COST AUDIT REPORT RULES Cost audit report The

- Slides: 14

COST AUDIT REPORT RULES

Cost audit report • The cost audit report is the end product of every audit of cost records and cost accounts. It is the medium through which an auditor expresses his opinion on the issues expected to be dealt with in a cost audit report.

Content of Cost Audit Report 1. Main Certificate: the following points that are covered in the cost audit report are as follows: – Whether all the information and explanation necessary for the purpose of audit was obtained or not. – Whether the proper cost accounting records are required under the Companies Act are maintained or not. – Whether proper returns from the branches not visited by the cost auditor where received or not. – Whether the books and records give a true and fair view of the cost of production, processing, manufacturing and marketing activities of the products under reference or not.

Contd… 2. Annexure: In the annexure the cost audit report the cost auditor has to give information in respect to the following. • General Introduction contains general information about the company. It includes name and address of the company and of cost auditor, reference number of the appointment, date of government’s cost audit order, date of incorporation, date of commencement of the business, location of the factories, date of annual general meetings etc. • Cost accounting system Consist of description and adequacy of cost accounting system, methods used for ascertaining the cost of product, nature and size of the business and a brief note on the cost accounting system. • Financial position It includes information on capital employed, interest on borrowings, bad debts, income tax, surcharges, profit before interest and tax, profit after tax, percentage of profit to the capital employed, percentage of profit to the sales etc.

• Production This paragraph implies quantity of goods manufactured, production to installed capacity, daily production, monthly production, reasons for short fall in the production if any and addition to production capacity. • Manufacturing process Under this paragraph cost auditor has to include information on the manufacturing process carried on by the company. He has to include impact of process on environment and a brief note on the process of manufacturing the product. • Raw materials Consist of quantity of raw materials consumed, value of raw materials consumed, direct expenses on the purchases of the raw materials, comparison of raw materials consumed in the current year with that of the previous year, comparison of actual consumption of raw materials with the budgeted materials, raw materials consumed per unit of finished goods and a brief note on the method of accounting followed for the raw materials.

• Power and fuel Consist of quantity of power and fuel consumed, rate per unit of power and fuel, total cost of power and fuel consumed and special features about the power and fuel if any. • Wages and salaries Comprises of total wages and salaries paid, direct wages, indirect wages, total labour cost, wages and salaries per unit of finished goods, total men days available, men days used, men days lost, various incentives schemes, labour cost per unit of goods manufactured etc. • Repairs and maintenance Include consumable stores and spare parts consumed, consumable stores and spare parts per unit of output, system of accounting followed for issuing consumable stores and spare parts, a brief note on the repairs and maintenance etc. • Depreciation Includes total amount of depreciation, methods used for calculation of the depreciation, apportionment of depreciation of the common assets, comparison of depreciation charged with that of the depreciation to be charged under the companies act, department wise depreciation on the fixed assets etc.

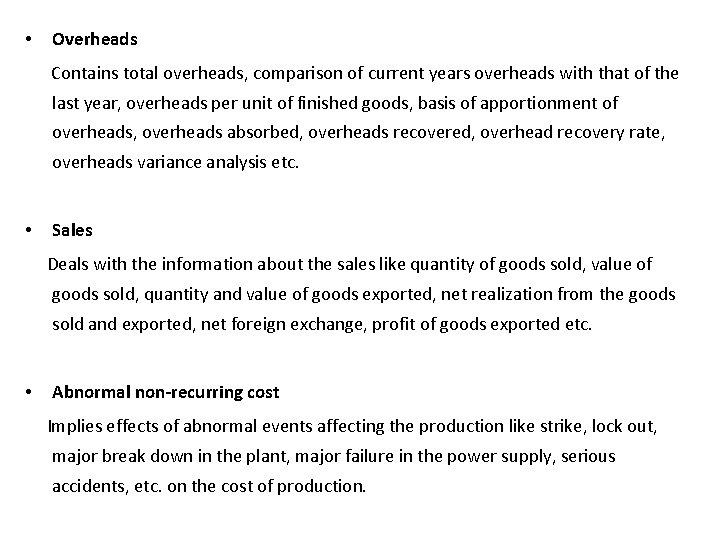

• Overheads Contains total overheads, comparison of current years overheads with that of the last year, overheads per unit of finished goods, basis of apportionment of overheads, overheads absorbed, overheads recovered, overhead recovery rate, overheads variance analysis etc. • Sales Deals with the information about the sales like quantity of goods sold, value of goods sold, quantity and value of goods exported, net realization from the goods sold and exported, net foreign exchange, profit of goods exported etc. • Abnormal non-recurring cost Implies effects of abnormal events affecting the production like strike, lock out, major break down in the plant, major failure in the power supply, serious accidents, etc. on the cost of production.

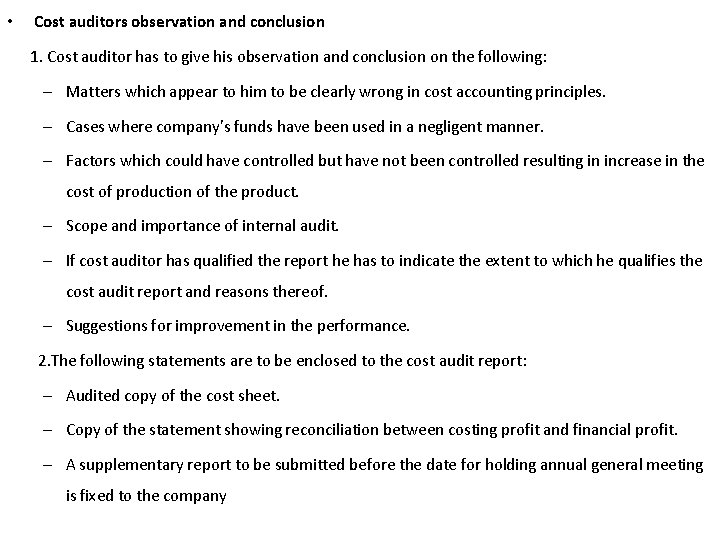

• Cost auditors observation and conclusion 1. Cost auditor has to give his observation and conclusion on the following: – Matters which appear to him to be clearly wrong in cost accounting principles. – Cases where company’s funds have been used in a negligent manner. – Factors which could have controlled but have not been controlled resulting in increase in the cost of production of the product. – Scope and importance of internal audit. – If cost auditor has qualified the report he has to indicate the extent to which he qualifies the cost audit report and reasons thereof. – Suggestions for improvement in the performance. 2. The following statements are to be enclosed to the cost audit report: – Audited copy of the cost sheet. – Copy of the statement showing reconciliation between costing profit and financial profit. – A supplementary report to be submitted before the date for holding annual general meeting is fixed to the company

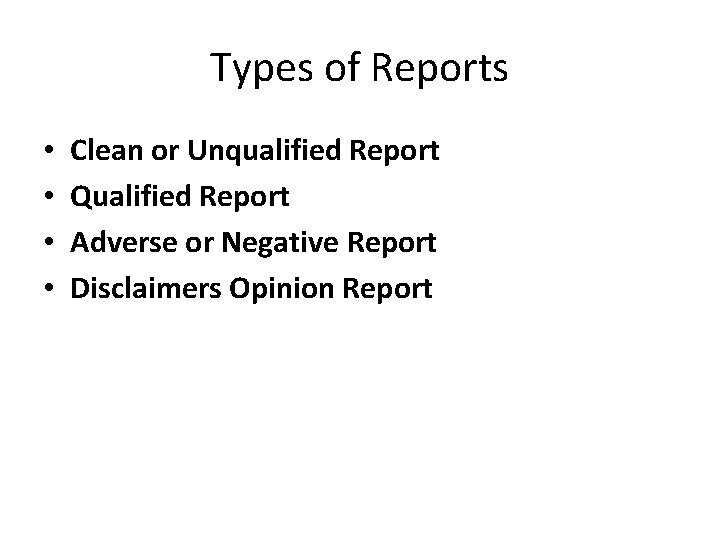

Types of Reports • • Clean or Unqualified Report Qualified Report Adverse or Negative Report Disclaimers Opinion Report

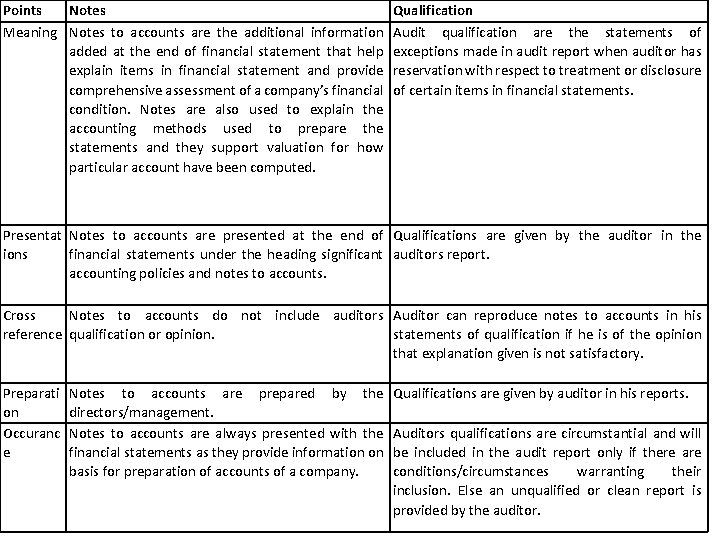

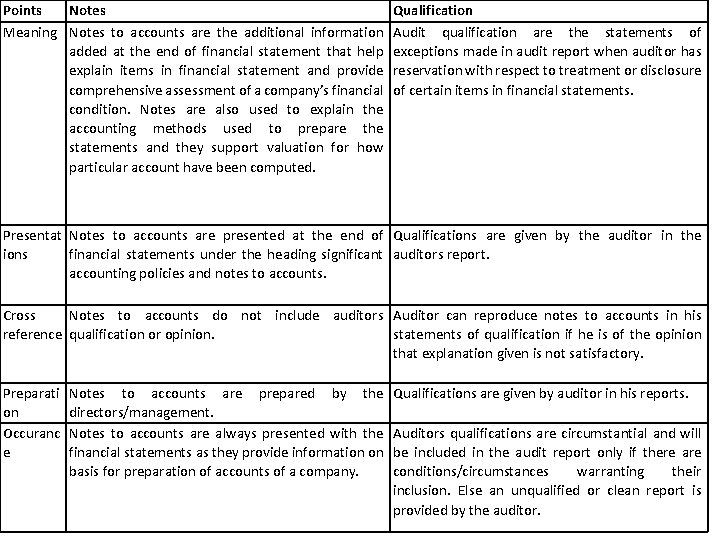

Points Notes Meaning Notes to accounts are the additional information added at the end of financial statement that help explain items in financial statement and provide comprehensive assessment of a company’s financial condition. Notes are also used to explain the accounting methods used to prepare the statements and they support valuation for how particular account have been computed. Qualification Audit qualification are the statements of exceptions made in audit report when auditor has reservation with respect to treatment or disclosure of certain items in financial statements. Presentat Notes to accounts are presented at the end of Qualifications are given by the auditor in the ions financial statements under the heading significant auditors report. accounting policies and notes to accounts. Cross Notes to accounts do not include auditors Auditor can reproduce notes to accounts in his reference qualification or opinion. statements of qualification if he is of the opinion that explanation given is not satisfactory. Preparati on Occuranc e Notes to accounts are prepared by the directors/management. Notes to accounts are always presented with the financial statements as they provide information on basis for preparation of accounts of a company. Qualifications are given by auditor in his reports. Auditors qualifications are circumstantial and will be included in the audit report only if there are conditions/circumstances warranting their inclusion. Else an unqualified or clean report is provided by the auditor.

End use of Cost Audit Report • • • Central Excise Authorities Price Fixing Authorities Income Tax Authorities Central Government Ministry of Commerce, department of revenue, ministry of finance

Cost audit as ani aid to management • As an aid to decision making • As an aid to information system • As an aid to determination and co-ordination of the company’s activities

Necessity of Cost Audit • The data from these reports, helps the government in fixing prices of various essential commodities like fuel, power, raw materials etc. • The regulators can take decisions based on the data and can keep a control on certain malpractices like over or under pricing and other unethical practices. • This data helps companies in regulating various costs and optimal utilization of resources. The true picture of the assets is placed before the management. • It helps the consumers getting products at reasonable prices.

Reports and Opinion