Dealing with New and Emerging Risks in an

- Slides: 21

Dealing with New and Emerging Risks in an Ever Changing World Paul J. Sobel Vice President/Chief Audit Executive – Georgia-Pacific, LLC Vice Chair – Professional Development for The Institute of Internal Auditors

Presentation Outline The Changing World Impact of Emerging Risks Evolving Risk Assessment Approach Dealing with Risks in a Dynamic Business World Summary 2

The Changing World Global and organizational change Stressed financial structure and cash availability Bankruptcy Fraud and restructuring from many fronts Legislative imperatives and pressure Technological Competition for market share Shareholders Client’s innovation demanding increased accountability changing expectations Pressure/expectations Strategic Mergers from stakeholders and citizens alliances and acquisitions 3

Impact of Emerging Risks New risks keep emerging Risk interdependencies are creating almost unimaginable risk scenarios Speed of change has rendered static, annual risk assessments almost meaningless There seems to be very little tolerance for ineffective risk management 4

Evolution of Risk Assessments In the 1980’s a formal risk assessment was an uncommon, somewhat unsophisticated practice In the 1990’s risk assessment became a “leading practice” ◦ While it was more structured and sophisticated, it still left many “blind spots” In the early 2000’s, annual risk assessments were a standard practice ◦ Some were updating risk assessments more frequently ◦ Still had “blind spot” issues The financial crisis beginning in 2008 caused many to question the value of risk assessments 5

Risk Identification Approach Continually scan the risk environment ◦ Check available public documents ◦ Search for specialist publications A lot of good stuff from outside the United States ◦ Deeper knowledge sharing with competitors Brainstorm previously unimaginable risk scenarios ◦ Disciplined structured process Embedded in strategic planning (60% of failures relate to strategic risks) ◦ Extensive consideration of interdependent risks ◦ May need to bring in specialists (e. g. , economists, analysts, deal makers, regulatory experts) Consistently challenge the completeness and veracity of all risk assumptions 6

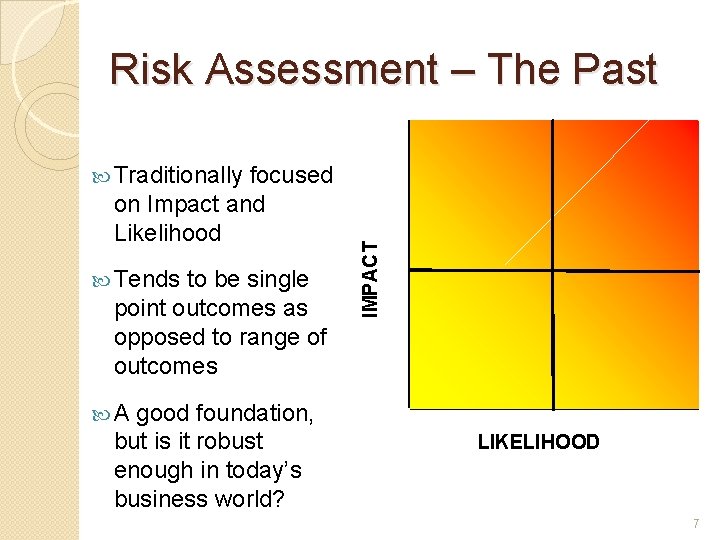

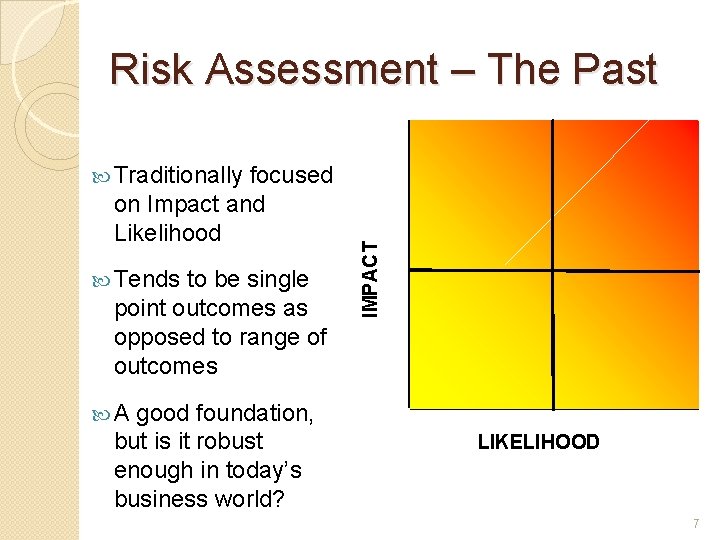

Tends to be single point outcomes as opposed to range of outcomes A good foundation, but is it robust enough in today’s business world? Low focused on Impact and Likelihood IMPACT Medium Traditionally High Risk Assessment – The Past Remote Possible LIKELIHOOD Probable 7

Other Risk Assessment Factors Velocity Readiness Capacity Controllability Monitorability Interdependencies Frequency of occurrence Volatility Maturity Degree of confidence 8

Risk Velocity This has become the risk assessment “criteria du jour; ” however, there are different types of velocity Speed of onset ◦ How quickly does the risk descend upon us? ◦ Do we have much warning? Speed of impact ◦ Do we feel the effects right away, or does the pain slowly increase? ◦ Does it spread and impact us in other ways; e. g. reputation? Speed of reaction ◦ Even if we see it coming, do we have the agility to timely react? 9

Risk Readiness Given that risk represents uncertainty, how ready are we to deal with a risk event? Focus is on an organization’s ability to: ◦ Recognize the onset of the risk ◦ Respond timely and effectively Must also consider 3 rd parties’ ability to respond timely and effectively Risk readiness is really the response part of the risk velocity criteria 10

Risk Capacity Decisions regarding risk readiness must consider an organization’s capacity to absorb or take on risk First consider organization’s appetite and tolerance for the risk outcomes (before sustainability is impacted) ◦ Resilience to consequences ◦ Cost/pain to manage Also consider recovery time – i. e. , how long until the outcomes/effects are no longer felt 11

Other Risk Characteristics Controllability – Do we even have the ability to mitigate/control the risk? Monitorability – Can we monitor: ◦ Risk signposts to anticipate risk onset? ◦ Risk impact to understand how much we’re bleeding? Interdependencies with other risks ◦ Vulnerability to other risks being triggered ◦ Correlation with other risks (Charles Kindleberger) 12

Other Risk Characteristics Frequency of Occurrence – Will a risk occurrence likely be a single event or will it occur multiple times? Risk Volatility – Does the risk lend itself to an infrequent assessment (e. g. , annually) or should it be re-assessed on a regular basis? Risk Management Maturity – Is our risk management mature enough to trust our initial reaction to a risk event? Degree of Confidence – How confident are we in our risk assessment judgments? 13

How Do You Make Sense of all This Information? Mapping Multiple Dimensions Won’t Work! 14

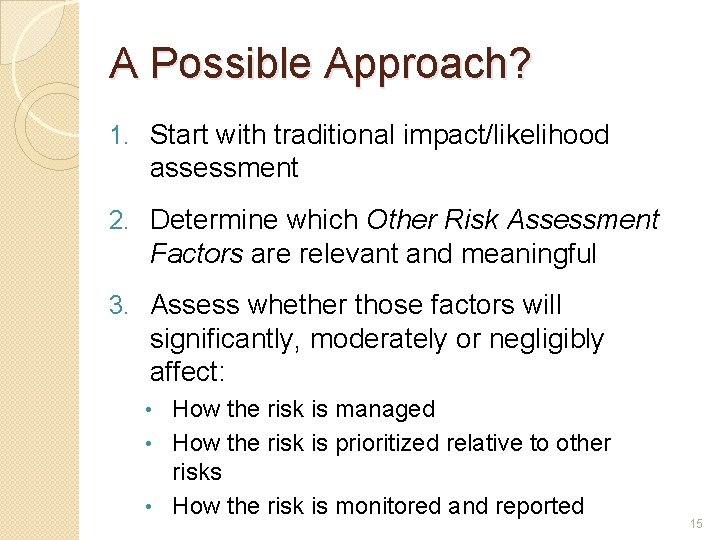

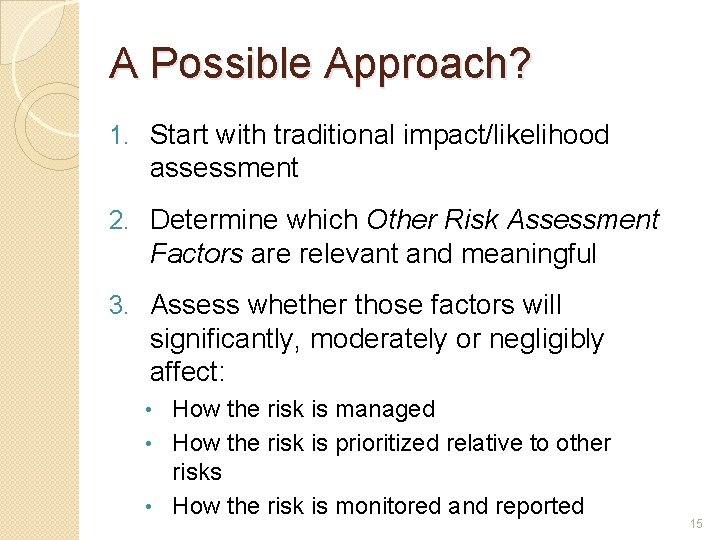

A Possible Approach? 1. Start with traditional impact/likelihood assessment 2. Determine which Other Risk Assessment Factors are relevant and meaningful 3. Assess whether those factors will significantly, moderately or negligibly affect: • How the risk is managed • How the risk is prioritized relative to other risks • How the risk is monitored and reported 15

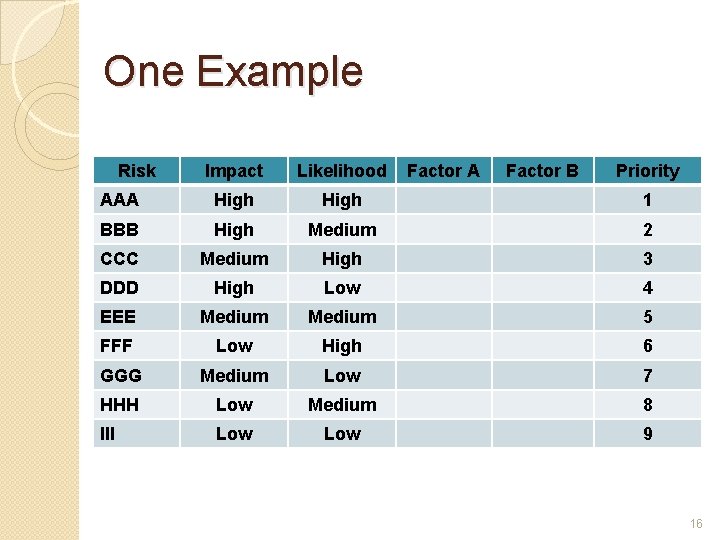

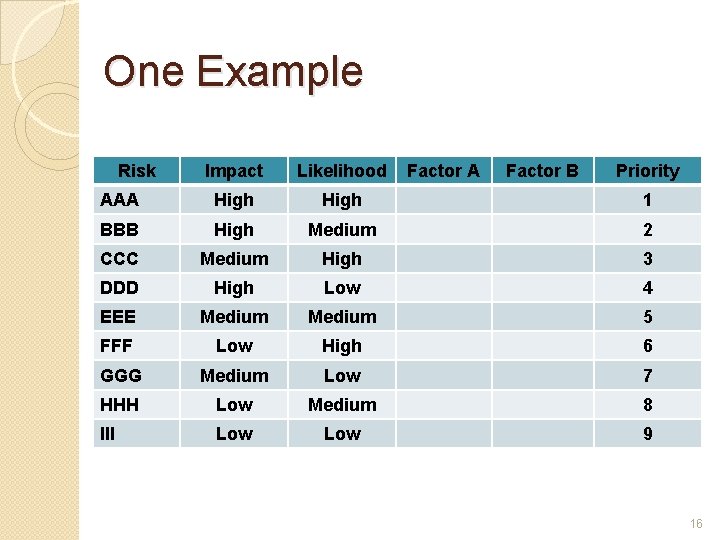

One Example Risk Impact Likelihood Factor A Factor B Priority AAA High 1 BBB High Medium 2 CCC Medium High 3 DDD High Low 4 EEE Medium 5 FFF Low High 6 GGG Medium Low 7 HHH Low Medium 8 III Low 9 16

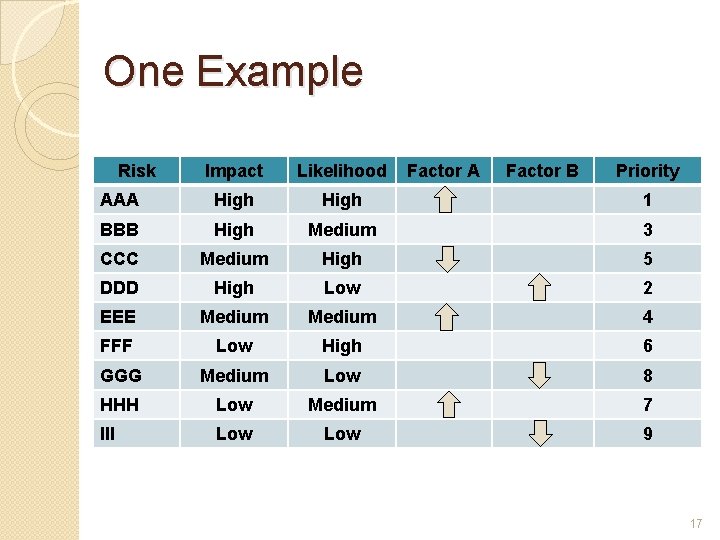

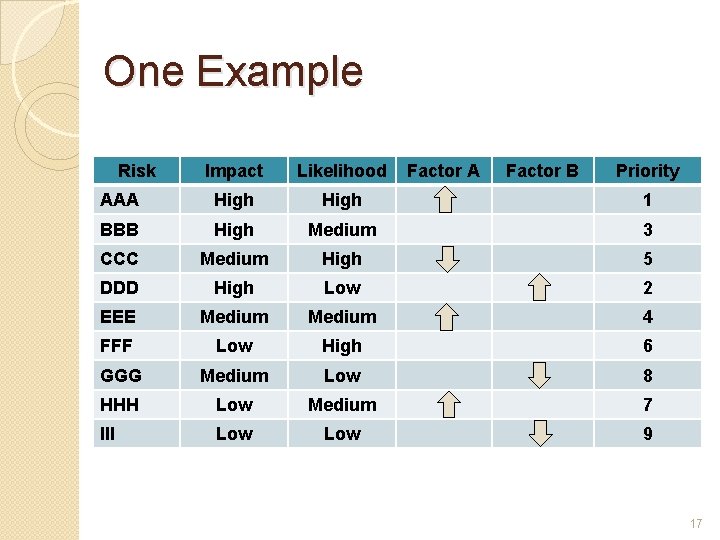

One Example Risk Impact Likelihood Factor A Factor B Priority AAA High 1 BBB High Medium 3 CCC Medium High 5 DDD High Low 2 EEE Medium 4 FFF Low High 6 GGG Medium Low 8 HHH Low Medium 7 III Low 9 17

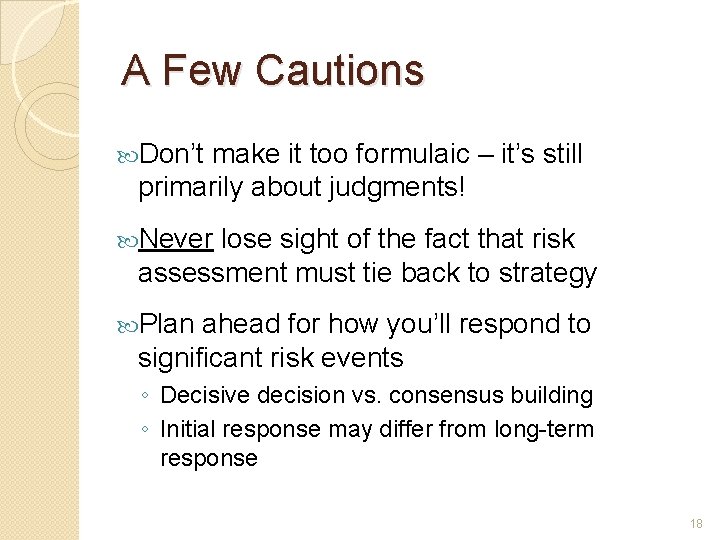

A Few Cautions Don’t make it too formulaic – it’s still primarily about judgments! Never lose sight of the fact that risk assessment must tie back to strategy Plan ahead for how you’ll respond to significant risk events ◦ Decisive decision vs. consensus building ◦ Initial response may differ from long-term response 18

Dealing with Risks in a Dynamic Business World No one-size-fits-all or simple answers Starts with good risk information ◦ Identify risk events early ◦ Initiate risk actions quickly ◦ Monitor effectiveness of risk actions Must have a good escalation process ◦ Who needs what information and when? Don’t just treat the symptoms; cure the disease Be flexible to change; don’t become too attached to what worked in the past 19

In Summary We live in a dynamic, ever changing business world ◦ The speed of change will continue to increase ◦ The impact of mistakes will become even greater Identifying possible emerging risk scenarios will be critical to success ◦ In particular, scenarios among interdependent risks Risk assessment must consider criteria beyond Impact and Likelihood ◦ But don’t make it too complex; it’s still about judgments Dealing with risk events requires a structured and disciplined approach; an ad hoc, reactionary approach won’t cut it 20

QUESTIONS? paul. sobel@gapac. com 21