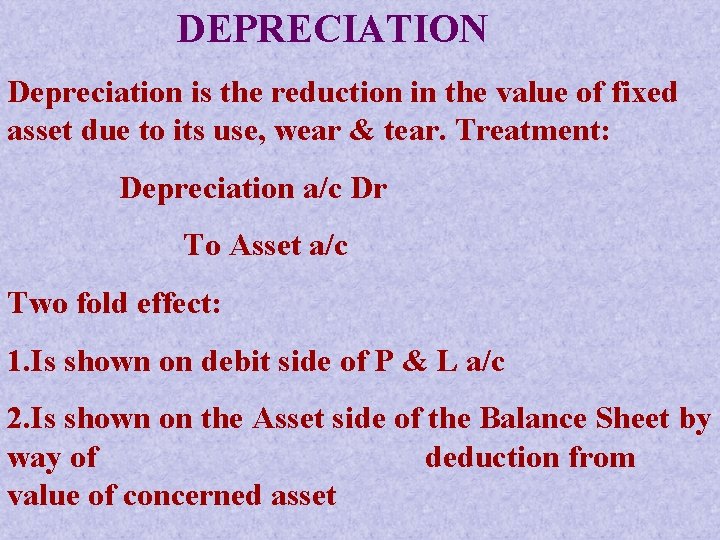

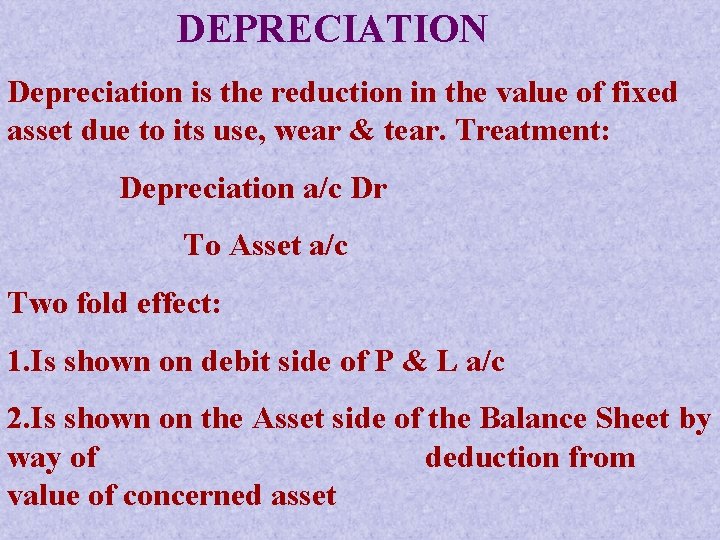

DEPRECIATION Depreciation is the reduction in the value of fixed asset due to its use, wear & tear. Treatment: Depreciation a/c Dr To Asset a/c Two fold effect: 1. Is shown on debit side of P & L a/c 2. Is shown on the Asset side of the Balance Sheet by way of deduction from value of concerned asset

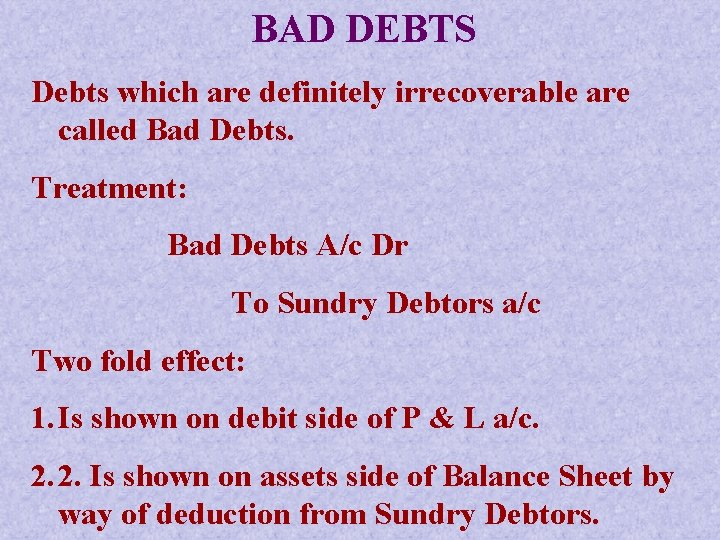

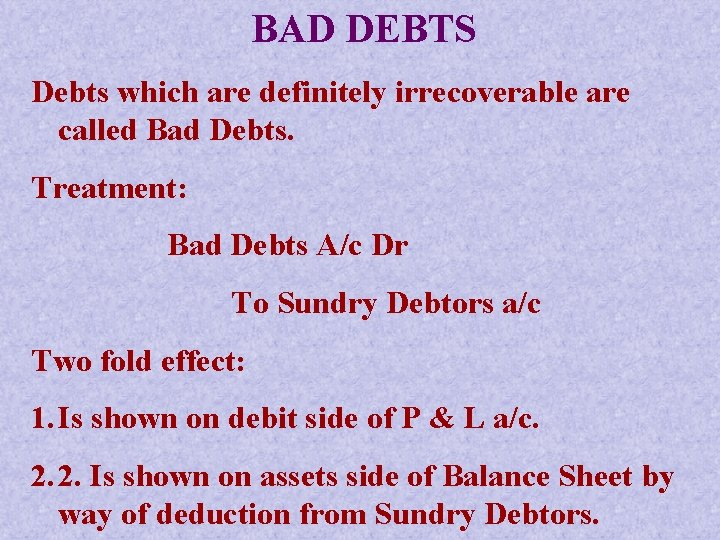

BAD DEBTS Debts which are definitely irrecoverable are called Bad Debts. Treatment: Bad Debts A/c Dr To Sundry Debtors a/c Two fold effect: 1. Is shown on debit side of P & L a/c. 2. 2. Is shown on assets side of Balance Sheet by way of deduction from Sundry Debtors.

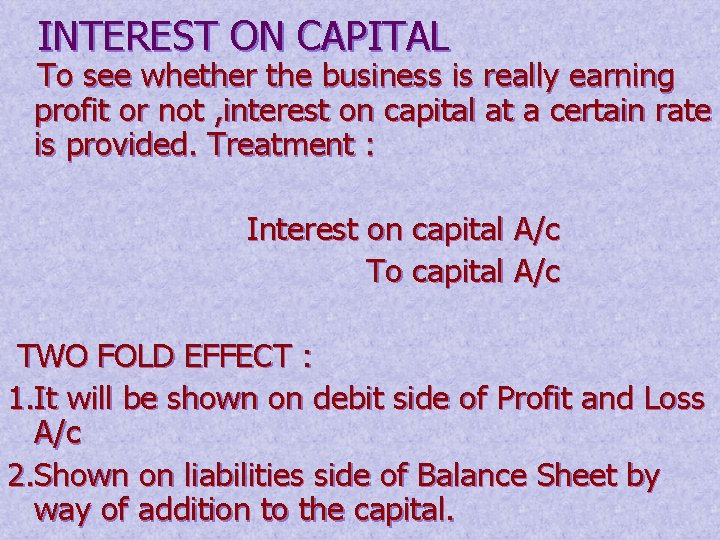

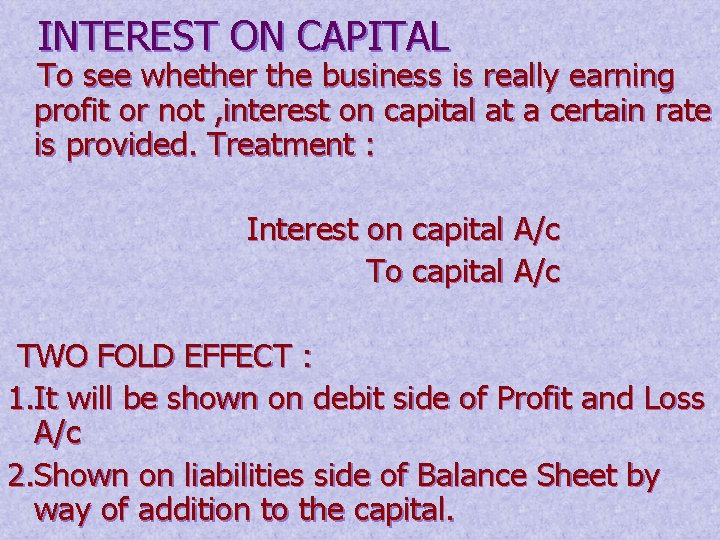

INTEREST ON CAPITAL To see whether the business is really earning profit or not , interest on capital at a certain rate is provided. Treatment : Interest on capital A/c To capital A/c TWO FOLD EFFECT : 1. It will be shown on debit side of Profit and Loss A/c 2. Shown on liabilities side of Balance Sheet by way of addition to the capital.

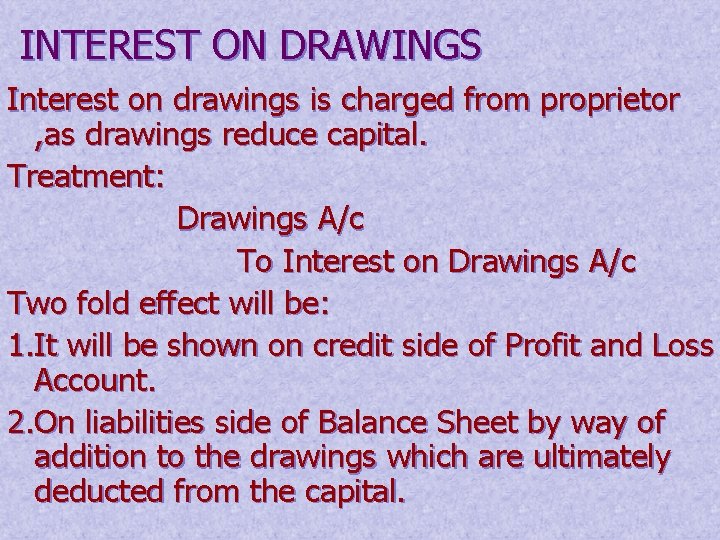

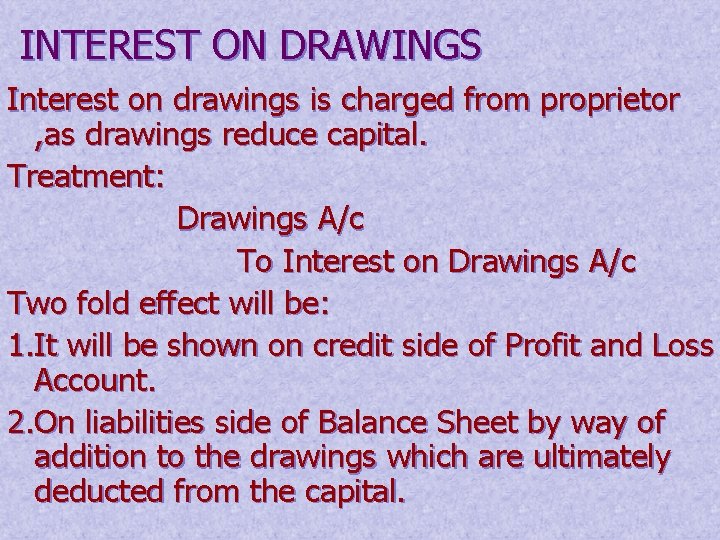

INTEREST ON DRAWINGS Interest on drawings is charged from proprietor , as drawings reduce capital. Treatment: Drawings A/c To Interest on Drawings A/c Two fold effect will be: 1. It will be shown on credit side of Profit and Loss Account. 2. On liabilities side of Balance Sheet by way of addition to the drawings which are ultimately deducted from the capital.

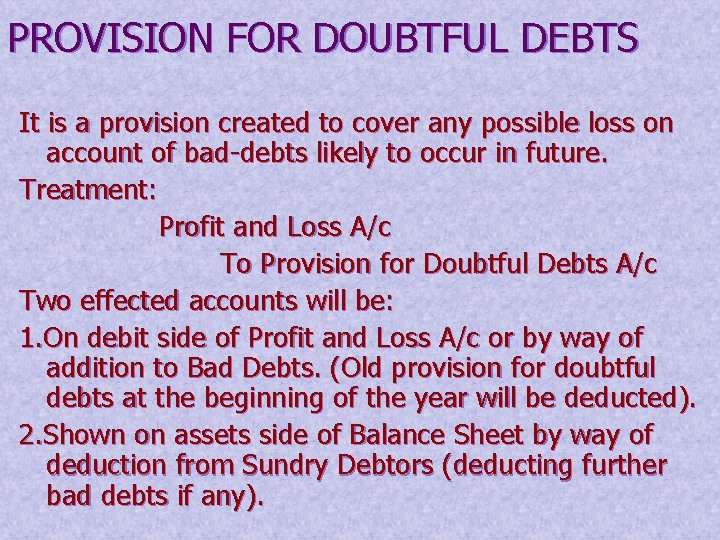

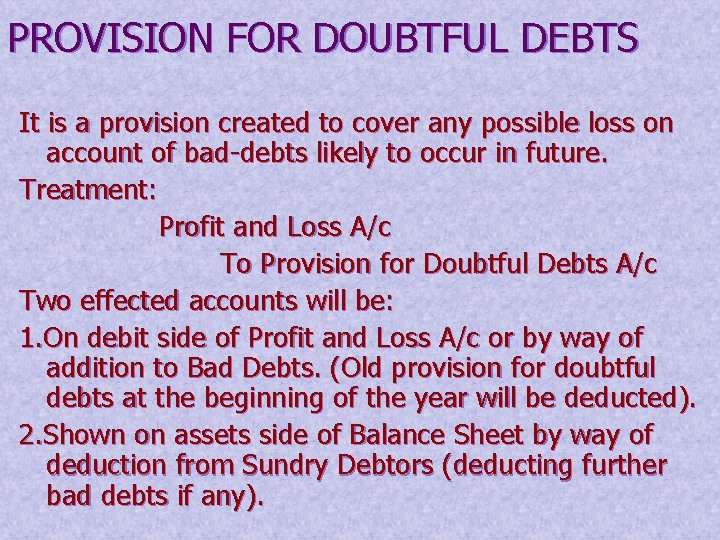

PROVISION FOR DOUBTFUL DEBTS It is a provision created to cover any possible loss on account of bad-debts likely to occur in future. Treatment: Profit and Loss A/c To Provision for Doubtful Debts A/c Two effected accounts will be: 1. On debit side of Profit and Loss A/c or by way of addition to Bad Debts. (Old provision for doubtful debts at the beginning of the year will be deducted). 2. Shown on assets side of Balance Sheet by way of deduction from Sundry Debtors (deducting further bad debts if any).

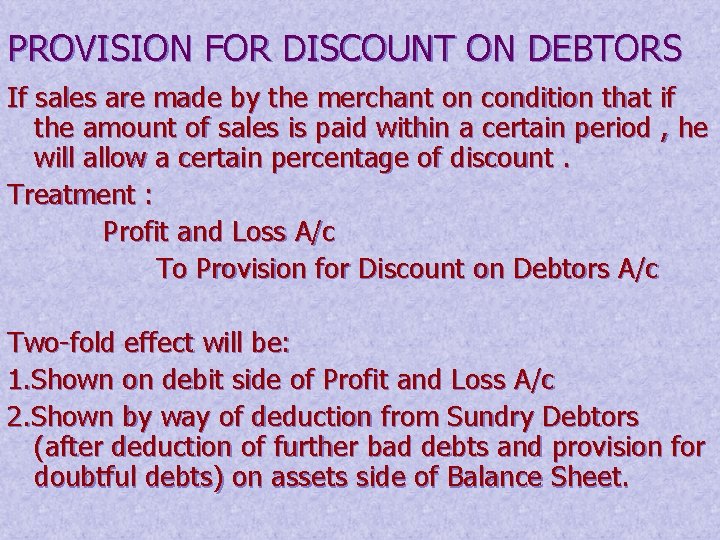

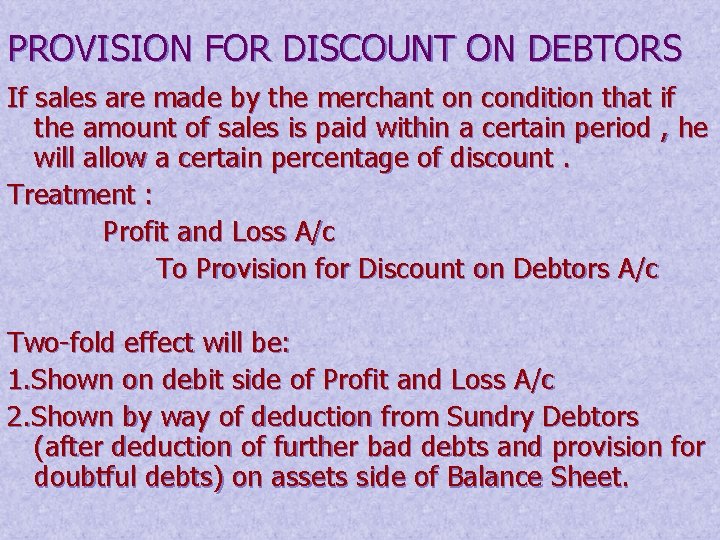

PROVISION FOR DISCOUNT ON DEBTORS If sales are made by the merchant on condition that if the amount of sales is paid within a certain period , he will allow a certain percentage of discount. Treatment : Profit and Loss A/c To Provision for Discount on Debtors A/c Two-fold effect will be: 1. Shown on debit side of Profit and Loss A/c 2. Shown by way of deduction from Sundry Debtors (after deduction of further bad debts and provision for doubtful debts) on assets side of Balance Sheet.

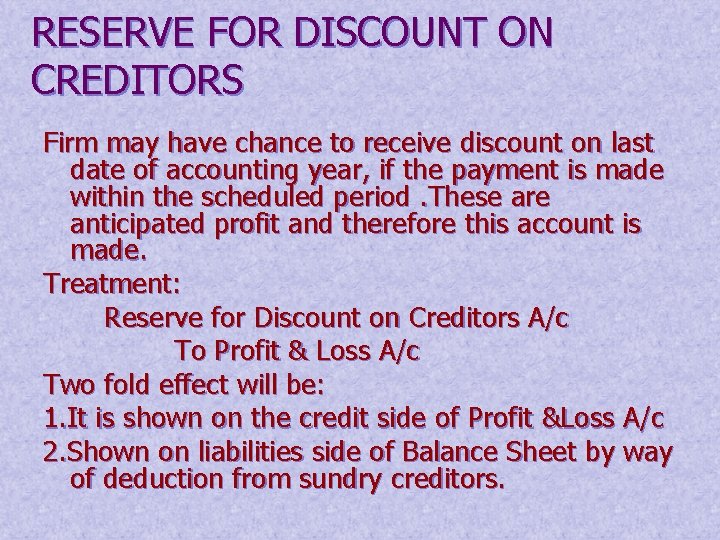

RESERVE FOR DISCOUNT ON CREDITORS Firm may have chance to receive discount on last date of accounting year, if the payment is made within the scheduled period. These are anticipated profit and therefore this account is made. Treatment: Reserve for Discount on Creditors A/c To Profit & Loss A/c Two fold effect will be: 1. It is shown on the credit side of Profit &Loss A/c 2. Shown on liabilities side of Balance Sheet by way of deduction from sundry creditors.

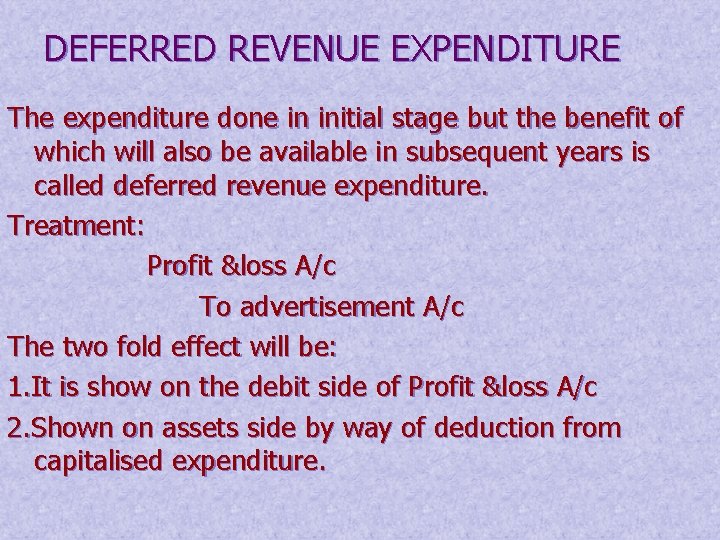

DEFERRED REVENUE EXPENDITURE The expenditure done in initial stage but the benefit of which will also be available in subsequent years is called deferred revenue expenditure. Treatment: Profit &loss A/c To advertisement A/c The two fold effect will be: 1. It is show on the debit side of Profit &loss A/c 2. Shown on assets side by way of deduction from capitalised expenditure.

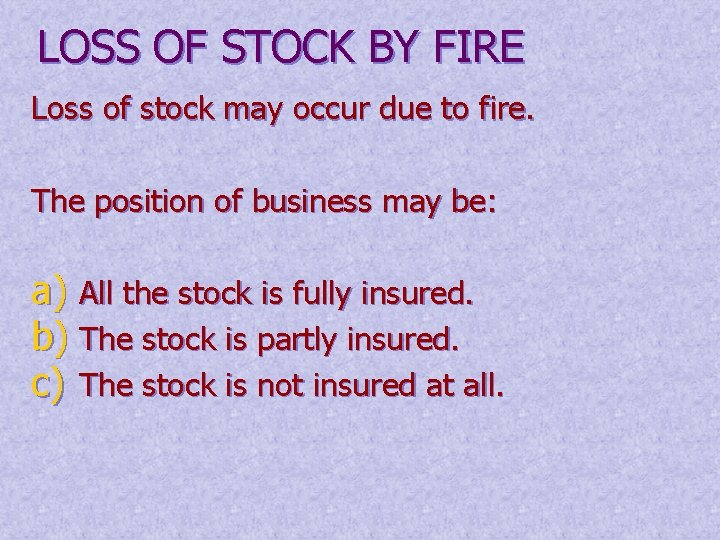

LOSS OF STOCK BY FIRE Loss of stock may occur due to fire. The position of business may be: a) All the stock is fully insured. b) The stock is partly insured. c) The stock is not insured at all.

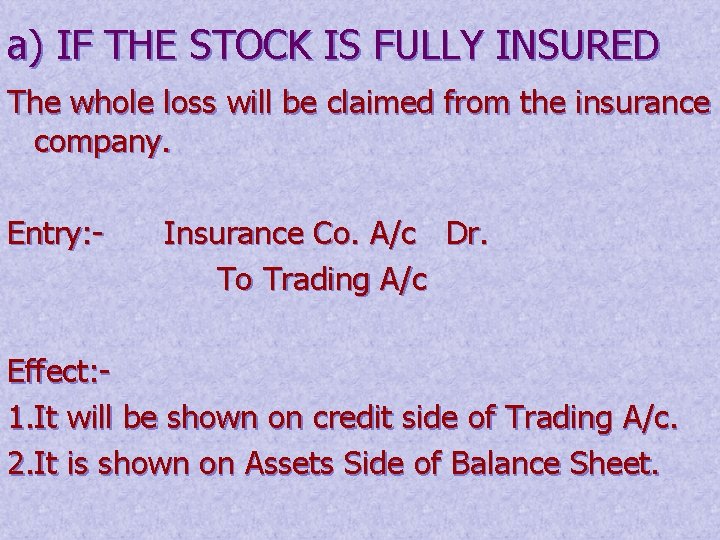

a) IF THE STOCK IS FULLY INSURED The whole loss will be claimed from the insurance company. Entry: - Insurance Co. A/c Dr. To Trading A/c Effect: 1. It will be shown on credit side of Trading A/c. 2. It is shown on Assets Side of Balance Sheet.

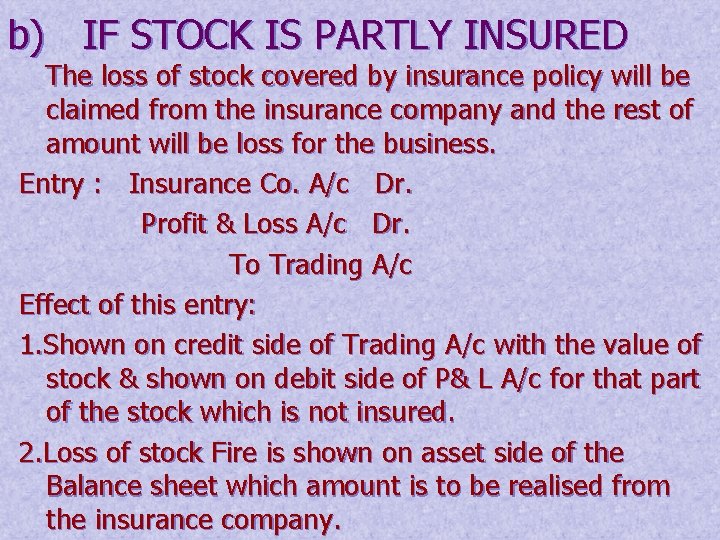

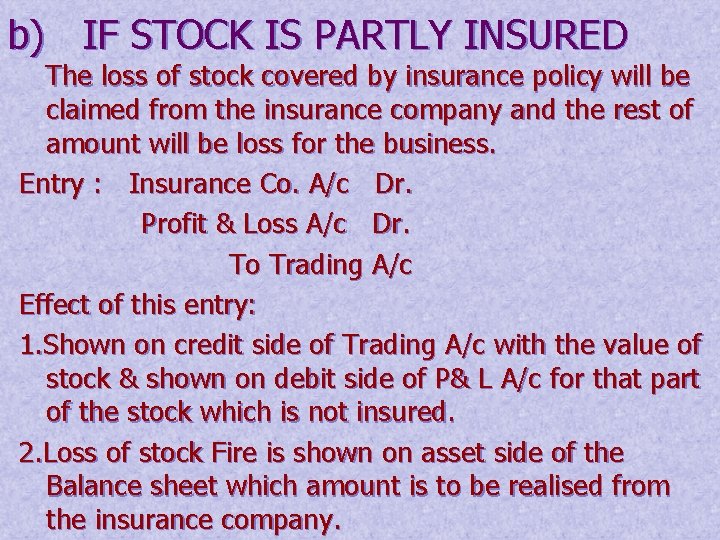

b) IF STOCK IS PARTLY INSURED The loss of stock covered by insurance policy will be claimed from the insurance company and the rest of amount will be loss for the business. Entry : Insurance Co. A/c Dr. Profit & Loss A/c Dr. To Trading A/c Effect of this entry: 1. Shown on credit side of Trading A/c with the value of stock & shown on debit side of P& L A/c for that part of the stock which is not insured. 2. Loss of stock Fire is shown on asset side of the Balance sheet which amount is to be realised from the insurance company.

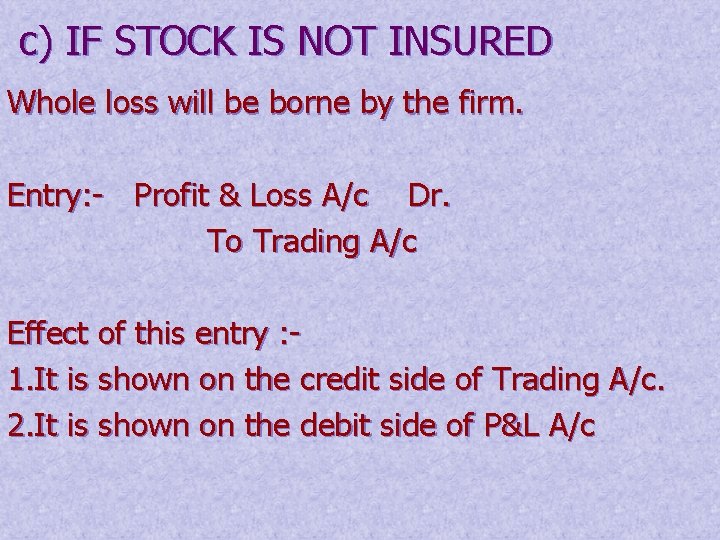

c) IF STOCK IS NOT INSURED Whole loss will be borne by the firm. Entry: - Profit & Loss A/c Dr. To Trading A/c Effect of this entry : 1. It is shown on the credit side of Trading A/c. 2. It is shown on the debit side of P&L A/c

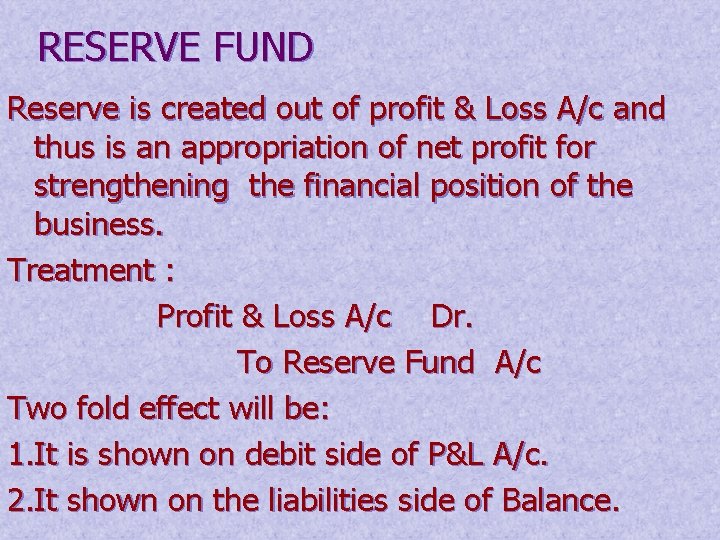

RESERVE FUND Reserve is created out of profit & Loss A/c and thus is an appropriation of net profit for strengthening the financial position of the business. Treatment : Profit & Loss A/c Dr. To Reserve Fund A/c Two fold effect will be: 1. It is shown on debit side of P&L A/c. 2. It shown on the liabilities side of Balance.

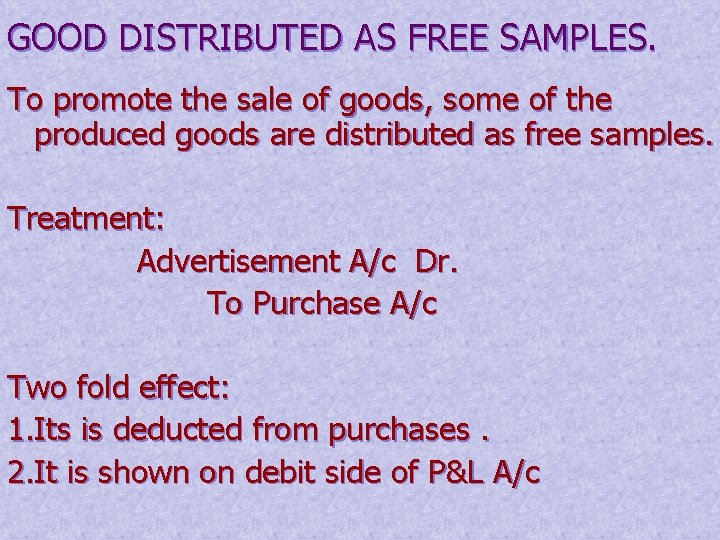

GOOD DISTRIBUTED AS FREE SAMPLES. To promote the sale of goods, some of the produced goods are distributed as free samples. Treatment: Advertisement A/c Dr. To Purchase A/c Two fold effect: 1. Its is deducted from purchases. 2. It is shown on debit side of P&L A/c

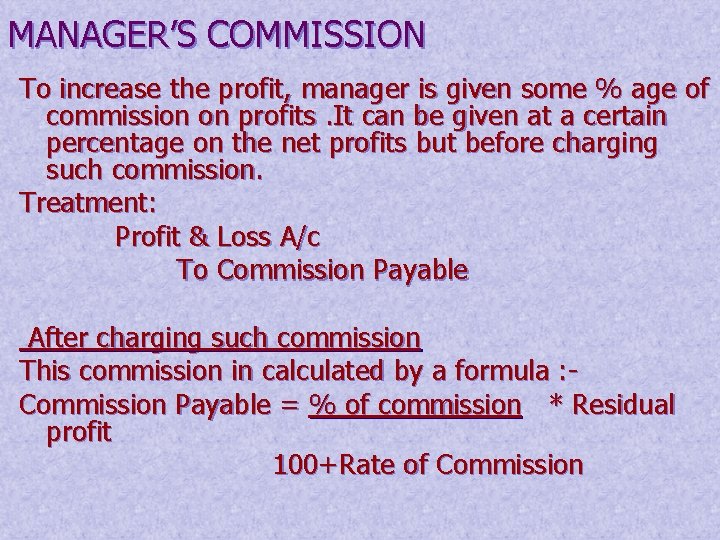

MANAGER’S COMMISSION To increase the profit, manager is given some % age of commission on profits. It can be given at a certain percentage on the net profits but before charging such commission. Treatment: Profit & Loss A/c To Commission Payable After charging such commission This commission in calculated by a formula : Commission Payable = % of commission * Residual profit 100+Rate of Commission

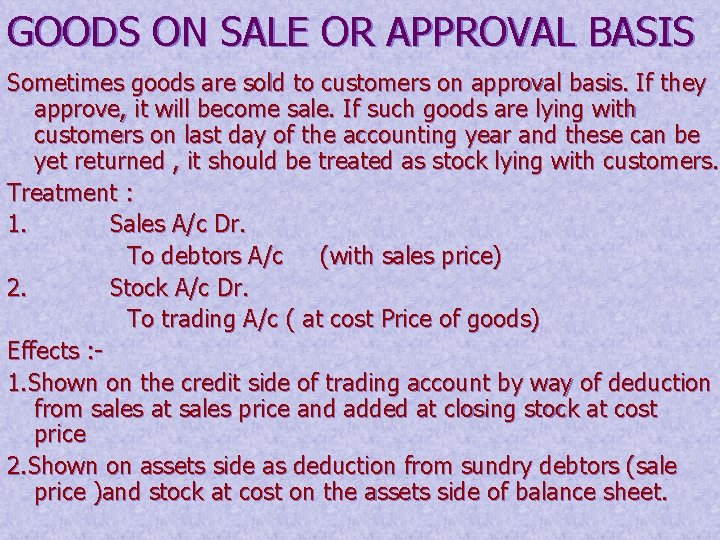

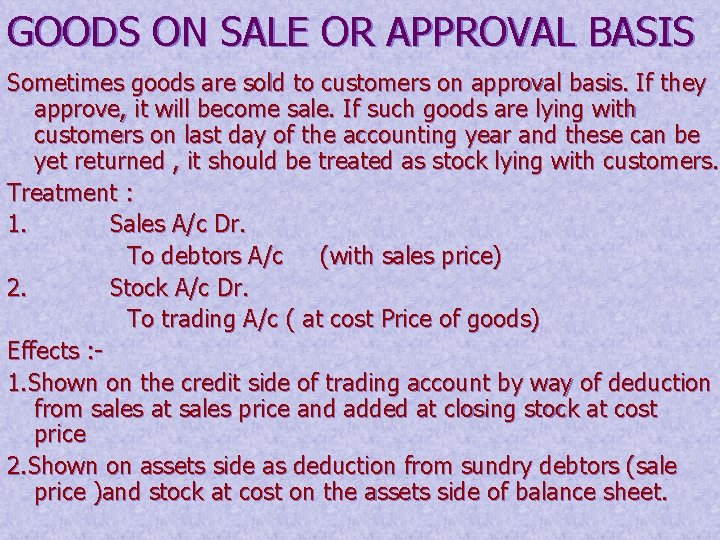

GOODS ON SALE OR APPROVAL BASIS Sometimes goods are sold to customers on approval basis. If they approve, it will become sale. If such goods are lying with customers on last day of the accounting year and these can be yet returned , it should be treated as stock lying with customers. Treatment : 1. Sales A/c Dr. To debtors A/c (with sales price) 2. Stock A/c Dr. To trading A/c ( at cost Price of goods) Effects : 1. Shown on the credit side of trading account by way of deduction from sales at sales price and added at closing stock at cost price 2. Shown on assets side as deduction from sundry debtors (sale price )and stock at cost on the assets side of balance sheet.

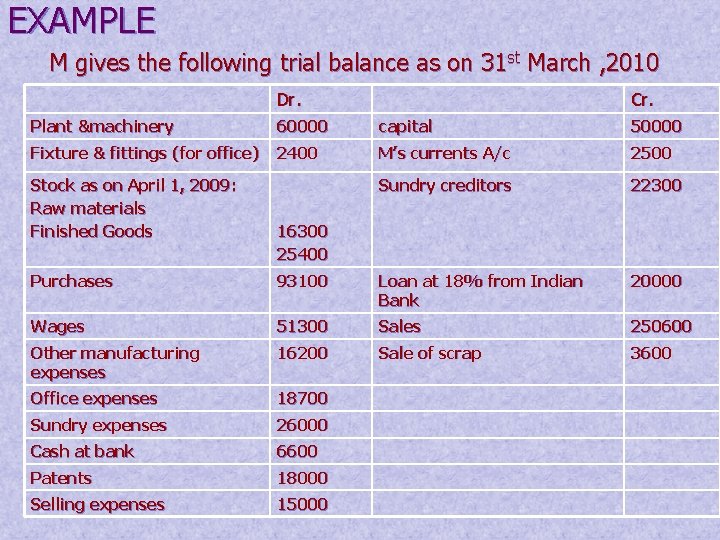

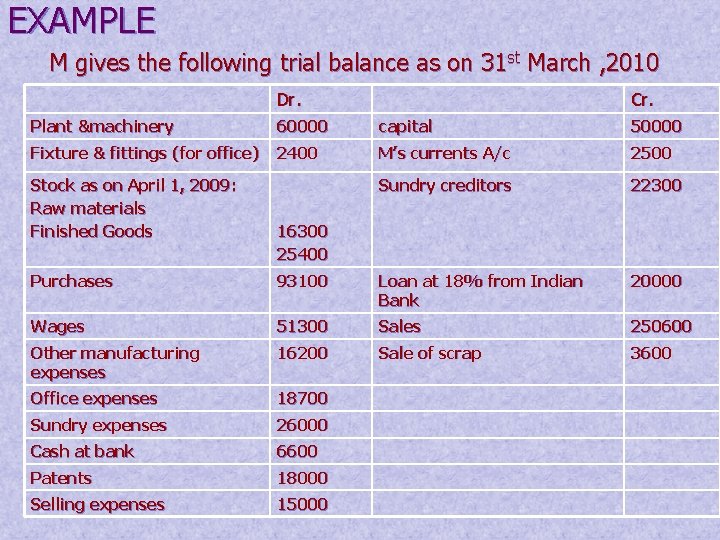

EXAMPLE M gives the following trial balance as on 31 st March , 2010 Dr. Cr. Plant &machinery 60000 capital 50000 Fixture & fittings (for office) 2400 M’s currents A/c 2500 Sundry creditors 22300 Stock as on April 1, 2009: Raw materials Finished Goods 16300 25400 Purchases 93100 Loan at 18% from Indian Bank 20000 Wages 51300 Sales 250600 Other manufacturing expenses 16200 Sale of scrap 3600 Office expenses 18700 Sundry expenses 26000 Cash at bank 6600 Patents 18000 Selling expenses 15000

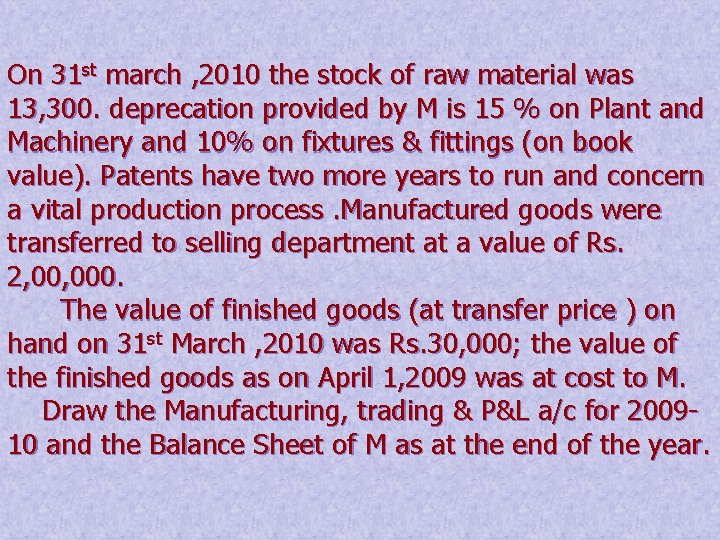

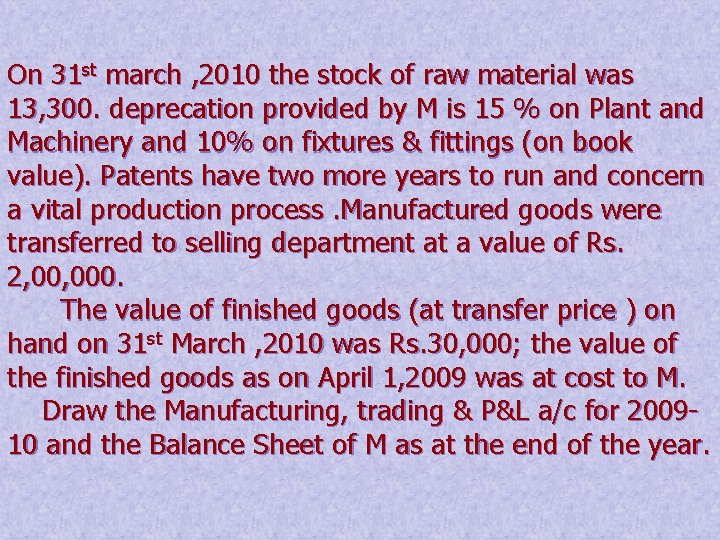

On 31 st march , 2010 the stock of raw material was 13, 300. deprecation provided by M is 15 % on Plant and Machinery and 10% on fixtures & fittings (on book value). Patents have two more years to run and concern a vital production process. Manufactured goods were transferred to selling department at a value of Rs. 2, 000. The value of finished goods (at transfer price ) on hand on 31 st March , 2010 was Rs. 30, 000; the value of the finished goods as on April 1, 2009 was at cost to M. Draw the Manufacturing, trading & P&L a/c for 200910 and the Balance Sheet of M as at the end of the year.

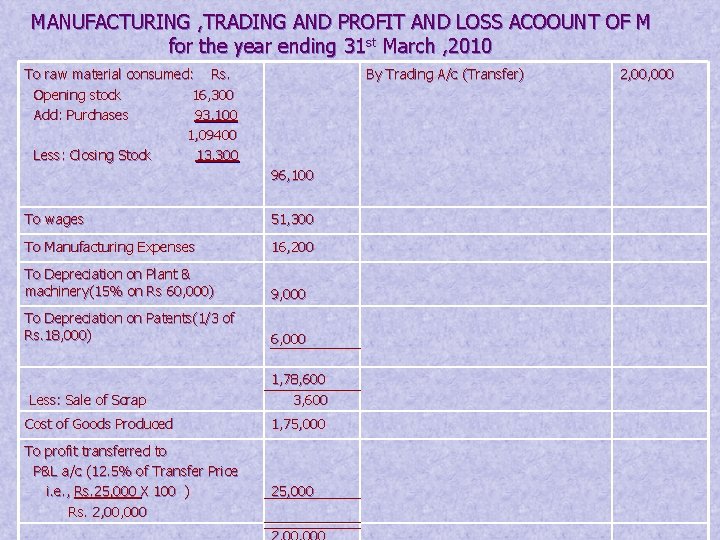

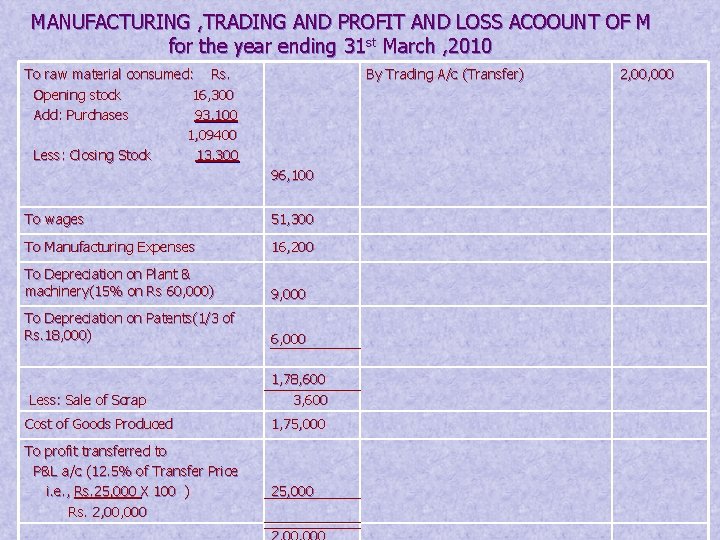

MANUFACTURING , TRADING AND PROFIT AND LOSS ACOOUNT OF M for the year ending 31 st March , 2010 To raw material consumed: Rs. Opening stock 16, 300 Add: Purchases 93, 100 1, 09400 Less: Closing Stock 13, 300 By Trading A/c (Transfer) 96, 100 To wages 51, 300 To Manufacturing Expenses 16, 200 To Depreciation on Plant & machinery(15% on Rs 60, 000) 9, 000 To Depreciation on Patents(1/3 of Rs. 18, 000) 6, 000 Less: Sale of Scrap Cost of Goods Produced To profit transferred to P&L a/c (12. 5% of Transfer Price i. e. , Rs. 25, 000 X 100 ) Rs. 2, 000 1, 78, 600 3, 600 1, 75, 000 2, 000

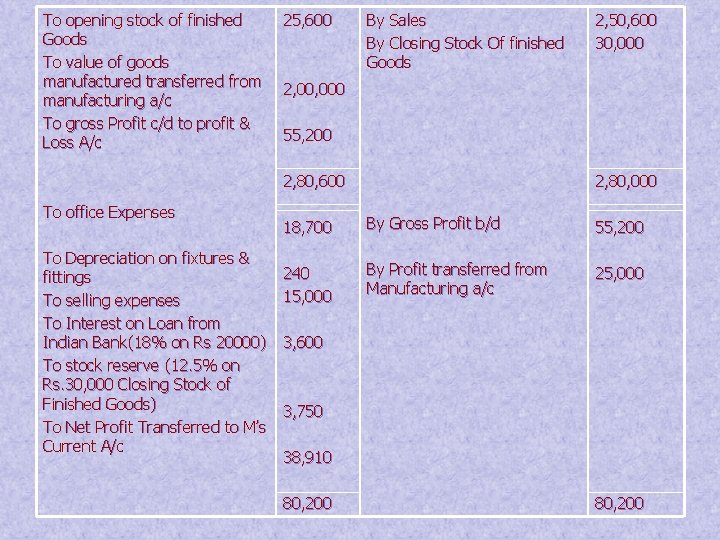

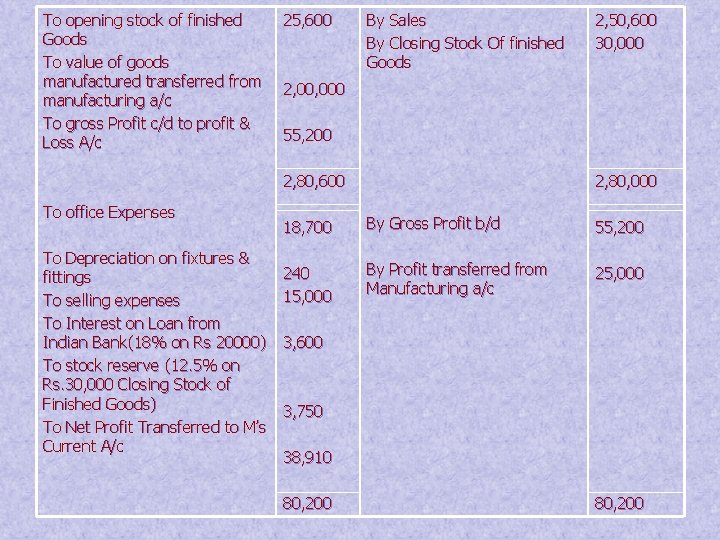

To opening stock of finished Goods To value of goods manufactured transferred from manufacturing a/c To gross Profit c/d to profit & Loss A/c 25, 600 By Sales By Closing Stock Of finished Goods 2, 000 55, 200 2, 80, 600 To office Expenses To Depreciation on fixtures & fittings To selling expenses To Interest on Loan from Indian Bank(18% on Rs 20000) To stock reserve (12. 5% on Rs. 30, 000 Closing Stock of Finished Goods) To Net Profit Transferred to M’s Current A/c 2, 50, 600 30, 000 2, 80, 000 18, 700 By Gross Profit b/d 55, 200 240 15, 000 By Profit transferred from Manufacturing a/c 25, 000 3, 600 3, 750 38, 910 80, 200

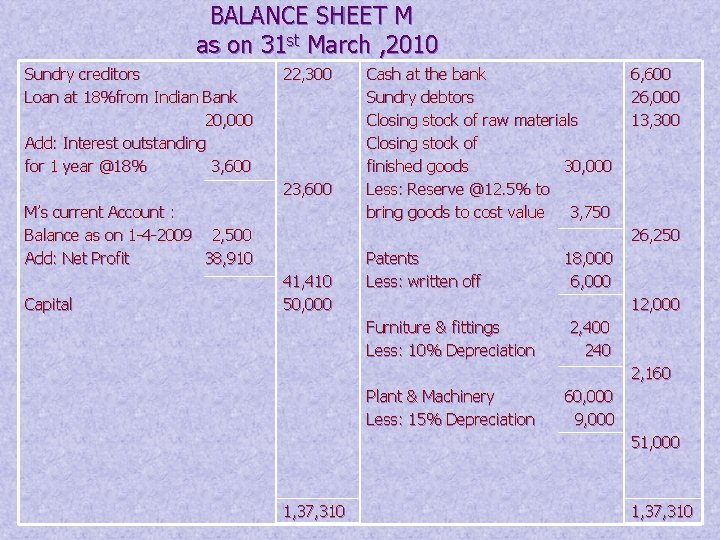

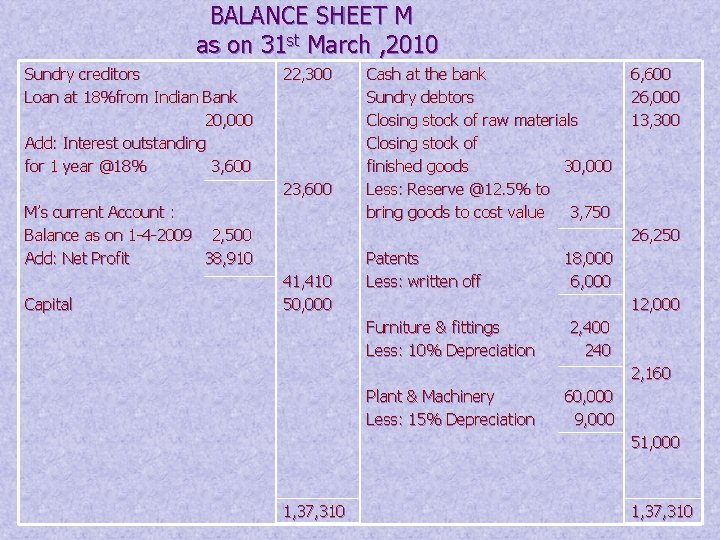

BALANCE SHEET M as on 31 st March , 2010 Sundry creditors Loan at 18%from Indian Bank 20, 000 Add: Interest outstanding for 1 year @18% 3, 600 22, 300 23, 600 M’s current Account : Balance as on 1 -4 -2009 2, 500 Add: Net Profit 38, 910 Capital Cash at the bank Sundry debtors Closing stock of raw materials Closing stock of finished goods 30, 000 Less: Reserve @12. 5% to bring goods to cost value 3, 750 6, 600 26, 000 13, 300 26, 250 41, 410 50, 000 Patents Less: written off 18, 000 6, 000 12, 000 Furniture & fittings Less: 10% Depreciation 2, 400 240 2, 160 Plant & Machinery Less: 15% Depreciation 60, 000 9, 000 51, 000 1, 37, 310