Entrepreneurship Venkatesh Sridhar Who is the guy Why

- Slides: 56

Entrepreneurship Venkatesh Sridhar

Who is the guy?

Why are you here?

What is Entrepreneurship

What is Entrepreneurship

What is Entrepreneurship

Entrepreneur

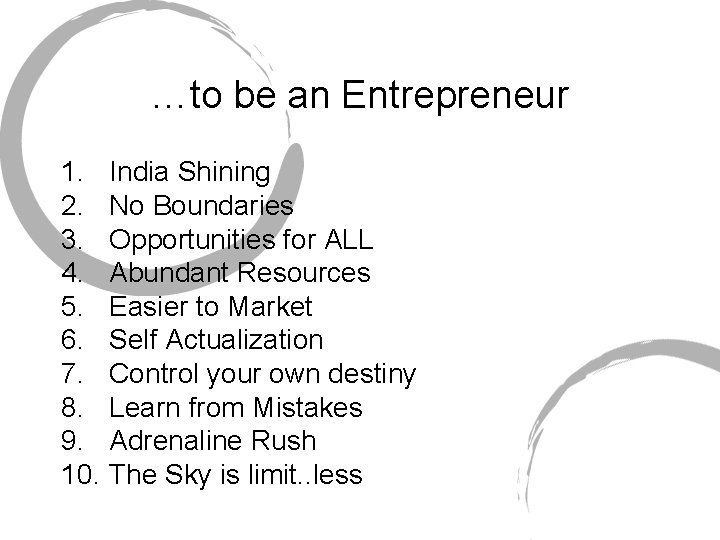

…to be an Entrepreneur 1. India Shining 2. No Boundaries 3. Opportunities for ALL 4. Abundant Resources 5. Easier to Market 6. Self Actualization 7. Control your own destiny 8. Learn from Mistakes 9. Adrenaline Rush 10. The Sky is limit. . less

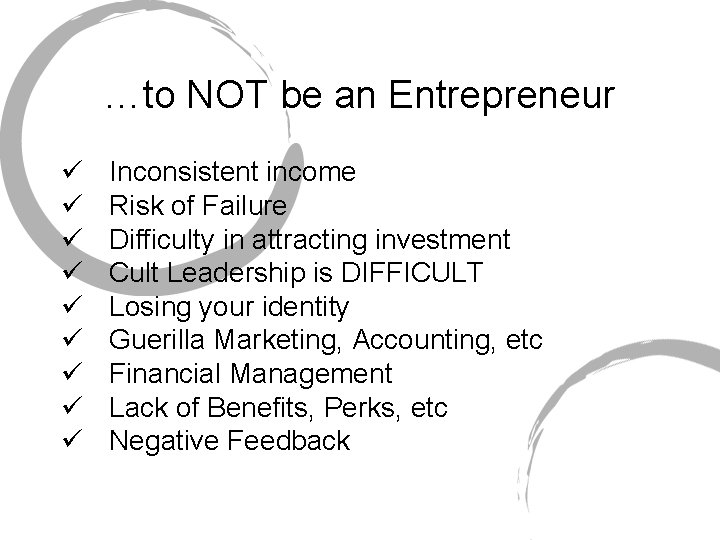

…to NOT be an Entrepreneur ü ü ü ü ü Inconsistent income Risk of Failure Difficulty in attracting investment Cult Leadership is DIFFICULT Losing your identity Guerilla Marketing, Accounting, etc Financial Management Lack of Benefits, Perks, etc Negative Feedback

Dream…

My Childhood Dreams ü ü ü ü Play Cricket for India Beat Prakash Padukone’s record Own a Mac First Car to be a BMW Be the CEO of an IT company Be richer than Bill Gates Be India’s PM

Difficulty of success

Difficulty of success 1. Business Plan 2. Sales 3. Poor Operational planning 4. Money 5. Poor Management 6. Lack of Exp. & Know. 7. Lack of Focus + Commitment 8. Poor Customer Service 9. Inadequate HR Management 10. Not taking professional advice - CAs, Lawyers, etc

What is VC? • private capital (equity) • early-stage, high-potential, growth companies • generate a return through an eventual realization event such as an IPO or trade sale of the company.

Who is a VC? • person or investment firm • Former entrepreneur or Fin guy • Types of VC: • Angel • VC • PE Investor • At early stage startup – Angel • Later stages of growth – VC • Last stage – PE Investor

How does the VC Industry work? • Sources of Capital: Professional Venture Capital Firms raise money from Insurance Companies, Educational Endowments, Pension Funds and Wealthy Individuals. These organizations have an investment portfolio which they allocate to various asset classes such as stocks (equities), bonds, real estate etc. One of the assets classes is called “Alternative Investments”- venture capital is such an investment. Perhaps 5% to 10% of the portfolio might be allocated to Alternative Investments. The portfolio owners seek to obtain high returns from these more risky Alternative Investments

VC Industry Overview • Successful Entrepreneurs, HNIs • Investment Firms • Venture Capital Fund either industry/sector specific General Partners Limited Partners Venture Capital Fund

What do VC’s do? • • Source Fund Mentor Manage

Why should I go to a VC? • You want Rs. 10 Lakhs to start business: • Borrow from friends & family • Borrow from banks • Borrow from VCs

What do I need to do to attract a VC

Things you need to showcase • First an understanding of whether a particular VC invests in the sector • A sound sensible b-plan with sensible PRO projections • Realistic valuations • Right Attitude • Respect for OPM

So, How does a business get funded?

Idea…

Consult & Validate

Identify

Vision

Build a team

Money, Money…

NO… But I might say yes • 10 Slides • 20 Minutes • Yes, No, Maybe?

What does a VC look for?

Revenues + Awesome Team =

What Should I be careful about?

98% Rejection: • • Exaggeration Poor articulation of revenue generation Under estimation of resources Over estimation of demand

Common Pitfalls • Raise too much or too little capital • Focus, Focus and FOCUS • Not deciding on valuation pre-money (value of organization before investment) • Not Identifying exit strategies for VC • Not reading term sheets carefully

So, how do I go about it?

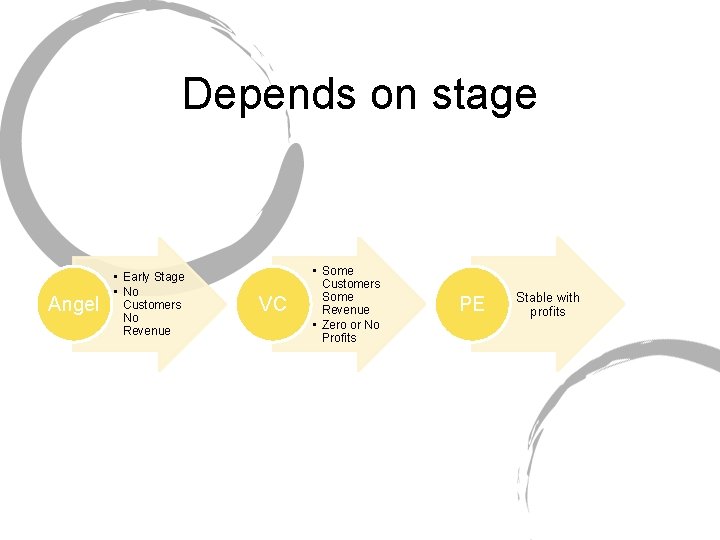

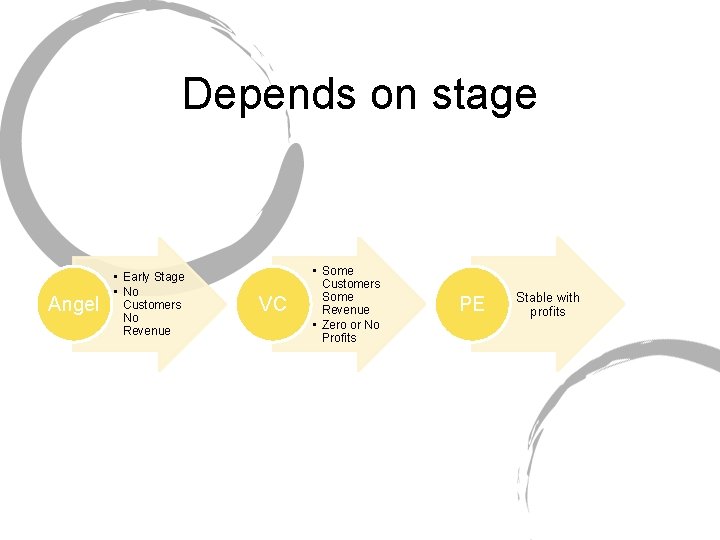

Depends on stage Angel • Early Stage • No Customers No Revenue VC • Some Customers Some Revenue • Zero or No Profits PE Stable with profits

Structuring Angel Investment • Decide on valuation pre-money – art not science • Carefully analyze amount to raise – less is easier • Identify milestones to achieve to create shareholder value for next round • Rule of thumb - $500 k-$1 M gets 1/3 of company • Usually in convertible preferred stock

Structuring (continued) • Don’t overprice deal – it will come back to haunt you • Summarize terms in term sheet • Use offering memo, term sheet and business plan to sell the deal • Many possible terms in deal – but structure it to sell. • Angels don’t make counter-offers

Most difficult part is finding enough investors • Can’t advertise • Can’t send out mailing to large number of strangers • Can’t use Internet to advertise or solicit investors • Usually can’t get a reputable securities dealer to sell the deal • Must rely on referrals to get to enough prospective investors • Rule of thumb – one in ten will invest

YOUR MISSION - Creative leverage • • • Customer prepayments Supplier extended terms Customer funded product development Subcontract manufacturing Avoid capital expenditures Preserve cash for marketing

PERSISTENCE IS KEY! • Persistence beyond belief • Harder than selling insurance • 9 no’s for every one yes

Assume you have raised $1, 000 and made progress • • • May now qualify for Venture Capital Assuming prototype and beta testing Exciting, growth market Early revenues management team

Raising $1 M to $5 M from VC firms • Usually only source for this size financing • Too small for public offering • Too large for individuals

The process of raising venture capital • • Decide Company is candidate Prepare even better business plan Get introductions to VC firms Get one VC firm to be lead

Process (continued) • • Due diligence by the lead VC firm Proposed letter of intent Many issues to negotiate Usually takes a minimum of 90 days

What to Expect • • Convertible preferred stock Convertible notes Notes with stock purchase warrants Board representation

What to Expect (continued) • Veto power over major corporate actions • Shareholder agreement • Limits on executive compensation • stock options to key employees • financial reporting

Raising Capital from Individuals or VC Firms is Legally Intensive • Securities laws - federal and state • Structure can be complex • Many issues - need experienced counsel • Expensive

Corporate Cleanup Is Usually Required • • • Stockholder disputes Shareholder agreements Contractual problems Stock option problems Shareholder loans

VC’s Bring More Than Money to the Table • Access to potential customers, suppliers, financial institutions • Instill discipline in the organization, painful but good • Good strategic sense • Understanding of future financing opportunities

How to Negotiate the VC Financing • Separate seminar • Get experienced advice • Most entrepreneurs only do this once or twice • Experienced lawyers do it weekly

Questions, Comments, Feedback