Enterprise Registration and Taxation SHIPRA JAIN FCA LL

- Slides: 13

Enterprise Registration and Taxation SHIPRA JAIN FCA, LL. B, B. COM SHIPRAJ 89@GMAIL. COM 7503585270

Enterprise-Meaning Ø An organization, especially a bu siness, or a difficult and important plan Ø Eagerness to do something new and clever, despite any risks

Types Of Enterprises 1. Sole proprietorship 2. One Person Company 3. Joint Hindu Family business 4. Partnership 5. Limited Liability Partnership(LLP) 6. Private Ltd Company 7. Public Ltd Company 8. Cooperatives

Sole Proprietorship It is one of the easiest and simplest form of business entity to register and maintain in India. ü No formal registrations Required ü No separate identity ü Less compliances ü Unlimited Liability ü Single Point Decisions ü Limited Growth ü Duplication of Names ü Risky-Untraceable

Registrations & Compliances-Sole Proprietor Ø Proprietor PAN Card Ø Bank Account Ø Certificate/license issued by the Municipal authorities under Shop & Establishment Act, Ø Indirect Tax Registrations as and when Required Ø Income Tax Returns & Indirect Tax returns if registered

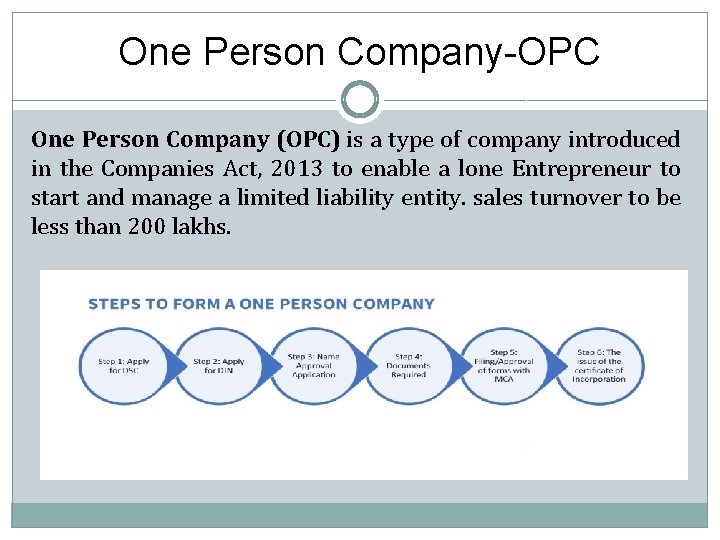

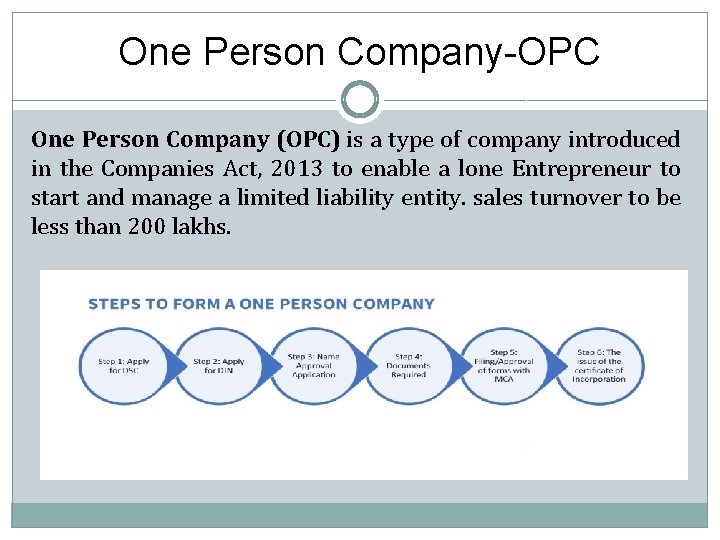

One Person Company-OPC One Person Company (OPC) is a type of company introduced in the Companies Act, 2013 to enable a lone Entrepreneur to start and manage a limited liability entity. sales turnover to be less than 200 lakhs.

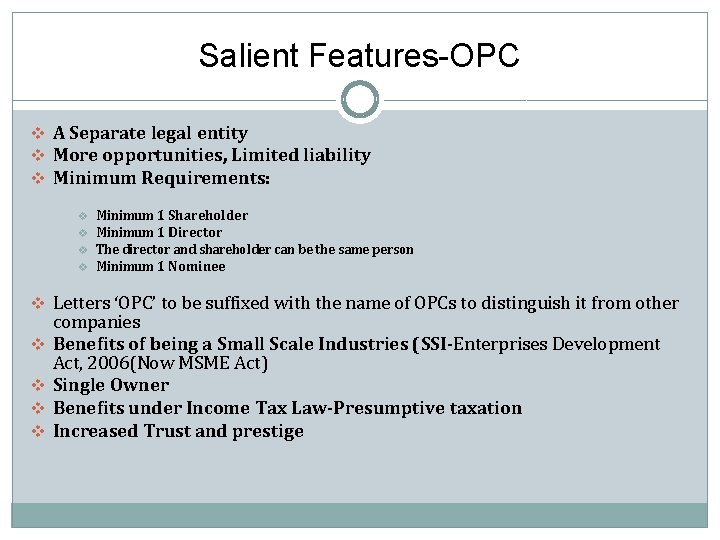

Salient Features-OPC v A Separate legal entity v More opportunities, Limited liability v Minimum Requirements: v v Minimum 1 Shareholder Minimum 1 Director The director and shareholder can be the same person Minimum 1 Nominee v Letters ‘OPC’ to be suffixed with the name of OPCs to distinguish it from other v v companies Benefits of being a Small Scale Industries (SSI-Enterprises Development Act, 2006(Now MSME Act) Single Owner Benefits under Income Tax Law-Presumptive taxation Increased Trust and prestige

Not For Profit Organisations q NGO (Non-Government Organisation) is an organization that works for non-profit/ charitable purposes. q NGOs can be registered in India under any of the following laws: a. Trust under Indian Trusts Act, 1882 b. Society under Societies Registration Act 1860 c. Section 8 Company under Companies Act, 2013

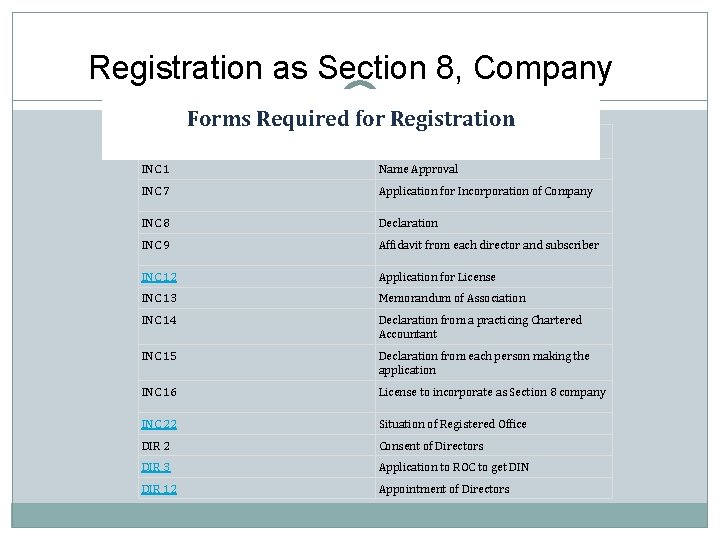

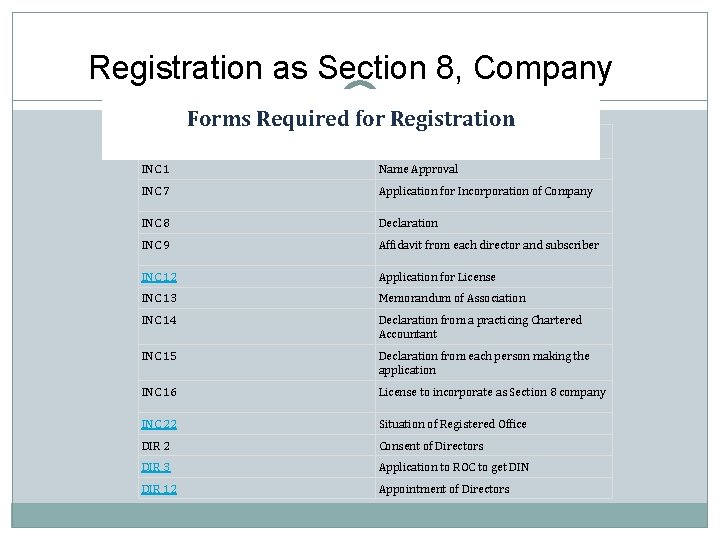

Registration as Section 8, Company Forms Required for Registration Name of the form Purpose of the Form INC 1 Name Approval INC 7 Application for Incorporation of Company INC 8 Declaration INC 9 Affidavit from each director and subscriber INC 12 Application for License INC 13 Memorandum of Association INC 14 Declaration from a practicing Chartered Accountant INC 15 Declaration from each person making the application INC 16 License to incorporate as Section 8 company INC 22 Situation of Registered Office DIR 2 Consent of Directors DIR 3 Application to ROC to get DIN DIR 12 Appointment of Directors

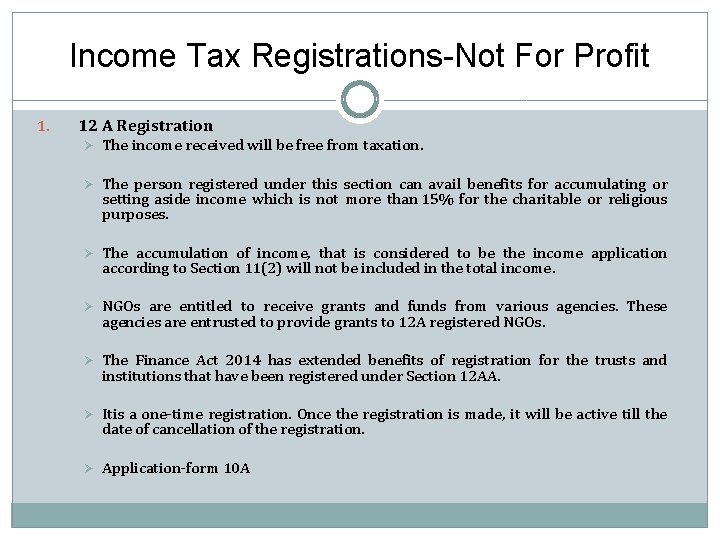

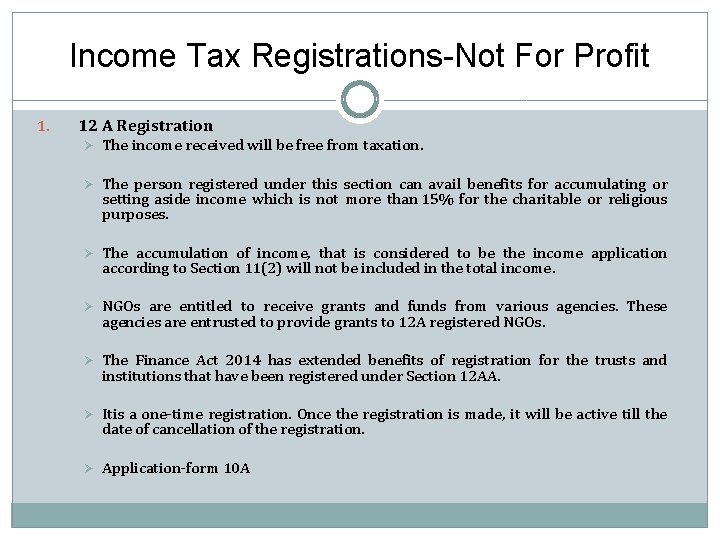

Income Tax Registrations-Not For Profit 1. 12 A Registration Ø The income received will be free from taxation. Ø The person registered under this section can avail benefits for accumulating or setting aside income which is not more than 15% for the charitable or religious purposes. Ø The accumulation of income, that is considered to be the income application according to Section 11(2) will not be included in the total income. Ø NGOs are entitled to receive grants and funds from various agencies. These agencies are entrusted to provide grants to 12 A registered NGOs. Ø The Finance Act 2014 has extended benefits of registration for the trusts and institutions that have been registered under Section 12 AA. Ø Itis a one-time registration. Once the registration is made, it will be active till the date of cancellation of the registration. Ø Application-form 10 A

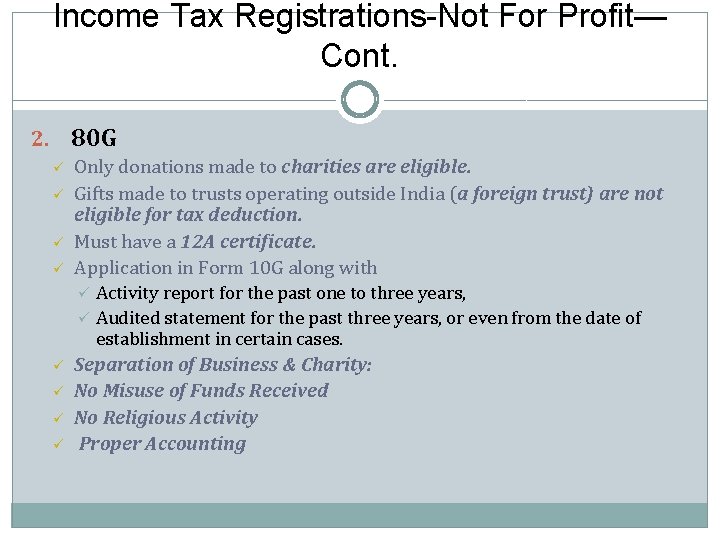

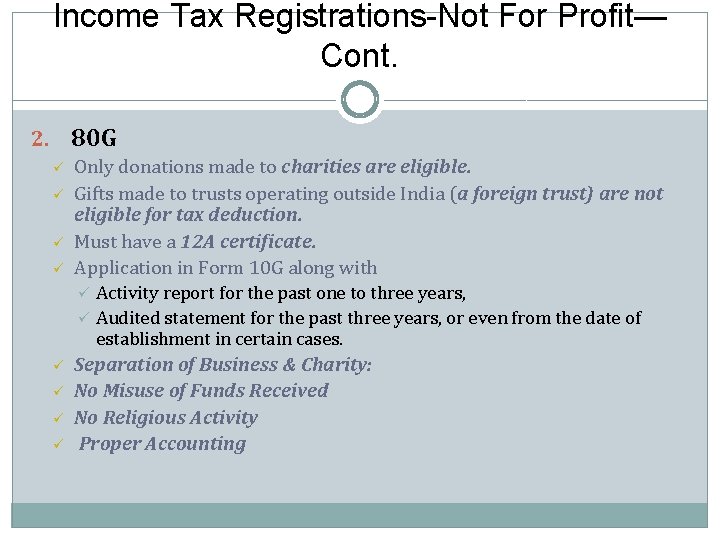

Income Tax Registrations-Not For Profit— Cont. 80 G 2. ü ü Only donations made to charities are eligible. Gifts made to trusts operating outside India (a foreign trust) are not eligible for tax deduction. Must have a 12 A certificate. Application in Form 10 G along with ü ü ü Activity report for the past one to three years, Audited statement for the past three years, or even from the date of establishment in certain cases. Separation of Business & Charity: No Misuse of Funds Received No Religious Activity Proper Accounting

Thank You

Effects of taxation

Effects of taxation Difference between ethics and legality

Difference between ethics and legality Taxation and budget reform commission

Taxation and budget reform commission Producer surplus tax

Producer surplus tax Efficient and equitable taxation

Efficient and equitable taxation Roman hierarchy

Roman hierarchy Fob paritet

Fob paritet Link.e.entry

Link.e.entry Frc fca volunteer

Frc fca volunteer Fca compliance manual

Fca compliance manual Fca welding practice plates thicker than 1/2 inch ____.

Fca welding practice plates thicker than 1/2 inch ____. Globular transfer welding

Globular transfer welding Loi tdsb

Loi tdsb Fca 1980

Fca 1980