Cost Transfers Closeout Date Presenter Name Presenter Phone

- Slides: 31

Cost Transfers & Closeout Date Presenter Name Presenter Phone Number Presenter E-mail

Recent Audits / Settlements • Mayo Clinic – May 2005 - $6. 5 million – Allegations of including over-expenditures on other grants – Investigation indicated: • Improper transfers • An accounting system unable to monitor and manage charges • Charges were first put on an unrestricted fund and then transferred to grant Source: Department of Justice, May 26 th, 2005 http: //www. usdoj. gov/opa/pr/2005/May/05_civ_292. htm 2

Recent Audits / Settlements • Florida International University – February 2005 - $11. 5 million – Major finding cost transfers • Incomplete cost transfer documentation • Grant used as a clearing account • “The University Controller’s Office repeatedly protested practice” (Miami Herald, August 15, 2005) • Cost transfers after the grant had closed 3

New fiscal policy 220 • UT has a fiscal policy with time limits and documentation requirements for cost transfers on sponsored projects • Other universities have this • Cost transfers should only be made to correct errors 4

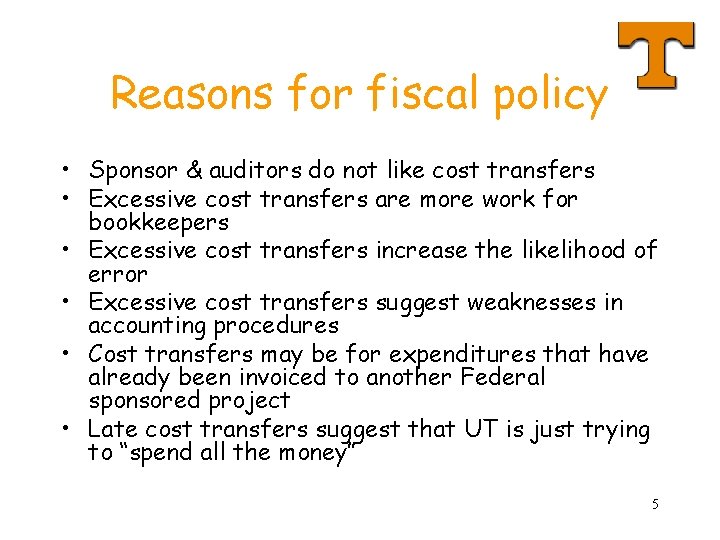

Reasons for fiscal policy • Sponsor & auditors do not like cost transfers • Excessive cost transfers are more work for bookkeepers • Excessive cost transfers increase the likelihood of error • Excessive cost transfers suggest weaknesses in accounting procedures • Cost transfers may be for expenditures that have already been invoiced to another Federal sponsored project • Late cost transfers suggest that UT is just trying to “spend all the money” 5

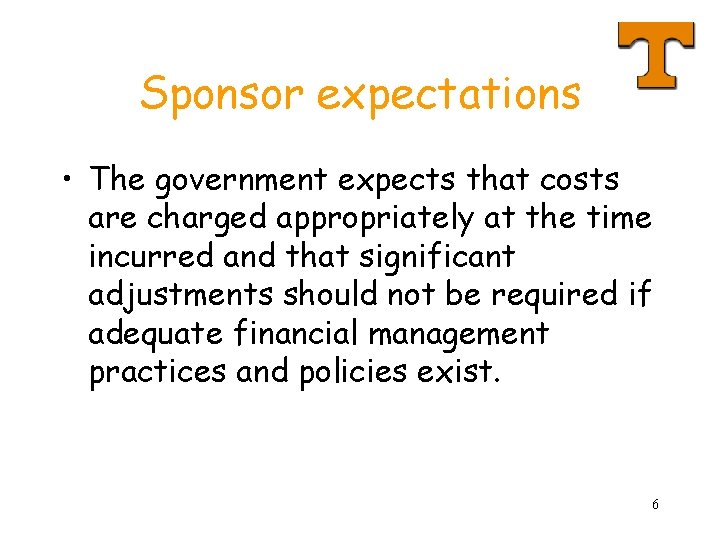

Sponsor expectations • The government expects that costs are charged appropriately at the time incurred and that significant adjustments should not be required if adequate financial management practices and policies exist. 6

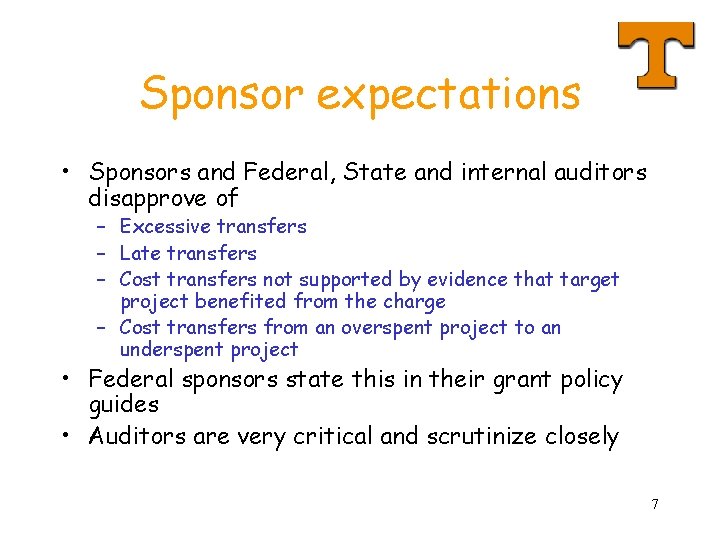

Sponsor expectations • Sponsors and Federal, State and internal auditors disapprove of – Excessive transfers – Late transfers – Cost transfers not supported by evidence that target project benefited from the charge – Cost transfers from an overspent project to an underspent project • Federal sponsors state this in their grant policy guides • Auditors are very critical and scrutinize closely 7

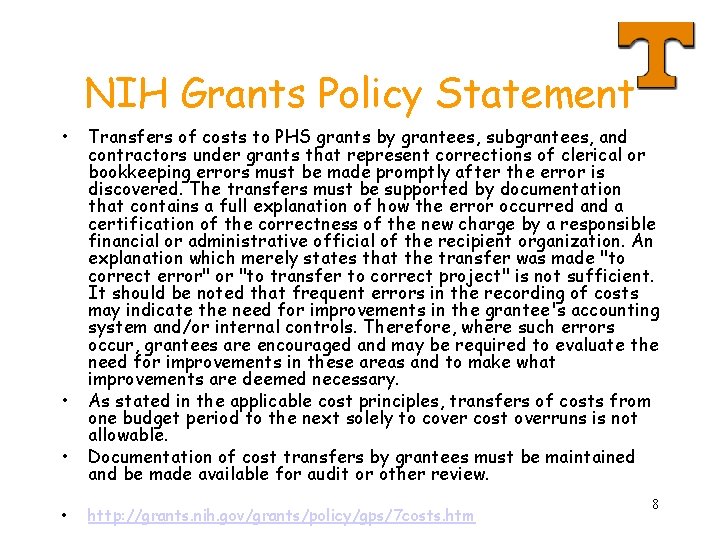

NIH Grants Policy Statement • • Transfers of costs to PHS grants by grantees, subgrantees, and contractors under grants that represent corrections of clerical or bookkeeping errors must be made promptly after the error is discovered. The transfers must be supported by documentation that contains a full explanation of how the error occurred and a certification of the correctness of the new charge by a responsible financial or administrative official of the recipient organization. An explanation which merely states that the transfer was made "to correct error" or "to transfer to correct project" is not sufficient. It should be noted that frequent errors in the recording of costs may indicate the need for improvements in the grantee's accounting system and/or internal controls. Therefore, where such errors occur, grantees are encouraged and may be required to evaluate the need for improvements in these areas and to make what improvements are deemed necessary. As stated in the applicable cost principles, transfers of costs from one budget period to the next solely to cover cost overruns is not allowable. Documentation of cost transfers by grantees must be maintained and be made available for audit or other review. http: //grants. nih. gov/grants/policy/gps/7 costs. htm 8

Federal Register Notice • The draft compliance program guidance from DHHS OIG identified Properly Allocating Charges to Award Projects as one of the compliance risk areas. – “The failure to account accurately for charges to various award projects can result in significant disallowances or, in certain circumstances, could subject an institution to criminal or civil fraud investigations” – Not just an accounting problem: “The failure to allocate correctly charges – whether because of poor recordkeeping or as part of an intent to deceive funding sources – has the effect of drawing away limited Federal research funds from projects for which they were intended” – Source: Federal Register, November 28, 2005 9

Excessive cost transfers • Excessive cost transfers are more work for bookkeepers • Excessive cost transfers increase the likelihood of error • Excessive cost transfers suggest weaknesses in accounting procedures – Why aren’t we able to put the original charge on the correct cost object to begin with? 10

Origin of charge • Real life story: – A department received a $100, 000 award document at the end of the one-year project period • R WBSE was quickly set up at the end of the award period and $100, 000 of costs were transferred onto it. • These $100, 000 of costs came from 3 Federal sponsored projects. These costs had already been invoiced and paid by these Federal agencies. Huge credits resulted on these 3 Federal projects because of the cost transfers. How do we explain this to the Federal agencies involved? 11

Late cost transfers • Late cost transfers suggest that UT is just trying to “spend all the money” – “For example, federal auditors will often assume that a late transfer of costs into an under-expended WBS element or cost center from an over-expended WBS element or cost center has been made simply to cover the over-expenditure” – From UT fiscal policy FI 220 12

Reasons for cost transfers • The technical work and related charges begin before R WBS Element is set up • The PI is late in providing bookkeeper with the correct cost object for charges • The department is trying to “use up” all of its funding and moves expenditures around • Errors 13

Timely WBSE setup • Cost transfers may be needed if technical work and related charges begin before R WBS Element is set up – Ideally, the award document is received and R WBS Element set up a month before work start date – Request Advance WBS Elements whenever possible to reduce cost transfers needed • Get WBSE set up in time for automated charges like payroll PIF’s & service centers to change to new account 14

Advance WBS Element • A restricted WBS Element can be established before the executed award document is received – PI wants to start working on the project • If costs will be incurred, then where will they post? • Never to another sponsored project WBS Element!!! – Department evaluates likelihood of award and authorized PI to start work without an executed award agreement – Submits signed form to the campus / unit business office – http: //admin. tennessee. edu/uwa/to/co/pdf/WBS. PDF • Risks? 15

Responsibilities • Dept acctg staff – Ensure that all charges are reasonable, allowable, allocable, & correctly classified as direct versus F&A – Ensure that all charges post to the correct sponsored project in a timely manner – initiate Advance WBS Element, if necessary – Process accounting entries accurately & in a timely manner – Monthly account reconciliation – Closeout in a timely manner • PI and Dept Head – Ensure that all charges are reasonable, allowable, allocable, & correctly classified as direct versus F&A – Ensure that all charges post to the correct sponsored project in a timely manner – initiate Advance WBS Element, if necessary – Ensure that support staff are performing tasks adequately – Ensure that support staff are given required information in a timely manner 16

Maximize funding • The department is trying to “use up” all of its funding and moves expenditures around – “Any costs allocable to a particular sponsored project under the standards provided in this policy may not be transferred to other sponsored projects in order to meet deficiencies caused by overruns or for other reasons of convenience” – From UT fiscal policy FI 220 – Be sure that the cost transfer documentation clearly explains how the cost benefits the project being charged 17

Correcting errors • Correct errors in original charges within 90 days of the error and provide an appropriate explanation of the error – “The federal government expects the official documentation for a cost transfer to include complete explanation of the reason the transfer is being made. The federal “Public Health Service (PHS) Grants Policy Statement” indicates that explanations such as “to correct error” or “to transfer to correct account” are not sufficient. See Chapter 7 of the PHS Grants Policy Statement, http: //grants. nih. gov/grants/policy/gps/” – From UT fiscal policy FI 220 18

Documentation • “Any cost transfer should be so complete or detailed that a person completely removed from the situation (e. g. , an auditor) will be able to look at the request five years from now and understand what and why the entry was made” – From UT fiscal policy FI 220 • All cost transfers should include the following information – Specific identification of the original charge (a copy of the charge must be attached) – Justification of the appropriateness of the charge to the receiving WBS element or cost center – A full explanation of why the transfer is necessary 19

Documentation in IRIS • All cost transfers should include the following information – Specific identification of the document number of the charge being transferred in the header and line item text 20

Real-life example • This cost transfer is not in compliance with the fiscal policy requirements for appropriate documentation. – Original charge is not referenced – Federal guidelines explicitly state that the explanation “To correct error” is insufficient – No additional text was attached that explains the reason for the transfer • How much should be entered in IRIS vs kept in departmental records? 21

Use the right cost element • Cost transfers should use the original cost element charged • Definitions of cost elements must be followed – http: //controller. tennessee. edu/ – Some cost elements are abused • 446600 Other University Departments • 444400 Cost Sharing 22

Time limits • Correct errors in original charges within 90 days of the error • All charges, including salaries, must be posted within 60 days after the grant or contract end date (or 30 days prior to the due date of final financial reports, whichever comes first) to ensure the timely submission of final financial reports – Effort certification that will cause a payroll charge retroactive change must be submitted within 30 days of the end date to be posted by the 60 day limit 23

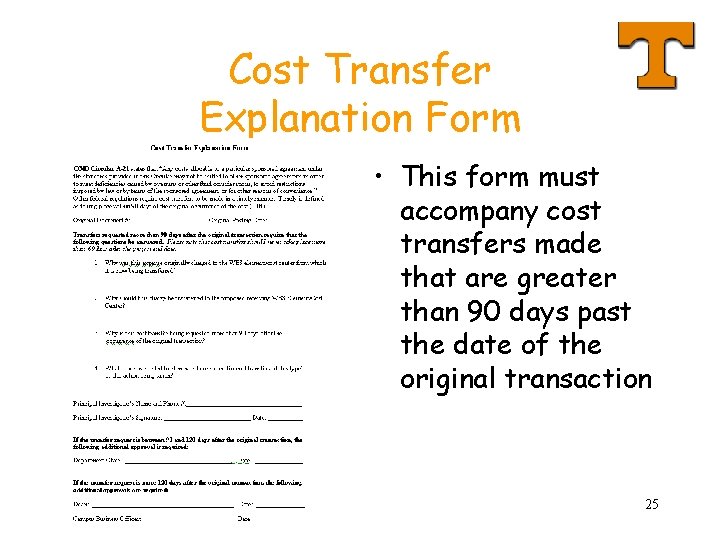

Untimely transfers • Note the Cost Transfer Explanation Form on the following slide • “Any cost transfer requests greater than 90 days require administrative approval. The department chair must sign requests for cost transfers to be processed between 91 and 120 days. If under some rare circumstances it should be necessary to make a cost transfer beyond 120 days, the dean’s signature will be required in addition to the department chair. Requests for late cost transfers should include an explanation of the extenuating circumstances that prevented the transaction from being made earlier. ” 24

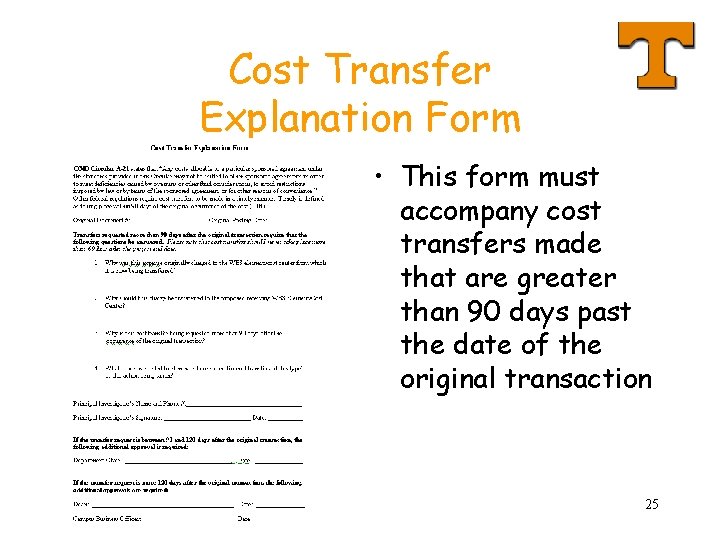

Cost Transfer Explanation Form • This form must accompany cost transfers made that are greater than 90 days past the date of the original transaction 25

Other guidelines • A cost transfer cannot be processed on a closed WBS element or cost center • A cost transfer that will overspend a WBS element or cost center will not be processed, unless an increase in funding is indicated • If the amount being transferred differs from the amount indicated on the backup documentation, the written explanation must include a justification for the difference • Requests to transfer costs later than 90 days after the original occurrence without an approved explanation of the extenuating circumstances will be denied and all charges must be covered by the department or college 26

Closeout • Sponsored projects should be closed out in the accounting system as quickly as possible – Since all cost transfers must post within 60 days of the project ending date, the project should be closed by 90 days after the ending date – UT fiscal policy FI 205 requires that all charges be finalized on a sponsored project within 60 days of the end date • Closing accounts in a timely manner causes less work in the long run for everyone – Less chance of erroneous charges – Fewer number of accounts to review 27

More on closeout • If you are new to a department, you cannot ignore pre-existing balances on old, expired projects. You must clean these up. • Credit balances can be more difficult to clear than debit balances. • If you don’t clear these balances, then your campus business office may clear them for you (cost share to E account). • You can find your department’s balances by using the IRIS transaction ZPS_REST_BAL (see next slide). 28

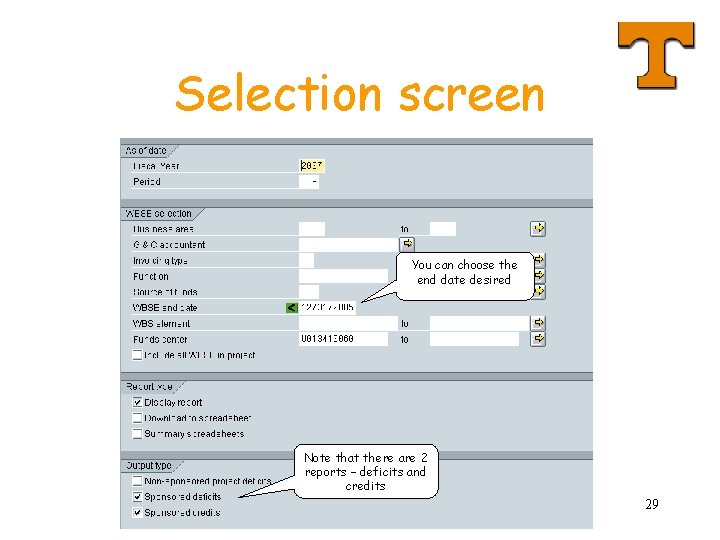

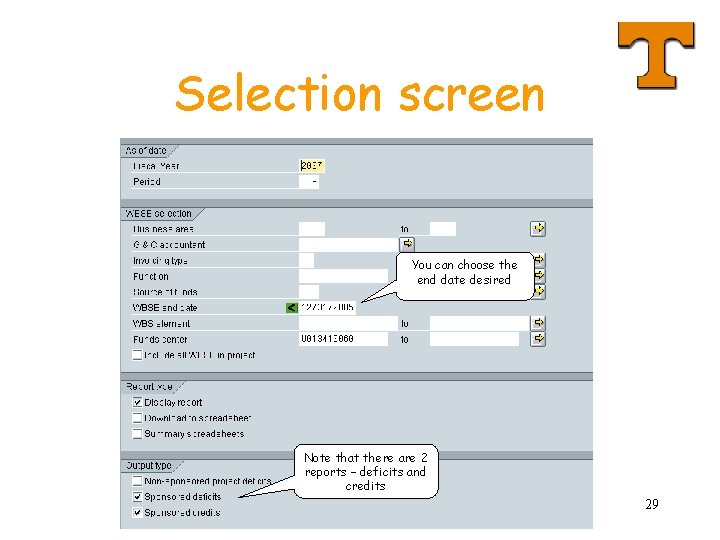

Selection screen You can choose the end date desired Note that there are 2 reports – deficits and credits 29

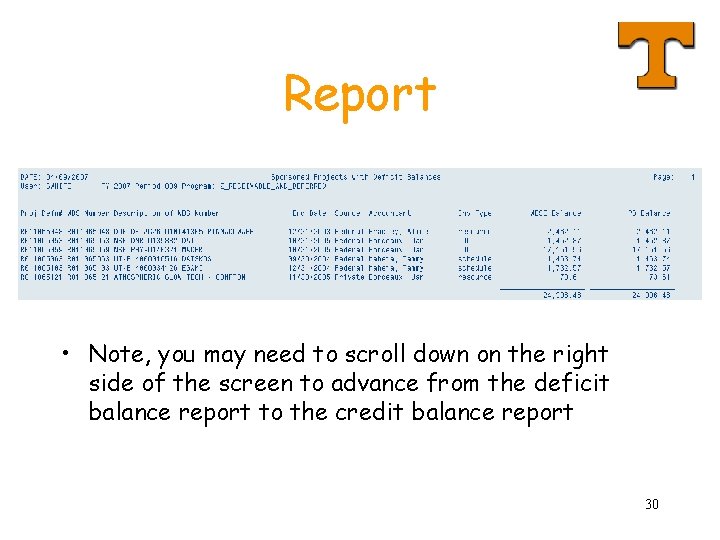

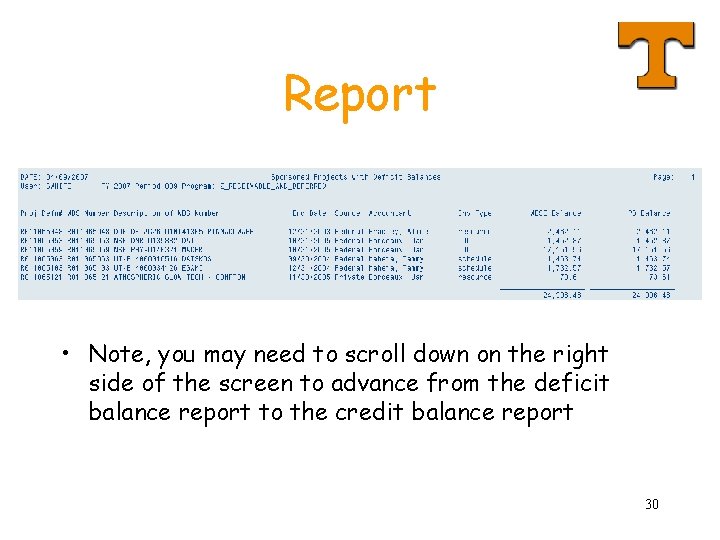

Report • Note, you may need to scroll down on the right side of the screen to advance from the deficit balance report to the credit balance report 30

Training classes • • • 1 Overview of Accounting for Sponsored Projects 2 OMB Circulars & Cost Accounting Standards 3 Understanding F&A Costs 4 Direct Costing 5 Cost Transfers & Closeout 6 Cost Sharing 7 Subcontract Monitoring 8 Advanced Topics 9 Invoicing, Reporting & Cash Receipts 10 Sponsored Projects Reports in IRIS • Other – IRIS reporting for sponsored projects 31