CSU Kuali Days Welcome to CSU Kuali Days

- Slides: 24

CSU Kuali Days Welcome to CSU Kuali Days! Overview Session for: Financial Transactions – Journal Entries April-May, 2009

Financial Transactions – Journal Entries Training Team Members • • • Valerie Monahan, Business & Financial Services 1 -3001 Richard Batman, Sponsored Programs 1 -4637 Sheri Hofeling, Mathematics 1 -7047 David Mornes, CVMBS 1 -6098 Malinda Sloan, College of Applied Human Sciences 1 -6365 Sally Tschirhart, Business & Financial Services 1 -2423

Accessing the Kuali Financial System • A link to the test site of KFS is provided on the B&FS website. • Effective July 1, 2009 access to KFS will be through the Campus Administrative Portal at https: //cap. is. colostate. edu • Log in using your e. ID (name) • Log out using the X

Important Reminders • KFS goes live on July 1 st for FY 2010 • Training materials are available at http: //kuali. colostate. edu and http: //busfin. colostate. edu • Virtual Kuali Help Desks can be accessed by going to the CAP at https: //cap. is. colostate. edu OR by clicking on the “Provide Feedback” found on most Kuali screens

Important Reminders (cont. ) • Please contact any training team member for assistance regarding this session • Registration for current Kuali training sessions is open until filled or completed • Hands-on training labs are scheduled June 1 st 5 th and June 8 th – 12 th (additional information will be provided soon)

Evaluations Please complete the evaluation survey - drop off in the session evaluation box or - with your training team member for this session or - return to Valerie Monahan: 6003 Campus Delivery

Documents Covered in this Overview • • General Error Correction (formerly CJE) Adjustment/Accrual Voucher Pre-Encumbrance (new) Distribution of Income and Expense * Note: Transfer of Funds and Indirect Cost Adjustment will be covered briefly today.

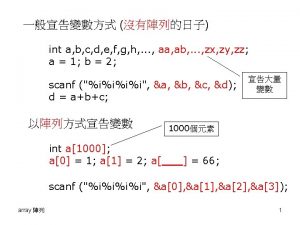

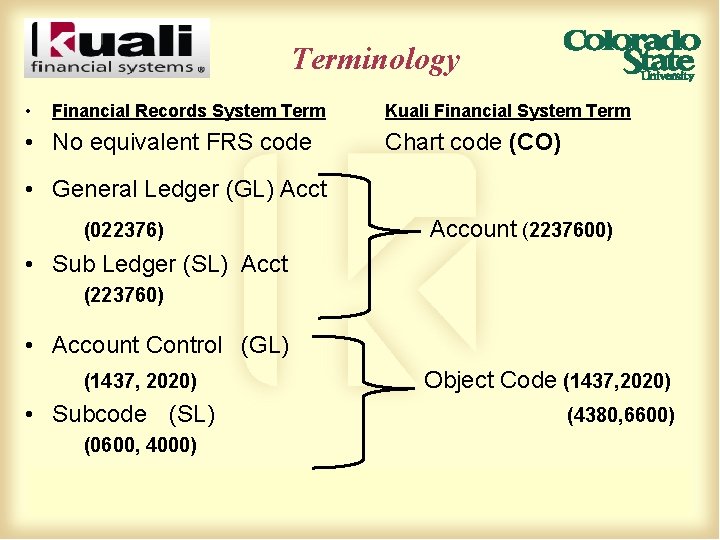

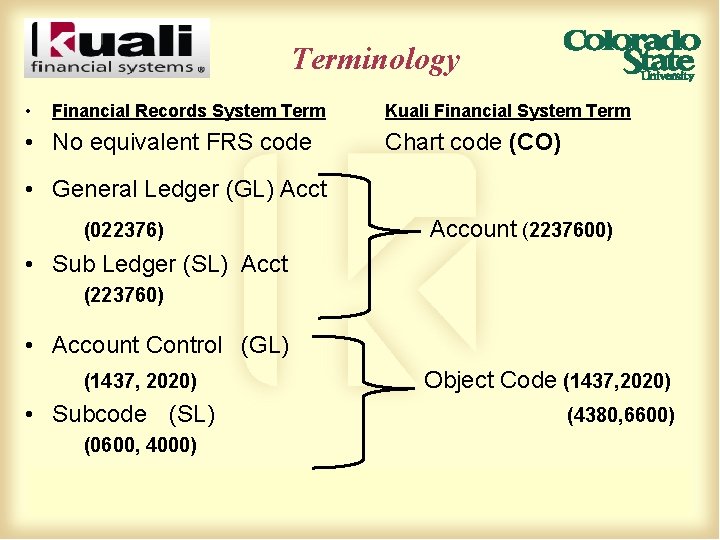

Terminology • Financial Records System Term • No equivalent FRS code Kuali Financial System Term Chart code (CO) • General Ledger (GL) Acct (022376) Account (2237600) • Sub Ledger (SL) Acct (223760) • Account Control (GL) (1437, 2020) • Subcode (SL) (0600, 4000) Object Code (1437, 2020) (4380, 6600)

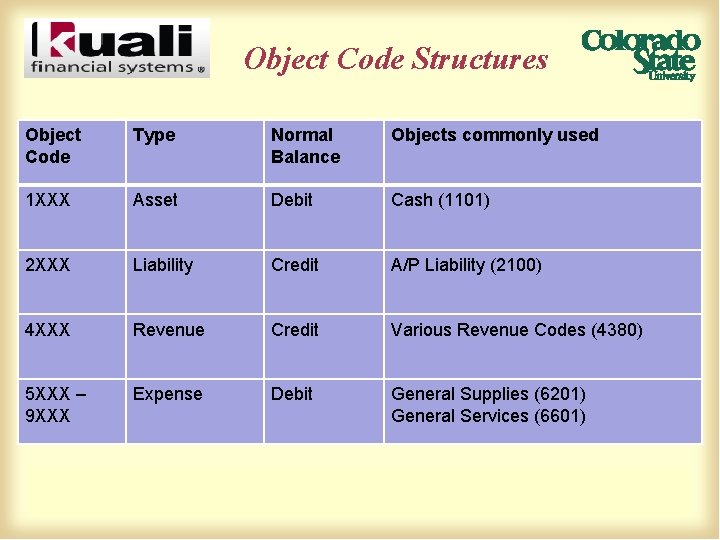

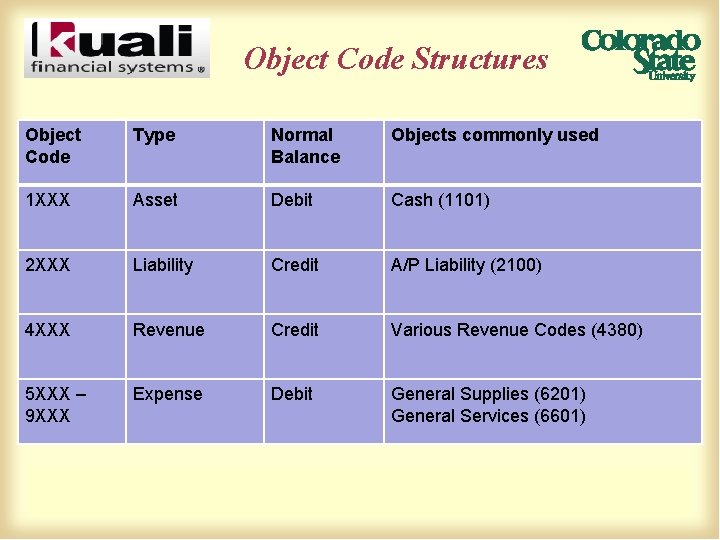

Object Code Structures Object Code Type Normal Balance Objects commonly used 1 XXX Asset Debit Cash (1101) 2 XXX Liability Credit A/P Liability (2100) 4 XXX Revenue Credit Various Revenue Codes (4380) 5 XXX – 9 XXX Expense Debit General Supplies (6201) General Services (6601)

To/From-The Basics INCREASE any account/classification (TO) DECREASE any account/classification (FROM)

To/From Assets: Increase an Asset (debit) (To) Decrease an Asset (credit) (From) Liabilities: Increase a Liability (credit) (To) Decrease a Liability (debit) (From) Revenues: Increase revenue (credit) (To) Decrease revenue (debit) (From) Expenses: Increase an Expense (debit) (To) Decrease an Expense (credit) (From)

To/From Examples Example: An expense was incorrectly charged to the wrong expense object code. Increase expense to the correct object code (To) Decrease expense from the wrong object code (From) Example: Expensed a service contract that covered 12 months. Six months of the contract should be prepaid (asset) Increase an asset (To) Decrease an expense (From)

To/From Examples Example: Receipts from customers were deposited into an expense object code and should have been recorded as revenue. Increase revenue (To) Increase expense (To) – removing credits from an expense object code Example: A revenue item was incorrectly deposited into the wrong revenue object code. Increase revenue to the correct object code (To) Decrease revenue from the wrong object code (From)

General Error Correction • Formerly known as CJE in CIS • Used to correct a posting error (wrong account number , wrong amount was used etc. ) • Org. Doc. # - (Org=organization’s) optional user-defined document number, 8 characters. • Reference Origin Code – where did the document originate from- 01 will be used most of the time- still in development • Org. Ref ID – (Org=organization’s)- similar to Ref 2 in FRS • Reference # - Can only be alpha or numeric-no spaces or periods (8 characters) similar to Ref 1 in FRS • Example #1

Adjustment/Accrual Voucher • Adjustment voucher- to recognize revenues in the period in which they are earned and expenses in the period they are incurred. No reversal date. • Example #2

Adjustment/Accrual Voucher (cont. ) • Accrual voucher – to post an accrual entry that will reverse in a designated month. • Example #3

Pre-Encumbrance • New in Kuali • Earmark funds for which unofficial commitments have already been made • Set aside future expenses that might not already be encumbered • All pre-encumbrances need to be disencumbered via reversal or manual • Example #4

Disencumbrance • New in Kuali • Reference # required- use the Kuali # for the encumbrance

Distribution of Income and Expense • Use the DI document to distribute income, expense, assets or liabilities from a holding account to one or more appropriate account(s) when one account has incurred expenses or received income on behalf of one or more other accounts

Distribution of Income and Expense (cont. ) • Importing lines • templates and instructions are available by clicking on the “? ” on each document and choosing the Accounting Line Import Templates • Remove the first two rows • Must be saved in CSV format • Click on “add” to import into the document • Example #5

Transfer of Funds • The Transfer of Funds (TF) document is used to transfer funds (cash) between accounts • There are two kinds of transfer transactions, mandatory and non-mandatory • Mandatory transfers are required to meet contractual agreements. Specific object codes are used to identify these transactions

Transfer of Funds cont’d • Non-mandatory transfers are allocations of unrestricted cash between fund groups, which are not required by any external agreements • Use of this document is primarily used by B&FS and is in development with respect to plant fund transfers

Indirect Cost Adjustment (ICA) • Used to adjust the amount of indirect cost expense charged to a contract and grant account and automatically adjust the associated amount of indirect cost revenue • Used by SP & B&FS only

QUESTIONS? ? ?

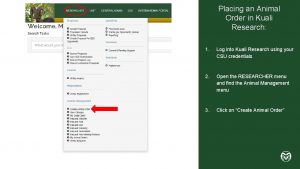

Kuali research csu

Kuali research csu Csu accounts payable

Csu accounts payable Csu kuali

Csu kuali Wise men three clever are we

Wise men three clever are we Kuali cornell

Kuali cornell Kuali ole

Kuali ole Kuali erp

Kuali erp Kuali umd

Kuali umd Kuali rice

Kuali rice Grant award notification email

Grant award notification email Kuali time iu

Kuali time iu Usc kuali login

Usc kuali login Asiary

Asiary Uc davis kuali

Uc davis kuali Csu bachelor of laws

Csu bachelor of laws Uc doorways validation

Uc doorways validation Csu ariesweb

Csu ariesweb Famweb csu

Famweb csu Csu pre law

Csu pre law Cs 270 csu

Cs 270 csu Csu otd

Csu otd Csu stanislaus msw program

Csu stanislaus msw program Eddy hall csu

Eddy hall csu Ereserves

Ereserves Csu canvs

Csu canvs