Evaluating Market Risk Factors in Positive and Negative

- Slides: 22

Evaluating Market Risk Factors in Positive and Negative World Markets Buhdy Bok Frank Liu Jeff Lu Brad Newcomer Ron Yee

Agenda § Hypothesis § Overview § Analysis § Applications § Next Steps

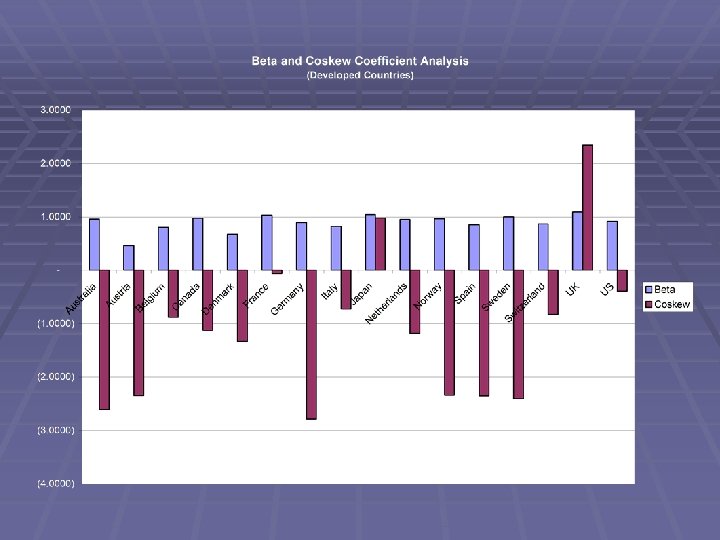

Hypothesis § Country market risk differ depending upon market conditions § Skewness is an important factor in evaluating country market risk

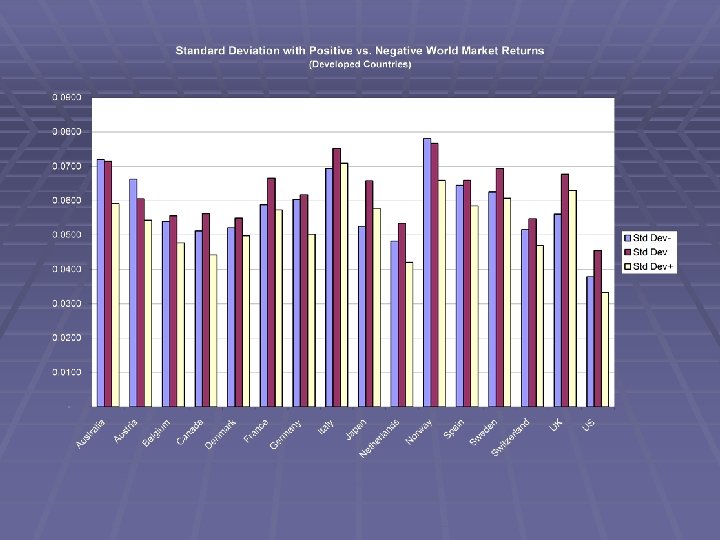

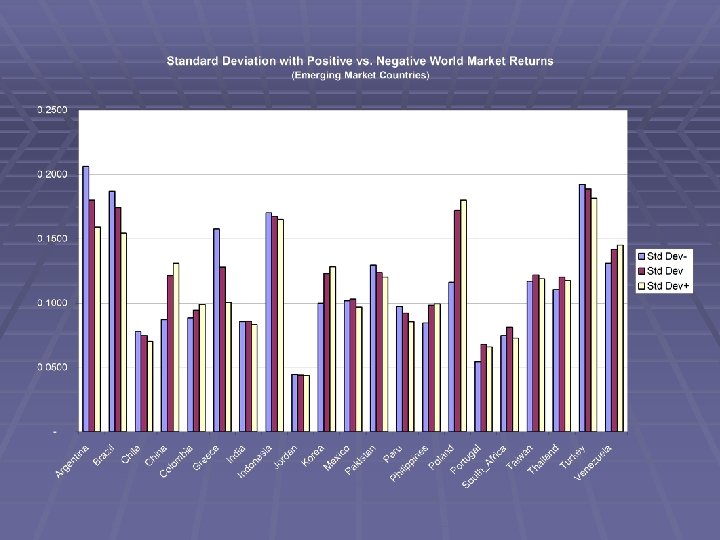

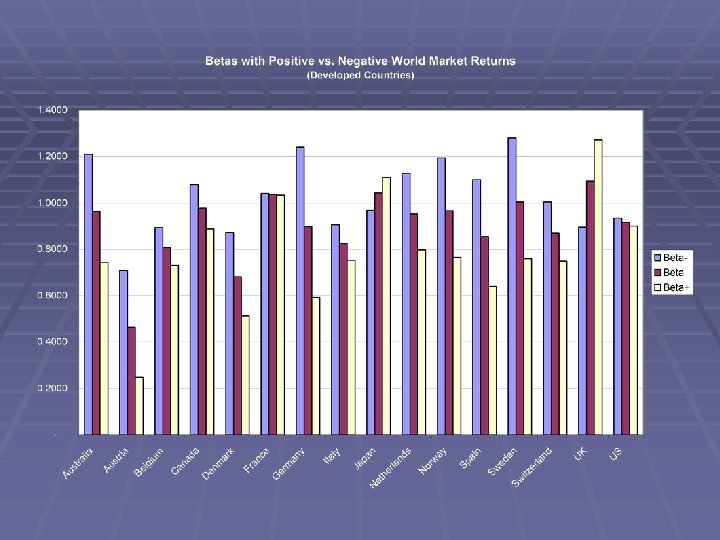

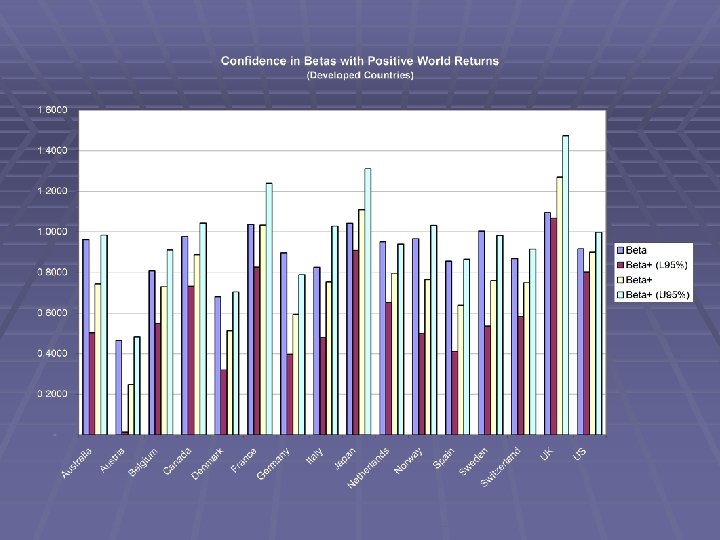

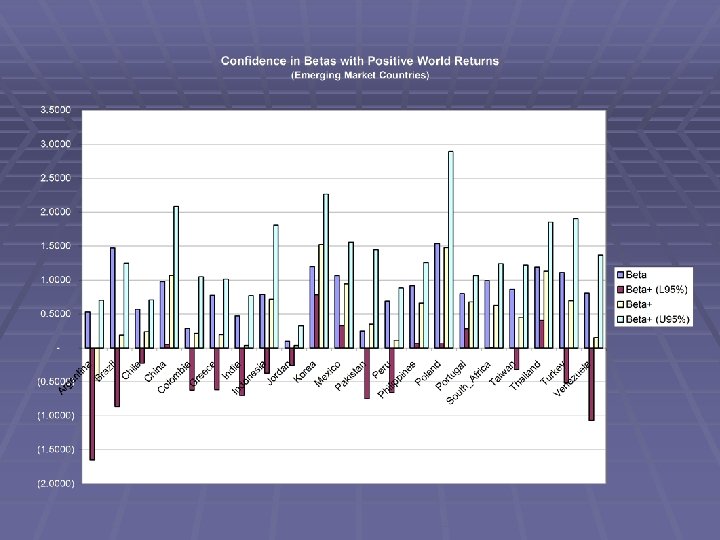

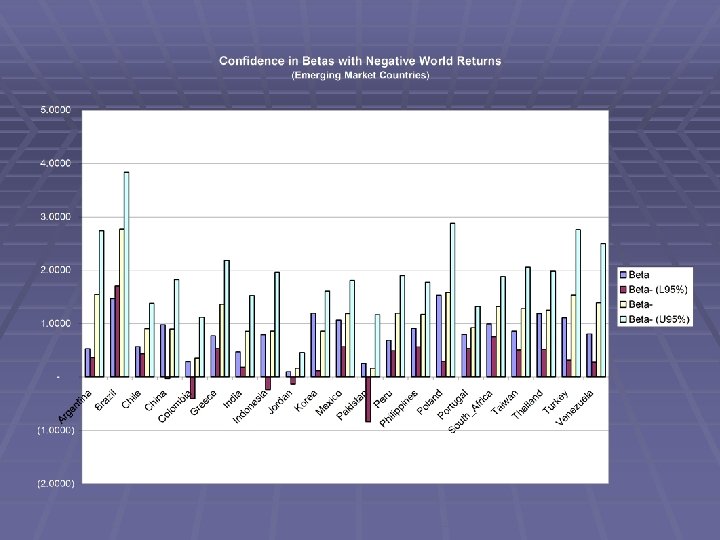

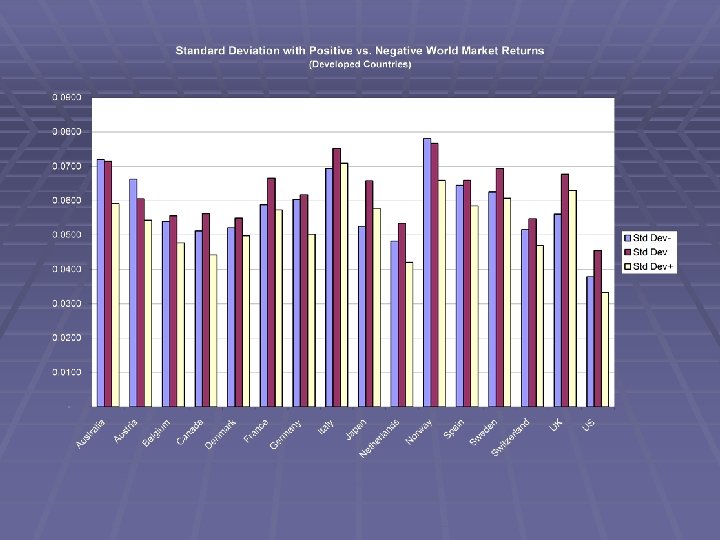

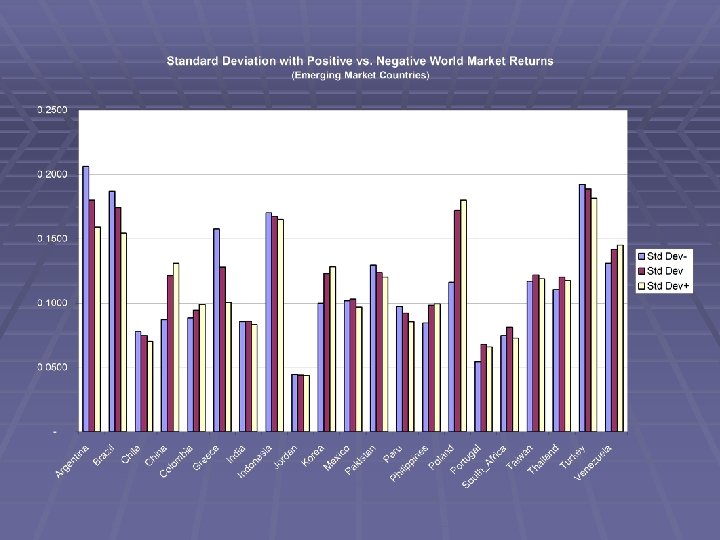

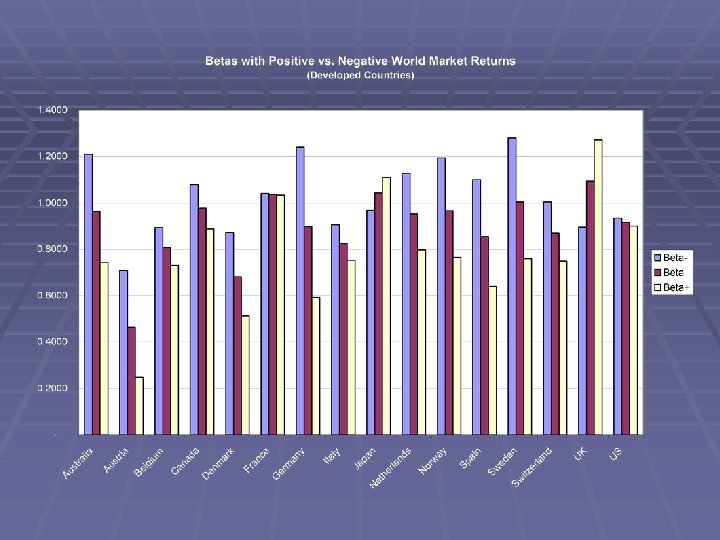

Overview § CAPM assumes an average beta § Volatility varies in different market conditions § Betas vary depending upon market conditions § CAPM assumes returns are normally distributed § Returns are not generally symmetrical § Returns typically exhibit positive or negative skewness

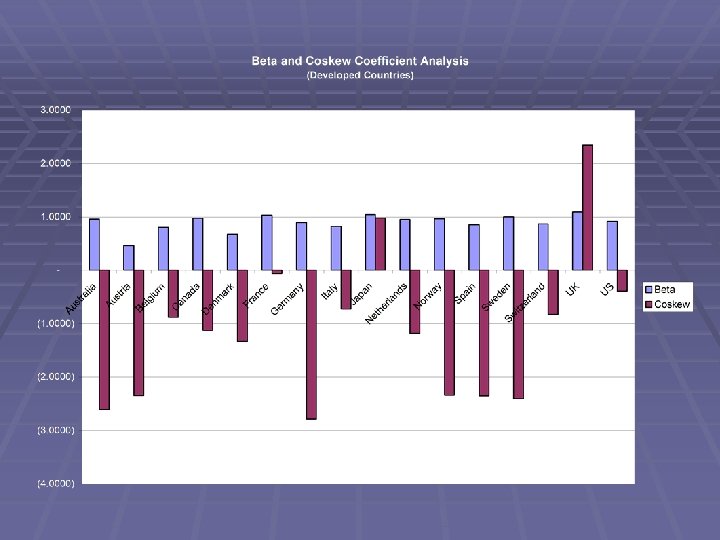

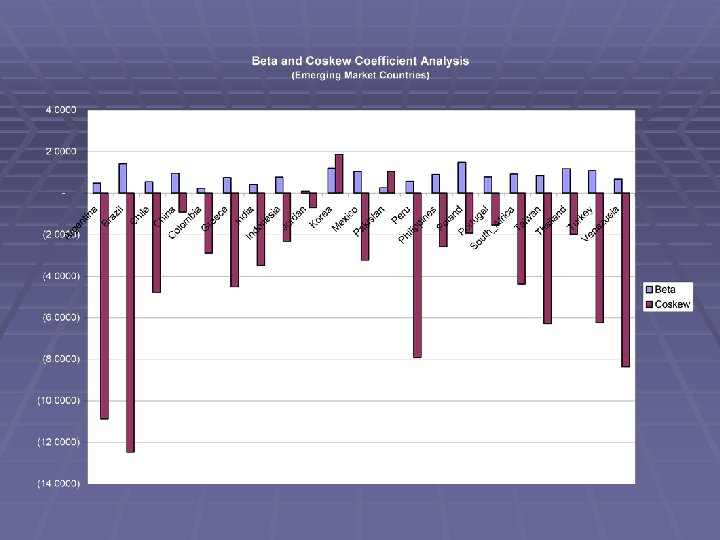

Data Source § Compared Monthly Returns - Equity Markets from 37 Countries vs. World Market (MSCI Indices) § 16 Developed Nations § 21 Emerging Markets

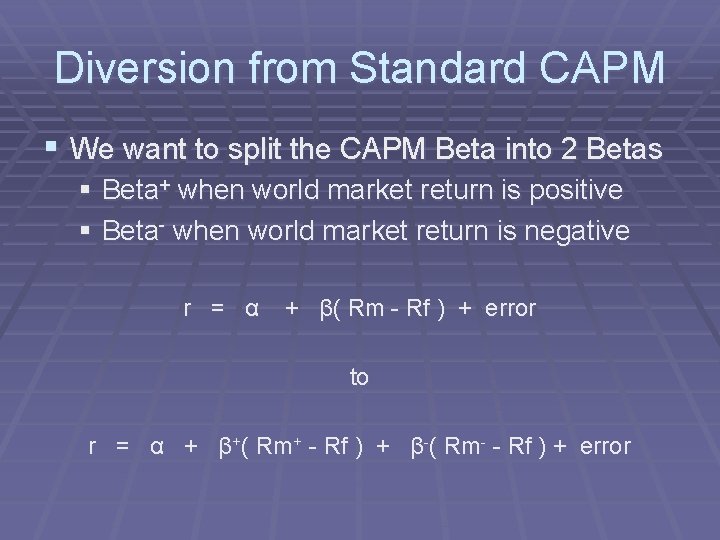

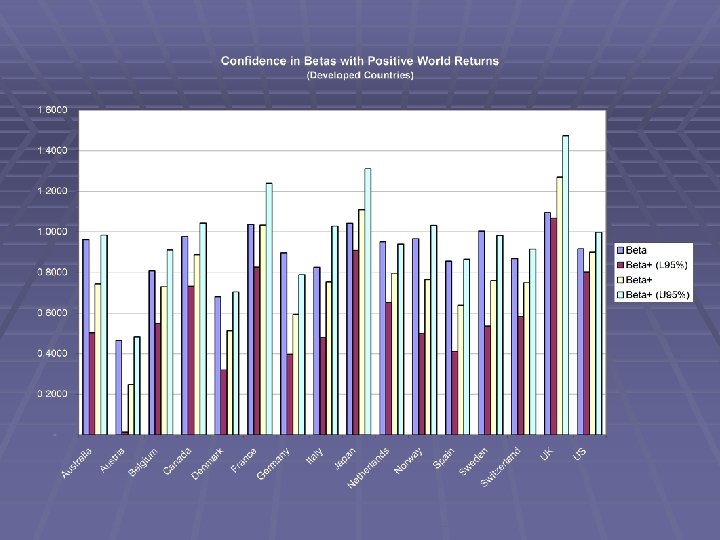

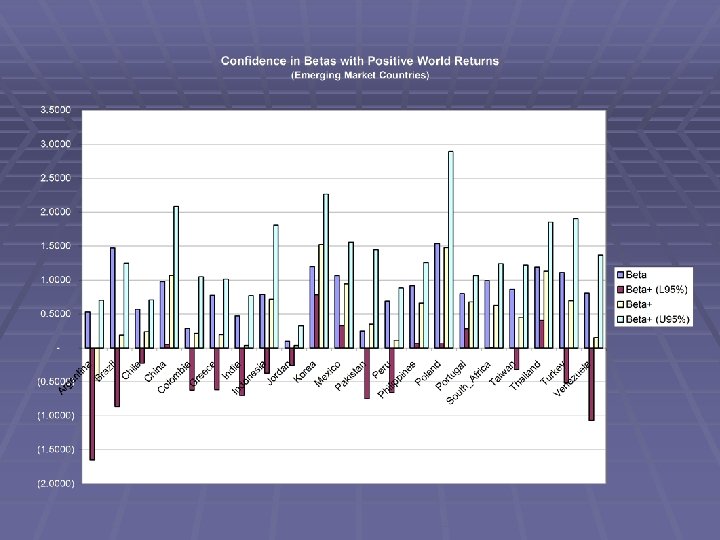

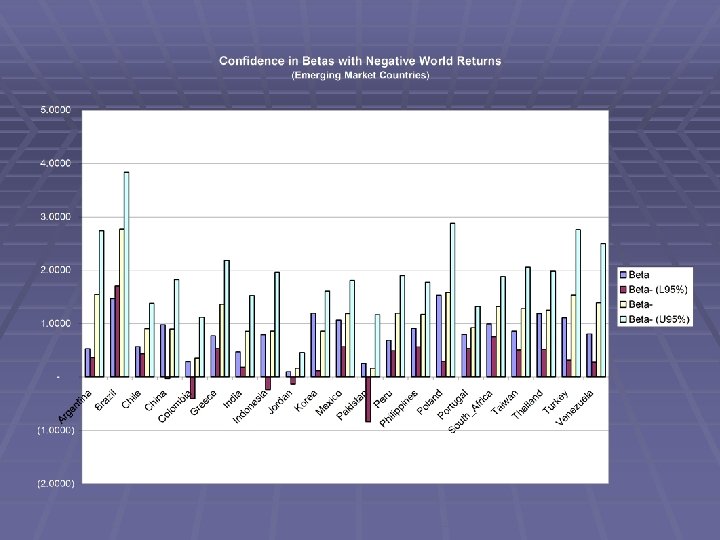

Diversion from Standard CAPM § We want to split the CAPM Beta into 2 Betas § Beta+ when world market return is positive § Beta- when world market return is negative r = α + β( Rm - Rf ) + error to r = α + β+( Rm+ - Rf ) + β-( Rm- - Rf ) + error

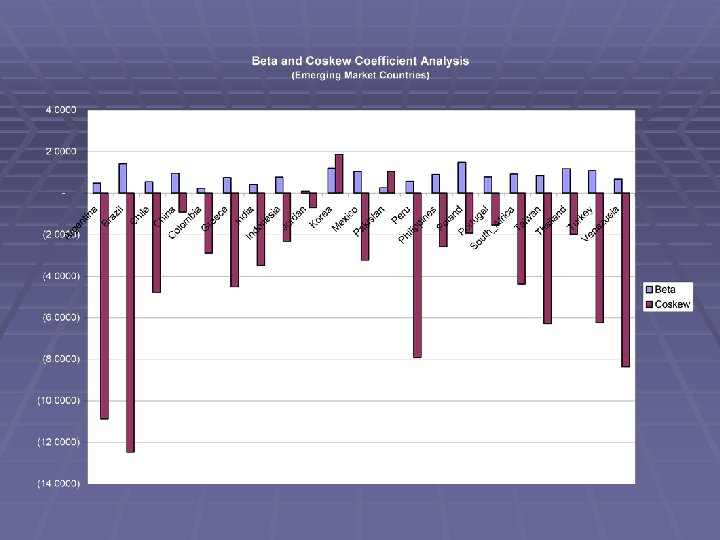

Coskewness Regression § Coskewness: The amount of skewness that an asset adds to the diversified portfolio (systematic skewness) r = α + β 1( RM ) + β 2( RM )2 + error

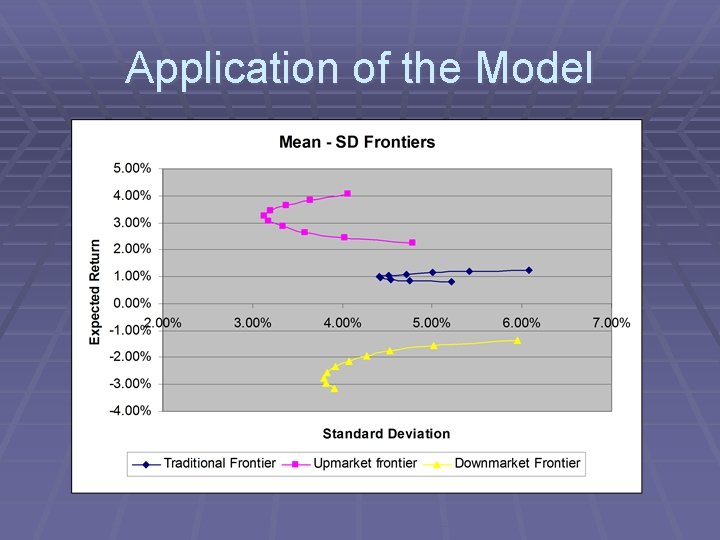

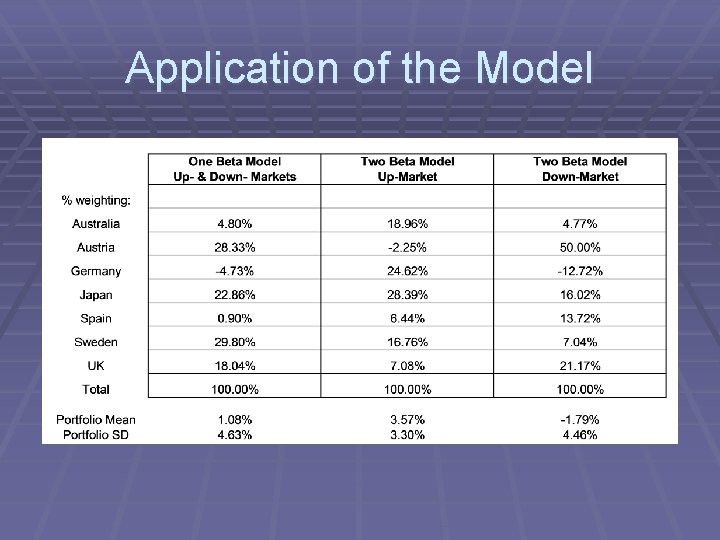

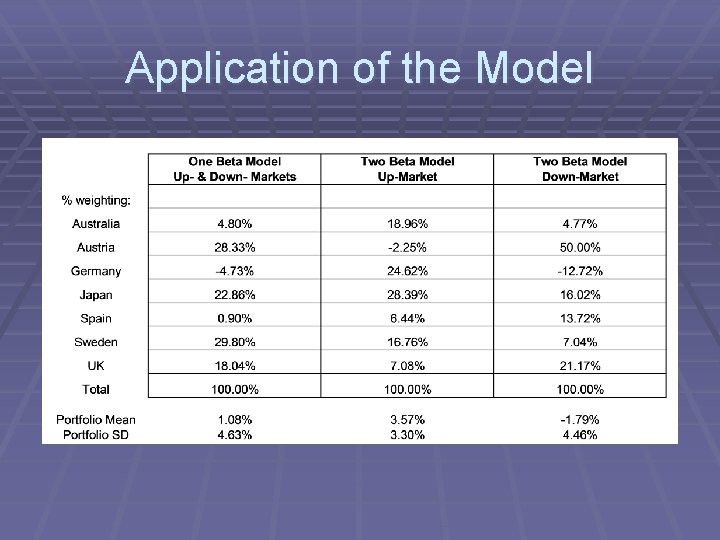

Application of the Model § Results demonstrate the significance of separate betas for up/down markets § A simple, intuitive refinement of the CAPM § Incorporating this concept into tactical allocation decisions will generate excess returns

Application of the Model § Requires a predictive model to forecast up/down markets § New procedure: 1. Create a predictive model to forecast +/market signals 2. Calculate the appropriate correlation matrix 3. Run optimization model (either up/down) 4. Use output to determine asset allocations

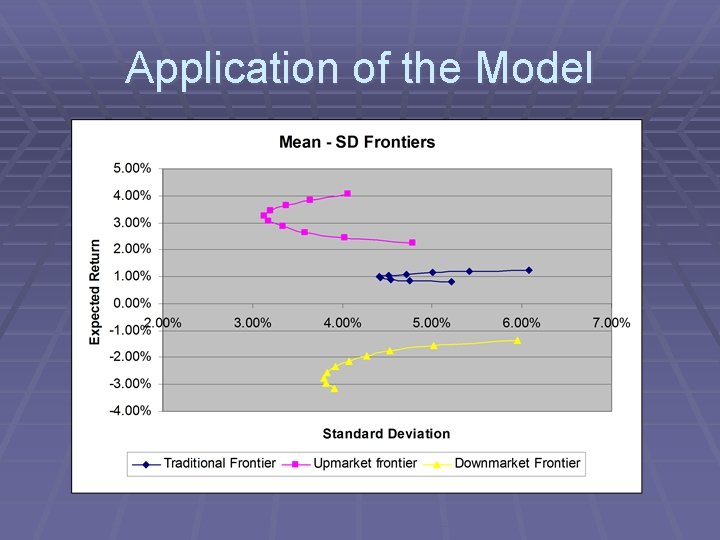

Application of the Model

Application of the Model

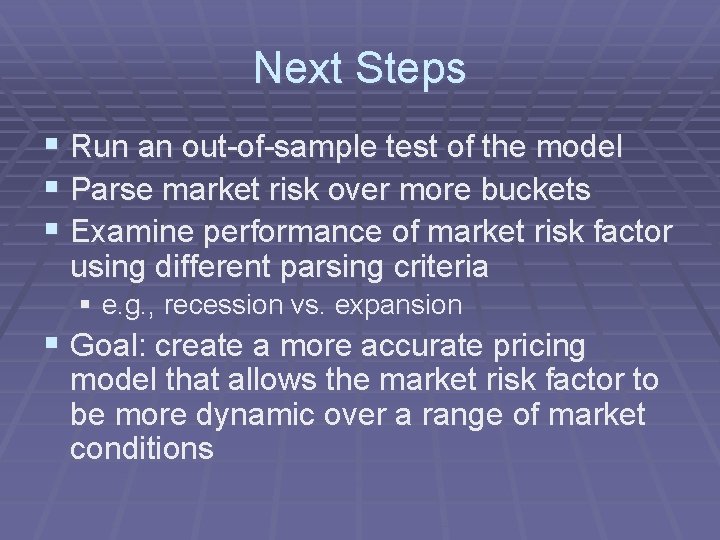

Next Steps § Run an out-of-sample test of the model § Parse market risk over more buckets § Examine performance of market risk factor using different parsing criteria § e. g. , recession vs. expansion § Goal: create a more accurate pricing model that allows the market risk factor to be more dynamic over a range of market conditions