COST MANAGEMENT Accounting Control HansenMowenGuan Chapter 20 Capital

- Slides: 38

COST MANAGEMENT Accounting & Control Hansen▪Mowen▪Guan • Chapter 20 • Capital Investment 1

Study Objectives 1. Describe the difference between independent and mutually exclusive capital investment decisions. 2. Explain the roles of the payback period and accounting rate of return in capital investment decisions. 3. Calculate the net present value (NPV) for independent projects. 4. Compute the internal rate of return (IRR) for independent projects. 5. Tell why NPV is better than IRR for choosing among mutually exclusive projects. 6. Convert gross cash flows to after-tax cash flows. 7. Describe capital investment for advanced technology and environmental impact settings. 2

Capital Investment Decisions • Capital investment decisions are concerned with – The planning process of planning – Setting goals and priorities – Arranging financing – Using certain criteria to select long-term assets 3

Capital Investment Decisions • Capital budgeting – The process of making capital investment decisions • Types of capital budgeting projects – Independent projects • Projects that, if accepted or rejected, will not affect the cash flows of another project. – Mutually exclusive projects • Projects that, if accepted, preclude the acceptance of competing projects. 4

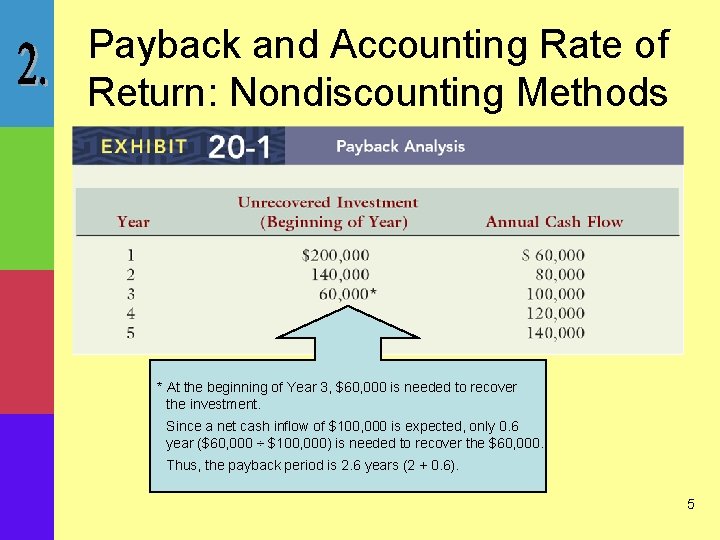

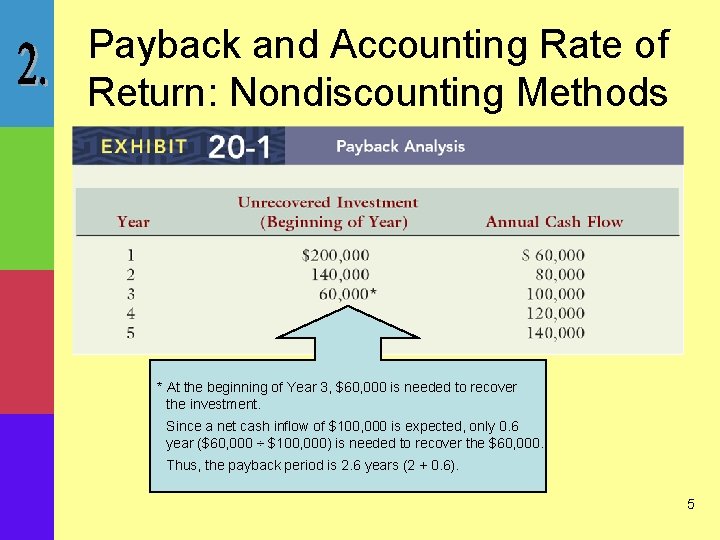

Payback and Accounting Rate of Return: Nondiscounting Methods Payback Analysis * At the beginning of Year 3, $60, 000 is needed to recover the investment. Since a net cash inflow of $100, 000 is expected, only 0. 6 year ($60, 000 ÷ $100, 000) is needed to recover the $60, 000. Thus, the payback period is 2. 6 years (2 + 0. 6). 5

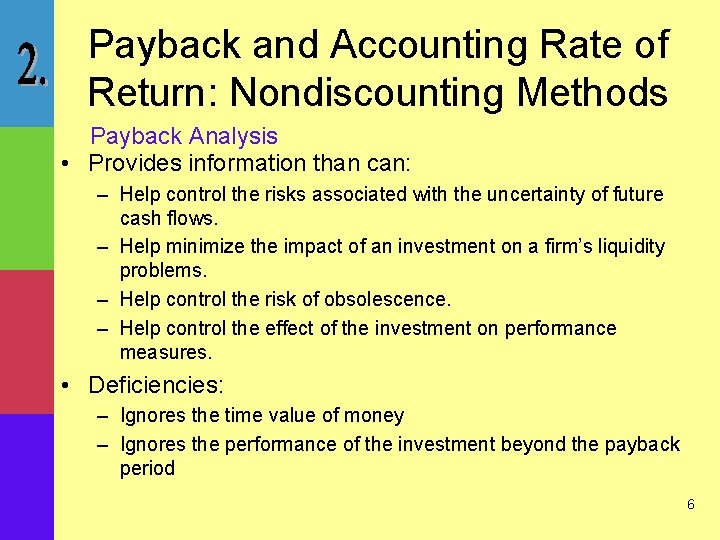

Payback and Accounting Rate of Return: Nondiscounting Methods Payback Analysis • Provides information than can: – Help control the risks associated with the uncertainty of future cash flows. – Help minimize the impact of an investment on a firm’s liquidity problems. – Help control the risk of obsolescence. – Help control the effect of the investment on performance measures. • Deficiencies: – Ignores the time value of money – Ignores the performance of the investment beyond the payback period 6

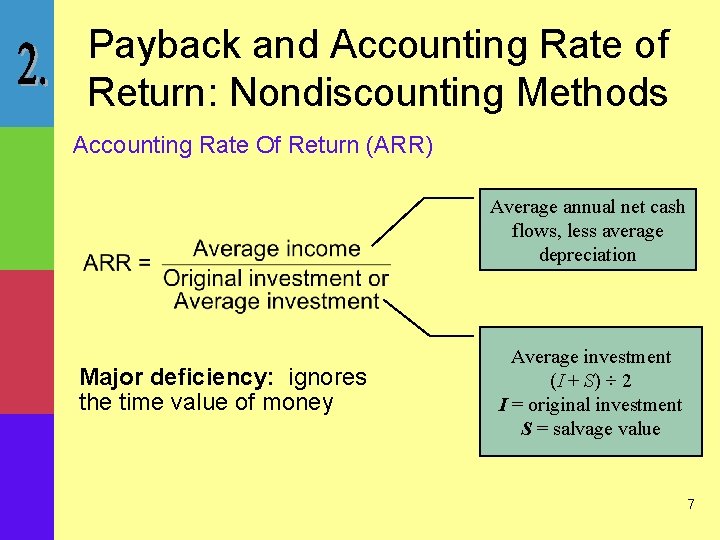

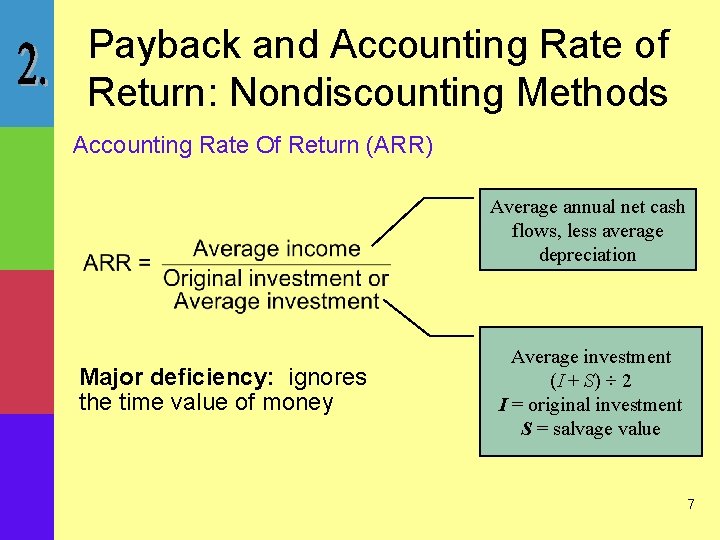

Payback and Accounting Rate of Return: Nondiscounting Methods Accounting Rate Of Return (ARR) Average annual net cash flows, less average depreciation Major deficiency: ignores the time value of money Average investment (I + S) ÷ 2 I = original investment S = salvage value 7

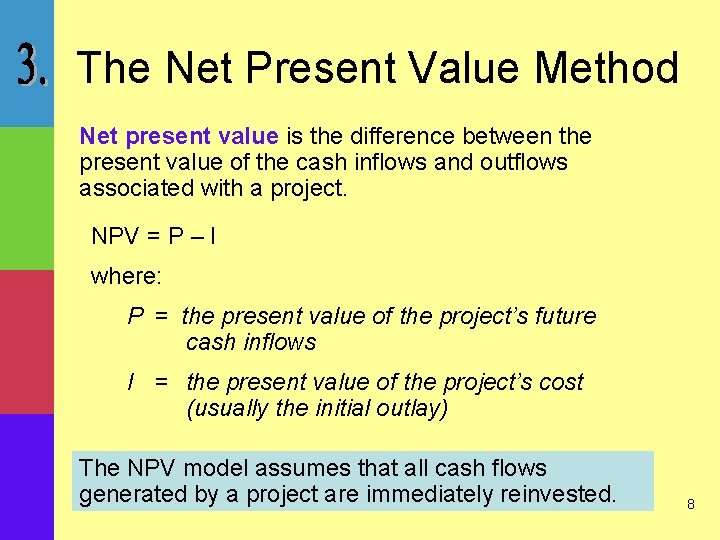

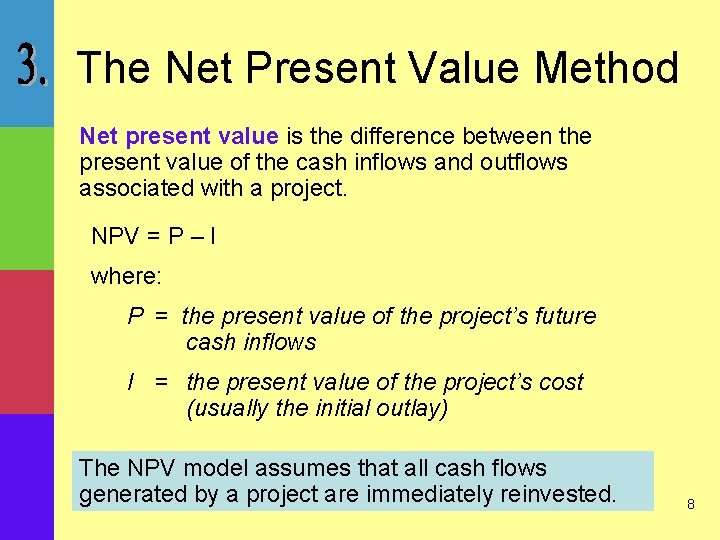

The Net Present Value Method Net present value is the difference between the present value of the cash inflows and outflows associated with a project. NPV = P – I where: P = the present value of the project’s future cash inflows I = the present value of the project’s cost (usually the initial outlay) The NPV model assumes that all cash flows generated by a project are immediately reinvested. 8

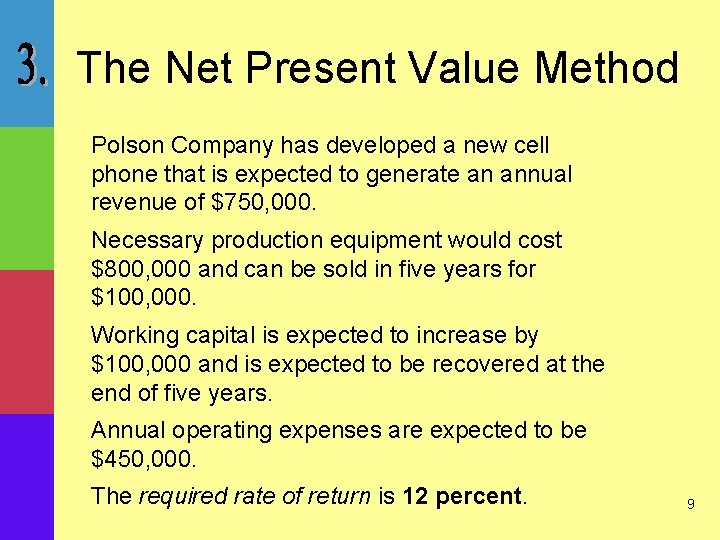

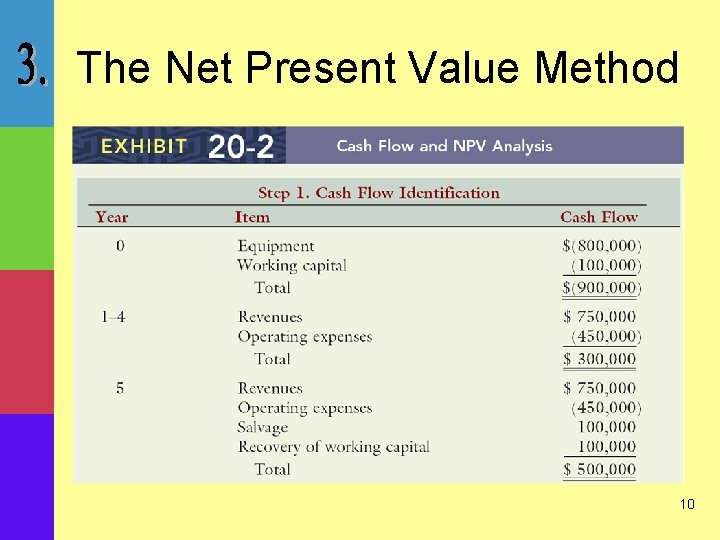

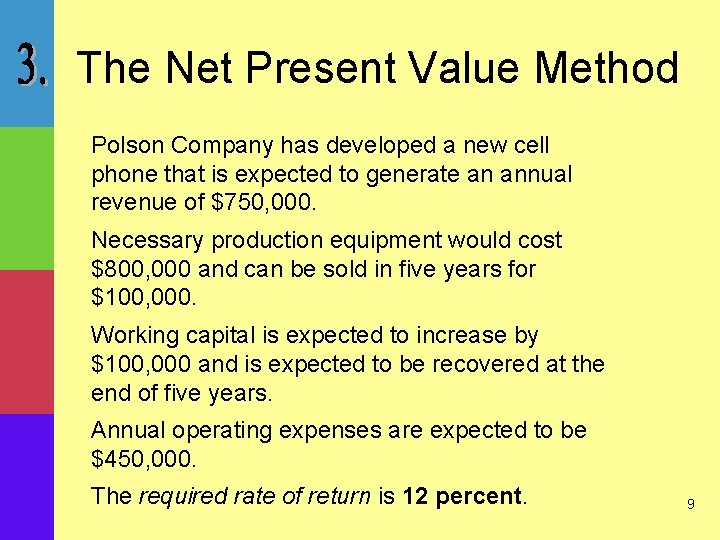

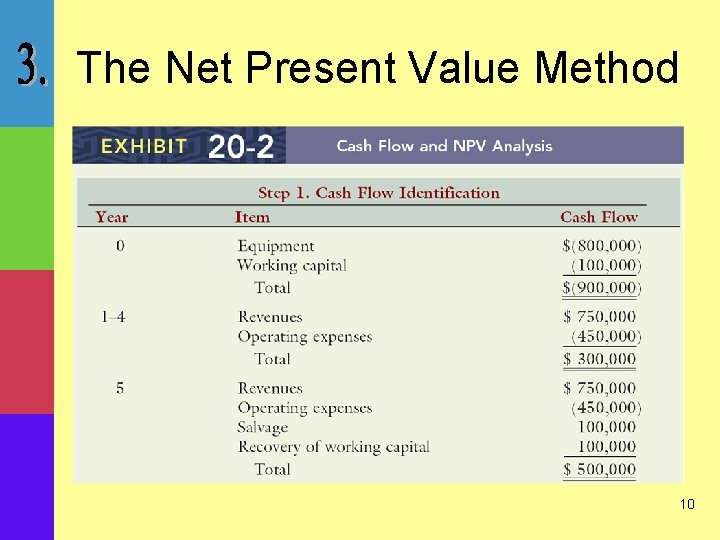

The Net Present Value Method Polson Company has developed a new cell phone that is expected to generate an annual revenue of $750, 000. Necessary production equipment would cost $800, 000 and can be sold in five years for $100, 000. Working capital is expected to increase by $100, 000 and is expected to be recovered at the end of five years. Annual operating expenses are expected to be $450, 000. The required rate of return is 12 percent. 9

The Net Present Value Method 10

The Net Present Value Method c difference due to rounding 11

The Net Present Value Method Decision Criteria for NPV If NPV > 0: 1. The initial investment has been recovered 2. The required rate of return has been recovered For the cell phone project, NPV = $294, 600 Polson should manufacture the cell phones. 12

Internal Rate of Return The internal rate of return (IRR) is the interest rate that sets the project’s NPV at zero. Thus, P = I for the IRR. Example: A project requires a $240, 000 investment and will return $99, 900 at the end of each of the next three years. What is the IRR? $240, 000 = $99, 900(df) $240, 000 ÷ $99, 900 = 2. 402 i = 12% 13

Internal Rate of Return Decision Criteria: If the IRR > Cost of Capital, accept the project If the IRR = Cost of Capital, accept or reject If the IRR < Cost of Capital, reject the project 14

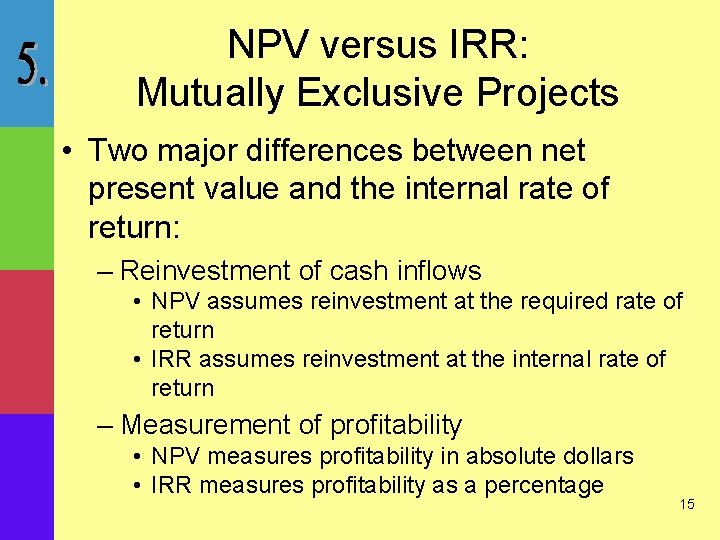

NPV versus IRR: Mutually Exclusive Projects • Two major differences between net present value and the internal rate of return: – Reinvestment of cash inflows • NPV assumes reinvestment at the required rate of return • IRR assumes reinvestment at the internal rate of return – Measurement of profitability • NPV measures profitability in absolute dollars • IRR measures profitability as a percentage 15

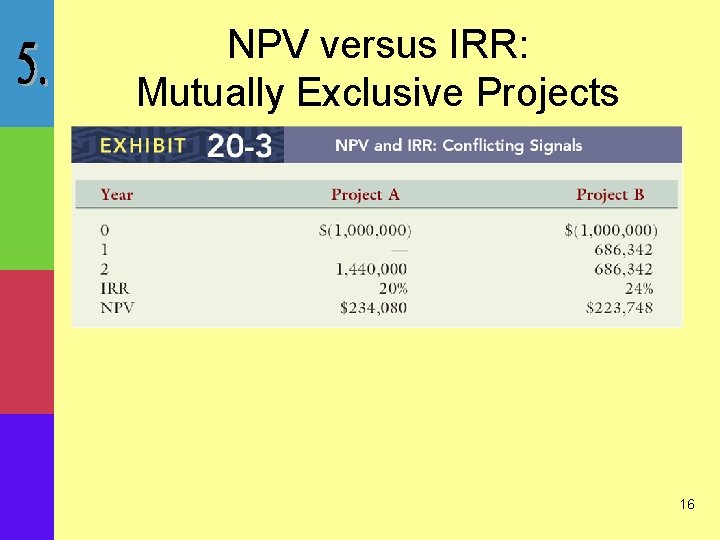

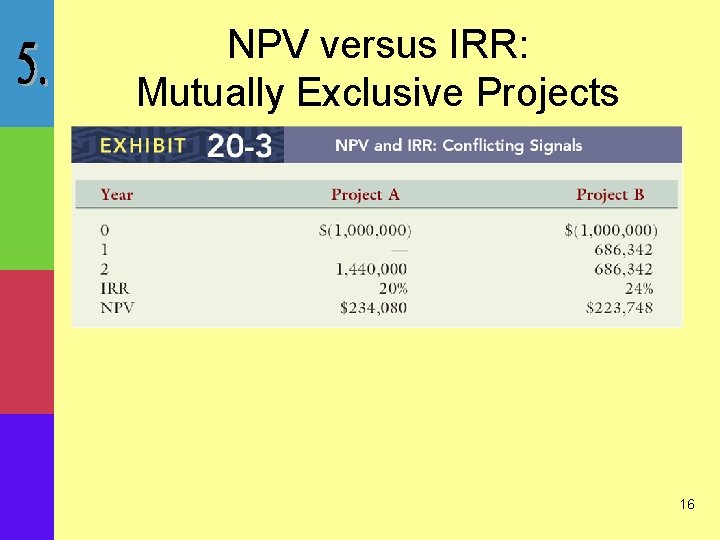

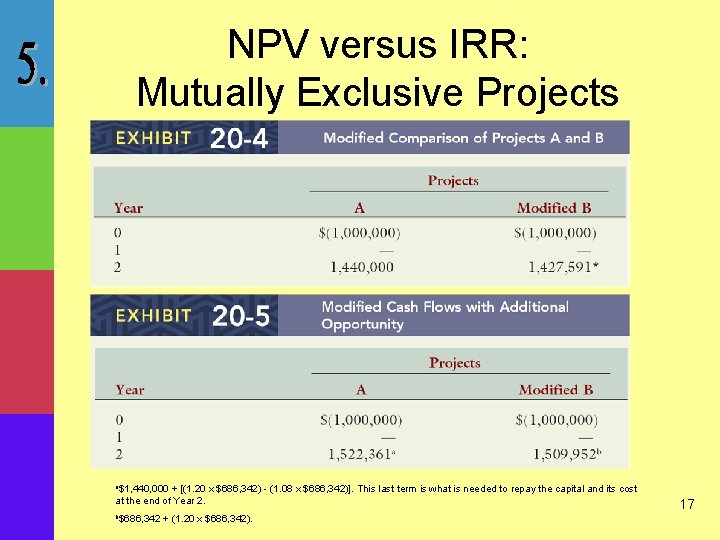

NPV versus IRR: Mutually Exclusive Projects 16

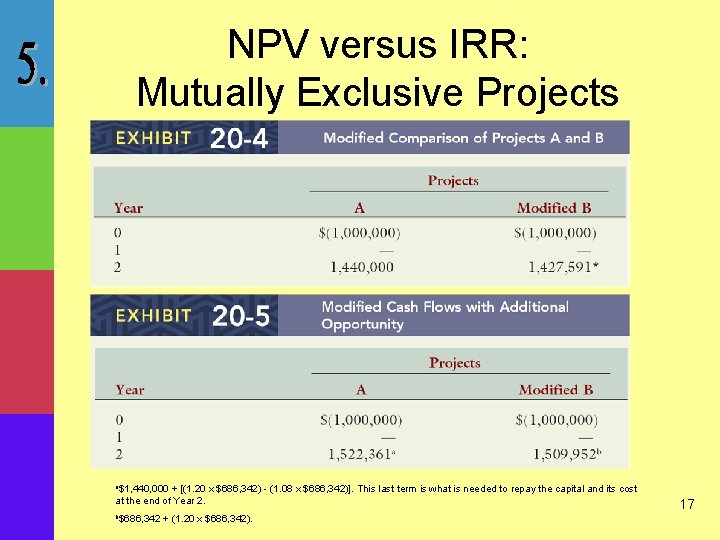

NPV versus IRR: Mutually Exclusive Projects a$1, 440, 000 + [(1. 20 x $686, 342) - (1. 08 x $686, 342)]. This last term is what is needed to repay the capital and its cost at the end of Year 2. b$686, 342 + (1. 20 x $686, 342). 17

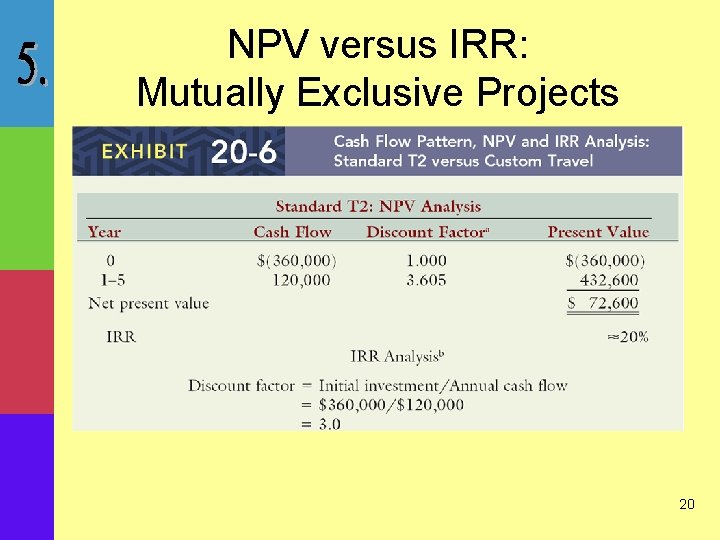

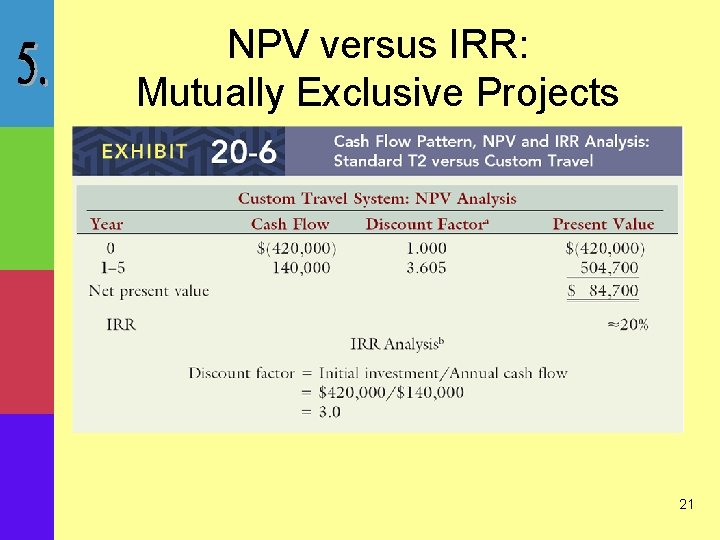

NPV versus IRR: Mutually Exclusive Projects Milagro Travel Agency Example Standard T 2 Annual revenues Annual operating costs System investment Project life $240, 000 120, 000 360, 000 5 years Custom Travel $300, 000 160, 000 420, 000 5 years The cost of capital is 12 percent 18

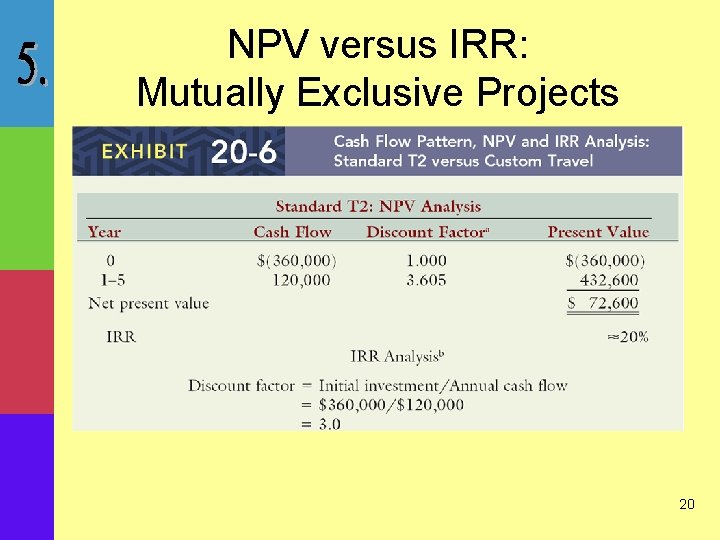

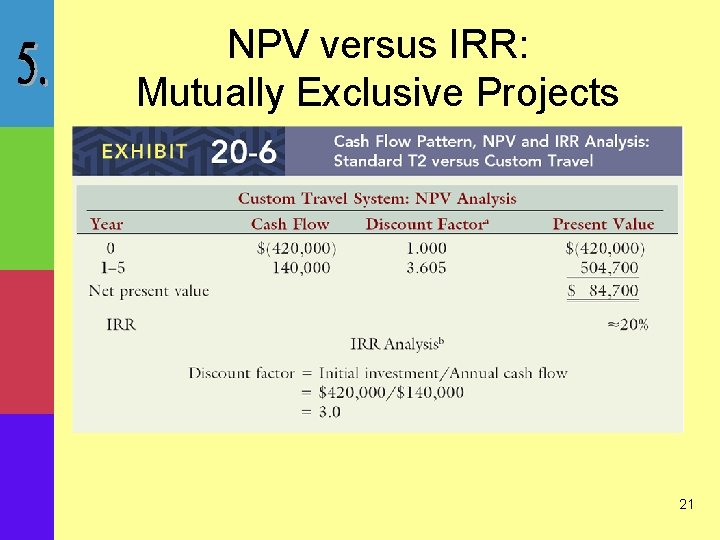

NPV versus IRR: Mutually Exclusive Projects 19

NPV versus IRR: Mutually Exclusive Projects 20

NPV versus IRR: Mutually Exclusive Projects 21

Computing After-Tax Cash Flows • Steps in computing cash flows – Forecast revenues, expenses, and capital outlays – Adjust cash flows for inflation and tax effects • The cost of capital is composed of two elements – The real rate – The inflationary element 22

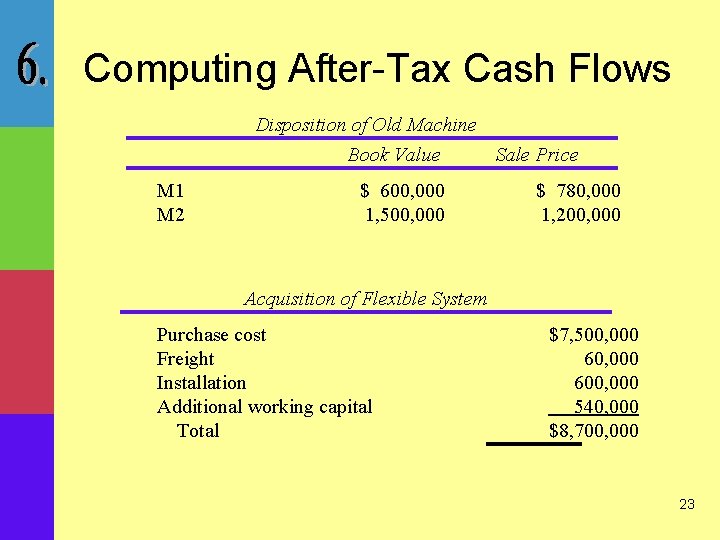

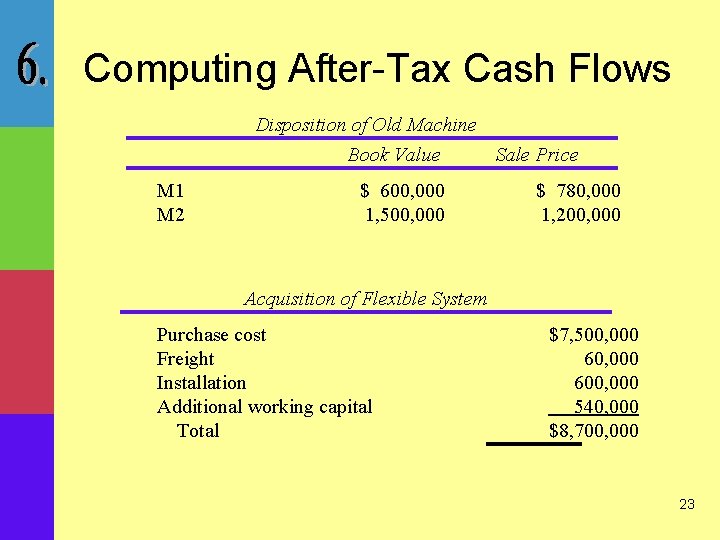

Computing After-Tax Cash Flows Disposition of Old Machine Book Value Sale Price M 1 M 2 $ 600, 000 1, 500, 000 $ 780, 000 1, 200, 000 Acquisition of Flexible System Purchase cost Freight Installation Additional working capital Total $7, 500, 000 600, 000 540, 000 $8, 700, 000 23

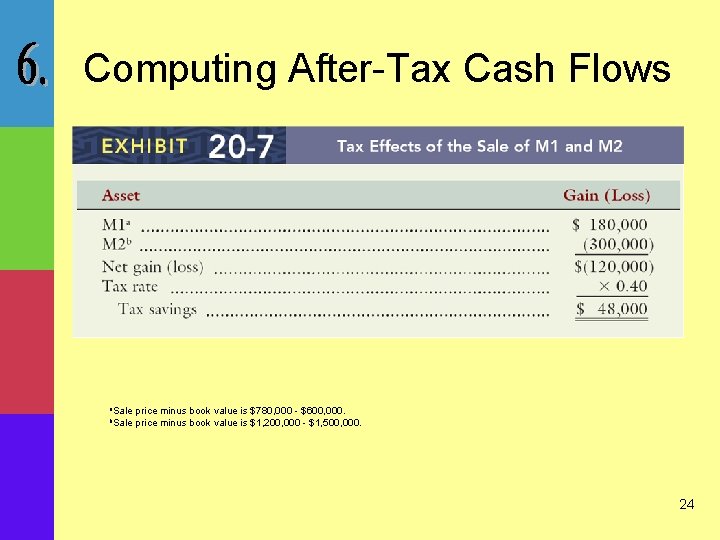

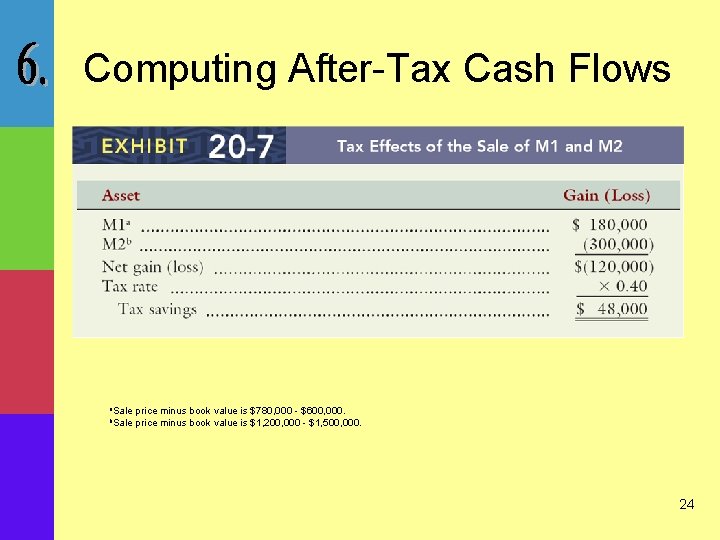

Computing After-Tax Cash Flows a. Sale b. Sale price minus book value is $780, 000 - $600, 000. price minus book value is $1, 200, 000 - $1, 500, 000. 24

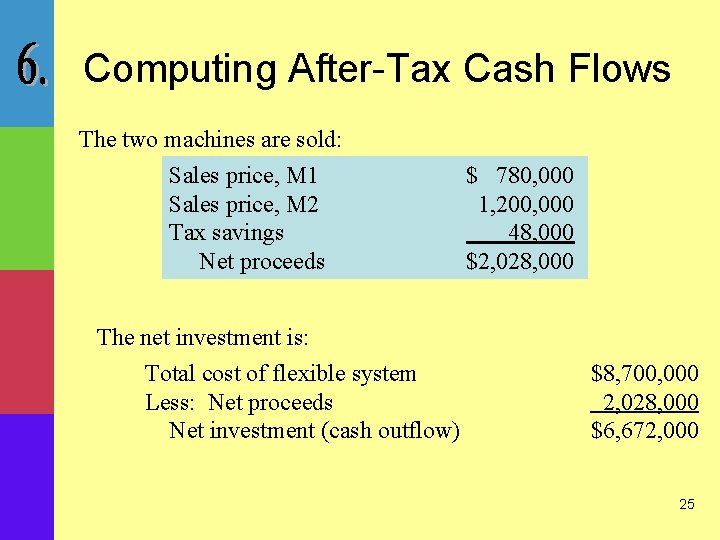

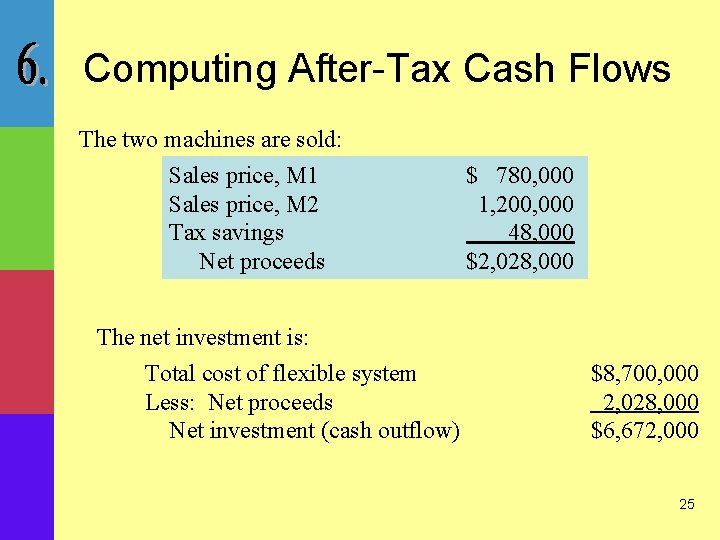

Computing After-Tax Cash Flows The two machines are sold: Sales price, M 1 Sales price, M 2 Tax savings Net proceeds The net investment is: Total cost of flexible system Less: Net proceeds Net investment (cash outflow) $ 780, 000 1, 200, 000 48, 000 $2, 028, 000 $8, 700, 000 2, 028, 000 $6, 672, 000 25

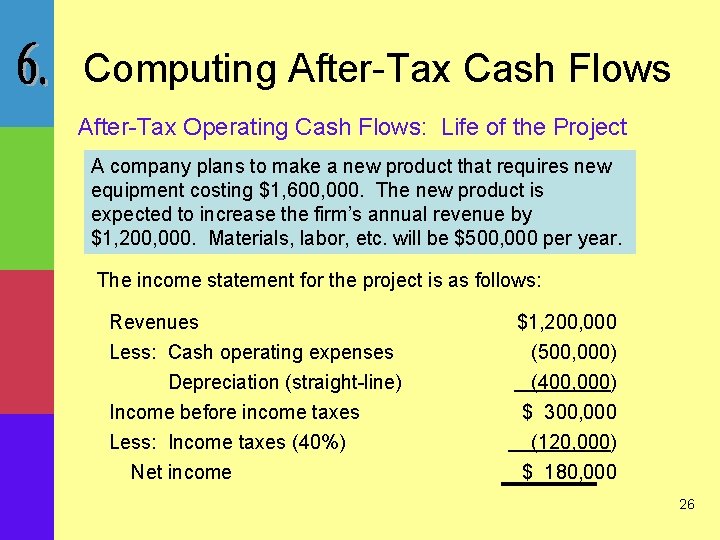

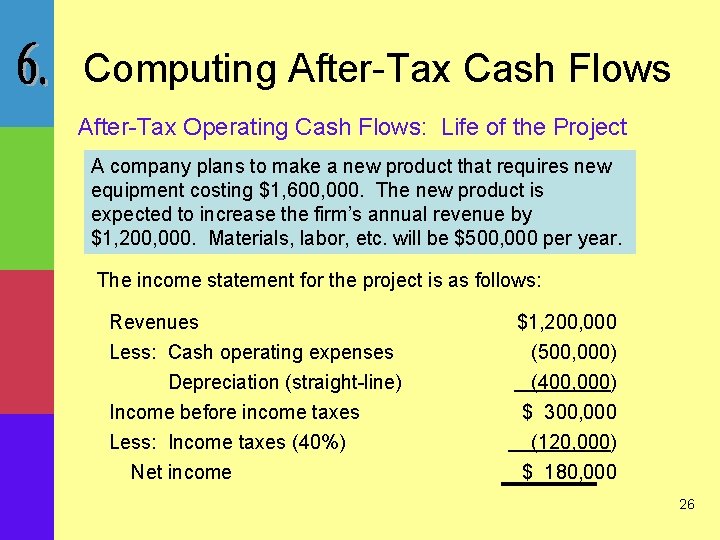

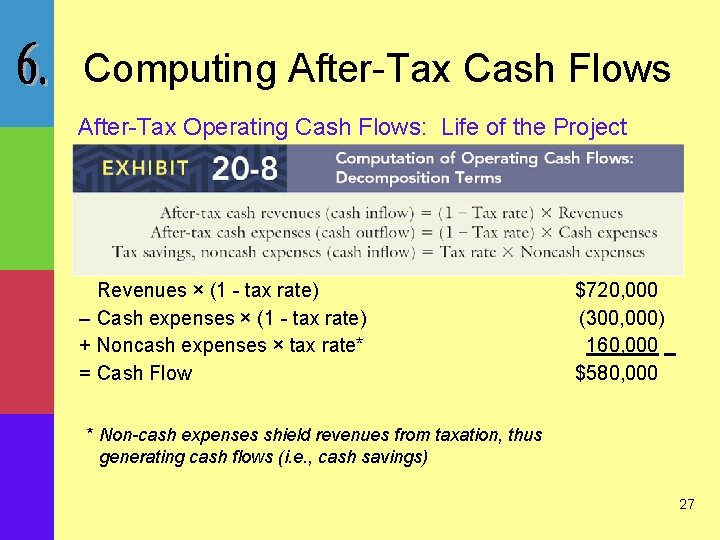

Computing After-Tax Cash Flows After-Tax Operating Cash Flows: Life of the Project A company plans to make a new product that requires new equipment costing $1, 600, 000. The new product is expected to increase the firm’s annual revenue by $1, 200, 000. Materials, labor, etc. will be $500, 000 per year. The income statement for the project is as follows: Revenues Less: Cash operating expenses $1, 200, 000 (500, 000) Depreciation (straight-line) Income before income taxes Less: Income taxes (40%) Net income (400, 000) $ 300, 000 (120, 000) $ 180, 000 26

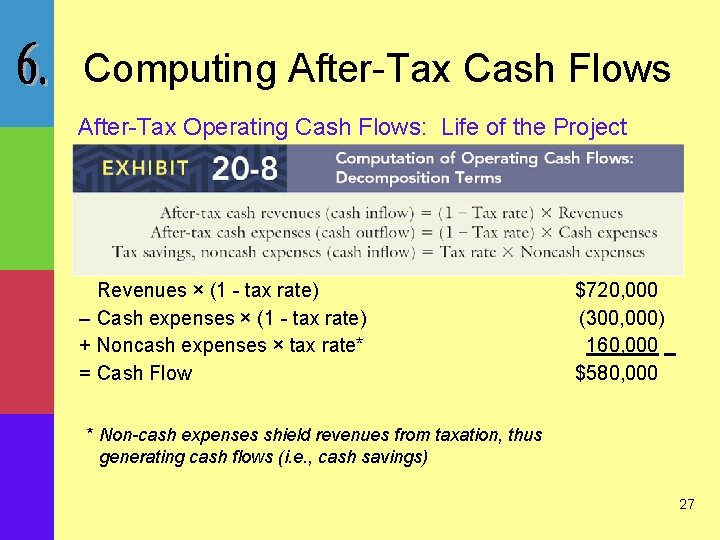

Computing After-Tax Cash Flows After-Tax Operating Cash Flows: Life of the Project Revenues × (1 - tax rate) – Cash expenses × (1 - tax rate) + Noncash expenses × tax rate* = Cash Flow $720, 000 (300, 000) 160, 000 $580, 000 * Non-cash expenses shield revenues from taxation, thus generating cash flows (i. e. , cash savings) 27

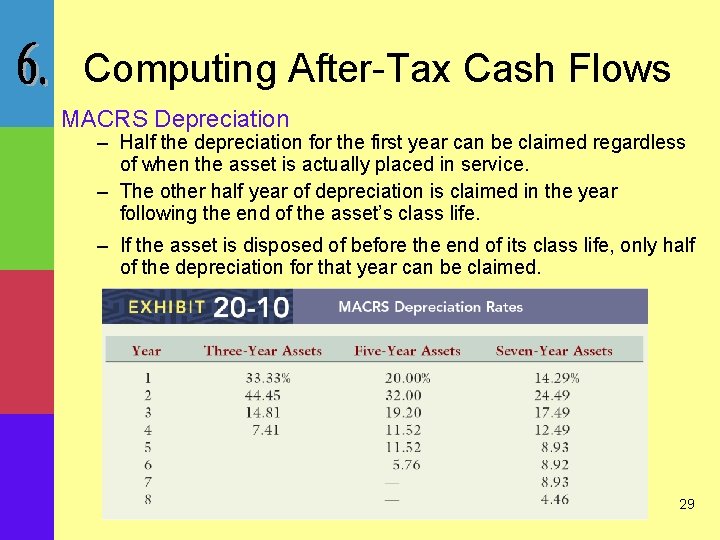

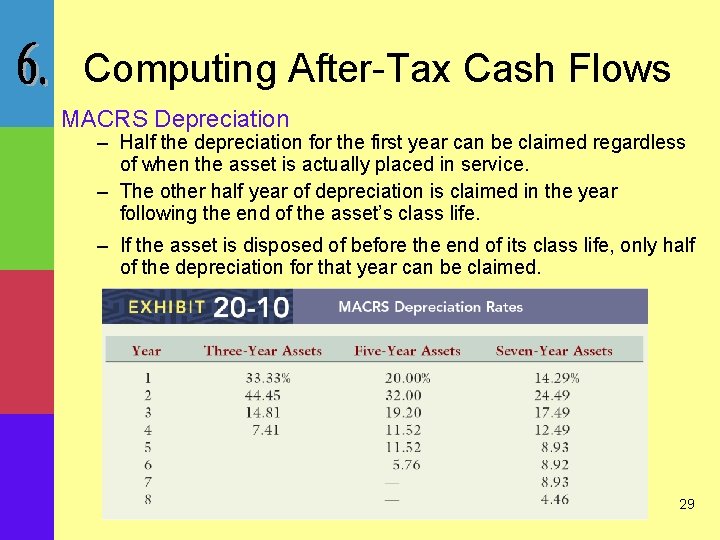

Computing After-Tax Cash Flows MACRS Depreciation The tax laws classify most assets into three classes (class = allowable years): Class 3 5 7 Types of Assets Most small tools Cars, light trucks, computer equipment Machinery, office equipment Assets in any of the three classes can be depreciated using either straight-line or MACRS (Modified Accelerated Cost Recovery System) with a half-year convention. 28

Computing After-Tax Cash Flows MACRS Depreciation – Half the depreciation for the first year can be claimed regardless of when the asset is actually placed in service. – The other half year of depreciation is claimed in the year following the end of the asset’s class life. – If the asset is disposed of before the end of its class life, only half of the depreciation for that year can be claimed. 29

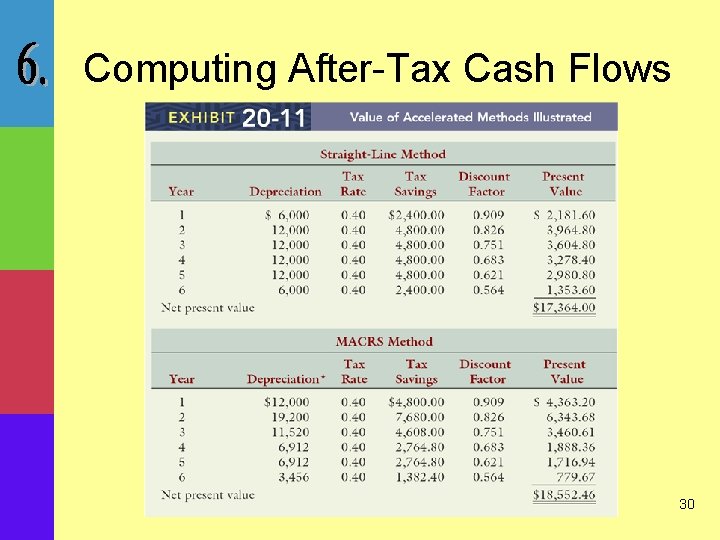

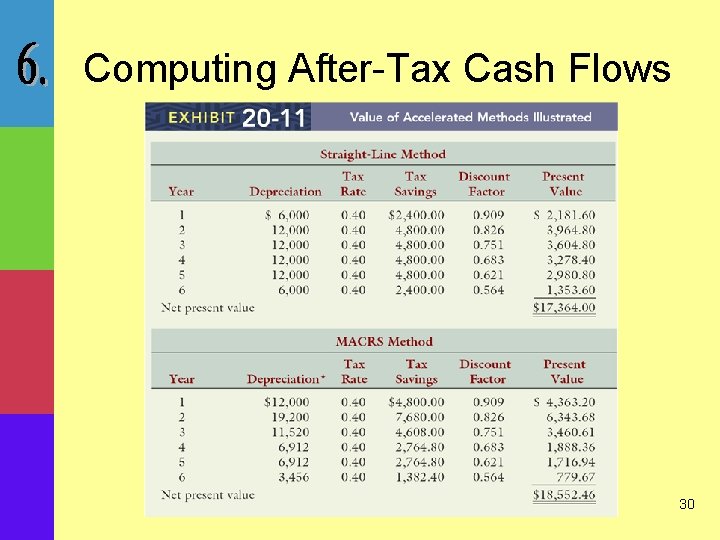

Computing After-Tax Cash Flows 30

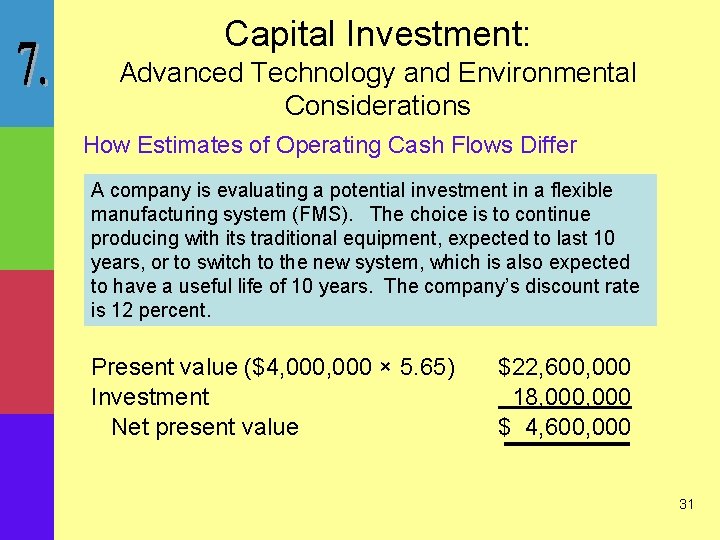

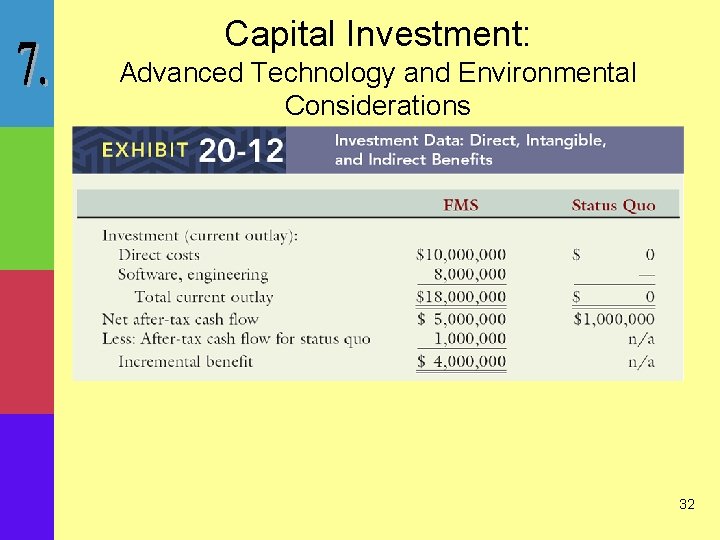

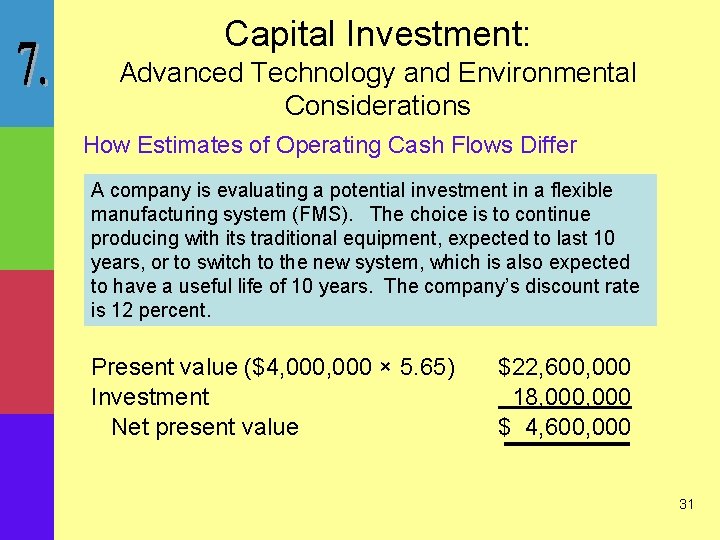

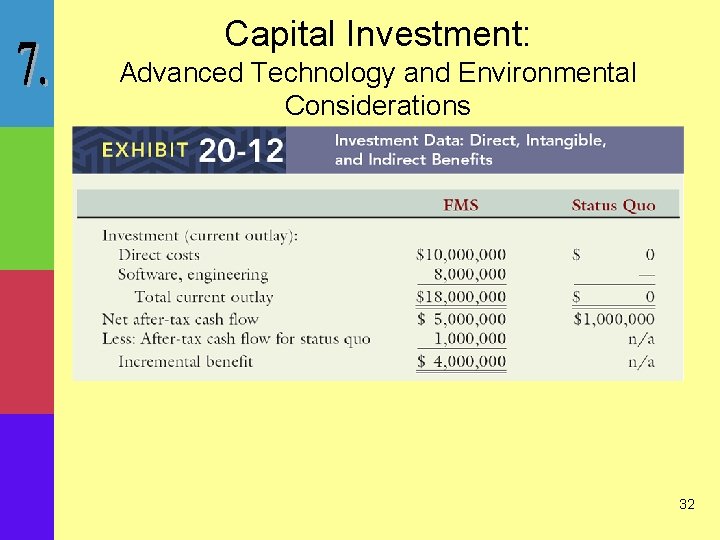

Capital Investment: Advanced Technology and Environmental Considerations How Estimates of Operating Cash Flows Differ A company is evaluating a potential investment in a flexible manufacturing system (FMS). The choice is to continue producing with its traditional equipment, expected to last 10 years, or to switch to the new system, which is also expected to have a useful life of 10 years. The company’s discount rate is 12 percent. Present value ($4, 000 × 5. 65) Investment Net present value $22, 600, 000 18, 000 $ 4, 600, 000 31

Capital Investment: Advanced Technology and Environmental Considerations 32

Capital Investment: Advanced Technology and Environmental Considerations 33

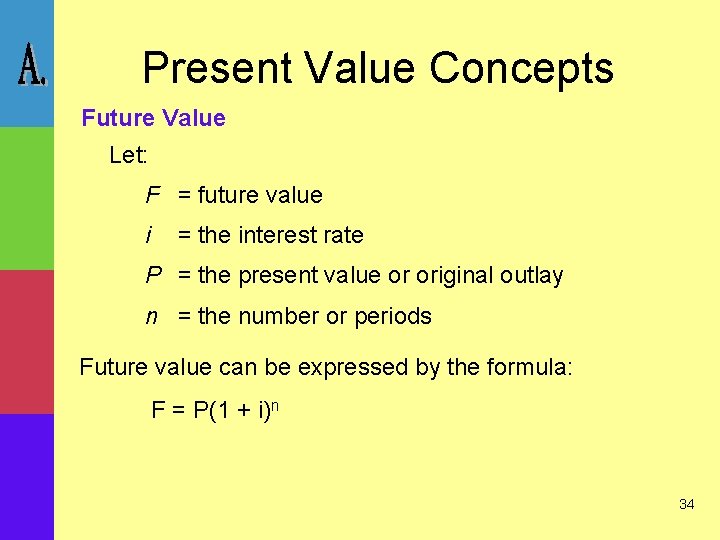

Present Value Concepts Future Value Let: F = future value i = the interest rate P = the present value or original outlay n = the number or periods Future value can be expressed by the formula: F = P(1 + i)n 34

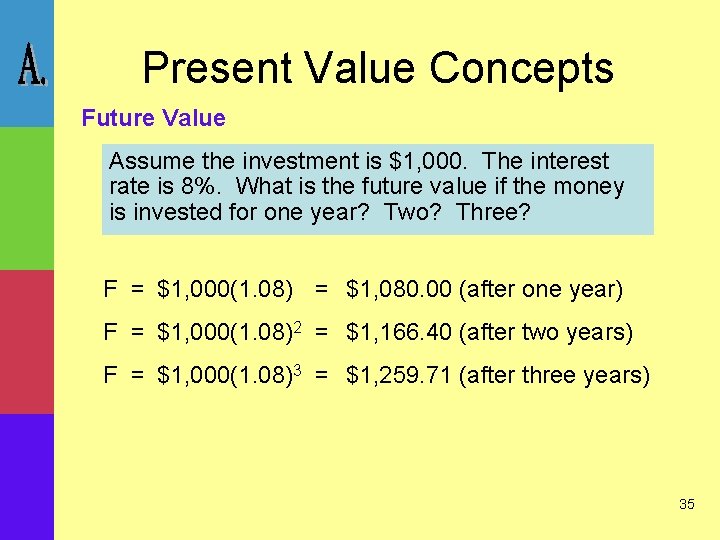

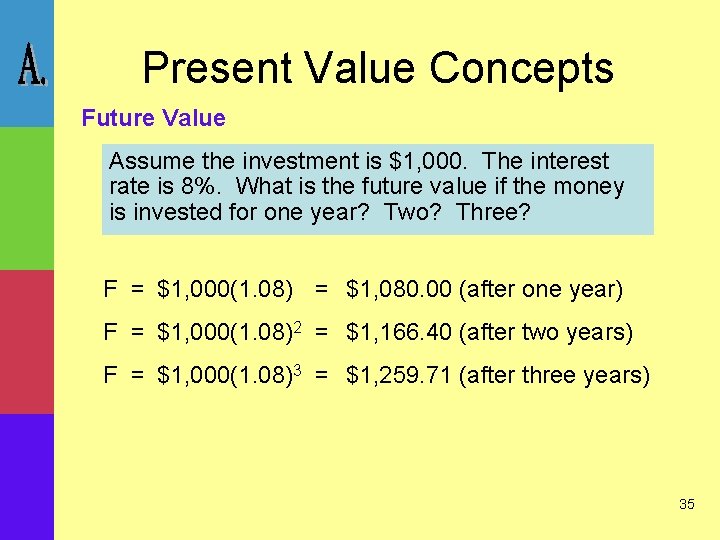

Present Value Concepts Future Value Assume the investment is $1, 000. The interest rate is 8%. What is the future value if the money is invested for one year? Two? Three? F = $1, 000(1. 08) = $1, 080. 00 (after one year) F = $1, 000(1. 08)2 = $1, 166. 40 (after two years) F = $1, 000(1. 08)3 = $1, 259. 71 (after three years) 35

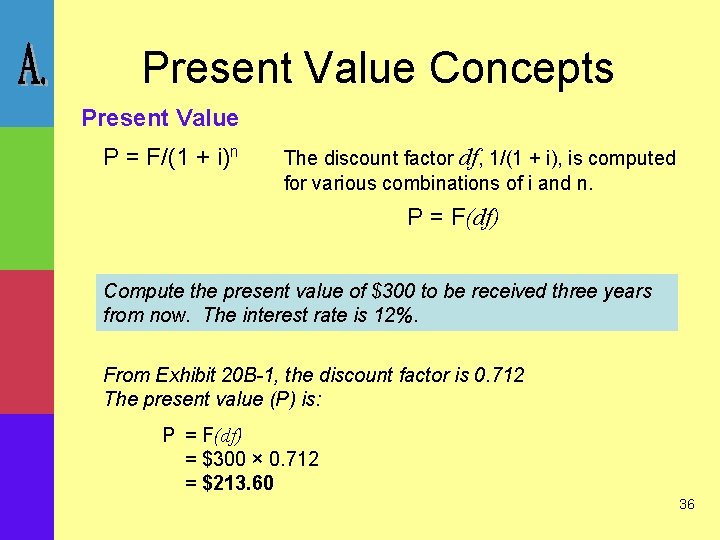

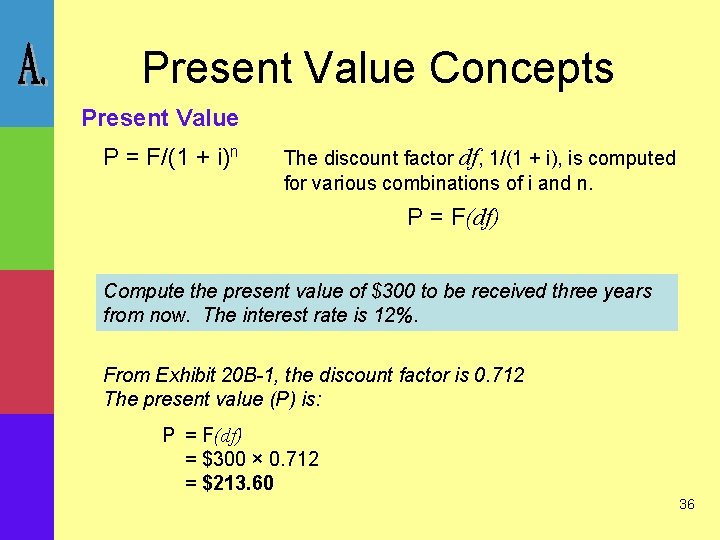

Present Value Concepts Present Value P = F/(1 + i)n The discount factor df, 1/(1 + i), is computed for various combinations of i and n. P = F(df) Compute the present value of $300 to be received three years from now. The interest rate is 12%. From Exhibit 20 B-1, the discount factor is 0. 712 The present value (P) is: P = F(df) = $300 × 0. 712 = $213. 60 36

Present Value Concepts 37

COST MANAGEMENT Accounting & Control Hansen▪Mowen▪Guan • End Chapter 20 38

Cost management accounting and control

Cost management accounting and control Cost management accounting and control

Cost management accounting and control Multinational cost of capital and capital structure

Multinational cost of capital and capital structure Multinational cost of capital and capital structure

Multinational cost of capital and capital structure Cost control and cost reduction difference

Cost control and cost reduction difference Cost control and cost reduction difference

Cost control and cost reduction difference Cost control and cost reduction project report

Cost control and cost reduction project report Cost control and cost reduction project report

Cost control and cost reduction project report Cost of capital in financial management

Cost of capital in financial management The following are disadvantages of the sml approach

The following are disadvantages of the sml approach Advanced cost and management accounting ppt

Advanced cost and management accounting ppt Role of management accounting ppt

Role of management accounting ppt Social responsibility of management ppt

Social responsibility of management ppt Relevant cost in management accounting

Relevant cost in management accounting Drury management and cost accounting

Drury management and cost accounting Drury c management and cost accounting

Drury c management and cost accounting Cost accounting chapter 9

Cost accounting chapter 9 What is job order costing

What is job order costing Examples of process cost system

Examples of process cost system Relevant range managerial accounting

Relevant range managerial accounting Cost accounting chapter 5

Cost accounting chapter 5 Chapter 1 managerial accounting and cost concepts

Chapter 1 managerial accounting and cost concepts Intermediate accounting chapter 1

Intermediate accounting chapter 1 Chapter 3 cost control

Chapter 3 cost control Six reasons why a bank may dishonor a check

Six reasons why a bank may dishonor a check Gross operating cycle

Gross operating cycle Source of capital reserve

Source of capital reserve Difference between capital reserve and reserve capital

Difference between capital reserve and reserve capital Regulatory capital vs economic capital

Regulatory capital vs economic capital Regulatory capital vs economic capital

Regulatory capital vs economic capital Constant capital and variable capital

Constant capital and variable capital Capital allocation line vs capital market line

Capital allocation line vs capital market line Cost management principles

Cost management principles Levered free cash flow

Levered free cash flow Marginal cost of capital

Marginal cost of capital Contoh discounting

Contoh discounting Damodaran optimal capital structure

Damodaran optimal capital structure Ibbotson cost of capital

Ibbotson cost of capital Cost of capital npv

Cost of capital npv