Cost of Capital RWJChapter 14 Once again Whats

- Slides: 35

+ Cost of Capital RWJ-Chapter 14

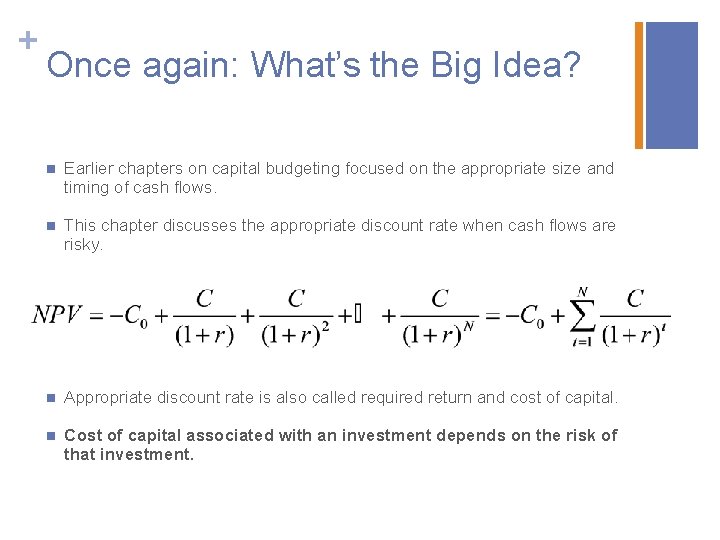

+ Once again: What’s the Big Idea? n Earlier chapters on capital budgeting focused on the appropriate size and timing of cash flows. n This chapter discusses the appropriate discount rate when cash flows are risky. n Appropriate discount rate is also called required return and cost of capital. n Cost of capital associated with an investment depends on the risk of that investment.

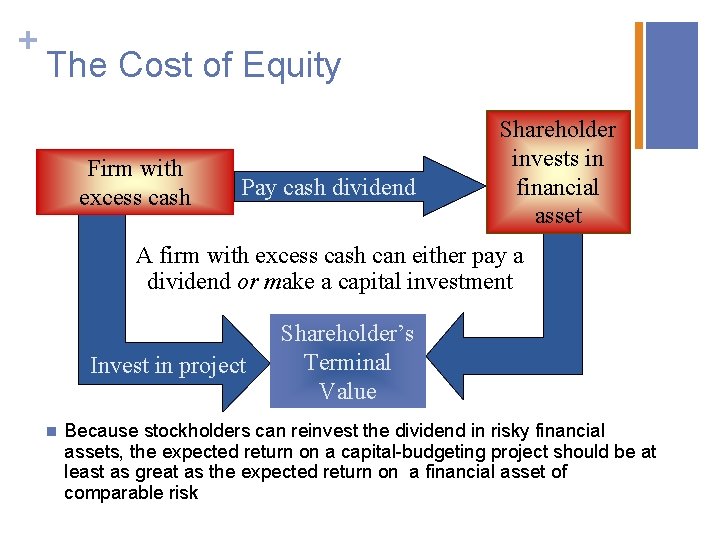

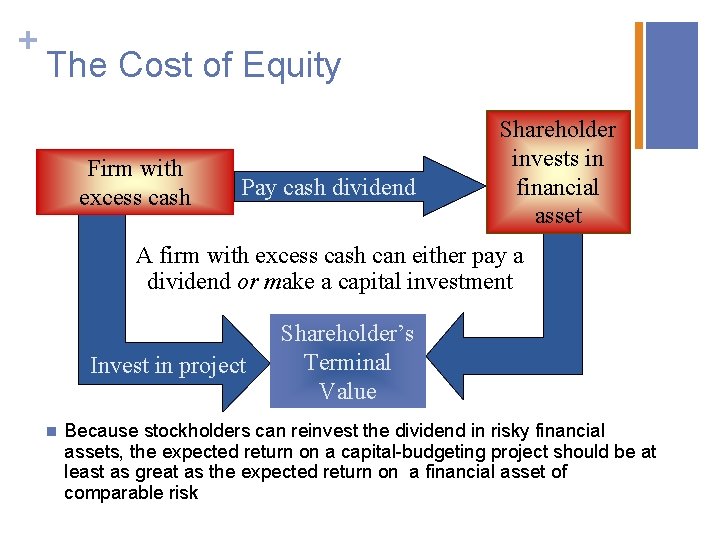

+ The Cost of Equity Firm with excess cash Pay cash dividend Shareholder invests in financial asset A firm with excess cash can either pay a dividend or make a capital investment Invest in project n Shareholder’s Terminal Value Because stockholders can reinvest the dividend in risky financial assets, the expected return on a capital-budgeting project should be at least as great as the expected return on a financial asset of comparable risk

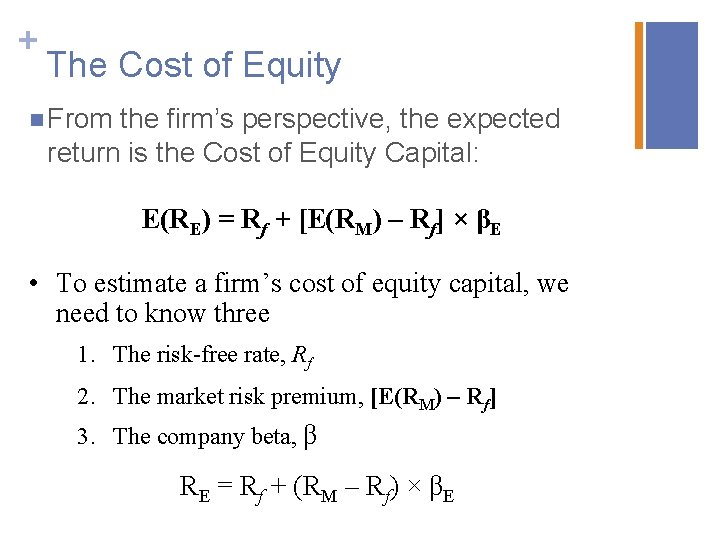

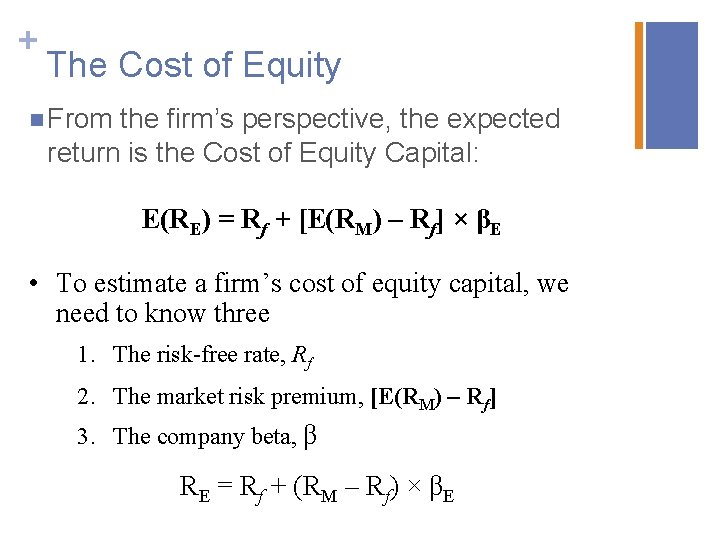

+ The Cost of Equity n From the firm’s perspective, the expected return is the Cost of Equity Capital: E(RE) = Rf + [E(RM) – Rf] × βE • To estimate a firm’s cost of equity capital, we need to know three 1. The risk-free rate, Rf 2. The market risk premium, [E(RM) – Rf] 3. The company beta, β RE = Rf + (RM – Rf) × βE

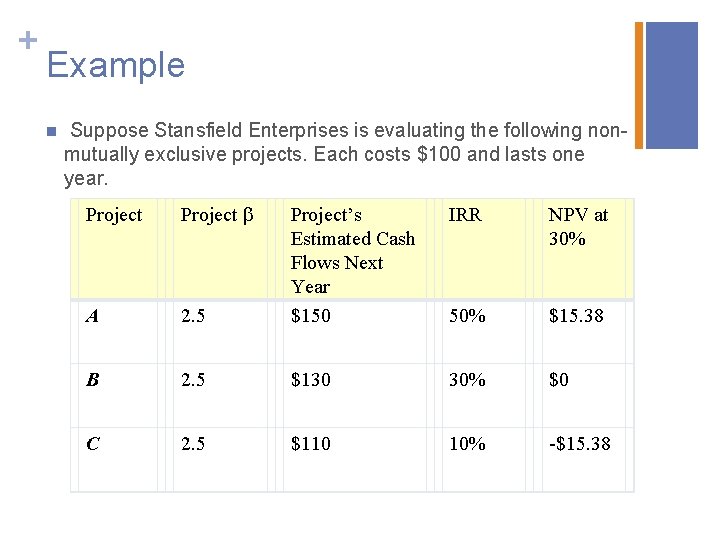

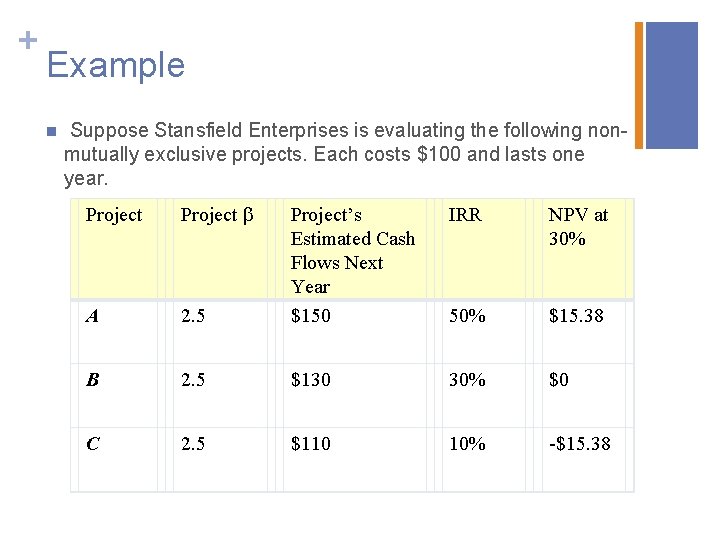

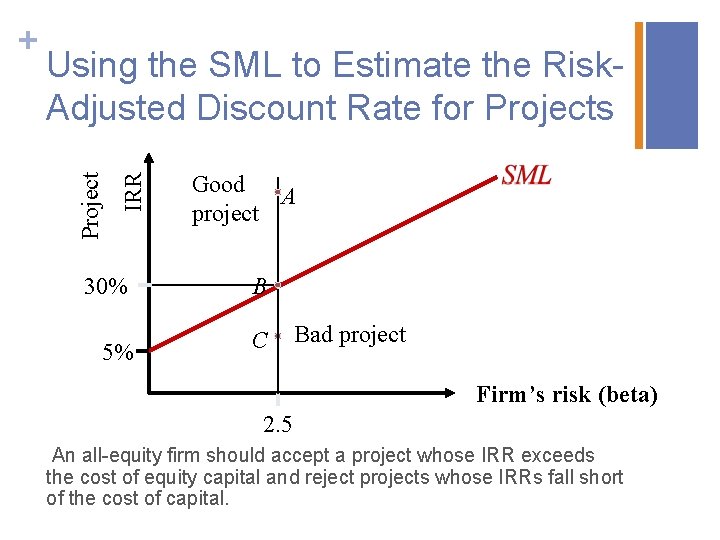

+ Example n Suppose Stansfield Enterprises is evaluating the following nonmutually exclusive projects. Each costs $100 and lasts one year. Project b A IRR NPV at 30% 2. 5 Project’s Estimated Cash Flows Next Year $150 50% $15. 38 B 2. 5 $130 30% $0 C 2. 5 $110 10% -$15. 38

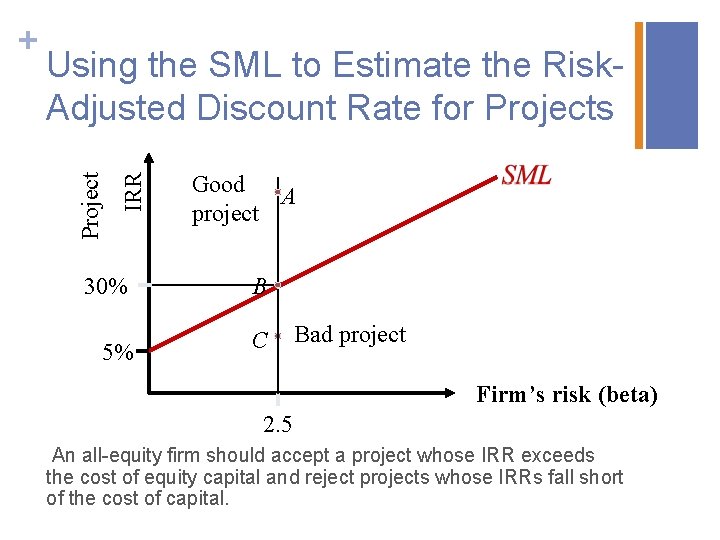

IRR Using the SML to Estimate the Risk. Adjusted Discount Rate for Projects Project + Good A project 30% B 5% C Bad project Firm’s risk (beta) 2. 5 An all-equity firm should accept a project whose IRR exceeds the cost of equity capital and reject projects whose IRRs fall short of the cost of capital.

+ Determinants of Beta n Business Risk n Cyclicality of Revenues n Operating Leverage n Financial Risk n Financial Leverage

+ Cyclicality of Revenues n Highly cyclical stocks have high betas. n Empirical evidence suggests that retailers and automotive firms fluctuate with the business cycle. n Transportation firms and utilities are less dependent upon the business cycle. n Note that cyclicality is not the same as variability—stocks with high standard deviations need not have high betas. n Movie studios have revenues that are variable, depending upon whether they produce “hits” or “flops”, but their revenues are not especially dependent upon the business cycle.

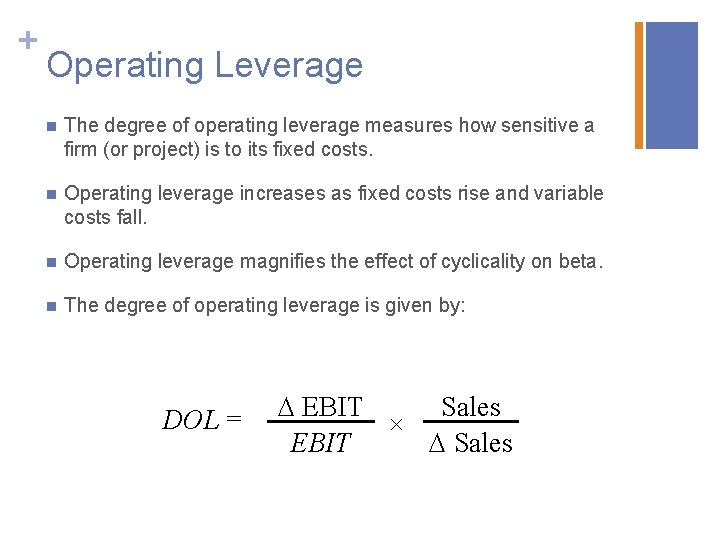

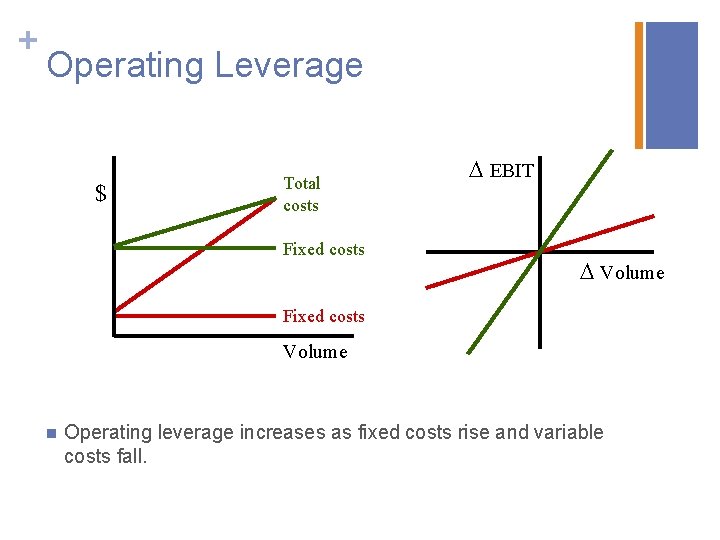

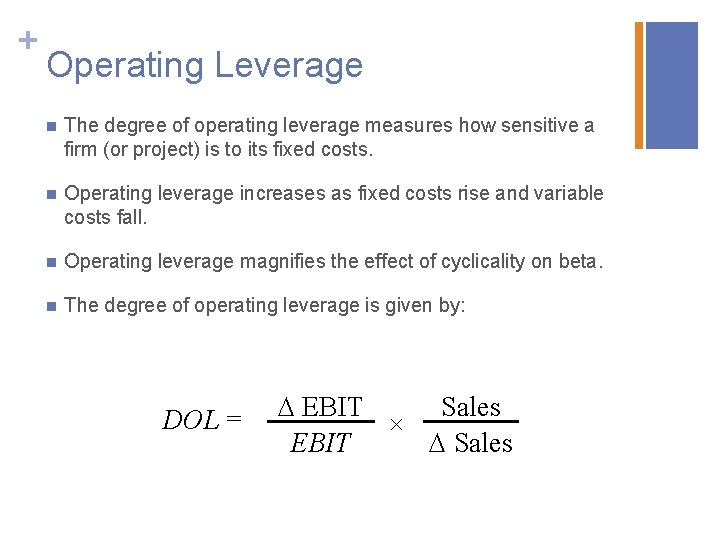

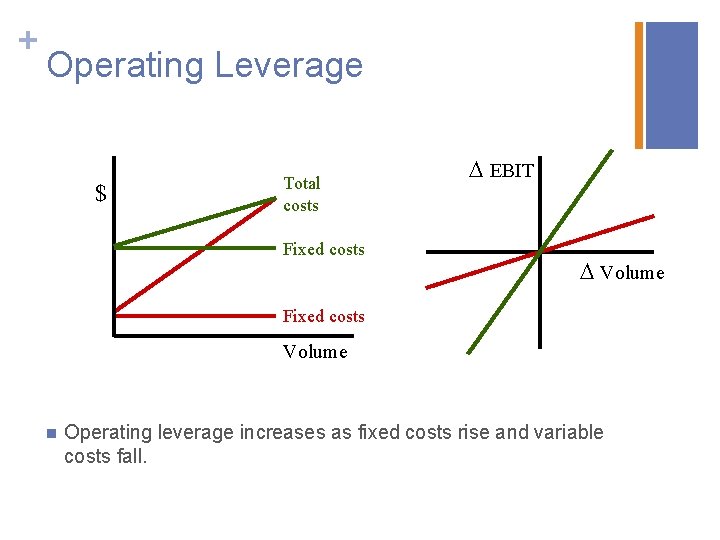

+ Operating Leverage n The degree of operating leverage measures how sensitive a firm (or project) is to its fixed costs. n Operating leverage increases as fixed costs rise and variable costs fall. n Operating leverage magnifies the effect of cyclicality on beta. n The degree of operating leverage is given by: DOL = EBIT Sales × EBIT Sales

+ Operating Leverage $ Total costs Fixed costs EBIT Volume Fixed costs Volume n Operating leverage increases as fixed costs rise and variable costs fall.

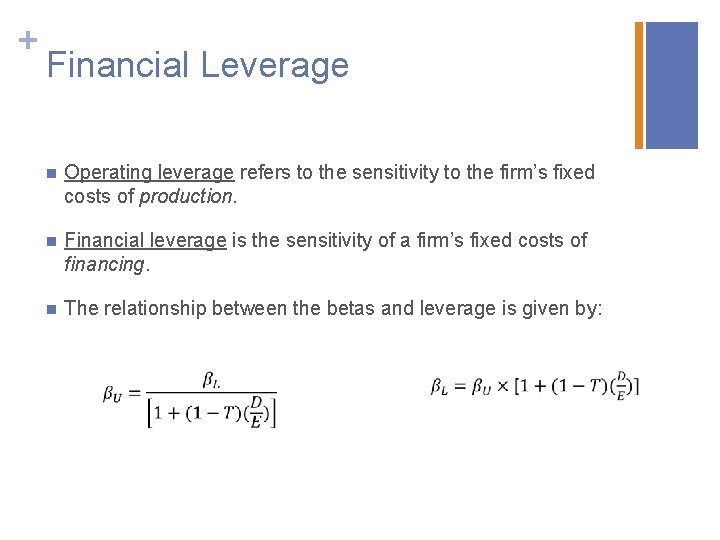

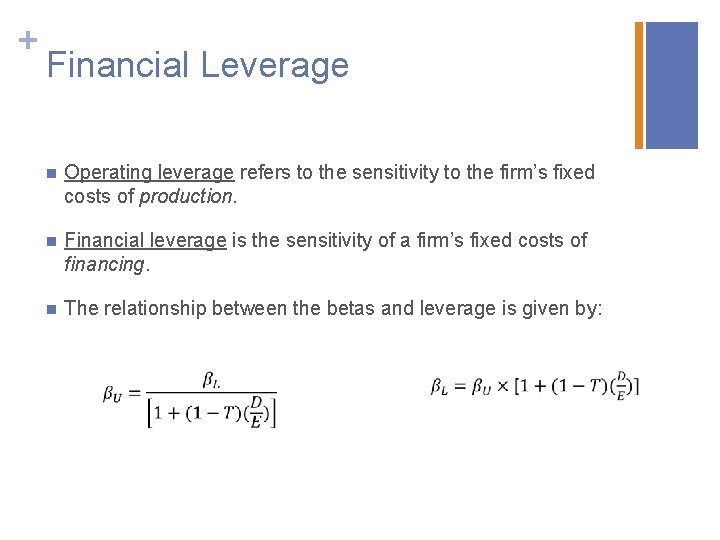

+ Financial Leverage n Operating leverage refers to the sensitivity to the firm’s fixed costs of production. n Financial leverage is the sensitivity of a firm’s fixed costs of financing. n The relationship between the betas and leverage is given by:

+ Example Consider Grand Sport, Inc. , which is currently all-equity and has a beta of 0. 90. The firm has decided to lever up to a capital structure of 1 part debt to 1 part equity. Since the firm will remain in the same industry, its asset beta should remain 0. 90. Assume that the tax rate is 35%.

+ The Costs of Debt and Preferred Stock n Cost of debt is the return that lenders require on the firm’s debt. n Cost of debt is the interest rate the firm must pay on NEW borrowing. n If the firm has bonds outstanding, then the yield to maturity on those bonds is the market-required rate on the firm’s debt. n If the firm’s bonds are rated, say AA, then we can use the interest rate on newly issued AA-rated bonds as cost of debt. n Caution: Coupon rate on the existing debt is irrelevant here. Coupon rate tells us the cost of debt when the bonds were first issued, not the cost of debt today.

+ Example n Suppose General Tool Company issued a 30 -year, 7 percent semiannual coupon bond with $1, 000 face value 8 years ago. The bond is currently selling for 96 percent of its face value. What is General Tool’s cost of debt?

+ The Cost of Preferred Stock n Preferred stock has a fixed dividend paid every period forever. n So, the cash flows from the preferred stock is a perpetuity. n Cost of preferred stock is calculated as: Rp = D/P 0

+ Example Alabama Power Co. has an issue of ordinary preferred stock with a $25 par value that traded on NYSE. The issue pays $1. 30 annually per share and sells for $21. 05 per share. What is Alabama Power’s cost of preferred stock?

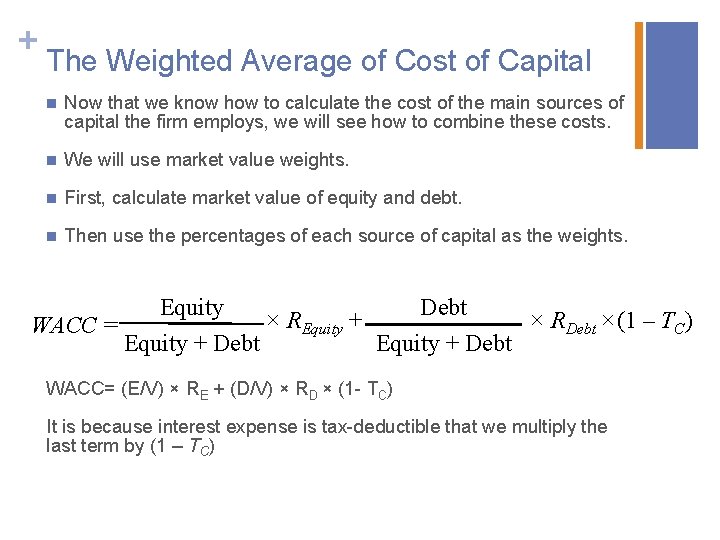

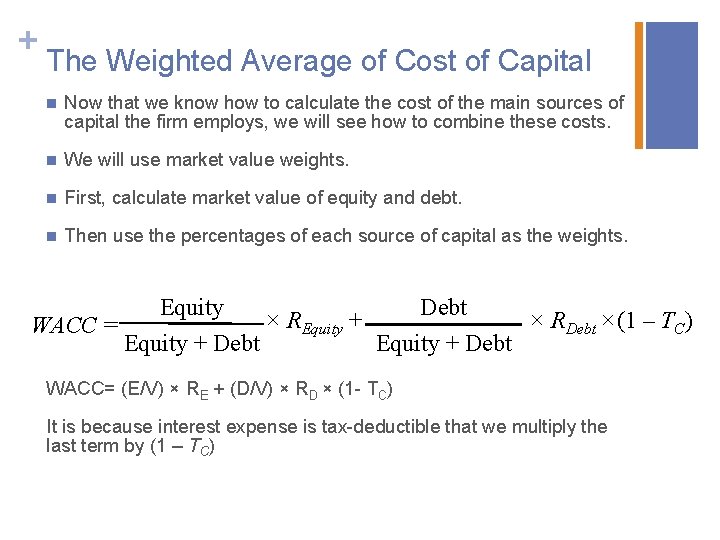

+ The Weighted Average of Cost of Capital n Now that we know how to calculate the cost of the main sources of capital the firm employs, we will see how to combine these costs. n We will use market value weights. n First, calculate market value of equity and debt. n Then use the percentages of each source of capital as the weights. WACC = Equity + Debt × REquity + Debt × RDebt ×(1 – TC) WACC= (E/V) × RE + (D/V) × RD × (1 - TC) It is because interest expense is tax-deductible that we multiply the last term by (1 – TC)

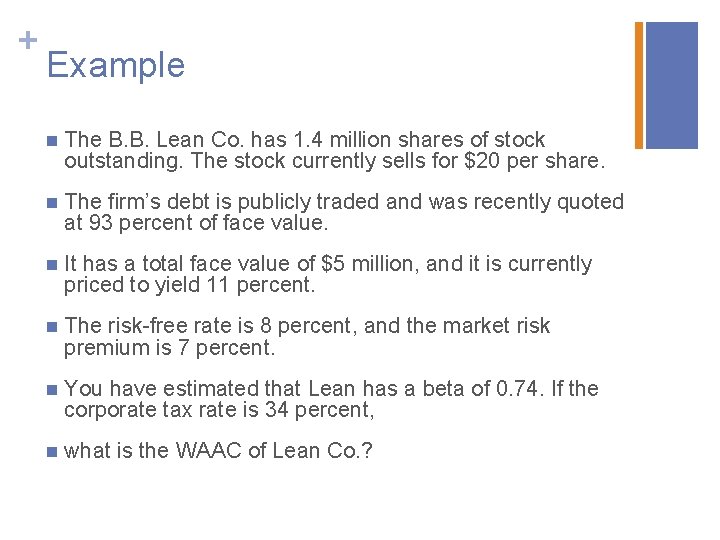

+ Example n The B. B. Lean Co. has 1. 4 million shares of stock outstanding. The stock currently sells for $20 per share. n The firm’s debt is publicly traded and was recently quoted at 93 percent of face value. n It has a total face value of $5 million, and it is currently priced to yield 11 percent. n The risk-free rate is 8 percent, and the market risk premium is 7 percent. n You have estimated that Lean has a beta of 0. 74. If the corporate tax rate is 34 percent, n what is the WAAC of Lean Co. ?

+ Divisional and Project Costs of Capital n Any project’s cost of capital depends on the use to which the capital is being put—not the source. n Therefore, it depends on the risk of the project and not the risk of the company.

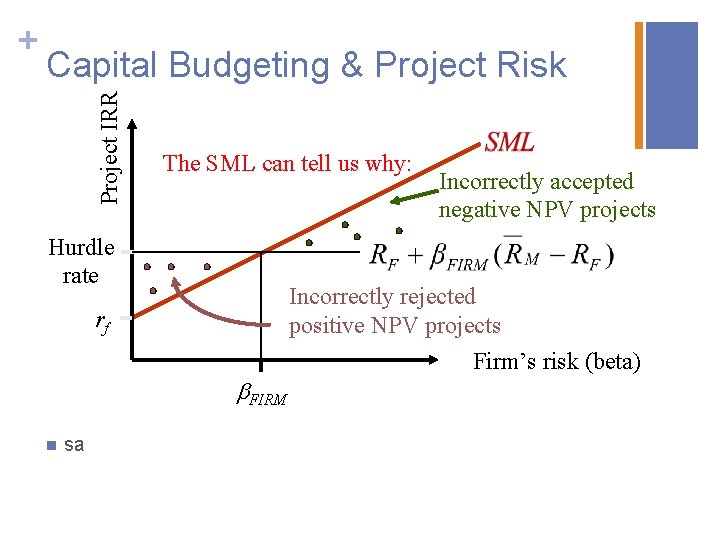

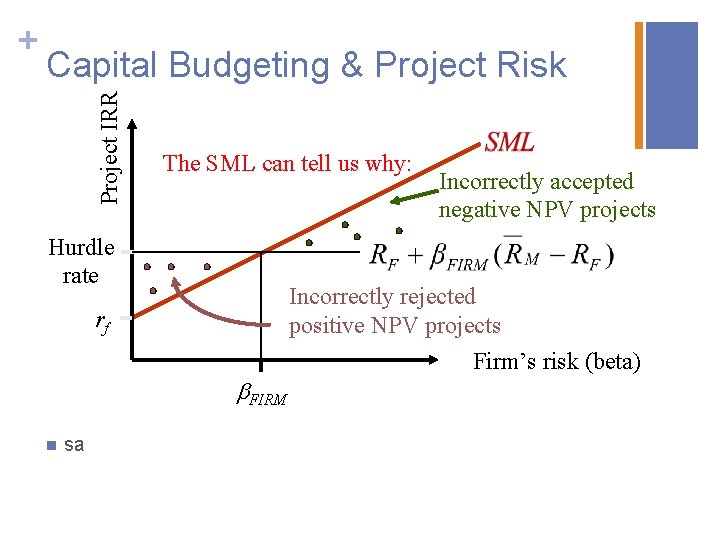

Capital Budgeting & Project Risk Project IRR + The SML can tell us why: Hurdle rate rf b. FIRM n sa Incorrectly accepted negative NPV projects Incorrectly rejected positive NPV projects Firm’s risk (beta)

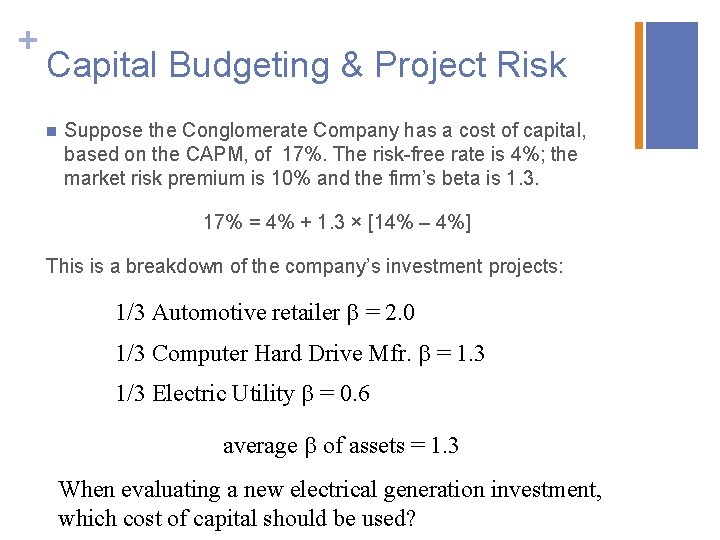

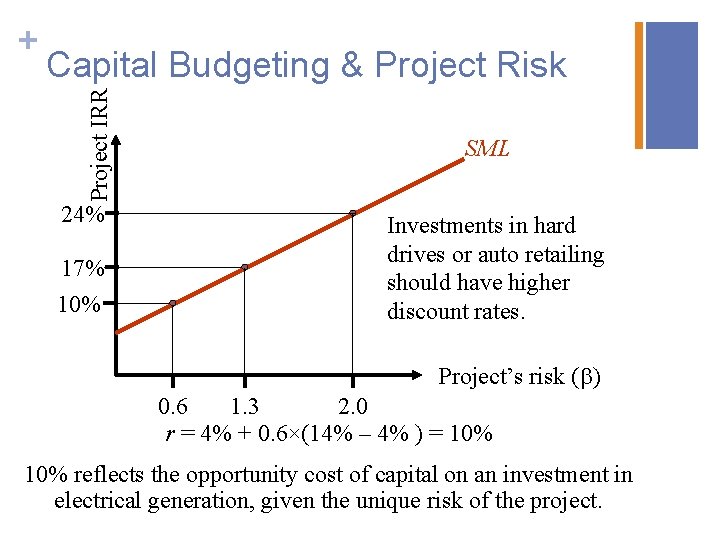

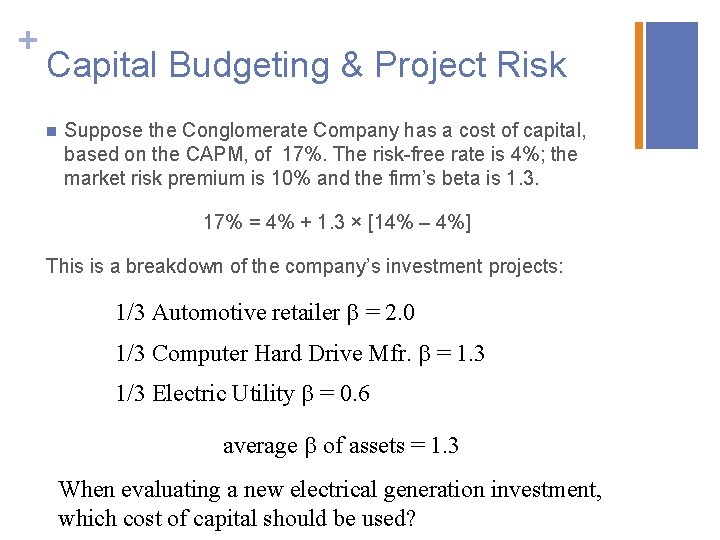

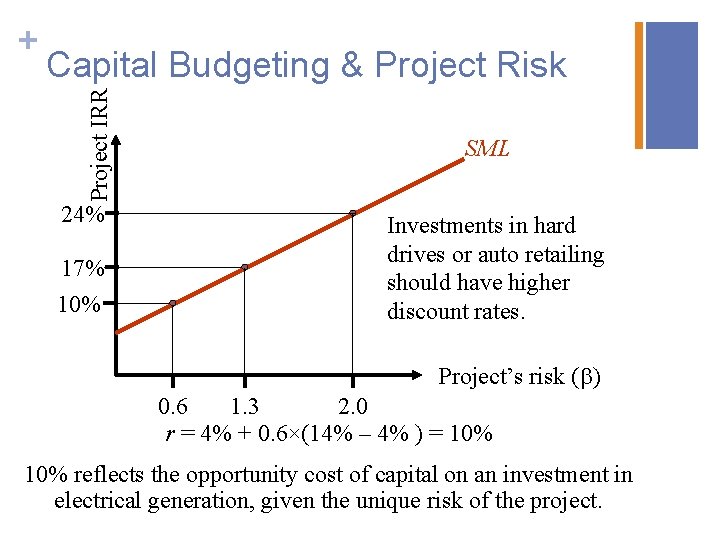

+ Capital Budgeting & Project Risk n Suppose the Conglomerate Company has a cost of capital, based on the CAPM, of 17%. The risk-free rate is 4%; the market risk premium is 10% and the firm’s beta is 1. 3. 17% = 4% + 1. 3 × [14% – 4%] This is a breakdown of the company’s investment projects: 1/3 Automotive retailer b = 2. 0 1/3 Computer Hard Drive Mfr. b = 1. 3 1/3 Electric Utility b = 0. 6 average b of assets = 1. 3 When evaluating a new electrical generation investment, which cost of capital should be used?

Capital Budgeting & Project Risk Project IRR + 24% 17% 10% SML Investments in hard drives or auto retailing should have higher discount rates. Project’s risk (b) 0. 6 1. 3 2. 0 r = 4% + 0. 6×(14% – 4% ) = 10% reflects the opportunity cost of capital on an investment in electrical generation, given the unique risk of the project.

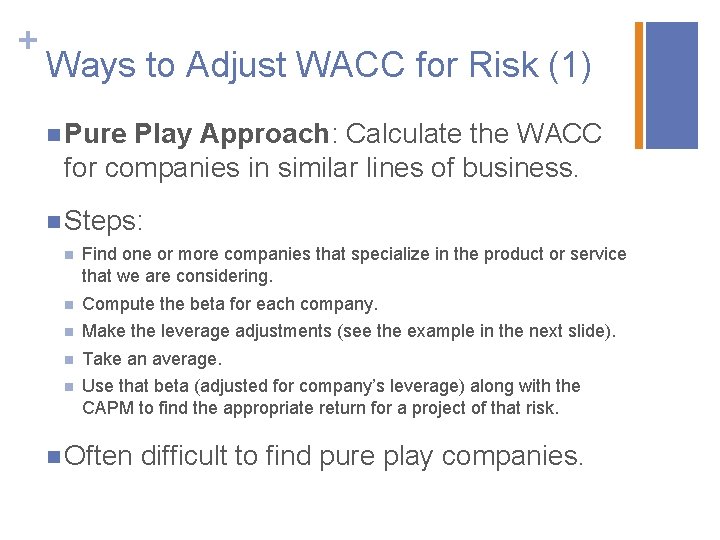

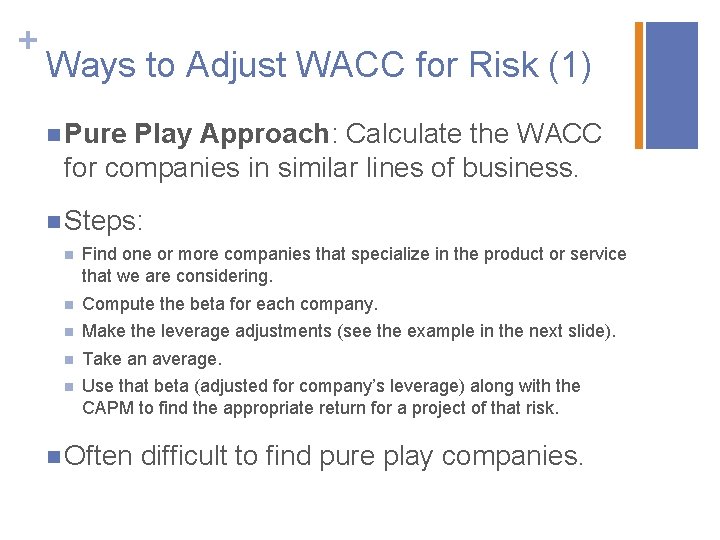

+ Ways to Adjust WACC for Risk (1) n Pure Play Approach: Calculate the WACC for companies in similar lines of business. n Steps: n Find one or more companies that specialize in the product or service that we are considering. n Compute the beta for each company. n Make the leverage adjustments (see the example in the next slide). n Take an average. n Use that beta (adjusted for company’s leverage) along with the CAPM to find the appropriate return for a project of that risk. n Often difficult to find pure play companies.

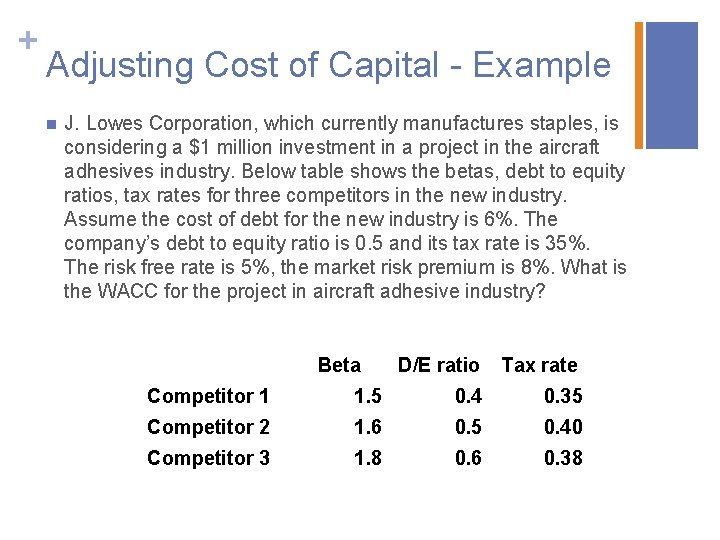

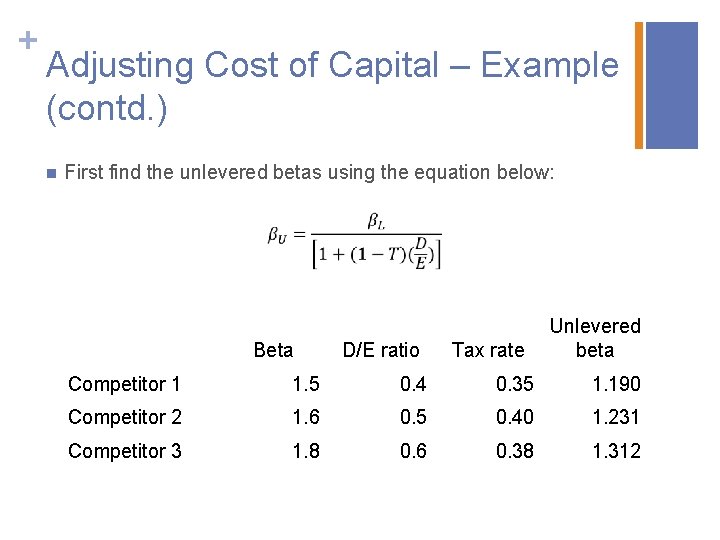

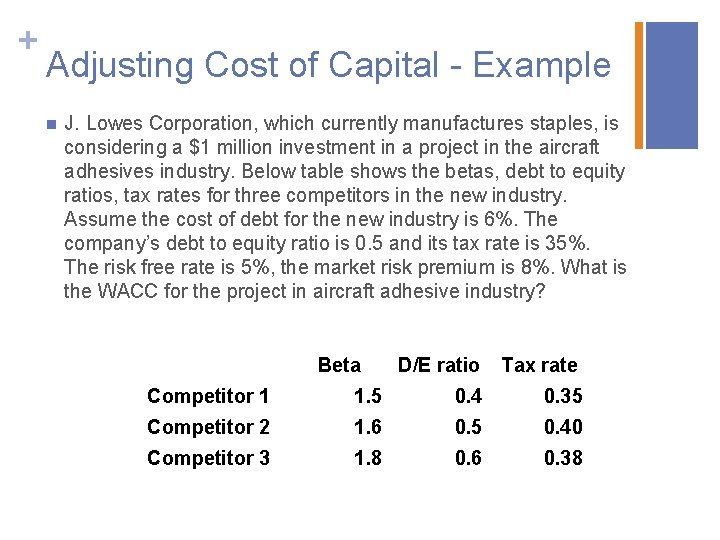

+ Adjusting Cost of Capital - Example n J. Lowes Corporation, which currently manufactures staples, is considering a $1 million investment in a project in the aircraft adhesives industry. Below table shows the betas, debt to equity ratios, tax rates for three competitors in the new industry. Assume the cost of debt for the new industry is 6%. The company’s debt to equity ratio is 0. 5 and its tax rate is 35%. The risk free rate is 5%, the market risk premium is 8%. What is the WACC for the project in aircraft adhesive industry? Beta D/E ratio Tax rate Competitor 1 1. 5 0. 4 0. 35 Competitor 2 1. 6 0. 5 0. 40 Competitor 3 1. 8 0. 6 0. 38

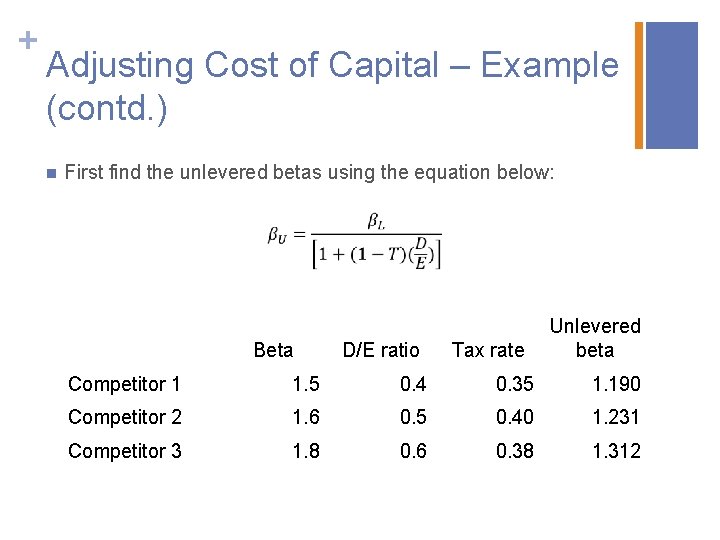

+ Adjusting Cost of Capital – Example (contd. ) n First find the unlevered betas using the equation below: Beta D/E ratio Tax rate Unlevered beta Competitor 1 1. 5 0. 4 0. 35 1. 190 Competitor 2 1. 6 0. 5 0. 40 1. 231 Competitor 3 1. 8 0. 6 0. 38 1. 312

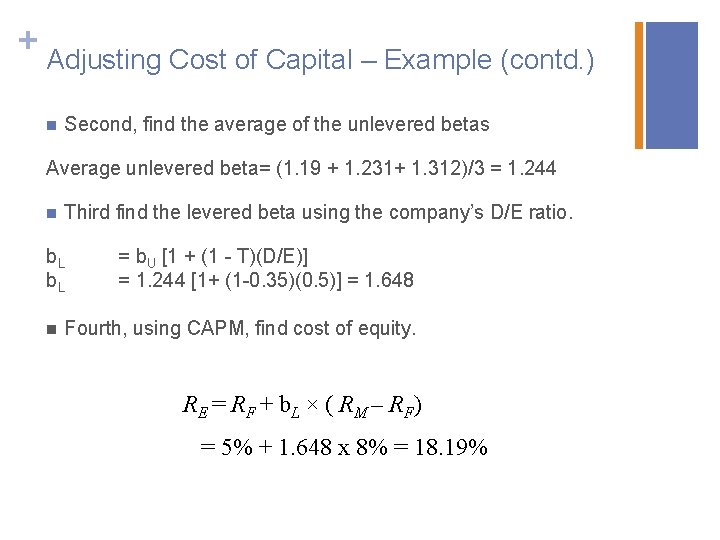

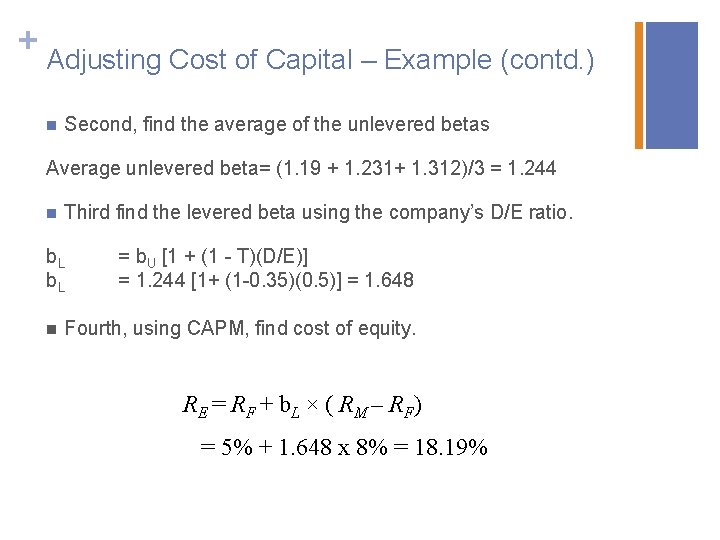

+ Adjusting Cost of Capital – Example (contd. ) n Second, find the average of the unlevered betas Average unlevered beta= (1. 19 + 1. 231+ 1. 312)/3 = 1. 244 n Third find the levered beta using the company’s D/E ratio. b. L n = b. U [1 + (1 - T)(D/E)] = 1. 244 [1+ (1 -0. 35)(0. 5)] = 1. 648 Fourth, using CAPM, find cost of equity. R E = R F + b L × ( R M – R F) = 5% + 1. 648 x 8% = 18. 19%

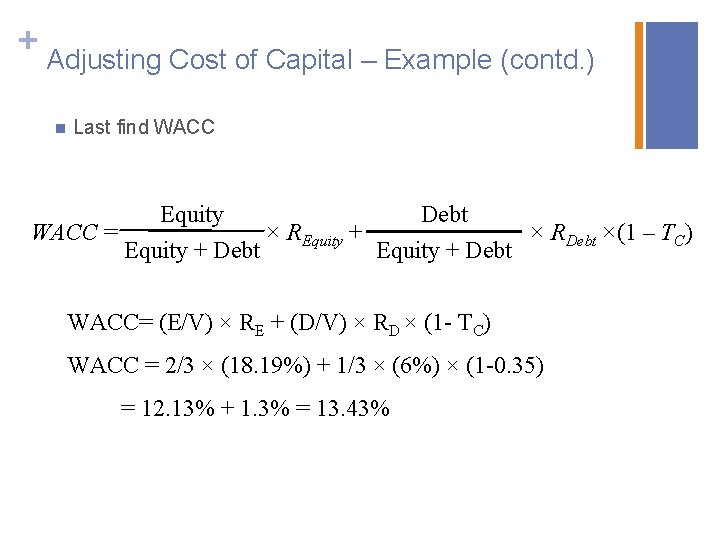

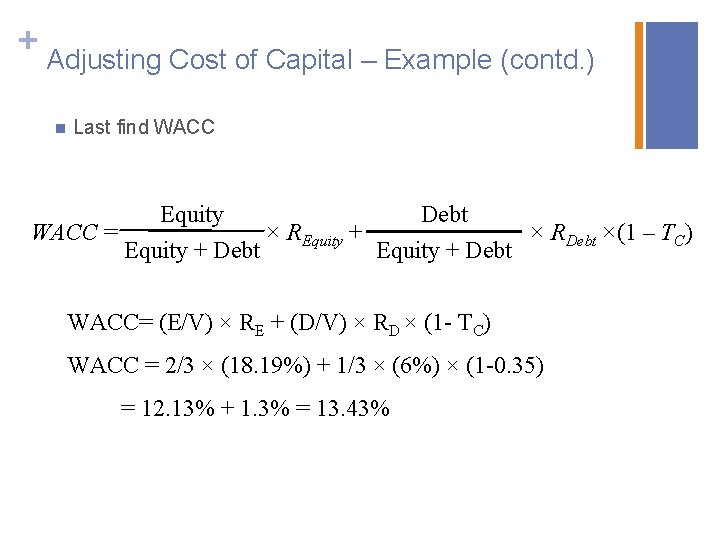

+ Adjusting Cost of Capital – Example (contd. ) n Last find WACC = Equity + Debt × REquity + Debt × RDebt ×(1 – TC) WACC= (E/V) × RE + (D/V) × RD × (1 - TC) WACC = 2/3 × (18. 19%) + 1/3 × (6%) × (1 -0. 35) = 12. 13% + 1. 3% = 13. 43%

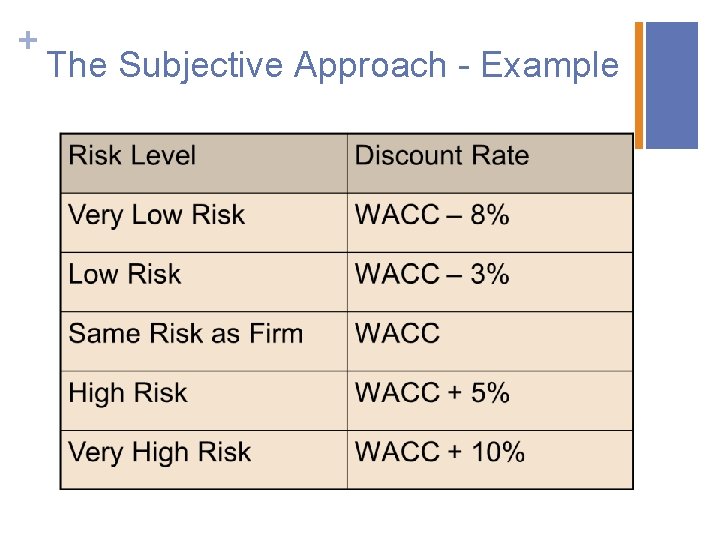

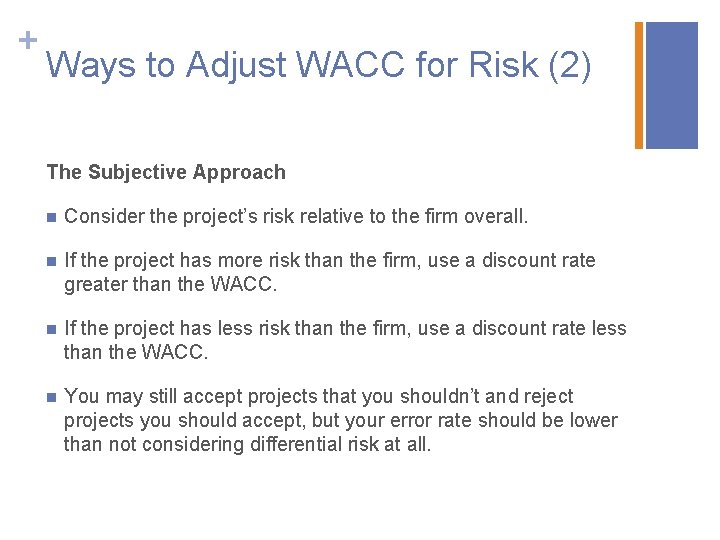

+ Ways to Adjust WACC for Risk (2) The Subjective Approach n Consider the project’s risk relative to the firm overall. n If the project has more risk than the firm, use a discount rate greater than the WACC. n If the project has less risk than the firm, use a discount rate less than the WACC. n You may still accept projects that you shouldn’t and reject projects you should accept, but your error rate should be lower than not considering differential risk at all.

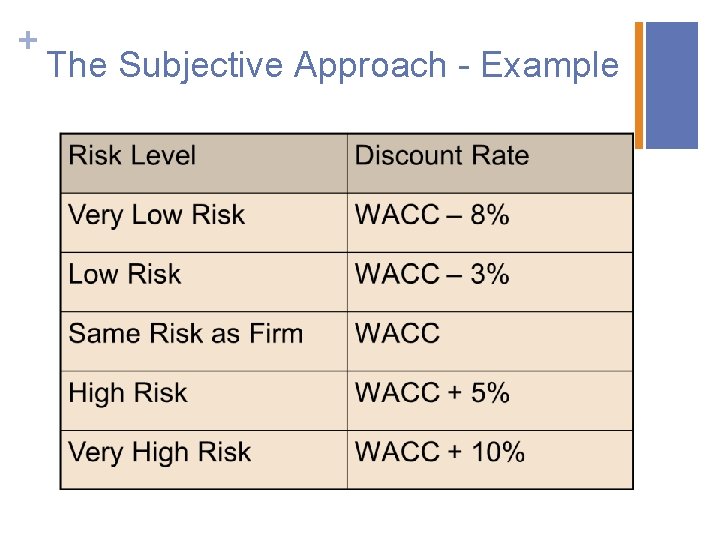

+ The Subjective Approach - Example

+ Flotation Costs n If the firm needs to issue new debt or equity to fund the new project, it will have to incur some flotation costs. These costs should be considered in the calculation of the NPV. n Here, the important issue is to always use the target weights in the calculation of WACC, even if the firm can finance the entire cost of the project with either debt or equity. n If a firm has a target debt-equity ratio of 1, for example, but chooses to finance a particular project with all debt, it will have to raise additional equity later on to maintain its target debtequity ratio.

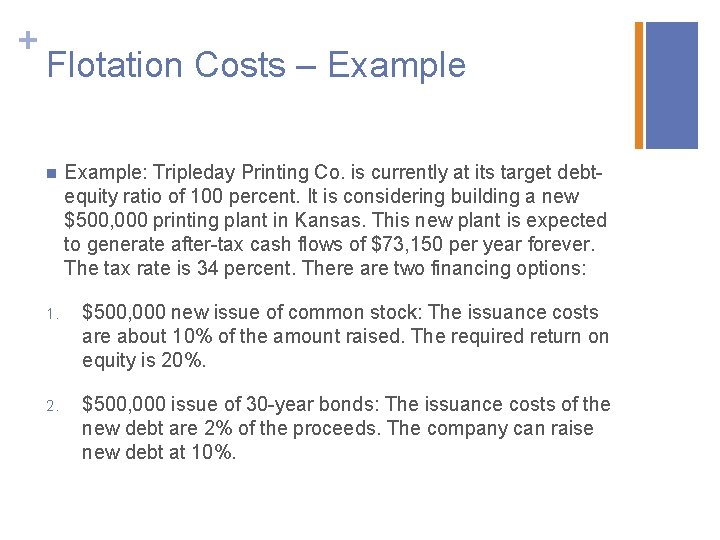

+ Flotation Costs – Example n Example: Tripleday Printing Co. is currently at its target debtequity ratio of 100 percent. It is considering building a new $500, 000 printing plant in Kansas. This new plant is expected to generate after-tax cash flows of $73, 150 per year forever. The tax rate is 34 percent. There are two financing options: 1. $500, 000 new issue of common stock: The issuance costs are about 10% of the amount raised. The required return on equity is 20%. 2. $500, 000 issue of 30 -year bonds: The issuance costs of the new debt are 2% of the proceeds. The company can raise new debt at 10%.

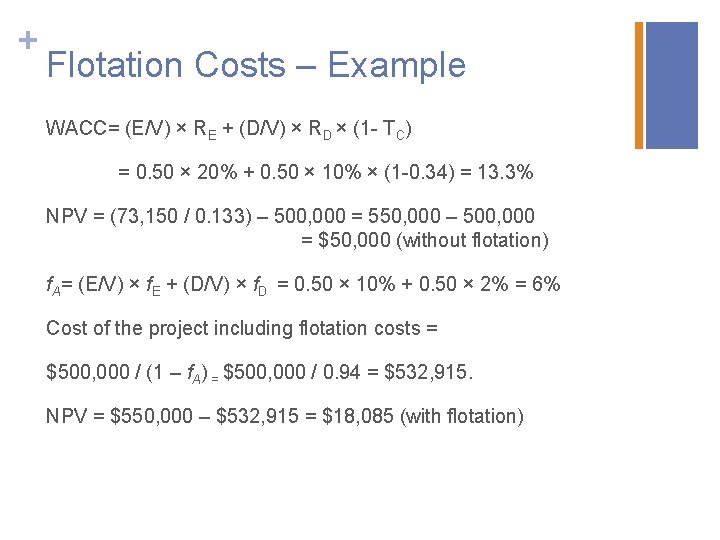

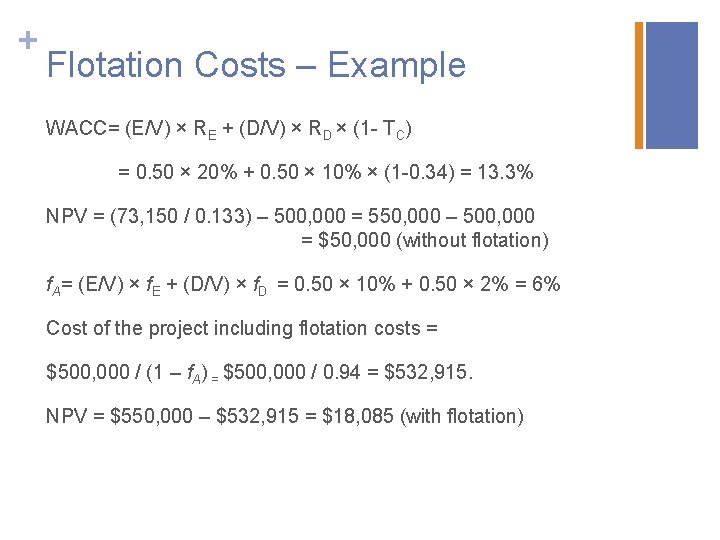

+ Flotation Costs – Example WACC= (E/V) × RE + (D/V) × RD × (1 - TC) = 0. 50 × 20% + 0. 50 × 10% × (1 -0. 34) = 13. 3% NPV = (73, 150 / 0. 133) – 500, 000 = 550, 000 – 500, 000 = $50, 000 (without flotation) f. A= (E/V) × f. E + (D/V) × f. D = 0. 50 × 10% + 0. 50 × 2% = 6% Cost of the project including flotation costs = $500, 000 / (1 – f. A) = $500, 000 / 0. 94 = $532, 915. NPV = $550, 000 – $532, 915 = $18, 085 (with flotation)

+ Cost of Capital in Practice n Survey of 392 CFOs by Graham and Harvey (1999) n How does your firm estimate cost of equity capital? n n Gitman and Mercurio (1982) find 29. 9% of participants use the CAPM. Graham and Harvey find 73. 5% use some form of CAPM. Size is important – large firms are more likely to use CAPM. Education is important - CFOs with MBAs more likely to use CAPM.

+ Cost of Capital in Practice n n What discount rate do you use for an overseas project? n More than half would “always” or “almost always” use the single company-wide discount rate. n Other half use a discount rate that reflects the particular project risks. n Implies that many (half) view investment overseas to have identical risk to domestic investment - or that international risks have been ignored (Graham and Harvey, 1999). Size is important – Large firms are more likely to adjust discount rates based on risk.

+ Summary and Conclusions n The expected return on any capital budgeting project should be at least as great as the expected return on a financial asset of comparable risk. Otherwise the shareholders would prefer the firm to pay a dividend. n The expected return on any asset is dependent upon b. n A project’s required return depends on the project’s b. n A project’s b can be estimated by considering comparable industries or the cyclicality of project revenues and the project’s operating leverage. n If the firm uses debt, the discount rate to use is the WACC. n In order to calculate WACC, the cost of equity and the cost of debt applicable to a project must be estimated.

Memory moment picture books

Memory moment picture books Alliteration in songs

Alliteration in songs Rise and rise again until lambs become lions

Rise and rise again until lambs become lions Signposts in reading examples

Signposts in reading examples Multinational cost of capital and capital structure

Multinational cost of capital and capital structure Multinational cost of capital and capital structure

Multinational cost of capital and capital structure On sitting down to read king lear once again analysis

On sitting down to read king lear once again analysis Let us sing of his love once again

Let us sing of his love once again Working capital management refers to

Working capital management refers to Source of capital reserve

Source of capital reserve Difference between capital reserve and reserve capital

Difference between capital reserve and reserve capital Regulatory capital vs economic capital

Regulatory capital vs economic capital Regulatory capital vs economic capital

Regulatory capital vs economic capital Variable capital examples

Variable capital examples Capital allocation line vs capital market line

Capital allocation line vs capital market line Interest tax shield calculation

Interest tax shield calculation Marginal cost of capital

Marginal cost of capital Social opportunity cost adalah

Social opportunity cost adalah Example of capital structure

Example of capital structure Wacc

Wacc International capital budgeting

International capital budgeting Requi

Requi Before tax cost of debt

Before tax cost of debt Marginal cost of capital

Marginal cost of capital Cost of capital in financial management

Cost of capital in financial management The following are disadvantages of the sml approach

The following are disadvantages of the sml approach Cost of capital

Cost of capital Capital cost estimate

Capital cost estimate Cost efficient capital market

Cost efficient capital market Objectives of cost of capital

Objectives of cost of capital Marriott corporation the cost of capital

Marriott corporation the cost of capital Ppt on cost of capital

Ppt on cost of capital Materi cost of capital

Materi cost of capital Social opportunity cost of capital

Social opportunity cost of capital The international availability of capital to mnes

The international availability of capital to mnes Book value of debt

Book value of debt