CREDIT UNIT TEST REVIEW CREDIT TEST REVIEW is

- Slides: 46

CREDIT UNIT TEST REVIEW

CREDIT TEST REVIEW _________ is an arrangement to receive cash, goods, or services now and pay for them in the future. CREDIT When credit is used for personal needs it is referred to as _____. CONSUMER CREDIT

CREDIT TEST REVIEW An entity that lends money is called an ________. CREDITOR List two great reasons to use credit q q Save money Purchase items that we cannot afford on a cash basis

CREDIT TEST REVIEW What are three factors to consider before using credit? q q q q Is there a down payment? Do you want to use savings instead of credit? Can you afford the item? Could you use the credit in a better way? Can you put off buying the item for a while? What are the opportunity costs of postponing the purchase? What are the costs of using credit?

CREDIT TEST REVIEW What are three advantages to using credit? n n Allows you to enjoy goods and services now and pay for them later. Safer than cash Easy to track spending Rewards and perks etc…

CREDIT TEST REVIEW A one time loan that will be paid back over a specified period of time, in payments of equal amounts. CLOSED END CREDIT List some examples of items that are usually purchased with closed-end credit: HOUSES, VEHICLES, FURNITURE

CREDIT TEST REVIEW Used for the purchase of merchandise, typically requires a down payment with remaining balance of loan being paid in installments. INSTALLMENT SALES CREDIT Money borrowed for personal reasons, does not necessarily require a down payment, balance is paid in installments. INSTALLMENT CASH CREDIT A loan that must be paid in full, by a specified day, typically within 30 -90 days. SINGLE LUMP-SUM CREDIT

CREDIT TEST REVIEW Credit as a loan with a certain limit on the amount of money you can borrow for a variety of goods and services. OPEN END CREDIT Examples of Open-End Credit: VISA, MASTERCARD, AMERICAN EXPRESS

CREDIT TEST REVIEW After your application for credit is approved, you typically can begin to make purchases as long as you do not exceed the LINE OF CREDIT Payment amounts, dates, applicable charges, and all other pertinent information regarding your account will be determined by the TERMS OF AGREEMENT

CREDIT TEST REVIEW Name two sources of commercial credit: Commercial Bank Credit Union Retail Stores etc… True or False: The average credit cardholder has more than six cards. TRUE

CREDIT TEST REVIEW Many credit card companies offer a _________, a time period during which no finance charges will be added to your account. GRACE PERIOD The total dollar amount you pay to use credit. FINANCE CHARGE

CREDIT TEST REVIEW True or False: Generally, if the balance is paid in full prior to the due date, there will be no finance charge to pay. TRUE How are debit cards different than credit cards? q Debit cards utilize cash in your checking account. Credit cards utilize borrowed money!

CREDIT TEST REVIEW Method by which most credit cards calculate the finance charges for the period. It is found by adding each day’s balance and then dividing the total number of days in a billing cycle. AVERAGE DAILY BALANCE The cost of credit on a yearly basis. It is expressed as a percentage. ANNUAL PERCENTAGE RATE (APR)

CREDIT TEST REVIEW The process of moving unpaid credit card debt from one issuer to another. Often comes with a fee of some form. BALANCE TRANSFER A charge by the lender for using the credit card to obtain cash. Can be a flat rate or percentage (2%/$10). CASH ADVANCE FEE

CREDIT TEST REVIEW The written statement provided to the cardholder outlining the terms and conditions. Required by Federal Reserve regulations. Must include the APR, monthly minimum payments formula, annual fee and cardholder’s rights in billing disputes. CARDHOLDER AGREEMENT

CREDIT TEST REVIEW The minimum amount a cardholder can pay to keep the account from going into default. MINIMUM PAYMENT When a potential customer has passed a preliminary credit-information screening. Does not guarantee a line of credit. PRE-APPROVED

CREDIT TEST REVIEW What are some ways you can apply for a credit card? q In person, at a financial institution q In person, through a promotional event like a sporting event or welcome week on a college campus q By telephone q Traditional mail q Online

CREDIT TEST REVIEW Outline of all of the specifics of your relationship with the creditor. TERMS AND CONDITIONS What are three things that you could find in your terms and conditions? q Finance charges q Due dates q Specific lending policies q Much, much more!

CREDIT TEST REVIEW What are the 5 C’s: CHARACTER, CAPACITY, CAPITAL, COLLATERAL AND CONDITIONS. Which “C” attempts to measure what type of person you are when it comes to paying your bills? CHARACTER

CREDIT TEST REVIEW How can creditors try to measure your character? References (Both personal and professional) q Criminal background check q Have you used credit before? q How long have you lived at your current address? q How long have you held your current job? q

CREDIT TEST REVIEW What “C” attempts to measure how much debt you can take on? CAPICITY What questions can a creditor ask to try to assess your capacity? What is your job and how much is your salary? q Do you have other sources of income? q What are your current debts? q

CREDIT TEST REVIEW A common ratio used to calculate capacity: DEBT PAYMENTS-TO-INCOME RATIO This ratio is calculated as follows: Total Monthly Debt (not inc. housing) Monthly Net Income It is highly recommended to keep this ratio under ? ? ? 20%

CREDIT TEST REVIEW Stuart just received his first job offer after graduating from beauty school. His expected monthly income is $2, 500. The only debt payments he has are school loan payments of $375 a month. What is his Debt Payments-to-Income Ratio? Debt Payments ÷ Monthly Net Income $375 ÷ $2, 500 =. 15 15%

CREDIT TEST REVIEW Any item of value that you own ASSET Examples of Assets q q Cash Property Personal possessions Investments

CREDIT TEST REVIEW Which “C” is represented by taking the total value of your assets and subtracting your total debt? CAPITAL Why do creditors care about how much capital you have? Capital tells them if you have other ways to pay back your debt besides new income.

CREDIT TEST REVIEW Which “C” is something pledged as a security for repayment of a loan. COLLATERAL Which “C” refers to both big and small picture concerns outside of just you. CONDITIONS

CREDIT TEST REVIEW What types of things to lenders look at when assessing conditions? q q q General economic conditions at the time of applying? Unemployment Rate Recession your specific company and position. Is your position in demand? How expendable are you?

CREDIT TEST REVIEW What are some tips or applying for credit if you don’t have much of a credit history (Young borrower or bad history) q q q Establish a checking or savings account Borrow against your savings account Open a department store credit card Gas Cards! Get a Cosigner

CREDIT TEST REVIEW The record of your complete credit history CREDIT REPORT Credit reports are collected and maintained by CREDIT BUREAUS

CREDIT TEST REVIEW The three major credit bureaus are: Experian q Trans Union q Equifax q How do credit bureaus make money? By selling the information they collect to creditors who are considering extending loans/credit.

CREDIT TEST REVIEW Where do credit bureaus get their information from? Banks, stores, other types of finance companies and lenders, courts and other public records The information they collect includes: Type of credit they have extended q The amounts and terms of the loans q Customer’s paying habits q

CREDIT TEST REVIEW A typical credit report includes what type of information? q q q q Name Address Social Security Number Employment Info (Where, Position & $$) Homeowner or Renter Status Checks returned for insufficient funds Your spouse’s information

CREDIT TEST REVIEW TRUE OR FALSE: Credit reports also contain very detailed information on EVERY loan or use of credit. TRUE These reports are updated regularly to show: q q q Payments you have made (Both amounts and number of) Late Payments Missed Payments How much you still owe Lawsuits & judgments against you

CREDIT TEST REVIEW To ensure citizens rights were being protected, Congress passed the ________ FAIR CREDIT REPORTING ACT The act regulates the use of credit reports by: q q Deleting out of date information Giving consumers access to their reports Giving consumers the right to correct discrepancies Limiting who can obtain your credit report

CREDIT TEST REVIEW The majority of information in your report may only be reported for how long? 7 years If you have declared personal bankruptcy this time frame becomes. . 10 years Credit Bureaus can disclose information past these time frames if: q q A credit application of $75, 000 or more Apply for life insurance of $150, 000 or more

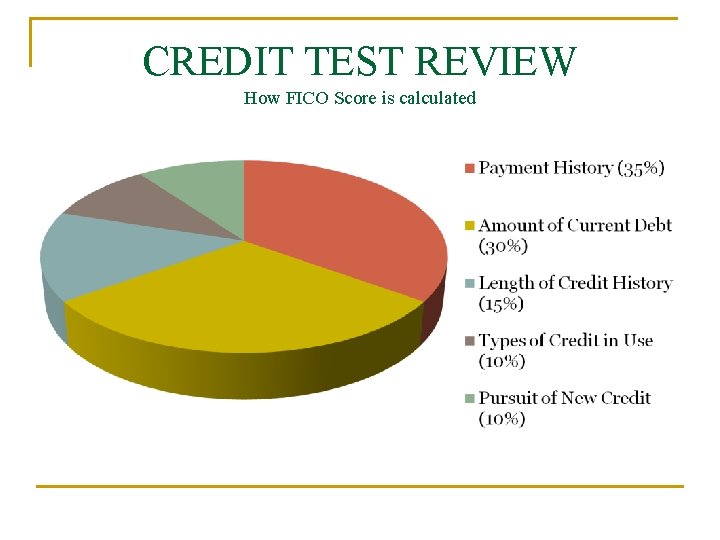

CREDIT TEST REVIEW A measure of a person’s ability and willingness to make credit payments on time. CREDIT SCORE Most commonly used credit score FICO SCORE How is your FICO score calculated? It’s a secret BUT it includes Payment History, Current Debt, Length of Credit History, Types of Credit Accounts and Attempts at New Credit

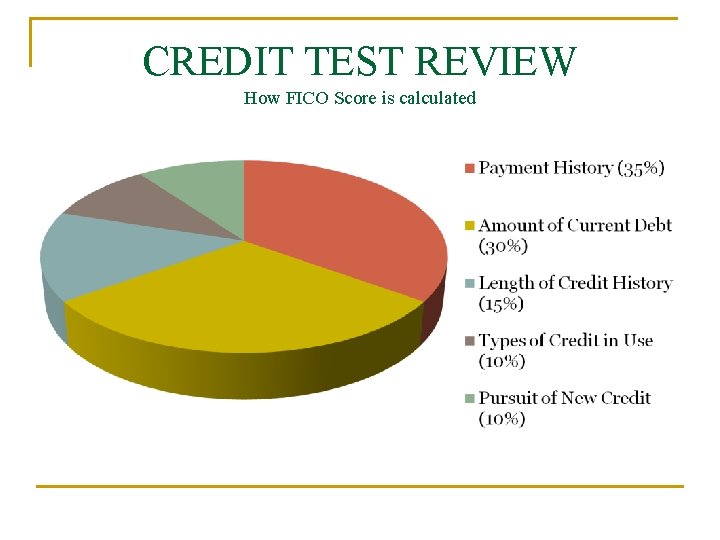

CREDIT TEST REVIEW How FICO Score is calculated

CREDIT TEST REVIEW Why is a good credit score important? q Determines whether or not your improved q High score means lower interest rates q Low scores mean higher rates and fees q Insurance rates are affected by credit scores too! How scores affect loan amounts example

CREDIT TEST REVIEW What can you do to improve your credit score? q Make payments on time! q Reduce overall debt q Review your credit report for errors q Limit your applications/inquiries

CREDIT TEST REVIEW When there is some form of error in billing to your credit account. BILLING ERROR Some examples of billing errors: q q q A charge for something you did not buy An amount on your bill that is different from the actual amount you paid Arithmetic errors “Double” billing Payments not credited to your account

CREDIT TEST REVIEW Using someone’s name, Social Security Number, credit card number, or personal information, without consent, for your own purposes. IDENTITY THEFT n Signs of Identity Theft include: n n n You see withdrawals from your bank account that you can’t explain. You don’t get your bills or other mail. Debt collectors call you about debts that aren’t yours. You find unfamiliar accounts or charges on your credit report. Medical providers bill you for services you didn’t use.

CREDIT TEST REVIEW What are a few steps you can take to try to prevent identify theft? q q q q Keep financial documents locked away Ask “Why” when probed for personal information Shred personal documents when no longer needed Watch your mail! Be clever with passwords Get good encryption and antivirus software REVIEW YOUR CREDIT INFORMATION REGULARLY!

CREDIT TEST REVIEW A ________ begins with an unpaid bill…. DEBT COLLECTION The companies who purchase this debt is called a DEBT COLLECTION AGENCY

CREDIT TEST REVIEW Debt collection agencies must adhere to protocols established by the: FAIR DEBT COLLECTION PRACTICES ACT List two protections provided by the Fair Debt Collection Practices Act: n n n Can’t call before 8 AM or after 9 PM Can’t Curse or insult you Can’t demand that you pay more than you owe Can’t claim papers they send you are legal forms if they are not Make up consequences for not paying your debt Can’t call you at work if your employer does not allow it

CREDIT TEST REVIEW TRUE or FALSE: All financial counseling programs are non-profit. FALSE. Beware! Not all financial counselors are built the same! Many companies in this industry exist purely for profit. The legal process in which some or all of the assets of a debtor are distributed among the creditors because the debtor is unable to pay their debt. BANKRUPTCY

CREDIT REVIEW TEST Which type of bankruptcy has the following conditions: n n n Many, but not all, of your debts are forgiven Majority of debtors assets are sold to pay off creditors The release from debt does not affect alimony, child support, fines stemming from driving while intoxicated among other things. CHAPTER SEVEN Which type of bankruptcy has the following conditions: n n n Debtor presents a plan to the court to eliminate their debts over a specific period of time. Debtor normally keeps all, or most, of their property During the plan (not to exceed 5 years), debtor makes regular payments to a Chapter 13 trustee who then distributes the money to the creditors. CHAPTER 13