EE 369 POWER SYSTEM ANALYSIS Lecture 17 Optimal

- Slides: 29

EE 369 POWER SYSTEM ANALYSIS Lecture 17 Optimal Power Flow, LMPs Tom Overbye and Ross Baldick 1

Announcements l Read Chapter 7 (sections 7. 1 to 7. 3). l Homework 12 is 6. 62, 6. 63, 6. 67 (calculate economic dispatch for values of load from 55 MW to 350 MW); due Tuesday, 11/29. l Class review and course evaluation on Tuesday, 11/29. l Midterm III on Thursday, 12/1, including material through Homework 12. 2

Electricity Markets • Over last 20 years electricity markets have moved from bilateral contracts between utilities to also include centralized markets operated by Independent System Operators/Regional Transmission Operators: – Day-ahead market that establishes unit commitment and “forward financial positions, ” – Real-time market, run every 5 or 15 minutes that arranges for physical dispatch, the “spot” market. • Basic “engine” for operating centralized markets is Optimal Power Flow (OPF). 3

Electricity Markets l OPF is used as basis for day-ahead and realtime dispatch pricing in US ISO/RTO electricity markets: l MISO, PJM, ISO-NE, NYISO, SPP, CA, and ERCOT. l Electricity (MWh) is treated as a commodity (like corn, coffee, natural gas) but with the extent of the market limited by transmission system constraints. l Tools of commodity trading have been widely adopted (options, forwards, hedges, swaps). 4

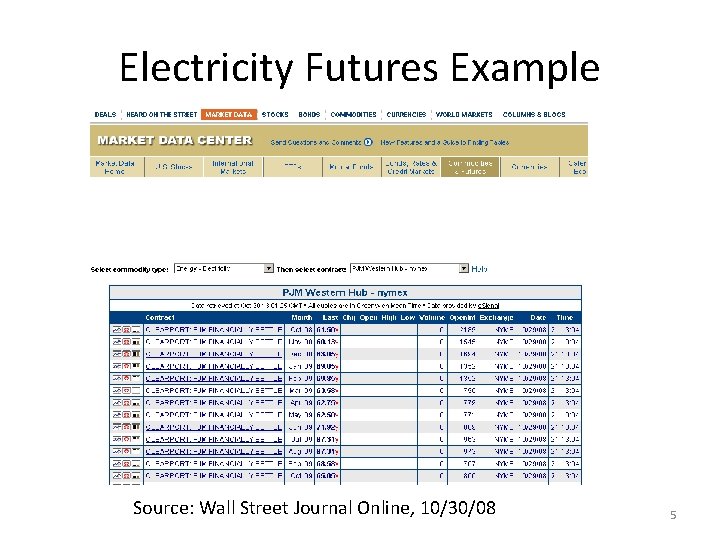

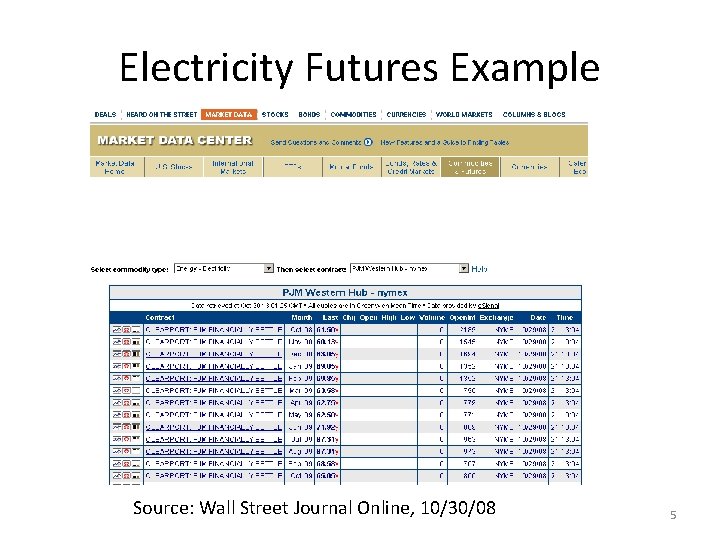

Electricity Futures Example Source: Wall Street Journal Online, 10/30/08 5

“Ideal” Power Market l Ideal power market is analogous to a lake. Generators supply energy to lake and loads remove energy. l Ideal power market has no transmission constraints l Single marginal cost associated with enforcing constraint that supply = demand – buy from the least cost unit that is not at a limit – this price is the marginal cost. l This solution is identical to the economic dispatch problem solution. 6

Two Bus ED Example 7

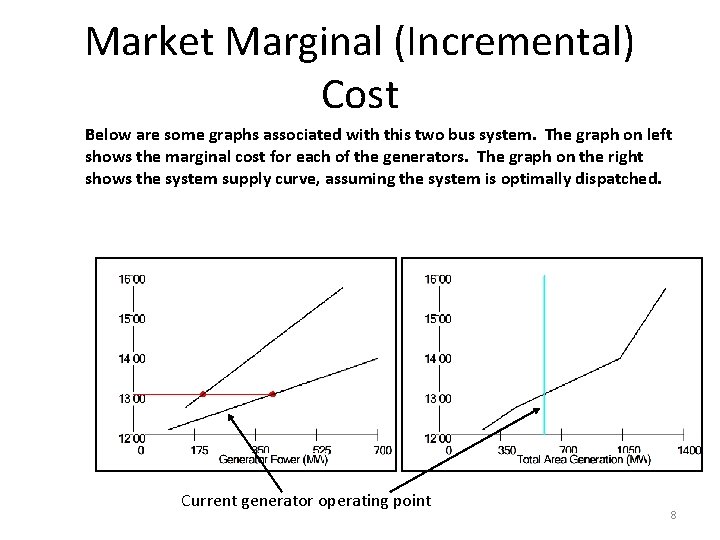

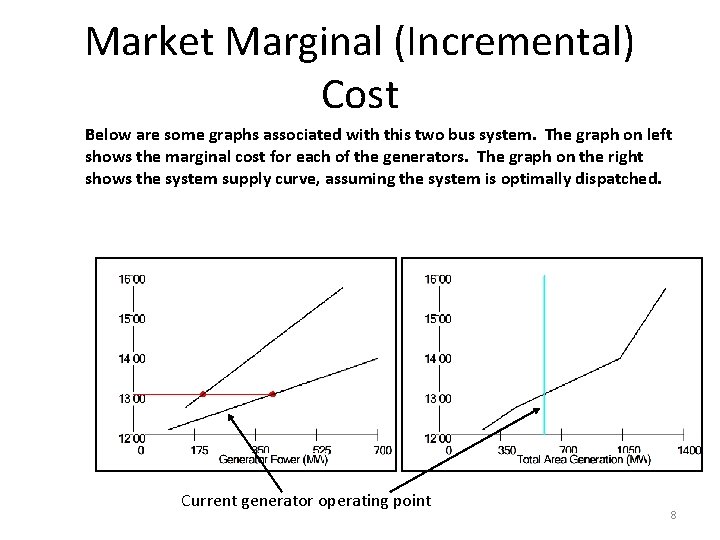

Market Marginal (Incremental) Cost Below are some graphs associated with this two bus system. The graph on left shows the marginal cost for each of the generators. The graph on the right shows the system supply curve, assuming the system is optimally dispatched. Current generator operating point 8

Real Power Markets l Different operating regions impose constraints – may limit ability to achieve economic dispatch “globally. ” l Transmission system imposes constraints on the market: l Marginal costs differ at different buses. l Optimal dispatch solution requires solution by an optimal power flow l Charging for energy based on marginal costs at different buses is called “locational marginal pricing” (LMP) or “nodal” pricing. 9

Pricing Electricity l LMP indicates the additional cost to supply an additional amount of electricity to bus. l All North American ISO/RTO electricicity markets price wholesale energy at LMP. l If there were no transmission limitations then the LMPs would be the same at all buses: l Equal to value of lambda from economic dispatch. l Transmission constraints result in differing LMPs at buses. l Determination of LMPs requires the solution of an “Optimal Power Flow” (OPF). 10

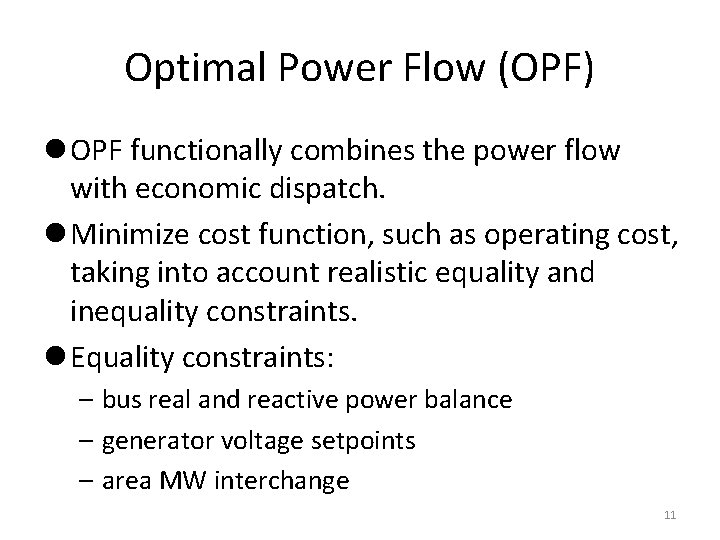

Optimal Power Flow (OPF) l OPF functionally combines the power flow with economic dispatch. l Minimize cost function, such as operating cost, taking into account realistic equality and inequality constraints. l Equality constraints: – bus real and reactive power balance – generator voltage setpoints – area MW interchange 11

OPF, cont’d l Inequality constraints: – transmission line/transformer/interface flow limits – generator MW limits – generator reactive power capability curves – bus voltage magnitudes (not yet implemented in Simulator OPF) l Available Controls: – generator MW outputs – transformer taps and phase angles 12

OPF Solution Methods l Non-linear approach using Newton’s method: – handles marginal losses well, but is relatively slow and has problems determining binding constraints l Linear Programming (LP): – fast and efficient in determining binding constraints, but can have difficulty with marginal losses. – used in Power. World Simulator 13

LP OPF Solution Method l Solution iterates between: – solving a full ac power flow solution lenforces real/reactive power balance at each bus lenforces generator reactive limits lsystem controls are assumed fixed ltakes into account non-linearities – solving an LP lchanges system controls to enforce linearized constraints while minimizing cost 14

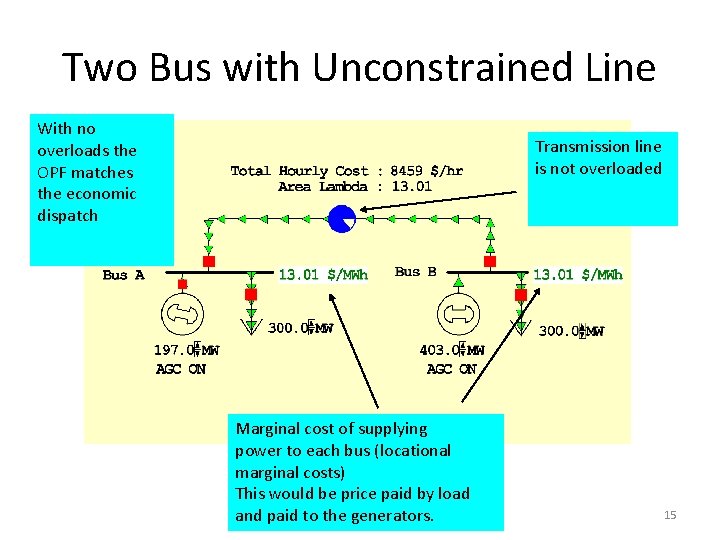

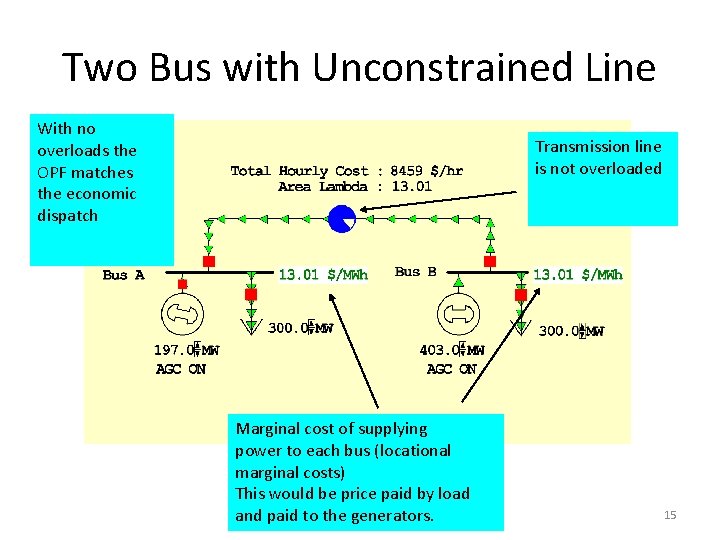

Two Bus with Unconstrained Line With no overloads the OPF matches the economic dispatch Transmission line is not overloaded Marginal cost of supplying power to each bus (locational marginal costs) This would be price paid by load and paid to the generators. 15

Two Bus with Constrained Line With the line loaded to its limit, additional load at Bus A must be supplied locally, causing the marginal costs to diverge. Similarly, prices paid by load and paid to generators will differ bus by bus. (In practice, some markets such as ERCOT charge zonal averaged price to load. ) 16

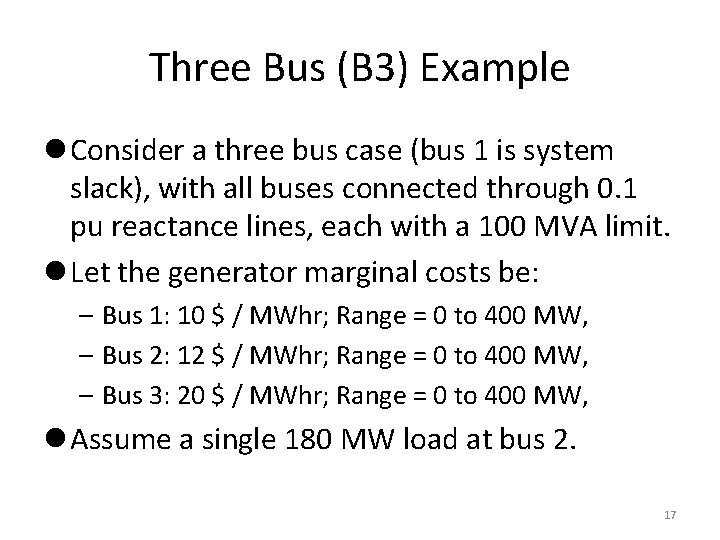

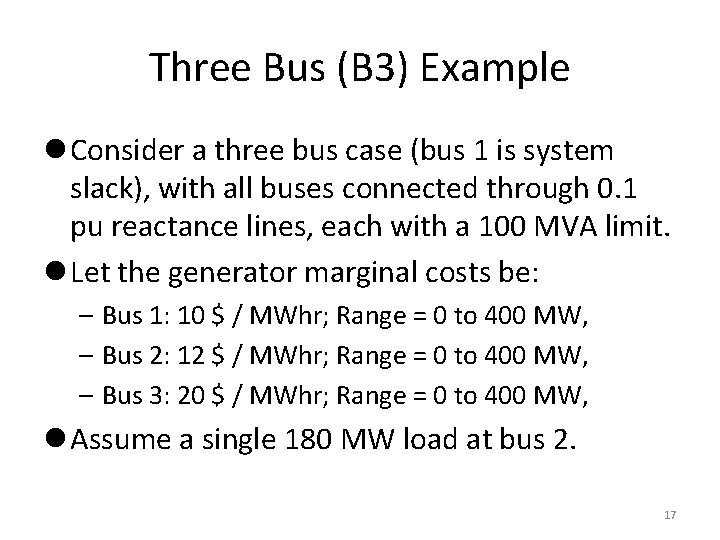

Three Bus (B 3) Example l Consider a three bus case (bus 1 is system slack), with all buses connected through 0. 1 pu reactance lines, each with a 100 MVA limit. l Let the generator marginal costs be: – Bus 1: 10 $ / MWhr; Range = 0 to 400 MW, – Bus 2: 12 $ / MWhr; Range = 0 to 400 MW, – Bus 3: 20 $ / MWhr; Range = 0 to 400 MW, l Assume a single 180 MW load at bus 2. 17

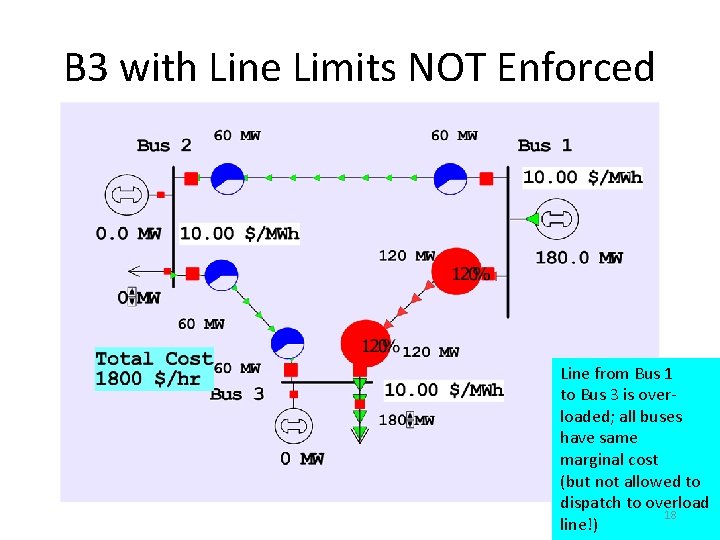

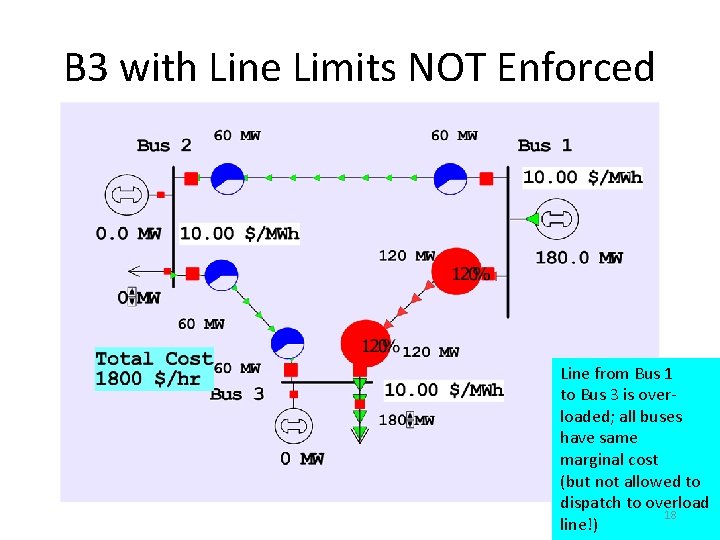

B 3 with Line Limits NOT Enforced Line from Bus 1 to Bus 3 is overloaded; all buses have same marginal cost (but not allowed to dispatch to overload 18 line!)

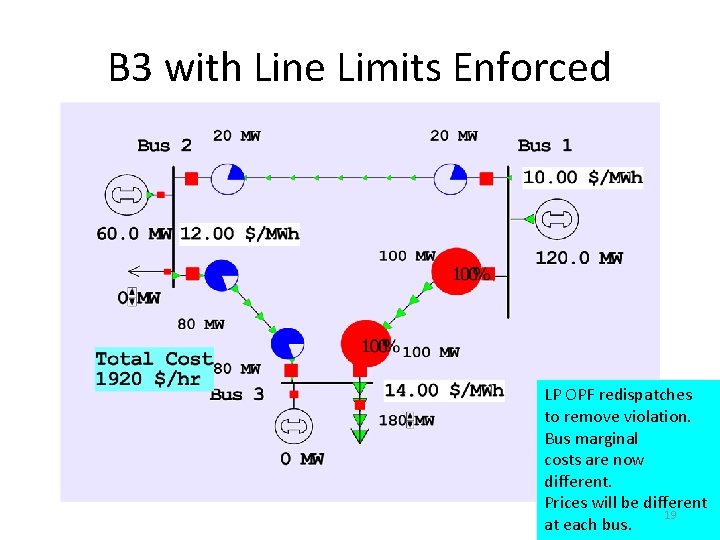

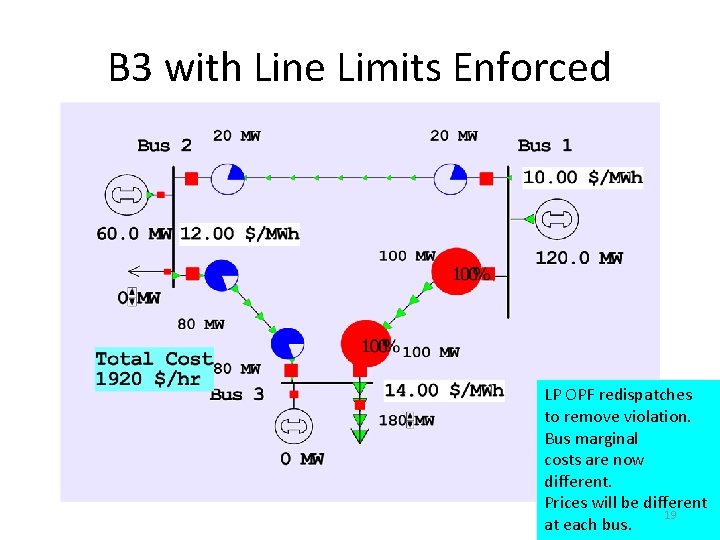

B 3 with Line Limits Enforced LP OPF redispatches to remove violation. Bus marginal costs are now different. Prices will be different 19 at each bus.

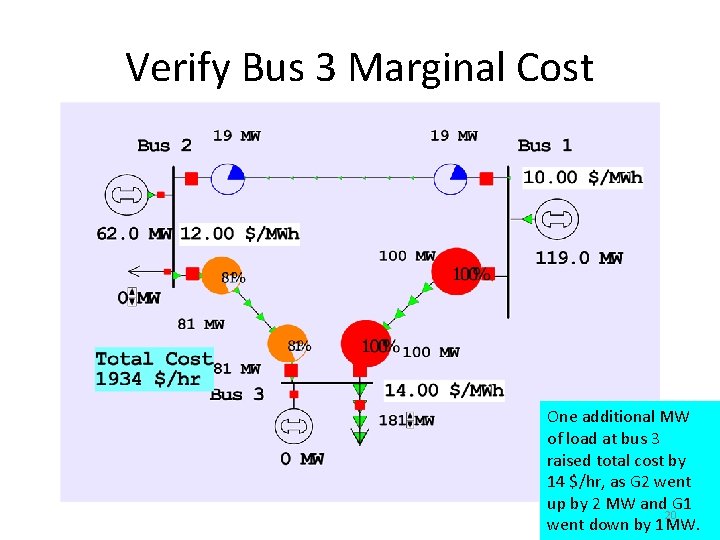

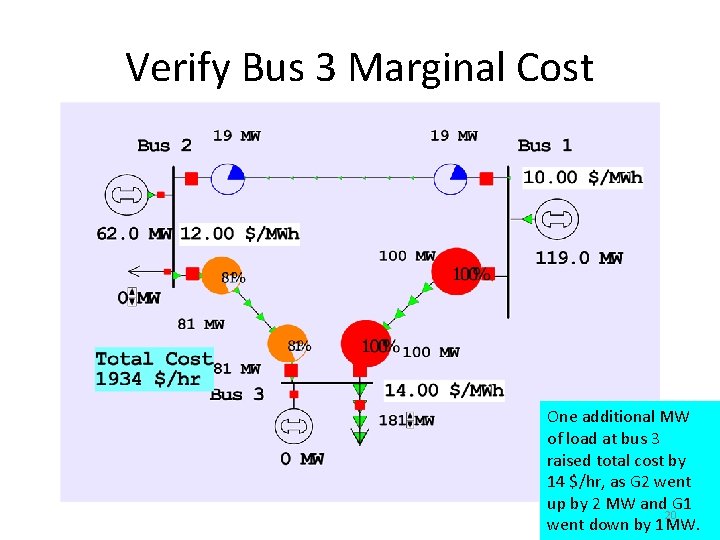

Verify Bus 3 Marginal Cost One additional MW of load at bus 3 raised total cost by 14 $/hr, as G 2 went up by 2 MW and G 1 20 went down by 1 MW.

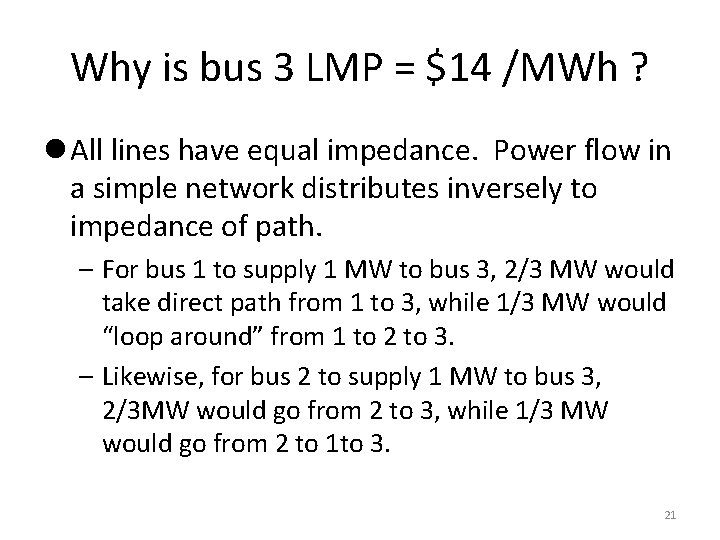

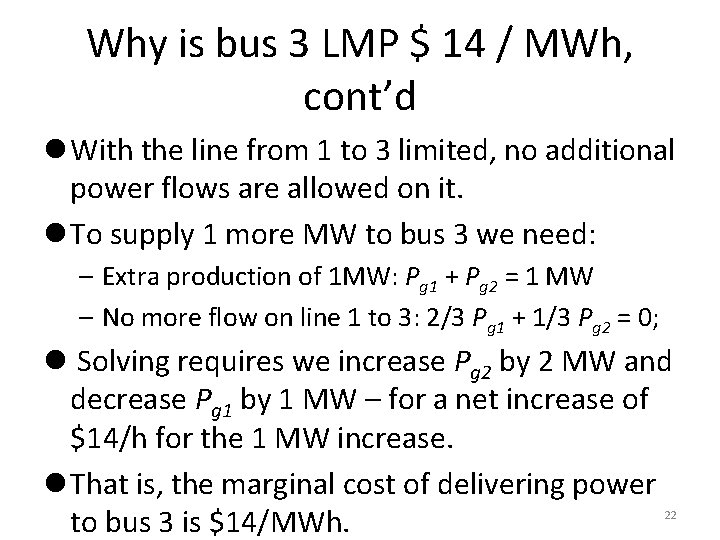

Why is bus 3 LMP = $14 /MWh ? l All lines have equal impedance. Power flow in a simple network distributes inversely to impedance of path. – For bus 1 to supply 1 MW to bus 3, 2/3 MW would take direct path from 1 to 3, while 1/3 MW would “loop around” from 1 to 2 to 3. – Likewise, for bus 2 to supply 1 MW to bus 3, 2/3 MW would go from 2 to 3, while 1/3 MW would go from 2 to 1 to 3. 21

Why is bus 3 LMP $ 14 / MWh, cont’d l With the line from 1 to 3 limited, no additional power flows are allowed on it. l To supply 1 more MW to bus 3 we need: – Extra production of 1 MW: Pg 1 + Pg 2 = 1 MW – No more flow on line 1 to 3: 2/3 Pg 1 + 1/3 Pg 2 = 0; l Solving requires we increase Pg 2 by 2 MW and decrease Pg 1 by 1 MW – for a net increase of $14/h for the 1 MW increase. l That is, the marginal cost of delivering power to bus 3 is $14/MWh. 22

Both lines into Bus 3 Congested For bus 3 loads above 200 MW, the load must be supplied locally. Then what if the bus 3 generator breaker opens? 23

Typical Electricity Markets l Electricity markets trade various commodities, with MWh being the most important. l A typical market has two settlement periods: day ahead and real-time: – Day Ahead: Generators (and possibly loads) submit offers for the next day (offer roughly represents marginal costs); OPF is used to determine who gets dispatched based upon forecasted conditions. Results are “financially” binding: either generate or pay for someone else. – Real-time: Modifies the conditions from the day ahead market based upon real-time conditions. 24

Payment l Generators are not paid their offer, rather they are paid the LMP at their bus, while the loads pay the LMP: l In most systems, loads are charged based on a zonal weighted average of LMPs. l At the residential/small commercial level the LMP costs are usually not passed on directly to the end consumer. Rather, these consumers typically pay a fixed rate that reflects time and geographical average of LMPs. l LMPs differ across the system due to transmission system “congestion. ” 25

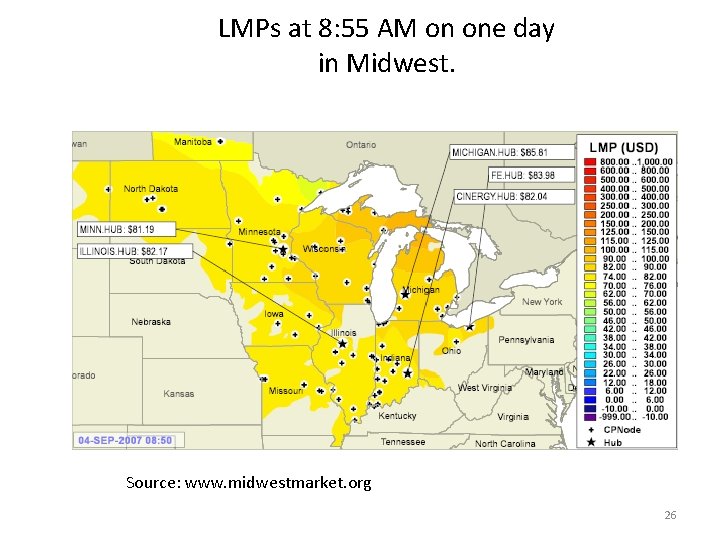

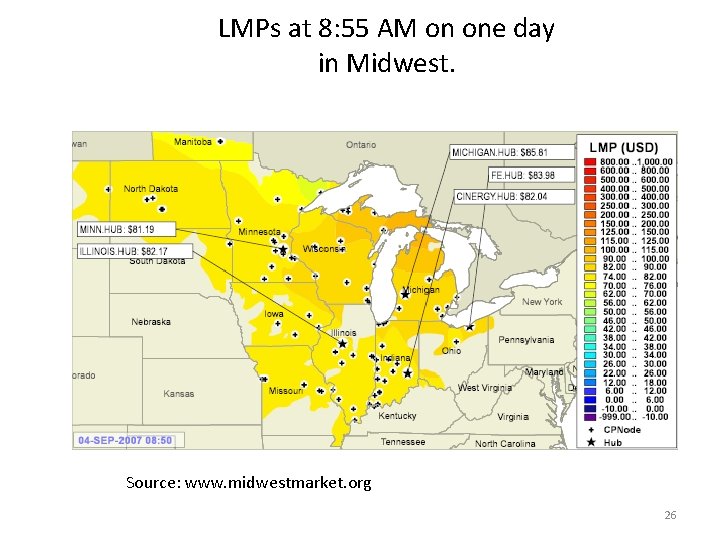

LMPs at 8: 55 AM on one day in Midwest. Source: www. midwestmarket. org 26

LMPs at 9: 30 AM on same day 27

MISO LMP Contours – 10/30/08 28

Limiting Carbon Dioxide Emissions • There is growing concern about the need to • limit carbon dioxide emissions. The two main approaches are 1) a carbon tax, or 2) a cap-and-trade system (emissions trading) • The tax approach involves setting a price and • emitter of CO 2 pays based upon how much CO 2 is emitted. A cap-and-trade system limits emissions by requiring permits (allowances) to emit CO 2. The government sets the number of allowances, allocates them initially, and then private markets set their prices and allow trade. 29