Evolutionary Changes in Markets Khurshid Ahmad Chair of

- Slides: 28

Evolutionary Changes in Markets Khurshid Ahmad, Chair of Computer Science Trinity College, Dublin, IRELAND 18 November 2011

Evolution in Financial Markets Historically, a recurrent theme in economics is that the values to which people respond are not confined to those one would expect based on the narrowly defined canons of rationality. http: //nobelprize. org/nobel_prizes/economics/laureates/2002/smith-lecture. pdf

Evolution in Financial Markets In his book Rationality in Economics, Vernon Smith suggests that ‘experimental economics and behavioral economics are complementary’: The experimentalists study market performance (market rationality), incentives in public good provision and small group interactions, and other environments with dispersed individual valuations, whereas cognitive psychologists the performance consistency (choice rationality) of individual decision making’. BUT the ‘connective interface between rationality at the individual level and the market level and how institutions modulate their interface is yet to be fully explored and understood’ (2008: 155) http: //nobelprize. org/nobel_prizes/economics/laureates/2002/smith-lecture. pdf

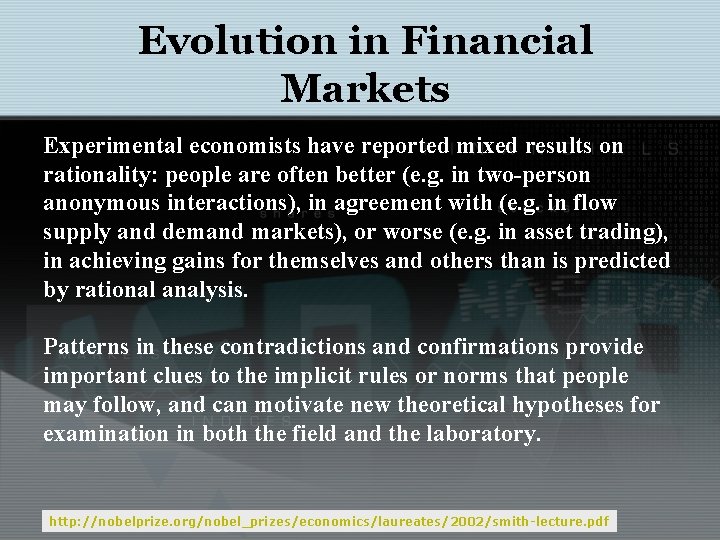

Evolution in Financial Markets Experimental economists have reported mixed results on rationality: people are often better (e. g. in two-person anonymous interactions), in agreement with (e. g. in flow supply and demand markets), or worse (e. g. in asset trading), in achieving gains for themselves and others than is predicted by rational analysis. Patterns in these contradictions and confirmations provide important clues to the implicit rules or norms that people may follow, and can motivate new theoretical hypotheses for examination in both the field and the laboratory. http: //nobelprize. org/nobel_prizes/economics/laureates/2002/smith-lecture. pdf

http: //nobelprize. org/nobel_prizes/economics/laureates/2002/smith-lecture. pdf Evolution in Financial Markets Constructivist rationality The first concept of a rational order derives from the standard socio-economic science model (SSSM) going back to the seventeenth century. The SSSM is an example of what Hayek has called constructivist rationality (or ‘constructivism’), which stems particularly from Descartes (also Bacon and Hobbes), who believed and argued that all worthwhile social institutions were and should be created by conscious deductive processes of human reason. In economics the SSSM leads to rational predictive models of decision that motivate research hypotheses that experimentalists have been testing in the laboratory since mid twentieth century.

Evolution in Financial Markets Ecological rationality These considerations lead to the second concept of a rational order, as an undesigned ecological system that emerges out of cultural and biological evolutionary processes: home grown principles of action, norms, traditions, and ‘morality’. Ecological rationality uses reason– rational reconstruction–to examine the behavior of individuals based on their experience and folk knowledge, who are ‘naïve’ in their ability to apply constructivist tools to the decisions they make; to understand the emergent order in human cultures; to discover the possible intelligence embodied in the rules, norms and institutions of our cultural and biological heritage that are created from human interactions but not by deliberate human design. People follow rules without being able to articulate them, but they can be discovered. http: //nobelprize. org/nobel_prizes/economics/laureates/2002/smith-lecture. pdf

Evolution in Financial Markets Ecological vs. Constructivist rationality Rational theory: one represents an observed socioeconomic situation with an abstract interactive game tree. Contrarily, the ecological concept of rationality asks from whence came the structure captured by the tree? Why this social practice, from which we can abstract a particular game, and not another? Were there other practices and associated game trees that lacked survival properties and were successfully invaded by what we observe?

Evolution in Financial Markets Case Studies for Ecological Rationality: Deregulation in the late 1970’s in the USA and to a lesser extent in Western Europe, is a good example of paradigmatic change in thought and action in markets. Airlines, flag-carriers or semistate monopolies, and monopolistic energy utilities, were deregulated after a status quo maintained since the 2 nd World War.

Evolution in Financial Markets Case Studies for Ecological Rationality: In airline and energy generation/supply deregulation we clearly see the role of technology that facilitated/hindered the success of the innovative economic/financial systems. The inclusion of computers and information technology artefacts in a milieu of changing attitudes of stakeholders - politicians, economists, a materially better-off populace, faster news and commentary devices- is a good example of what Hardy and Mackenzie’s (2005) ‘assemblage’ or agencement that is the collective stakeholders and machines. Stakeholders in airlines and energy utilities did fail to update their beliefs correctly, sometimes machines in the agencement them, and stakeholders did act in a contrarian manner. Stakeholders, particularly the regulators, appeared risk averse in gainful situations and other stakeholders, like owners of enterprises and customers appeared risk seeking in turbulent times. Hardie, Iain & Mac. Kenzie, Donald. (July 2005). An Economy of Calculation: Agencement and Distributed Cognition in a Hedge Fund (available from D. Mac. Kenzie@ed. ac. uk)

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: Federal Express An innovation in point-to-point freight delivery with inter-connected airground systems with a hub-and-spoke model : One central points through which N points were connected making no more than N connections; direct connections between N points, requires N(N-1) connections!!. Hub-and-spoke was made possible with an agencement of entrepreneurs (Fred Smith), real-time/cheap computers and communications systems, innovations in supply-chains, and the adaptation of topology theory, economic theory (Hayek’s theory of money and fluctuations, for example), development in aeronautics and aerospace, and investment banking.

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: Federal Express An innovation in point-to-point freight delivery with inter-connected air-ground systems with a hub-and-spoke model : One central points through which N points were connected making no more than N connections; direct connections between N points, requires N(N-1) connections!!. Hub-and-spoke was made possible with an agencement of stakeholders and machines ECOLOGICAL RATIONALITY: entrepreneurs (Fred Smith), real-time/cheap computers and communications systems, innovations in supply-chains, development in aeronautics and aerospace, operations research and investment banking. CONSTRUCTIVIST RATIONALITY: topology theory, economic theory (Hayek’s theory of money and fluctuations, for example).

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California Electricity Deregulation An innovation that was designed to help key stakeholders in the energy business – generators, suppliers, customers- for a maximizing their utility under the watchful eye of a number of regulators. The development of efficient and low-cost control systems, will help in the efficient operation of the network where customers and shareholders will get best-value-for money and the state will maximise the tax revenue. Wholesale prices were deregulated, retail prices were capped, owners of existing transmission networks, often generators, had their rights/investments protected.

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California Electricity Deregulation Unfortunately, ‘the traditional volatility in the marginal cost of generated electricity was immediately translated into volatile intraday and intraseasonal wholesale prices’. More importantly, droughts, floods, catastrophic machine failure – ‘Events of small probability happen at about the expected frequency, and since there are many such events, the unexpected is not that unlikely’ (Smith 2008: 50 -51)

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California Electricity Deregulation An innovation that was designed to help key stakeholders in the energy business – generators, suppliers, customers- for a maximizing their utility under the watchful eye of a number of regulators. The development of efficient and low-cost control systems, will help in the efficient operation of the network where customers and shareholders will get best-valuefor money and the state will maximise the tax revenue. Wholesale prices were deregulated, retail prices were capped, owners of existing transmission networks, often generators, had their rights/investments protected. California Electricity was conceived with an agencement of stakeholders and machines ECOLOGICAL RATIONALITY: entrepreneurs (Kenneth Lay), real-time/cheap computers and communications systems, innovations in transmission, developments in micro-generation, operations research and investment banking. CONSTRUCTIVIST RATIONALITY: Regulatory framework, New Deal/Stuart Mill approach to public good via monopolies,

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California Electricity Deregulation An innovation that was designed to help key stakeholders in the energy business – generators, suppliers, customers- for a maximizing their utility under the watchful eye of a number of regulators. The development of efficient and low-cost control systems, will help in the efficient operation of the network where customers and shareholders will get best-valuefor money and the state will maximise the tax revenue. Wholesale prices were deregulated, retail prices were capped, owners of existing transmission networks, often generators, had their rights/investments protected. California Electricity De-regulation was conceived with an agencement of stakeholders and machines The customer was not able to get electricity from the cheapest and most cost-effective source as the transmission network owners did not facilitate ‘free flow’ of energy; innovations like micro- and portable energy generation devices could not be easily connected to the transmission.

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California’s electricity market deregulation process from a subsidy viewpoint (Ritschel and Smestad 2003) ‘Deregulation and re-regulation of California’s electricity market not only failed in terms of anticipated cost reductions, improved customer service and higher competition, it also led to the introduction of various additional energy subsidies. Under deregulation in California, investorowned utilities were not allowed to pass their energy procurement costs fully on to their customers, and therefore subsequently, and inevitably, ran into severe financial problems. Such retail price regulation is an energy subsidy that is both economically and environmentally unfavorable, because it veils true price signals to electricity consumers and, in this way, discourages energy conservation. ‘( 2003: 1379) Alexander Ritschel, Greg P. Smestad (2003) Energy subsidies in California’s electricity market deregulation. Energy Policy Vol. 31, pp 1379– 1391

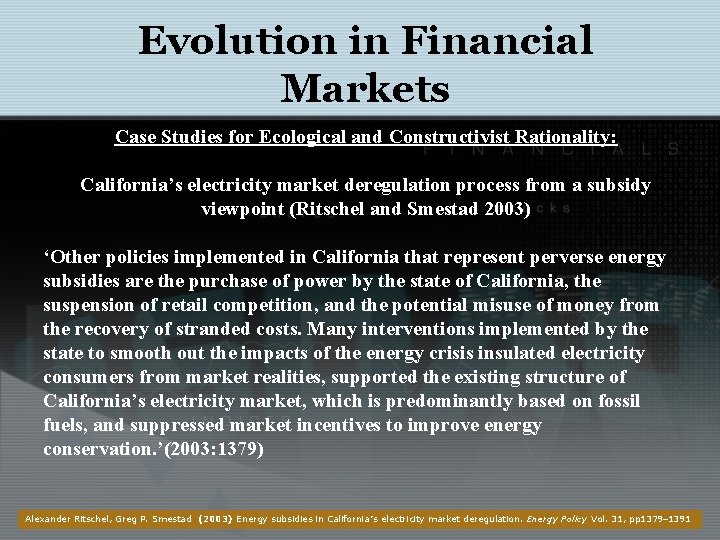

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California’s electricity market deregulation process from a subsidy viewpoint (Ritschel and Smestad 2003) ‘Other policies implemented in California that represent perverse energy subsidies are the purchase of power by the state of California, the suspension of retail competition, and the potential misuse of money from the recovery of stranded costs. Many interventions implemented by the state to smooth out the impacts of the energy crisis insulated electricity consumers from market realities, supported the existing structure of California’s electricity market, which is predominantly based on fossil fuels, and suppressed market incentives to improve energy conservation. ’(2003: 1379) Alexander Ritschel, Greg P. Smestad (2003) Energy subsidies in California’s electricity market deregulation. Energy Policy Vol. 31, pp 1379– 1391

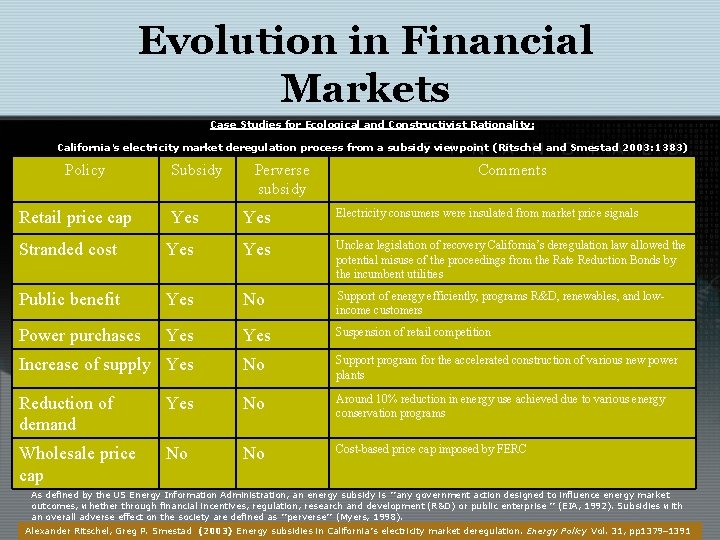

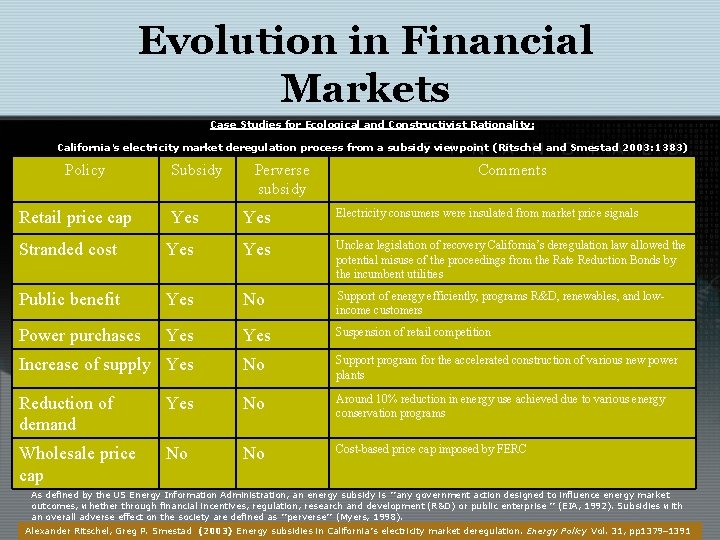

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: California’s electricity market deregulation process from a subsidy viewpoint (Ritschel and Smestad 2003: 1383) Policy Subsidy Perverse subsidy Comments Retail price cap Yes Electricity consumers were insulated from market price signals Stranded cost Yes Unclear legislation of recovery California’s deregulation law allowed the potential misuse of the proceedings from the Rate Reduction Bonds by the incumbent utilities Public benefit Yes No Support of energy efficiently, programs R&D, renewables, and lowincome customers Power purchases Yes Suspension of retail competition Increase of supply Yes No Support program for the accelerated construction of various new power plants Reduction of demand Yes No Around 10% reduction in energy use achieved due to various energy conservation programs Wholesale price cap No No Cost-based price cap imposed by FERC As defined by the US Energy Information Administration, an energy subsidy is ‘‘any government action designed to influence energy market outcomes, whether through financial incentives, regulation, research and development (R&D) or public enterprise ’’ (EIA, 1992). Subsidies with an overall adverse effect on the society are defined as ‘‘perverse’’ (Myers, 1998). Alexander Ritschel, Greg P. Smestad (2003) Energy subsidies in California’s electricity market deregulation. Energy Policy Vol. 31, pp 1379– 1391

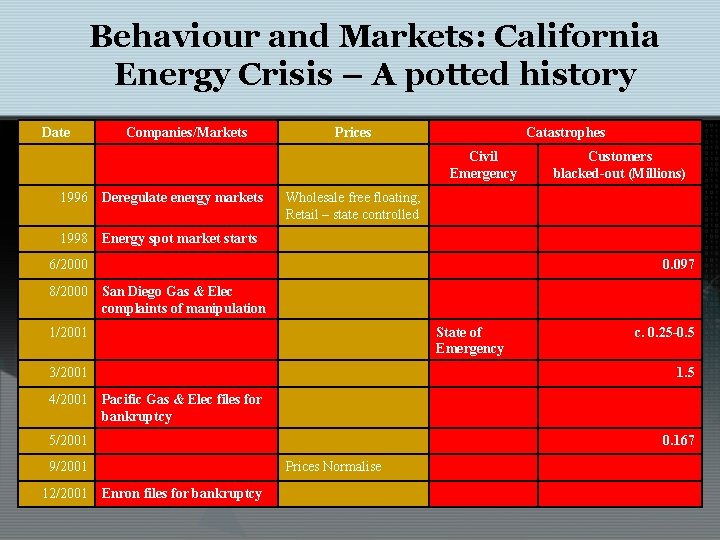

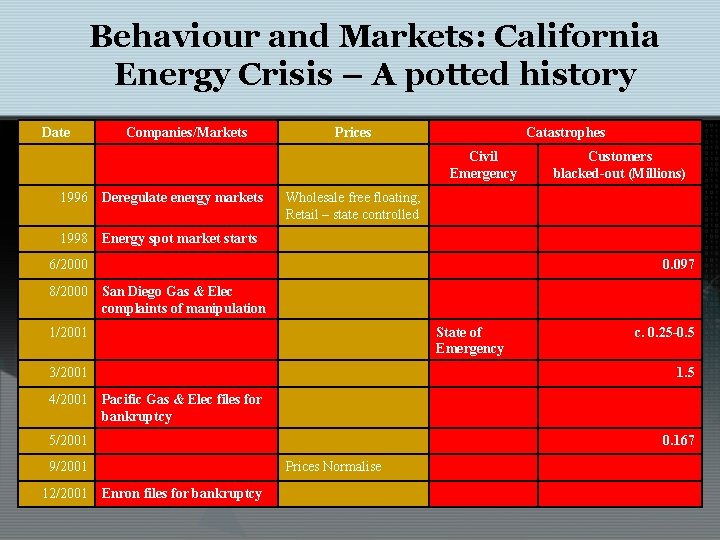

Behaviour and Markets: California Energy Crisis – A potted history 1996 California begins to loosen controls on its energy market and takes measures to increase competition. April 1998 Spot market for energy begins operation. May 2000 Significant energy price rises. June 14, 2000 Blackouts affect 97, 000 customers in San Francisco Bay area during a heat wave. August 2000 San Diego Gas & Electric Company files a complaint alleging manipulation of the markets. January 17– 18, 2001 Blackouts affect several hundred thousand customers. January 17, 2001 Governor Davis declares a state of emergency. March 19– 20, 2001 Blackouts affect 1. 5 million customers. April 2001 Pacific Gas & Electric Co. files for bankruptcy. May 7– 8, 2001 Blackouts affect upwards of 167, 000 customers. September 2001 Energy prices normalize. December 2001 Following the bankruptcy of Enron, it is alleged that energy prices were manipulated by Enron.

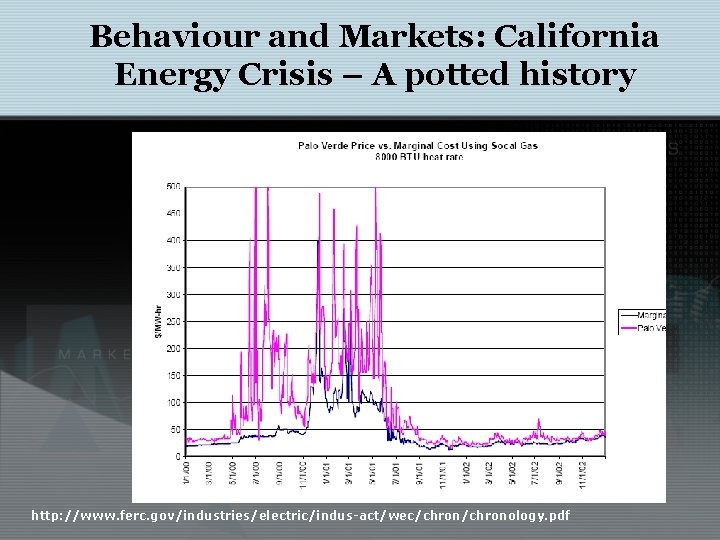

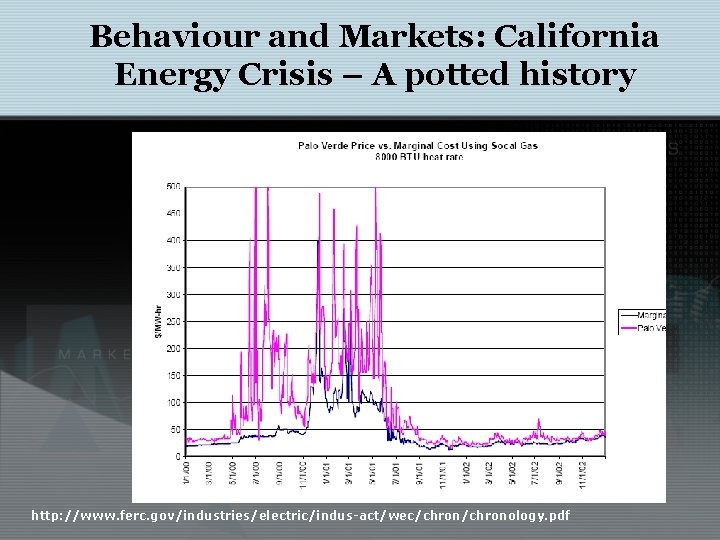

Behaviour and Markets: California Energy Crisis – A potted history http: //www. ferc. gov/industries/electric/indus-act/wec/chronology. pdf

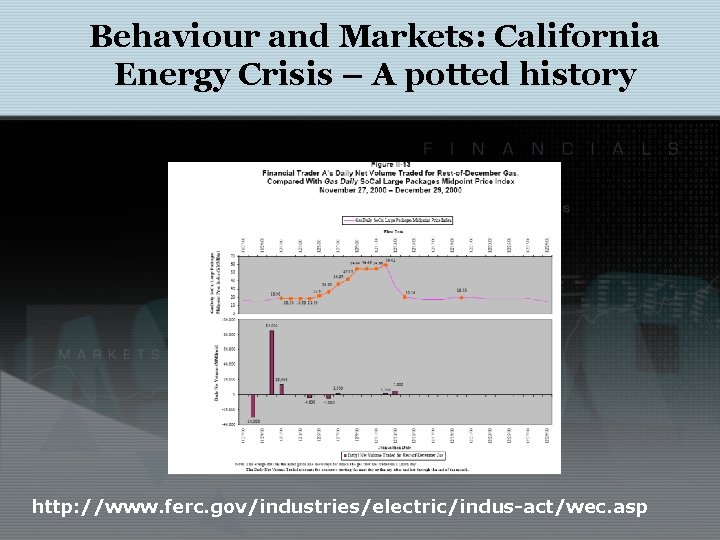

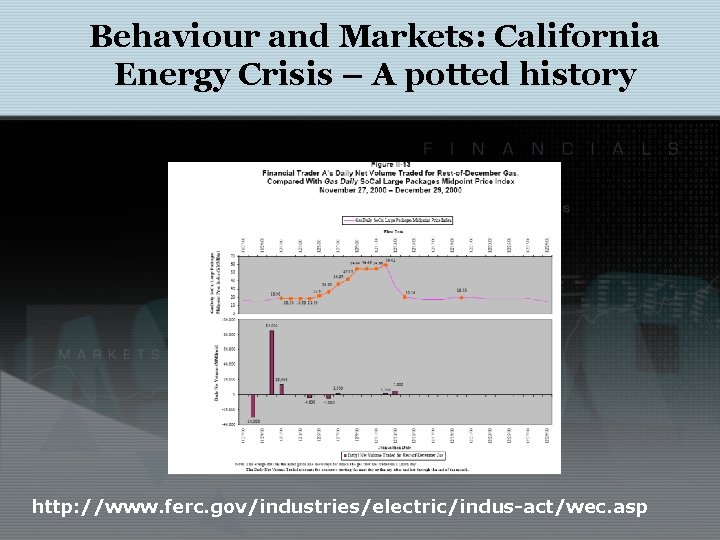

Behaviour and Markets: California Energy Crisis – A potted history http: //www. ferc. gov/industries/electric/indus-act/wec. asp

Behaviour and Markets: California Energy Crisis – A potted history Date Companies/Markets Prices Catastrophes Civil Emergency 1996 Deregulate energy markets 1998 Energy spot market starts Wholesale free floating; Retail – state controlled 6/2000 8/2000 0. 097 San Diego Gas & Elec complaints of manipulation 1/2001 State of Emergency 3/2001 4/2001 c. 0. 25 -0. 5 1. 5 Pacific Gas & Elec files for bankruptcy 5/2001 0. 167 9/2001 12/2001 Customers blacked-out (Millions) Prices Normalise Enron files for bankruptcy

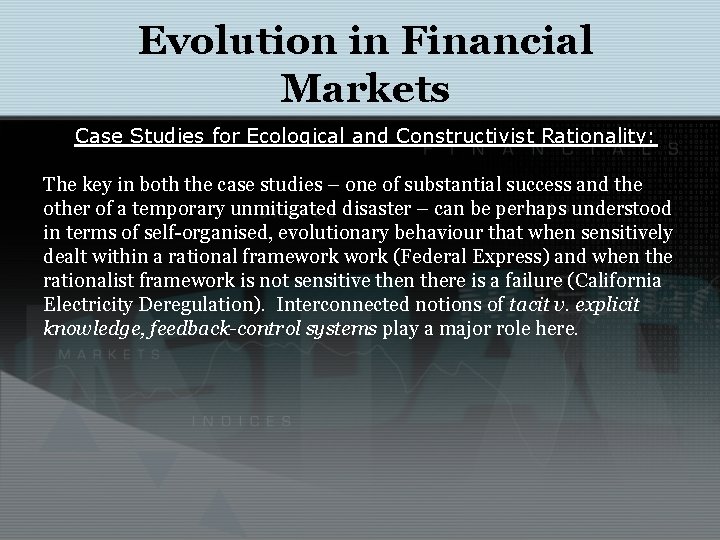

Evolution in Financial Markets Case Studies for Ecological and Constructivist Rationality: The key in both the case studies – one of substantial success and the other of a temporary unmitigated disaster – can be perhaps understood in terms of self-organised, evolutionary behaviour that when sensitively dealt within a rational framework (Federal Express) and when the rationalist framework is not sensitive then there is a failure (California Electricity Deregulation). Interconnected notions of tacit v. explicit knowledge, feedback-control systems play a major role here.

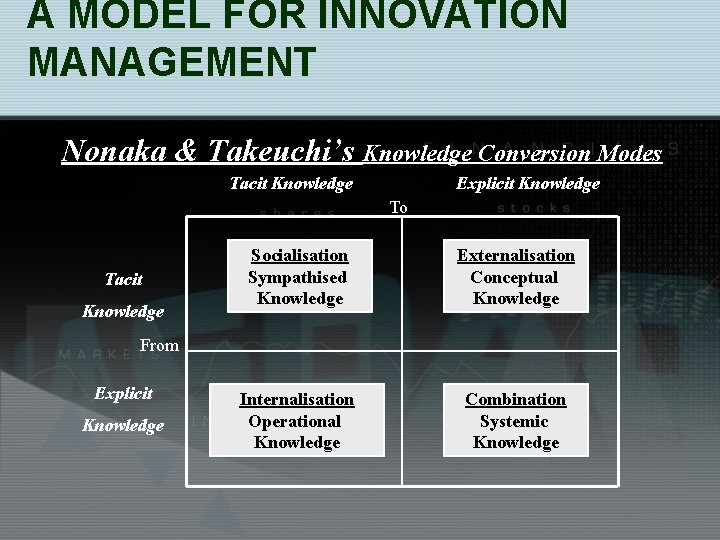

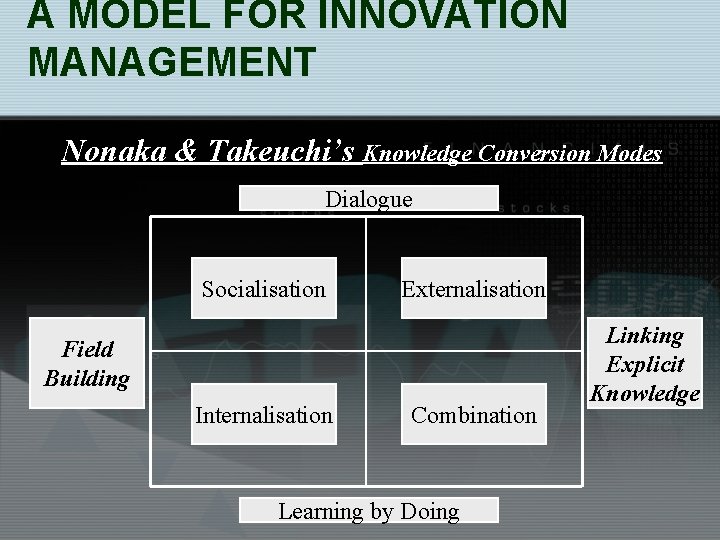

A MODEL FOR INNOVATION MANAGEMENT Nonaka & Takeuchi’s Knowledge Conversion Modes Tacit Knowledge Explicit Knowledge To Tacit Knowledge Socialisation Sympathised Knowledge Externalisation Conceptual Knowledge Internalization Operational Knowledge Combination Systemic Knowledge From Explicit Knowledge

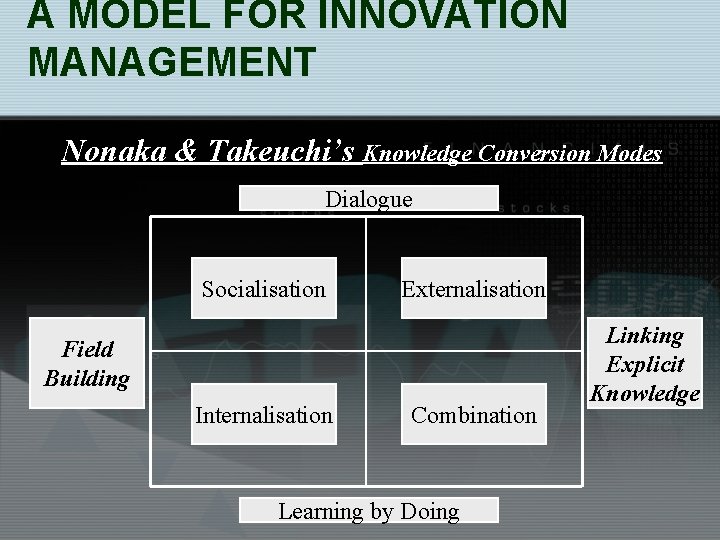

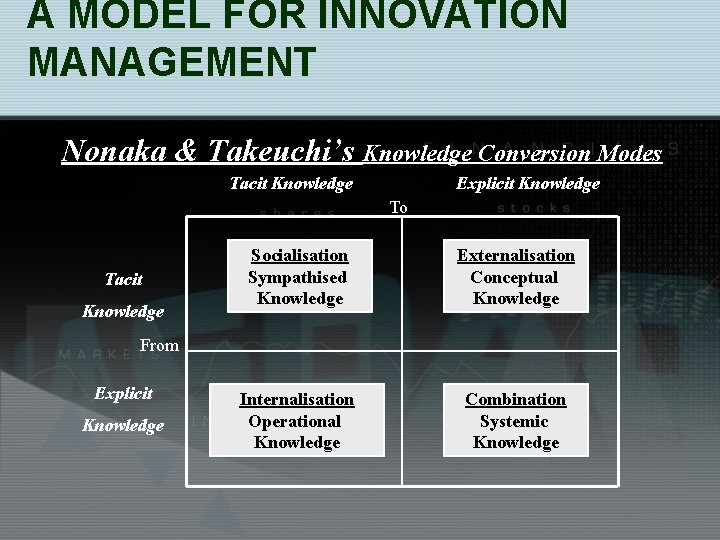

A MODEL FOR INNOVATION MANAGEMENT Nonaka & Takeuchi’s Knowledge Conversion Modes Dialogue Socialisation Externalisation Field Building Internalisation Combination Learning by Doing Linking Explicit Knowledge

A MODEL FOR INNOVATION MANAGEMENT Nonaka & Takeuchi’s Knowledge Conversion Modes Tacit Knowledge Explicit Knowledge To Tacit Knowledge Socialisation Sympathised Knowledge Externalisation Conceptual Knowledge Internalisation Operational Knowledge Combination Systemic Knowledge From Explicit Knowledge

A MODEL FOR INNOVATION MANAGEMENT Dialogue Socialization Externalisation Linking Explicit Knowledge Field Building Internalisation Combination Learning by doing

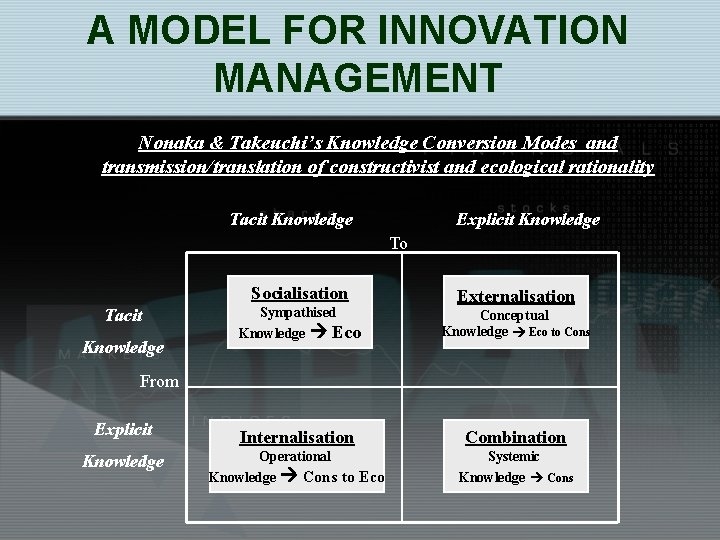

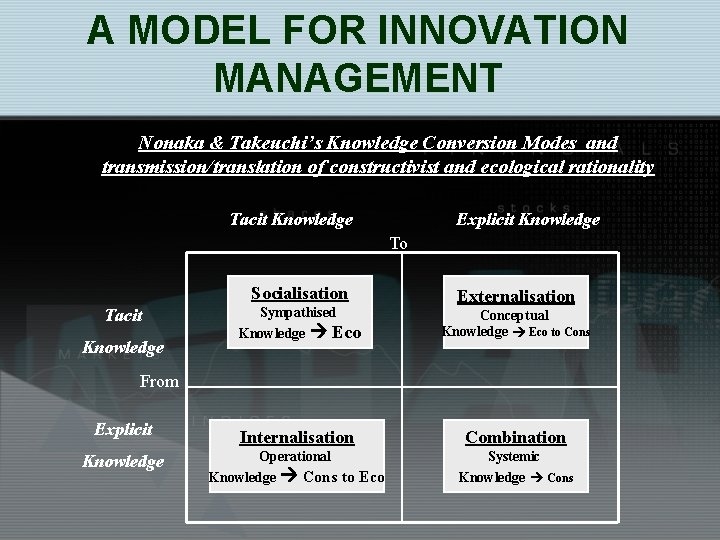

A MODEL FOR INNOVATION MANAGEMENT Nonaka & Takeuchi’s Knowledge Conversion Modes and transmission/translation of constructivist and ecological rationality Tacit Knowledge Explicit Knowledge To Socialisation Tacit Knowledge Externalisation Sympathised Knowledge Eco Conceptual Knowledge Eco to Cons Internalisation Combination Operational Knowledge Cons to Eco Systemic Knowledge Cons From Explicit Knowledge

Defination

Defination Sarfraz khurshid

Sarfraz khurshid Elizabeth mulroney

Elizabeth mulroney Examples of physical changes

Examples of physical changes Advantages of filtration

Advantages of filtration Aijaz ahmad jameson's rhetoric of otherness summary

Aijaz ahmad jameson's rhetoric of otherness summary Trofozit

Trofozit Victoria school ghazipur

Victoria school ghazipur Ahmad boestamam sejarah tingkatan 4

Ahmad boestamam sejarah tingkatan 4 Nephrtic syndrome

Nephrtic syndrome Ahmad makki hasan

Ahmad makki hasan Dr mirza ahmad

Dr mirza ahmad Dr ahmad faisal

Dr ahmad faisal Nur ahmad husin

Nur ahmad husin Who is aflatoon in the kite runner

Who is aflatoon in the kite runner Saad ahmad md

Saad ahmad md Ahmad ibrahim kulliyyah of laws

Ahmad ibrahim kulliyyah of laws Dr. ahmad muchlis

Dr. ahmad muchlis 7 stars doctor fkui

7 stars doctor fkui Ahmad gozali perencana keuangan

Ahmad gozali perencana keuangan Dr ani binti ahmad

Dr ani binti ahmad Dr nur ahmad tabri

Dr nur ahmad tabri Ahmad rafiki

Ahmad rafiki What do you mean by duty cycle

What do you mean by duty cycle Pengenalan pengakap malaysia

Pengenalan pengakap malaysia Hyperventilation treatment

Hyperventilation treatment Sayed ahmad salehi

Sayed ahmad salehi Kompetensi manajerial kepala perpustakaan

Kompetensi manajerial kepala perpustakaan Mian ahmad farhan

Mian ahmad farhan