Does the Stock Market See a Zero or

![n n n CAR[-1, 1]: Cumulative abnormal returns from 1 day before the earnings n n n CAR[-1, 1]: Cumulative abnormal returns from 1 day before the earnings](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-8.jpg)

![1992 -2004 ES Range [-3¢, -2¢) [-2¢, -1¢) [-1¢, 0) [0, 1¢] (1¢, 2¢] 1992 -2004 ES Range [-3¢, -2¢) [-2¢, -1¢) [-1¢, 0) [0, 1¢] (1¢, 2¢]](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-13.jpg)

![Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1992 -1997) Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1992 -1997)](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-22.jpg)

![Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1998 -204) Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1998 -204)](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-23.jpg)

- Slides: 25

Does the Stock Market See a Zero or Small Positive Earnings Surprise as a Red Flag? Zhi-Xing Lin Michael Shih NUS Business School National University of Singapore 1

ØEarnings management is costly (reduces earnings in the future and heightens earnings expectations in the future) ØManipulation of analyst expectations is costly (lose credibility with analysts) ØThus, firms are likely to manage earnings and/or analyst expectations just enough to meet or narrowly beat analysts’ earnings forecasts. 2

n Hypothesis 1: Investors and analysts see a zero or small positive earnings surprise as a red flag on the earnings announcement date in their attempt to identify manipulators of earnings and/or analyst earnings expectations. 3

vthere is an increasing tendency of firms to manage earnings and/or analyst expectations to avoid a small negative earnings surprise, as our test results show. v. Academic research showed in late 1990 s (Burghstahler and Dichev 1997; Degeorge et al. 1999) the frequency of firms meeting or narrowly beating earnings benchmarks is higher than expected. v. Thus, investors and analysts should be more suspicious of firms that report a zero or small 4 positive earnings surprise.

n Hypothesis 2: Investors and analysts see a zero or small positive earnings surprise as more of a red flag on the earnings announcement date in late 1990 s and early 2000 s. 5

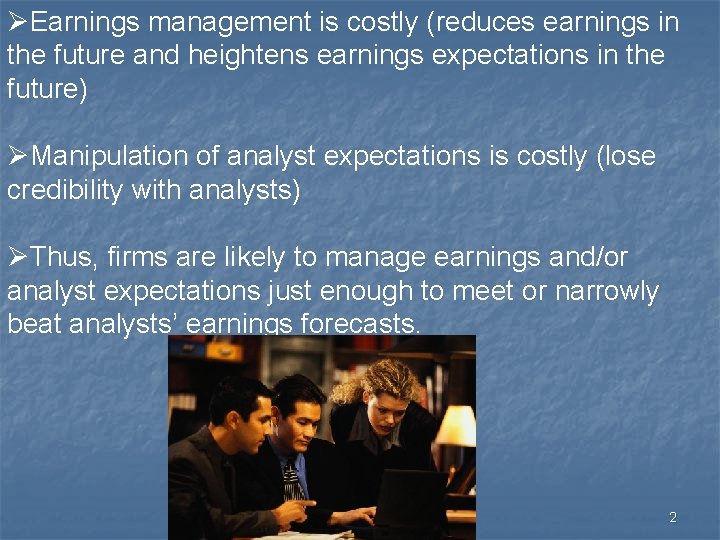

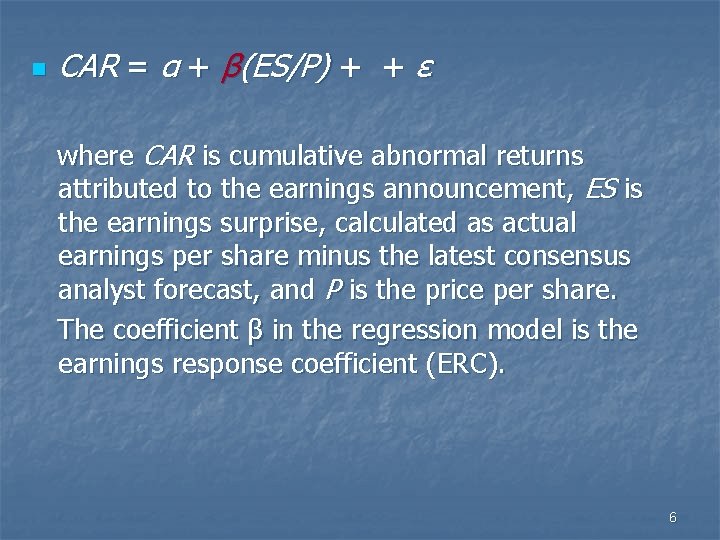

n CAR = α + β(ES/P) + + ε where CAR is cumulative abnormal returns attributed to the earnings announcement, ES is the earnings surprise, calculated as actual earnings per share minus the latest consensus analyst forecast, and P is the price per share. The coefficient β in the regression model is the earnings response coefficient (ERC). 6

Divide sample into earnings surprise class/range: n n n n Class R-7: Earnings surprises less than -8¢ per share Class R-6 comprises ES’s in the [-8¢, -6¢) range Class R-5 comprises ES’s in the [-6¢, -4¢) range; Class R-4 comprises ES’s in the [ -4¢, -3¢) range; Class R-3 comprises ES’s in the [-3¢ , -2¢) range; Class R-2 comprises ES’s in the [-2¢ , -1¢) range; Class R-1 comprises ES’s in the [-1¢, 0); Class R 0 comprises ES’s in the [0, 1¢] range; Class R 1 comprises ES’s in the (1¢, 2¢] range; Class R 2 comprises ES’s in the (2¢, 3¢] range; Class R 3 comprises ES’s in the (3¢, 4¢] range; Class R 4 comprises ES’s in the (4¢, 6¢] range; Class R 5 comprises ES’s in the (6¢, 8¢] range; nd 7 Class R 6 comprises ES’s greater than 8¢.

![n n n CAR1 1 Cumulative abnormal returns from 1 day before the earnings n n n CAR[-1, 1]: Cumulative abnormal returns from 1 day before the earnings](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-8.jpg)

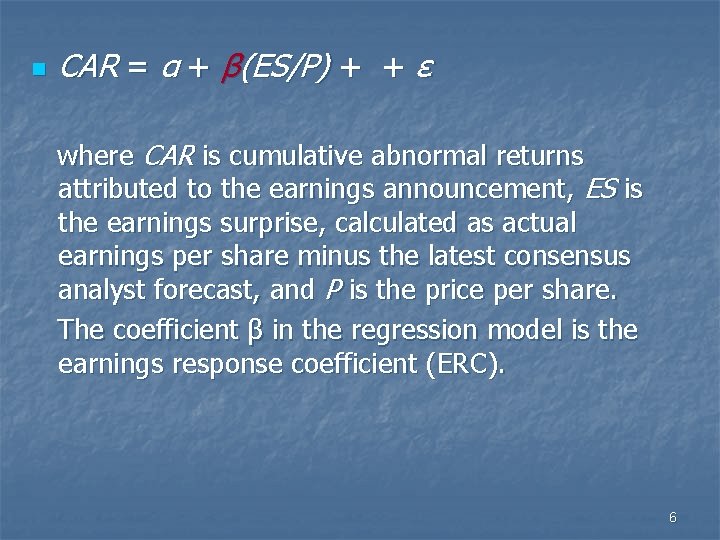

n n n CAR[-1, 1]: Cumulative abnormal returns from 1 day before the earnings announcement date to 1 day after; CAR[-20, -2]: cumulative abnormal returns from 20 days before the earnings announcement date to 2 days before; ES/P: earnings surprise (ES) scaled by the share price twenty-one days before the earnings announcement date (P); Dk: earnings surprise dummy, equal to one if the unscaled earnings surprise (ES) falls in Class Rk and zero otherwise. 8

n n FREV is the analyst forecast revision for next-quarter earnings, calculated as the first consensus analyst next -quarter earnings forecast after the current-quarter earnings announcement minus the latest consensus analyst next-quarter earnings forecast before the current-quarter earnings announcement. The coefficient βk, k=-7… 6, captures analysts’ response to earnings surprises in each range. We refer to this coefficient as the analyst earnings response coefficient (hereafter AERC). 9

n n Sample: Firm-quarters in 1992 -2004 in the intersection of I/B/E/S, CRSP and Compustat. Sample size: 118, 136 firm-quarters for 7, 394 firms. 10

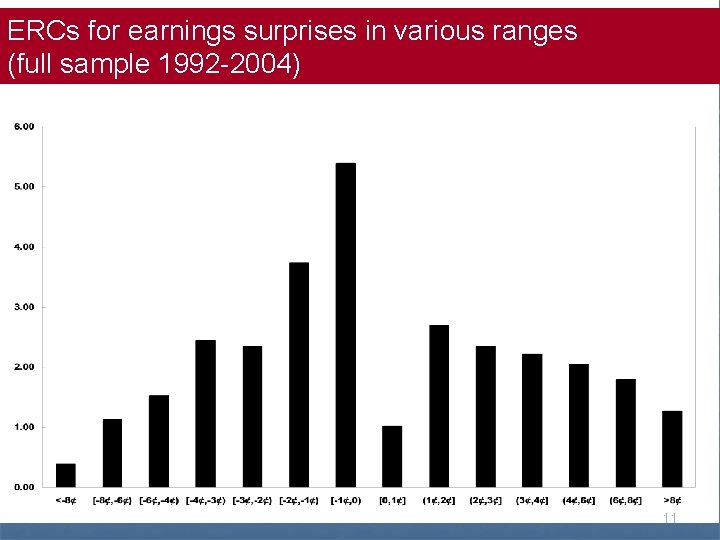

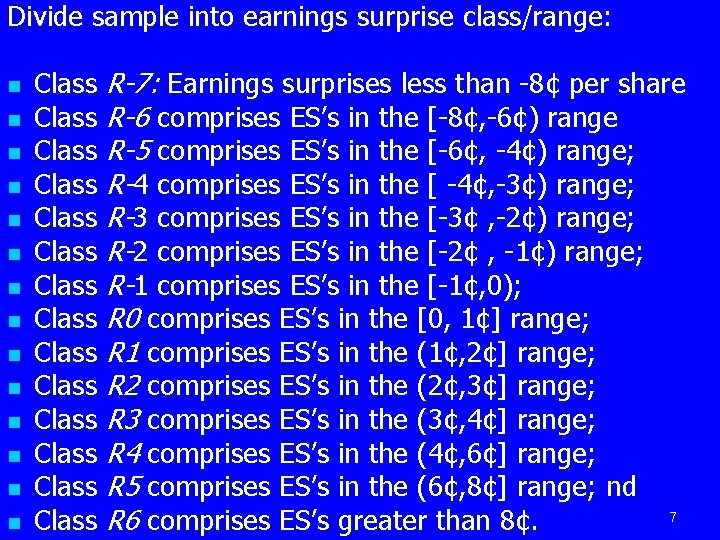

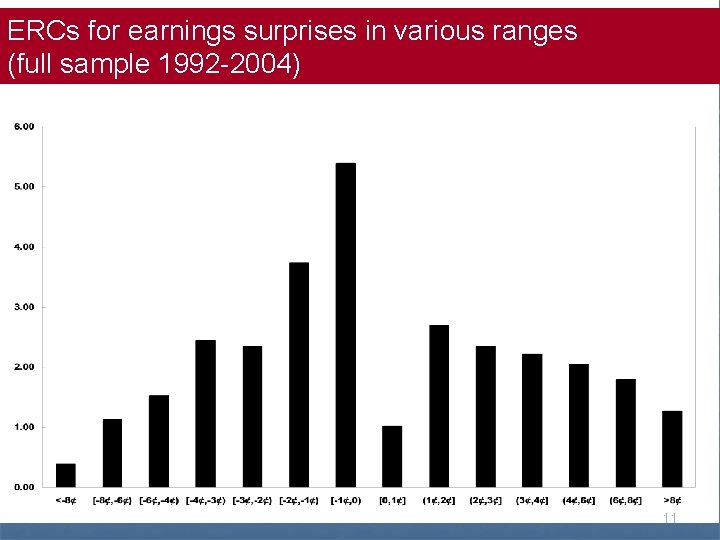

ERCs for earnings surprises in various ranges (full sample 1992 -2004) 11

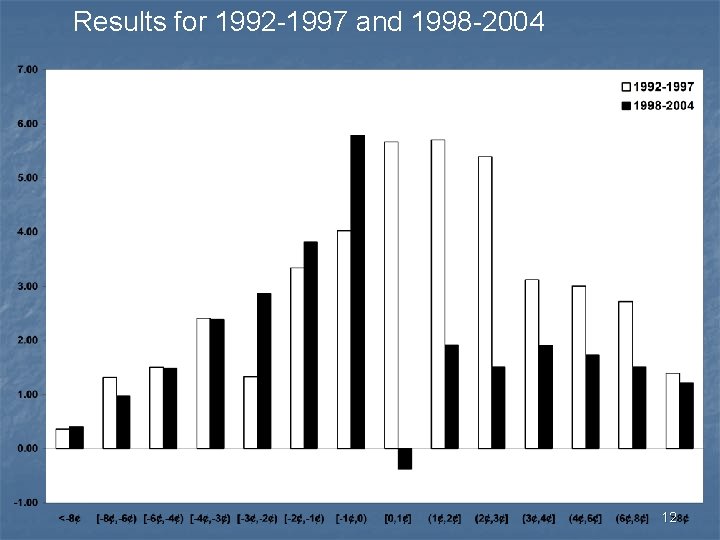

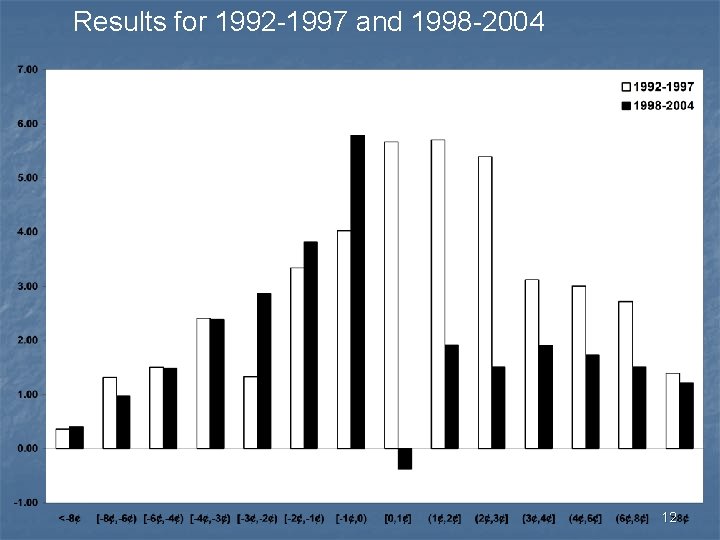

Results for 1992 -1997 and 1998 -2004 12

![1992 2004 ES Range 3 2 2 1 1 0 0 1 1 2 1992 -2004 ES Range [-3¢, -2¢) [-2¢, -1¢) [-1¢, 0) [0, 1¢] (1¢, 2¢]](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-13.jpg)

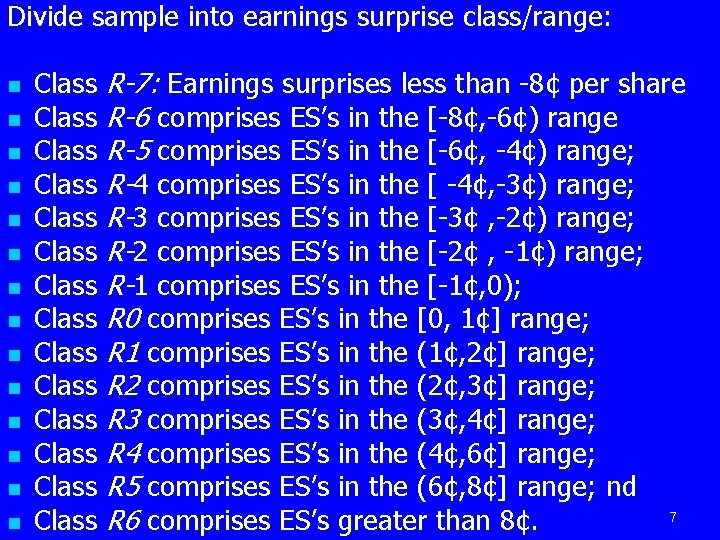

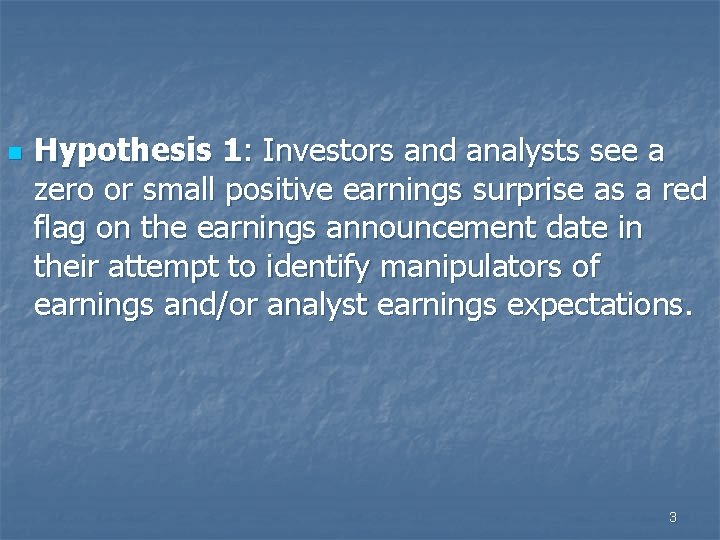

1992 -2004 ES Range [-3¢, -2¢) [-2¢, -1¢) [-1¢, 0) [0, 1¢] (1¢, 2¢] (2¢, 3¢] (3¢, 4¢] ERC t-stat 2. 35 10. 44 3. 74 12. 53 5. 39 10. 56 1. 02 2. 27 2. 69 10. 14 2. 34 10. 94 2. 22 11. 50 1992 -1997 1998 -2004 ERC t-stat. 1. 33 3. 34 4. 03 5. 67 3. 97 7. 44 4. 94 7. 12 2. 86 3. 82 5. 78 -0. 38 9. 45 9. 59 8. 74 -0. 68 5. 71 11. 35 5. 39 13. 30 3. 12 9. 85 1. 91 1. 51 1. 90 5. 91 5. 79 7. 68 13

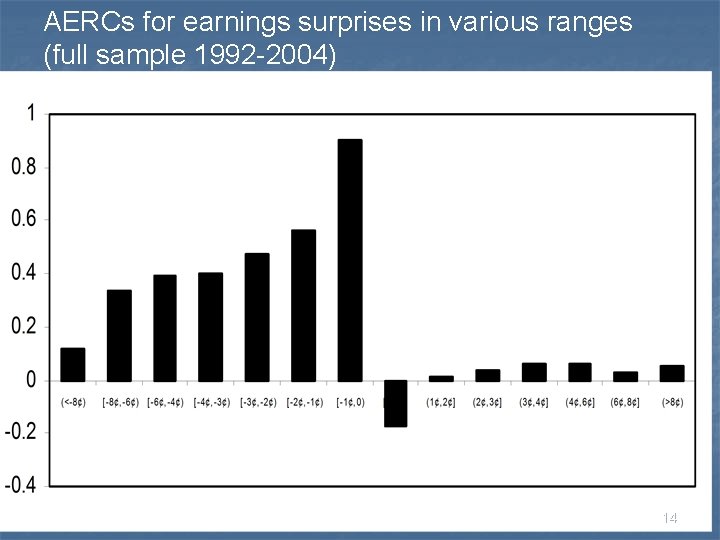

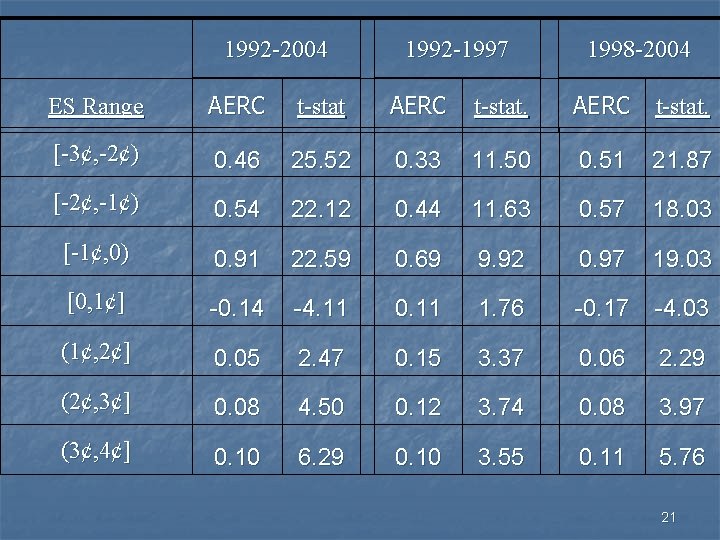

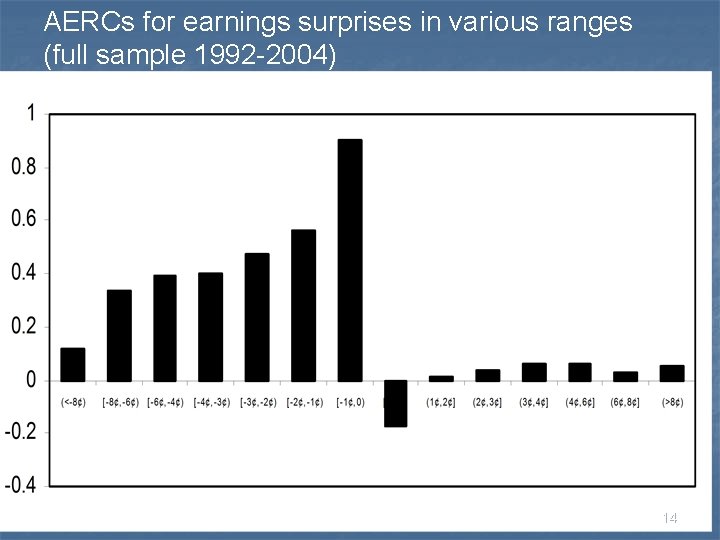

AERCs for earnings surprises in various ranges (full sample 1992 -2004) 14

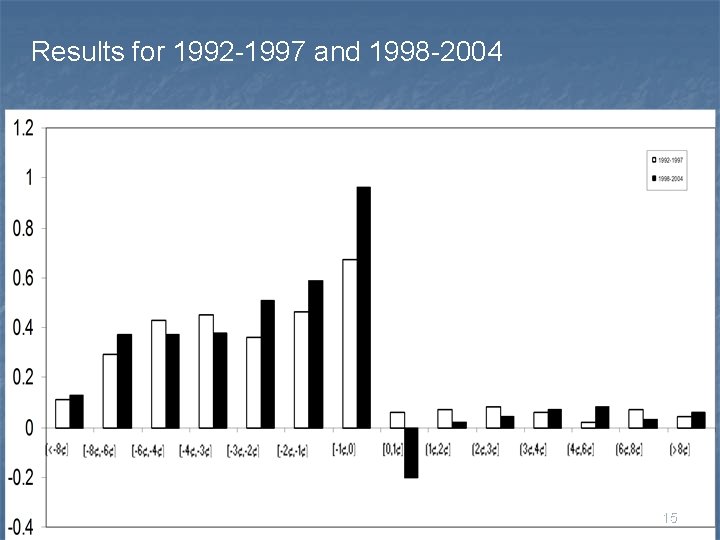

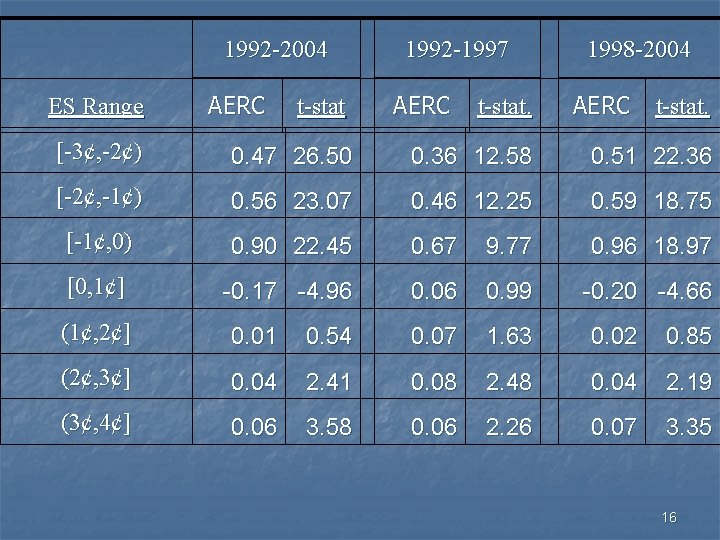

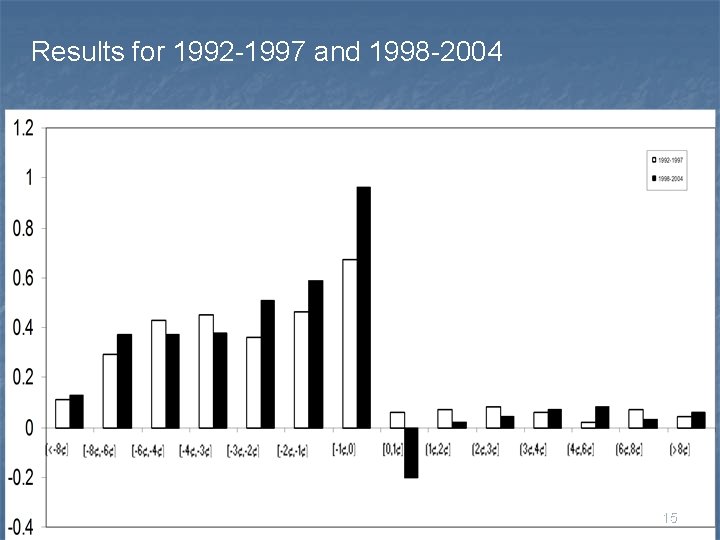

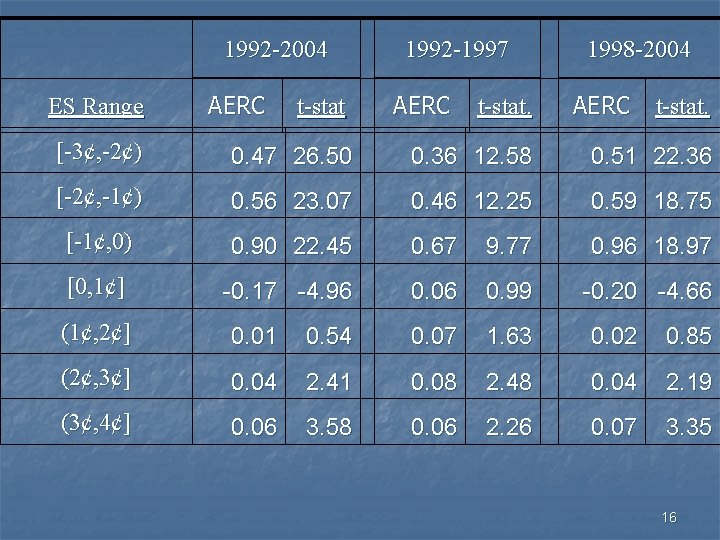

Results for 1992 -1997 and 1998 -2004 15

1992 -2004 ES Range AERC t-stat 1992 -1997 AERC t-stat. 1998 -2004 AERC t-stat. [-3¢, -2¢) 0. 47 26. 50 0. 36 12. 58 0. 51 22. 36 [-2¢, -1¢) 0. 56 23. 07 0. 46 12. 25 0. 59 18. 75 [-1¢, 0) 0. 90 22. 45 0. 67 9. 77 0. 96 18. 97 [0, 1¢] -0. 17 -4. 96 0. 06 0. 99 -0. 20 -4. 66 (1¢, 2¢] 0. 01 0. 54 0. 07 1. 63 0. 02 0. 85 (2¢, 3¢] 0. 04 2. 41 0. 08 2. 48 0. 04 2. 19 (3¢, 4¢] 0. 06 3. 58 0. 06 2. 26 0. 07 3. 35 16

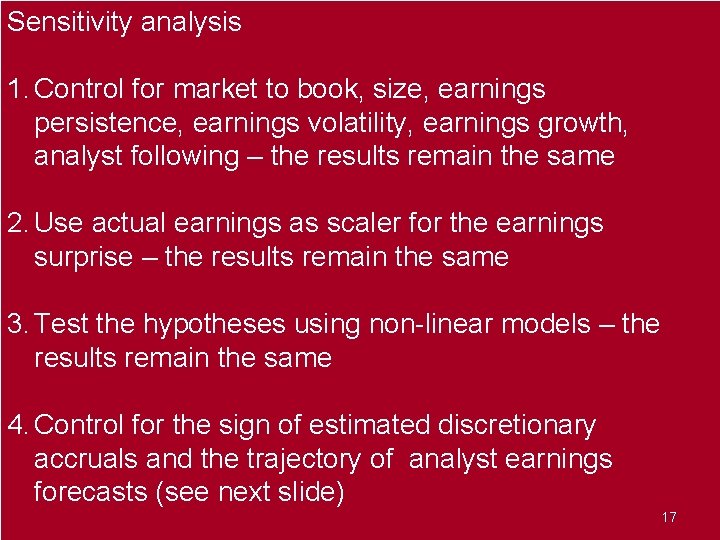

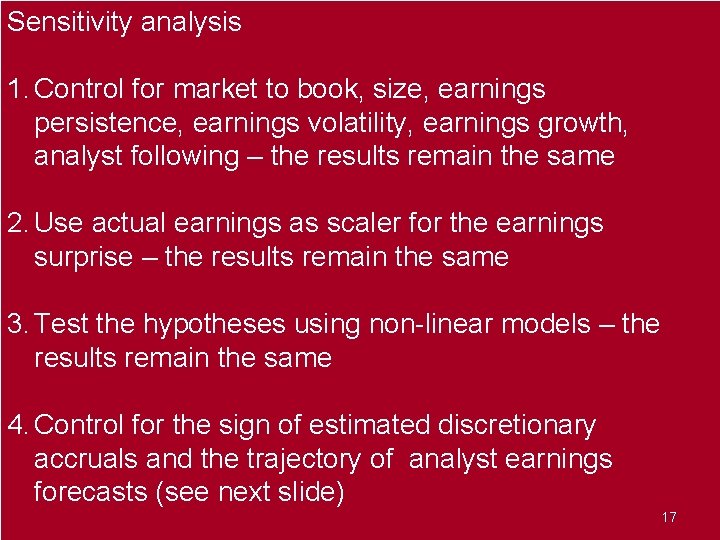

Sensitivity analysis 1. Control for market to book, size, earnings persistence, earnings volatility, earnings growth, analyst following – the results remain the same 2. Use actual earnings as scaler for the earnings surprise – the results remain the same 3. Test the hypotheses using non-linear models – the results remain the same 4. Control for the sign of estimated discretionary accruals and the trajectory of analyst earnings forecasts (see next slide) 17

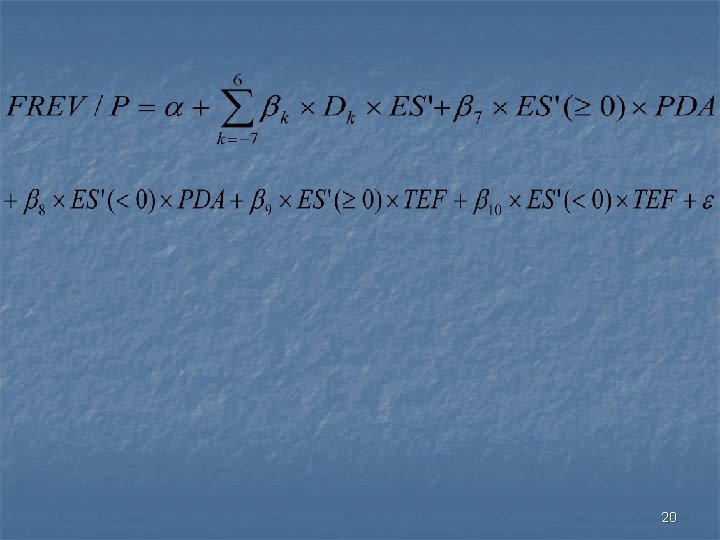

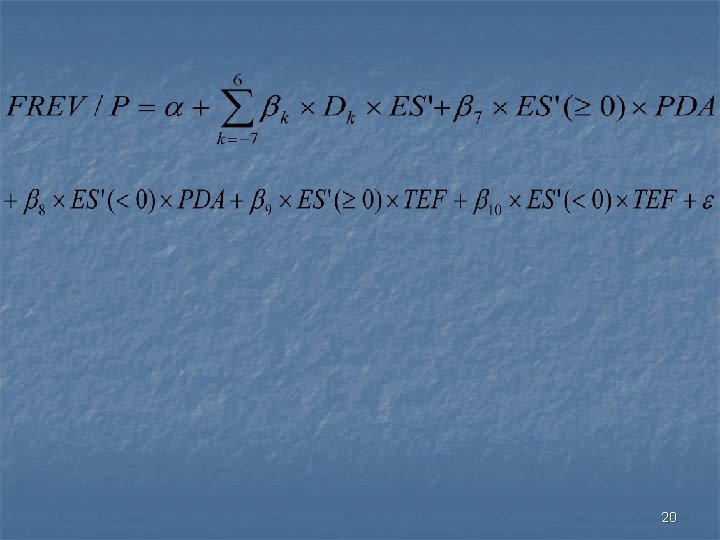

where: ES’ = ES/P, or earnings surprise scaled by share price; ES’(≥ 0) = ES’ if ES’ is non-negative (zero or positive), and zero otherwise; ES’(<0) = ES’ if ES’ is negative, and zero otherwise; PDA = positive discretionary accruals dummy, equal to 1 if estimated discretionary accruals are positive, and zero otherwise; TEF = trajectory of analyst earnings forecast dummy, equal to 1 the trajectory is downward before the earnings announcement, and zero otherwise. 18

19922004 ES Range 2. [-3¢, -2¢) 35 3. [-2¢, -1¢) 80 5. [-1¢, 0) 40 1. [0, 1¢] 55 3. (1¢, 2¢] (3¢, 4¢]09 19921997 ERC 19982004 t-stat 10. 1. 4. 2. 28 37 02 85 12. 3. 7. 3. 62 33 31 94 10. 4. 4. 5. 48 06 94 80 3. 5. 7. 0. 42 92 42 24 11. 6. 11. 2. 39 2. 54 13 9512. 83 34 ERC t-stat. 9. 26 9. 80 8. 67 0. 42 7. 073. 31 10. 22 2. 29 19 9. 01

20

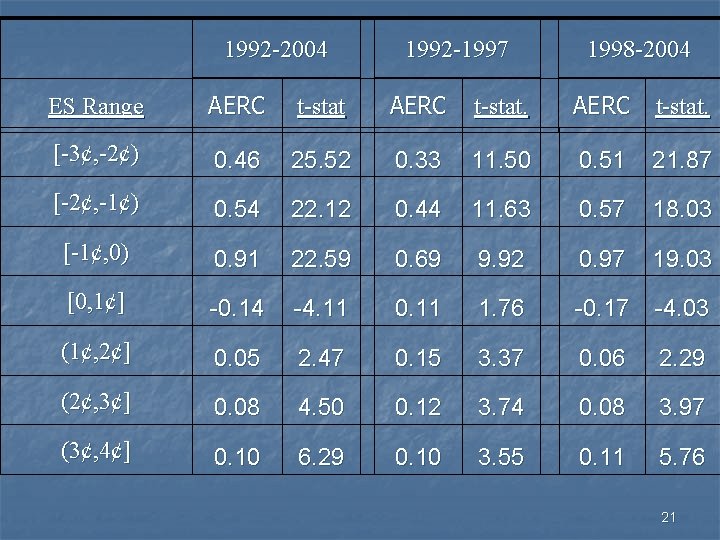

1992 -2004 1992 -1997 1998 -2004 ES Range AERC t-stat. [-3¢, -2¢) 0. 46 25. 52 0. 33 11. 50 0. 51 21. 87 [-2¢, -1¢) 0. 54 22. 12 0. 44 11. 63 0. 57 18. 03 [-1¢, 0) 0. 91 22. 59 0. 69 9. 92 0. 97 19. 03 [0, 1¢] -0. 14 -4. 11 0. 11 1. 76 -0. 17 -4. 03 (1¢, 2¢] 0. 05 2. 47 0. 15 3. 37 0. 06 2. 29 (2¢, 3¢] 0. 08 4. 50 0. 12 3. 74 0. 08 3. 97 (3¢, 4¢] 0. 10 6. 29 0. 10 3. 55 0. 11 5. 76 21

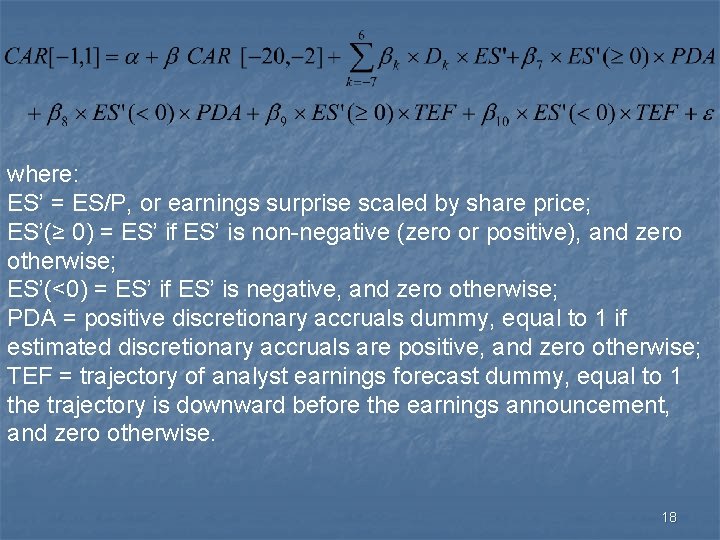

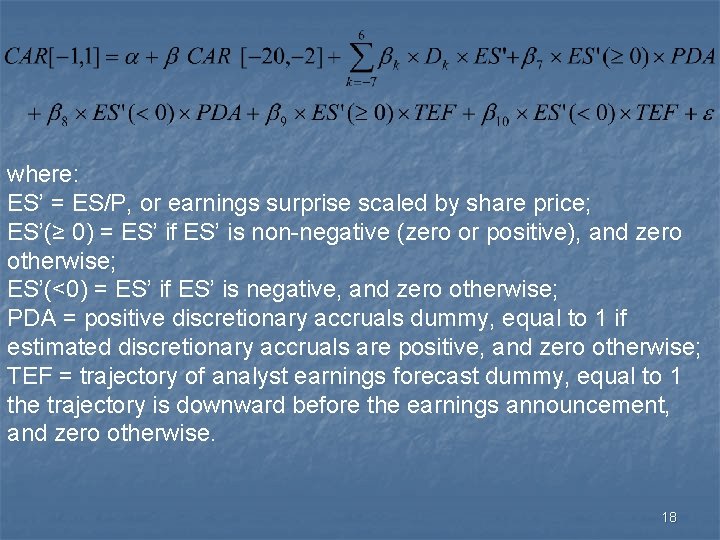

![Cumulative Abnormal Returns in the Event Window 1 60 after Earnings Announcement 1992 1997 Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1992 -1997)](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-22.jpg)

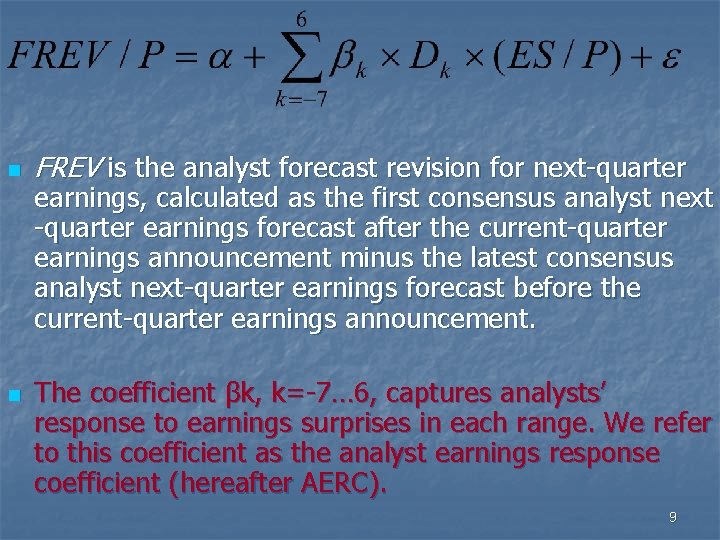

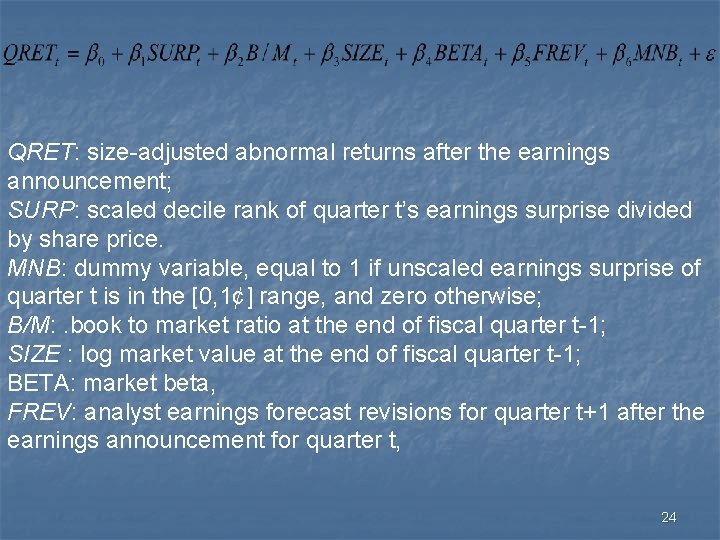

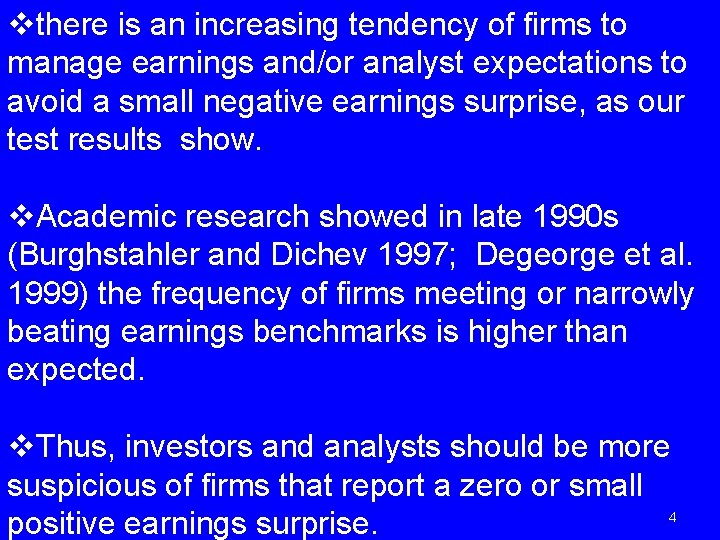

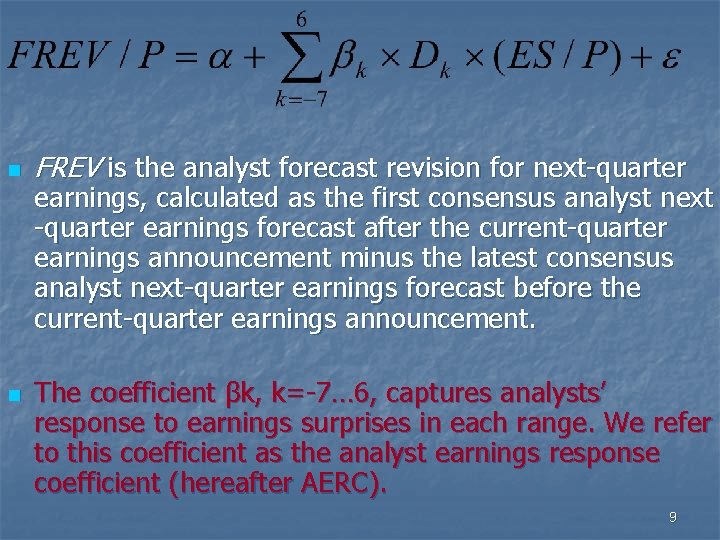

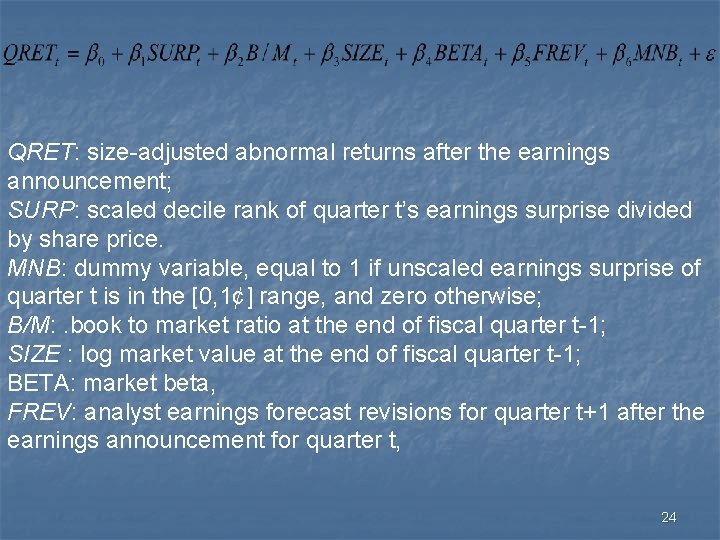

Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1992 -1997) 22

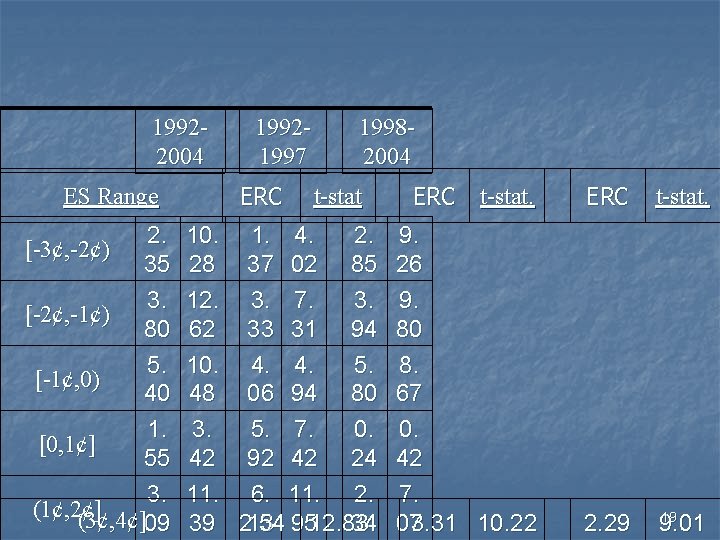

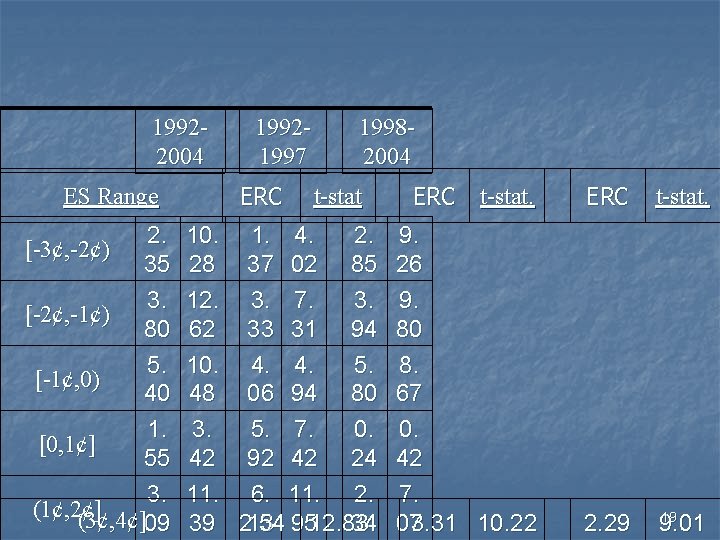

![Cumulative Abnormal Returns in the Event Window 1 60 after Earnings Announcement 1998 204 Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1998 -204)](https://slidetodoc.com/presentation_image/30db256b114bbfa54b0bda7fe61fd1f8/image-23.jpg)

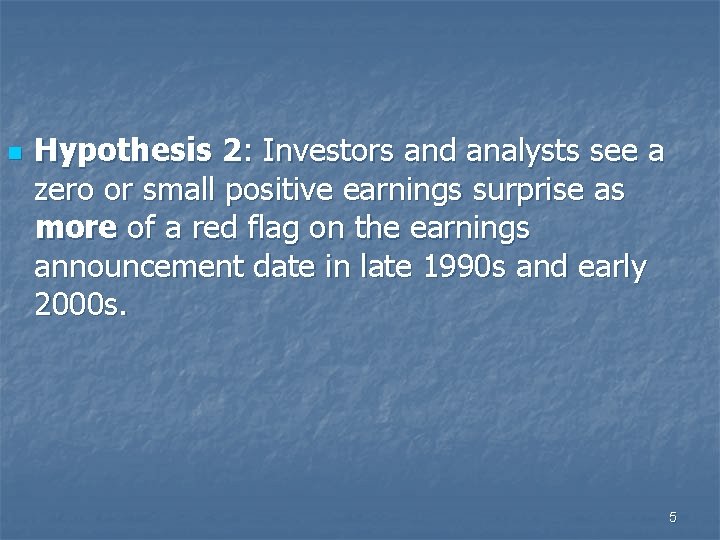

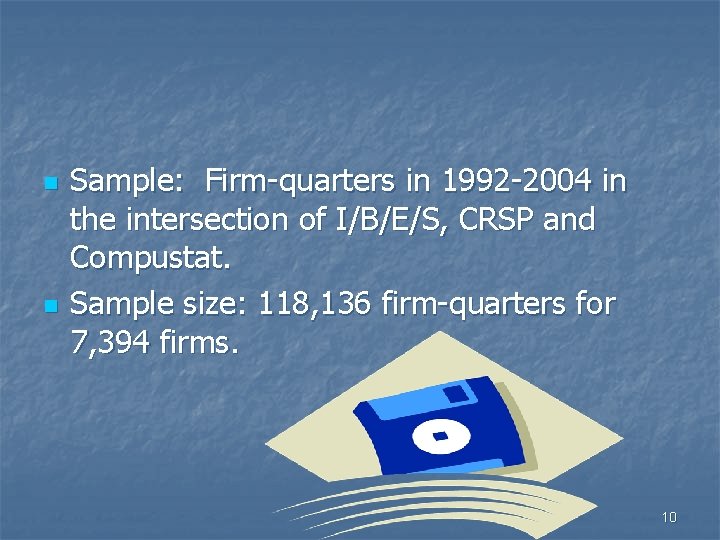

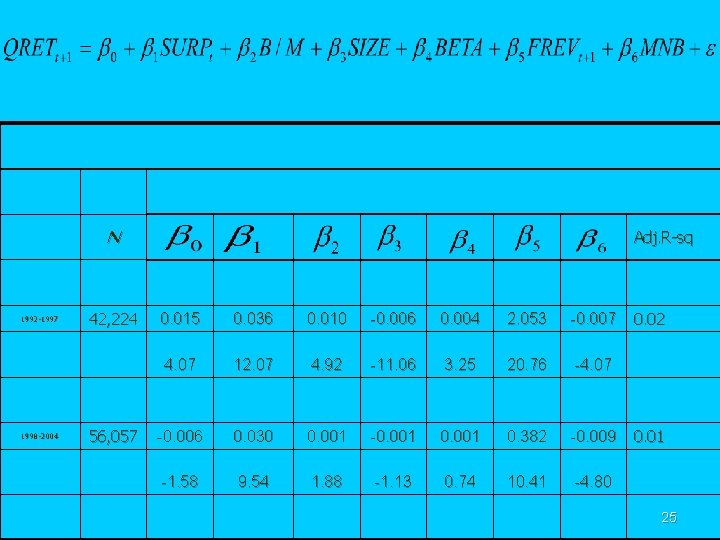

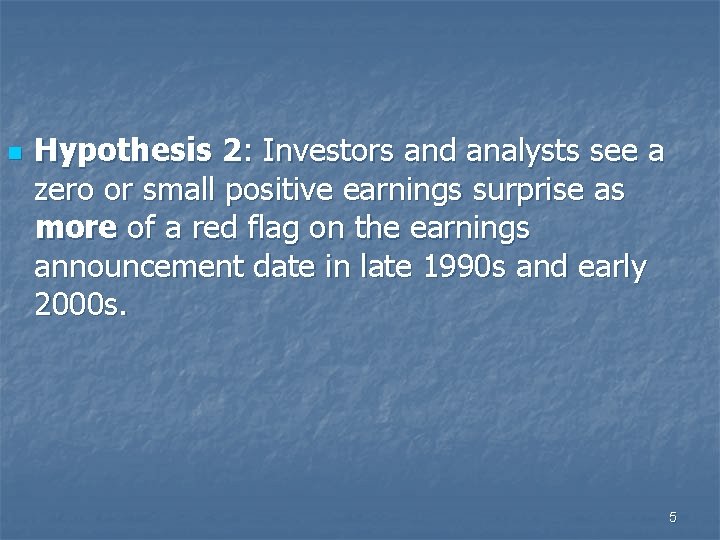

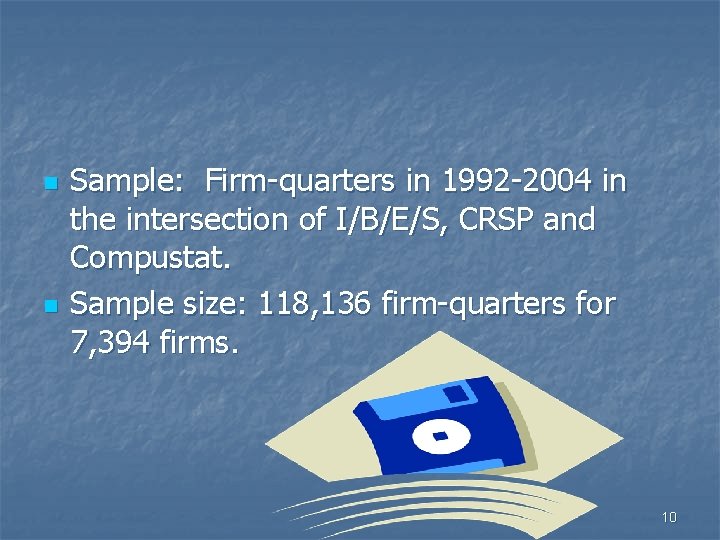

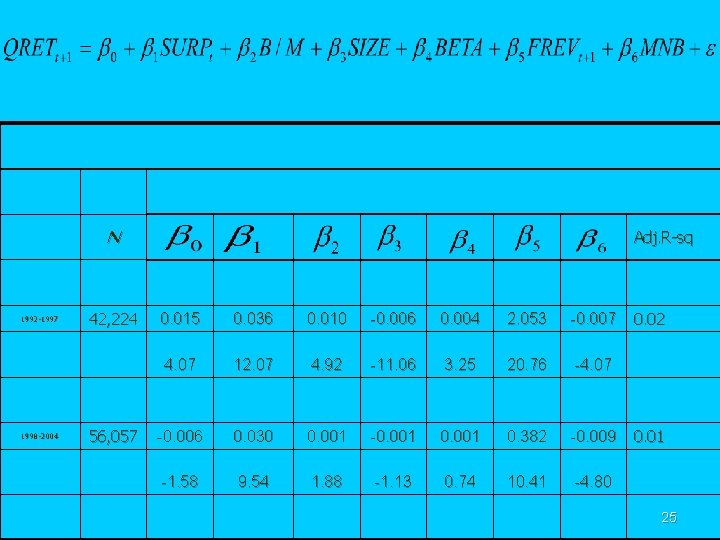

Cumulative Abnormal Returns in the Event Window [+1, +60] after Earnings Announcement (1998 -204) 0. 04 ES<0¢ 0¢<=ES<=1¢ ES>1¢ 0. 03 0. 02 0. 01 0 -0. 01 0 10 20 30 40 50 23 60

QRET: size-adjusted abnormal returns after the earnings announcement; SURP: scaled decile rank of quarter t’s earnings surprise divided by share price. MNB: dummy variable, equal to 1 if unscaled earnings surprise of quarter t is in the [0, 1¢] range, and zero otherwise; B/M: . book to market ratio at the end of fiscal quarter t-1; SIZE : log market value at the end of fiscal quarter t-1; BETA: market beta, FREV: analyst earnings forecast revisions for quarter t+1 after the earnings announcement for quarter t, 24

N 1992 -1997 1998 -2004 42, 224 56, 057 Adj. R-sq 0. 015 0. 036 0. 010 -0. 006 0. 004 2. 053 -0. 007 4. 07 12. 07 4. 92 -11. 06 3. 25 20. 76 -4. 07 -0. 006 0. 030 0. 001 -0. 001 0. 382 -0. 009 -1. 58 9. 54 1. 88 -1. 13 0. 74 10. 41 -4. 80 0. 02 0. 01 25