Filing Status Determine the most advantageous and allowable

Filing Status Determine the most advantageous (and allowable) filing status for the taxpayer.

INTAKE/INTERVIEW Process • Form 13614 -C

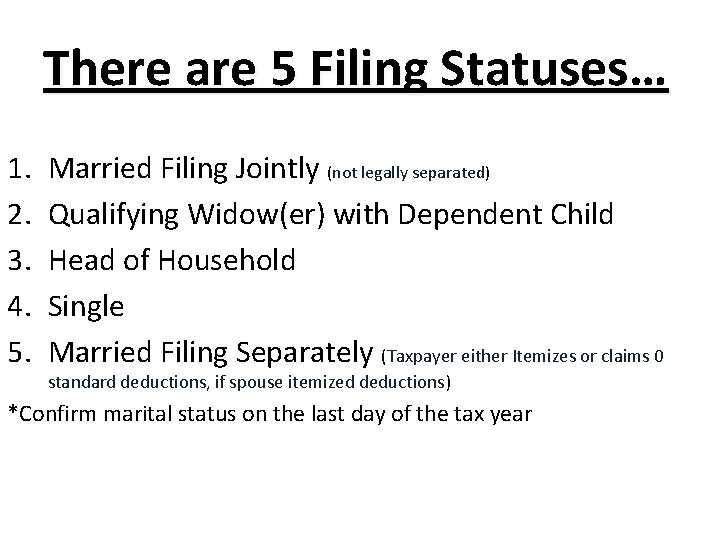

There are 5 Filing Statuses… 1. 2. 3. 4. 5. Married Filing Jointly (not legally separated) Qualifying Widow(er) with Dependent Child Head of Household Single Married Filing Separately (Taxpayer either Itemizes or claims 0 standard deductions, if spouse itemized deductions) *Confirm marital status on the last day of the tax year

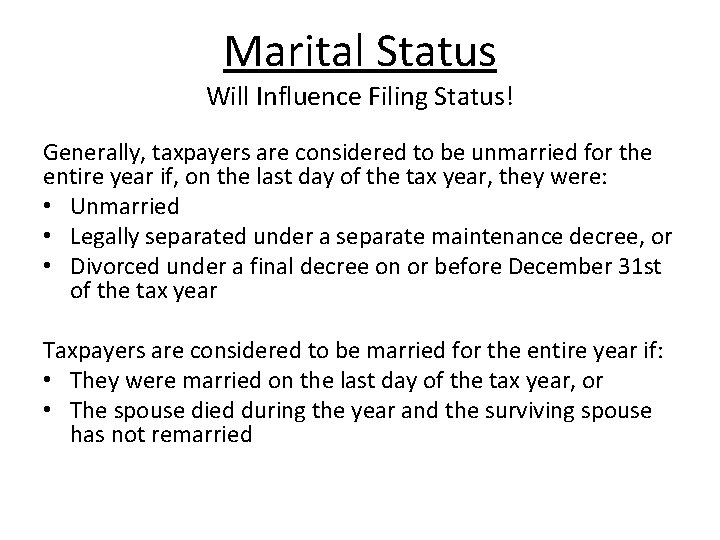

Marital Status Will Influence Filing Status! Generally, taxpayers are considered to be unmarried for the entire year if, on the last day of the tax year, they were: • Unmarried • Legally separated under a separate maintenance decree, or • Divorced under a final decree on or before December 31 st of the tax year Taxpayers are considered to be married for the entire year if: • They were married on the last day of the tax year, or • The spouse died during the year and the surviving spouse has not remarried

Married Filing Jointly Both taxpayers must include all income on their joint return • Determine if married taxpayers wish to file jointly, the following will apply if on the last day of the tax year; • They are married and: Live together as husband wife, or • Live apart but are not legally separated or divorced • They live together in a recognized common law marriage • They are separated under an interlocutory (not final) divorce decree • The taxpayer's spouse died during the year and the taxpayer has not remarried

Common Question! Does it matter if one spouse does not have any income? No. Taxpayers can choose either the Married Filing Jointly status or the Married Filing Separately status even if only one spouse has income.

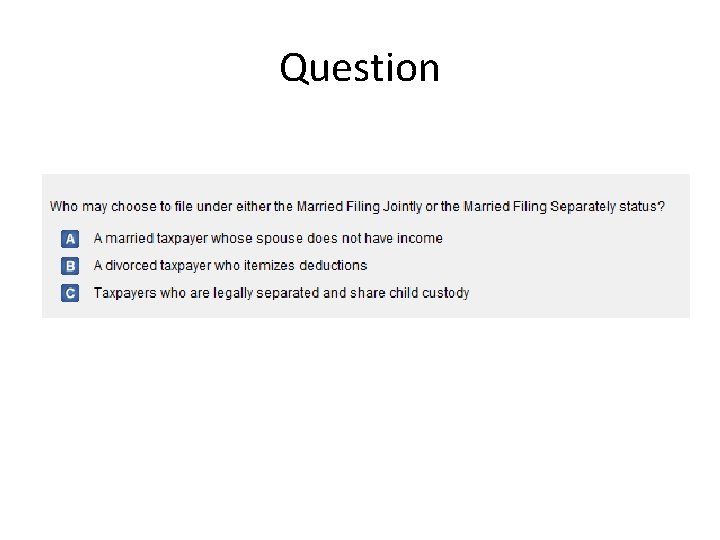

Question

Answer • A – All married taxpayers can choose either status

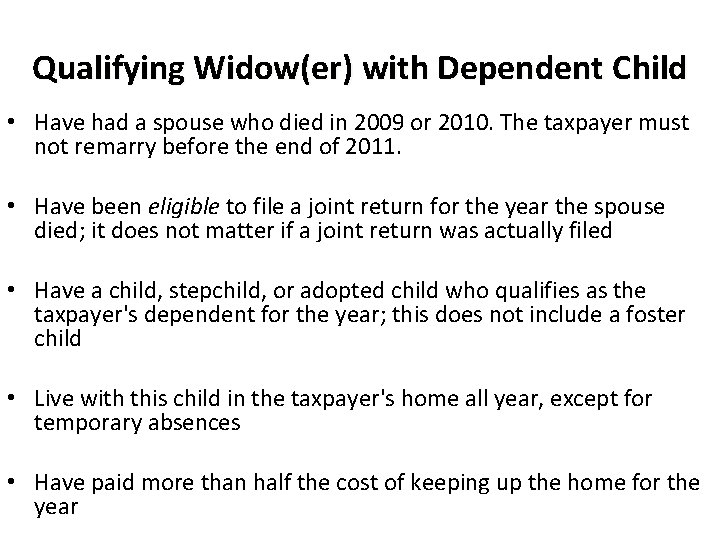

Qualifying Widow(er) with Dependent Child • Have had a spouse who died in 2009 or 2010. The taxpayer must not remarry before the end of 2011. • Have been eligible to file a joint return for the year the spouse died; it does not matter if a joint return was actually filed • Have a child, stepchild, or adopted child who qualifies as the taxpayer's dependent for the year; this does not include a foster child • Live with this child in the taxpayer's home all year, except for temporary absences • Have paid more than half the cost of keeping up the home for the year

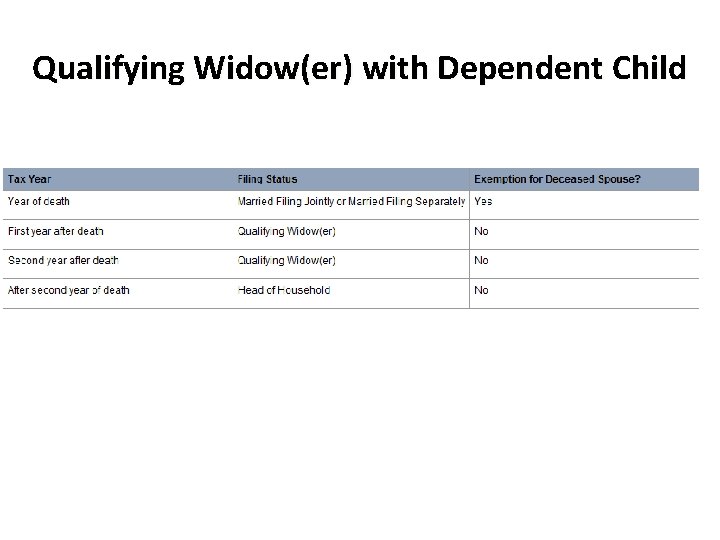

Qualifying Widow(er) with Dependent Child

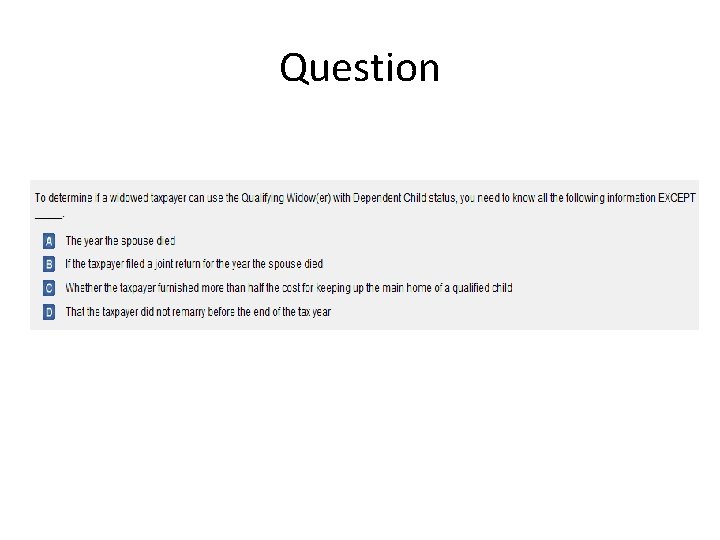

Question

Answer • B – The taxpayer must have been eligible to file a joint return; it does not matter if a joint return was actually filed.

Head of Household • Unmarried or "considered unmarried" on the last day of the tax year, and • Paid more than half the cost of keeping up a home for the tax year, and • Had a qualifying person living in their home with them more than half the year (except for temporary absences) – – A qualifying child A married child who can be claimed as a dependent A dependent parent A qualifying relative who lived with the taxpayer more than half the year and is one of the relatives listed in the Volunteer Resource Guide (Tab C), Interview Tips, Table 2: Dependency Exemption for Qualifying Relative, Step 2 – Pub 4012 25

Married and Living Apart with Dependent Child… • Permitted to file as Head of Household and receive the benefit of lower tax amounts if they: • File a return, separate from their spouse, for the tax year. • Paid more than half the cost of keeping up their home for the year. See the Cost of Keeping Up a Home worksheet in Publication 17, Filing Status. • Lived apart from their spouse during the entire last six months of the tax year. The spouse is considered to have lived in the home even if temporarily absent due to special circumstances, such as military service or education. • Provided the main home for more than half the year of a dependent child, stepchild, or foster child placed by an authorized agency. This test is met if the taxpayer cannot claim the exemption only because the noncustodial parent can claim the child using the rules described in Publication 17, Personal Exemptions and Dependents, Children of divorced or separated

Question

Answer • No – Michael cannot file Head of Household because he does not have a qualifying person. Justin does not meet the definition of a qualifying child or qualifying relative.

Question

Answer • NO – Even though Todd provided over half the cost of providing a home for Jane and Amanda, he cannot file Head of Household because Amanda did not live with him over half the year. Jane cannot be Head of Household either because she did not provide more than one-half the cost of keeping up the home for her daughter. See the Volunteer Resource Guide (Tab B), Filing Status for Head of Household.

Question

Answer • False – Abner is the noncustodial parent and cannot claim Head of Household filing status. If Abner has another qualifying relative for HOH purposes, then he may claim HOH based on the other person.

Question

Answer • Yes – Carlos can file as Head of Household because his parents are qualifying persons for this filing status.

Question

Answer • NO – Jeffrey cannot file as Head of Household because neither Janice nor John are qualifying persons for Jeffrey.

Single • A taxpayer is considered single if, on the last day of the tax year, the taxpayer was: • Not married • Legally separated or divorced, or • Widowed before the first day of the tax year and not remarried during the year • Although a taxpayer is considered single, the taxpayer may qualify for another filing status that gives a lower tax, such as Head of Household or Qualifying Widow(er) with Dependent Child.

Question

Answer • Yes – Even though Maxine did not live with her, Maxine is Nancy's qualifying person for Head of Household filing status because Nancy can claim her mother as a dependent under the rules for qualifying relative.

Married Filing Separately • The Married Filing Separately (MFS) status is for married taxpayers and either: • Choose to file separate returns, which means the husband wife report their own income and deductions, or • Cannot agree to file a joint return

Married Filing Separately • If a taxpayer uses the Married Filing Separately filing status and the spouse itemizes deductions, the taxpayer must: • Also itemize deductions, or • Claim zero as the standard deduction Special rules apply to Married Filing Separately taxpayers, which generally result in the taxpayer paying a higher tax; • The tax rate is generally higher than on a joint return • Taxpayers cannot take credits for child and dependent care expenses, earned income, and certain adoption and education expenses • Some credits and deductions are reduced at income levels that are half those for a joint return such as the child tax credit and the retirement savings contribution credit

Question

Answer • C – A taxpayer whose spouse itemizes deductions or losses must either itemize deductions or claim "0" as the standard deduction

Question

Answer • C – The Qualifying Widow(er) with Dependent Child filing status yields as low a tax amount as Married Filing Jointly

- Slides: 34