DB Supply Information Management DB Supplier Management Solutions

D&B Supply Information Management D&B Supplier Management Solutions Saturday, March 6, 2021 Paolo Nobili Sales Representative, National dept. nobilip@dnb. com +39 347 0655038

D&B’s Background • Premier Information Provider enabling business to business commerce for over 161 years • Focus is helping customers “Decide with Confidence” • Trusted Source of Information. . . 90% of customers appear on Fortune 1000 list • Web Focused

Supply Objectives Sourcing objectives • Rebuild vendor file with robust, accurate data • Identify and leverage aggregated family spend • Optimise supply base • Develop a strategy that will assess risk, dependency and diversity compliance

Challenges ü Providing visibility of and access to {customer name} global spend ü Rationalisation of diversity segment within the supply base ü Implementation of an Information Strategy that: • Achieves significant cost savings, year over year • Supports process changes to increase accuracy of spend classification • Continues to optimise the size of the supply base through a robust analysis of consolidated spend • Assures compliance with existing and future sourcing policy • Meets diversity objectives in its supply base • Identifies and minimizes risk to assurance of supply • Utilises contract knowledge to develop sourcing strategies

The Spend Analysis will: Demonstrate how {company name} can leverage D&B’s Solutions by: ü Identify, quantify, leverage and manage savings opportunities • Aggregate and Consolidate Spend • Optimize the supplier base on an on-going basis ü Proactively manage supplier relationships by limiting the level of risk in the supply base, thereby decreasing risks to the supply pipeline and its effects on production, service and R&D. ü Monitor and increase compliance on contracts to capture additional savings ü Plan, manage and grow diversity initiatives Action in these critical areas can deliver significant savings and positively impact {company name} bottom line.

D&B’s Spend Analysis Agenda Supplier Information Profiles Supplier Information Cleansing Supplier Information Enrichment A map of the spend through the enriched D&B data Detail Reports Drill down of high level information from the first sections Spend aggregation Special Suppliers Identify spend aggregation opportunities Identify key supplier categories (e. g. top spend)

D&B’s Spend Analysis Agenda Supplier Information Cleansing Supplier Information Enrichment An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency

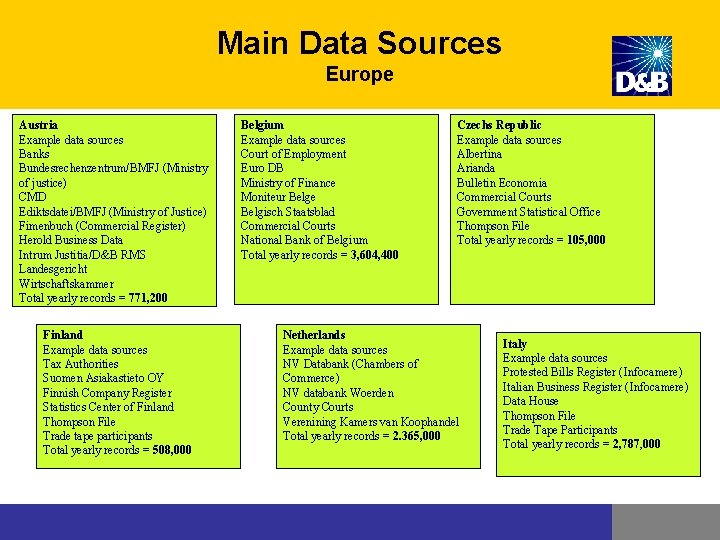

Main Data Sources Europe Austria Example data sources Banks Bundesrechenzentrum/BMFJ (Ministry of justice) CMD Ediktsdatei/BMFJ (Ministry of Justice) Fimenbuch (Commercial Register) Herold Business Data Intrum Justitia/D&B RMS Landesgericht Wirtschaftskammer Total yearly records = 771, 200 Finland Example data sources Tax Authorities Suomen Asiakastieto OY Finnish Company Register Statistics Center of Finland Thompson File Trade tape participants Total yearly records = 508, 000 Belgium Example data sources Court of Employment Euro DB Ministry of Finance Moniteur Belge Belgisch Staatsblad Commercial Courts National Bank of Belgium Total yearly records = 3, 604, 400 Czechs Republic Example data sources Albertina Arianda Bulletin Economia Commercial Courts Government Statistical Office Thompson File Total yearly records = 105, 000 Netherlands Example data sources NV Databank (Chambers of Commerce) NV databank Woerden County Courts Verenining Kamers van Koophandel Total yearly records = 2. 365, 000 Italy Example data sources Protested Bills Register (Infocamere) Italian Business Register (Infocamere) Data House Thompson File Trade Tape Participants Total yearly records = 2, 787, 000

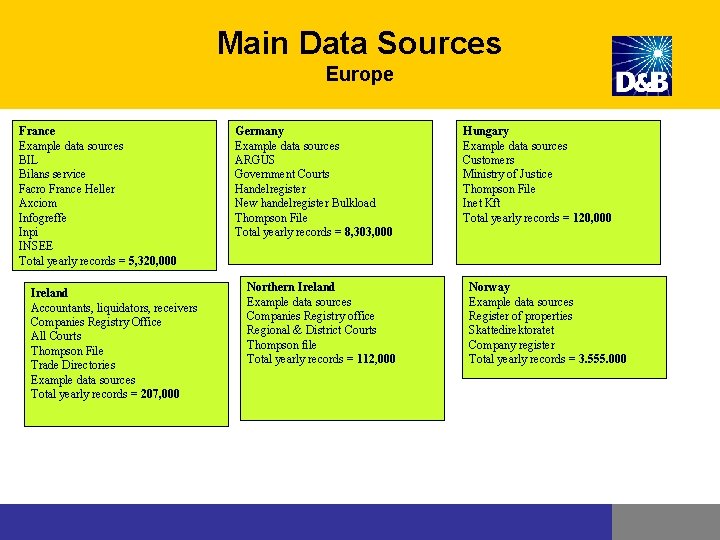

Main Data Sources Europe France Example data sources BIL Bilans service Facro France Heller Axciom Infogreffe Inpi INSEE Total yearly records = 5, 320, 000 Ireland Accountants, liquidators, receivers Companies Registry Office All Courts Thompson File Trade Directories Example data sources Total yearly records = 207, 000 Germany Example data sources ARGUS Government Courts Handelregister New handelregister Bulkload Thompson File Total yearly records = 8, 303, 000 Northern Ireland Example data sources Companies Registry office Regional & District Courts Thompson file Total yearly records = 112, 000 Hungary Example data sources Customers Ministry of Justice Thompson File Inet Kft Total yearly records = 120, 000 Norway Example data sources Register of properties Skattedirektoratet Company register Total yearly records = 3. 555. 000

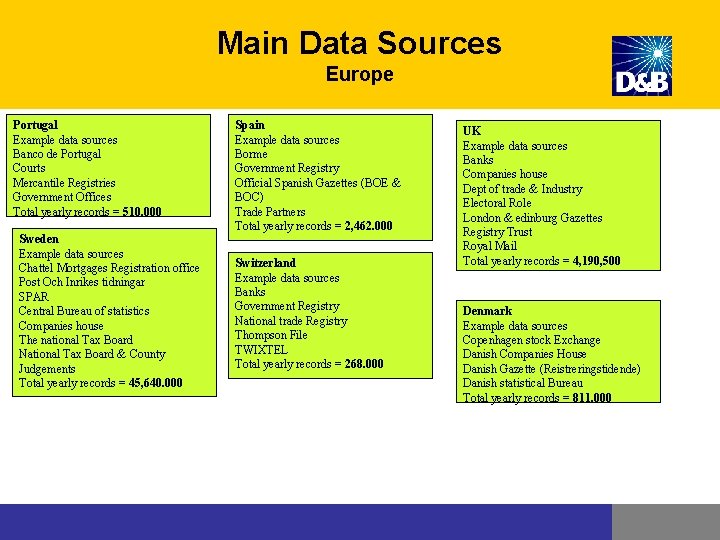

Main Data Sources Europe Portugal Example data sources Banco de Portugal Courts Mercantile Registries Government Offices Total yearly records = 510. 000 Sweden Example data sources Chattel Mortgages Registration office Post Och Inrikes tidningar SPAR Central Bureau of statistics Companies house The national Tax Board National Tax Board & County Judgements Total yearly records = 45, 640. 000 Spain Example data sources Borme Government Registry Official Spanish Gazettes (BOE & BOC) Trade Partners Total yearly records = 2, 462. 000 Switzerland Example data sources Banks Government Registry National trade Registry Thompson File TWIXTEL Total yearly records = 268. 000 UK Example data sources Banks Companies house Dept of trade & Industry Electoral Role London & edinburg Gazettes Registry Trust Royal Mail Total yearly records = 4, 190, 500 Denmark Example data sources Copenhagen stock Exchange Danish Companies House Danish Gazette (Reistreringstidende) Danish statistical Bureau Total yearly records = 811. 000

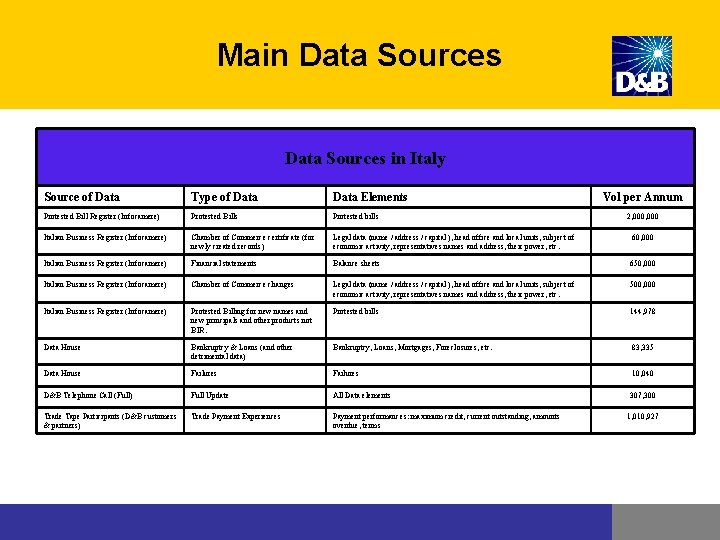

Main Data Sources in Italy Source of Data Type of Data Elements Vol per Annum Protested Bill Register (Infocamere) Protested Bills Protested bills Italian Business Register (Infocamere) Chamber of Commerce certificate (for newly created records) Legal data (name / address / capital ), head office and local units, subject of economic activity, representatives names and address, their power, etc. 60, 000 Italian Business Register (Infocamere) Financial statements Balance sheets 650, 000 Italian Business Register (Infocamere) Chamber of Commerce changes Legal data (name / address / capital ), head office and local units, subject of economic activity, representatives names and address, their power, etc. 500, 000 Italian Business Register (Infocamere) Protested Billing for new names and new principals and other products not BIR. Protested bills 144, 978 Data House Bankruptcy & Loans (and other detrimental data) Bankruptcy, Loans, Mortgages, Foreclosures, etc. 83, 335 Data House Failures 10, 040 D&B Telephone Call (Full) Full Update All Data elements 307, 300 Trade Tape Participants (D&B customers & partners) Trade Payment Experiences Payment performances: maximum credit, current outstanding, amounts overdue, terms 2, 000 1, 010, 927

How Often is Data Updated? • A company changes control every 15 minutes • 1 million updates are made per day “worldwide” • A new set of accounts are keyed every 36 seconds, company enters liquidation, receivership etc. every 3 minutes • A new business is registered every 2. 5 minutes • A new non-corporate record is created every 22 seconds • A secured change is registered every 5 minutes • A company name change is registered every 15 minutes • A directorship change happens every 32 seconds • A share ownership change happens every 6 minutes • A company changes control every 15 minutes • A trade reference is received every second

D&B’s DUNS Number & Family Linkage Fictional example

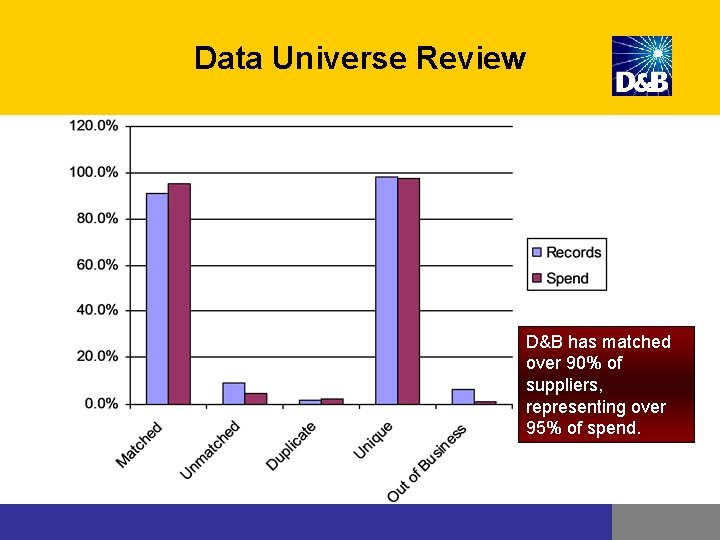

Data Universe Review D&B has matched over 90% of suppliers, representing over 95% of spend.

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency Profiles A map of the spend through the appended D&B data

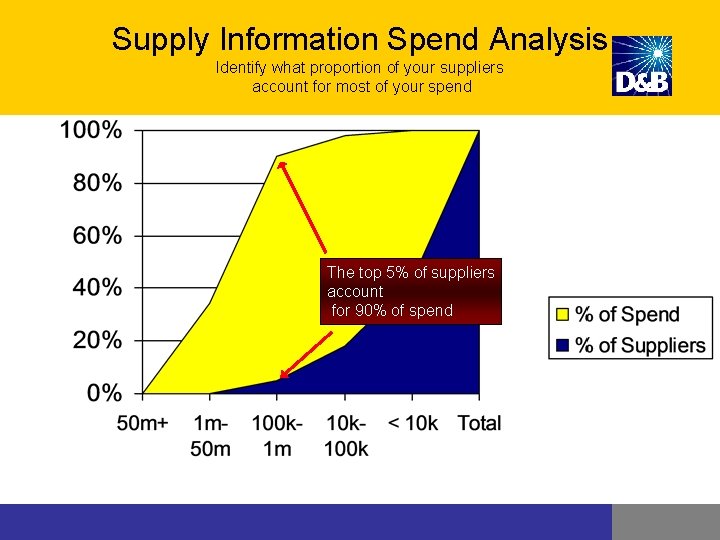

Supply Information Spend Analysis Identify what proportion of your suppliers account for most of your spend The top 5% of suppliers account for 90% of spend

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency Profiles A map of the spend through the appended D&B data

S. I. C Profiles • Major Industry Group Segmentation • % of Total Spend • Suppliers • Purchases • Drilldown to Three Key Industry Segments (Based on SIC) • The spend “Family Tree” based on 2 -digit SIC code • % of Total Spend • Suppliers • Purchases

SIC Codes • • • SIC stands for Standard Industrial Classification Code. The SIC is a code originally developed by the U. S government to describe business activities at an industry level. D&B assigns SIC codes based on management interviews conducted by D&B that define business operations and percentages of revenue derived from each activity. D&B will assign up to 6 four digit SIC codes based on the revenue derived from specific business operations. The order of SIC codes are according to the percentage of total revenue that the activity comprises. The primary SIC code represents the activity with the largest percentage of total revenue. The SIC codes are extracted from D&B’s database on DUNS numbers assigned to a customer’s Master Vendor File.

SIC Code vs. Commodity Code • SIC codes, are assigned based on a business’s operations. Therefore, these codes are industry specific. SIC codes can identify the industry in which a business operates, but does not define the products that the business sells. • Commodity codes (UNSPSC, e. Cl@ss or custom codes), are applied to products and services purchased by a company. These codes are assigned based on descriptions of items found in a company’s Item Master File. These are product specific codes that are used to determine what is purchased.

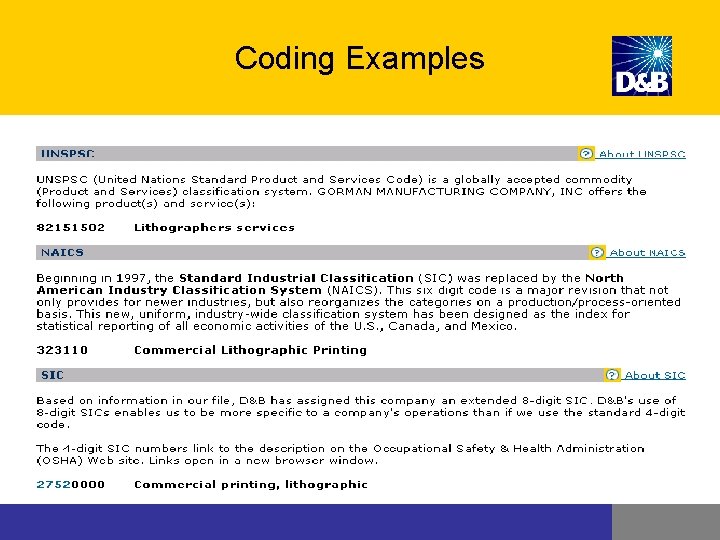

Coding Examples

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency Profiles A map of the spend through the appended D&B data

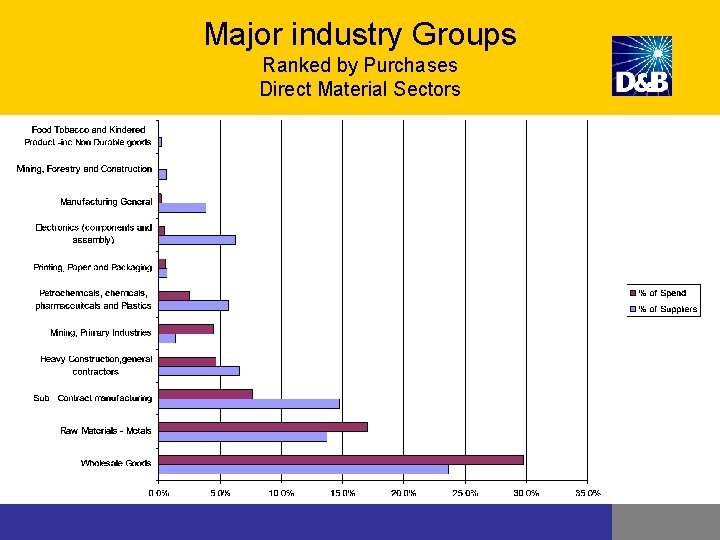

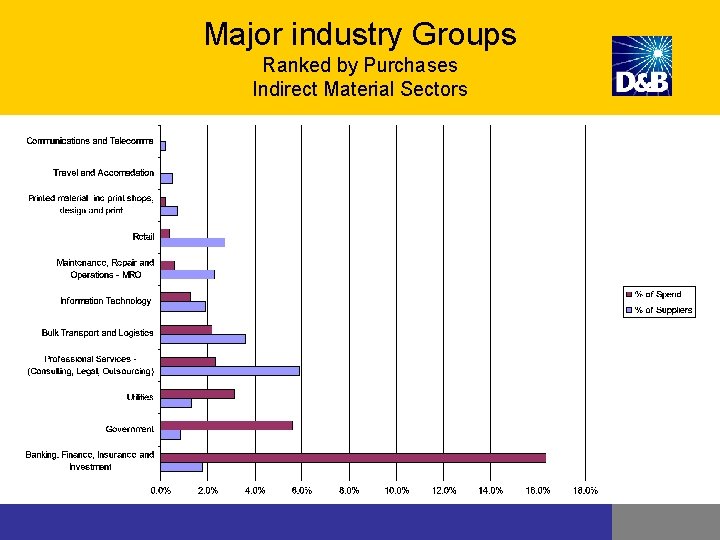

Industry Profiling • D&B has catagorised spend into 24 high level industry/spend sectors, by grouping S. I. C codes together. These can be used to identify significant opportunities and to “drill down” and identify more specific opportunities. Direct sectors description Indirect sectors description Mining, forestry and construction Bulk transport and logistics Manufacturing, general Utilities Mining, primary industries Information technology Food, tobacco and kindred products (inc. non durable goods) Banking, finance, insurance and investment Heavy construction, general contractors Professional services (consulting, legal, outsourcing) Printing, paper and packaging Other services Petrochemicals, pharmaceuticals and plastics Maintenance, repair, operations – MRO Raw materials – metals Travel and accommodation (inc automotive dealers, gas stations and event management) Sub-contract manufacturing Retail Electronics (components and assembly) Printed material (inc print shops, photo copying, brochure design and print) Wholesale durable goods Communications and telecommunications Government Non classifiable

Major industry Groups Ranked by Purchases Direct Material Sectors

Major industry Groups Ranked by Purchases Indirect Material Sectors

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency Profiles A map of the spend through the enriched D&B data

Amount of Spend High Strategic Opportunities for improved Supply Management High spend and relatively low number of suppliers: Spend already optimised to a considerable extent. It may be advisable to examine risk of over-dependency on suppliers of key products & services. STRATEGIC High number of suppliers And high spend: LOWER PRIORITY TACTICAL Low spend spread among a high number of suppliers: Total spend and number of suppliers both relatively low. Savings still possible, especially for those in the “bottom-right” of this quadrant. 0 This is the key area presenting opportunities to leverage spend by negotiating strategic deals. This presents tactical opportunities to consolidate spend amongst fewer suppliers. Number of Suppliers High

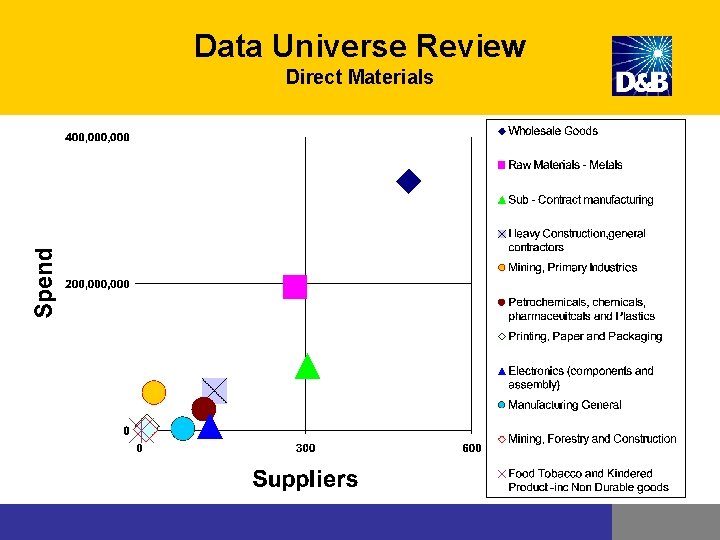

Data Universe Review Direct Materials

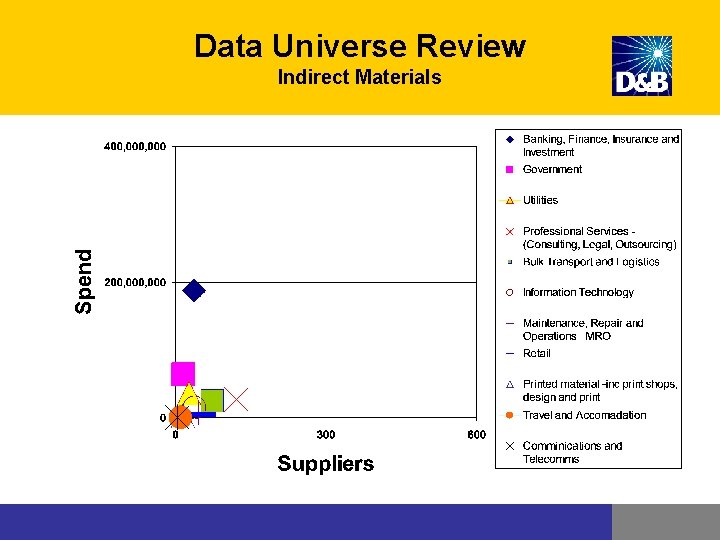

Data Universe Review Indirect Materials

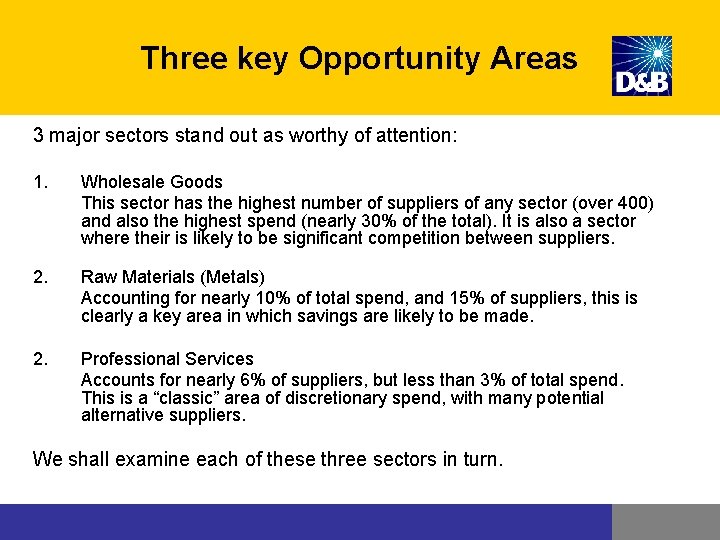

Three key Opportunity Areas 3 major sectors stand out as worthy of attention: 1. Wholesale Goods This sector has the highest number of suppliers of any sector (over 400) and also the highest spend (nearly 30% of the total). It is also a sector where their is likely to be significant competition between suppliers. 2. Raw Materials (Metals) Accounting for nearly 10% of total spend, and 15% of suppliers, this is clearly a key area in which savings are likely to be made. 2. Professional Services Accounts for nearly 6% of suppliers, but less than 3% of total spend. This is a “classic” area of discretionary spend, with many potential alternative suppliers. We shall examine each of these three sectors in turn.

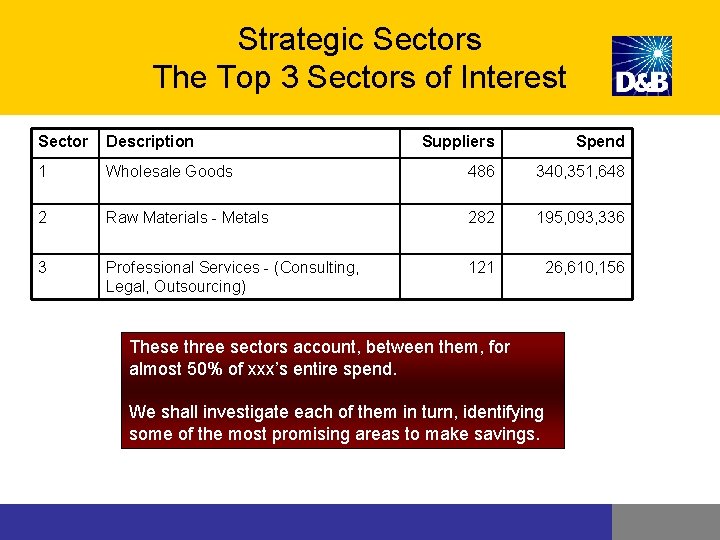

Strategic Sectors The Top 3 Sectors of Interest Sector Description Suppliers Spend 1 Wholesale Goods 486 340, 351, 648 2 Raw Materials - Metals 282 195, 093, 336 3 Professional Services - (Consulting, Legal, Outsourcing) 121 26, 610, 156 These three sectors account, between them, for almost 50% of xxx’s entire spend. We shall investigate each of them in turn, identifying some of the most promising areas to make savings.

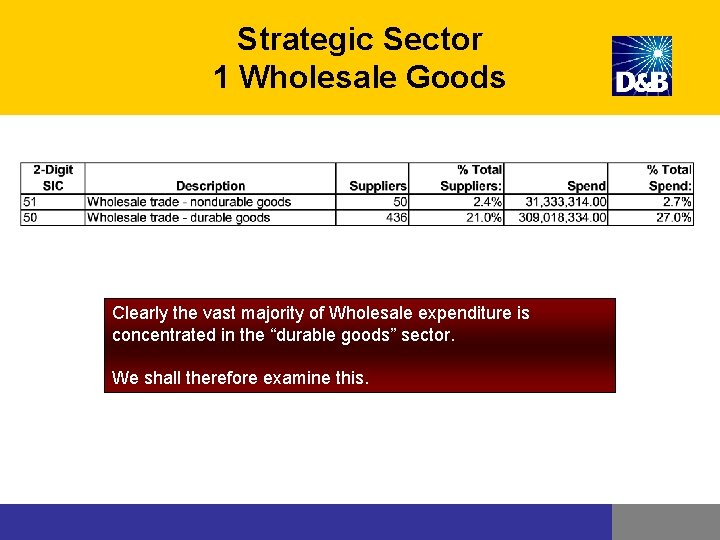

Strategic Sector 1 Wholesale Goods Clearly the vast majority of Wholesale expenditure is concentrated in the “durable goods” sector. We shall therefore examine this.

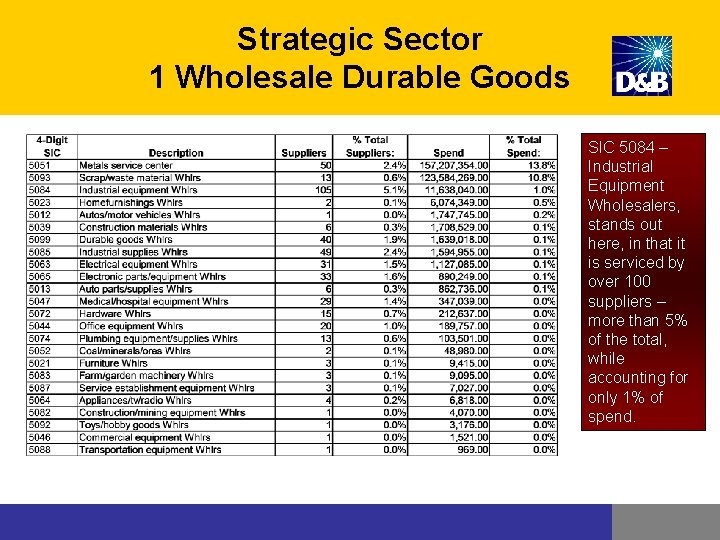

Strategic Sector 1 Wholesale Durable Goods SIC 5084 – Industrial Equipment Wholesalers, stands out here, in that it is serviced by over 100 suppliers – more than 5% of the total, while accounting for only 1% of spend.

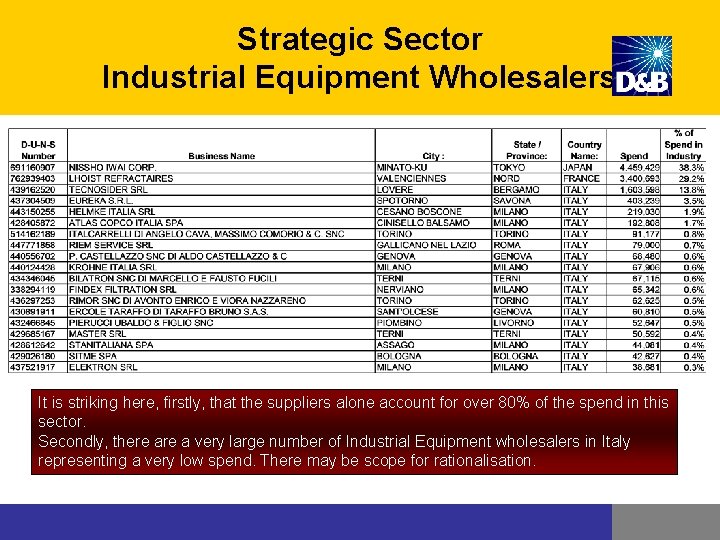

Strategic Sector Industrial Equipment Wholesalers It is striking here, firstly, that the suppliers alone account for over 80% of the spend in this sector. Secondly, there a very large number of Industrial Equipment wholesalers in Italy representing a very low spend. There may be scope for rationalisation.

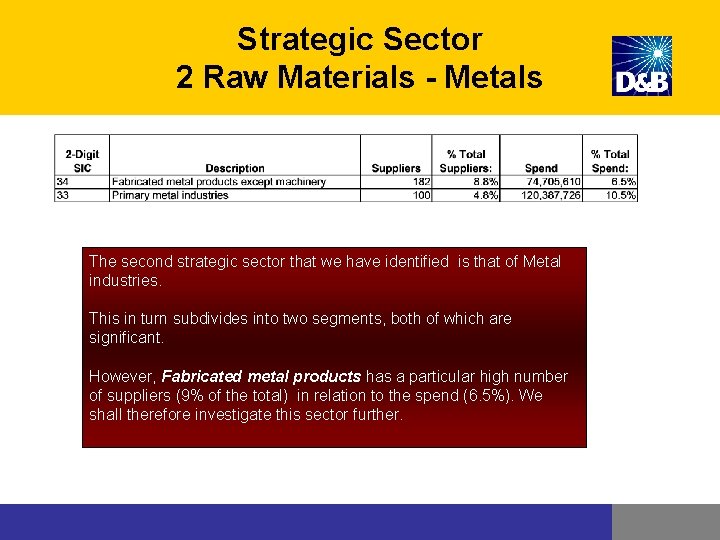

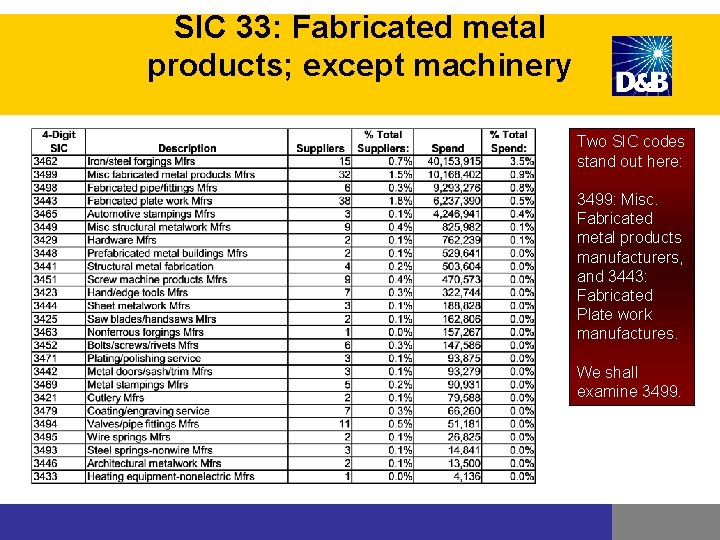

Strategic Sector 2 Raw Materials - Metals The second strategic sector that we have identified is that of Metal industries. This in turn subdivides into two segments, both of which are significant. However, Fabricated metal products has a particular high number of suppliers (9% of the total) in relation to the spend (6. 5%). We shall therefore investigate this sector further.

SIC 33: Fabricated metal products; except machinery Two SIC codes stand out here: 3499: Misc. Fabricated metal products manufacturers, and 3443: Fabricated Plate work manufactures. We shall examine 3499.

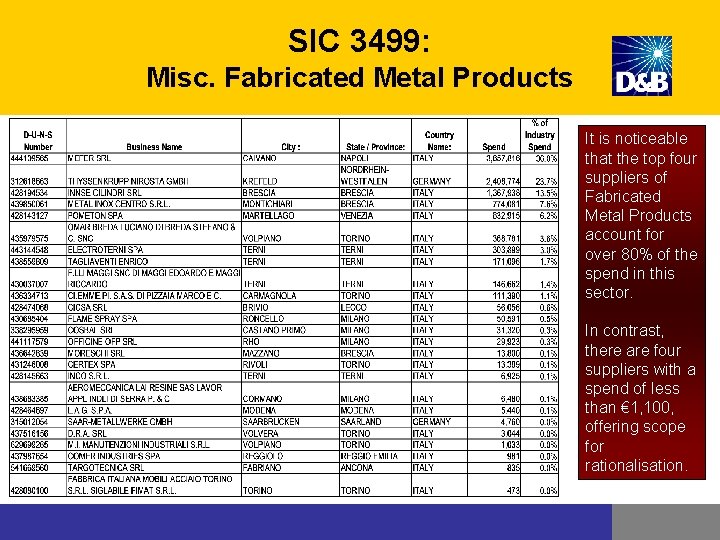

SIC 3499: Misc. Fabricated Metal Products It is noticeable that the top four suppliers of Fabricated Metal Products account for over 80% of the spend in this sector. In contrast, there are four suppliers with a spend of less than € 1, 100, offering scope for rationalisation.

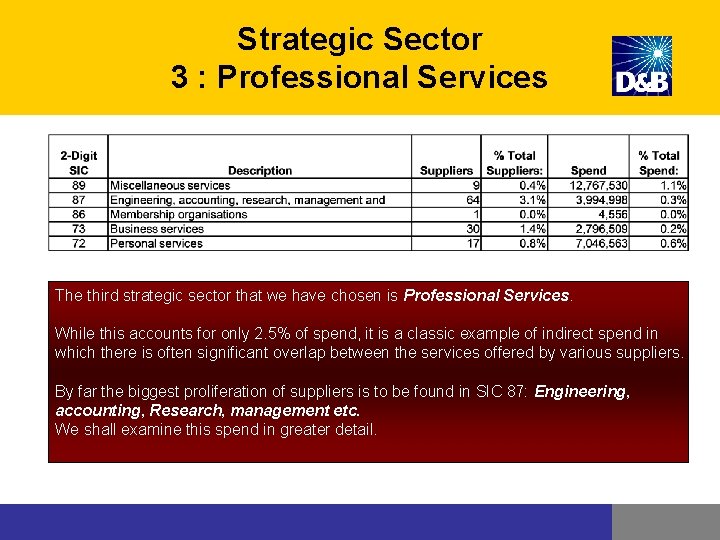

Strategic Sector 3 : Professional Services The third strategic sector that we have chosen is Professional Services. While this accounts for only 2. 5% of spend, it is a classic example of indirect spend in which there is often significant overlap between the services offered by various suppliers. By far the biggest proliferation of suppliers is to be found in SIC 87: Engineering, accounting, Research, management etc. We shall examine this spend in greater detail.

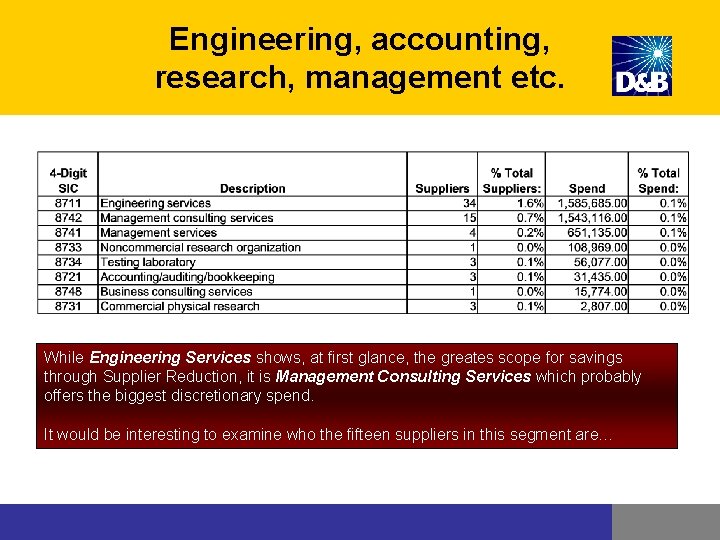

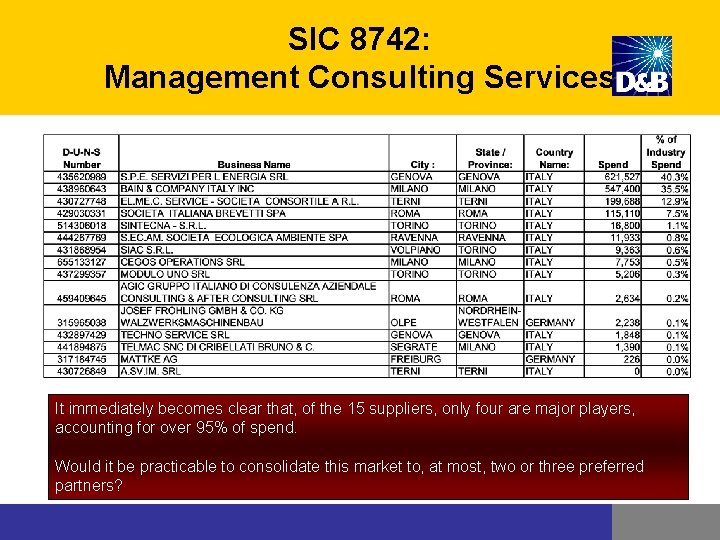

Engineering, accounting, research, management etc. While Engineering Services shows, at first glance, the greates scope for savings through Supplier Reduction, it is Management Consulting Services which probably offers the biggest discretionary spend. It would be interesting to examine who the fifteen suppliers in this segment are…

SIC 8742: Management Consulting Services It immediately becomes clear that, of the 15 suppliers, only four are major players, accounting for over 95% of spend. Would it be practicable to consolidate this market to, at most, two or three preferred partners?

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency Profiles A map of the spend through the enriched D&B data

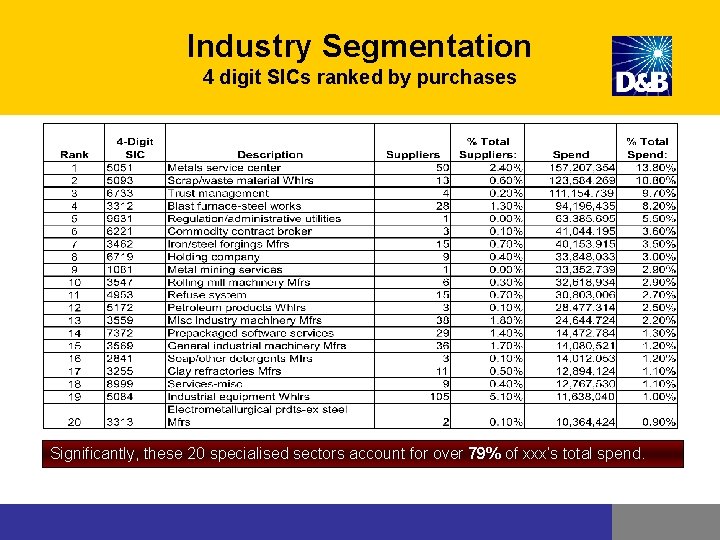

Industry Segmentation 4 digit SICs ranked by purchases Significantly, these 20 specialised sectors account for over 79% of xxx’s total spend.

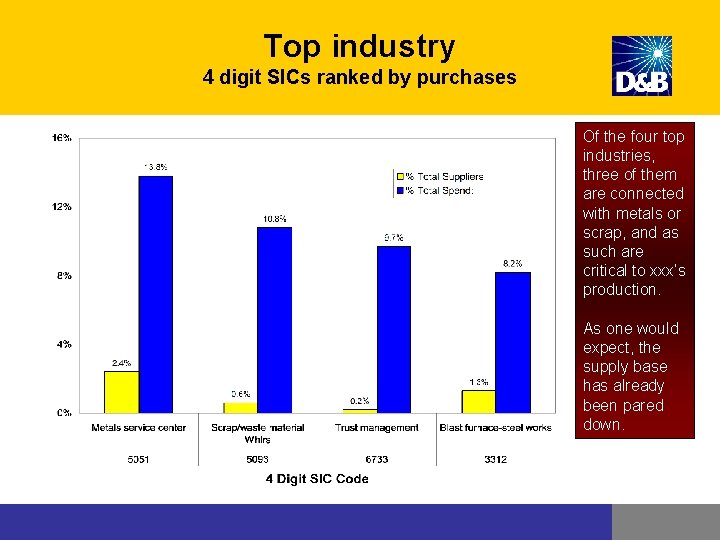

Top industry 4 digit SICs ranked by purchases Of the four top industries, three of them are connected with metals or scrap, and as such are critical to xxx’s production. As one would expect, the supply base has already been pared down.

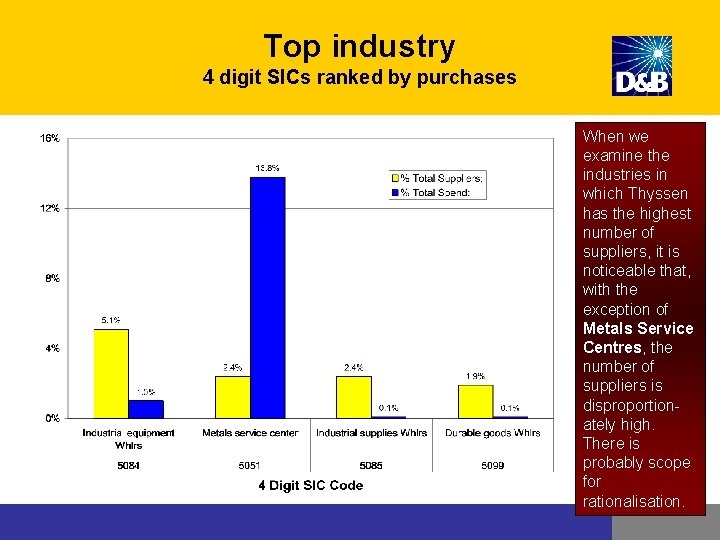

Industry Segmentation 4 digit SICs ranked by suppliers

Top industry 4 digit SICs ranked by purchases When we examine the industries in which Thyssen has the highest number of suppliers, it is noticeable that, with the exception of Metals Service Centres, the number of suppliers is disproportionately high. There is probably scope for rationalisation.

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency Profiles A map of the spend through the enriched D&B data

Geographic Analysis Content • Major Country Segmentation – % of Total Spend – Suppliers – Purchases • Drilldown to a number of key countries (Based on SIC) • The supplier risk analysis – % of Total Spend – Suppliers

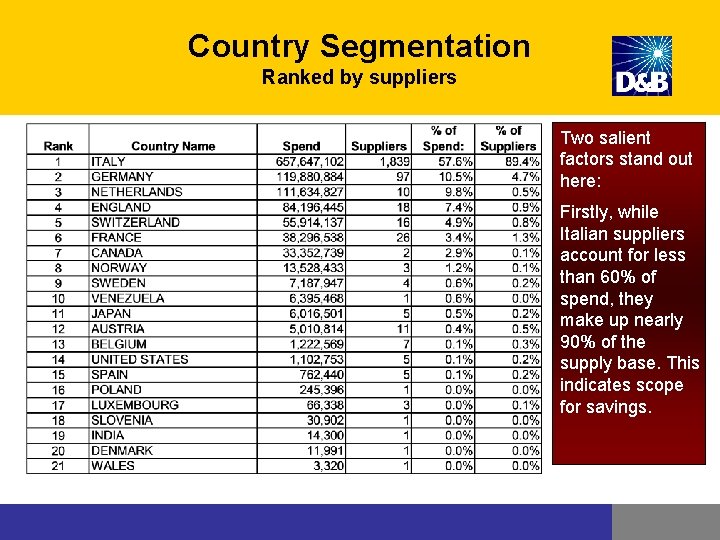

Country Segmentation Ranked by suppliers Two salient factors stand out here: Firstly, while Italian suppliers account for less than 60% of spend, they make up nearly 90% of the supply base. This indicates scope for savings.

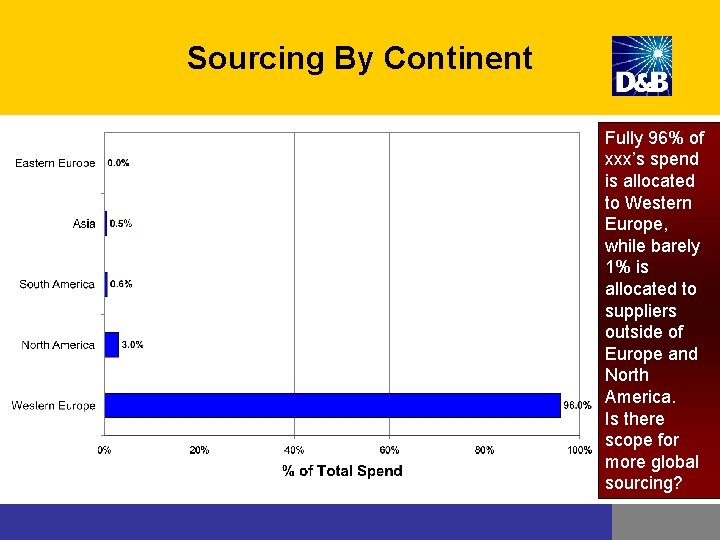

Sourcing By Continent Fully 96% of xxx’s spend is allocated to Western Europe, while barely 1% is allocated to suppliers outside of Europe and North America. Is there scope for more global sourcing?

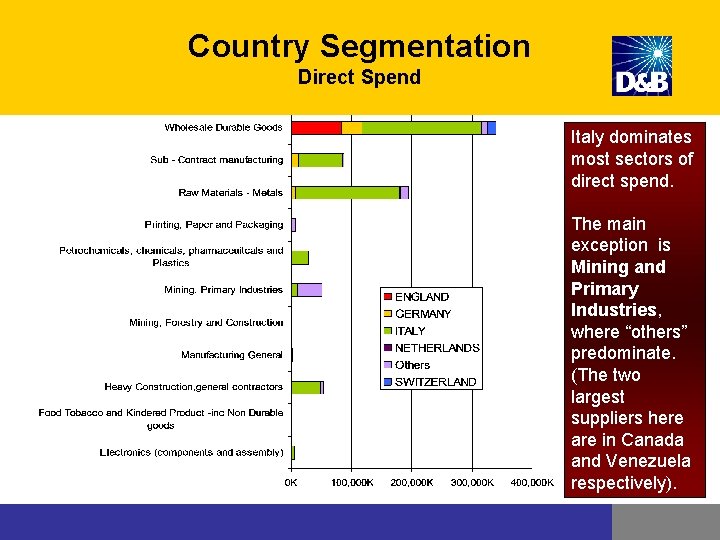

Country Segmentation Direct Spend Italy dominates most sectors of direct spend. The main exception is Mining and Primary Industries, where “others” predominate. (The two largest suppliers here are in Canada and Venezuela respectively).

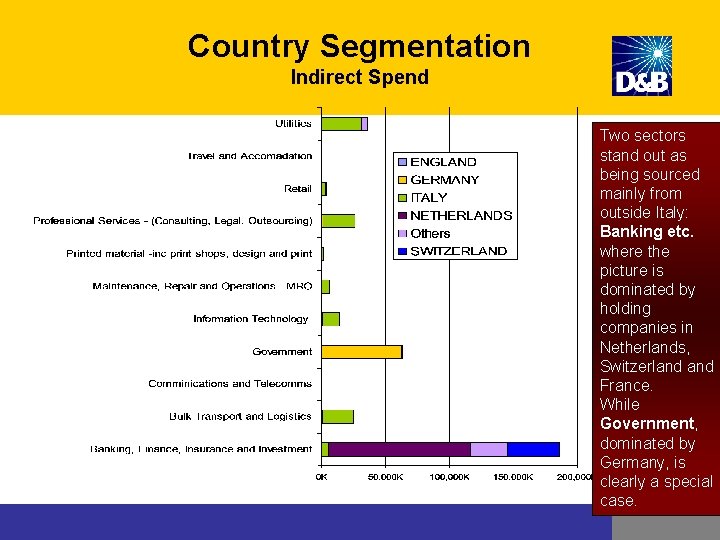

Country Segmentation Indirect Spend Two sectors stand out as being sourced mainly from outside Italy: Banking etc. where the picture is dominated by holding companies in Netherlands, Switzerland France. While Government, dominated by Germany, is clearly a special case.

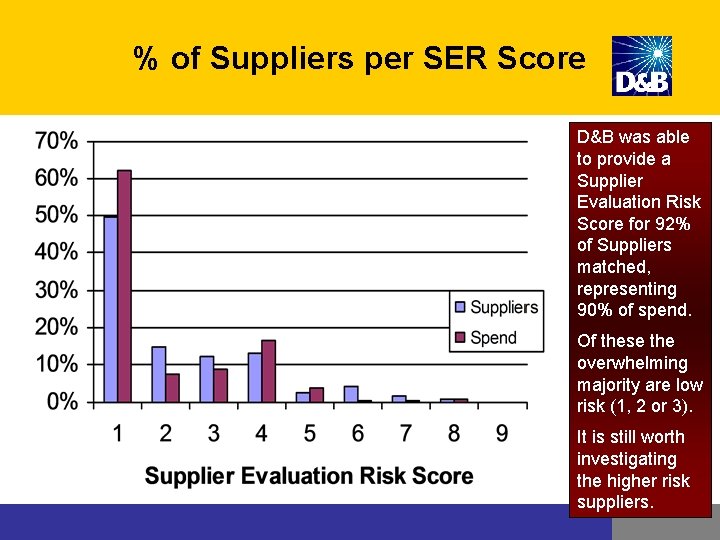

D&B’s Suppliers Risk Score Suppliers are grouped together based on SER scores. The Supplier Risk Score (SER) predicts the likelihood of a firm ceasing business without paying all creditors in full, or reorganizing or obtaining relief from creditors under state law over the next 12 months. Scores are awarded to each supplier. The scores range from 0 -9 and a lower SER score indicates a lower risk and a higher score a higher risk.

% of Suppliers per SER Score D&B was able to provide a Supplier Evaluation Risk Score for 92% of Suppliers matched, representing 90% of spend. Of these the overwhelming majority are low risk (1, 2 or 3). It is still worth investigating the higher risk suppliers.

Suppliers Ranked by Risk Rating Two suppliers in particular, Mefer SRL and IOSA Carlo SRL, appear to present a high risk exposure with a spend of over € 3 million apiece, and an SER Score of 8.

D&B’s Spend Analysis Agenda Spend aggregation Identify spend aggregation opportunities An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Duplicate records & Family trees Supplier dependency

Spend Aggregation Content • Top Duplicate Suppliers - Purchases • Top Interrelated Firms - Suppliers - Purchases

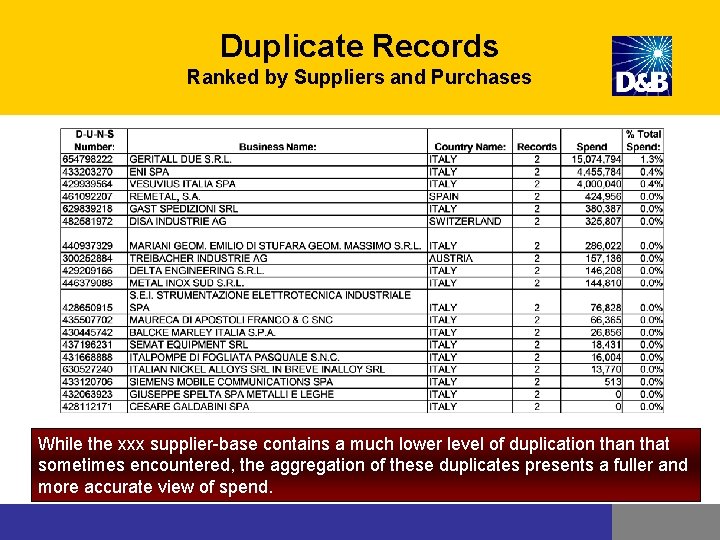

Duplicate Records Ranked by Suppliers and Purchases While the xxx supplier-base contains a much lower level of duplication that sometimes encountered, the aggregation of these duplicates presents a fuller and more accurate view of spend.

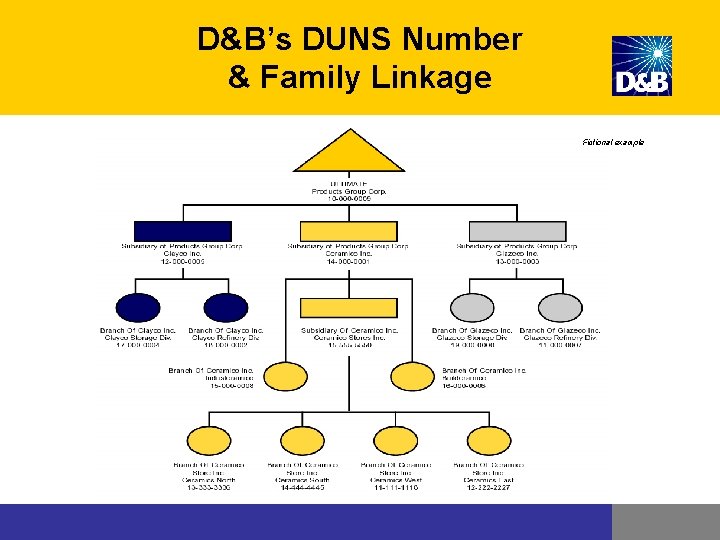

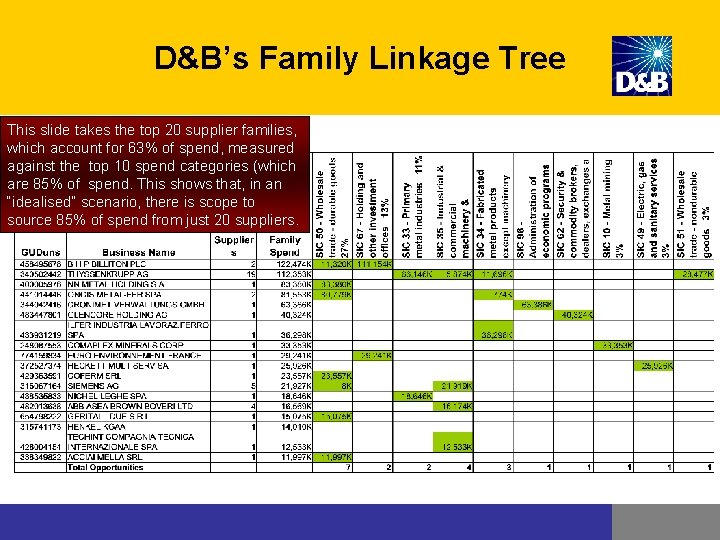

D&B’s Family Linkage Tree D&B provides ownership detail utilising the DUNS Number at three Levels: • Immediate upward linkage: Parent /Headquarters • Highest ranking member of a family tree in the same country as the subject business : Domestic Ultimate • Highest ranking member of a family tree worldwide : Global Ultimate D&B utilises the tree to establish family relationships within a vendor master file. This allows analysis of inter-company relationships to: • Leverage buying power within a corporate family rather than with individual suppliers only • Provide an overview of the overlap of suppliers across multiple purchase sites 60

D&B’s Family Linkage Tree This slide takes the top 20 supplier families, which account for 63% of spend, measured against the top 10 spend categories (which are 85% of spend. This shows that, in an “idealised” scenario, there is scope to source 85% of spend from just 20 suppliers.

D&B’s Spend Analysis Agenda An analysis of: Data overview SIC code analysis Major industry groups Identification of strategic opportunities Industry segmentation Supplier risk Supplier dependency Special Suppliers Identify key supplier categories (e. g. top spend)

Top Individual Suppliers Ranked by Purchases

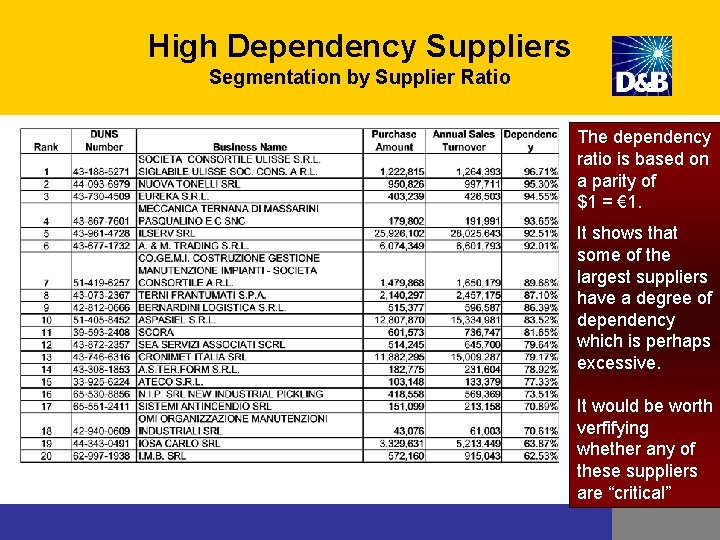

High Dependency Suppliers Segmentation by Supplier Ratio The dependency ratio is based on a parity of $1 = € 1. It shows that some of the largest suppliers have a degree of dependency which is perhaps excessive. It would be worth verfifying whether any of these suppliers are “critical”

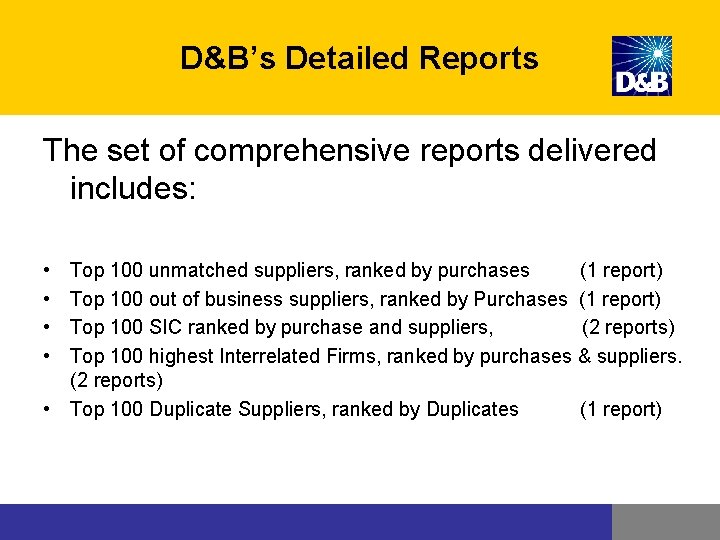

D&B’s Detailed Reports The set of comprehensive reports delivered includes: • • Top 100 unmatched suppliers, ranked by purchases (1 report) Top 100 out of business suppliers, ranked by Purchases (1 report) Top 100 SIC ranked by purchase and suppliers, (2 reports) Top 100 highest Interrelated Firms, ranked by purchases & suppliers. (2 reports) • Top 100 Duplicate Suppliers, ranked by Duplicates (1 report)

D&B’s Spend Analysis Questions?

- Slides: 66