Economic Modelling Lecture 17 Small Open Economy 1

- Slides: 19

Economic Modelling Lecture 17 Small Open Economy 1

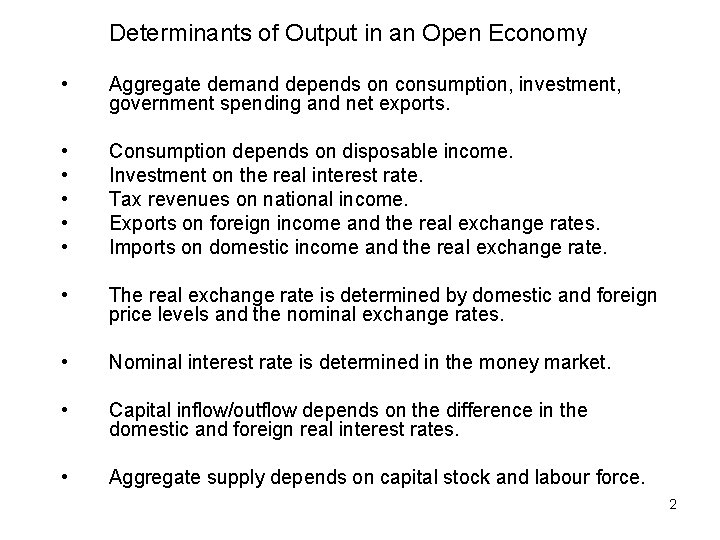

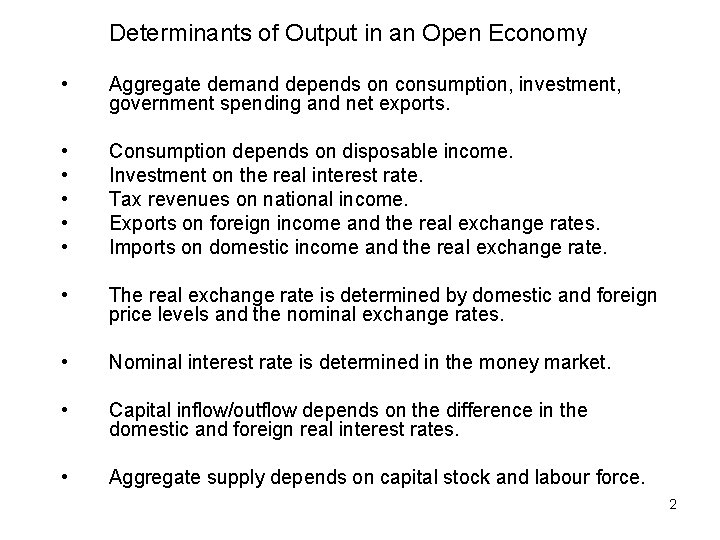

Determinants of Output in an Open Economy • Aggregate demand depends on consumption, investment, government spending and net exports. • • • Consumption depends on disposable income. Investment on the real interest rate. Tax revenues on national income. Exports on foreign income and the real exchange rates. Imports on domestic income and the real exchange rate. • The real exchange rate is determined by domestic and foreign price levels and the nominal exchange rates. • Nominal interest rate is determined in the money market. • Capital inflow/outflow depends on the difference in the domestic and foreign real interest rates. • Aggregate supply depends on capital stock and labour force. 2

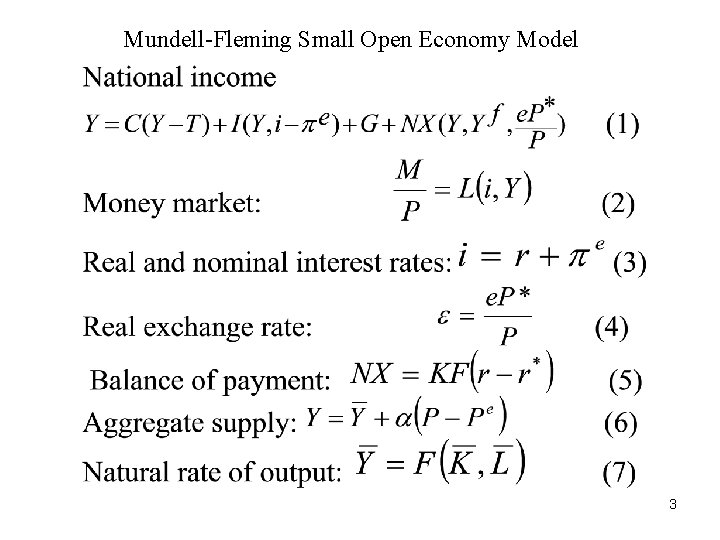

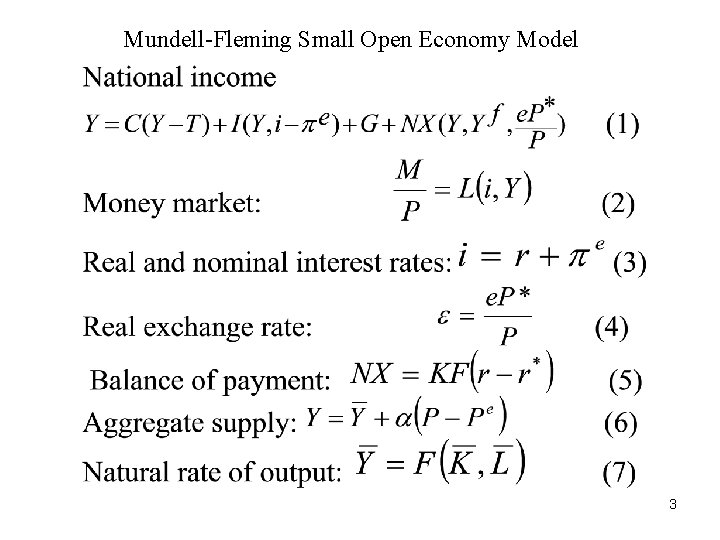

Mundell-Fleming Small Open Economy Model 3

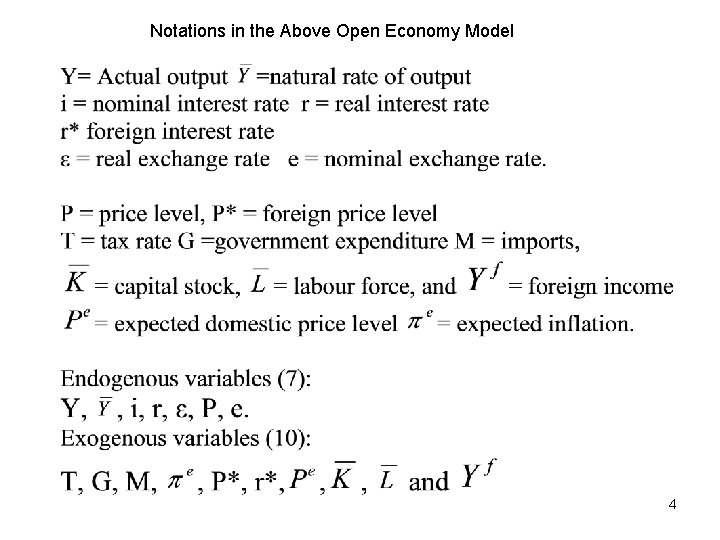

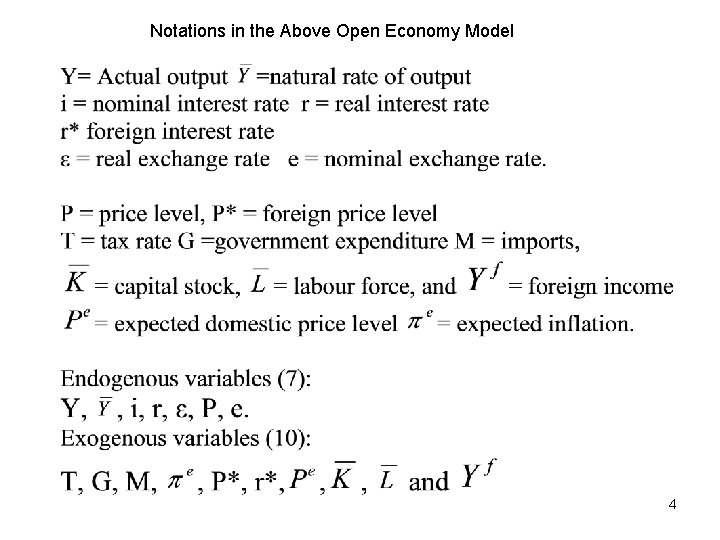

Notations in the Above Open Economy Model 4

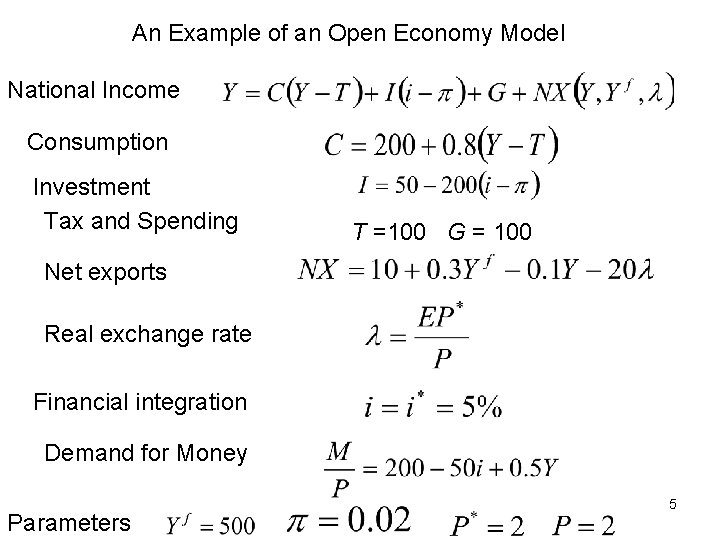

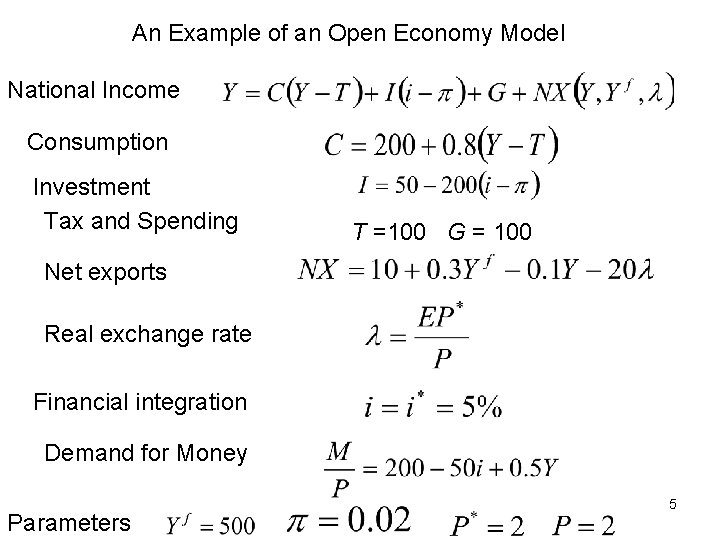

An Example of an Open Economy Model National Income Consumption Investment Tax and Spending T =100 G = 100 Net exports Real exchange rate Financial integration Demand for Money Parameters 5

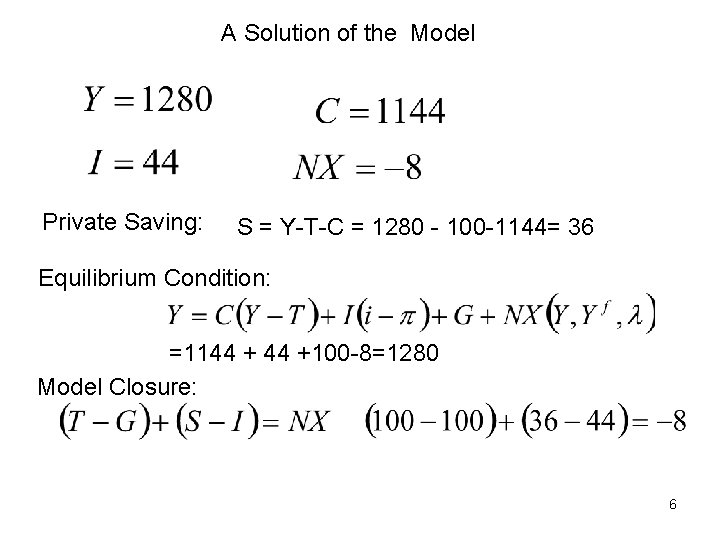

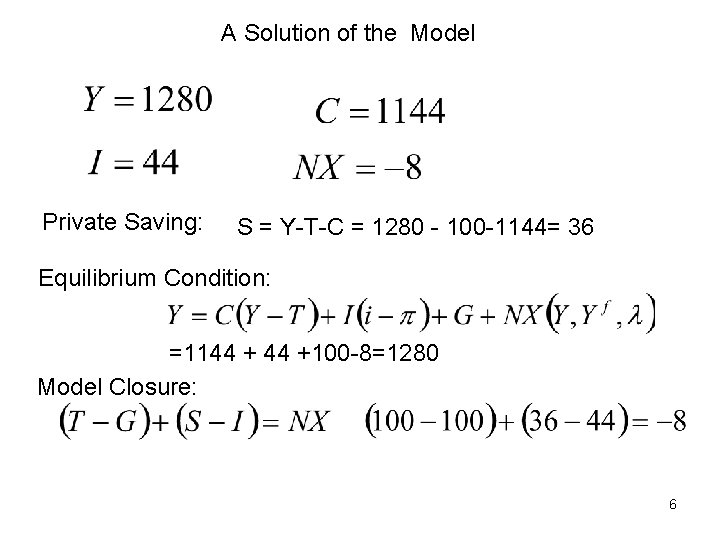

A Solution of the Model Private Saving: S = Y-T-C = 1280 - 100 -1144= 36 Equilibrium Condition: =1144 +100 -8=1280 Model Closure: 6

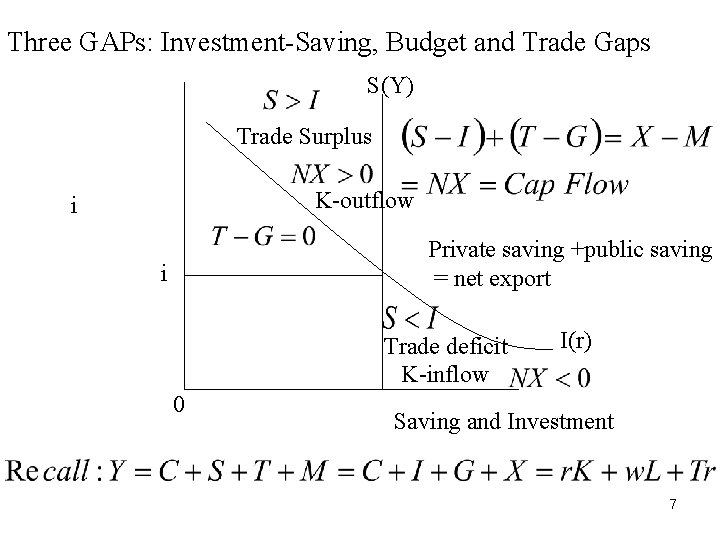

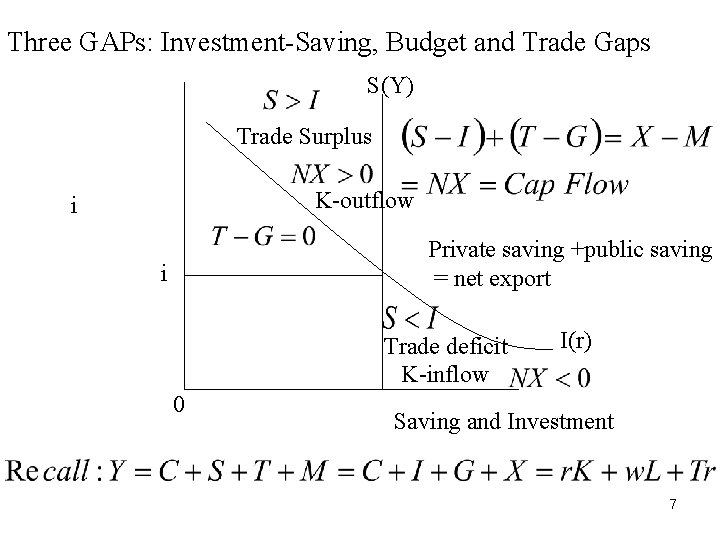

Three GAPs: Investment-Saving, Budget and Trade Gaps S(Y) Trade Surplus K-outflow i Private saving +public saving = net export i Trade deficit K-inflow 0 I(r) Saving and Investment 7

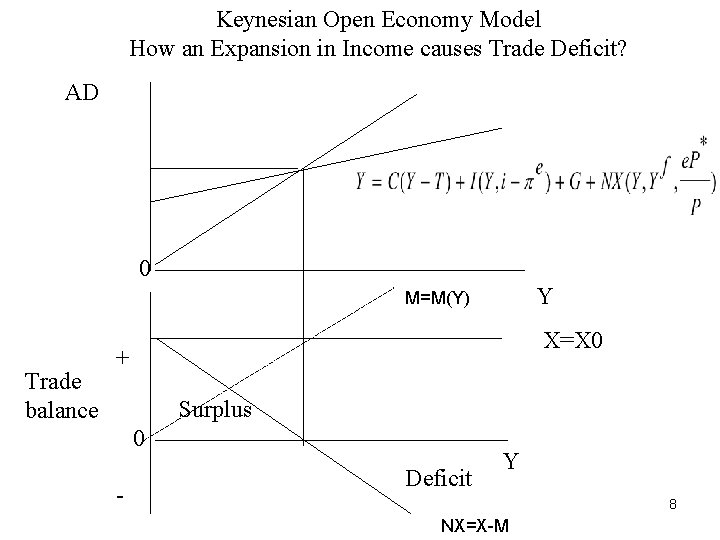

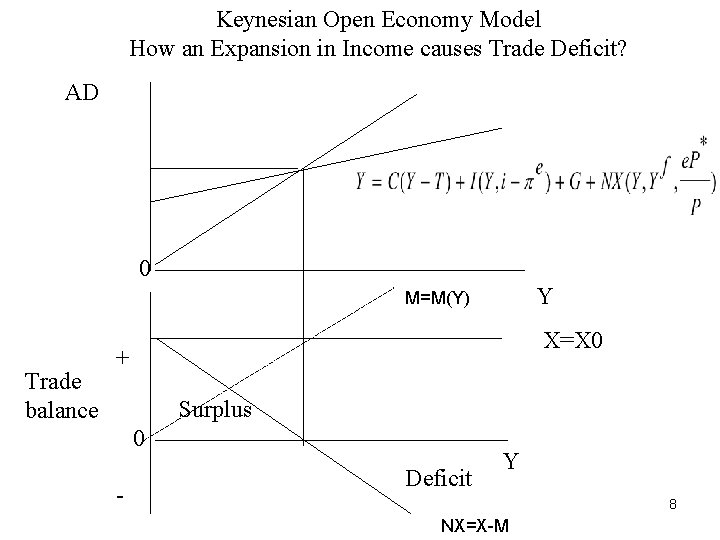

Keynesian Open Economy Model How an Expansion in Income causes Trade Deficit? AD 0 Y M=M(Y) Trade balance X=X 0 + Surplus 0 - Deficit Y 8 NX=X-M

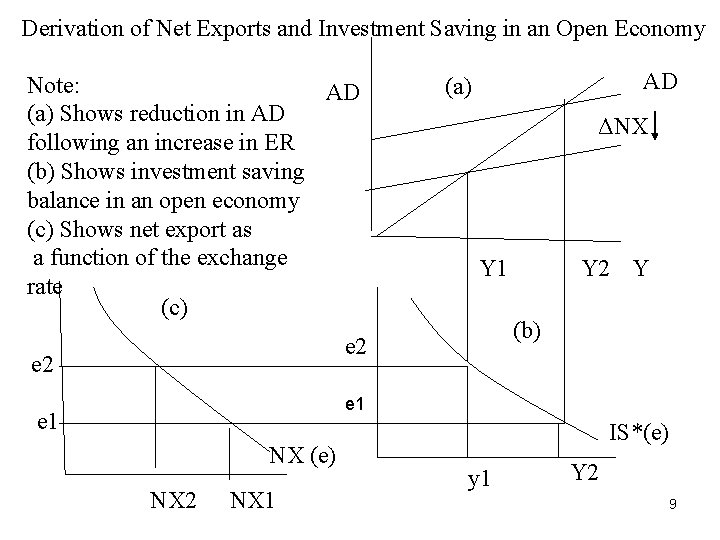

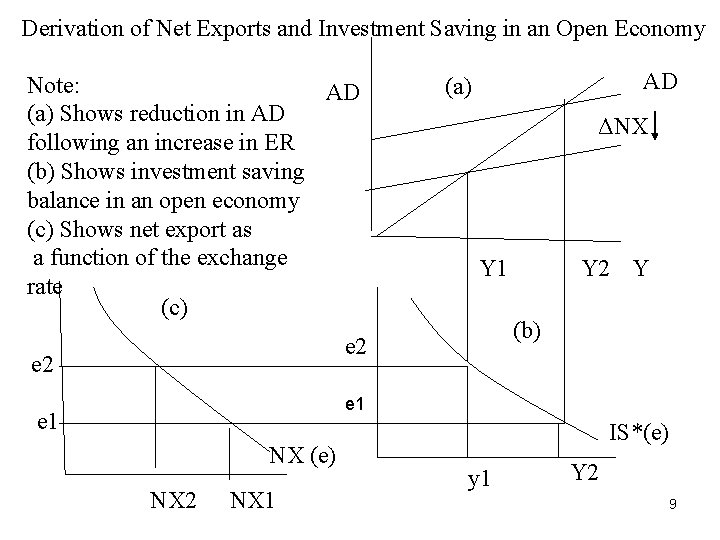

Derivation of Net Exports and Investment Saving in an Open Economy Note: AD (a) Shows reduction in AD following an increase in ER (b) Shows investment saving balance in an open economy (c) Shows net export as a function of the exchange rate (c) AD (a) ΔNX Y 1 (b) e 2 Y 2 Y e 1 NX (e) NX 2 NX 1 IS*(e) y 1 Y 2 9

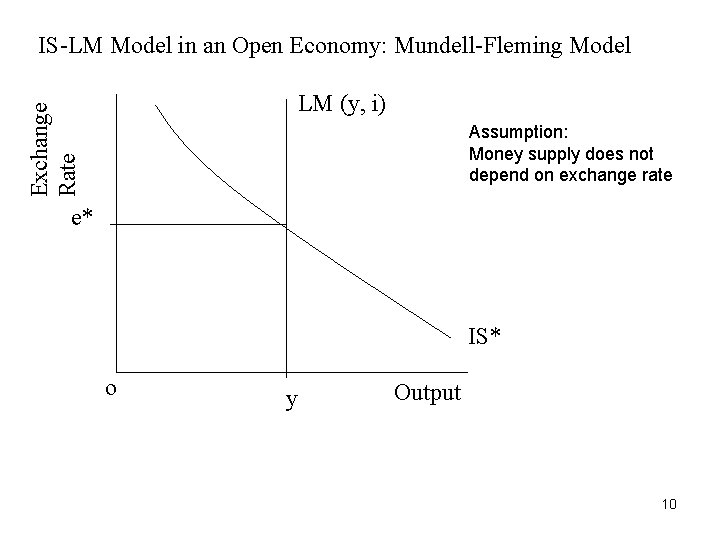

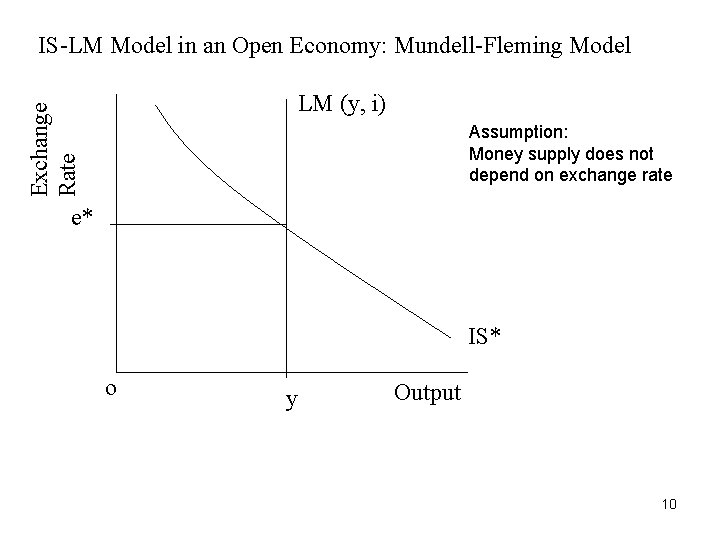

IS-LM Model in an Open Economy: Mundell-Fleming Model Exchange Rate LM (y, i) Assumption: Money supply does not depend on exchange rate e* IS* o y Output 10

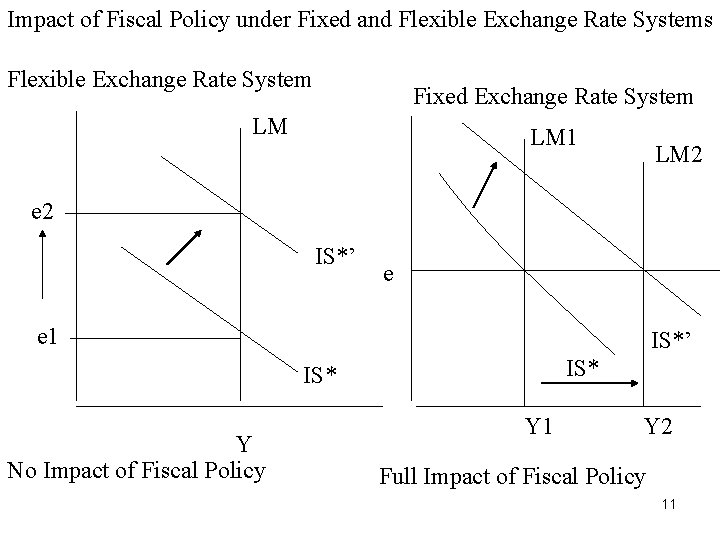

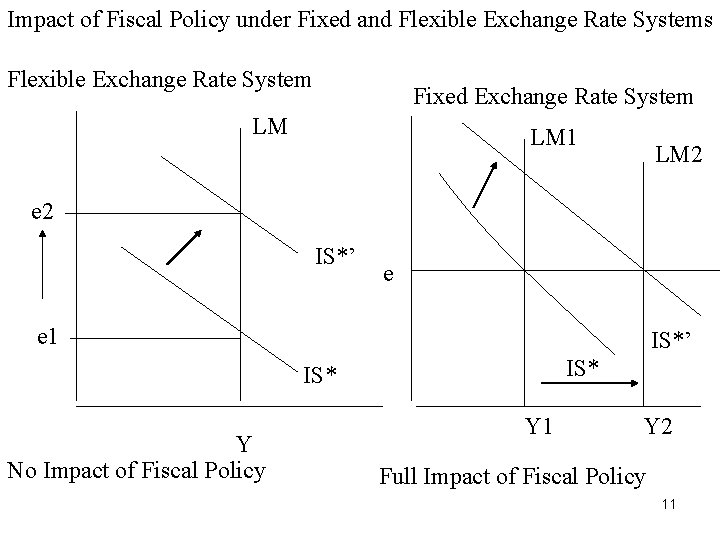

Impact of Fiscal Policy under Fixed and Flexible Exchange Rate Systems Flexible Exchange Rate System Fixed Exchange Rate System LM LM 1 LM 2 e 2 IS*’ e e 1 IS*’ IS* Y No Impact of Fiscal Policy Y 1 Y 2 Full Impact of Fiscal Policy 11

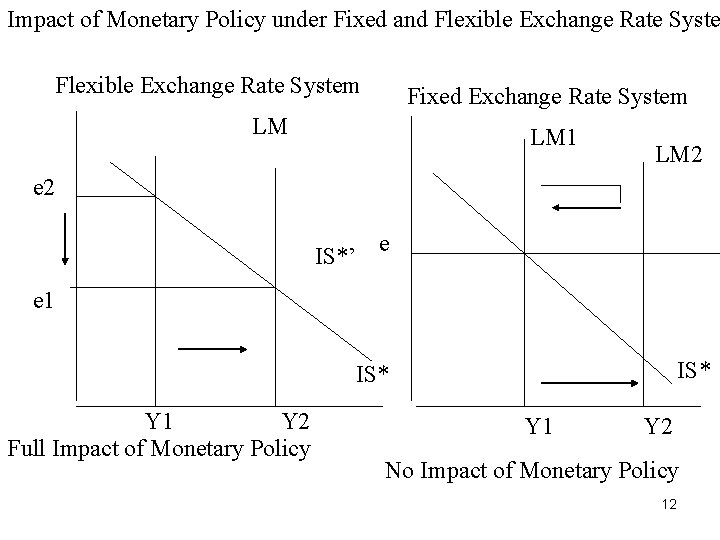

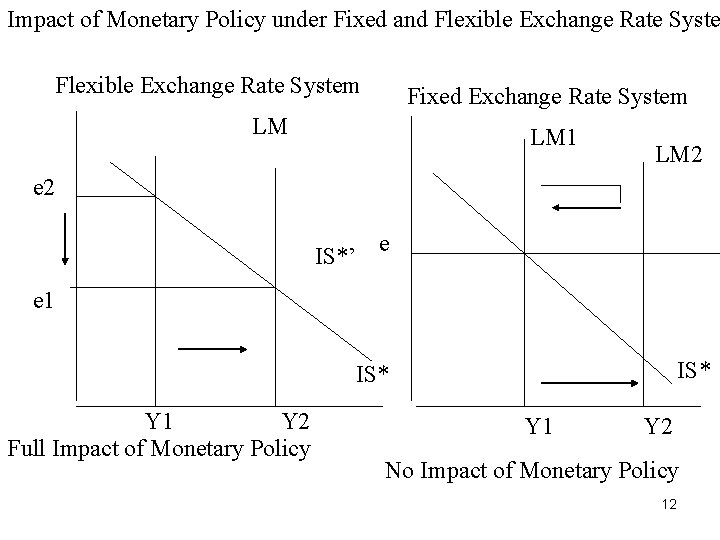

Impact of Monetary Policy under Fixed and Flexible Exchange Rate System Fixed Exchange Rate System LM LM 1 LM 2 e 2 IS*’ e e 1 IS* Y 1 Y 2 Full Impact of Monetary Policy Y 1 Y 2 No Impact of Monetary Policy 12

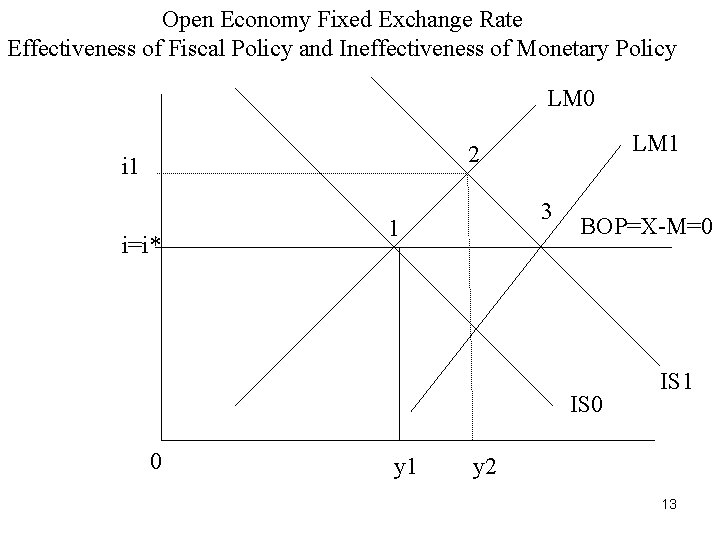

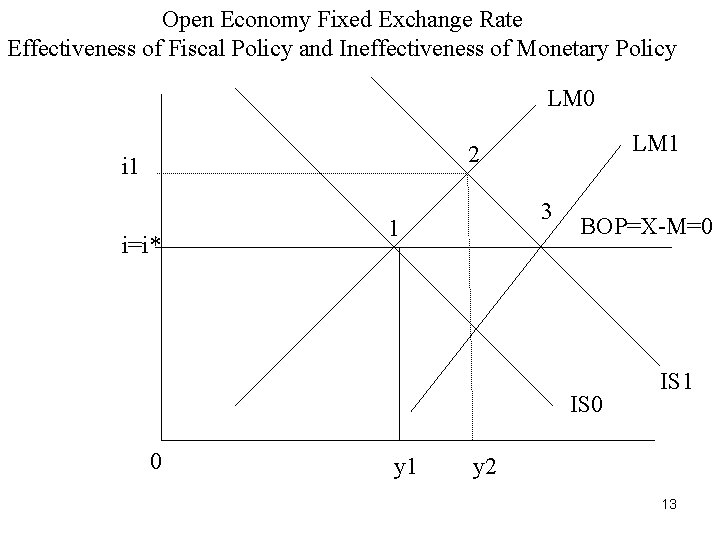

Open Economy Fixed Exchange Rate Effectiveness of Fiscal Policy and Ineffectiveness of Monetary Policy LM 0 LM 1 2 i 1 i=i* 3 1 BOP=X-M=0 IS 0 0 y 1 IS 1 y 2 13

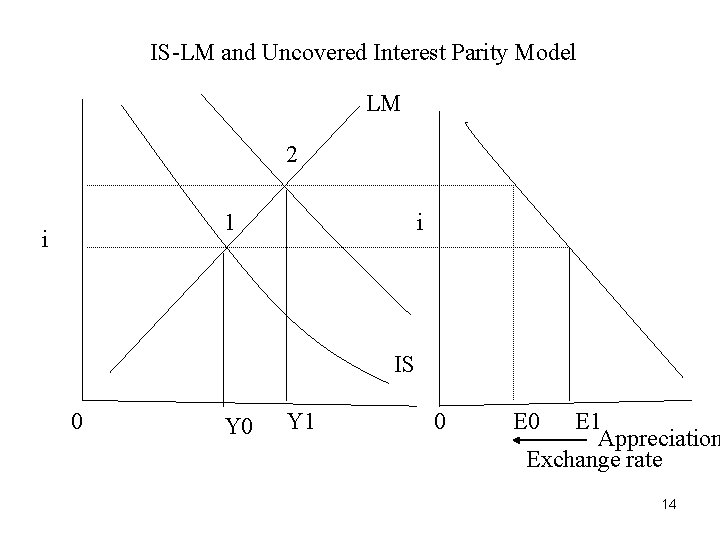

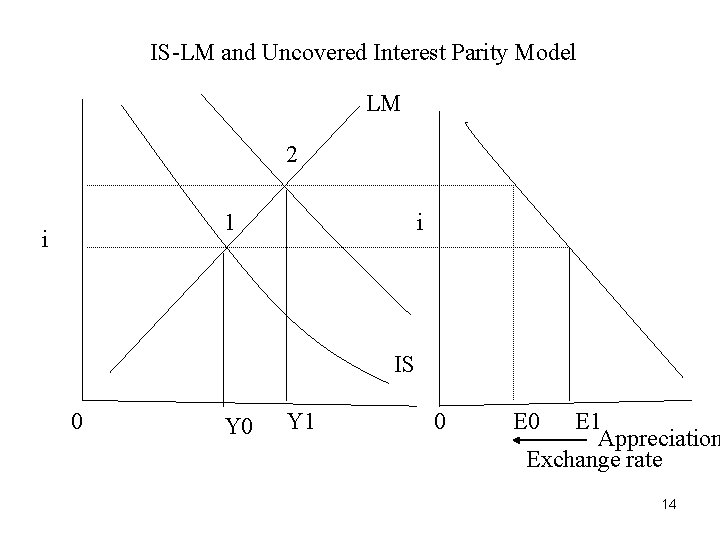

IS-LM and Uncovered Interest Parity Model LM 2 1 i i IS 0 Y 1 0 E 1 Appreciation Exchange rate 14

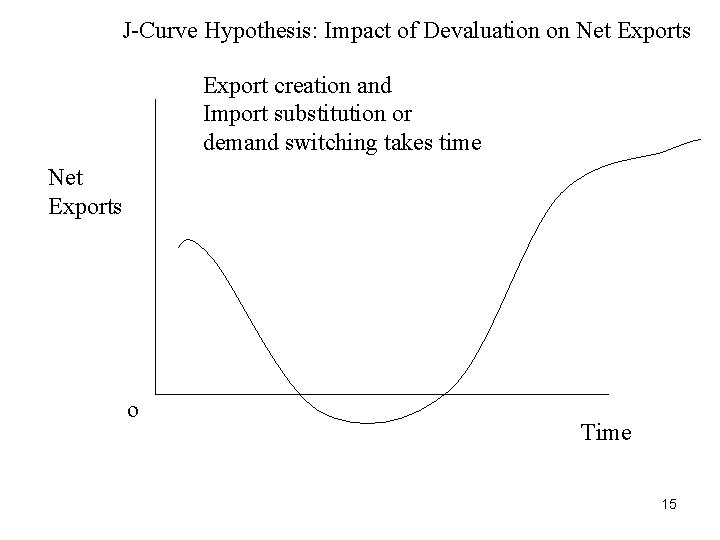

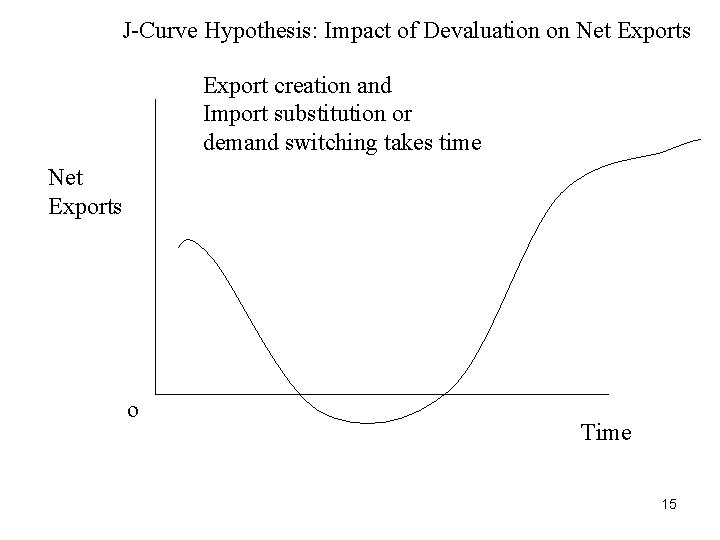

J-Curve Hypothesis: Impact of Devaluation on Net Exports Export creation and Import substitution or demand switching takes time Net Exports o Time 15

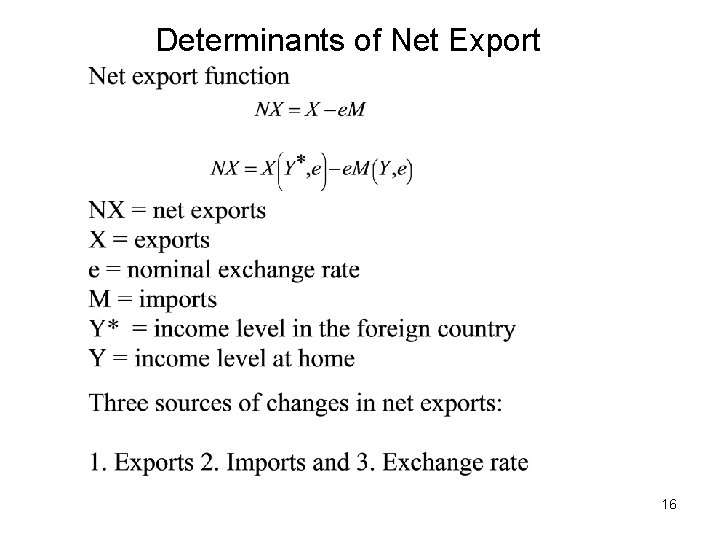

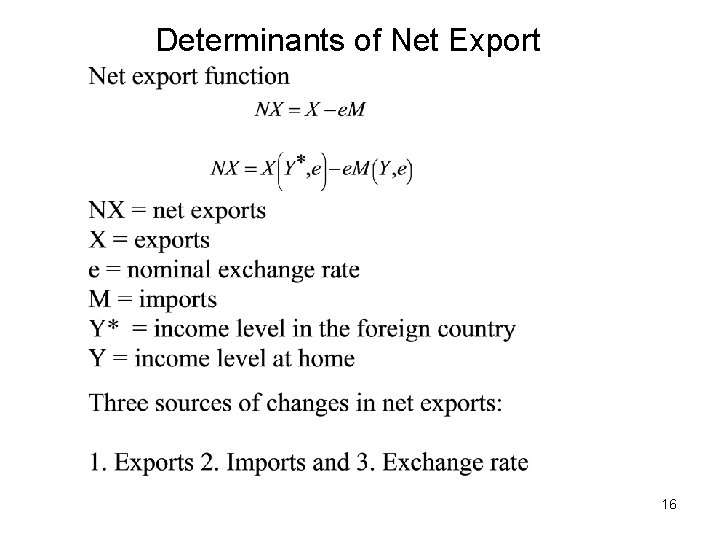

Determinants of Net Export 16

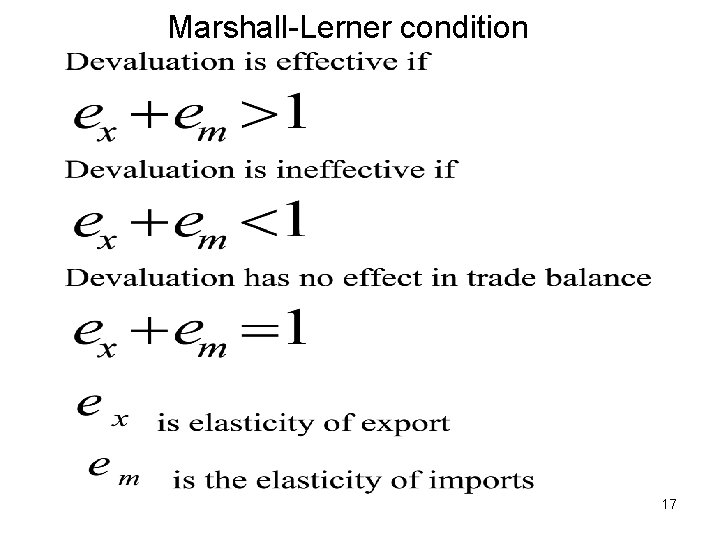

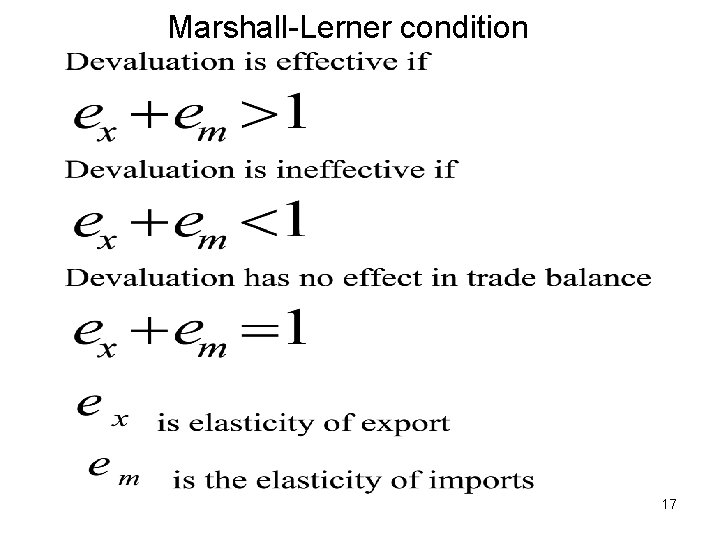

Marshall-Lerner condition 17

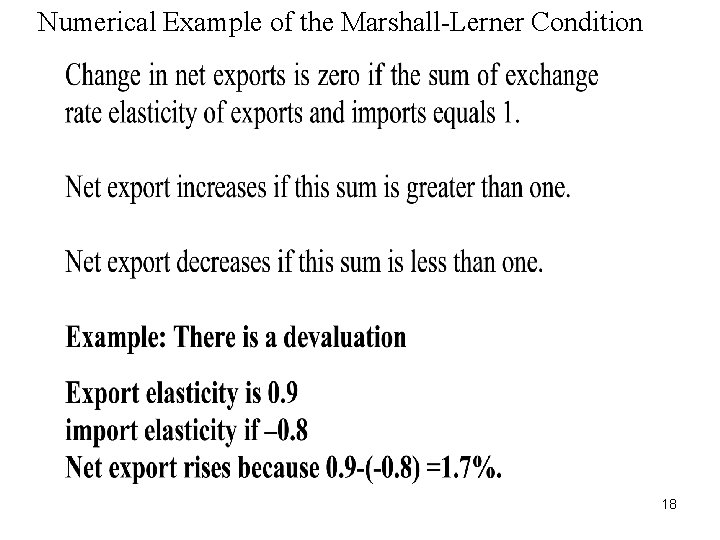

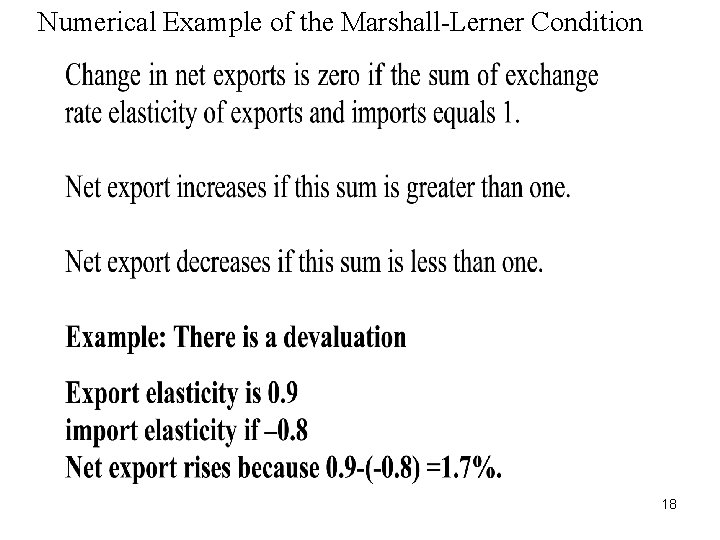

Numerical Example of the Marshall-Lerner Condition 18

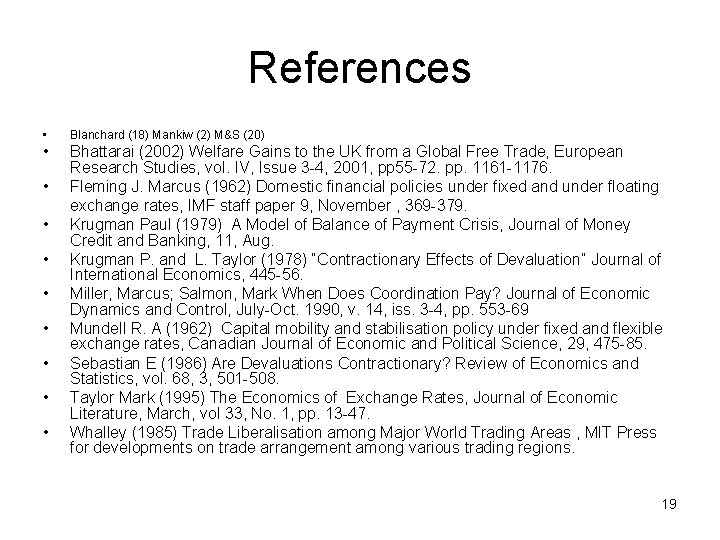

References • Blanchard (18) Mankiw (2) M&S (20) • Bhattarai (2002) Welfare Gains to the UK from a Global Free Trade, European Research Studies, vol. IV, Issue 3 -4, 2001, pp 55 -72. pp. 1161 -1176. Fleming J. Marcus (1962) Domestic financial policies under fixed and under floating exchange rates, IMF staff paper 9, November , 369 -379. Krugman Paul (1979) A Model of Balance of Payment Crisis, Journal of Money Credit and Banking, 11, Aug. Krugman P. and L. Taylor (1978) “Contractionary Effects of Devaluation” Journal of International Economics, 445 -56. Miller, Marcus; Salmon, Mark When Does Coordination Pay? Journal of Economic Dynamics and Control, July-Oct. 1990, v. 14, iss. 3 -4, pp. 553 -69 Mundell R. A (1962) Capital mobility and stabilisation policy under fixed and flexible exchange rates, Canadian Journal of Economic and Political Science, 29, 475 -85. Sebastian E (1986) Are Devaluations Contractionary? Review of Economics and Statistics, vol. 68, 3, 501 -508. Taylor Mark (1995) The Economics of Exchange Rates, Journal of Economic Literature, March, vol 33, No. 1, pp. 13 -47. Whalley (1985) Trade Liberalisation among Major World Trading Areas , MIT Press for developments on trade arrangement among various trading regions. • • 19