Discounted cash flow analysis is the most accurate

- Slides: 7

• Discounted cash flow analysis is the most accurate and flexible method for valuing projects, divisions, and companies. • In DCF valuation, the objective is to find the value of assets, given their cash flow, growth, and risk characteristics. • In relative valuation (i. e. the multiples approach), the objective is to value assets based on how similar assets are currently priced in the market. • While multiples are easy to use and intuitive, they are also easy to misuse. • There are two components to relative valuation: – To value assets on a relative basis, prices have to be standardized, usually by converting prices into multiples of earnings, book values, or sales. – To find similar firms. This is difficult to do since no two firms are identical and firms in the same business can still differ on risk, growth potential, and cash flows. 1

• The strengths of relative valuation are also its weaknesses: – The ease with which a relative valuation can be put together, pulling together a multiple and a group of comparable firms, can also result in inconsistent estimates of value where key variables such as risk, growth, or cash flow potential are ignored. – The fact that multiples reflect the market mood also implies that using relative valuation to estimate the value of an asset can result in values that are too high when the market is overvaluing comparable firms, or too low when it is undervaluing these firms. – While there is scope for bias in any type of valuation, the lack of transparency regarding the underlying assumptions in relative valuations make them particularly vulnerable to manipulation. 2

• The most common multiples used are: – – – Price-earnings (PE) ratio Price-book (PB) ratio Price-sales (PS) ratio Enterprise value/EBITDA Enterprise value/Sales 3

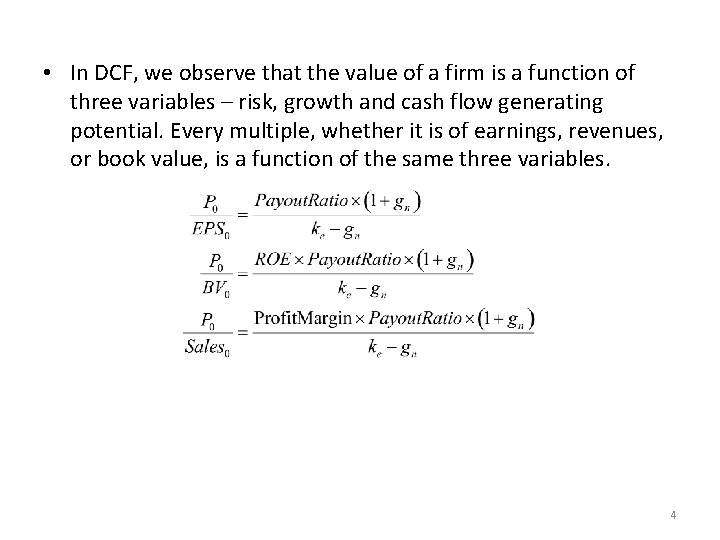

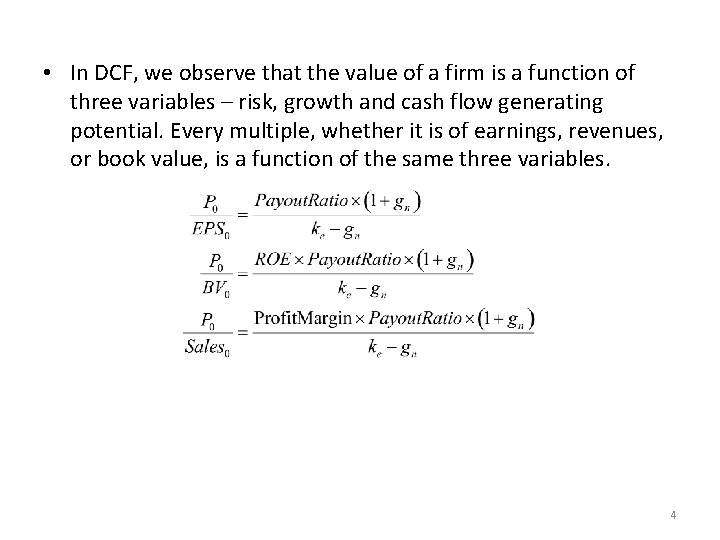

• In DCF, we observe that the value of a firm is a function of three variables – risk, growth and cash flow generating potential. Every multiple, whether it is of earnings, revenues, or book value, is a function of the same three variables. 4

• Companion variables – These are variables (usually a financial ratio) that have been found to have a high explanatory power over a particular multiple. – Some of the items that go together are : 1) growth and P/E; 2) ROE and P/B; 3) profit margin and P/S; 4) operating margin and EV/Sales. – We need to control for these companion variables because they explain why firms can be trading above or below the industry median (or average). We expect firms with better characterics (i. e. companion variables) to have a higher multiple (which means they may not necessarily be overvalued). So, when analyzing the P/E, for example, we can group the firms by their growth rates, and look at the P/E. We expect firms with higher growth rates to trade at a higher P/E. Your firm is undervalued if it has a high growth rate and a low P/E, compared to the rest of the industry. We can apply the same logic to the other multiples, after controlling for the companion variable. 5

• How do we use multiples? – Compare with a firm’s historical multiples – Compare with sector multiples – Valuation • Sum-of-the-parts valuation 6

• Sources: – Damodaran, Investment Valuation, 2 nd ed. – Mc. Kinsey & Company, Koller, Goedhardt, and Wessels, Valuation: Measuring and managing the value of companies, 5 th ed. 7