Earned Income Credit EIC What is EIC The

- Slides: 12

Earned Income Credit (EIC)

What is EIC? �The Earned Income Credit (EIC) is a refundable tax credit available to eligible taxpayers who do not earn high incomes. �The purpose of the EIC is to reduce the tax burden and supplement the wages of working families whose earnings are less than the maximum for their filing status. �Taxpayers who qualify for this credit can receive a refund even if they have no filing requirement, owe no tax, and had no income tax withheld.

Qualifying for the EIC �There are three sets of rules for claiming the EIC: General eligibility rules for everyone Rules for taxpayers with one or more qualifying children Rules for taxpayers who do not have a qualifying child

Be Careful �When applying these rules, be careful to avoid the most common EIC filing errors: Incorrectly reporting income Incorrectly reported social security numbers Married taxpayers incorrectly filing as a Single or Head of Household Claiming a child who is not a qualifying child

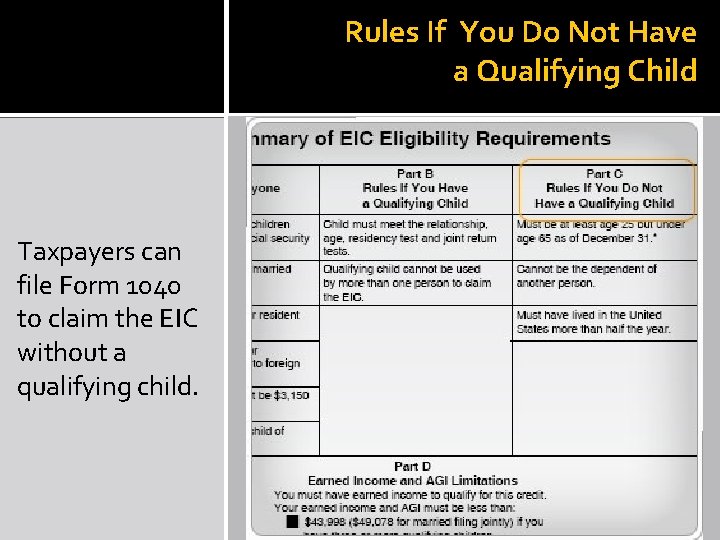

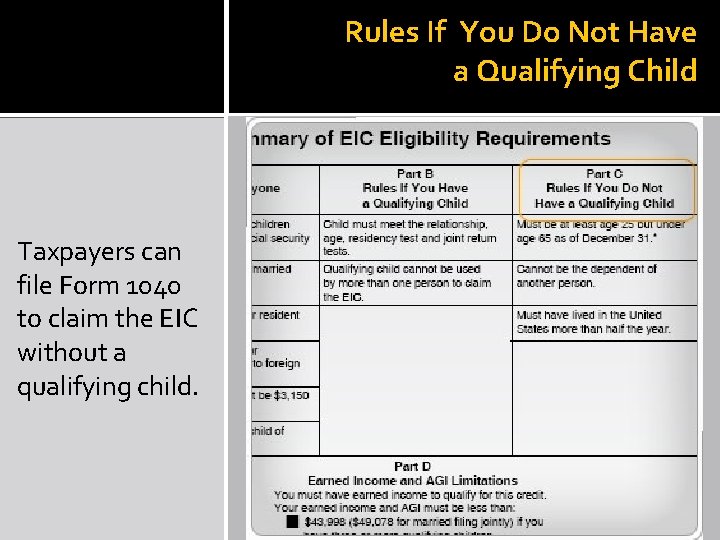

Summary of EIC Eligibility Requirements

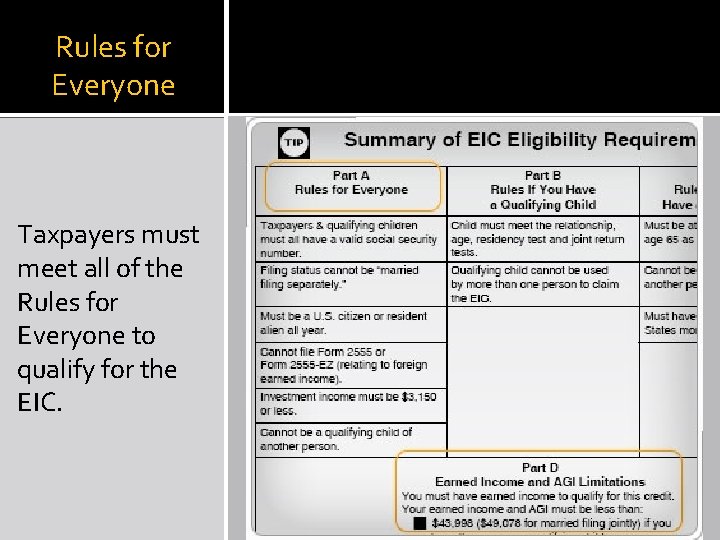

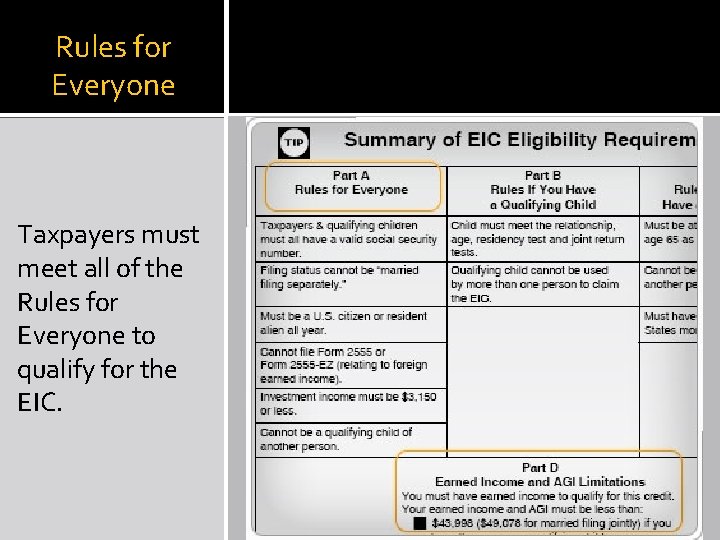

Rules for Everyone Taxpayers must meet all of the Rules for Everyone to qualify for the EIC.

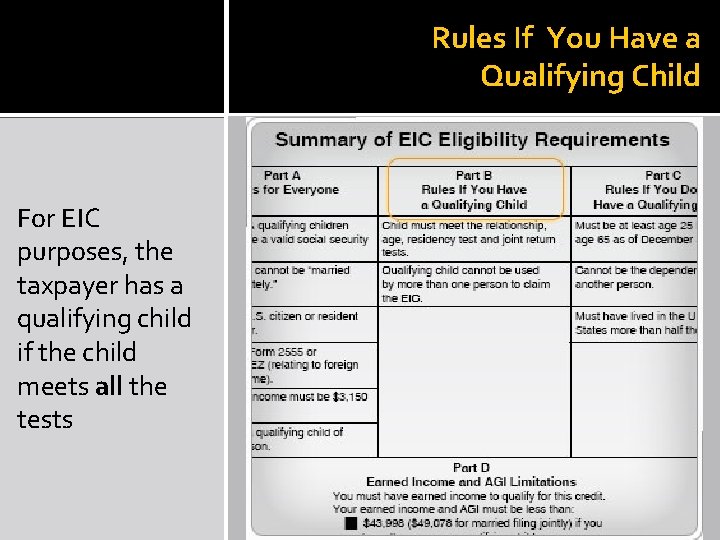

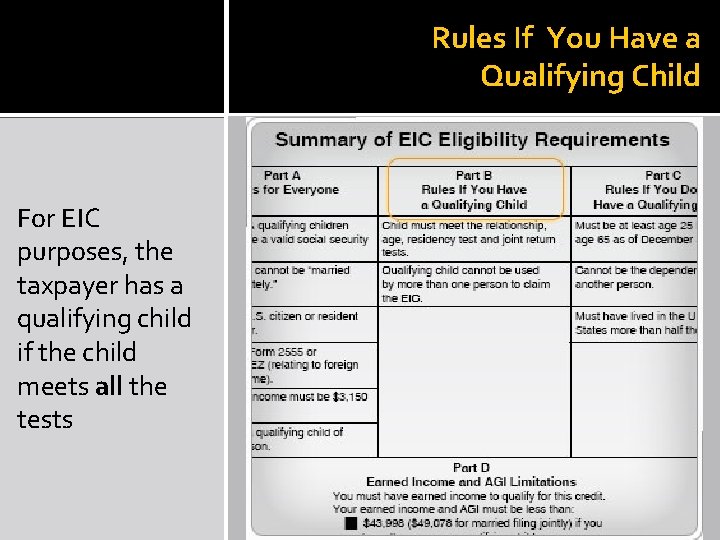

Rules If You Have a Qualifying Child For EIC purposes, the taxpayer has a qualifying child if the child meets all the tests

Rules If You Do Not Have a Qualifying Child Taxpayers can file Form 1040 to claim the EIC without a qualifying child.

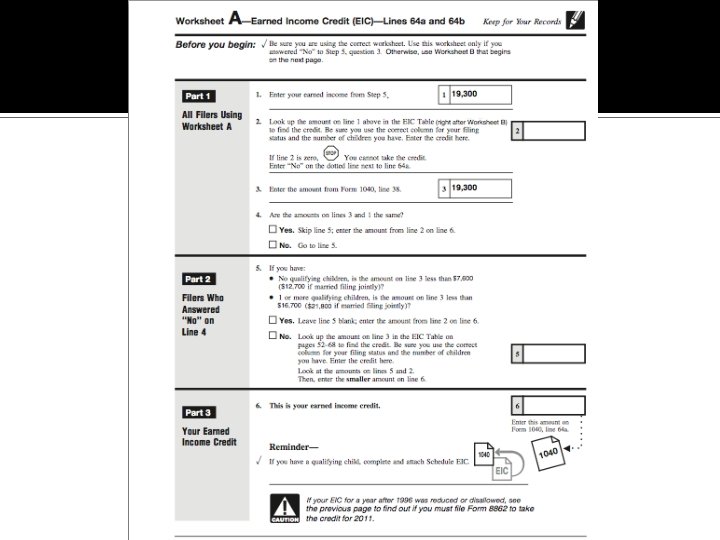

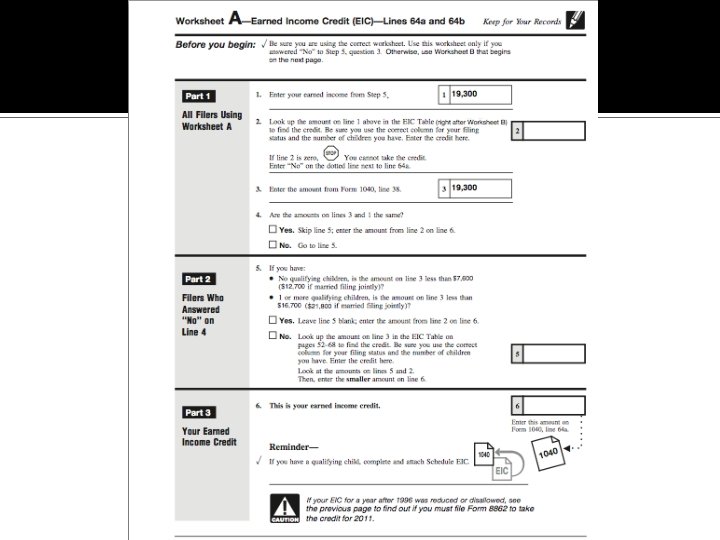

Worksheets and Tables �The amount of the EIC credit is determined using worksheets and the earned income credit tables. �The EIC worksheets and tables can be found in Publication 596 or the Form 1040 Instructions.

Ross has an eligible foster child, Vince is 14 years old and began living with Ross in August of the tax year. Ross's earned income and his adjusted gross income are each $14, 275. Can Ross claim the earned income credit? Yes or No? Q U E O S N T I

No The qualifying child must have lived with the taxpayer for more than half the year. A N S W E R