DIVIDEND VALUATION AND EARNING CAPITALISATION MODEL DIVIDEND Dividend

- Slides: 12

DIVIDEND VALUATION AND EARNING CAPITALISATION MODEL

DIVIDEND Dividend refers to the corporate net profits distributed among shareholders. Dividends are irrelevant, or are a passive residual, is based on the assumption that the investors are indifferent between dividends and capital gains. So long as the firm is able to earn more than the equity- capitalisation rate (ke), the investors would be content with the firm retaining the earnings. In contrast, if the return is less than the ke, investors would prefer to receive the earnings (i. e. dividends).

DIVIDEND VALUATION MODEL Dividend valuation model was given by Myron. J. gordon in the year 1959 this model is also called Gordon Growth model. Dividend valuation model is a way of valuing accompany based on theory that a stock value is worth the discounted sum of all its future dividends payments. It is used to value stocks based on Net present value of its future dividends.

Equation: - P = D 1/r-g Where : P is the value of current stock G is the constant growth rate D 1 is the next year (future) dividend R is the constant discounting factor or cost of equity for that company

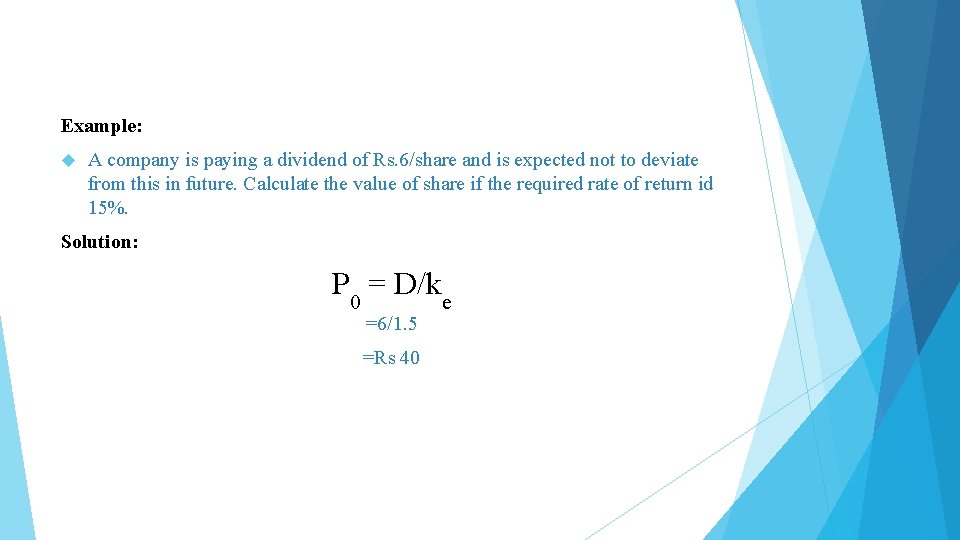

Example: A company is paying a dividend of Rs. 6/share and is expected not to deviate from this in future. Calculate the value of share if the required rate of return id 15%. Solution: P 0 = D/ke =6/1. 5 =Rs 40

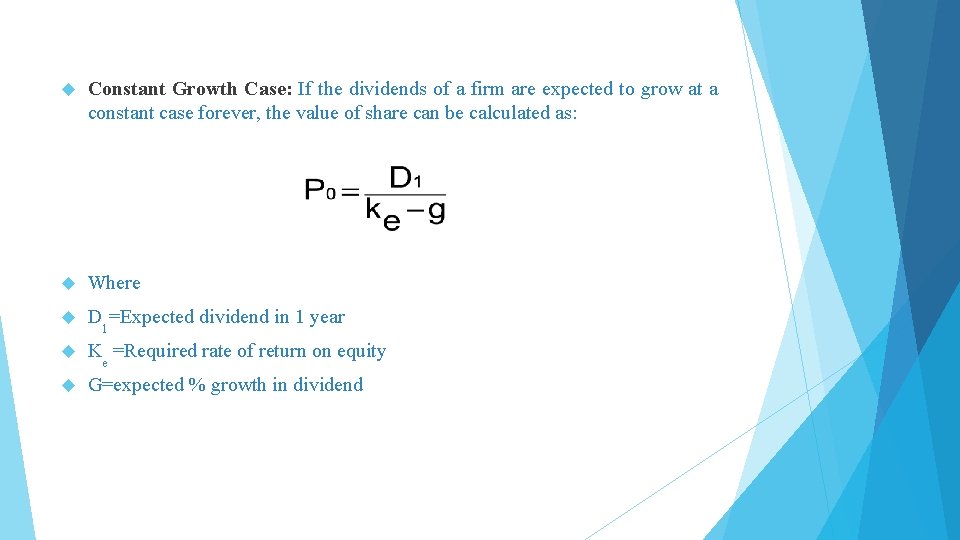

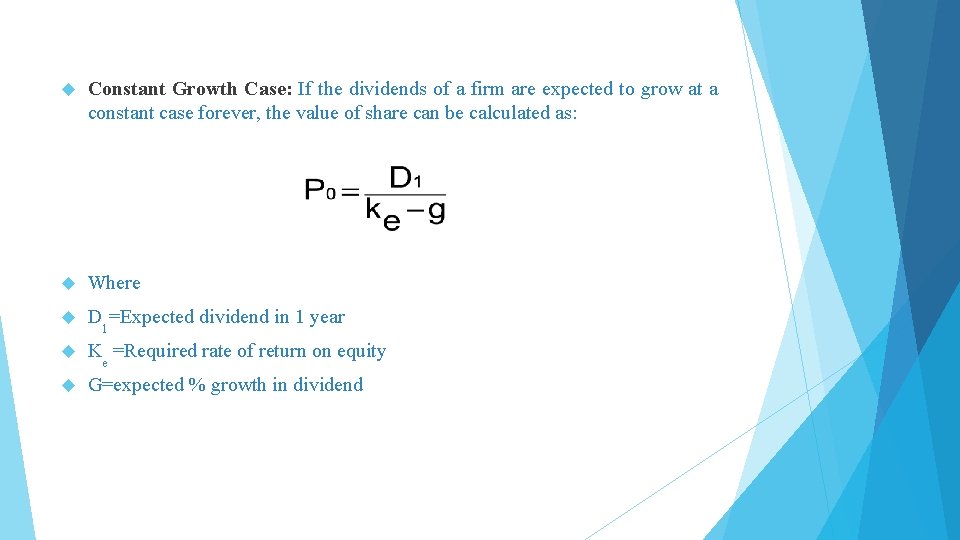

Constant Growth Case: If the dividends of a firm are expected to grow at a constant case forever, the value of share can be calculated as: Where D 1=Expected dividend in 1 year Ke =Required rate of return on equity G=expected % growth in dividend

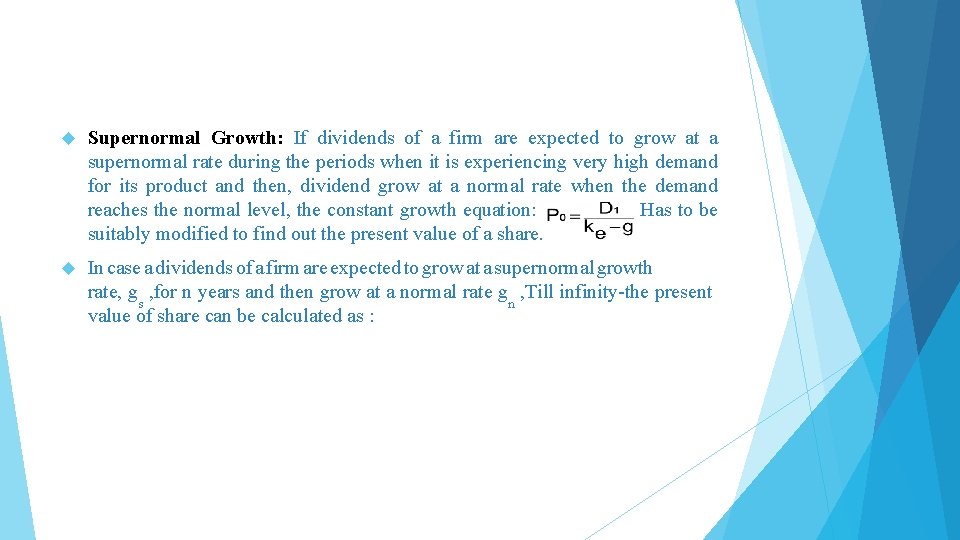

Supernormal Growth: If dividends of a firm are expected to grow at a supernormal rate during the periods when it is experiencing very high demand for its product and then, dividend grow at a normal rate when the demand reaches the normal level, the constant growth equation: Has to be suitably modified to find out the present value of a share. In case a dividends of a firm are expected to grow at a supernormal growth rate, gs , for n years and then grow at a normal rate gn , Till infinity-the present value of share can be calculated as :

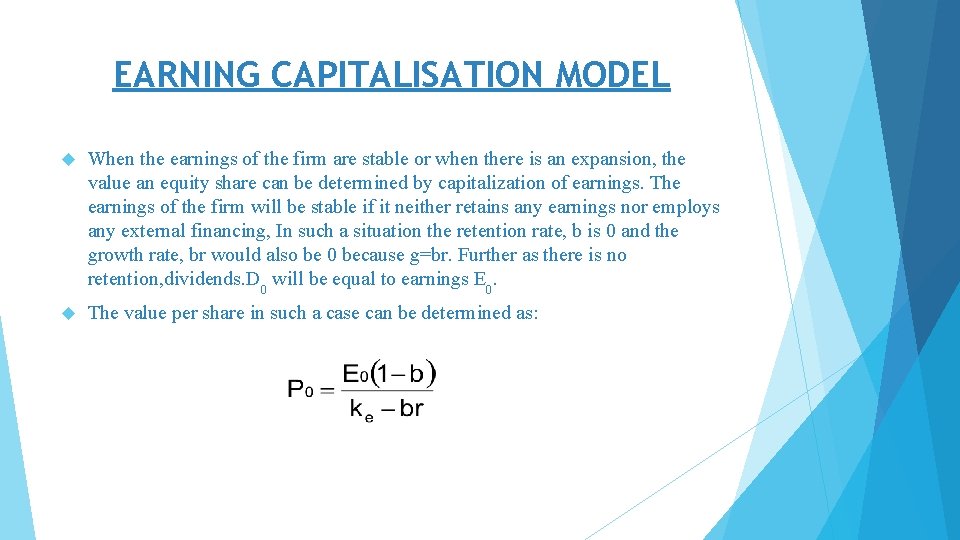

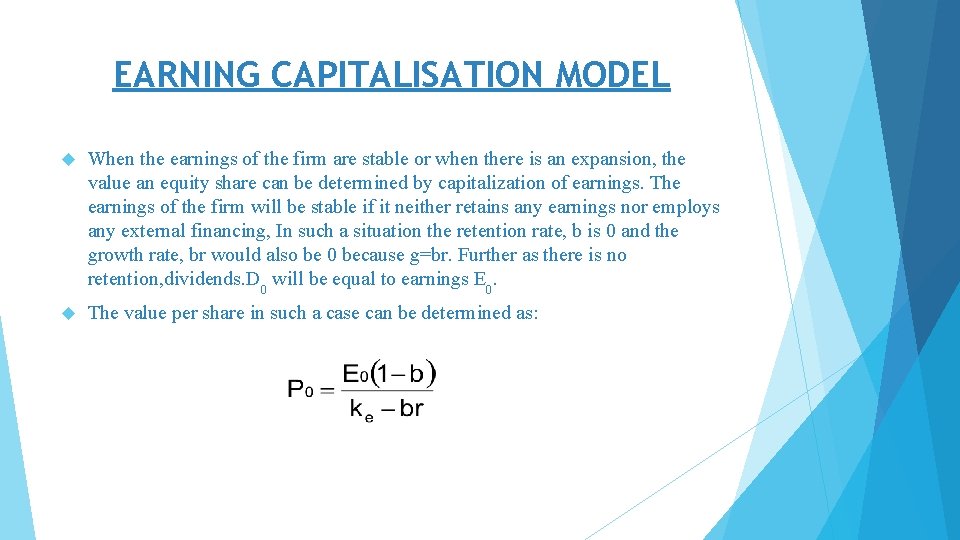

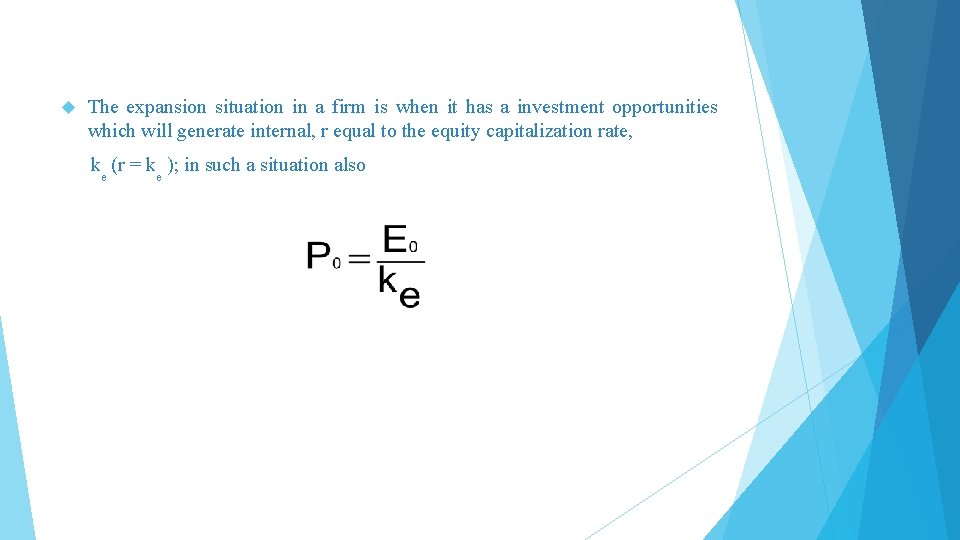

EARNING CAPITALISATION MODEL When the earnings of the firm are stable or when there is an expansion, the value an equity share can be determined by capitalization of earnings. The earnings of the firm will be stable if it neither retains any earnings nor employs any external financing, In such a situation the retention rate, b is 0 and the growth rate, br would also be 0 because g=br. Further as there is no retention, dividends. D 0 will be equal to earnings E 0. The value per share in such a case can be determined as:

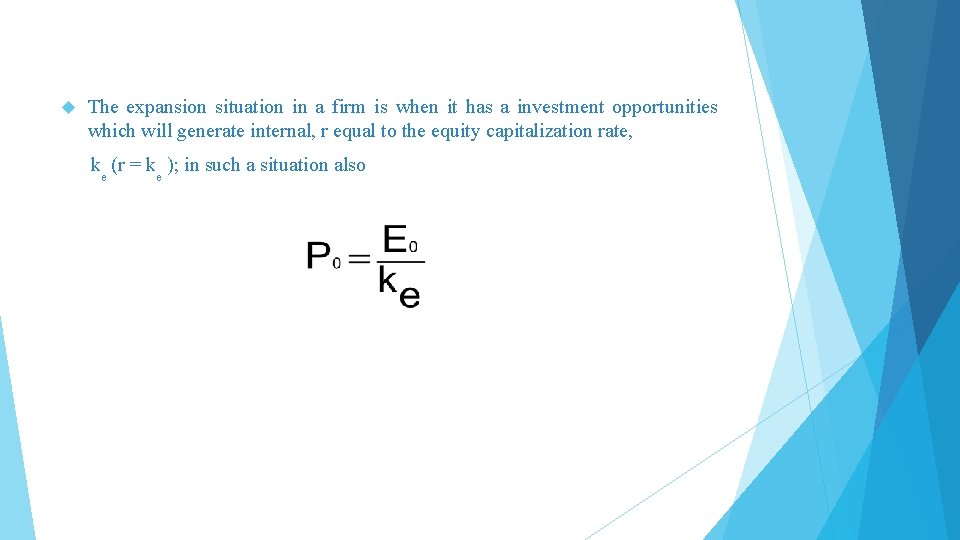

The expansion situation in a firm is when it has a investment opportunities which will generate internal, r equal to the equity capitalization rate, ke (r = ke ); in such a situation also

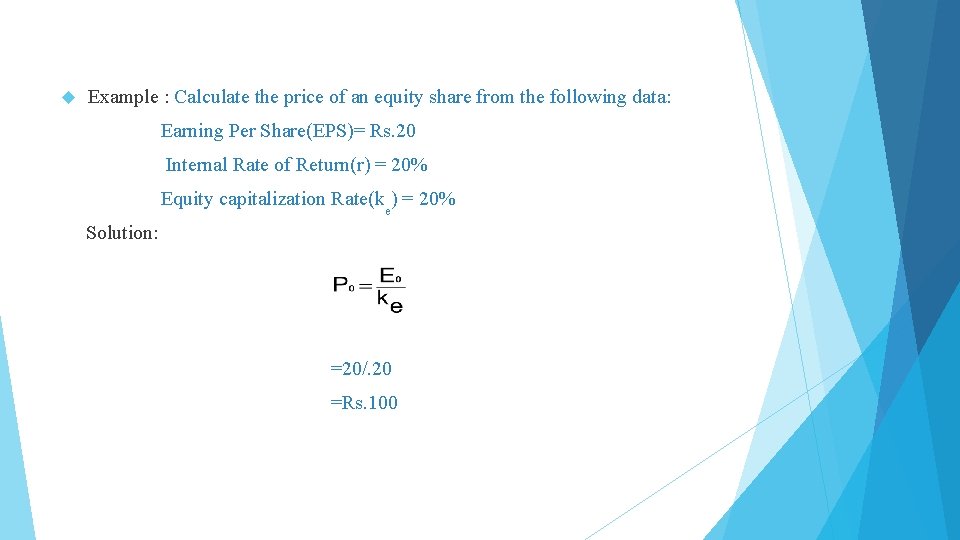

Example : Calculate the price of an equity share from the following data: Earning Per Share(EPS)= Rs. 20 Internal Rate of Return(r) = 20% Equity capitalization Rate(ke) = 20% Solution: =20/. 20 =Rs. 100