Federal Grid Company Investor Presentation Andrey Kazachenkov Deputy

- Slides: 17

Federal Grid Company Investor Presentation Andrey Kazachenkov , Deputy Chairman of the Management Board 28 March, 2011 London

Disclaimer The materials comprising this Presentation have been prepared by the Company solely for use by the Company’s management at investor meetings with a limited number of institutional investors who have agreed to attend such meetings and to be subject to obligations to maintain the confidentiality of this Presentation. This Presentation does not constitute or form part of and should not be construed as, an offer to sell or issue or the solicitation of an offer to buy or acquire securities of the Company or any of its subsidiaries in any jurisdiction or an inducement to enter into investment activity. No part of this Presentation, nor the fact of its distribution, should form the basis of, or be relied on in connection with, any contract or commitment or investment decision whatsoever. This Presentation does not constitute a recommendation regarding the securities of the Company. This Presentation is not directed at, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, state, country or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. The forward-looking statements in this Presentation are based upon various assumptions, many of which are based, in turn, upon further assumptions, including without limitation, management’s examination of historical operating trends, data contained in the Company’s records and other data available from third parties. These assumptions are inherently subject to significant uncertainties and contingencies which are difficult or impossible to predict and are beyond its control and it may not achieve or accomplish these expectations, beliefs or projections. In addition, important factors that, in the view of the Company, could cause actual results to differ materially from those discussed in the forward-looking statements include the achievement of the anticipated levels of profitability, growth, cost and its recent acquisitions, the timely development of new projects, the impact of competitive pricing, the ability to obtain necessary regulatory approvals, and the impact of general business and global economic conditions. Past performance should not be taken as an indication or guarantee of future results, and no representation or warranty, express or implied, is made regarding future performance. Page 1

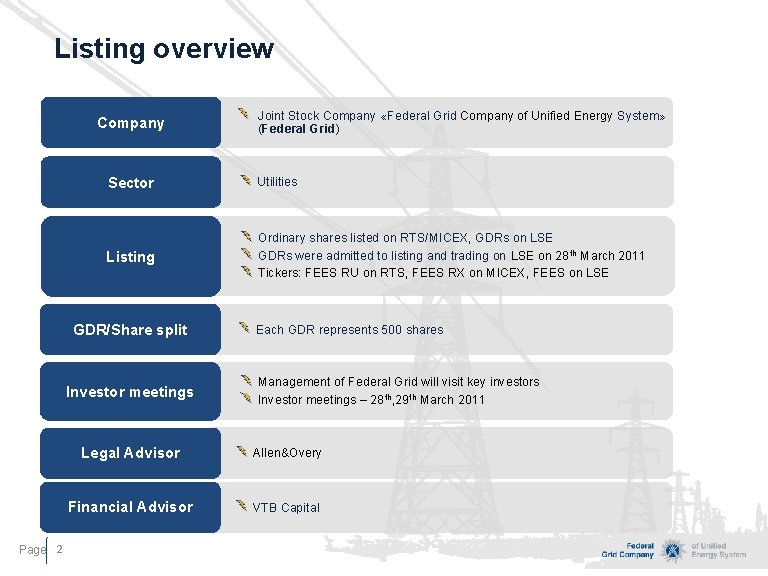

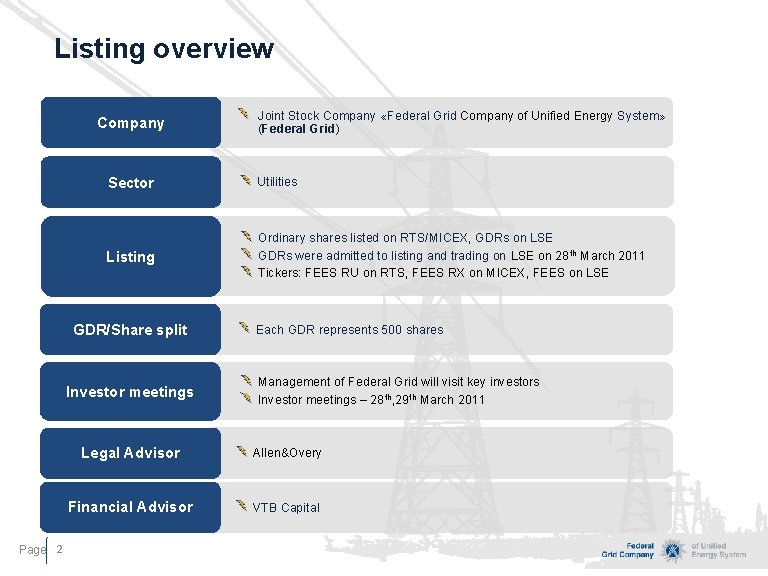

Listing overview Company Sector Utilities Listing Ordinary shares listed on RTS/MICEX, GDRs on LSE GDRs were admitted to listing and trading on LSE on 28 th March 2011 Tickers: FEES RU on RTS, FEES RX on MICEX, FEES on LSE GDR/Share split Investor meetings Page 2 Joint Stock Company «Federal Grid Company of Unified Energy System» (Federal Grid) Each GDR represents 500 shares Management of Federal Grid will visit key investors Investor meetings – 28 th, 29 th March 2011 Legal Advisor Allen&Overy Financial Advisor VTB Capital

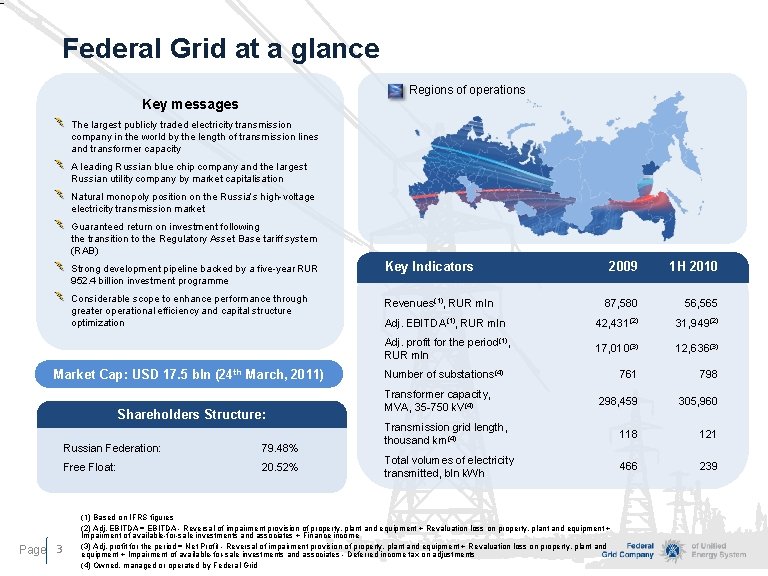

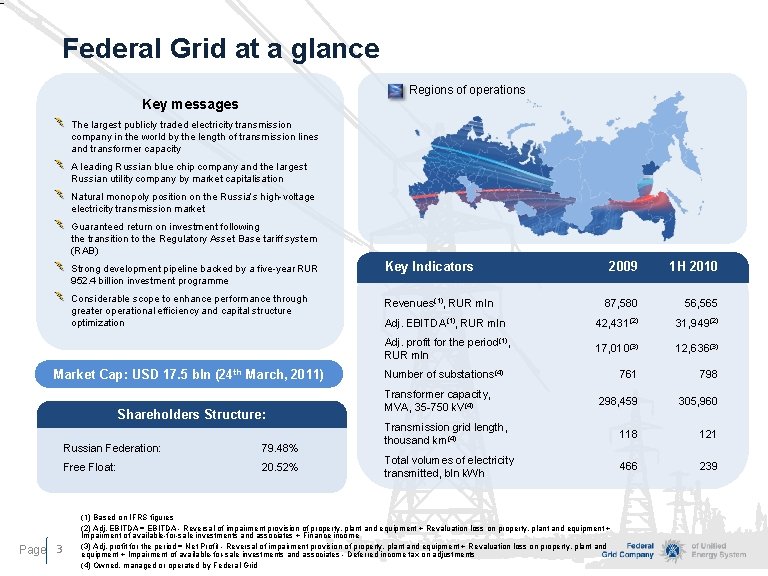

Federal Grid at a glance Regions of operations Key messages The largest publicly traded electricity transmission company in the world by the length of transmission lines and transformer capacity A leading Russian blue chip company and the largest Russian utility company by market capitalisation Natural monopoly position on the Russia’s high-voltage electricity transmission market Guaranteed return on investment following the transition to the Regulatory Asset Base tariff system (RAB) Strong development pipeline backed by a five-year RUR 952. 4 billion investment programme Key Indicators Considerable scope to enhance performance through greater operational efficiency and capital structure optimization Revenues(1), RUR mln Market Cap: USD 17. 5 bln (24 th March, 2011) Shareholders Structure: Page 3 Russian Federation: 79. 48% Free Float: 20. 52% 2009 1 H 2010 87, 580 56, 565 Adj. EBITDA(1), RUR mln 42, 431(2) 31, 949(2) Adj. profit for the period(1), RUR mln 17, 010(3) 12, 636(3) 761 798 298, 459 305, 960 Transmission grid length, thousand km(4) 118 121 Total volumes of electricity transmitted, bln k. Wh 466 239 Number of substations(4) Transformer capacity, MVA, 35 -750 k. V(4) (1) Based on IFRS figures (2) Adj. EBITDA = EBITDA - Reversal of impairment provision of property, plant and equipment + Revaluation loss on property, plant and equipment + Impairment of available-for-sale investments and associates + Finance income (3) Adj. profit for the period = Net Profit - Reversal of impairment provision of property, plant and equipment + Revaluation loss on property, plant and equipment + Impairment of available-for-sale investments and associates - Deferred income tax on adjustments (4) Owned, managed or operated b y Federal Grid

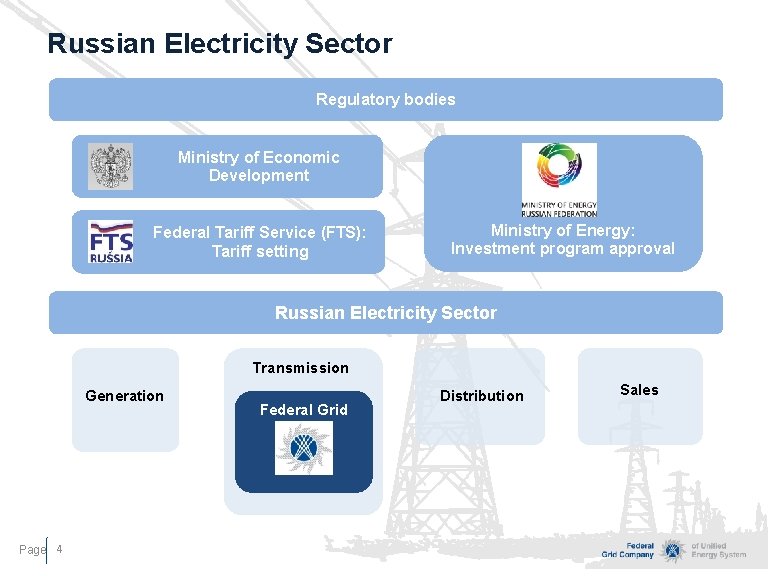

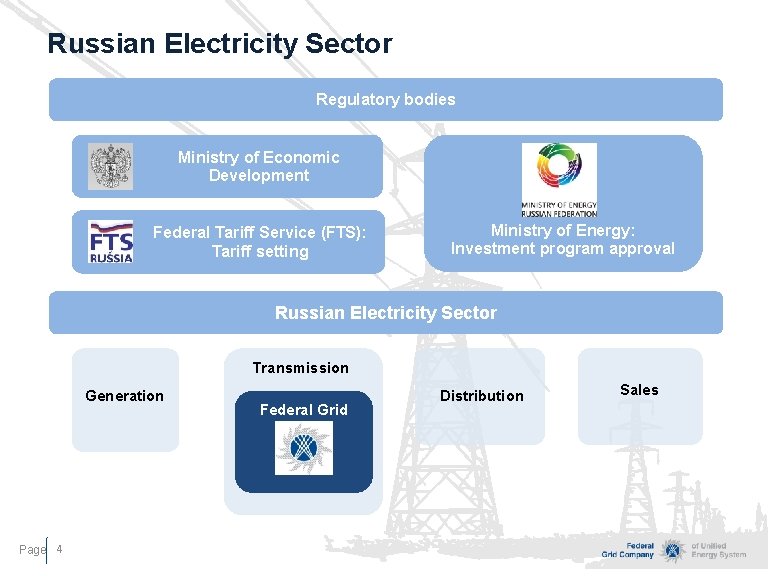

Russian Electricity Sector Regulatory bodies Ministry of Economic Development Federal Tariff Service (FTS): Tariff setting Ministry of Energy: Investment program approval Russian Electricity Sector Transmission Generation Page 4 Federal Grid Distribution Sales

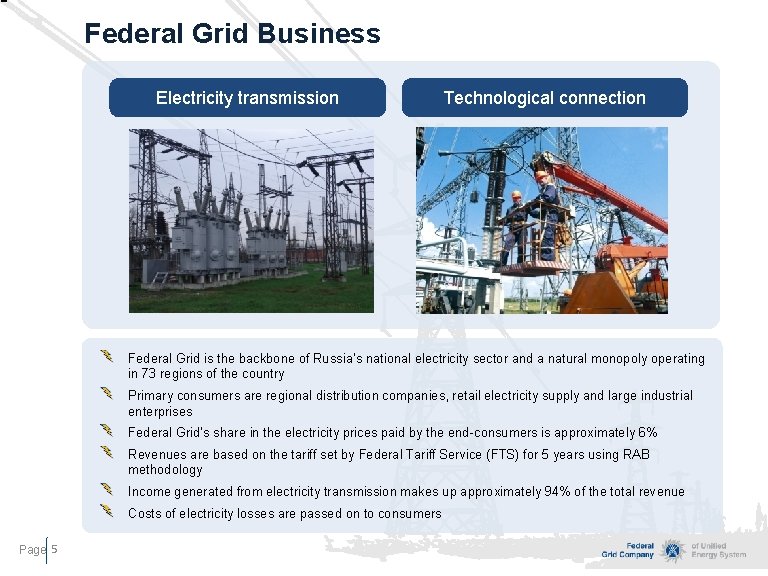

Federal Grid Business Electricity transmission Technological connection Federal Grid is the backbone of Russia’s national electricity sector and a natural monopoly operating in 73 regions of the country Primary consumers are regional distribution companies, retail electricity supply and large industrial enterprises Federal Grid’s share in the electricity prices paid by the end-consumers is approximately 6% Revenues are based on the tariff set by Federal Tariff Service (FTS) for 5 years using RAB methodology Income generated from electricity transmission makes up approximately 94% of the total revenue Costs of electricity losses are passed on to consumers Page 5

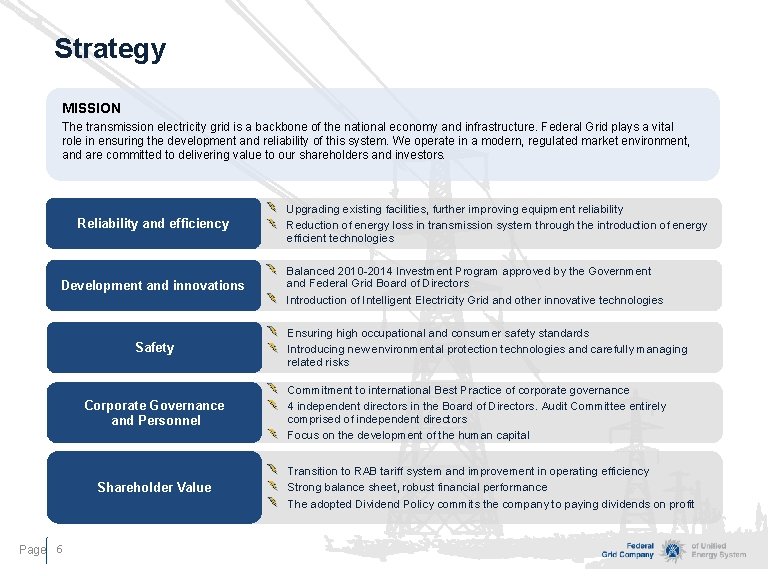

Strategy MISSION The transmission electricity grid is a backbone of the national economy and infrastructure. Federal Grid plays a vital role in ensuring the development and reliability of this system. We operate in a modern, regulated market environment, and are committed to delivering value to our shareholders and investors. Reliability and efficiency Development and innovations Safety Corporate Governance and Personnel Shareholder Value Page 6 Upgrading existing facilities, further improving equipment reliability Reduction of energy loss in transmission system through the introduction of energy efficient technologies Balanced 2010 -2014 Investment Program approved by the Government and Federal Grid Board of Directors Introduction of Intelligent Electricity Grid and other innovative technologies Ensuring high occupational and consumer safety standards Introducing new environmental protection technologies and carefully managing related risks Commitment to international Best Practice of corporate governance 4 independent directors in the Board of Directors. Audit Committee entirely comprised of independent directors Focus on the development of the human capital Transition to RAB tariff system and improvement in operating efficiency Strong balance sheet, robust financial performance The adopted Dividend Policy commits the company to paying dividends on profit

Investment Program 2010 – 2014 Total amount of planned investments 2010 -2014 is RUR 952. 4 bln Capacity provision (NPP, HPP, TPP) (5, 180 km; 10, 936 MVA) Grid upgrades under Federal Programs(2) (4, 808 km; 4, 181 MVA) Joint projects with regional authorities(1) (5, 367 km; 10, 890 MVA) Upgrading grid facilities in Moscow, St. Petersburg, Tyumen (980 km; 17, 531 MVA) Other grid development projects Long-haul grids development(3) (5, 367 km; 10, 890 MVA) Technological connection (33 km; 2, 577 MVA) Renewal of fixed assets (10, 468 km; 37, 866 MVA) Page 7 (1) Excluding Moscow, St. Petersburg, Tyumen (2) East Siberia – Pacific Ocean oil pipeline, Sochi Olympic Games, Vankor, Sayan, etc. (3) Excluding joint projects with regional authorities Innovations and energy efficiency, technological operations improvement

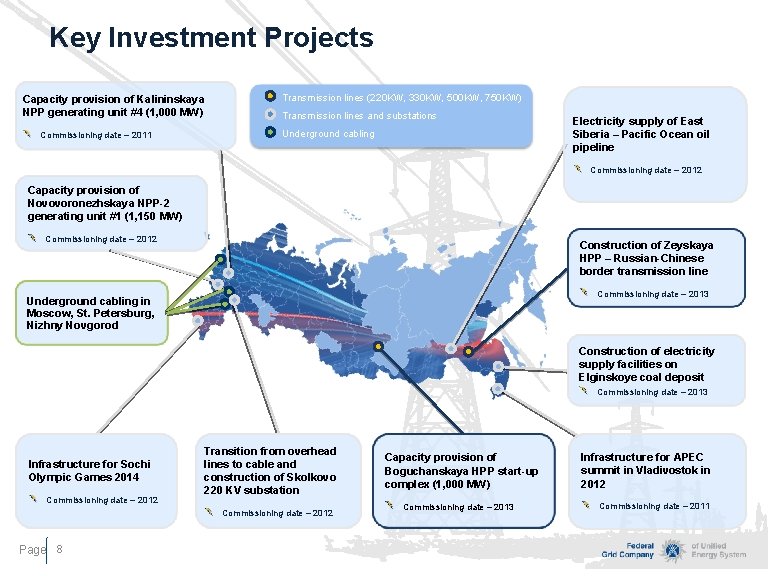

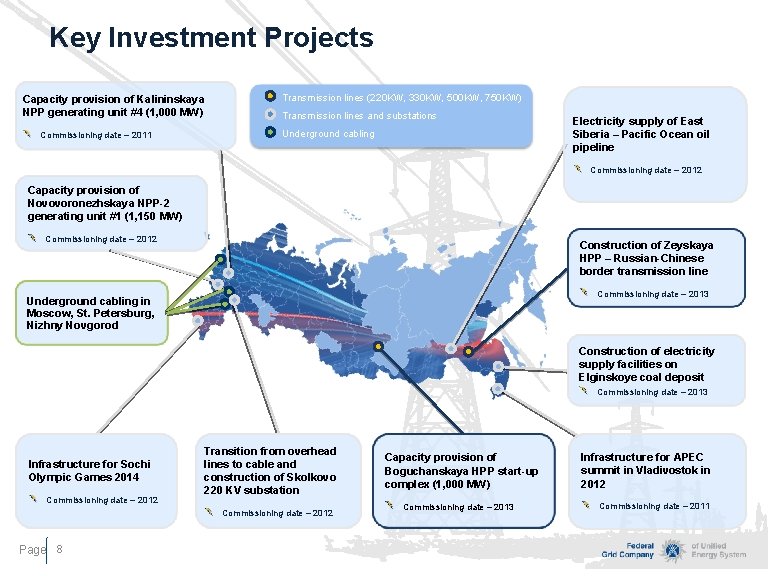

Key Investment Projects Capacity provision of Kalininskaya NPP generating unit #4 (1, 000 MW) Commissioning date – 2011 Transmission lines (220 KW, 330 KW, 500 KW, 750 KW) Transmission lines and substations Underground cabling Electricity supply of East Siberia – Pacific Ocean oil pipeline Commissioning date – 2012 Capacity provision of Novovoronezhskaya NPP-2 generating unit #1 (1, 150 MW) Commissioning date – 2012 Construction of Zeyskaya HPP – Russian-Chinese border transmission line Commissioning date – 2013 Underground cabling in Moscow, St. Petersburg, Nizhny Novgorod Construction of electricity supply facilities on Elginskoye coal deposit Commissioning date – 2013 Infrastructure for Sochi Olympic Games 2014 Commissioning date – 2012 Transition from overhead lines to cable and construction of Skolkovo 220 KV substation Commissioning date – 2012 Page 8 Capacity provision of Boguchanskaya HPP start-up complex (1, 000 MW) Commissioning date – 2013 Infrastructure for APEC summit in Vladivostok in 2012 Commissioning date – 2011

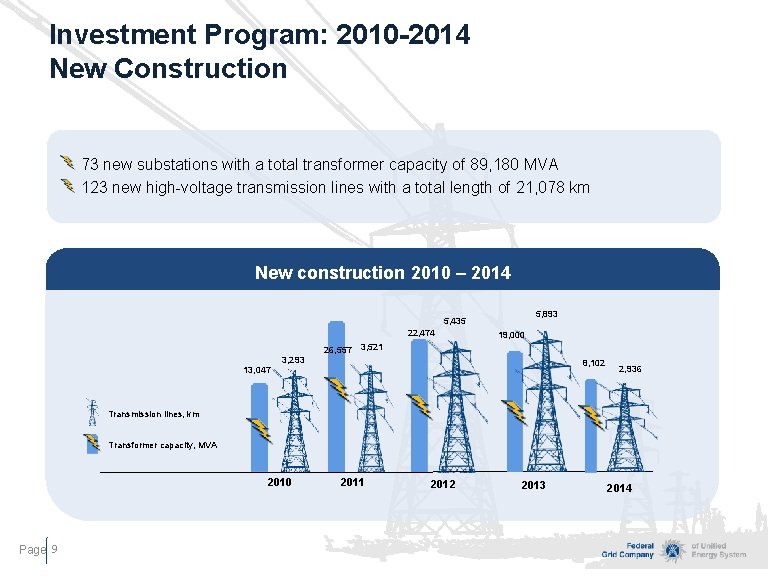

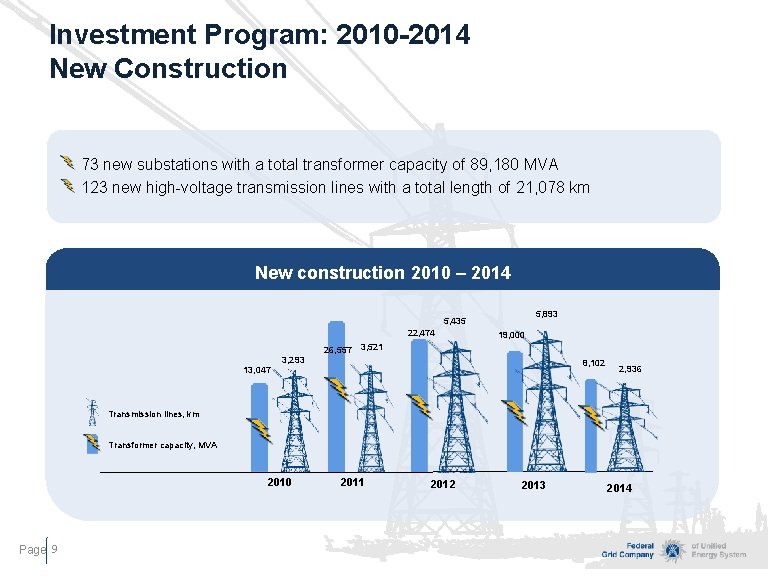

Investment Program: 2010 -2014 New Construction 73 new substations with a total transformer capacity of 89, 180 MVA 123 new high-voltage transmission lines with a total length of 21, 078 km New construction 2010 – 2014 5, 893 5, 435 22, 474 3, 293 26, 557 19, 000 3, 521 8, 102 13, 047 2, 936 Transmission lines, km Transformer capacity, MVA 2010 Page 9 2011 2012 2013 2014

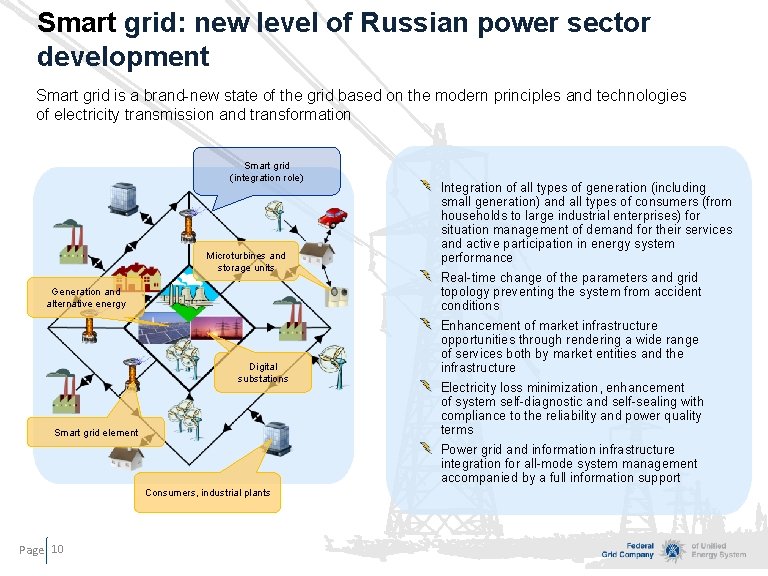

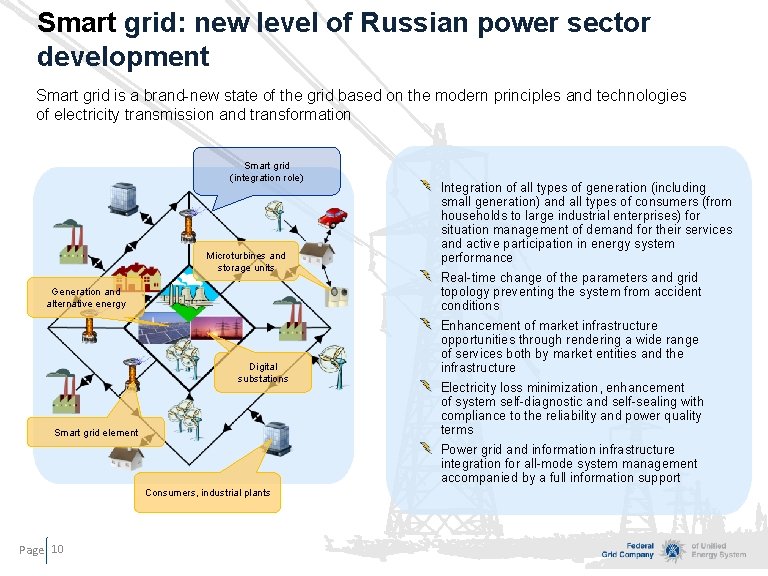

Smart grid: new level of Russian power sector development Smart grid is a brand-new state of the grid based on the modern principles and technologies of electricity transmission and transformation Smart grid (integration role) Microturbines and storage units Generation and alternative energy Digital substations Smart grid element Integration of all types of generation (including small generation) and all types of consumers (from households to large industrial enterprises) for situation management of demand for their services and active participation in energy system performance Real-time change of the parameters and grid topology preventing the system from accident conditions Enhancement of market infrastructure opportunities through rendering a wide range of services both by market entities and the infrastructure Electricity loss minimization, enhancement of system self-diagnostic and self-sealing with compliance to the reliability and power quality terms Power grid and information infrastructure integration for all-mode system management accompanied by a full information support Consumers, industrial plants Page 10

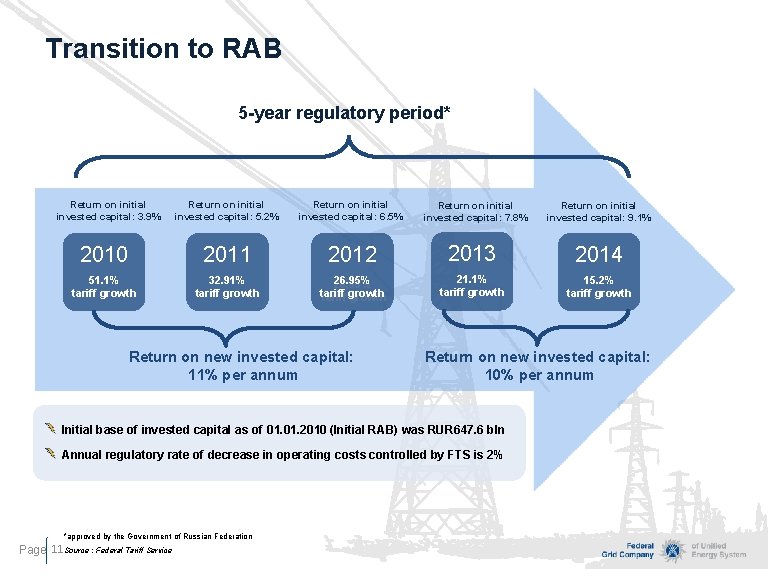

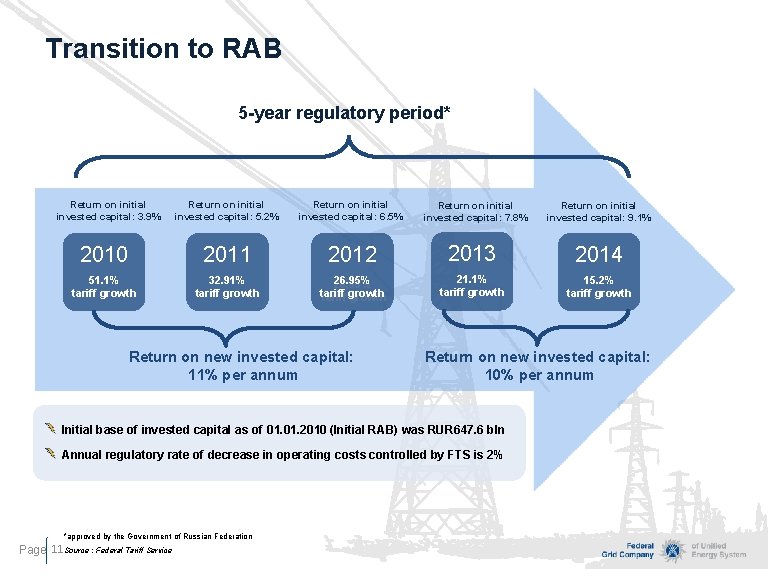

Transition to RAB 5 -year regulatory period* Return on initial invested capital: 5. 2% Return on initial invested capital: 6. 5% 2010 2011 2012 2013 2014 51. 1% tariff growth 32. 91% tariff growth 26. 95% 26, 95% tariff growth 21. 1% tariff growth 15. 2% tariff growth Return on initial invested capital: 3. 9% Return on new invested capital: 11% per annum Return on initial invested capital: 7. 8% Return on new invested capital: 10% per annum Initial base of invested capital as of 01. 2010 (Initial RAB) was RUR 647. 6 bln Annual regulatory rate of decrease in operating costs controlled by FTS is 2% *approved by the Government of Russian Federation Page 11 Source : Federal Tariff Service Return on initial invested capital: 9. 1%

Financial Performance(1) (2007 – 1 H 2010) P&L indicators, RUR mln (2) (4) (3) Key profitability ratios Indicator Page 12 2007 2008 2009 1 H 2010 Adjusted operating profit margin, % 18. 3% 11. 1% 15. 6% 24. 7% Adjusted EBITDA margin, % 37. 1% 48. 8% 48. 4% 56. 5% Adjusted profit for the period margin, % 3. 3% 17. 7% 19. 4% 22. 3% (1) Based on IFRS figures (2) Adj. EBITDA = EBITDA - Reversal of impairment provision of property, plant and equipment + Revaluation loss on property, plant and equipment + Impairment of available-for-sale investments and associates + Finance income (3) Adjusted operating profit is calculated as operating profit or loss adjusted for reversal of impairment provision of property, plant and equipment, specific impairment of property, plant and equipment and intangible assets, revaluation loss on property, plant and equipment and gain on sale of available-for-sale investments (4) Adj. profit for the period = Net Profit-Reversal of impairment provision of property, plant and equipment + Revaluation loss on property, plant and equipment + Impairment of available-for-sale investments and associates - Deferred income tax on adjustments

1 H 2010 Financial Performance(1) P&L indicators, RUR mln Key profitability ratios Page 13 (1) Under International Financial Reporting Standards (IFRS)

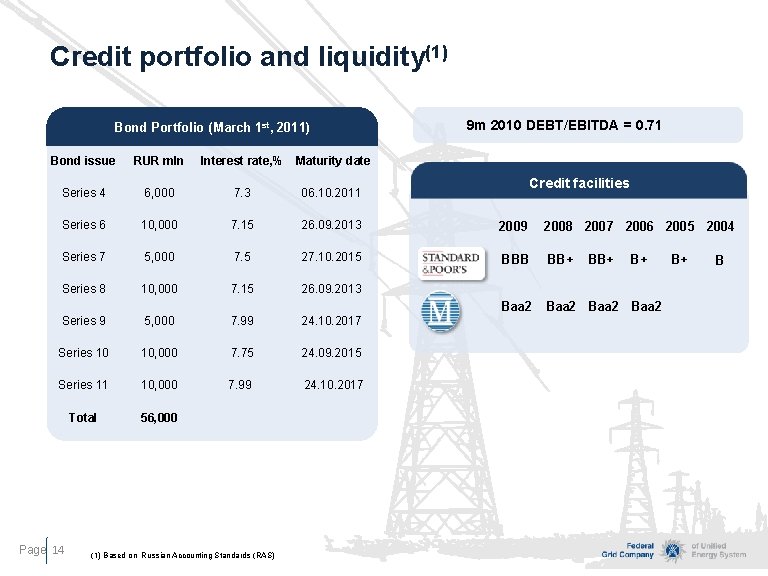

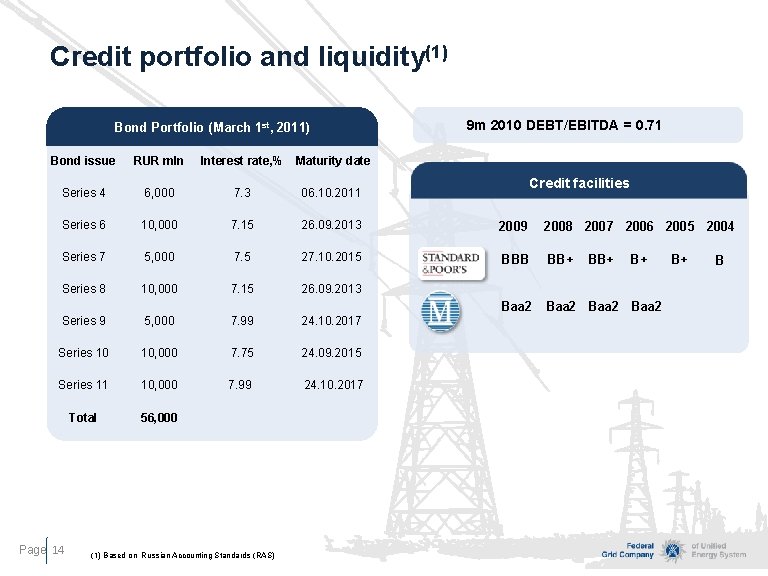

Credit portfolio and liquidity(1) Bond Portfolio (March 1 st, 2011) 9 m 2010 DEBT/EBITDA = 0. 71 Bond issue RUR mln Interest rate, % Maturity date Series 4 6, 000 7. 3 06. 10. 2011 Series 6 10, 000 7. 15 26. 09. 2013 2009 2008 2007 2006 2005 2004 Series 7 5, 000 7. 5 27. 10. 2015 BBB BB+ Series 8 10, 000 7. 15 26. 09. 2013 Baa 2 Series 9 5, 000 7. 99 24. 10. 2017 Series 10 10, 000 7. 75 24. 09. 2015 Series 11 10, 000 7. 99 24. 10. 2017 Total 56, 000 Page 14 (1) Based on Russian Accounting Standards (RAS) Credit facilities BB+ B+ B+ B

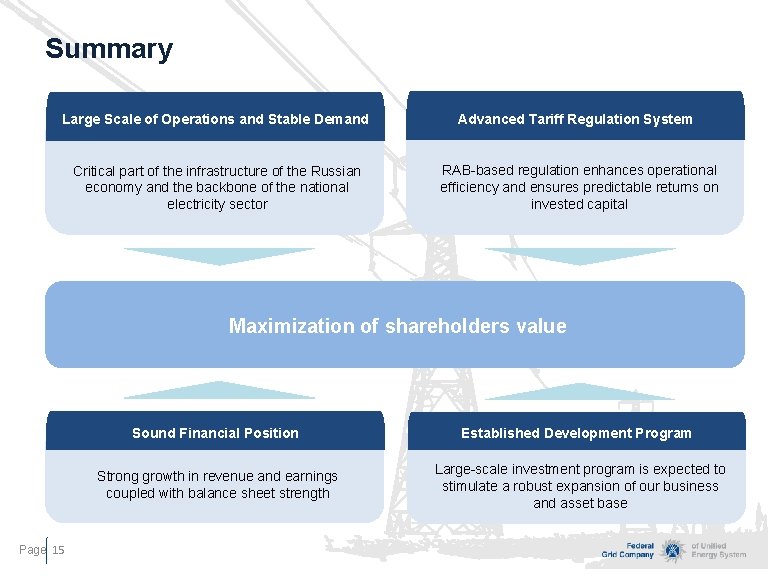

Summary Large Scale of Operations and Stable Demand Advanced Tariff Regulation System Critical part of the infrastructure of the Russian economy and the backbone of the national electricity sector RAB-based regulation enhances operational efficiency and ensures predictable returns on invested capital Maximization of shareholders value Page 15 Sound Financial Position Established Development Program Strong growth in revenue and earnings coupled with balance sheet strength Large-scale investment program is expected to stimulate a robust expansion of our business and asset base

Contacts Federal Grid Company of Unified Energy System 5 A, Akademika Chelomeya Str. , Moscow, Russia, 117630 Head of Investor Relations Alexander Duzhinov Head of Investor Relations Tel. : +7 (495) 710 90 64 Mob. : +7 (916) 041 80 53 E-mail: ir@fsk-ees. ru Page 16

Walt disney company investor relations

Walt disney company investor relations Andrey shcherbenok

Andrey shcherbenok Andrey chubukov

Andrey chubukov Pizzeria gli antenati

Pizzeria gli antenati Andrey razoomovsky

Andrey razoomovsky Andrey marinov

Andrey marinov Andrey dementyev

Andrey dementyev Andrey korytov

Andrey korytov Yuri krotov

Yuri krotov Inurl:/responsible-disclosure/ university

Inurl:/responsible-disclosure/ university Andrey baryshev

Andrey baryshev Andrey andoko

Andrey andoko Andrey zinchenko

Andrey zinchenko πμμ

πμμ Dow corning investor relations

Dow corning investor relations Nvr investor presentation

Nvr investor presentation Walmart investor presentation

Walmart investor presentation Kotak mahindra bank organisational structure

Kotak mahindra bank organisational structure