Fin 603 Week 5 Forward Rates Duration and

- Slides: 75

Fin 603 Week 5 Forward Rates, Duration, and Interest Rate Swaps Fall 2005 Professor Ross Miller • Fall 2005 University at Albany School of Business Copyright 2005 by Ross M. Miller. All rights reserved

Some Quick Notes Ø Class slides to appear sooner and be more stable • Barring unforeseen circumstances, slides will appear by midnight the day before they are first presented • Changes to slides once they are posted should be minimal (minor typos, etc. )—any major changes will be noted on Web. CT Ø Professor Miller will not be holding office hours on Thursday, October 20 Professor Ross Miller • Fall 2005 1

Looking Ahead to Week 6 Ø Quick review of the course to date Ø Go over Week 5 problems Ø Preview of the two class projects Ø More on bonds, including topics from BKM Chapters 14 – 16 that have not yet been covered Professor Ross Miller • Fall 2005 2

The Following Week: The Mid-Term Exam Ø Place and Time • BA 229 (the usual classroom) • Special time: 6: 15 PM – 8: 15 PM (with an additional 20 “grace minutes”) • Dates: Thursday, October 20 Ø Format • 10 True-False (3 points each) • 2 Problems each with 5 questions (10 questions in total worth 7 points each) • Partial credit is possible throughout the exam Professor Ross Miller • Fall 2005 3

Parameters for Open-Book Exam Ø Allowed • Anything in print form, including textbooks, class slides, notes, etc. • Calculators (including financial, scientific, and graphing); however, all problems can be solved with a cheap, minimal calculator Ø Prohibited • Any device remotely capable of communication including cell phones, PDAs, and computers Professor Ross Miller • Fall 2005 4

100 Total Points Possible for an Exam, Which are then Converted to GPA points Ø Points convert to GPA equivalent number according to the following formula: GPA equivalent = 4. 33 – (100 – Test score)/15 Ø For example, • 95 = 4. 00 = A 88 = 3. 53 = lowest A • 83 = 3. 20 = lowest B+ 73 = 2. 52 = lowest B- Ø Grades (in rare circumstances) may be “curved up, ” they will never be “curved down” Professor Ross Miller • Fall 2005 5

What the Mid-Term Exam Covers Ø New material covered in class from Weeks 1 through 5 and in the Week 6 in-class problem review Ø New material introduced in Week 6, while useful for understand the previous material, is not explicitly covered on the mid-term Ø The main focus is what is covered in class and a basic understanding of the world’s current financial situation (exchange rates, yields, the Fed, etc. ) Ø Although you should try doing Week 5 problems yourself before looking at the answers, the answers are already posted here Professor Ross Miller • Fall 2005 6

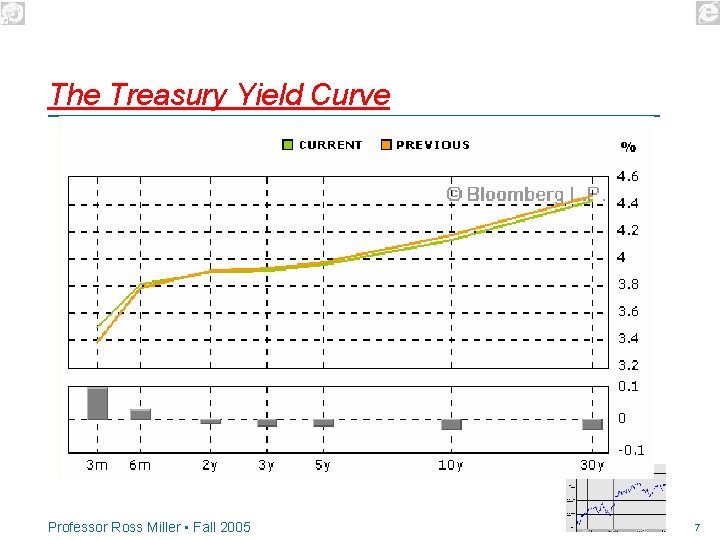

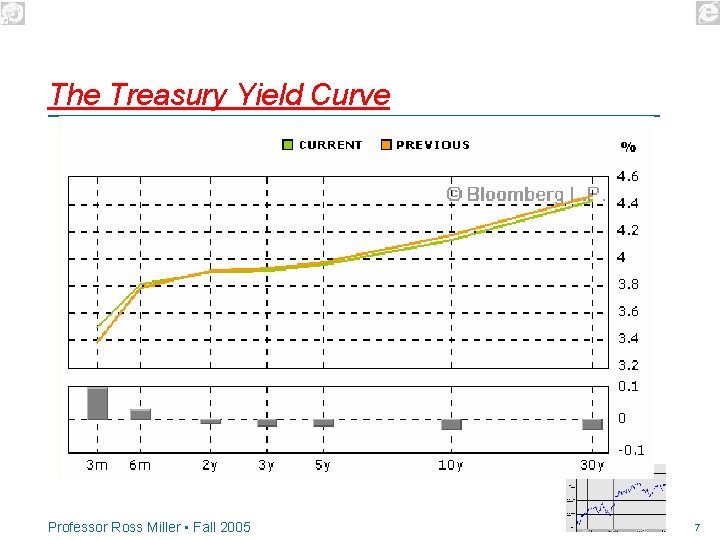

The Treasury Yield Curve Professor Ross Miller • Fall 2005 7

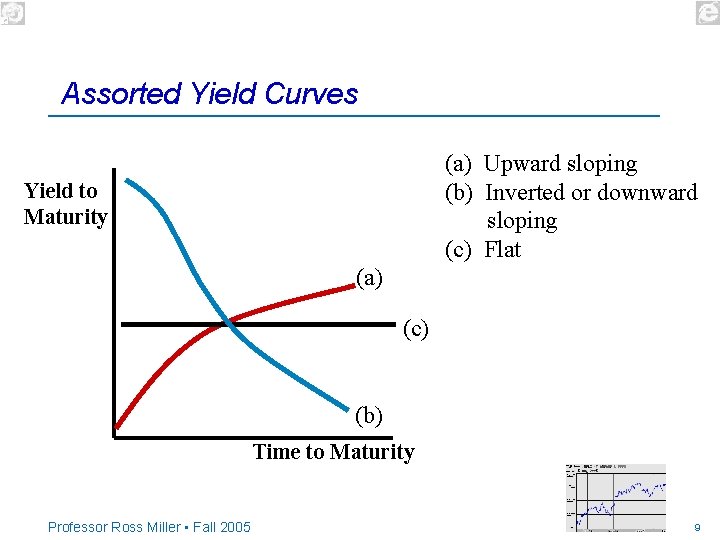

Four Main Yield Curve Shapes Ø Upward-sloping • The situation that occurs most of the now (including currently) • Provides a higher interest rate to lenders willing to assume the risk and reduced liquidity that comes from lending for a longer period of time Ø Downward-sloping (also known as inverted) • Usually the result of prolong Fed tightening • Often the forerunner of a recession Ø Flat (a fleeting moment between the above two) Ø Humped (so rare that few worry about it) Professor Ross Miller • Fall 2005 E=mc 2 8

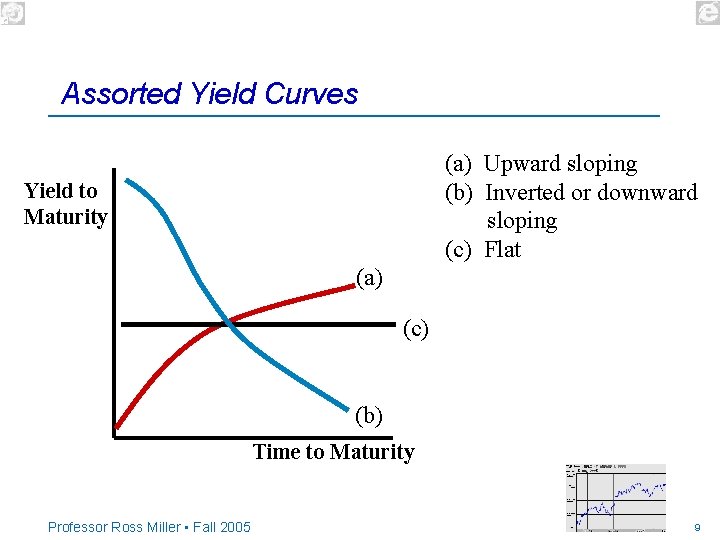

Assorted Yield Curves (a) Upward sloping (b) Inverted or downward sloping (c) Flat Yield to Maturity (a) (c) (b) Time to Maturity Professor Ross Miller • Fall 2005 9

The Yield Curve Is Dynamic Ø One component of this is predictable as the yield curve, as we shall soon see, contains information about the expected shape of future yield curves Ø Much of the movements, however, are unpredictable Ø View the animated history of the yield curve Professor Ross Miller • Fall 2005 10

Why Sweat the Yield Curve? Ø It contains within it a forecast of future interest rates and provides the prices of forward rate agreements (FRAs) and interest rate swaps Ø The bond yield curve that is typically given in newspapers is not the one used by professionals because it is complicated by the coupon payments of the bonds Ø Professionals use the pure yield curve based on zero-coupon securities Ø It is a reminder that despite the fact that most of financial analysis assumes all cash flows from an investment can be discounted using the same interest rate, doing so it sometimes unwise Professor Ross Miller • Fall 2005 E=mc 2 11

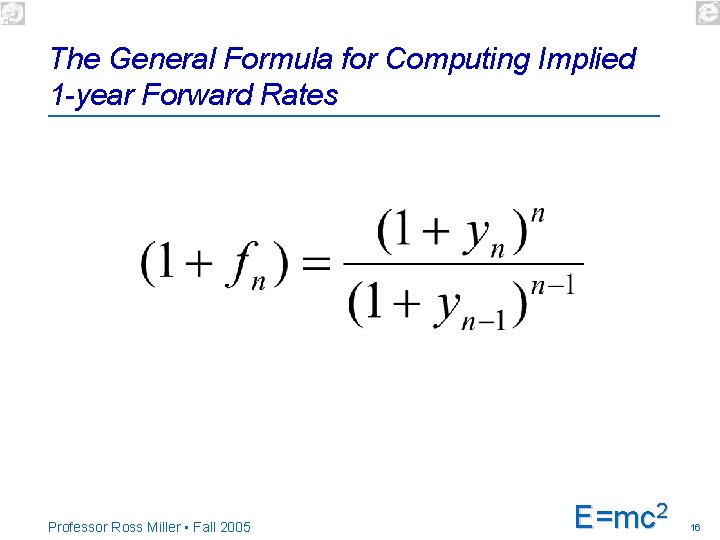

What Hides Inside the (Pure) Yield Curve Ø Estimates of forward interest rates are there for the taking Ø An example of the basic idea: If you know the yield out 2 years (y 2) and the yield out one year (y 1), you can reverse engineering the what the one-year yield should be one year from now (this is an implied forward rate) Ø The same idea works between any two points in time Professor Ross Miller • Fall 2005 E=mc 2 12

A Note on the Approach Taken by BKM Ø BKM introduce the idea of a short interest rate (itself a confusing term) Ø As BKM note repeatedly, these rates do not really exist in reality, they are purely theoretical constructs that act just like the forward rates that can be implied from the pure yield curve Ø If they help you understand things, that is fine; otherwise, feel free to ignore them Professor Ross Miller • Fall 2005 E=mc 2 13

Consider This Situation from BKM Ø 1 -year yield is 8. 000% Ø 2 -year yield is 8. 995% Ø So what is the implied forward rate for 1 year starting 1 year into the future • If interest rate math were user-friendly, a rate of 9. 990% for the second year would then make the 2 -year average rate be exactly 8. 995% • Instead, we have to remember that (1+yn)n is the appropriate way to discount cash flows Professor Ross Miller • Fall 2005 E=mc 2 14

Computing the Implied 1 -Year Forward Rate Ø $1, 000 invested in the 2 -year 8. 995% zero-coupon bond gives: $1, 000(1+y 2)2 = $1, 000(1. 08995)2 = $1, 187. 99 Ø $1, 000 invested ion the 1 -year 8. 000% zero-coupon bonds gives: $1, 000(1+y 1)1 = $1, 000(1. 08) = $1, 080. 00 Ø Turning the $1, 080 into $1, 187. 99 requires a oneyear forward yield of: f 2 = $1, 000(1+y 2)2 / $1, 000(1+y 1)1 – 1 = $1, 187. 99/$1, 080. 00 – 1 = 10. 00% Professor Ross Miller • Fall 2005 E=mc 2 15

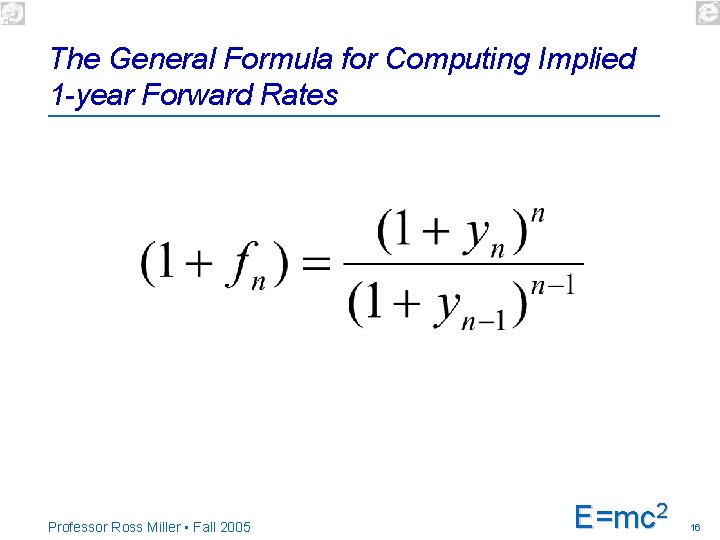

The General Formula for Computing Implied 1 -year Forward Rates Professor Ross Miller • Fall 2005 E=mc 2 16

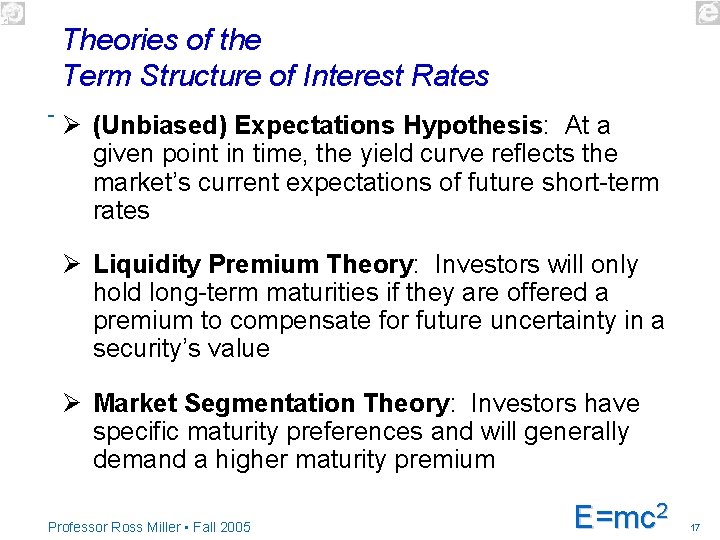

Theories of the Term Structure of Interest Rates Ø (Unbiased) Expectations Hypothesis: At a given point in time, the yield curve reflects the market’s current expectations of future short-term rates Ø Liquidity Premium Theory: Investors will only hold long-term maturities if they are offered a premium to compensate for future uncertainty in a security’s value Ø Market Segmentation Theory: Investors have specific maturity preferences and will generally demand a higher maturity premium Professor Ross Miller • Fall 2005 E=mc 2 17

The (Unbiased) Expectations Hypothesis and Implied Forward Rates Ø Under this hypothesis, the forward rates implied from the yield curve are an unbiased (accurate on average) estimate of what interest rates will be in the future Ø Even without this hypothesis, the implied forward rates from the curves should be very close to the actual forward rates that prevail in the market • If they were not, profitable arbitrage could occur • This is very similar to interest-rate parity Professor Ross Miller • Fall 2005 E=mc 2 18

A Closer Look at f 2 Ø In the example, the implied 1 -year forward rate 1 year from now, f 2, was 10% Ø If we were a financial institution, we would like to have a way to “lock in” a 10% one-year fixed rate on money we borrow for 1 year beginning 1 year from today (Note: This is a liability to the bank) Ø If the agreement involves a loan of $1, 000, we would pay $1, 100, 000 a year later Professor Ross Miller • Fall 2005 E=mc 2 19

What if a Year from Now (When the Loan Begins) the Interest Rate Rises to 11% Ø Then, instead of paying $1, 100, 000 back on the loan, we would have to pay $1, 110, 000 back, which is $10, 000 more Ø We could, however, be “made whole” (get back to the original 10% rate) if someone gave us $9, 009, which is $10, 000/1. 11 Ø At the end of the year, this $9, 009 (at 11% interest) would become $10, 000—making up for the extra $10, 000 in interest we would need to pay out Professor Ross Miller • Fall 2005 E=mc 2 20

What if a Year from Now (When the Loan Begins) the Interest Rate Drops to 9% Ø Then, instead of paying $1, 100, 000 back on the loan, we would have to pay $1, 090, 000 back, which is $10, 000 less Ø Now to get back to the 10% rate we would pay $9, 174, which is $10, 000/1. 09 Ø At the end of the year, this $9, 174 (at 9% interest) would become $10, 000—offsetting the extra $10, 000 in interest we made when rates dropped Professor Ross Miller • Fall 2005 E=mc 2 21

Forward Rate Agreement (FRA) Ø The financial arrangement described in the previous slides constitutes a forward rate agreement or FRA Ø It has the effect of freezing a future interest rate at a fixed level determined by the implied forward rate Ø The “twist” is that it is settled in cash rather than by making the two parties to the agreement actually transact at the fixed rate Professor Ross Miller • Fall 2005 22

Eurodollar Futures (traded on the CME) Ø A popular exchange-traded alternative to FRAs Ø Very similar because most FRAs are quoted in terms of Eurodollars Ø Like FRAs, Eurodollar futures are settled in cash rather than through the actual physical delivery of a 3 -month Eurodollar Ø Because it is a futures contract, cash flows related to posting and maintaining margin take place prior to the “delivery” date Professor Ross Miller • Fall 2005 23

The PV of Fixed-Rate Securities Vary With Interest Rates Ø Obviously this is the case for a bond that pays a fixed coupon rate—rates go up and its PV goes down and vice versa Ø Somewhat less obviously this is the case for a bank that enters into an FRA that commits it to borrow money at a fixed rate Ø When rates go up, this commitment becomes less of a liability to the bank (someone else would be happy to pay the bank to be committed to borrow at 10%, for example, when the going rate is 11% Professor Ross Miller • Fall 2005 E=mc 2 24

What About a Floating-Rate Alternative? Ø Suppose that the bank agrees to borrow $1, 000 for a year one year from today; however, it will not commit to a rate now. Instead, it will pay whatever the prevailing rate is in a year Ø What would someone be willing to pay (or need to pay) to relieve the bank of this liability? Professor Ross Miller • Fall 2005 ? ? ? 25

Duration: A Measure of Interest Rate Sensitivity Ø The duration of an investment is a quantitative indication of its interest rate sensitivity that is measured in years Ø Higher duration means a greater sensitivity (in percentage terms) to changes in interest rates Ø Doubling duration means doubling the interest rate sensitivity • A bond with a duration of 6 years will drop twice as much (as a percent of its price) as a bond with a duration of 3 years when interest rates increase by 1 basis point (0. 01%) Professor Ross Miller • Fall 2005 E=mc 2 26

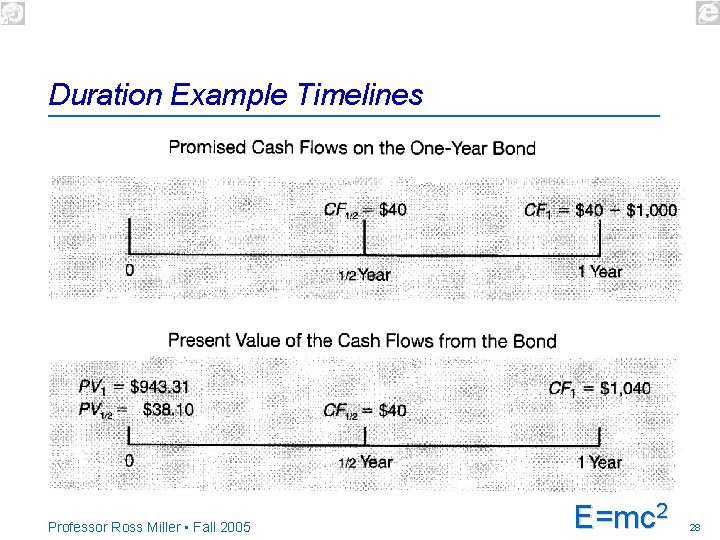

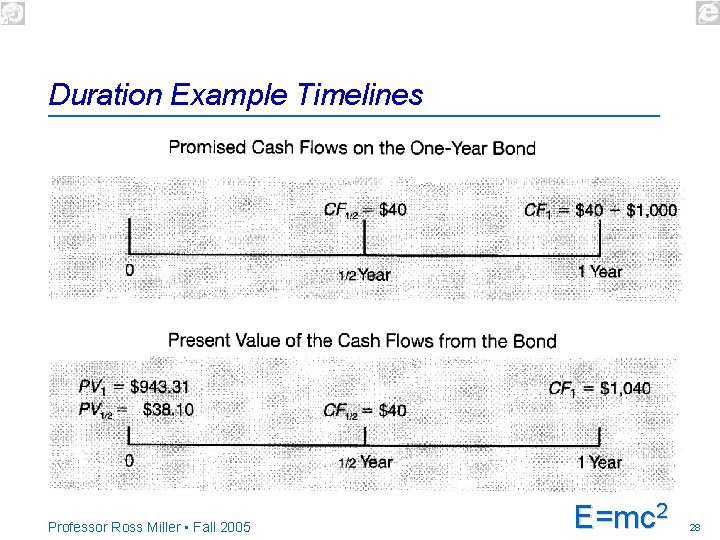

Duration Example Ø Consider a Treasury bond (or note) with the following properties • • One year left to maturity $1, 000 face value 8% coupon rate (paid semiannually) Its yield (to maturity) is 10% Ø Cash flow from this bond • $40 (4% of $1, 000) paid in ½ year • $1, 040 (4% of $1, 000 plus the $1, 000 face value) paid in 1 year Professor Ross Miller • Fall 2005 E=mc 2 27

Duration Example Timelines Professor Ross Miller • Fall 2005 E=mc 2 28

Computing the Present Value of the Bond Ø Value of $40 in ½ year = $40/(1. 05) = $38. 10 Ø Value of $1, 040 in 1 year = $1, 040/(1. 05)2 = $943. 31 Ø Total value = $38. 10 + $943. 31 = $981. 41 Professor Ross Miller • Fall 2005 E=mc 2 29

Computing Duration Ø Duration is the cash-flow weighted time to maturity Duration = (38. 10)(0. 5) + (943. 31)(1. 0) 981. 41 = 0. 9806 years Ø Notice that if the first cash flow were eliminated, making the total value of the bond $943. 31, the duration of the bond would simply be 1 year Professor Ross Miller • Fall 2005 E=mc 2 30

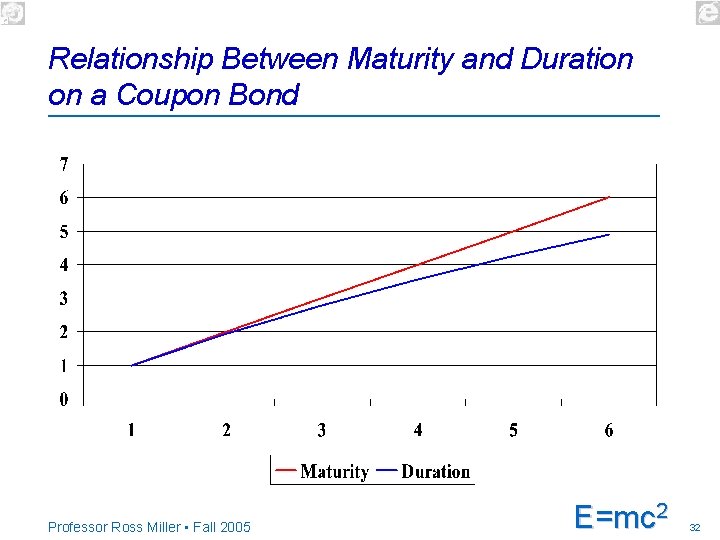

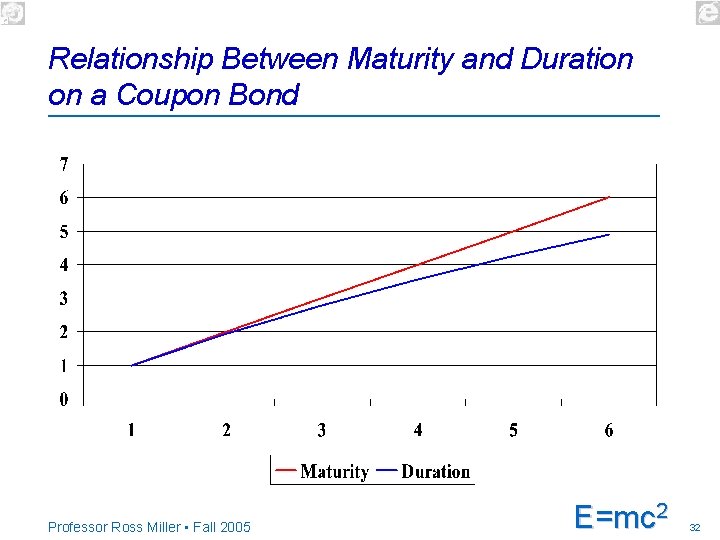

Features of Duration Ø Duration and Coupon Interest • The higher the coupon payment, the lower is a bond’s duration Ø Duration and Yield to Maturity • Duration decreases as yield to maturity increases Ø Duration and Maturity • Duration increases with the maturity of a bond but at a decreasing rate Professor Ross Miller • Fall 2005 E=mc 2 31

Relationship Between Maturity and Duration on a Coupon Bond Professor Ross Miller • Fall 2005 E=mc 2 32

Duration, Zero-Coupon Bonds, and Bond Portfolios Ø For a zero-coupon bond, duration equals maturity Ø The duration of a portfolio of bonds is the valueweighted average of the durations of the individual bonds Ø A portfolio with $1, 000 in a bond with a duration of 2 years and $2, 000 in a bond with a duration of 4 years has a duration of [2(1, 000)+4(2, 000)]/(3, 000) = 3. 33 years Professor Ross Miller • Fall 2005 E=mc 2 33

Stocks Also Have Duration Ø The typical stock goes down on average when interest rates go up Ø Unlike bonds, however, they sometimes go up with interest rates (usually when the economy is getting stronger) Ø Why should this happen? The value of a stock is determined by (uncertain) discounted cash flows Ø Stock duration is usually high (20 years and up) and ignored by most finance people Professor Ross Miller • Fall 2005 E=mc 2 34

Modified Duration Ø Duration works out nicely because an N-year zero-coupon bond has a duration of N years Ø Duration has one problem, as a measure of interest-rate sensitivity it is calibrated to changes in the discount factor (1+r) Ø To calibrate duration to interest rates directly (r), one needs to compute modified duration Ø The problem with modified duration is that the duration of an N-year zero-coupon bond is now less than N years Professor Ross Miller • Fall 2005 E=mc 2 35

A Big Problem with Both Durations Ø Duration only applies to very small changes in the discount factor (as the price of the bond changes, so does duration) • The duration of zero-coupon bonds; however, only changes with time, not price Ø The measure of how much duration changes is known as convexity, which we will cover in great depth next time Professor Ross Miller • Fall 2005 E=mc 2 36

Financial Institutions and Other Corporations Often Desire Immunity from Interest Rates Ø The concept of duration can be extended to a company’s balance sheet Ø The ideal situation for most companies is total immunity—no balance sheet exposure to changes in interest rate Ø This can be achieved (in theory) by matching asset duration with liability duration • Note: Because shareholder equity is greater than zero, assets will exceed liabilities Professor Ross Miller • Fall 2005 E=mc 2 37

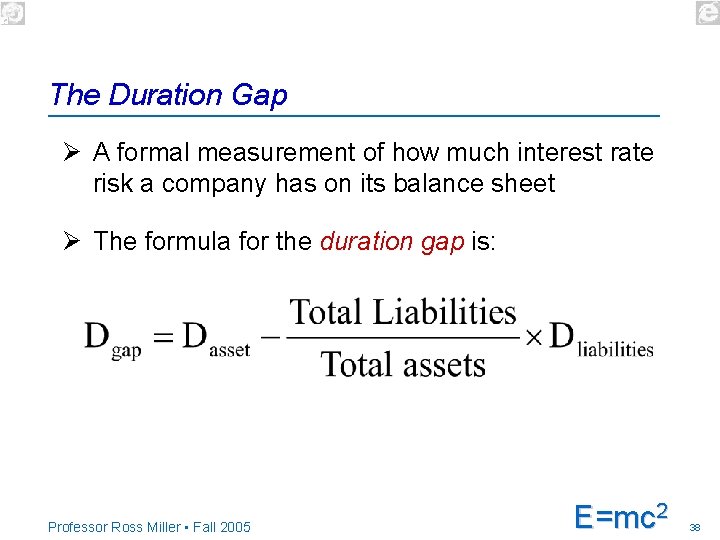

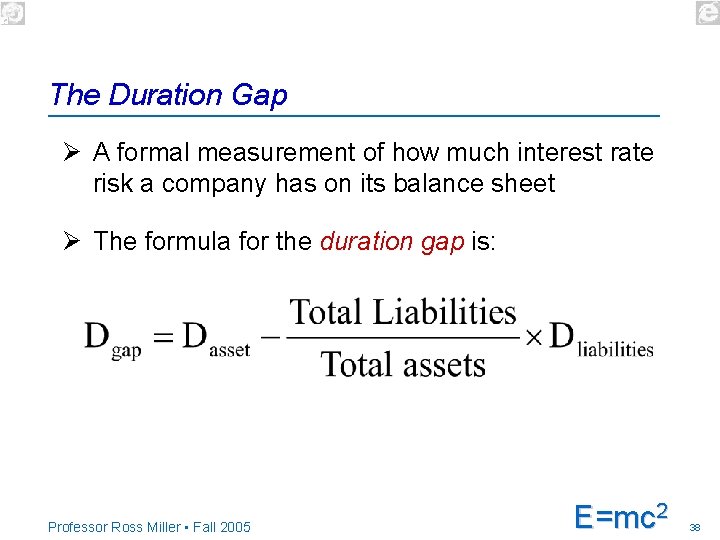

The Duration Gap Ø A formal measurement of how much interest rate risk a company has on its balance sheet Ø The formula for the duration gap is: Professor Ross Miller • Fall 2005 E=mc 2 38

Condition Where Duration Gap is 0 Dassets x Total assets = Dliabilities x Total liabilities Professor Ross Miller • Fall 2005 E=mc 2 39

Quick Duration Gap Example Ø Assets of $1, 000 with a duration of 4. 2 year Ø Liabilities of $800 with a duration of 4. 4 years (Note: Shareholders’ equity must be $200) Duration Gap = 4. 2 – ($800/$1, 000) x 4. 4 = 0. 68 years When interest rates go up, this company’s assets will drop faster than its liabilities, eating into its equity Professor Ross Miller • Fall 2005 E=mc 2 40

More About Duration Gaps Ø If the duration gap is positive • Same situation as holding a bond with a positive duration – Increase in interest rates hurts earnings – Decrease in interest rates helps earnings – Hence, the FI is betting that rates will drop Ø If the duration gap is negative – Increase in interest rates helps earnings – Decrease in interest rates hurts earnings – Hence, the FI is betting that rates will raise Professor Ross Miller • Fall 2005 E=mc 2 41

How to Reduce the Gap Ø One solution: Sell some of the bank’s loans and hold “cash” instead Ø A better solution: Enter into a contract that hedges the interest rate risk Ø While both the forward and futures contracts described earlier can do this, a variant on them known as an interest rate swap is the preferred method Professor Ross Miller • Fall 2005 E=mc 2 42

Interest Rate Swaps Ø Designed as an exchange of fixed-rate interest payments (high duration) for floating-rate interest payments (low duration) Ø A swap enables one to change one’s level of interest rate risk without disrupting the underlying portfolio or the balance sheet • Most swaps have a value of zero at the time of creation • The value of a swap changes with changes in interest rates Ø Popular with bankers, corporate treasurers, and portfolio managers who need to manage interest rate risk Professor Ross Miller • Fall 2005 43

Why Interest Rate Swaps Affect Duration Ø The fixed side of the swap has the standard positive duration of a fixed coupon bond—for shortterm bonds this duration is a bit less than the bond’s maturity as we saw earlier Ø The floating side of the swap has only a slightly positive duration because the interest rate is reset frequently—if the interest rate were continuously reset, the floating side would have zero duration Ø The net duration is then almost that of the fixedrate side Professor Ross Miller • Fall 2005 E=mc 2 44

Swaps from the Financial Institution’s Perspective Ø Interest rate swaps affect the duration of the financial institution’s liabilities Ø The buyer of a swap (the one who pays the fixed rate) increases the duration of the liabilities, which decreases the value of the duration gap Ø The seller of a swap (the one who pays the floating rate) decreases the duration of the liabilities, which increases the value of the duration gap Professor Ross Miller • Fall 2005 E=mc 2 45

An Important Point: The Assets Themselves Are Not Swapped Ø An interest rate swap is equivalent to a series (or bundle) of FRAs Ø Both parties to the swap continue to own the “swapped” assets Ø Only the cash flows are swapped Ø Each period during the swap, the difference in cash flows between the two assets is computed and the difference is paid Professor Ross Miller • Fall 2005 E=mc 2 46

Swaps Are the Prime Determinant of U. S. and Most Global Interest Rates Ø Swaps are the easiest way for large financial institutions to adjust their duration Ø Large swap transactions by influential market participants affect the entire yield curve Ø Hence, the influence of swaps on interest rates is similar to what we will see is the effect of S&P Index futures on the stock market Professor Ross Miller • Fall 2005 E=mc 2 47

A Useful Comparison Ø At the short end of the yield curve, the management of cash/reserves (liquidity) by financial institutions drives the market Ø At the longer end, the management of interest rate risk (duration) by financial institutions drives the market Professor Ross Miller • Fall 2005 E=mc 2 48

Some Swap Details Ø The standard type of interest rate swap is the fixed for floating rate swap • One party makes a fixed interest rate payment to another party making a floating interest rate payment • Only the net payment (difference check), if any, is made when the swap is entered into • The firm paying the fixed rate is the swap buyer • The firm paying the floating rate is the swap seller Professor Ross Miller • Fall 2005 E=mc 2 49

International Swaps and Derivatives Association (ISDA) Ø Like forward contracts, swaps are private, nontraded agreements between two parties Ø ISDA exists to provide some standardization in the forms of master agreements that are revised roughly every ten years (last revised in 2002) Ø Interest rates are most frequently tied to sixmonth LIBOR Professor Ross Miller • Fall 2005 50

More Swap Terminology Ø A plain vanilla swap refers to a standard contract with no unusual features Ø The swap facilitator will find a counterparty to a desired swap for a fee or take the other side Ø A facilitator acting as an agent is a swap broker Ø A swap facilitator taking the other side is a swap dealer (swap bank) Professor Ross Miller • Fall 2005 E=mc 2 51

Major Swap Players Ø Investment Bankers • J. P. Morgan Chase – Has a market share of over 50% – Known as the “derivatives king” – Especially dominant in credit swaps • Citigroup – Parent of Salomon Smith Barney – The “bank” itself also is active in swaps and derivatives Ø Some Large Clients • Enron, Fannie Mae, and Freddie Mac Professor Ross Miller • Fall 2005 52

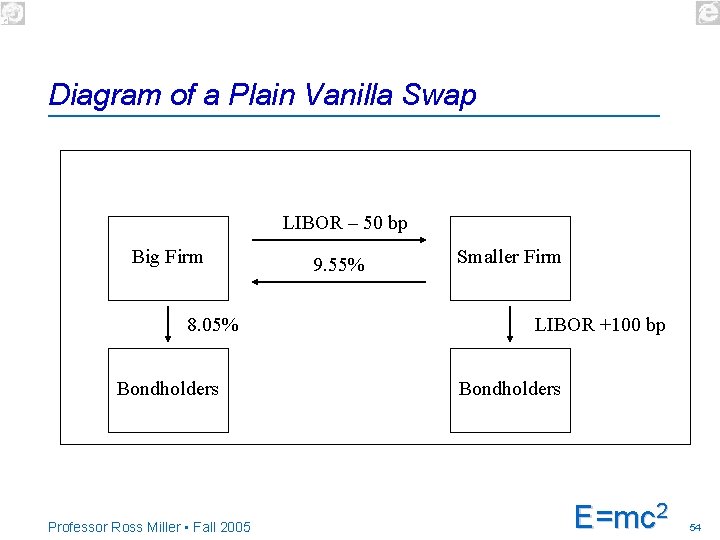

Plain Vanilla Swap Example Ø A large firm pays a fixed interest rate to its bondholders, while a smaller firm pays a floating interest rate to its bondholders. Ø The two firms could engage in a swap transaction which results in the larger firm paying floating interest rates to the smaller firm, and the smaller firm paying fixed interest rates to the larger firm. Professor Ross Miller • Fall 2005 E=mc 2 53

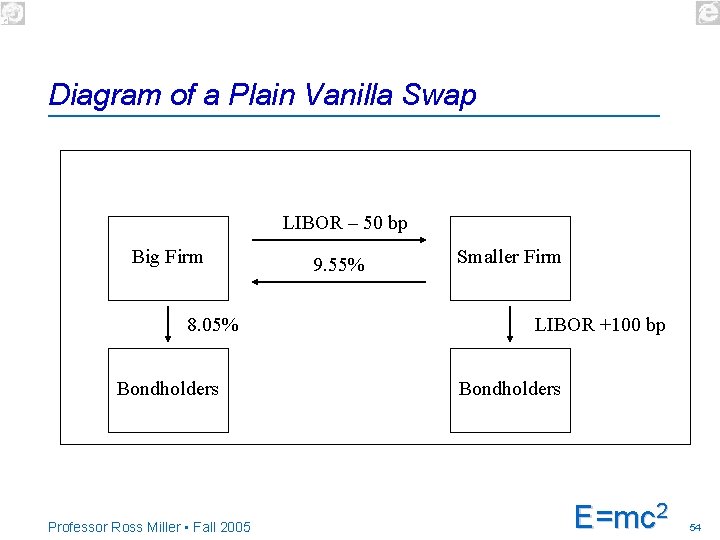

Diagram of a Plain Vanilla Swap LIBOR – 50 bp Big Firm 8. 05% Bondholders Professor Ross Miller • Fall 2005 9. 55% Smaller Firm LIBOR +100 bp Bondholders E=mc 2 54

Plain Vanilla Swap Details Ø Note the big firm can borrow on better terms than the smaller firm Ø Situation after the swap • Big firm pays LIBOR – 50 bp • Smaller firm pays 9. 55% Ø The absolute advantage of the big firm is 150 bp (= 1. 50%) Professor Ross Miller • Fall 2005 E=mc 2 55

Even More Swap Terminology Ø The swap price is the fixed rate that the two parties agree upon Ø The swap tenor is the term of the swap Ø The notional principal determines the size of the interest rate payments Ø Counterparty risk refers to the risk that the other party to the swap will not honor its part of the agreement Professor Ross Miller • Fall 2005 E=mc 2 56

The Case of Two Hypothetical Banks: Trekkers & Third National Ø Trekker buys a swap with a notional value of $100 million for a price of 8. 5% fixed. Ø Third National (the seller) pays LIBOR + 100 b. p. Ø Rates are computed so no difference check is required Ø The swap tenor is 2 year with a payment frequency of every 6 months (this is the most common payment frequency) Professor Ross Miller • Fall 2005 E=mc 2 57

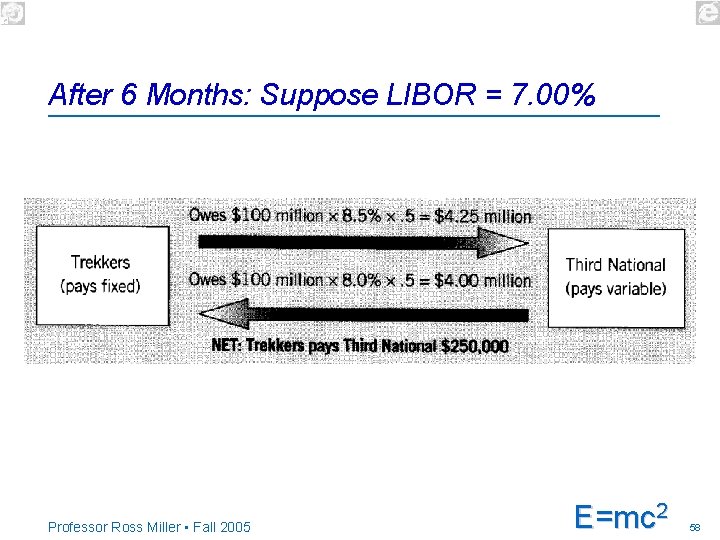

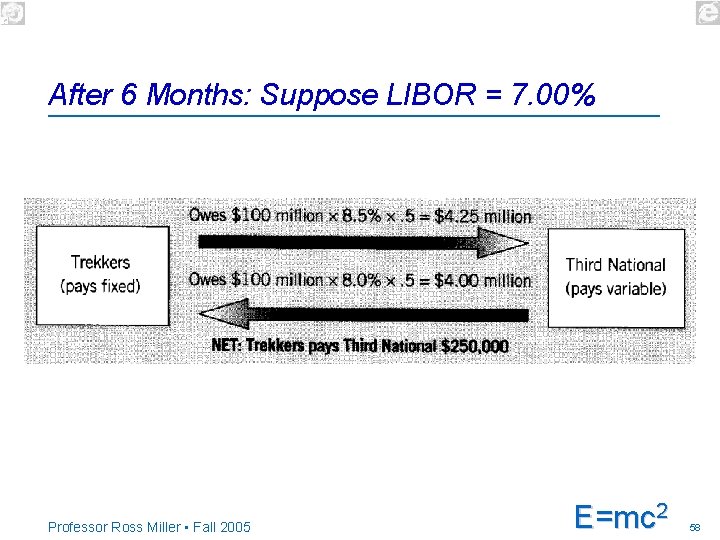

After 6 Months: Suppose LIBOR = 7. 00% Professor Ross Miller • Fall 2005 E=mc 2 58

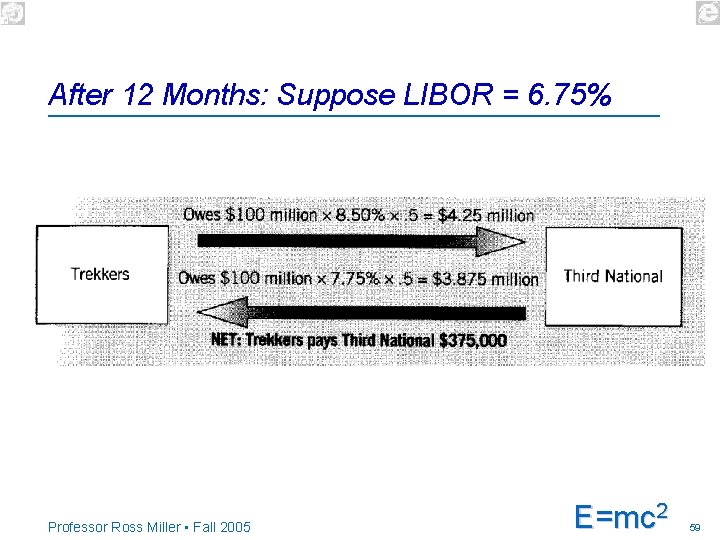

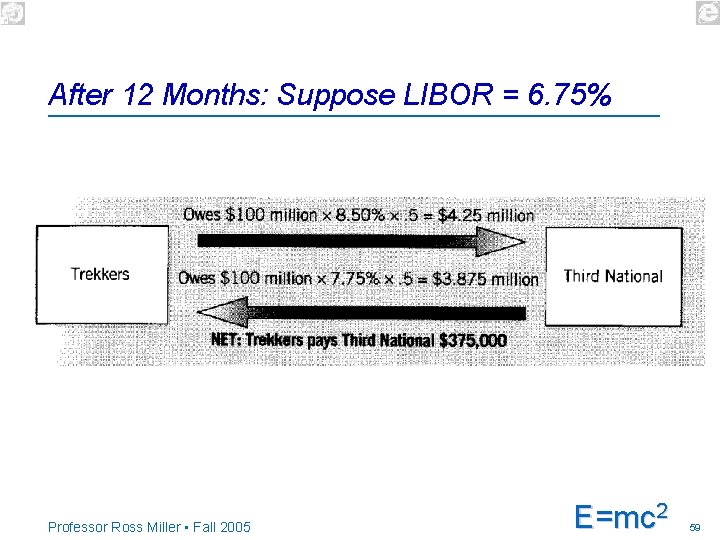

After 12 Months: Suppose LIBOR = 6. 75% Professor Ross Miller • Fall 2005 E=mc 2 59

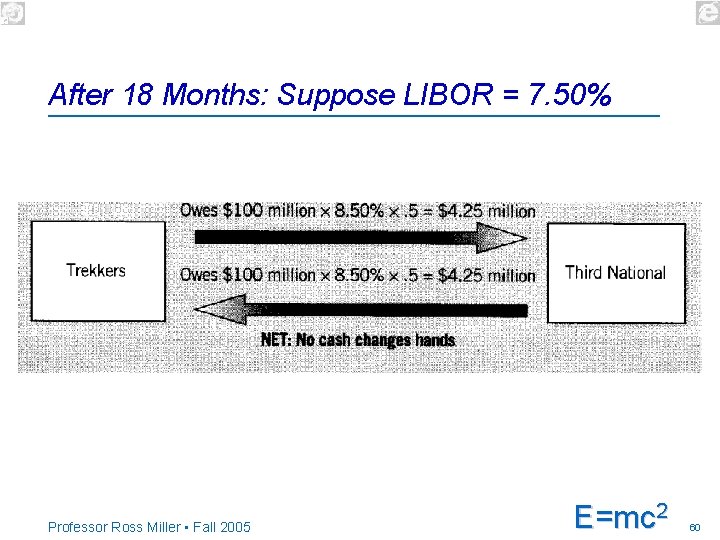

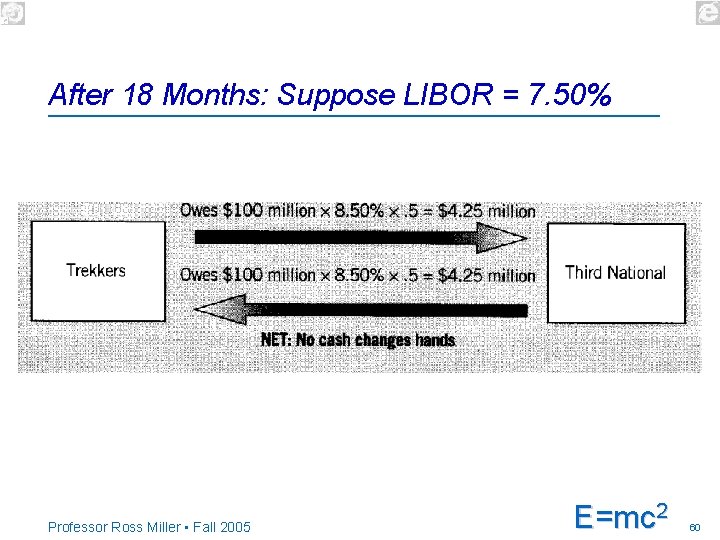

After 18 Months: Suppose LIBOR = 7. 50% Professor Ross Miller • Fall 2005 E=mc 2 60

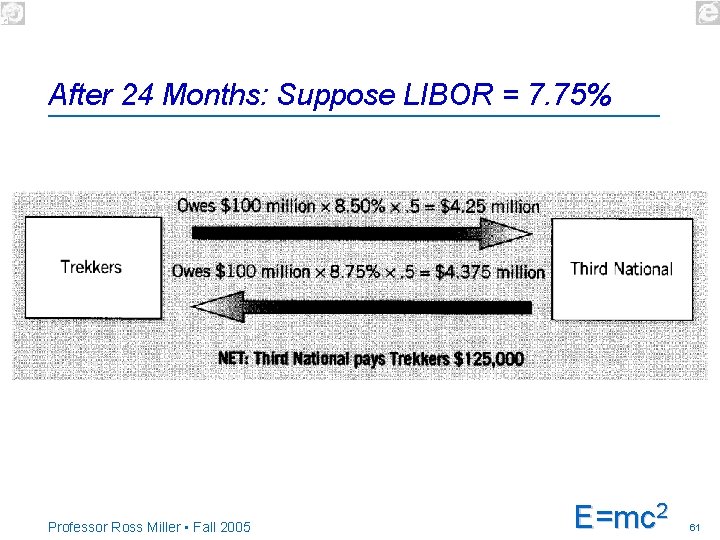

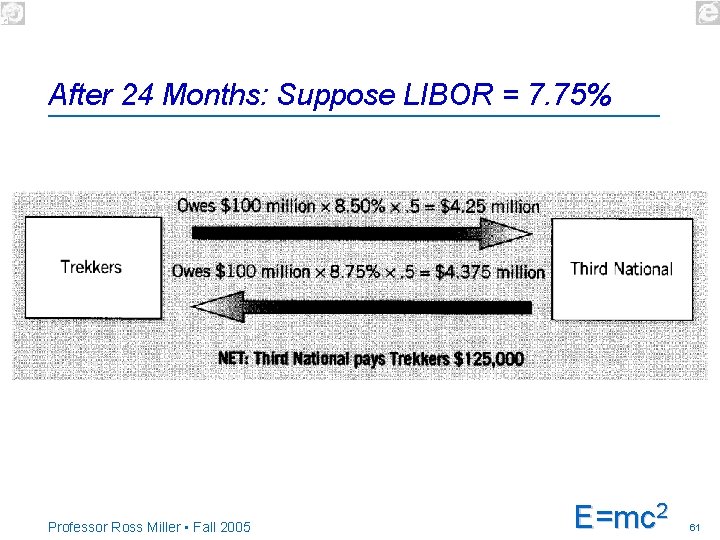

After 24 Months: Suppose LIBOR = 7. 75% Professor Ross Miller • Fall 2005 E=mc 2 61

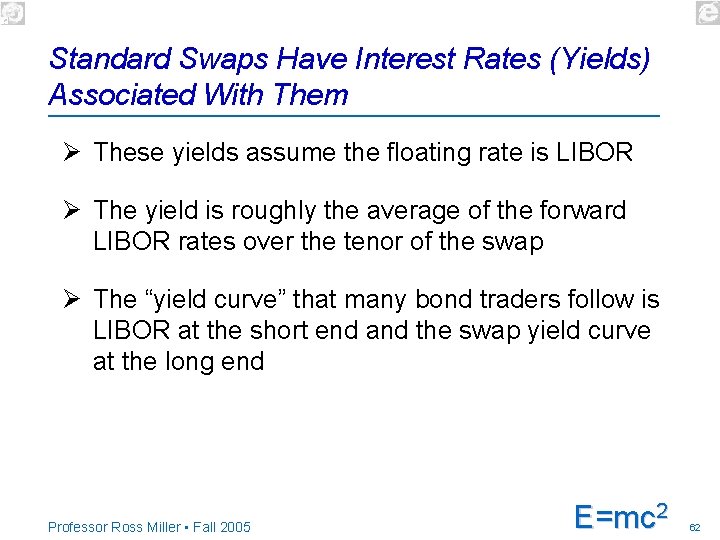

Standard Swaps Have Interest Rates (Yields) Associated With Them Ø These yields assume the floating rate is LIBOR Ø The yield is roughly the average of the forward LIBOR rates over the tenor of the swap Ø The “yield curve” that many bond traders follow is LIBOR at the short end and the swap yield curve at the long end Professor Ross Miller • Fall 2005 E=mc 2 62

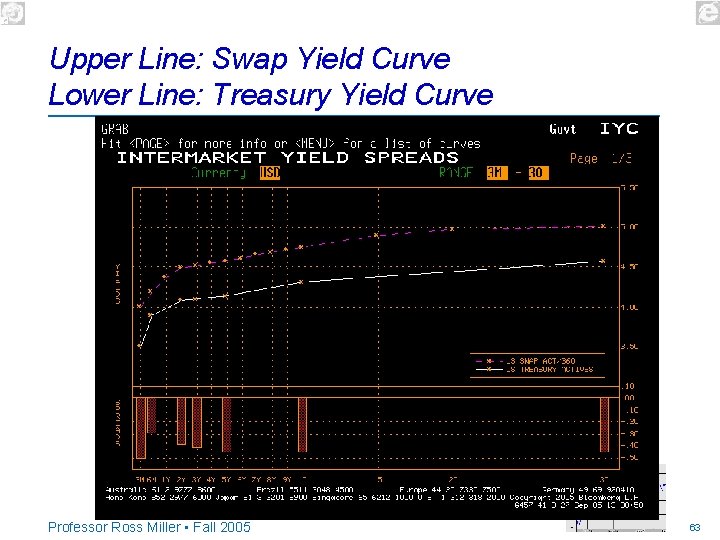

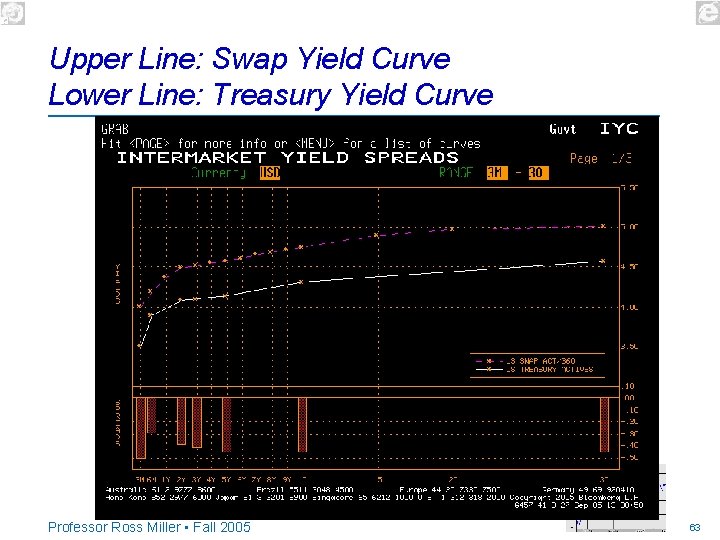

Upper Line: Swap Yield Curve Lower Line: Treasury Yield Curve Professor Ross Miller • Fall 2005 63

Swaps Were Not Intended as Duration Shifters at First Ø They originally came about because some companies could get better terms on fixed-rate and others did relatively better with floating rates Ø Many practitioners and academics believe that as the market has matured, most of the advantage to be gained from swapping loan terms has disappeared Ø Bottom line: The current swaps market is currently driven almost entirely by duration considerations Professor Ross Miller • Fall 2005 E=mc 2 64

Relatives of Interest Rate Swaps Ø Swaptions (options to engage in a swap) Ø Rate cap (sets an upper limit on a floating rate) Ø Rate floor (sets a lower limit on a floating rate) Ø A swap is equivalent to a combination of a rate cap and a rate floor Professor Ross Miller • Fall 2005 65

A Few of the Many Other Kinds of Swaps Ø Currency swaps • Not as popular as interest rate swaps • Require real cash flows up front Ø Credit (or default) swaps • Idea: Strip the credit risk off of corporate bonds • Pioneered by J. P. Morgan (before the Chase merger) • An important part of the process where banks got loans off their balance sheets in the late 1990 s (a result of high loan reserve requirements) Professor Ross Miller • Fall 2005 E=mc 2 66

One Last Piece of the Interest Rate Puzzle to be Covered Next Time Ø The long-term debt market as seen by financial institutions in the U. S. is dominated not by corporate borrowing, but by mortgages and other forms of securitized debt Ø The origination of mortgages is what drives the swaps market (and, in turn, the other debt markets) Ø According to the Fed, in the second quarter of 2005, annualized home mortgage borrowing ($892. 4 B) was almost a third greater than all business borrowing ($672. 0 B) Professor Ross Miller • Fall 2005 E=mc 2 67

For Next Time Ø Follow the links on the slides Ø Read all of BKM Chapters 14– 16 that you have not already read (and rereading the parts you have read will not hurt) Ø Figure out any questions you have up to this point in the course and ask them either in class, via email or Web. CT, or at office hours Ø Do the problems on the 6 slides that follow this one Professor Ross Miller • Fall 2005 68

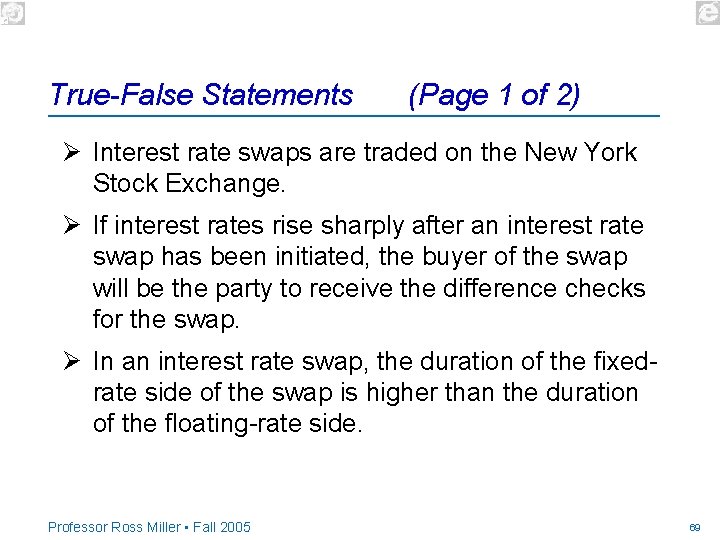

True-False Statements (Page 1 of 2) Ø Interest rate swaps are traded on the New York Stock Exchange. Ø If interest rates rise sharply after an interest rate swap has been initiated, the buyer of the swap will be the party to receive the difference checks for the swap. Ø In an interest rate swap, the duration of the fixedrate side of the swap is higher than the duration of the floating-rate side. Professor Ross Miller • Fall 2005 69

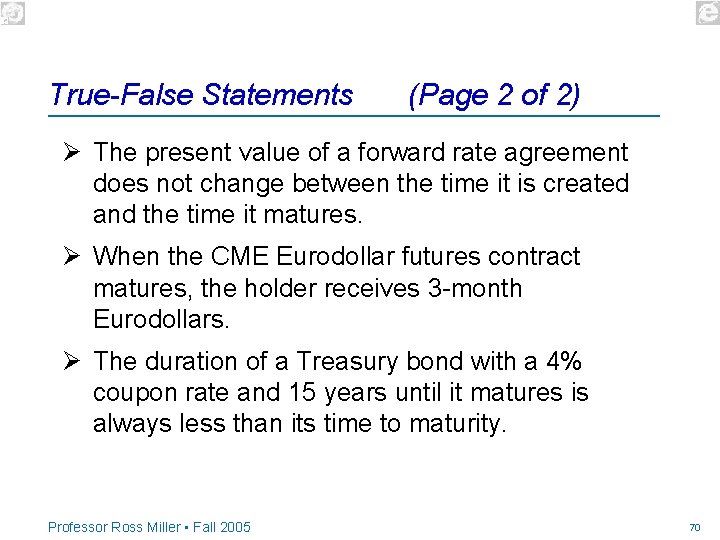

True-False Statements (Page 2 of 2) Ø The present value of a forward rate agreement does not change between the time it is created and the time it matures. Ø When the CME Eurodollar futures contract matures, the holder receives 3 -month Eurodollars. Ø The duration of a Treasury bond with a 4% coupon rate and 15 years until it matures is always less than its time to maturity. Professor Ross Miller • Fall 2005 70

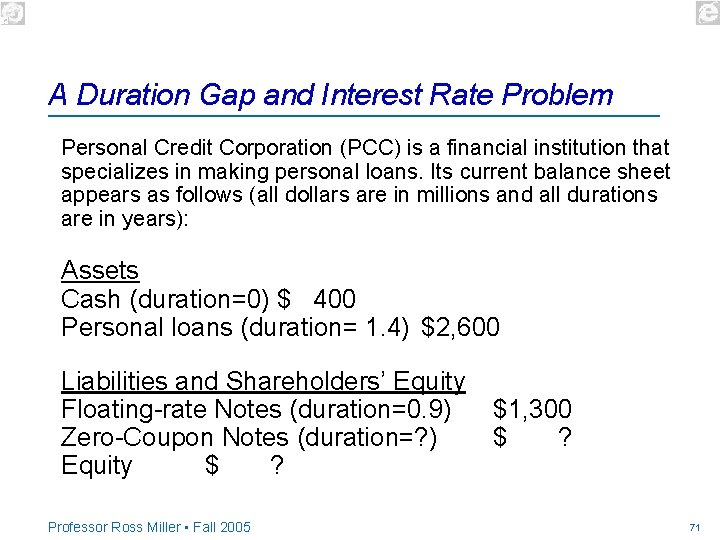

A Duration Gap and Interest Rate Problem Personal Credit Corporation (PCC) is a financial institution that specializes in making personal loans. Its current balance sheet appears as follows (all dollars are in millions and all durations are in years): Assets Cash (duration=0) $ 400 Personal loans (duration= 1. 4) $2, 600 Liabilities and Shareholders’ Equity Floating-rate Notes (duration=0. 9) Zero-Coupon Notes (duration=? ) Equity $ ? Professor Ross Miller • Fall 2005 $1, 300 $ ? 71

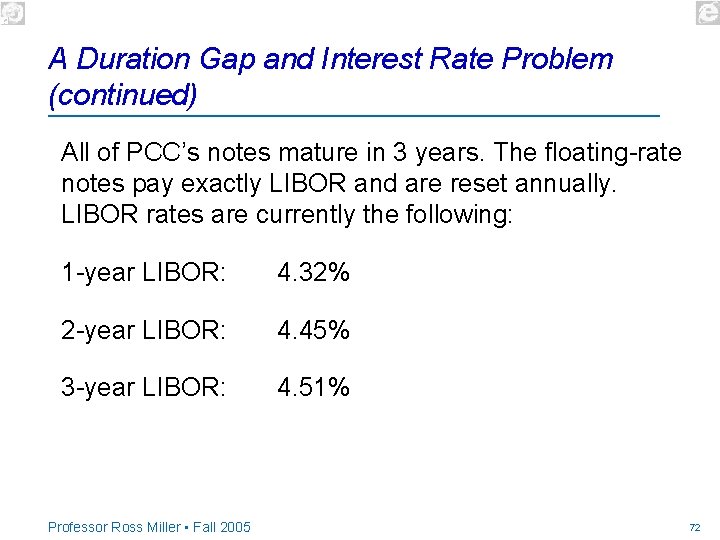

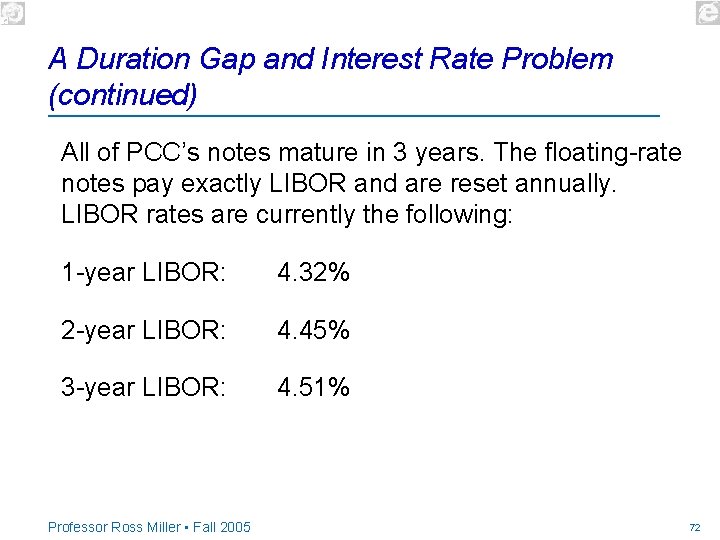

A Duration Gap and Interest Rate Problem (continued) All of PCC’s notes mature in 3 years. The floating-rate notes pay exactly LIBOR and are reset annually. LIBOR rates are currently the following: 1 -year LIBOR: 4. 32% 2 -year LIBOR: 4. 45% 3 -year LIBOR: 4. 51% Professor Ross Miller • Fall 2005 72

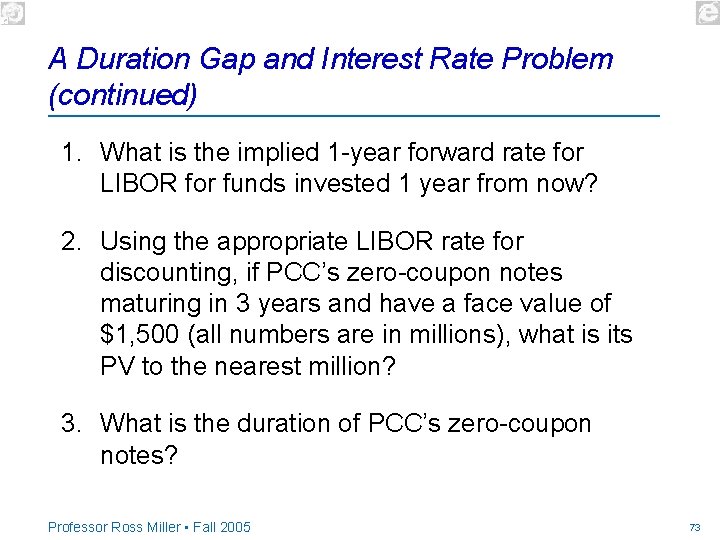

A Duration Gap and Interest Rate Problem (continued) 1. What is the implied 1 -year forward rate for LIBOR for funds invested 1 year from now? 2. Using the appropriate LIBOR rate for discounting, if PCC’s zero-coupon notes maturing in 3 years and have a face value of $1, 500 (all numbers are in millions), what is its PV to the nearest million? 3. What is the duration of PCC’s zero-coupon notes? Professor Ross Miller • Fall 2005 73

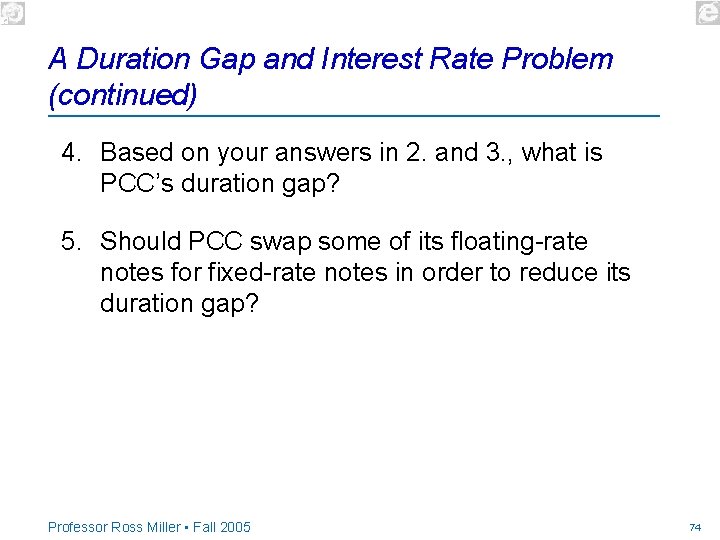

A Duration Gap and Interest Rate Problem (continued) 4. Based on your answers in 2. and 3. , what is PCC’s duration gap? 5. Should PCC swap some of its floating-rate notes for fixed-rate notes in order to reduce its duration gap? Professor Ross Miller • Fall 2005 74