FDI and FDI data more and more slippery

- Slides: 15

FDI and FDI data – more and more slippery? Katalin Antalóczy, BGE, Budapest Magdolna Sass, MTA KRTK and BGE, Budapest Szeged University Conference, 24 th of March, 2017

Outline � Background � Post-crisis • • • o changes Decreased interest of MNCs in the region Ever increased use of tax optimisation techniques, both in IFDI and OFDI New data about composition according to final investor countries Preliminary conclusions and consequences for policy

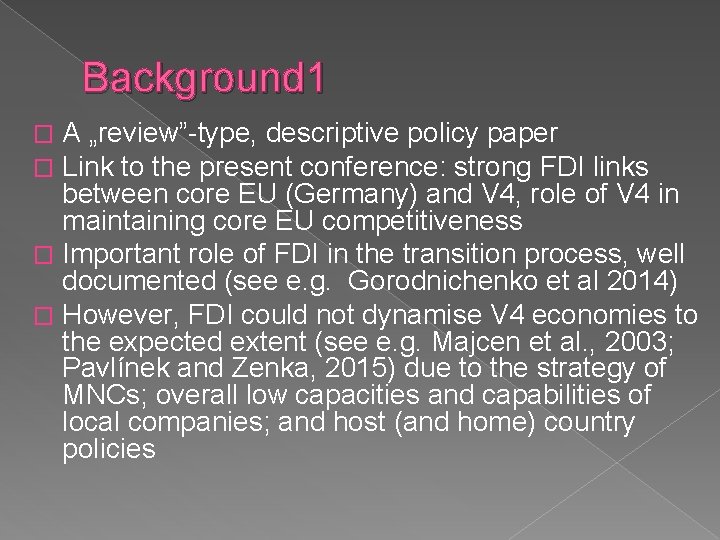

Background 1 A „review”-type, descriptive policy paper Link to the present conference: strong FDI links between core EU (Germany) and V 4, role of V 4 in maintaining core EU competitiveness � Important role of FDI in the transition process, well documented (see e. g. Gorodnichenko et al 2014) � However, FDI could not dynamise V 4 economies to the expected extent (see e. g. Majcen et al. , 2003; Pavlínek and Zenka, 2015) due to the strategy of MNCs; overall low capacities and capabilities of local companies; and host (and home) country policies � �

Background 2 FDI is perceived as: � Dunning: � „An investment realised by an investing company outside of the economy in which it is headquartered but within the company itself. FDI is effectively a package comprising capital, technology, management and manufacturing know-how as well as access to markets. ” Dunning (1994) � IMF: „direct investment means control or significant influence and long-term ties. Alongside financing, a direct investor provides know-how, technology, management and marketing expertise. ” (IMF, 2009, p 99)

Background 3 � More and more problems with FDI data, thus reflecting less and less „real” FDI flows and stocks, due to • Globalisation: larger and more complicated company networks even in the pre-crisis period, with increasing goods and capital flows between them More and more countries offering space/opportunities for such techniques (partly due to overcoming problems related to crisisdriven fiscal erosion) Increased role of emerging MNCs with more incentive to conceal their real origins • • • Increased competitive pressures during the crisis years and thus an increase in tax optimisation and tax evasion techniques applied by MNCs – increased opportunities offered

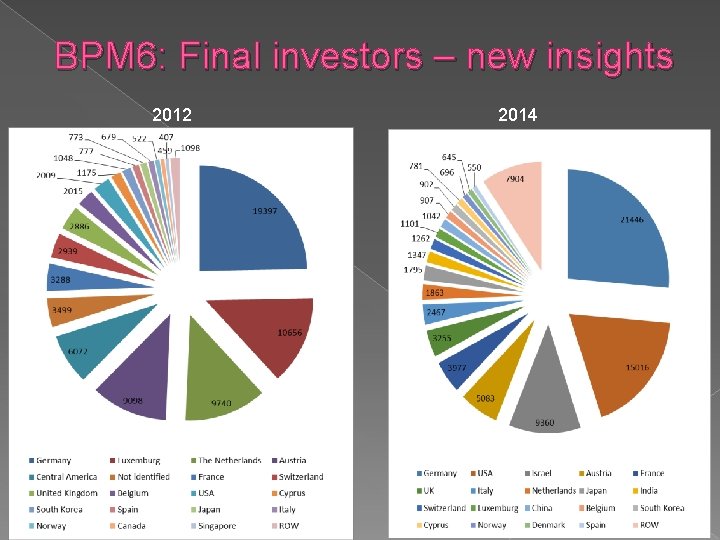

Background 4 Certain central banks addressed this issue by introducing new categories (special purpose entities, capital in transit) of FDI, which on paper fulfil all criteria of FDI, thus should be recorded as FDI, but in reality does not result in long-term ties, control or significant influence over a local entity � 2015: New methodology of compiling FDI statistics in the balance of payments (BPM 6), resulting in new data after 2013 on final investor countries and more differentiation between „real” FDI and other types of financial flows � (Continuation of research Antalóczy and Sass 2014, 2015) �

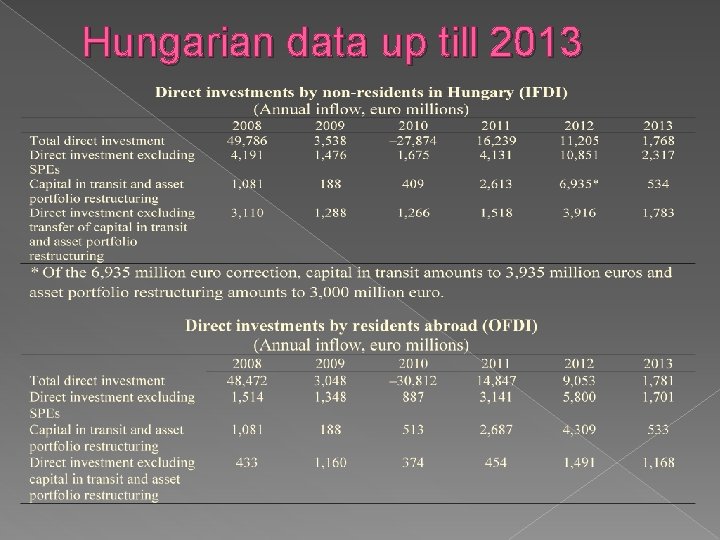

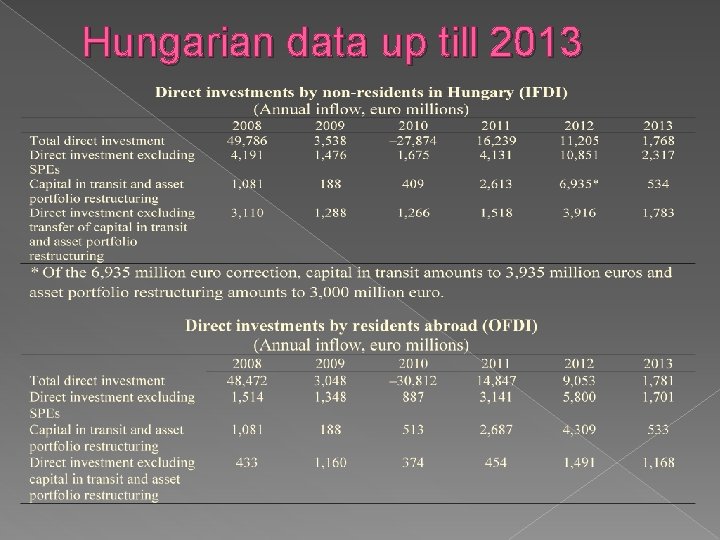

Hungarian data up till 2013

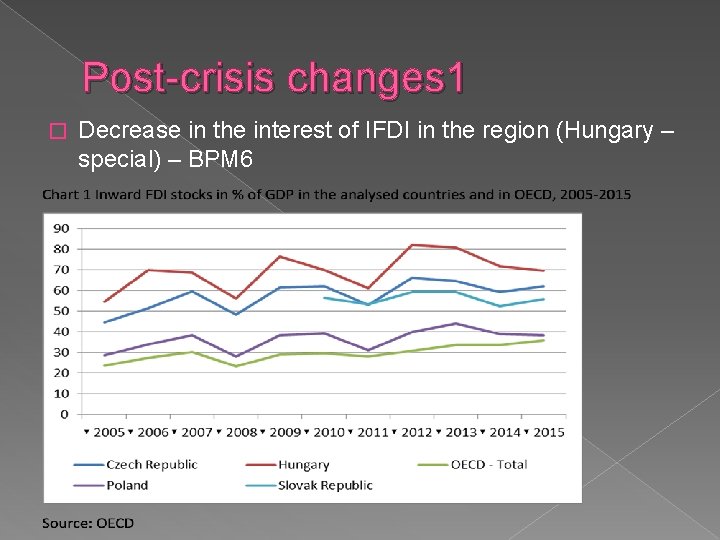

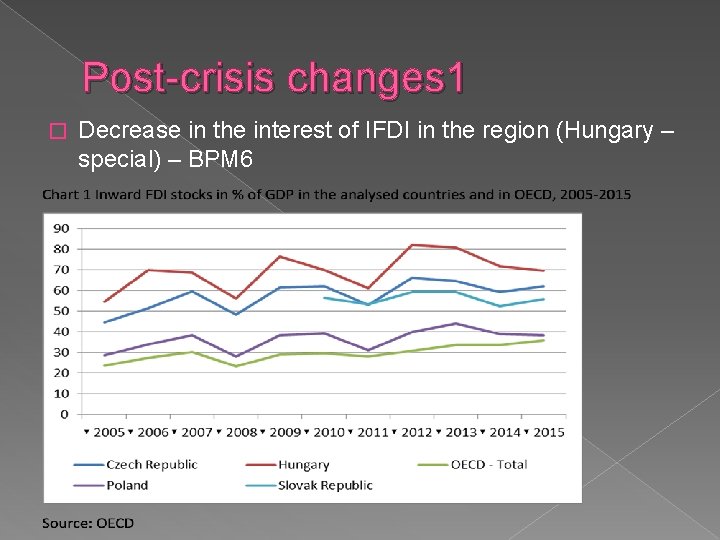

Post-crisis changes 1 � Decrease in the interest of IFDI in the region (Hungary – special) – BPM 6

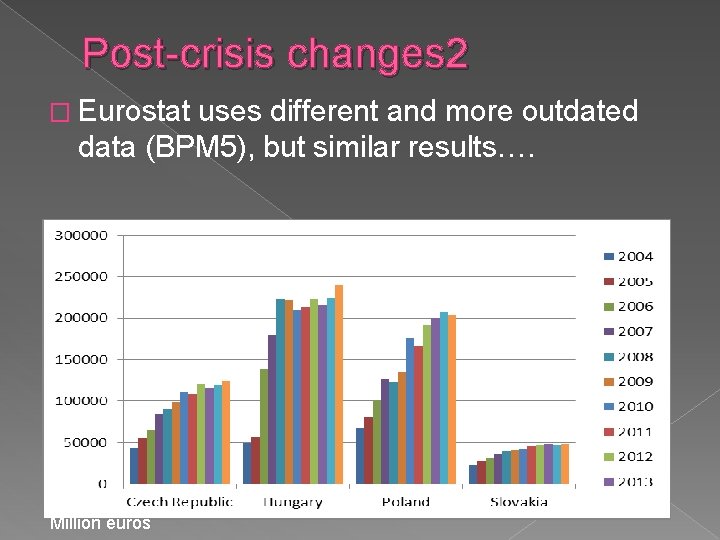

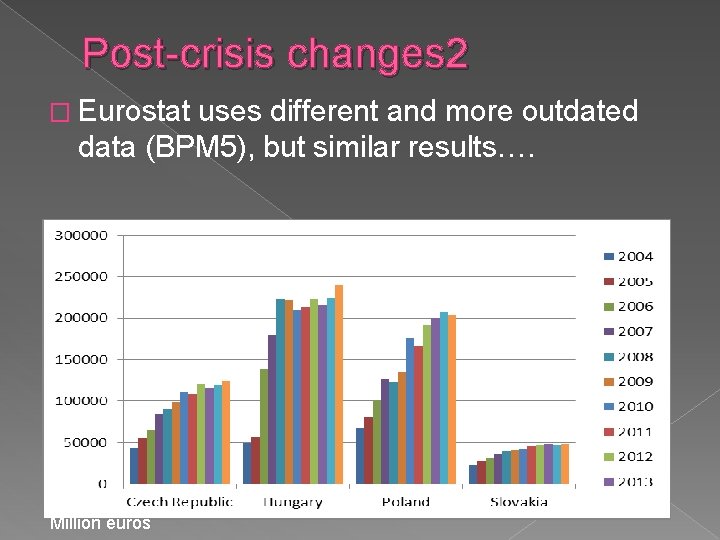

Post-crisis changes 2 � Eurostat uses different and more outdated data (BPM 5), but similar results…. Million euros

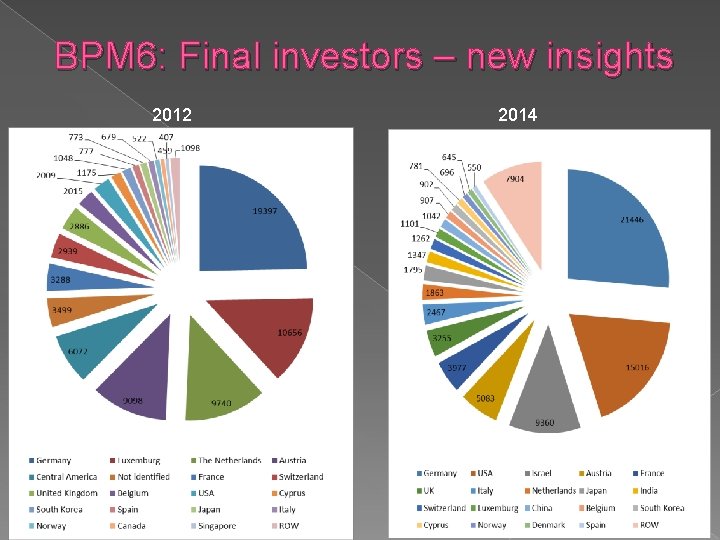

BPM 6: Final investors – new insights 2012 2014

Top investor countries in Hungary (2014, without SCV) Source: MNB Direct investor country 1. Germany 2. Netherland 3. Luxemburg 4. Austria 5. United Kingdom 6. France 7. Belgium 8. USA 9. Svitzerland 10. Cyprus Final investor country 1. Germany 2. USA 3. Israel 4. Austria 5. France 6. United Kingdom 7. Italy 8. Japan 9. India 10. Switzerland

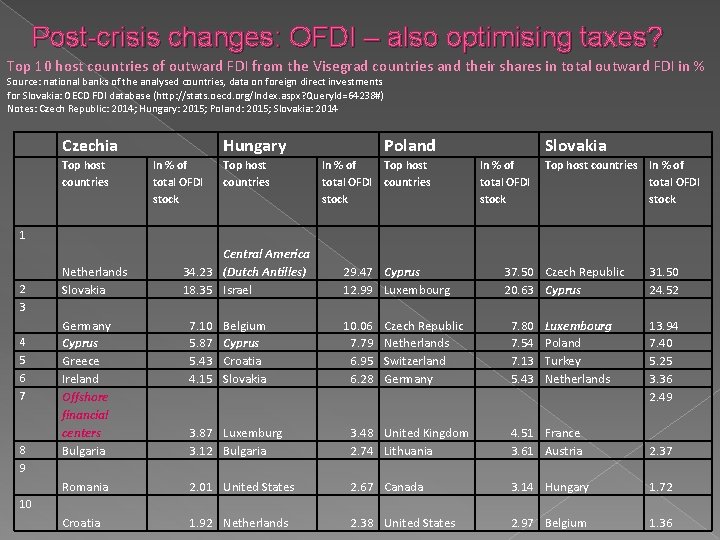

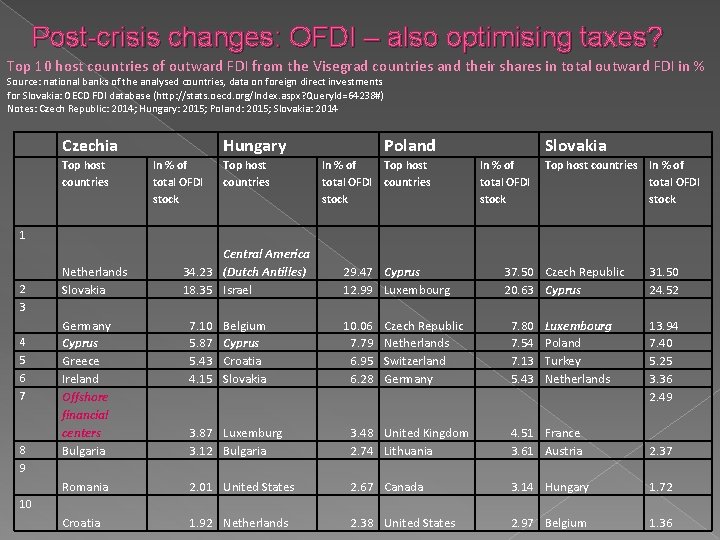

Post-crisis changes: OFDI – also optimising taxes? Top 10 host countries of outward FDI from the Visegrad countries and their shares in total outward FDI in % Source: national banks of the analysed countries, data on foreign direct investments for Slovakia: OECD FDI database (http: //stats. oecd. org/Index. aspx? Query. Id=64238#) Notes: Czech Republic: 2014; Hungary: 2015; Poland: 2015; Slovakia: 2014 Czechia Top host countries Hungary In % of total OFDI stock Top host countries Poland In % of Top host total OFDI countries stock Slovakia In % of total OFDI stock Top host countries In % of total OFDI stock 1 2 3 4 5 6 7 8 9 Netherlands Slovakia Central America 34. 23 (Dutch Antilles) 18. 35 Israel Belgium Cyprus Croatia Slovakia 29. 47 Cyprus 12. 99 Luxembourg 10. 06 7. 79 6. 95 6. 28 Czech Republic Netherlands Switzerland Germany 37. 50 Czech Republic 20. 63 Cyprus 7. 80 7. 54 7. 13 5. 43 Luxembourg Poland Turkey Netherlands 31. 50 24. 52 Germany Cyprus Greece Ireland Offshore financial centers Bulgaria 7. 10 5. 87 5. 43 4. 15 13. 94 7. 40 5. 25 3. 36 2. 49 3. 87 Luxemburg 3. 12 Bulgaria 3. 48 United Kingdom 2. 74 Lithuania 4. 51 France 3. 61 Austria 2. 37 Romania 2. 01 United States 2. 67 Canada 3. 14 Hungary 1. 72 Croatia 1. 92 Netherlands 2. 38 United States 2. 97 Belgium 1. 36 10

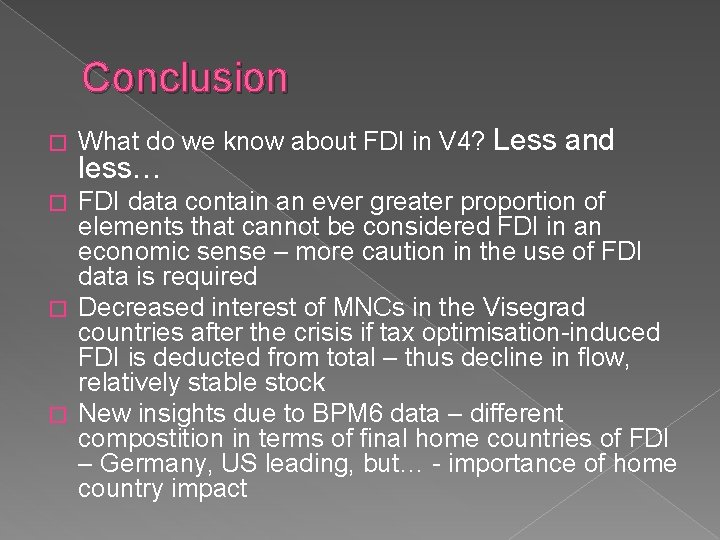

Conclusion � What do we know about FDI in V 4? Less and less… FDI data contain an ever greater proportion of elements that cannot be considered FDI in an economic sense – more caution in the use of FDI data is required � Decreased interest of MNCs in the Visegrad countries after the crisis if tax optimisation-induced FDI is deducted from total – thus decline in flow, relatively stable stock � New insights due to BPM 6 data – different compostition in terms of final home countries of FDI – Germany, US leading, but… - importance of home country impact �

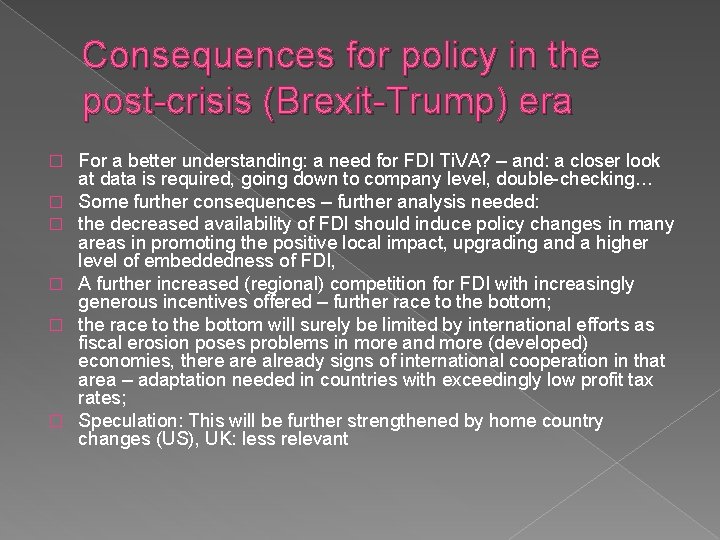

Consequences for policy in the post-crisis (Brexit-Trump) era � � � For a better understanding: a need for FDI Ti. VA? – and: a closer look at data is required, going down to company level, double-checking… Some further consequences – further analysis needed: the decreased availability of FDI should induce policy changes in many areas in promoting the positive local impact, upgrading and a higher level of embeddedness of FDI, A further increased (regional) competition for FDI with increasingly generous incentives offered – further race to the bottom; the race to the bottom will surely be limited by international efforts as fiscal erosion poses problems in more and more (developed) economies, there already signs of international cooperation in that area – adaptation needed in countries with exceedingly low profit tax rates; Speculation: This will be further strengthened by home country changes (US), UK: less relevant

Thank you for your attention

More more more i want more more more more we praise you

More more more i want more more more more we praise you More more more i want more more more more we praise you

More more more i want more more more more we praise you New market entry strategy

New market entry strategy Walking on slippery surfaces

Walking on slippery surfaces Slippery stuff lubricant walgreens

Slippery stuff lubricant walgreens Bekah definition

Bekah definition Abigail's promise fallacy meaning

Abigail's promise fallacy meaning Vagueness fallacy

Vagueness fallacy False analogy fallacy

False analogy fallacy Logical fallacies exercise

Logical fallacies exercise As slippery as a

As slippery as a Kabiri zoetermeer

Kabiri zoetermeer Whats a simile

Whats a simile Slippery slope

Slippery slope Slippery slope fallacy

Slippery slope fallacy Tooth numbering systems

Tooth numbering systems