Electronic Payment Systems 20 763 Lecture 11 Electronic

- Slides: 26

Electronic Payment Systems 20 -763 Lecture 11 Electronic Cash

Electronic Cash • Token money in the form of bits, except unlike token money it can be copied. This creates new problems: • Copy of a real bill = counterfeit. Copy of an ecash string is not counterfeit (or a perfect counterfeit) • How is it issued? Spent? • Counterfeiting • Loss • Fraud, merchant fraud, use in crime, double spending • Efficiency (offline use -- no need to visit a site) • Anonymity (even with collusion) No existing system solves all these problems 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Online v. Offline Systems • An online system requires access to a server for each transaction. – Example: credit card authorization. Merchant must get code from issuing bank. • An offline system allows transactions with no server. – Example: cash transaction. Merchant inspects money. No communications needed. 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Electronic Cash -- Idea 1 • Bank issues character strings containing: – denomination – serial number – bank ID + encryption of the above • First person to return string to bank gets the money PROBLEMS: • Can’t use offline. Must verify money not yet spent. • Not anonymous. Bank can record serial number. • Sophisticated transaction processing system required with locking to prevent double spending. • Eavesdropping! 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

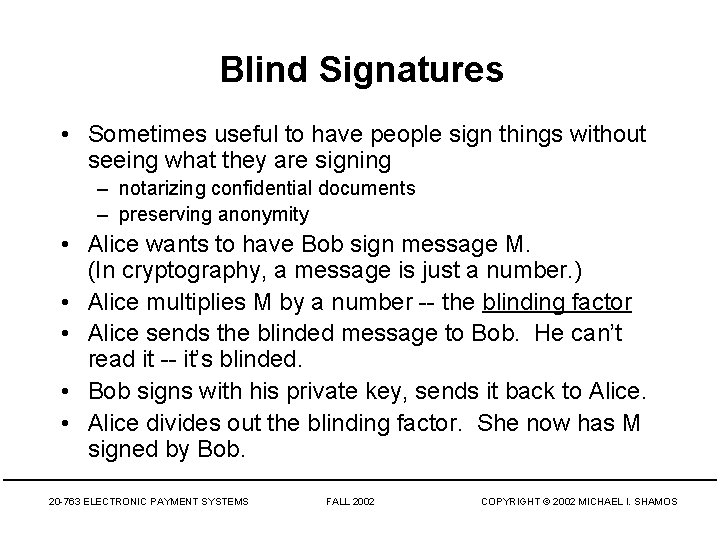

Blind Signatures • Sometimes useful to have people sign things without seeing what they are signing – notarizing confidential documents – preserving anonymity • Alice wants to have Bob sign message M. (In cryptography, a message is just a number. ) • Alice multiplies M by a number -- the blinding factor • Alice sends the blinded message to Bob. He can’t read it -- it’s blinded. • Bob signs with his private key, sends it back to Alice. • Alice divides out the blinding factor. She now has M signed by Bob. 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Blind Signatures • • Alice wants to have Bob sign message M. Bob’s public key is (e, n). Bob’s private key is d. Alice picks a blinding factor k between 1 and n. Alice blinds the message M by computing T = M ke (mod n) She sends T to Bob. e • d = 1 (mod n) • Bob signs T by computing Td = (M ke)d (mod n) = Md k (mod n) • Alice unblinds this by dividing out the blinding factor: S = Td/k = Md k (mod n)/k = Md (mod n) • But this is the same as if Bob had just signed M, except Bob was unable to read T 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Blind Signatures • It’s a problem signing documents you can’t read • Blind signatures are only used in special situations • Example: – Ask a bank to sign (certify) an electronic coin for $100 – It uses a special signature good only for $100 coins • Blind signatures are the basis of anonymous ecash 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

e. Cash (Formerly Digi. Cash) ALICE SEND UNSIGNED BLINDED COINS TO THE BANK Withdrawal (Minting): WALLET SOFTWARE ALICE BUYS DIGITAL COINS FROM A BANK SIGNS COINS, SENDS THEM BACK. ALICE UNBLINDS THEM BOB VERIFIES COINS NOT SPENT ALICE PAYS BOB Spending: BOB DEPOSITS Personal Transfer: CINDY VERIFIES COINS NOT SPENT ALICE TRANSFERS COINS TO CINDY GETS COINS BACK 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

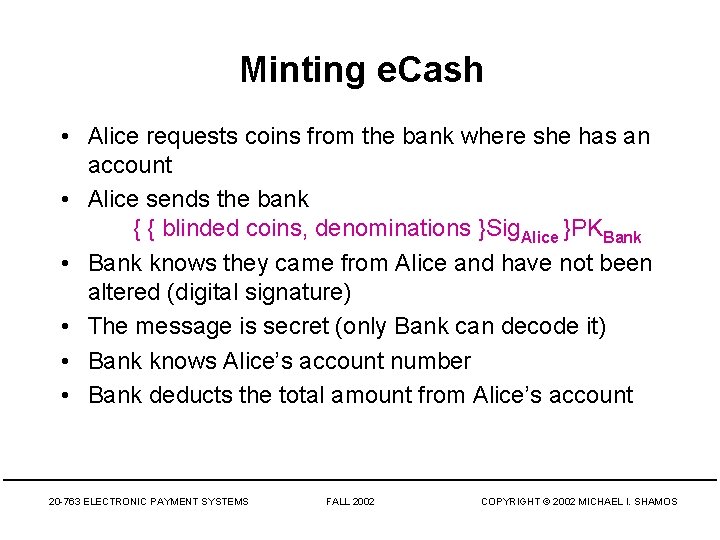

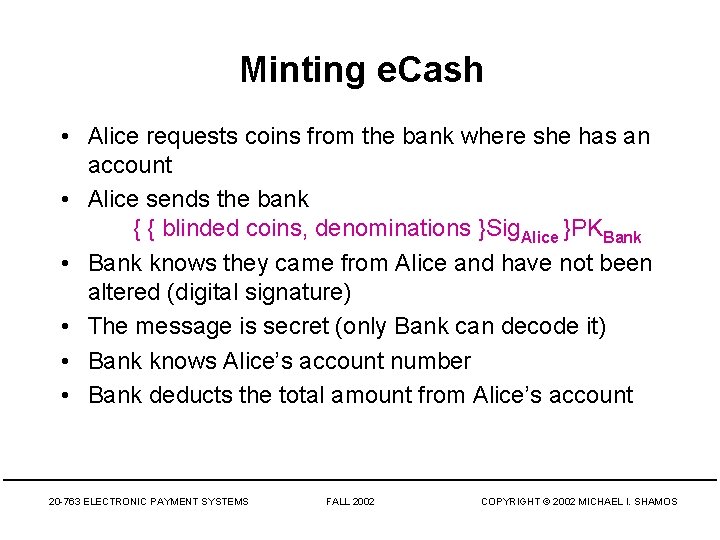

Minting e. Cash • Alice requests coins from the bank where she has an account • Alice sends the bank { { blinded coins, denominations }Sig. Alice }PKBank • Bank knows they came from Alice and have not been altered (digital signature) • The message is secret (only Bank can decode it) • Bank knows Alice’s account number • Bank deducts the total amount from Alice’s account 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Minting e. Cash, cont. • Bank now must produce signed coins for Alice • Each of Alice’s blinded coins has a serial# • Bank’s public key for $5 coins is (e 5, m 5) (exponent and modulus). Private key is d 5. • Alice selects blinding factor r • Alice blinds serial# by multiplying by r e 5 (mod m 5) e 5 • d 5 = 1 (mod m 5) (serial# r e 5) (mod m 5) • Banks signs the coin with its private d 5 key: (serial# r e 5)d 5 (mod m 5) = (serial#)d 5 r (mod m 5) • Alice divides out the blinding factor r. What’s left is (serial#)d 5 (mod m 5) = { serial# } SKBank 5 Just as if bank signed serial#. But Bank doesn’t know serial#. 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

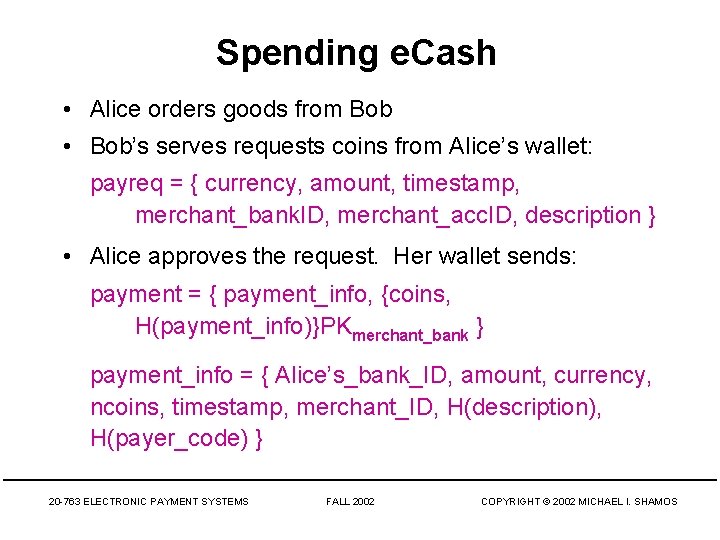

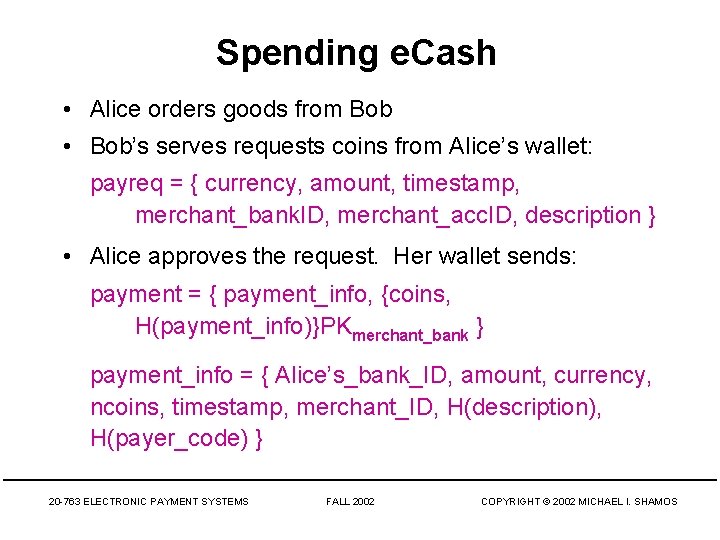

Spending e. Cash • Alice orders goods from Bob • Bob’s serves requests coins from Alice’s wallet: payreq = { currency, amount, timestamp, merchant_bank. ID, merchant_acc. ID, description } • Alice approves the request. Her wallet sends: payment = { payment_info, {coins, H(payment_info)}PKmerchant_bank } payment_info = { Alice’s_bank_ID, amount, currency, ncoins, timestamp, merchant_ID, H(description), H(payer_code) } 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

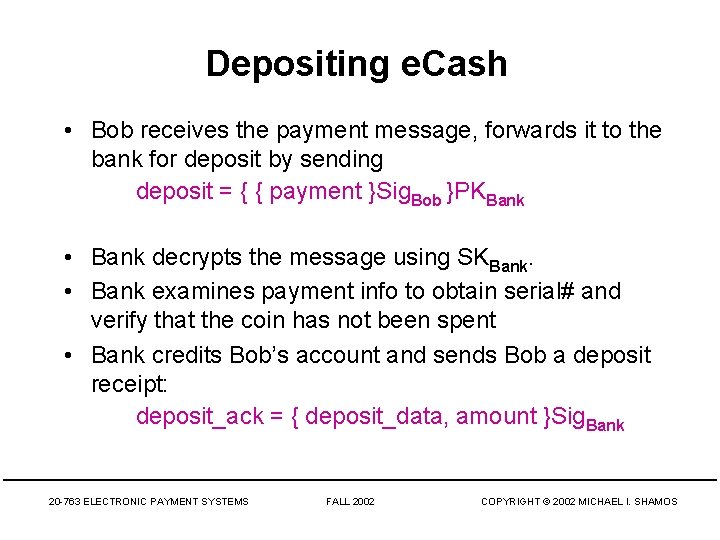

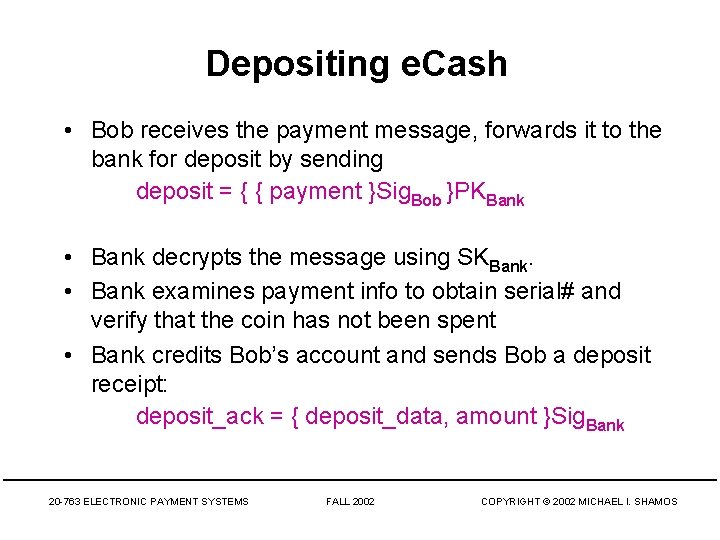

Depositing e. Cash • Bob receives the payment message, forwards it to the bank for deposit by sending deposit = { { payment }Sig. Bob }PKBank • Bank decrypts the message using SKBank. • Bank examines payment info to obtain serial# and verify that the coin has not been spent • Bank credits Bob’s account and sends Bob a deposit receipt: deposit_ack = { deposit_data, amount }Sig. Bank 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

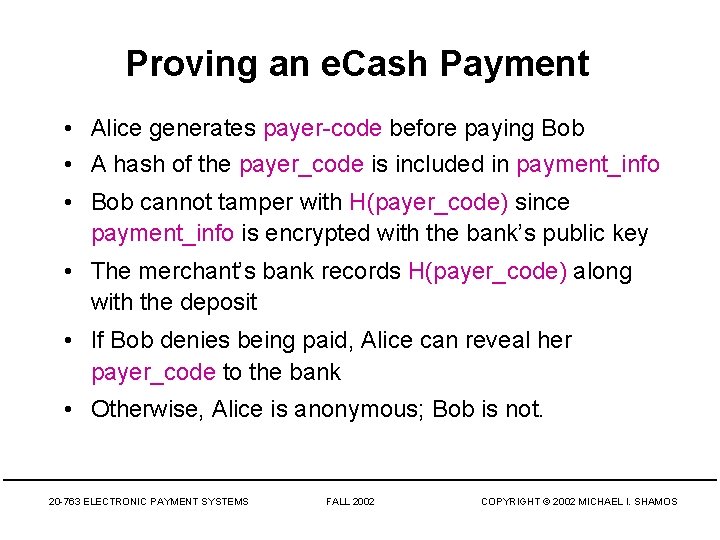

Proving an e. Cash Payment • Alice generates payer-code before paying Bob • A hash of the payer_code is included in payment_info • Bob cannot tamper with H(payer_code) since payment_info is encrypted with the bank’s public key • The merchant’s bank records H(payer_code) along with the deposit • If Bob denies being paid, Alice can reveal her payer_code to the bank • Otherwise, Alice is anonymous; Bob is not. 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Lost e. Cash • Ecash can be “lost”. Disk crashes, passwords forgotten, numbers written on paper are lost. • Alice sends a message to the bank that coins have been lost • Banks re-sends Alice her last n batches of blinded coins (n = 16) • If Alice still has the blinding factor, she can unblind • Alice deposits all the coins bank in the bank. (The ones that were spent will be rejected. ) • Alice now withdraws new coins 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Anonymous Ecash Crime • • Kidnapper takes hostage Ransom demand is a series of blinded coins Bank signs the coins to pay ransom Kidnapper tells bank to publish the coins in the newspaper (they’re just strings) • Only the kidnapper can unblind the coins (only he knows the blinding factor) • Kidnapper can now use the coins and is completely anonymous 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Offline Double-Spending • Double spending easy to stop in online systems: System maintains record of serial numbers of spent coins. • Suppose Bob can’t check every coin online. How does he know a coin has not been spent before? • Method 1: create a tamperproof dispenser (smart card) that will not dispense a coin more than once. – Problem: replay attack. Just record the bits as they come out. • Method 2: protocol that provably identifies the doublespender but is anonymous for the single-spender. 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Chaum Double-Spending Protocol • Is there a way for the single-sender to remain anonymous by the double-spender is revealed? • YES, if the coins are spent by trusted software • Idea: – Each time the coin is spent, insert information about the buyer of the coin – But, the information can be read only if two different pieces of data are received – If the coin is spent only once, no possibility of different data 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Chaum Double-Spending Protocol • Alice wants 100 five-dollar coins. • Alice sends 200 five-dollar coins to the bank (twice as many as she needs). For each coin, she – Combines b different random numbers with her account number and the coin serial number (using exclusive-OR ) – Blinds the coin • Bank selects half the coins (100), signs them, gives them back to Alice • Bank asks her for the random numbers for the other 100 coins and uses it to read her account number – Bank feels safe that the blinded coins it signed had her real account number. (It picked the 100 out of 200, not Alice. ) 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

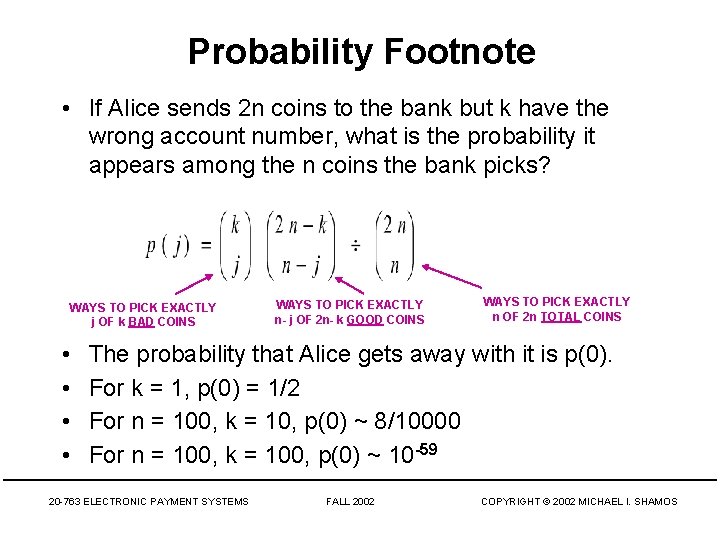

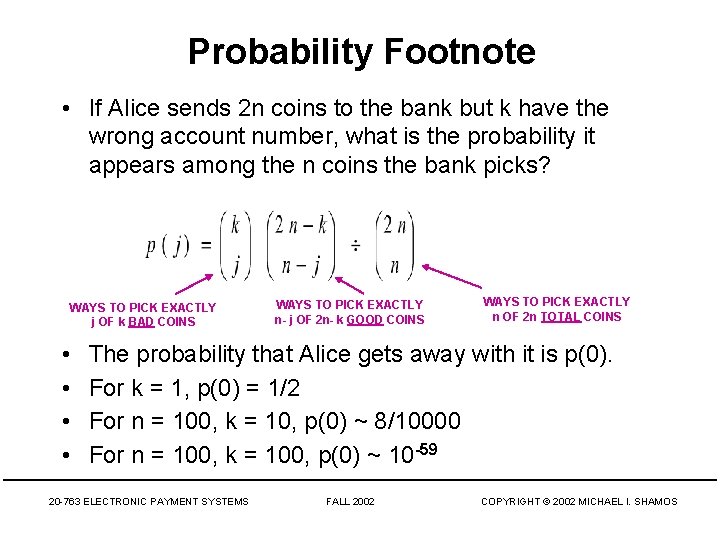

Probability Footnote • If Alice sends 2 n coins to the bank but k have the wrong account number, what is the probability it appears among the n coins the bank picks? WAYS TO PICK EXACTLY j OF k BAD COINS • • WAYS TO PICK EXACTLY n- j OF 2 n- k GOOD COINS WAYS TO PICK EXACTLY n OF 2 n TOTAL COINS The probability that Alice gets away with it is p(0). For k = 1, p(0) = 1/2 For n = 100, k = 10, p(0) ~ 8/10000 For n = 100, k = 100, p(0) ~ 10 -59 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Chaum Protocol • Alice’s account number is 12, which in hex is 0 C = 00001100 • Alice picks serial number 100 and blinding number 5 • She asks the bank for a coin with serial number 100 x 5 = 500 • Alice chooses a number b and creates b random numbers for this coin. Say b=6 • Alice’s wallet XORs each random number with her account number: 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

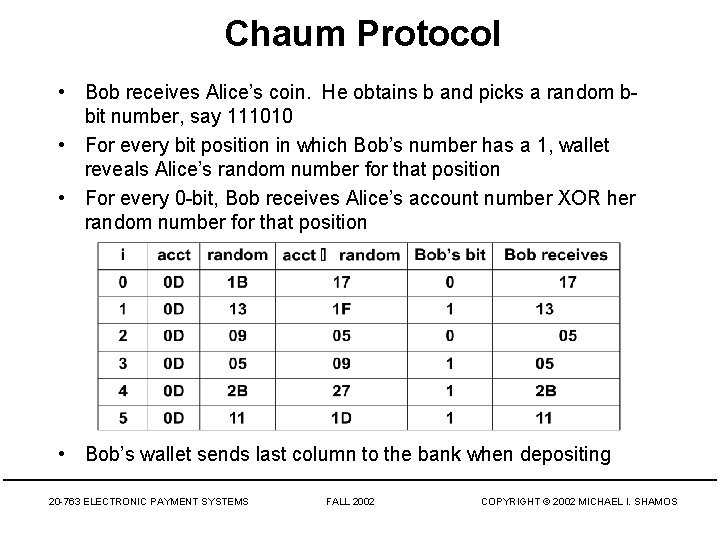

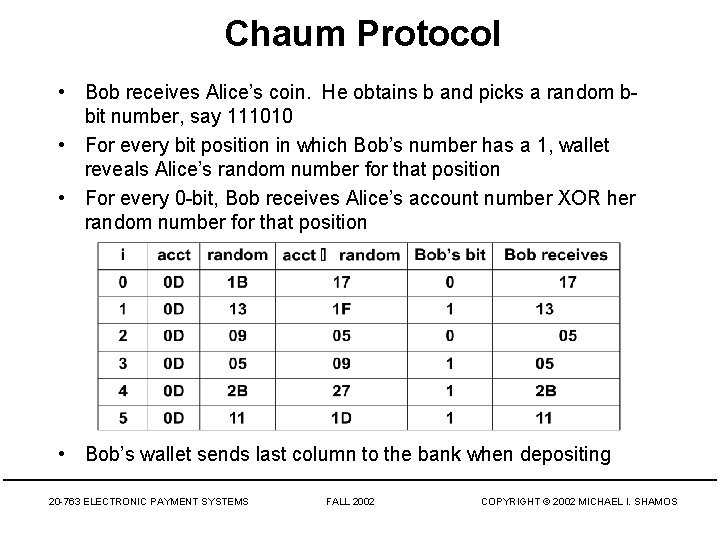

Chaum Protocol • Bob receives Alice’s coin. He obtains b and picks a random bbit number, say 111010 • For every bit position in which Bob’s number has a 1, wallet reveals Alice’s random number for that position • For every 0 -bit, Bob receives Alice’s account number XOR her random number for that position • Bob’s wallet sends last column to the bank when depositing 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

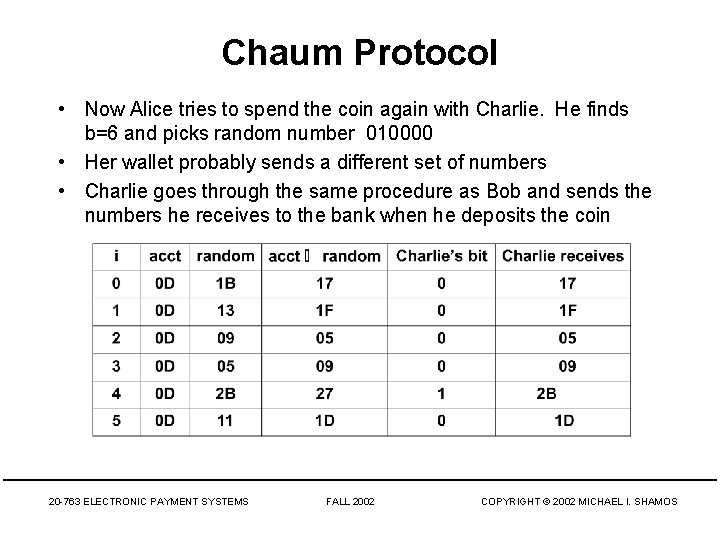

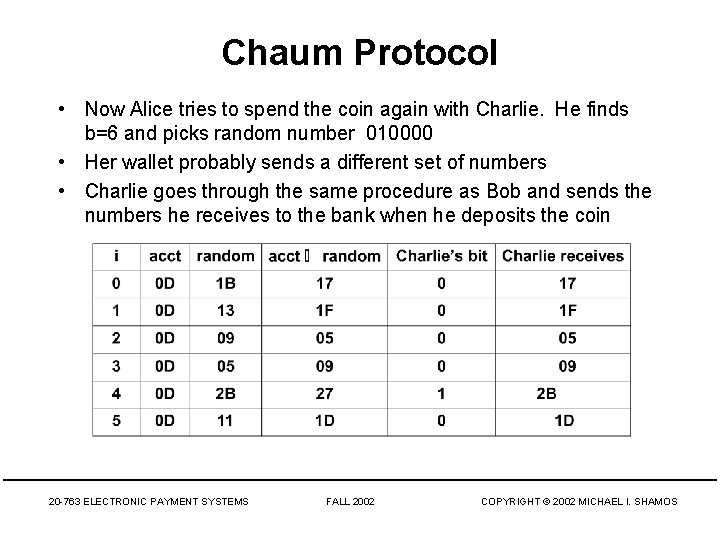

Chaum Protocol • Now Alice tries to spend the coin again with Charlie. He finds b=6 and picks random number 010000 • Her wallet probably sends a different set of numbers • Charlie goes through the same procedure as Bob and sends the numbers he receives to the bank when he deposits the coin 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Chaum Protocol • The bank refuses to pay Charlie, since the coin was previously deposited by Bob • The bank combines data from Bob and Charlie (or both) using XOR where it has different data from the two sources: • This identifies Alice as the cheater! Neither Bob nor Alice nor the bank could do it alone 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Chaum Protocol • If Alice’s random number has b bits, what is the probability she can spend a coin twice without being detected? • Bob and Charlie’s random numbers would have to be identical. If they differ by 1 bit, the bank can identify Alice. • Probability that two b-bit numbers are identical p(b) = 2 -b p(1) = 0. 5 p(10) ~. 001 p(20) ~ 1/1, 000 p(30) ~ 1/1, 000, 000 p(64) ~ 5 x 10 -20 p(128) ~ 3 x 10 -39 • Chaum protocol does not guarantee detection 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Major Ideas • • e. Cash raises great security concerns e. Cash provides protection against loss e. Cash raises significant legal problems e. Cash is difficult to implement with both anonymity and protection against double spending • e. Cash may not be successful because of storedvalue cards and peer-to-peer systems 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS

Q&A 20 -763 ELECTRONIC PAYMENT SYSTEMS FALL 2002 COPYRIGHT © 2002 MICHAEL I. SHAMOS