Ecommerce Applications 200910 ECommerce Applications Epayment Session 3

- Slides: 17

Ecommerce Applications 2009/10 E-Commerce Applications E-payment Session 3 1

Ecommerce Applications 2008/9 Overview • • • Payment process Credit card payment online Payment systems Risks and challenges Chargeback Internet fraud Session 3 2

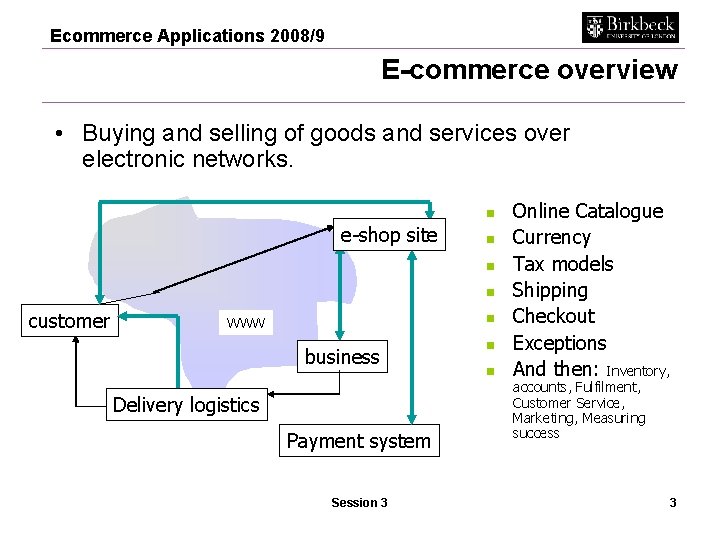

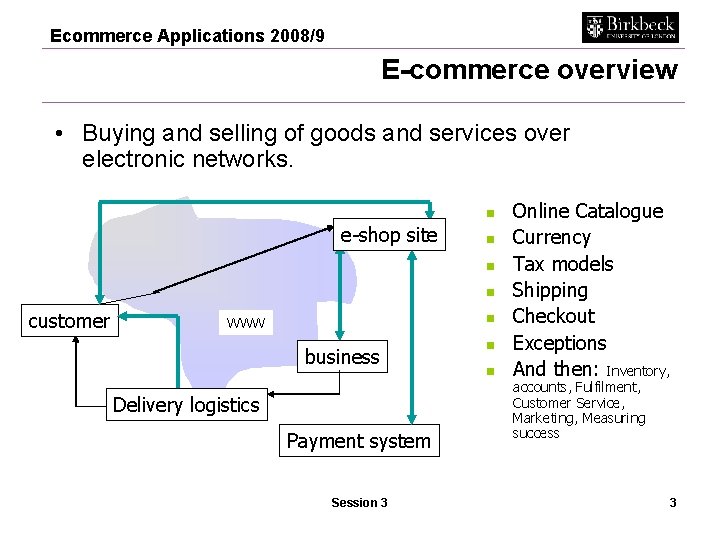

Ecommerce Applications 2008/9 E-commerce overview • Buying and selling of goods and services over electronic networks. n e-shop site n n n customer n WWW business Delivery logistics Payment system Session 3 n n Online Catalogue Currency Tax models Shipping Checkout Exceptions And then: Inventory, accounts, Fulfilment, Customer Service, Marketing, Measuring success 3

Ecommerce Applications 2008/9 Payment: Customer point of view – Browser or search for products and fill basket – Completes order form – Choose payment method/credit card. Notes that order taken in secure environment and protected by digital certificate – Places Order – Receives email confirmation of order – Receives email receipt of payment Session 3 4

Ecommerce Applications 2008/9 Payment: Business point of view • Business owners/retailers point of view – Customer places order – Note: the customer receives email confirmation of order which has been edited/configured by retailer – Retailer gets email confirming order has come in. – Retailer logs on to Administration site to collect order and payment details – E-payment supplier request merchant services providers to send funds to retailer’s bank account Session 3 5

Ecommerce Applications 2008/9 Payment systems • Fundamentals – take money, anyway that suits the customer – manage risk of fraud and chargeback • Options – – – Credit Card manual processing, or online processing Digital Cash Micropayments Smart cards Payment of delivery Direct money transfer Session 3 6

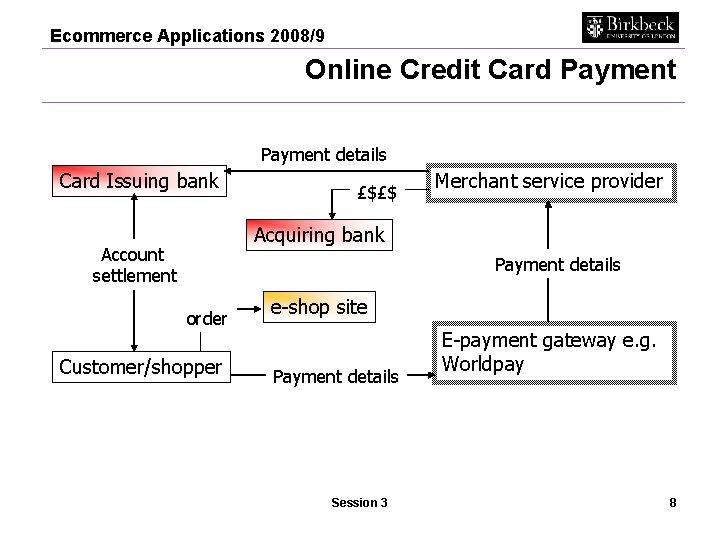

Ecommerce Applications 2008/9 Credit card payment online • Actors involved: – – – Customer E-shop owner (business) might be merchant Card issuing bank Merchant service providers Web agency (ASP) Regulatory bodies Session 3 7

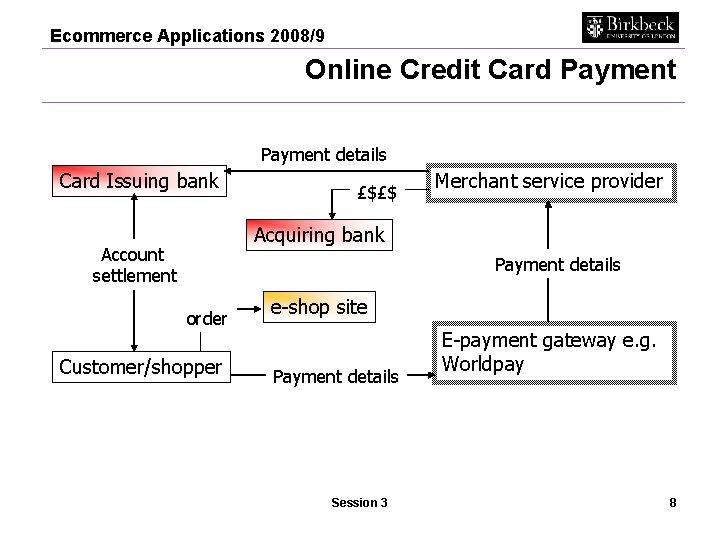

Ecommerce Applications 2008/9 Online Credit Card Payment details Card Issuing bank £$£$ Merchant service provider Acquiring bank Account settlement Payment details order Customer/shopper e-shop site Payment details Session 3 E-payment gateway e. g. Worldpay 8

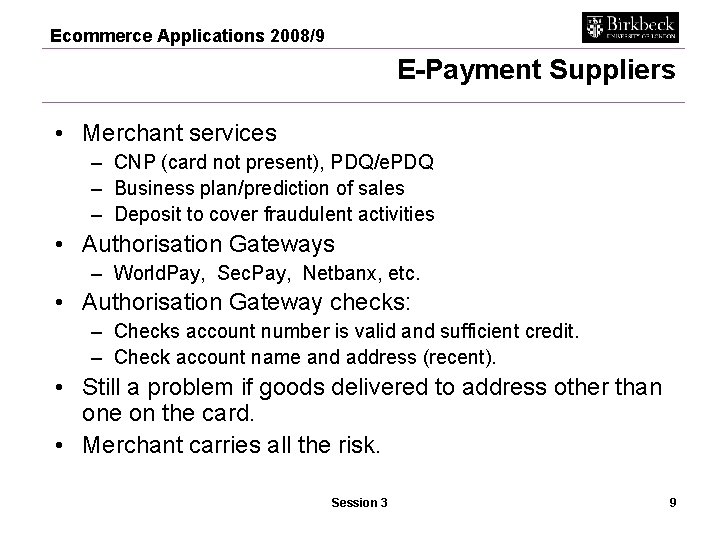

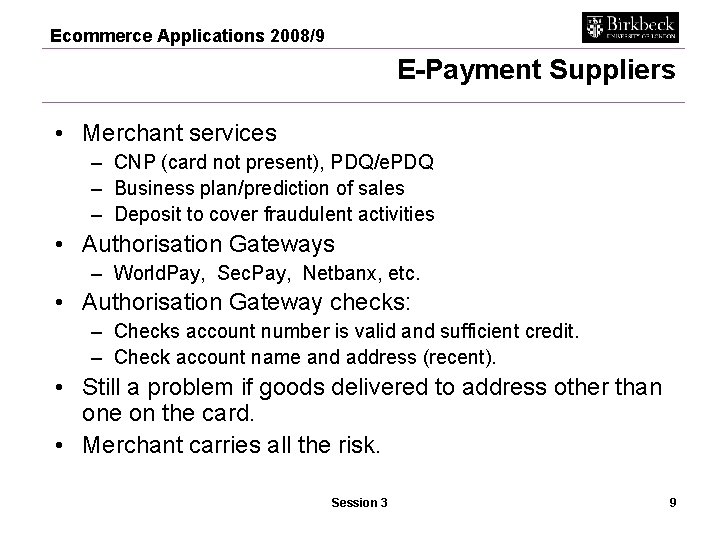

Ecommerce Applications 2008/9 E-Payment Suppliers • Merchant services – CNP (card not present), PDQ/e. PDQ – Business plan/prediction of sales – Deposit to cover fraudulent activities • Authorisation Gateways – World. Pay, Sec. Pay, Netbanx, etc. • Authorisation Gateway checks: – Checks account number is valid and sufficient credit. – Check account name and address (recent). • Still a problem if goods delivered to address other than one on the card. • Merchant carries all the risk. Session 3 9

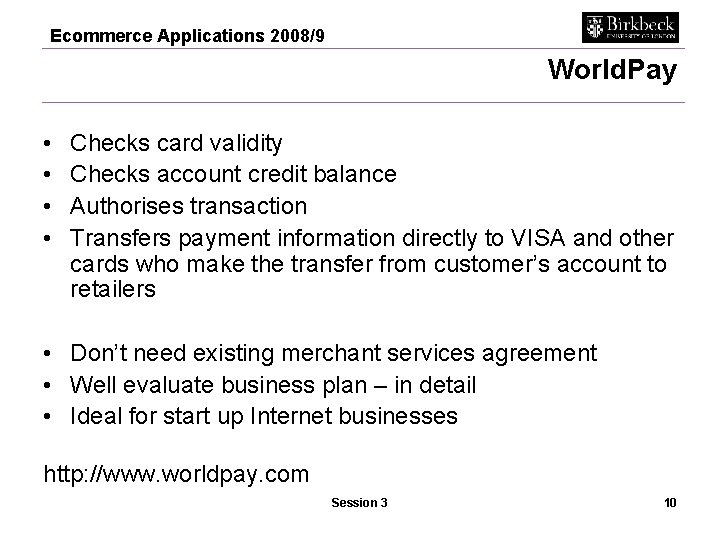

Ecommerce Applications 2008/9 World. Pay • • Checks card validity Checks account credit balance Authorises transaction Transfers payment information directly to VISA and other cards who make the transfer from customer’s account to retailers • Don’t need existing merchant services agreement • Well evaluate business plan – in detail • Ideal for start up Internet businesses http: //www. worldpay. com Session 3 10

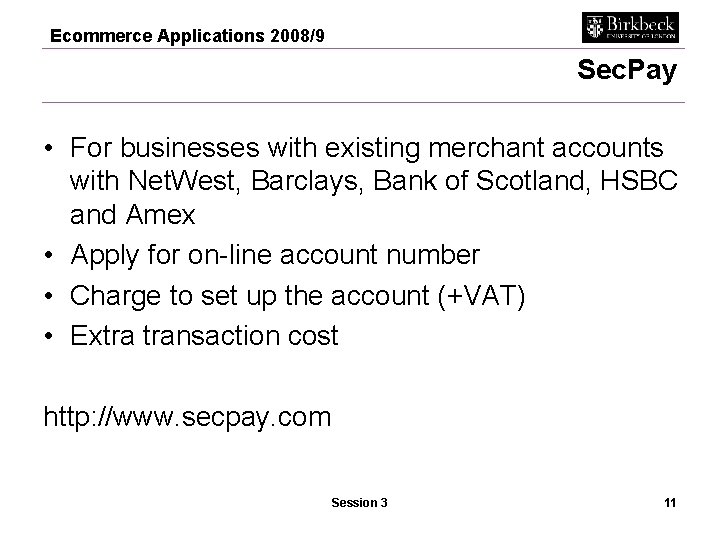

Ecommerce Applications 2008/9 Sec. Pay • For businesses with existing merchant accounts with Net. West, Barclays, Bank of Scotland, HSBC and Amex • Apply for on-line account number • Charge to set up the account (+VAT) • Extra transaction cost http: //www. secpay. com Session 3 11

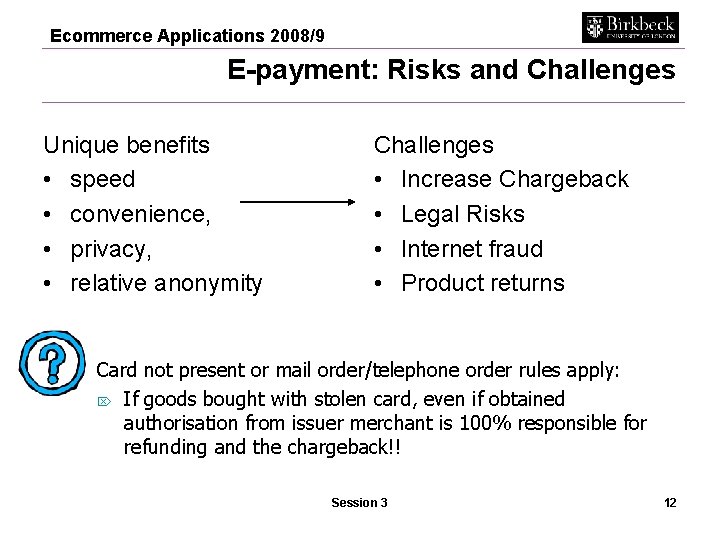

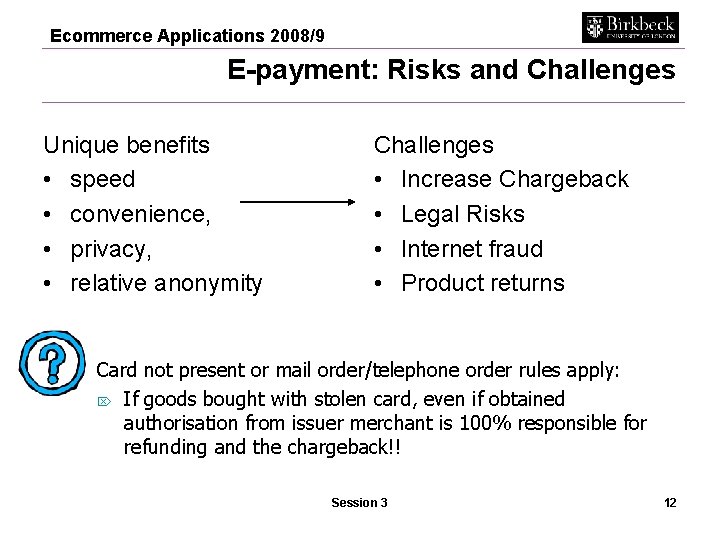

Ecommerce Applications 2008/9 E-payment: Risks and Challenges Unique benefits • speed • convenience, • privacy, • relative anonymity Challenges • Increase Chargeback • Legal Risks • Internet fraud • Product returns Card not present or mail order/telephone order rules apply: Ö If goods bought with stolen card, even if obtained authorisation from issuer merchant is 100% responsible for refunding and the chargeback!! Session 3 12

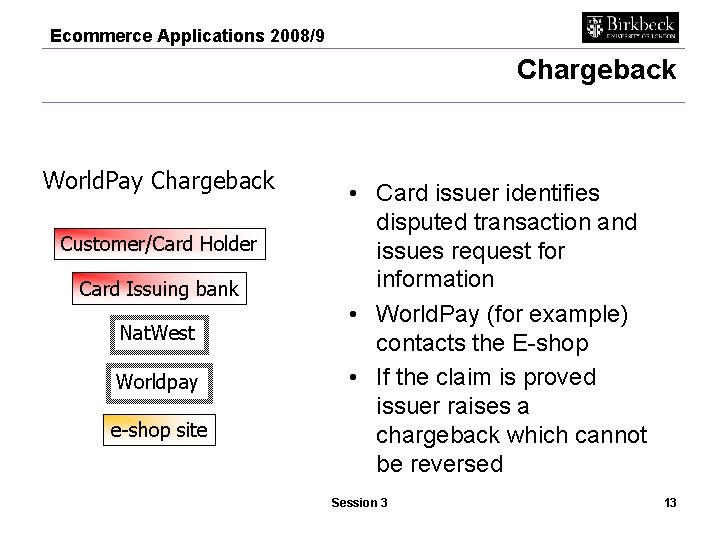

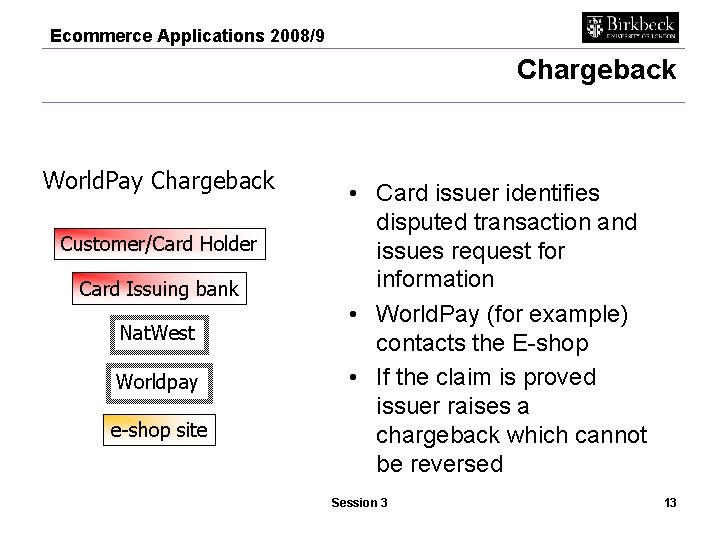

Ecommerce Applications 2008/9 Chargeback World. Pay Chargeback Customer/Card Holder Card Issuing bank Nat. West Worldpay e-shop site • Card issuer identifies disputed transaction and issues request for information • World. Pay (for example) contacts the E-shop • If the claim is proved issuer raises a chargeback which cannot be reversed Session 3 13

Ecommerce Applications 2008/9 Risk: reasons for chargeback Card holder: • did not receive goods • returned them • states did not authorise transaction • states did not participate in transaction • states that paid by other means • Claims received defective merchandise • Claims goods did not arrive • Card expired, accepted before valid, incorrect card number Session 3 14

Ecommerce Applications 2008/9 Risks: chargeback burden • Chargeback applies: • Up to 6 months after transaction • If merchants does not have: – Signature or proof of receipt – Email or mail confirmation of order • If any part of the order tracking documentation is incomplete, inaccurate, or not delivered with in a required time limit Session 3 15

Ecommerce Applications 2008/9 Internet Fraud • Stolen Cards used before owner detects it missing • Identity Fraud where thieves assume identity of owner and use the advantage of anonymity on the Internet • Card Generators where fraudulent credit card numbers are generated using software programs • Post-Purchase “Ship To” charges after valid transaction Session 3 16

Ecommerce Applications 2008/9 Summary • • • Payment process Credit card payment online Payment systems Risks and challenges Chargeback Internet fraud Session 3 17