CTG Annual Tax Conference 28 April 2016 The

- Slides: 115

CTG Annual Tax Conference 28 April 2016 The voice of charities on Tax

The voice of charities on Tax

New CTG Website § Interactive version of the Charity Tax Map § Searchable by activity type and tax type § Links to HMRC guidance § Regular, personalised updates on key tax topics § Register for events and respond to consultations online The voice of charities on Tax

Funders and contributors The voice of charities on Tax

Review of tax developments Panel chaired by John Hemming, CTG Chairman and Wellcome Trust The voice of charities on Tax

Business rates and loans to participators John Hemming, CTG Chairman and Wellcome Trust The voice of charities on Tax

Business Rates § Wide-ranging Government review of business rates in 2015 -16 § Formal confirmation from HM Treasury that charity rate reliefs will be maintained § BUT Local Authorities challenging more arrangements The voice of charities on Tax

Loans to participators – charity exemption § New exemption applied from October 2015 The voice of charities on Tax

Apprenticeship Levy Karen Atkinson, Prostate Cancer UK The voice of charities on Tax

Apprenticeship Levy § Background to the levy § Basic requirements § Concerns § Current thinking The voice of charities on Tax

Apprenticeship Levy – Background § Government wishes to focus on improving the productivity of UK Plc § Significantly increasing the number of opportunities for apprenticeships is seen as a key policy move to influence this need The voice of charities on Tax

Apprenticeship Levy – Basic Requirements § Introduction from April 2017 § Levy set at 0. 5% of employers paybill § Applies to paybills in excess of £ 3 m pa § Collected alongside normal PAYE process § Employers receive an allowance of £ 15 k via a digital account § Will be possible to top-up your digital account The voice of charities on Tax

Charity X Charity Y Apprenticeship Levy – Worked Example Total paybill £ 2 m £ 10 m Levy Calculation 0. 5% of £ 2 m = £ 10, 000 0. 5% of £ 10 m = £ 50, 000 £ 15, 000 Allowance applied £ 10, 000 - £ 15, 000 £ 50, 000 - £ 15, 000 Annual Levy payment £ 0 £ 35, 000 The voice of charities on Tax

Apprenticeship Levy – Concerns § Some charities have roles for apprentices. Many do not § Restricted funding models could place restrictions on experience levels of staff involved in projects § Research funding pays for staff costs – will grants have to increase? The voice of charities on Tax

Apprenticeship Levy – Concerns § Funds in digital account can only be used for training costs of approved providers – not salaries § If in-house training provided, needs to meet recognised standards & be open to OFSTED inspection § Connected Charities rule may mean some charities that would otherwise be unaffected are impacted simply because of their structure The voice of charities on Tax

Apprenticeship Levy – Current thinking § No employer sector will be exempt § Disproportionate impact on charities, due to use of volunteers & limited use of apprentices § Effectively this is another payroll tax § Connected Charities rules likely to be reviewed following representations by CTG § Continue to seek discussions with BIS/HMRC The voice of charities on Tax

Common Reporting Standard Alana Petraske, Withers LLP The voice of charities on Tax

Charity Tax Group Annual Conference Common Reporting Standard (CRS) and charities Alana Petraske, Withers LLP 28 April 2016 London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

What is CRS? • OECD-level global model for Automatic Exchange • • Aimed at increasing transparency Purpose: combat cross-border tax evasion Based on US FATCA Requires certain institutions to collect data and report it to HMRC for later exchange with other countries • Will replace CDOT or ‘UK FATCA’ • Implemented by: • EU Directive (binding on the UK) • UK Regulations (implementing the Directive) London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

Why and how does this affect charities? • CRS requires Financial Institutions to report to HMRC on Account Holders • • No exclusion for charities as there is under FATCA! Grant makers are most likely to be Financial Institutions All grantees = Account Holders (including UK and individuals) Due diligence and reporting obligation • If not a Financial Institution then still completing Self. Certification forms for banks, investment managers, but no reporting London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

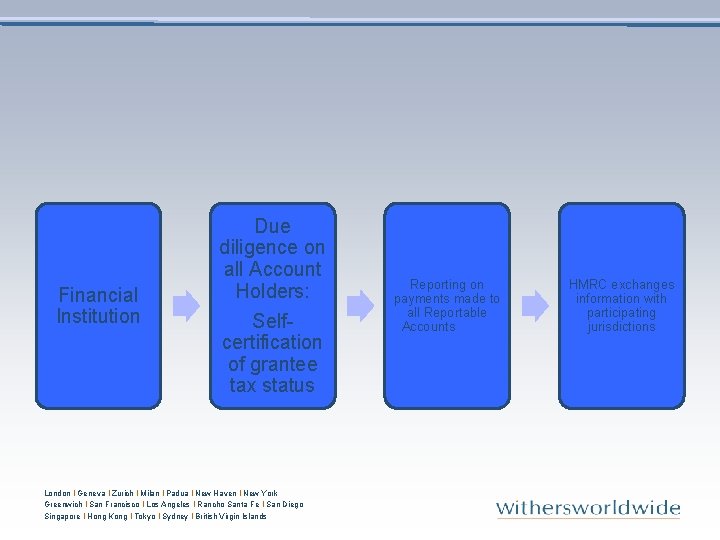

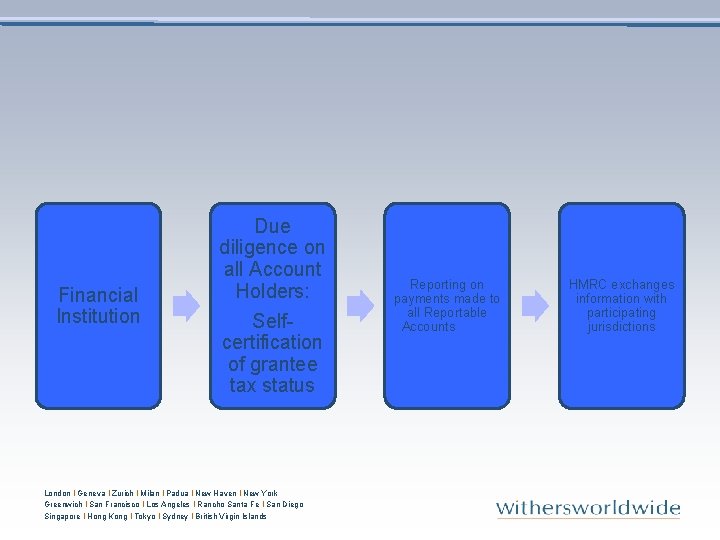

Financial Institution Due diligence on all Account Holders: Selfcertification of grantee tax status London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands Reporting on payments made to all Reportable Accounts HMRC exchanges information with participating jurisdictions

Is CRS in force? • Yes – in force as of 1 January 2016 • Reporting in 2017 in respect of calendar year 2016 • Some jurisdictions implementing in coming years – data collection obligation now to ‘future proof’ • NB - CDOT (or ‘UK FATCA’) already reporting in respect of calendar year 2015 (Isle of Man, Guernsey, Jersey and Gibraltar) London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

CRS Challenges • Administrative burden for charities and grantees • Different than FATCA • Regime designed with banks in mind • Terminology heavy (and counter-intuitive for charities) • OECD and EU level policy decision not to exclude charities • Difficult to argue with transparency… London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

What should charities be doing? • Figure out their CRS status now (and CDOT if relevant)! • Review charity-specific Guidance when issued by HMRC • If a Financial Institution: • Gather self-certification information from 2016 grantees now • Review grantee due diligence procedures generally • Stay in touch with sector bodies and feed back experience London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

Sector consultation and activity • Charity Tax Forum – special Working Party with HMRC • Many sector organisations participating: • CTG • Charity Law Assoc • Charity Investors’ Group • Charity Finance Group • Assoc of Church Accountants • Philanthropy • Stewardship Impact • Liaison with European Foundation Centre London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands • Assoc. of Charitable Foundations

Guidance? • HMRC general manual released now (some teething problems) • Charity-specific guidance expected imminently • HMRC open to comments – please feed back via CTG or other sector groups London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

Alana Petraske, Special Counsel Withers LLP Alana. Petraske@withersworldwide. com London l Geneva l Zurich l Milan l Padua l New Haven l New York Greenwich l San Francisco l Los Angeles l Rancho Santa Fe l San Diego Singapore l Hong Kong l Tokyo l Sydney l British Virgin Islands

Taxation of Cross-Border Philanthropy Hanna Surmatz, European Foundation Centre The voice of charities on Tax

Taxation of Cross. Border Philanthropy in the EU What can be done to ease it? UK Charity Tax Group Conference 28 UK Charity Tax Group Conference 2 London

What’s the issue? • EU law requires non-discrimination in taxation of philanthropy • Divergence of law and practice – barriers remain: • Non-implementation in some MSs • Unclear implementation – lack of user awareness • Varied and sometimes complex approaches to the comparability test • Need to develop practical and policy solutions

Why does this matter? • Cross-border philanthropy growing • Citizens increasingly mobile • Issues do not have borders

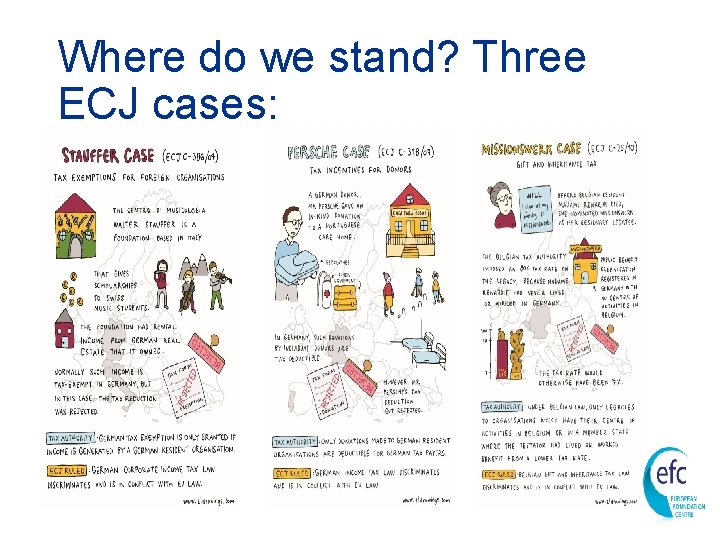

Where do we stand? Three ECJ cases:

First phase of the research • 2014 joint study by EFC and TGE • Author Thomas von Hippel • National experts across EU 28 • Mapping of the 3 ECJ scenarios • Legal requirements • Approaches to implementation

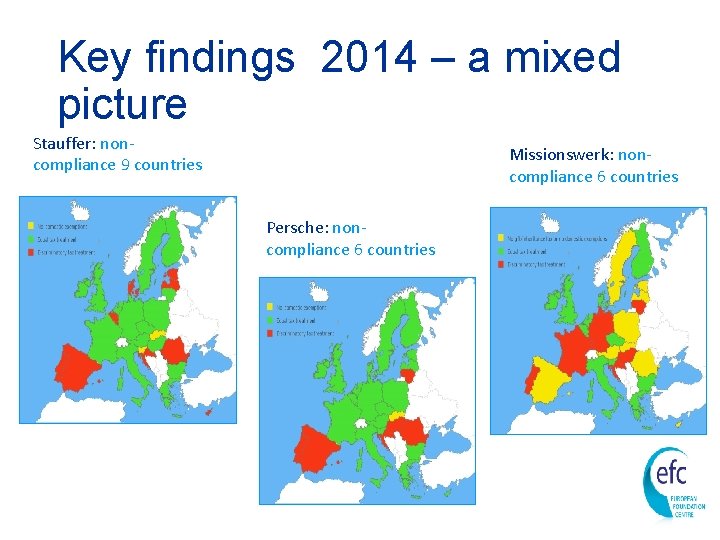

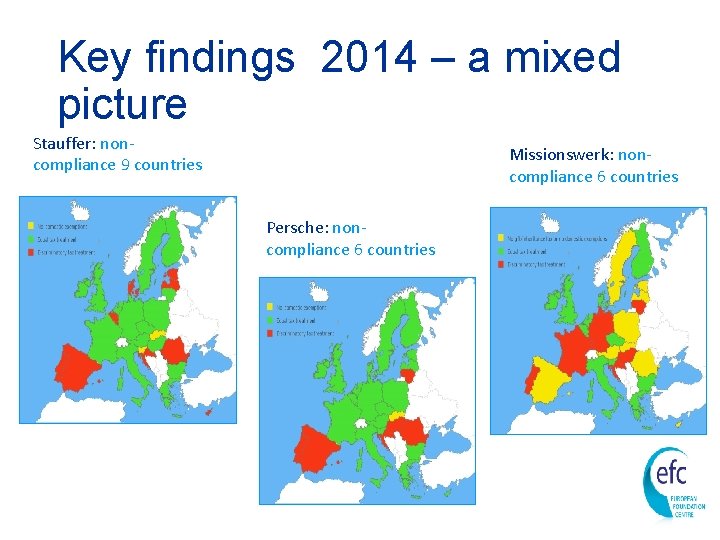

Key findings 2014 – a mixed picture Stauffer: noncompliance 9 countries Missionswerk: noncompliance 6 countries Persche: noncompliance 6 countries

Key findings – comparability test • Divergent approaches • Different type of evidence required • Different authorities responsible (national level, local/regional level) • Wide discretion by authorities • Recognition may be awarded on case by case basis • Administrative costs and barriers (translation, notarization etc. )

What next? • Binding multilateral or bilateral treaties? • Automatic comparability in national tax laws? • Strictest common denominator approach in Model Statutes? • Recommendations to Member States/fiscal authorities to carry out the comparability test with core elements of public-benefit status in mind – feasible or crazy dream? • Can existing national approaches for the comparability test serve as models?

Thank you ! Hanna Surmatz: hsurmatz@efc. be Ludwig Forrest: Forrest. L@Kbs-frb. be

Donations to parent charities Ian Short, KPMG The voice of charities on Tax

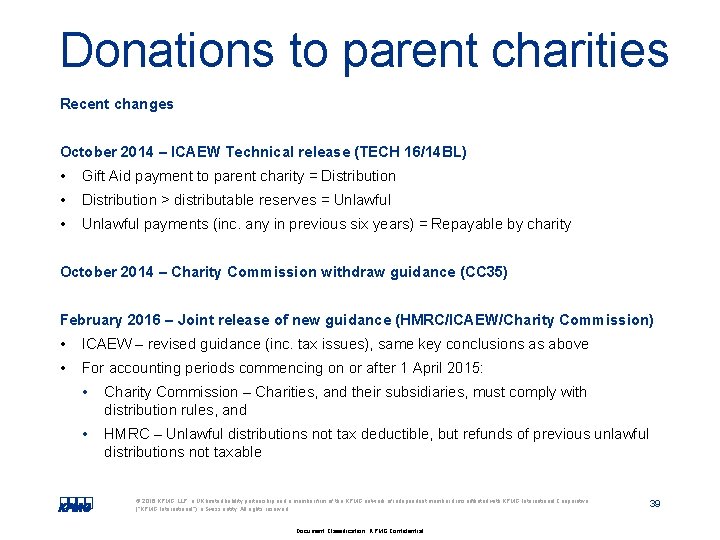

Donations to parent charities Recent changes October 2014 – ICAEW Technical release (TECH 16/14 BL) • Gift Aid payment to parent charity = Distribution • Distribution > distributable reserves = Unlawful • Unlawful payments (inc. any in previous six years) = Repayable by charity October 2014 – Charity Commission withdraw guidance (CC 35) February 2016 – Joint release of new guidance (HMRC/ICAEW/Charity Commission) • ICAEW – revised guidance (inc. tax issues), same key conclusions as above • For accounting periods commencing on or after 1 April 2015: • Charity Commission – Charities, and their subsidiaries, must comply with distribution rules, and • HMRC – Unlawful distributions not tax deductible, but refunds of previous unlawful distributions not taxable © 2016 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Document Classification: KPMG Confidential 39

Donations to parent charities Prior periods Key issues to consider • Have there been any previous unlawful payments? • If so: • • What refunds need to be made? • Is the previous tax deduction affected? Per HMRC guidance, refunds of prior unlawful payments are not taxable © 2016 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Document Classification: KPMG Confidential 40

Donations to parent charities The way forward Insufficient distributable reserves? • Potential remedies (see ICAEW guidance): • Use of post year end profits (i. e. reserves at payment date) • Capital reduction • Loan waivers (but note Charity Commission guidance) • Transfers of assets Ongoing issues? • Non-deductible expenditure may cause issues, e. g. • Depreciation (in excess of capital allowances) • Pension provisions • Entertaining etc… • FRS 102 adjustments? © 2016 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Document Classification: KPMG Confidential 41

Donations to parent charities Further issues What is a parent charity – is it only 100% parent? • Parent charity not defined • Position of control (or joint control)? • Distribution rules still need to be followed if a parent What if it is a distribution, and company not wholly owned by a charity/charities? • Payment not tax deductible, even if it is lawful! © 2016 KPMG LLP, a UK limited liability partnership and a member firm of the KPMG network of independent member firms affiliated with KPMG International Cooperative (“KPMG International”), a Swiss entity. All rights reserved. Document Classification: KPMG Confidential 42

Coffee Break The voice of charities on Tax

VAT: Technical Updates Panel chaired by Graham Elliott, CTG Technical Adviser The voice of charities on Tax

VAT case law update Graham Elliott, CTG Technical Adviser The voice of charities on Tax

Input Tax – Sveda UAB (C-126/14) § Relates to free of charge activity provision and impact on VAT recovery on related costs where there is also a taxable activity § Case related to a commercial company but no reason to doubt its application to charities § Involved expenditure on a ‘theme’ path to which people were to be admitted for no charge, but § The path also led to a retail and catering outlet run by company § CJEU decided that input tax recovery was allowed in full despite element of free use. The voice of charities on Tax

Input Tax – Sveda UAB (C-126/14) § HMRC yet to announce policy in wake of decision § CTG in discussion with HMRC § Suggests that where a cost has a direct link with a taxable activity, elements on non-charged activity can be ignored § No ‘motive test’ applied by the CJEU – so charitable purposes should prove to be irrelevant § May affect visitor attractions, but should also go wider The voice of charities on Tax

Partial Exemption – Chester Zoo (TC 04479) § Whether animal keep costs could be apportioned by reference to all turnover when considering the ‘override’ § HMRC argued that the animal costs only related to exempt admissions and taxable animal experiences § But the tribunal decided that the costs did have a direct link with taxable catering and merchandise supplies § This has echoes of Sveda in so far as it considers the wider commercial picture when determining VAT recovery The voice of charities on Tax

Staff Supplies – Adecco (TC 04743) § Relates to temp staff and whether the employment bureau supplies them or merely intermediates § Follows the earlier Reed Employment case which suggests that bureau cannot coerce worker to take work, so can only be an intermediary § The difference at stake is whether the entire cost of a temp worker is subject to VAT, or only the bureau’s element The voice of charities on Tax

Staff Supplies – Adecco (TC 04743) § The tribunal disagreed with the decision in Reed Employment § It held that the bureau did supply staff and did not merely intermediate § The staff were controlled by Adecco, albeit with cooperation of the user § In most cases, the route of the supply would ‘follow the money’, Adecco paid the worker § The contracts appeared to reflect employer obligations on Adecco The voice of charities on Tax

Education – Brockenhurst College (EWCA Civ 1196) § Whether charges to third parties can ever be exempt as though a supply to the student § Both First tier and Upper Tribunals had accepted that this was effectively ancillary to exempt education § But Brockenhurst and HMRC agreed to apply to the Court of Appeal to have the matter referred to the CJEU § The Court of Appeal agreed to make the reference. The voice of charities on Tax

Education – Wakefield College (UKUT 19) § Whether the College was ‘in business’ when it made charges to certain students (thus impacting on the VAT treatment of its new building) § Charges made to minority of students and at very low levels, but § Charges not ‘means tested’ as such § Therefore the Upper Tribunal rejected the parallel with the Finland CJEU decision and held that the supplies were economic activities The voice of charities on Tax

Economic Activity/RCP – Longridge § Whether the use of the new building was for an RCP § Both the First Tier and the Upper Tribunal had accepted that it was (though the UT simply said the FTT had the right to conclude that) § HMRC appealed to the Court of Appeal which was heard last week § Issue is whether charges made at below cost, using volunteers, and where capital costs met from donations, is a business § Issue of broad importance where certain charities address narrow society needs (e. g. disability) and make very low charges, as well as Longridge types of example The voice of charities on Tax

VAT and direct mail Peter Jenkins, CTG Technical Adviser The voice of charities on Tax

VAT and Direct Mail § HMRC stated that printing and distribution of mail packs is a single supply of marketing services liable to VAT not zero rated supplies of printed matter § Contradicted HMRC’s own guidance and general practice & understanding § HMRC expected VAT to be applied to these supplies from 1 October 2014 § CTG raised serious concerns with senior HMRC officials and called for a transitional period and no retrospective action The voice of charities on Tax

VAT and Direct Mail – HMRC action § No retrospective action unless evidence of fraud/artificiality § Postponed start date of new interpretation by 10 months § Accepted that certain alterations to customer address lists (MPS/ suppressions) can be ancillary to the zero rated supply of printed goods § Updated VAT Notices & Business Brief on transitional period § CTG concerns that assessments by HMRC compliance have undermined some of the agreements reached with policy branch on the agreement not to take retrospective action The voice of charities on Tax

VAT and Direct Mail – Next steps § Composite zero rated supply of delivered goods of print and delivery of charity mail packs no longer possible § Agency disbursement a way of mitigating VAT costs § Industry-wide review of the definition of “creative” services § CTG to monitor the scope and type of assessments carried out by HMRC – feedback is needed from members § Charities should discuss future arrangements with suppliers and inform CTG of any ongoing discussions suppliers are having with HMRC The voice of charities on Tax

VAT – grants and contracts sponsorship Neil Cohen, Trowers & Hamlins The voice of charities on Tax

Presentation ———— 28 April 2016 VAT - grants and contracts/sponsorship - developments and next steps with HMRC Neil Cohen – Trowers & Hamlins

Grants and contracts

Grants and contracts – current position • A critical area of VAT practice for the charity sector • as grant givers and recipients • can result in significant cost if the VAT treatment is incorrect • A difficult and complex area, for example • can a “grant” be subject to VAT? • what are the “badges” of taxable and non-taxable payments? • extensive case law needs interpretation

Grants and contracts – current position • HMRC has circulated draft updated guidance • VATSC 51600 - Consideration: Payments that are not Consideration: Grants • and related guidance • 26 paragraphs in all

Grants and contracts – current position • The CTG VAT Experts Group (VEG) has considered the draft updated guidance • a great improvement • VEG has provided detailed comments on the updated guidance • meeting with HMRC requested to take the matter further • VEG wishes to collaborate closely with HMRC in this area

Sponsorship

Sponsorship – current position • Another complex area of the VAT regime • Difficulties around, for example • when is sponsorship a non-taxable donation • when is it a taxable payment e. g. for advertising? • very fact sensitive • HMRC Notice 701/41 (1 March 2002) • in need of updating and expanding • HMRC has circulated a draft updated Notice

Sponsorship – current position • VEG has considered the draft updated Notice • helpful and welcome, but demonstrates the need for a major review of HMRC policy in this area of VAT • meeting with HMRC requested to take the matter further before VEG comments in detail • VEG wishes to collaborate closely with HMRC in this area

Cost-sharing exemption and VAT Grouping Graham Elliott, CTG Technical Adviser Neil Cohen, Trowers & Hamlins The voice of charities on Tax

Gift Aid: Practical issues for charities Panel chaired by Justin Bevan, Oxfam The voice of charities on Tax

Implementing the new Gift Aid Declaration Barnaby Brand Service Delivery Executive WWF-UK * - 69

Knowledge • Get informed early. • Key dates • Inform: Who needs to know? • Inform: How can I sell this to them? • Market: The benefits of the new Gift Aid Declaration to campaign managers. * - 70

Documentation • Ensure that you have a central document with the up to date Gift Aid Declaration available for colleagues to use. • Encourage them to archive old Gift Aid Declaration wording and images to prevent their use as templates for new material. • Update the website, and check that it has been done! 3/8/2021 - 71

Campaign sign off process • As part of our campaign approval process all Gift Aid components are approved by my team. • If colleagues are still using old or incorrect wording, update and educate them (nicely!). 3/8/2021 - 72

“Gone-aways” and data cleansing Justin Bevan, Oxfam The voice of charities on Tax

Resident Bureau “PO 3” • Opportunities for supporters to update details • Effectiveness of data cleaning agencies • Identify and share best practice

Gift Aid: Liability issues Laurent Maumus, Cancer Research UK The voice of charities on Tax

Gift Aid - Liability Issues Laurent Maumus – Cancer Research UK 28/04/2016

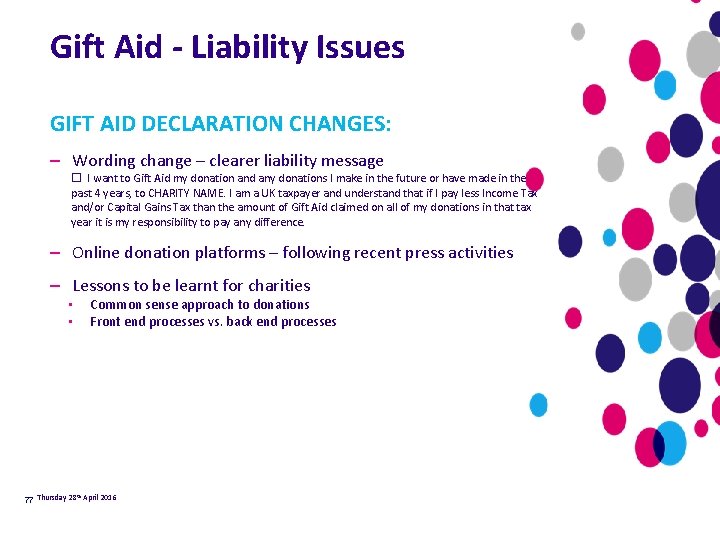

Gift Aid - Liability Issues GIFT AID DECLARATION CHANGES: – Wording change – clearer liability message I want to Gift Aid my donation and any donations I make in the future or have made in the past 4 years, to CHARITY NAME. I am a UK taxpayer and understand that if I pay less Income Tax and/or Capital Gains Tax than the amount of Gift Aid claimed on all of my donations in that tax year it is my responsibility to pay any difference. – Online donation platforms – following recent press activities – Lessons to be learnt for charities • • Common sense approach to donations Front end processes vs. back end processes th 77 Thursday 28 April 2016

Retail Gift Aid Robin Osterley, Charity Retail Association The voice of charities on Tax

Retail Gift Aid ROBIN OSTERLEY 28/4/16

WHERE WE ARE AT • • • Has been around some time, take up around 33% now New Gift Aid guidance issued by HMRC after extensive consultation with CRA and others Burden on charity retailers now substantially reduced Still basic requirements to report sales to donors Templates and new declaration now published on HMRC website

NEW TRAINING GUIDANCE • • • Training a very important issue for HMRC New training guidance to be issued as a CRA member service Developed by BDO with input from HMRC, CRA and our members Oxfam, Helen & Douglas House, BHF, CRUK and Eproductive

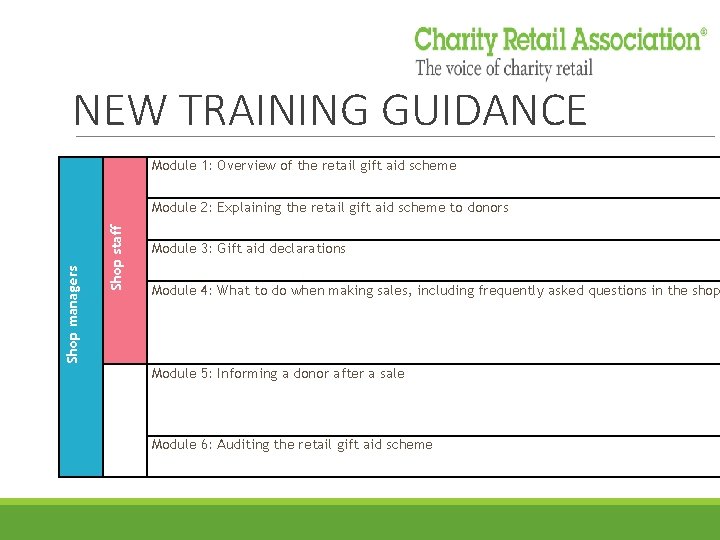

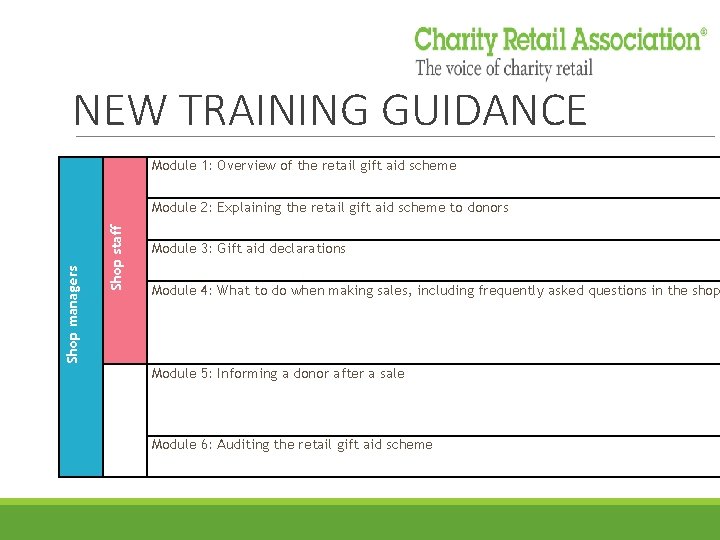

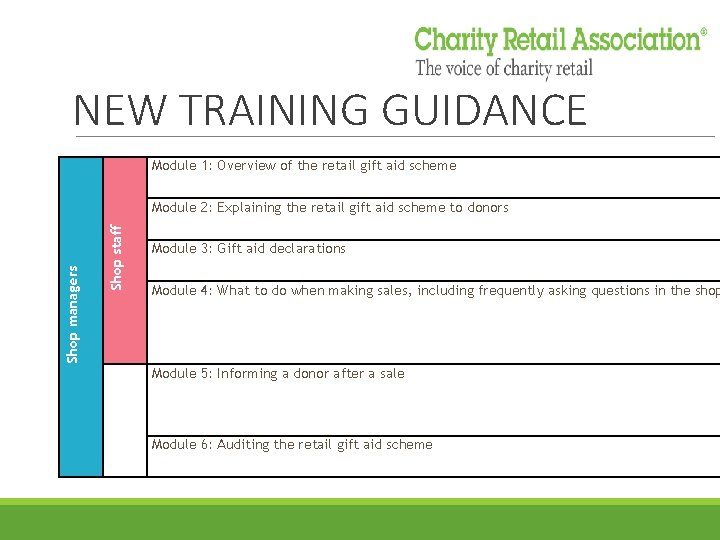

NEW TRAINING GUIDANCE Module 1: Overview of the retail gift aid scheme Shop staff Shop managers Module 2: Explaining the retail gift aid scheme to donors Module 3: Gift aid declarations Module 4: What to do when making sales, including frequently asked questions in the shop Module 5: Informing a donor after a sale Module 6: Auditing the retail gift aid scheme

NEW TRAINING GUIDANCE • Due to be finalised midend May • Launch on 9 th June at BDO • Training guidance available to CRA members FOC, to others at a cost

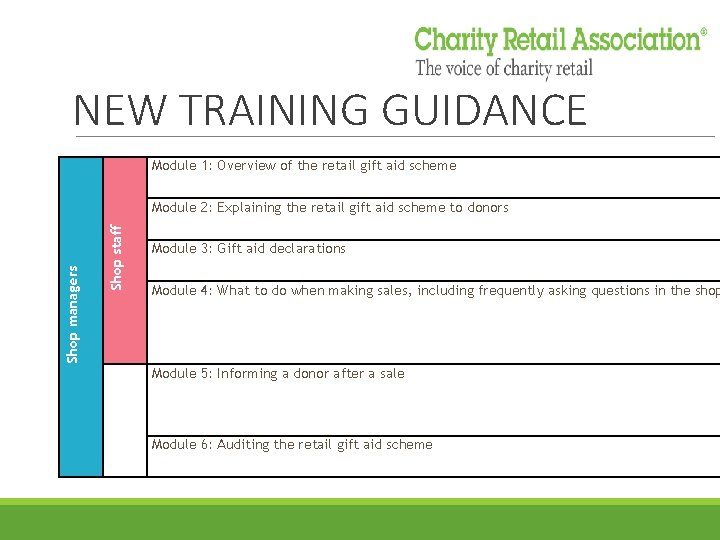

NEW TRAINING GUIDANCE Module 1: Overview of the retail gift aid scheme Shop staff Shop managers Module 2: Explaining the retail gift aid scheme to donors Module 3: Gift aid declarations Module 4: What to do when making sales, including frequently asking questions in the shop Module 5: Informing a donor after a sale Module 6: Auditing the retail gift aid scheme

Q & A with Expert Panel Including Alan Causer, Tony Johnson and Sue Pennicott, HMRC The voice of charities on Tax

Lunch The voice of charities on Tax

Future of VAT rates and reliefs Panel chaired by Graham Elliott, CTG Technical Adviser The voice of charities on Tax

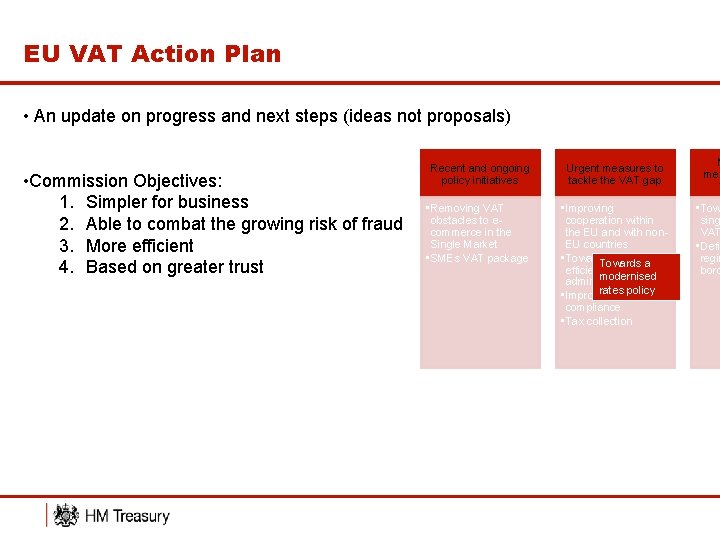

EU VAT Action Plan Ian Broadhurst, HMRC The voice of charities on Tax

EU VAT Action Plan • An update on progress and next steps (ideas not proposals) • Commission Objectives: 1. Simpler for business 2. Able to combat the growing risk of fraud 3. More efficient 4. Based on greater trust Recent and ongoing policy initiatives • Removing VAT obstacles to ecommerce in the Single Market • SMEs VAT package Urgent measures to tackle the VAT gap • Improving cooperation within the EU and with non. EU countries • Towards more Towards a efficient tax modernised administrations. rates policy • Improving voluntary compliance • Tax collection M mea t • Tow sing VAT • Defi regim bord

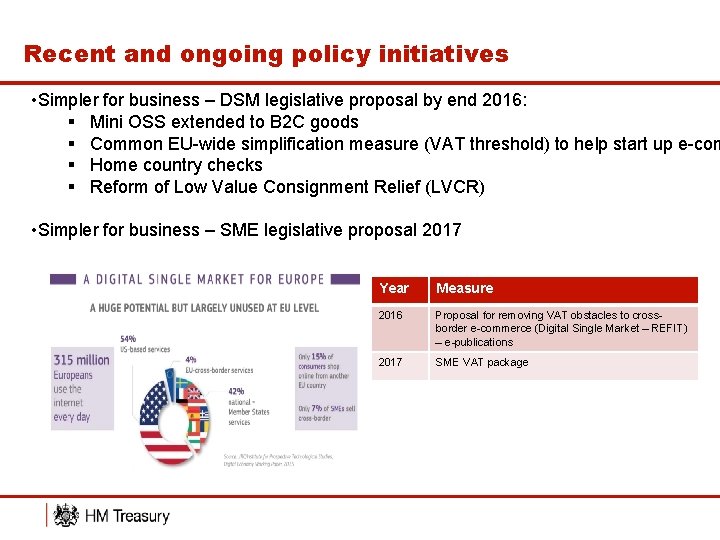

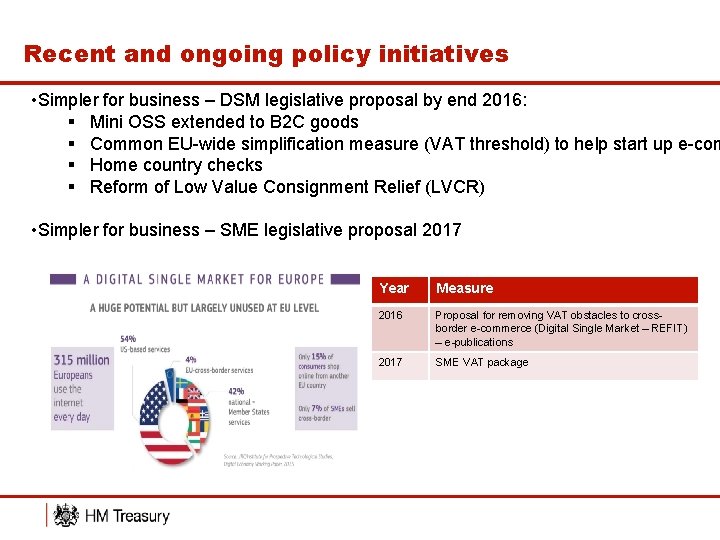

Recent and ongoing policy initiatives • Simpler for business – DSM legislative proposal by end 2016: § Mini OSS extended to B 2 C goods § Common EU-wide simplification measure (VAT threshold) to help start up e-com § Home country checks § Reform of Low Value Consignment Relief (LVCR) • Simpler for business – SME legislative proposal 2017 Year Measure 2016 Proposal for removing VAT obstacles to crossborder e-commerce (Digital Single Market – REFIT) – e-publications 2017 SME VAT package

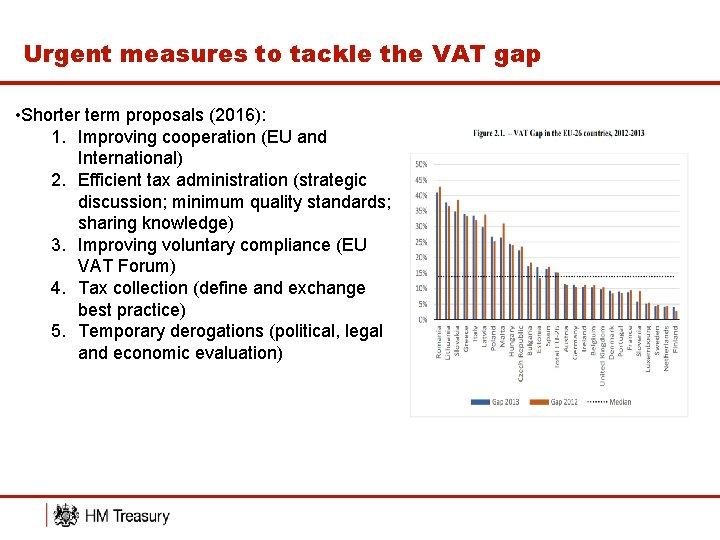

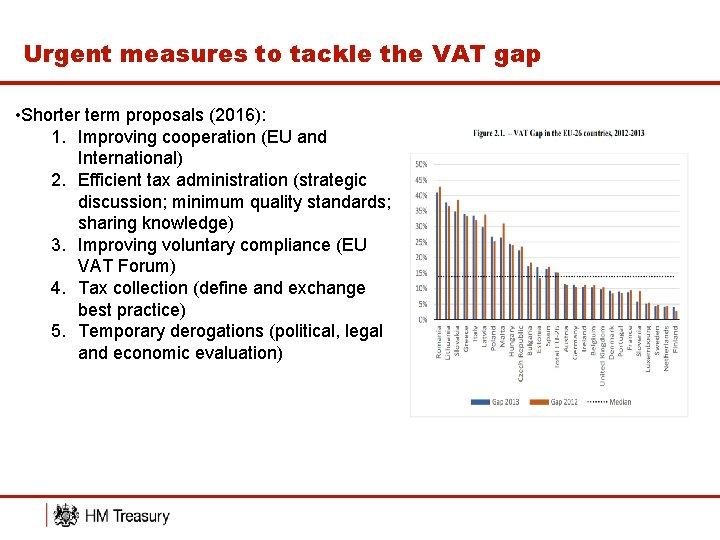

Urgent measures to tackle the VAT gap • Shorter term proposals (2016): 1. Improving cooperation (EU and International) 2. Efficient tax administration (strategic discussion; minimum quality standards; sharing knowledge) 3. Improving voluntary compliance (EU VAT Forum) 4. Tax collection (define and exchange best practice) 5. Temporary derogations (political, legal and economic evaluation)

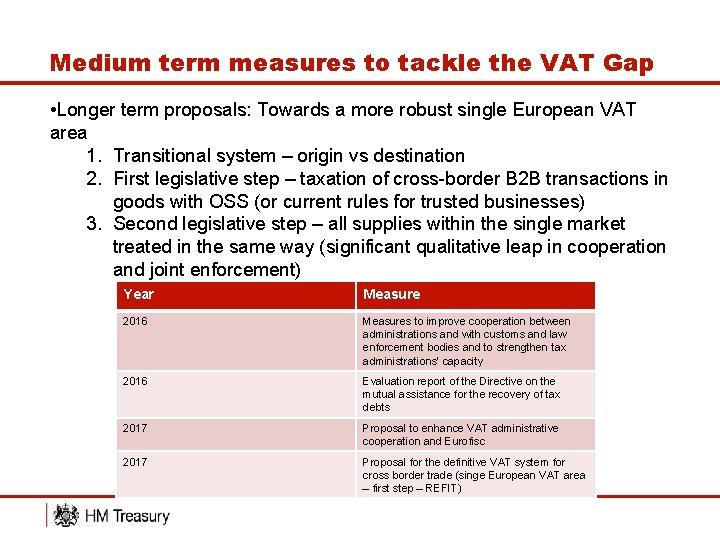

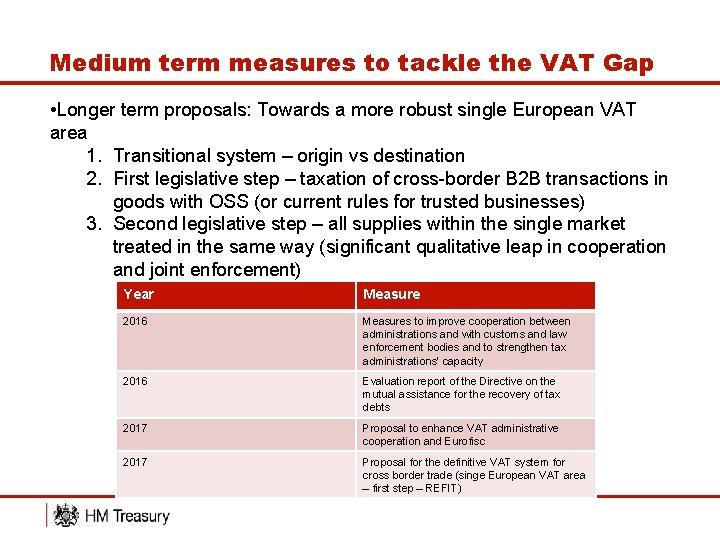

Medium term measures to tackle the VAT Gap • Longer term proposals: Towards a more robust single European VAT area 1. Transitional system – origin vs destination 2. First legislative step – taxation of cross-border B 2 B transactions in goods with OSS (or current rules for trusted businesses) 3. Second legislative step – all supplies within the single market treated in the same way (significant qualitative leap in cooperation and joint enforcement) Year Measure 2016 Measures to improve cooperation between administrations and with customs and law enforcement bodies and to strengthen tax administrations’ capacity 2016 Evaluation report of the Directive on the mutual assistance for the recovery of tax debts 2017 Proposal to enhance VAT administrative cooperation and Eurofisc 2017 Proposal for the definitive VAT system for cross border trade (singe European VAT area – first step – REFIT)

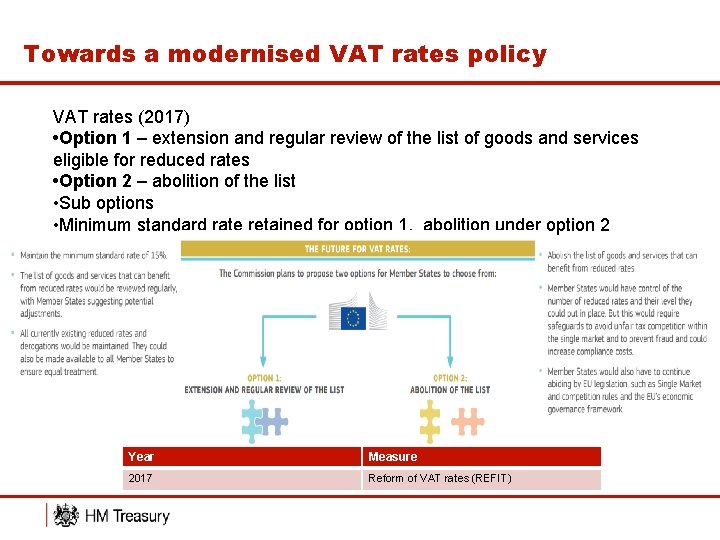

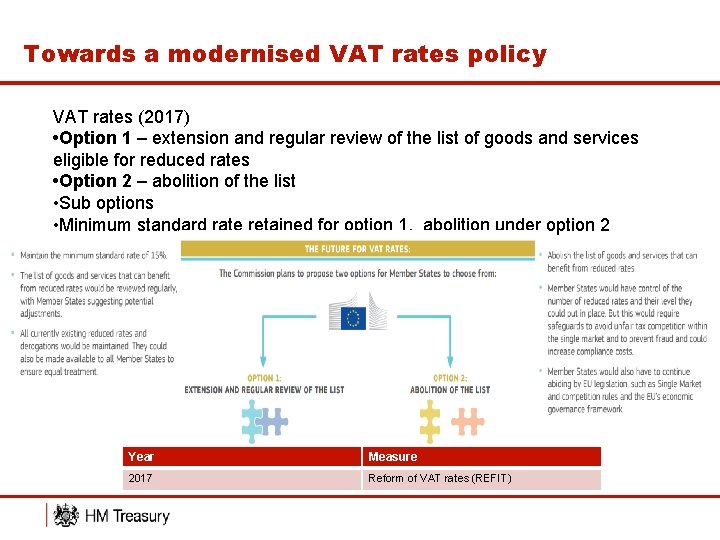

Towards a modernised VAT rates policy VAT rates (2017) • Option 1 – extension and regular review of the list of goods and services eligible for reduced rates • Option 2 – abolition of the list • Sub options • Minimum standard rate retained for option 1, abolition under option 2 Year Measure 2017 Reform of VAT rates (REFIT)

EU VAT Action Plan – UK charity perspective Peter Jenkins, CTG Technical Adviser The voice of charities on Tax

Future of VAT – View from the sector § Confirmation that zero/reduced rates will not be scrapped § No direct references to charity reliefs but Commission officials confirmed the sector will be consulted § Opportunities and threats The voice of charities on Tax

Option 1: Extension and regular review of the list of zero and reduced rates § Maintain minimum standard rate of 15% § Reduced rates list of goods and services reviewed regularly § Member States to suggest adjustments § Existing reduced rates and derogations to be maintained and possibly widened to other Member States ensuring equal treatment § Completely new zero rates cannot be introduced by Member States The voice of charities on Tax

Option 2: Abolition of the list § Abolish list altogether § Member States to control the number of reduced rates and their level § Safeguards required to avoid unfair tax competition within the single market and prevent fraud § Could increase compliance costs The voice of charities on Tax

Implications for the sector § Option 1 offers incremental approach unlikely to threaten existing zero rates § Option 2 offers chance to secure new zero rates. More radical approach – is it workable given competition rules? § Any reform will enable rates to be updated to reflect technological developments e. g. e-books The voice of charities on Tax

Next steps § Agreement required from all 28 Member States § Detailed legislative proposals expected in 2017 § CTG and ECCVAT will press the case for charities § Important that CTG and the sector map the scope and value of existing charity zero/reduced rates The voice of charities on Tax

VAT refund schemes – European developments § Commission review of public bodies on hold § However it demonstrated the distortions in the marketplace and disincentives to contracting out to charities § Structural reform allowing “exemption with refund” for charities (ie full input tax recovery) not yet achieved The voice of charities on Tax

EU VAT Action Plan – European charity perspective Hanna Surmatz, European Foundation Centre The voice of charities on Tax

Charities and Tax: Government priorities Exchequer Secretary to the Treasury, Damian Hinds MP The voice of charities on Tax

Coffee Break The voice of charities on Tax

Where next for Gift Aid? Panel chaired by Richard Bray, Cancer Research UK The voice of charities on Tax

Gift Aid: Donor Benefits Daniel Pease, HM Treasury The voice of charities on Tax

Gift Aid Small Donations Scheme Sue Pennicott, HMRC The voice of charities on Tax

Implications of Scottish tax devolution for Gift Aid Richard Bray, Cancer Research UK Kevin Russell, Stewardship The voice of charities on Tax

Devolution of tax powers in Scotland § Smith Commission recommended that the Scottish Parliament has power to set rates of Income Tax § New powers introduced in Scotland Act 2016 § Important implications for Gift Aid The voice of charities on Tax

Implications for Gift Aid § What are the reform options? § When would any changes be implemented? § Could any reforms be future proofed? § Will Gift Aid be able to retain its status as a tax relief? § What complexity/administrative burden will donors, charities and HMRC face? The voice of charities on Tax

Possible reform options § Maintaining Gift Aid operating at the r. UK basic rate (currently 20%) irrespective of the Income Tax system in Scotland § Transferring Gift Aid into a public spending measure to be paid at a composite rate across whole of UK § Operating a Scottish Rate of Gift Aid pinned to Scottish basic rate of Income Tax, which may differ from the r. UK rate § Giving donors full relief on their donations with no relief going direct to charities § Removing Gift Aid and replace it with Payroll Giving § Do nothing The voice of charities on Tax

Maintaining the status quo § Donors in Scotland would need to pay enough Income Tax at Scottish Basic Rate to cover Gift Aid at r. UK basic rate § Example: if the Scottish basic rate was 10% a donor would need £ 200 taxable earnings to claim £ 20 Gift Aid on donations, whereas their English counterpart would only need £ 100 taxable earnings. § Would Gift Aid remain a tax relief? Would total relief on offer (to charities/ donors) equal total tax paid? § Would charities with a large proportion of donors north/south of the border feel they are losing out if tax rates diverged? § How easy would this be for fundraisers to explain? § Responsive to Scottish Income Tax system? Future-proof? The voice of charities on Tax

Making Gift Aid a public spending measure § Rate could be based on expected average effective (i. e. including higher/additional) income tax rate of all UK donors claiming Gift Aid § Would a relief based on public expenditure be secure? § Which charities would win/lose as a result of composite rate? § Would this require EU approval re State Aid? § What are the implications for higher rate donors? § What information would be the charity need to collect? The voice of charities on Tax

Scottish Rate of Gift Aid § Donors need to express their residency on the Declaration to determine which rate should be applied, causing large fraud/error risks § Would existing Enduring Declarations be invalidated? § Who would need to keep a track of donor residency records – HMRC/charities? § What happens if residencies change mid-year or the donor does not know where they are resident? § Would charities with a large proportion of donors north/south of the border feel they are losing out? The voice of charities on Tax

Q & A The voice of charities on Tax

Review of the day John Hemming, CTG Chairman and Wellcome Trust Philip Spedding, The London Library The voice of charities on Tax

Stfm abstract submission

Stfm abstract submission Gie annual conference

Gie annual conference Gcyf 2011 annual conference

Gcyf 2011 annual conference Nacada annual conference

Nacada annual conference Stfm conference

Stfm conference Annual fuze conference

Annual fuze conference 2017 dvhimss annual fall conference

2017 dvhimss annual fall conference Hepi annual conference

Hepi annual conference Pbfeam

Pbfeam Https //bit.ly2v

Https //bit.ly2v Iowa league of cities annual conference

Iowa league of cities annual conference Nmls annual conference 2019

Nmls annual conference 2019 Travel health insurance association annual conference

Travel health insurance association annual conference Organization development network annual conference

Organization development network annual conference Roland purcell a technical writer

Roland purcell a technical writer Conclusion of gst

Conclusion of gst Deloitte shared services conference 2016

Deloitte shared services conference 2016 Tax technology conference

Tax technology conference Insurance tax conference

Insurance tax conference Tocodynamometer placement

Tocodynamometer placement Toko ctg

Toko ctg Ctg machine

Ctg machine Diametro sotto occipito bregmatico

Diametro sotto occipito bregmatico Cosx sinx

Cosx sinx Ctg activo por patente

Ctg activo por patente Ctg deceleraties

Ctg deceleraties Ctg como interpretar

Ctg como interpretar Saltatoir ctg

Saltatoir ctg Decelerations on ctg

Decelerations on ctg Saltatory variability

Saltatory variability Next generation operating system

Next generation operating system Saltatorni ctg

Saltatorni ctg Pseudo sinusoidal fetal heart rate pattern

Pseudo sinusoidal fetal heart rate pattern Test ctg

Test ctg Meconium grade 1 2 3

Meconium grade 1 2 3 Ctg akzeleration

Ctg akzeleration Ctgs

Ctgs Preterminaal

Preterminaal Ctg

Ctg Fetal monitoring

Fetal monitoring Ctg-1

Ctg-1 Ctg 270

Ctg 270 Acog classificazione ctg

Acog classificazione ctg Normal ctg

Normal ctg Các môn thể thao bắt đầu bằng từ đua

Các môn thể thao bắt đầu bằng từ đua Khi nào hổ con có thể sống độc lập

Khi nào hổ con có thể sống độc lập điện thế nghỉ

điện thế nghỉ Các loại đột biến cấu trúc nhiễm sắc thể

Các loại đột biến cấu trúc nhiễm sắc thể Nguyên nhân của sự mỏi cơ sinh 8

Nguyên nhân của sự mỏi cơ sinh 8 Trời xanh đây là của chúng ta thể thơ

Trời xanh đây là của chúng ta thể thơ Voi kéo gỗ như thế nào

Voi kéo gỗ như thế nào Thiếu nhi thế giới liên hoan

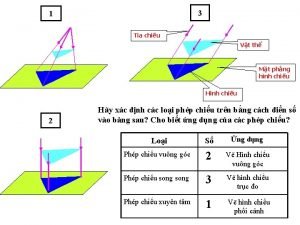

Thiếu nhi thế giới liên hoan Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Một số thể thơ truyền thống

Một số thể thơ truyền thống Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Thế nào là hệ số cao nhất

Thế nào là hệ số cao nhất Sơ đồ cơ thể người

Sơ đồ cơ thể người Ng-html

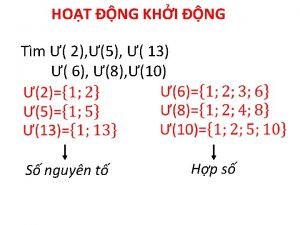

Ng-html Số nguyên tố là số gì

Số nguyên tố là số gì Tư thế ngồi viết

Tư thế ngồi viết đặc điểm cơ thể của người tối cổ

đặc điểm cơ thể của người tối cổ Cách giải mật thư tọa độ

Cách giải mật thư tọa độ Chụp phim tư thế worms-breton

Chụp phim tư thế worms-breton ưu thế lai là gì

ưu thế lai là gì Thẻ vin

Thẻ vin Cái miệng nó xinh thế chỉ nói điều hay thôi

Cái miệng nó xinh thế chỉ nói điều hay thôi Các châu lục và đại dương trên thế giới

Các châu lục và đại dương trên thế giới Từ ngữ thể hiện lòng nhân hậu

Từ ngữ thể hiện lòng nhân hậu Bổ thể

Bổ thể Tư thế ngồi viết

Tư thế ngồi viết Diễn thế sinh thái là

Diễn thế sinh thái là Giọng cùng tên là

Giọng cùng tên là Phép trừ bù

Phép trừ bù Thơ thất ngôn tứ tuyệt đường luật

Thơ thất ngôn tứ tuyệt đường luật Hát lên người ơi

Hát lên người ơi Hổ sinh sản vào mùa nào

Hổ sinh sản vào mùa nào đại từ thay thế

đại từ thay thế Vẽ hình chiếu vuông góc của vật thể sau

Vẽ hình chiếu vuông góc của vật thể sau Công thức tính độ biến thiên đông lượng

Công thức tính độ biến thiên đông lượng Tỉ lệ cơ thể trẻ em

Tỉ lệ cơ thể trẻ em Thế nào là mạng điện lắp đặt kiểu nổi

Thế nào là mạng điện lắp đặt kiểu nổi Hát kết hợp bộ gõ cơ thể

Hát kết hợp bộ gõ cơ thể Lời thề hippocrates

Lời thề hippocrates Vẽ hình chiếu đứng bằng cạnh của vật thể

Vẽ hình chiếu đứng bằng cạnh của vật thể Quá trình desamine hóa có thể tạo ra

Quá trình desamine hóa có thể tạo ra độ dài liên kết

độ dài liên kết Sabbath day calendar

Sabbath day calendar 23 april international children's day turkey

23 april international children's day turkey April school activities

April school activities April goth

April goth April ford incentives

April ford incentives 2006 calendar year

2006 calendar year 24 april 2007

24 april 2007 Site:slidetodoc.com

Site:slidetodoc.com 27 april 2001

27 april 2001 April ericsson

April ericsson April reprogle

April reprogle April christian

April christian Leonardo da vini

Leonardo da vini This day in history april 15

This day in history april 15 William shakespeare born and death

William shakespeare born and death April 28 day of mourning

April 28 day of mourning April rain song

April rain song Easter is a joyful festival which happens

Easter is a joyful festival which happens April decker

April decker La bamba gary soto

La bamba gary soto April 6 1992

April 6 1992 Adolf hitler kindheit

Adolf hitler kindheit Rosalind franklin photo 51

Rosalind franklin photo 51 April bjornsen

April bjornsen Vårmåneder

Vårmåneder April fools day in portugal

April fools day in portugal April dye

April dye April romagnano

April romagnano Astronomy picture of the day 17 april 2001

Astronomy picture of the day 17 april 2001 April piscids

April piscids