Cost accounting Introduction of cost Accounting Definition According

- Slides: 32

Cost accounting

Introduction of cost Accounting

Definition According to ICMA London, cost accounting is the application of costing and cost accounting principles , methods and techniques to the science, art and practice of cost control and ascertainment of profitability. it includes the presentation of information for the purpose of decision making.

Objectives of cost accounting • To find out the total cost and cost per unit • To disclose the proportion of different elements in the total cost • To provide necessary data for fixing the selling price • To ascertain the profitability of each product • To identify the sources of wastages and losses • To help in the preparation of budgets and its implementation • To formulate incentive bonus plans and implement them • To exercise effective control on the idle times of men and machines

Advantages of cost accounting • Helps in decision making • Helps in fixing prices • Formulation of future plans • Avoidance of wastage • Highlights causes • Reward to efficiency • Prevention of fraud • Improvement in profitability

Demerits of cost accounting • It is unnecessary • It is expensive • It is a failure • Too much of paper work • Restricted applicability

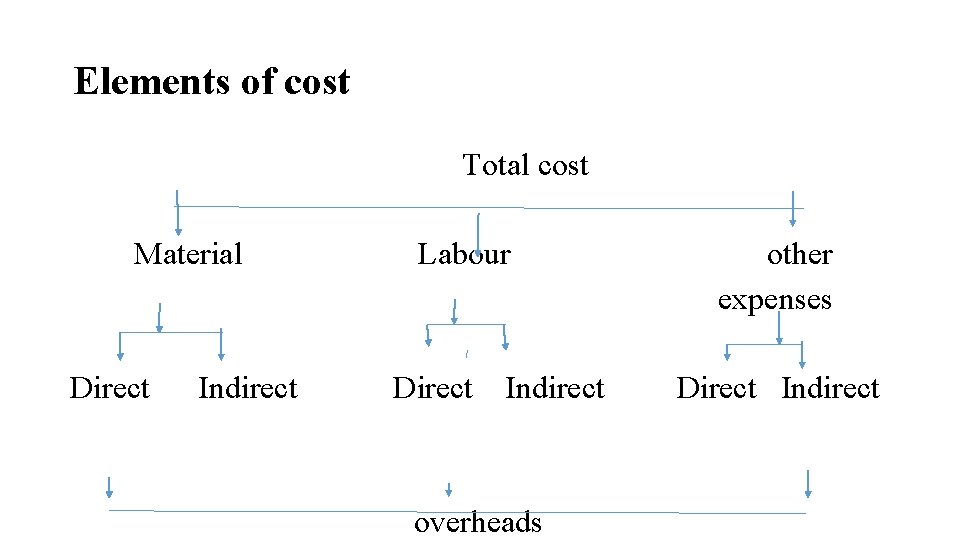

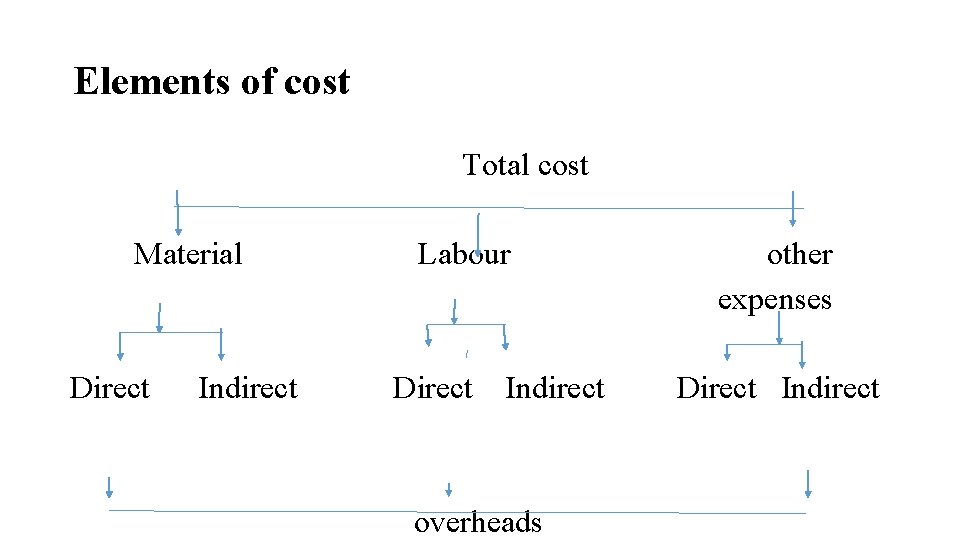

Elements of cost Total cost Material Direct Indirect Labour Direct Indirect overheads other expenses Direct Indirect

Classification of cost • Classification according to nature element • Classification according to function • Classification according to variability a)Fixed cost b)variable cost c)semi-variable cost • Classification according to normality a)Normal cost b)Abnormal cost • Classification according to controllability a)controllable cost b)uncontrollable cost

• Classification by time a)Historical cost b)Pre –determined cost • Classification according to managerial decisions a)Marginal cost b)Differential cost c)Imputed cost d)Replacement cost e)opportunity cost f)sunk cost • Classification according to capital and revenue a)capital costs b)Revenue costs • Classification by association with products a)products cost b)period cost

Methods of costing • Job costing • Contract costing • Batch costing • Process costing • Unit costing • Operating costing • Multiple costing

Techniques of costing • Historical costing • Direct costing • Absorption costing • Uniform costing • Marginal costing • Standard costing

Cost unit A cost unit refers to a unit of product, service or time in relation to which costs may be ascertained or expressed. Cost Centre A cost Centre is a location , person or item of equipment for which cost may be ascertained and used for the purpose of cost control

Cost sheet is a statement. it provides information regarding the various elements of cost incurred in production. it discloses the total cost and the cost per unit of products manufactured during the given period.

Types of cost Centre • Production cost Centre • Service cost Centre • Personal cost Centre • Impersonal cost Centre • Operation cost Centre • Process cost Centre • Profit Centre

Material control is defined as a systematic control over purchasing , storage and consumption of materials, so as to maintain a regular supply of materials and avoiding at the same time overstocking

Objectives of material control • To make available the right type of materials at the right time • To ensure effective utilization of material • To prevent over stocking of materials and consequent locking of materials • To procure appropriately raw materials at reasonable price • To prevent losses during storage of materials • To supply information to the management

Pricing issues of material • � Pricing of materials may change from time to time. • � Materials are usually acquired by several deliveries at differe prices. • � Actual costs can then take on several different values. • � Therefore, the materials pricing system adopted should be simplest and the most effective one.

Methods of stock valuation �First-in-first-out(FIFO) �Last-in-first-out(LIFO) �Weight average cost (WAVCO) �Specific identification/unit cost method

First-in-first-out • �This • • method assumes that the first stock to be received is the first to be sold. �The cost of materials used is based on the oldest prices. �The closing stock is valued at the most recent prices.

Last-in-first-out (LIFO) � This method assumes that the last stock to be received is the first to be sold. �Therefore, the cost of materials used is based on the most recent prices. �The closing stock is valued at the oldest prices.

Weight average cost (WAVCO) � This method assumes that the cost of materials used and closing stock are valued at the weighted average cost.

Specific identification/unit cost method � This method assumes that each item of the stock has its own identity. �The costs of materials used and closing stock are determined by associating the units of stock with their specific unit cost.

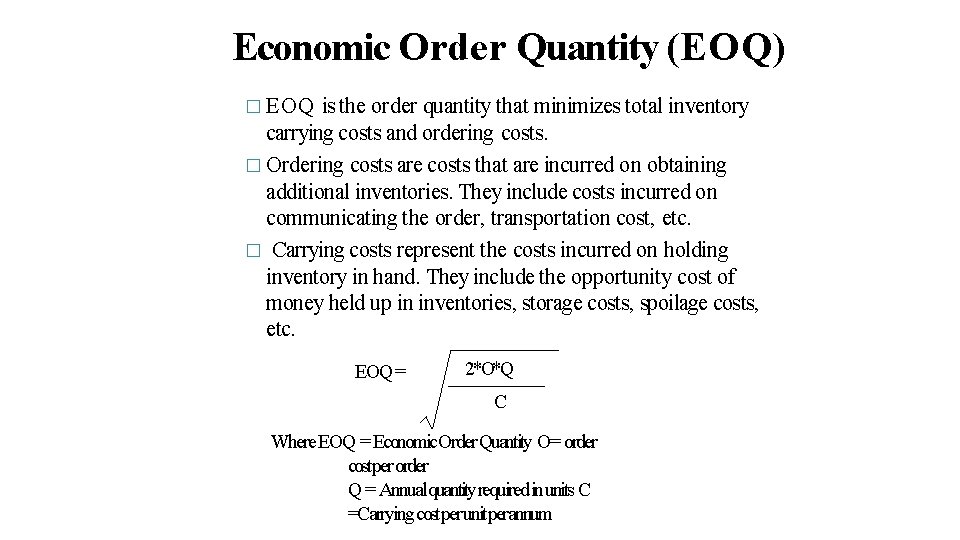

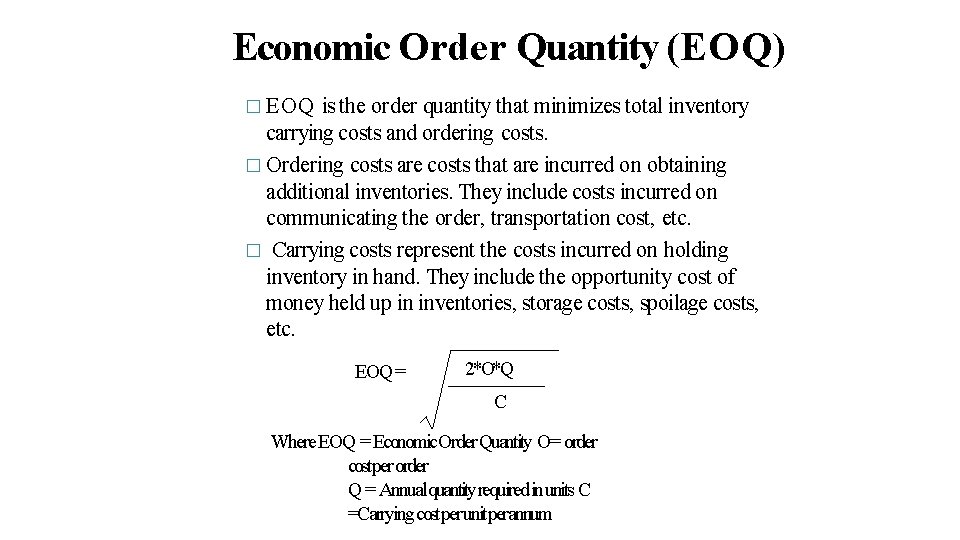

Economic Order Quantity (EOQ) � EOQ is the order quantity that minimizes total inventory carrying costs and ordering costs. � Ordering costs are costs that are incurred on obtaining additional inventories. They include costs incurred on communicating the order, transportation cost, etc. � Carrying costs represent the costs incurred on holding inventory in hand. They include the opportunity cost of money held up in inventories, storage costs, spoilage costs, etc. EOQ = 2*O*Q C Where EOQ = Economic. Order Quantity O= order costper order Q = Annual quantityrequired in units C =Carrying costper unitperannum

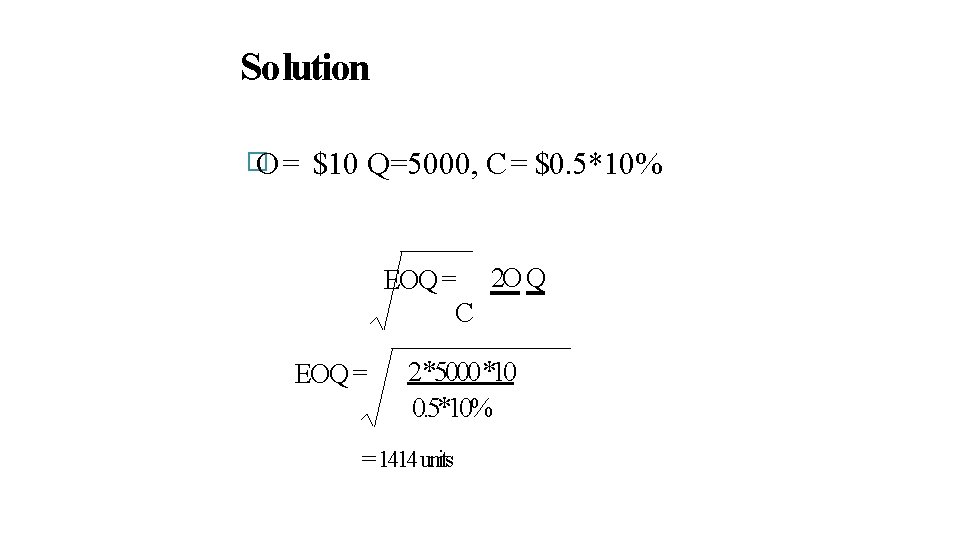

Example � The annual consumption of a part “X” is 5000 units. The procurement cost per order is $10 and the cost per unit is $0. 5. The storage and carrying cost is 10% of the material unit cost. Required: Calculate the EOQ

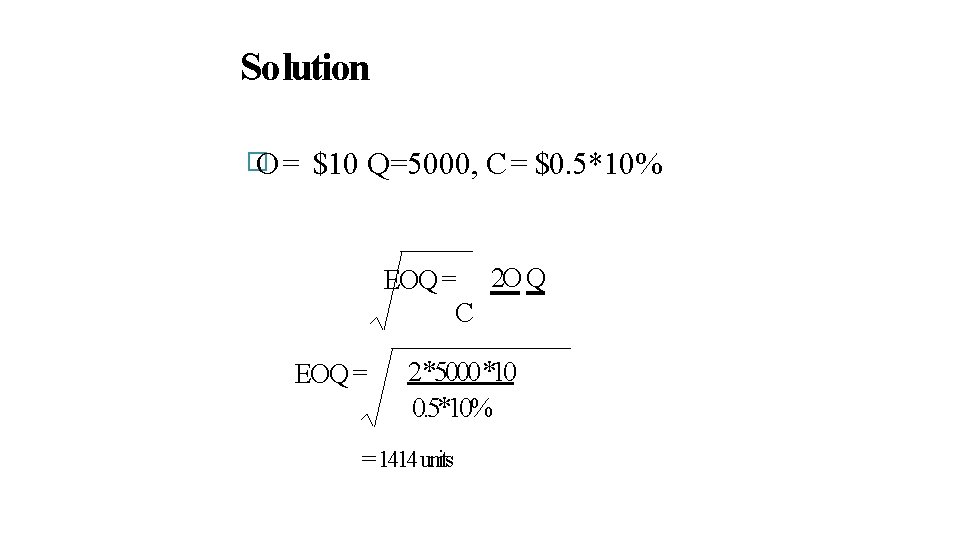

Solution � O= $10 Q=5000, C= $0. 5*10% EOQ = 2 O Q C EOQ = 2*5000 *10 0. 5*10% = 1414 units

Level setting • � It • is to determine the correct or most optimal stock level so as to avoid overstocking or understocking of materials. �These levels are known as the Maximum, Minimum and Re-order levels.

Re-order level � The level of stock of material at which a new order for the material should be placed. �The formula: Re-order level = (Maximum usage *Maximumlead time )

Maximum level �The maximum stock level is highest level of stock planned to be held. �Any amount above the maximum level will be considered as excessive stock. �The formula: Maxlevel= re-order level+ Re-order quantity(EOQ) –Min anticipatedusagein Minimum lead

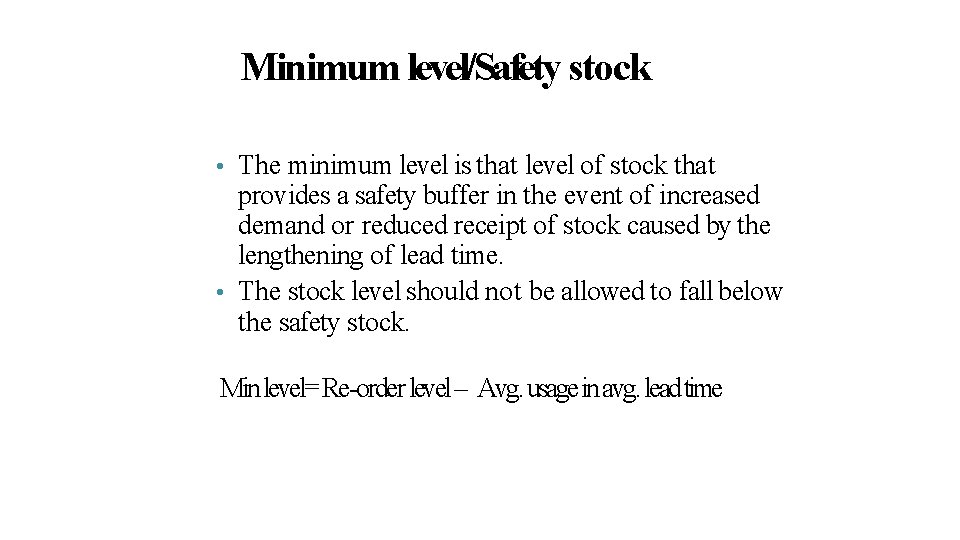

Minimum level/Safety stock The minimum level is that level of stock that provides a safety buffer in the event of increased demand or reduced receipt of stock caused by the lengthening of lead time. • The stock level should not be allowed to fall below the safety stock. • Min level= Re-order level – Avg. usage in avg. lead time

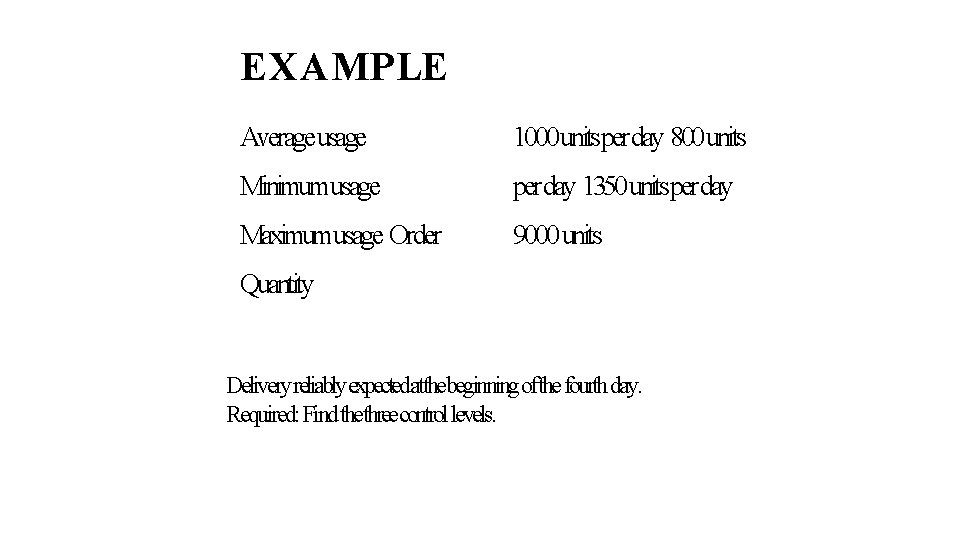

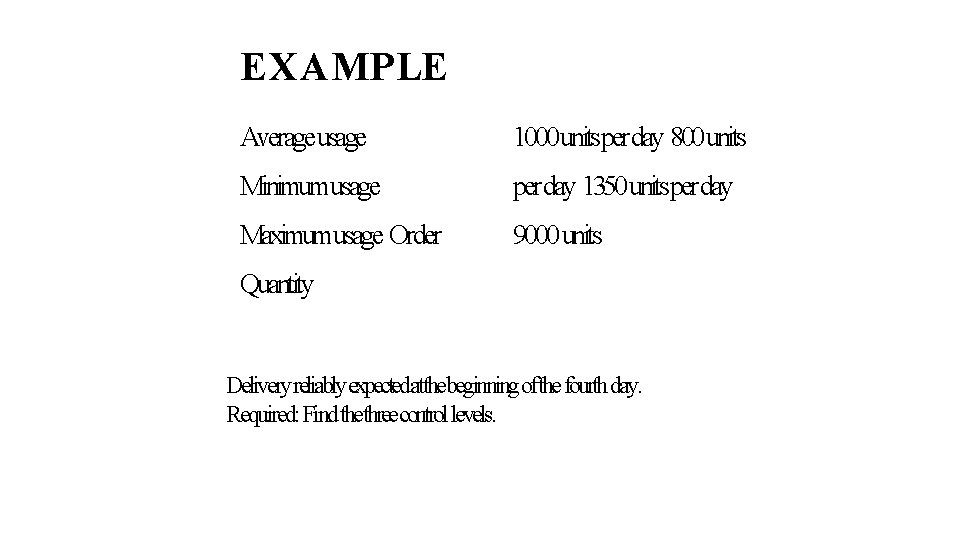

EXAMPLE Averageusage 1000 unitsperday 800 units Minimumusage perday 1350 unitsperday Maximumusage Order 9000 units Quantity Delivery reliablyexpectedatthebeginningofthe fourth day. Required: Find thethreecontrol levels.

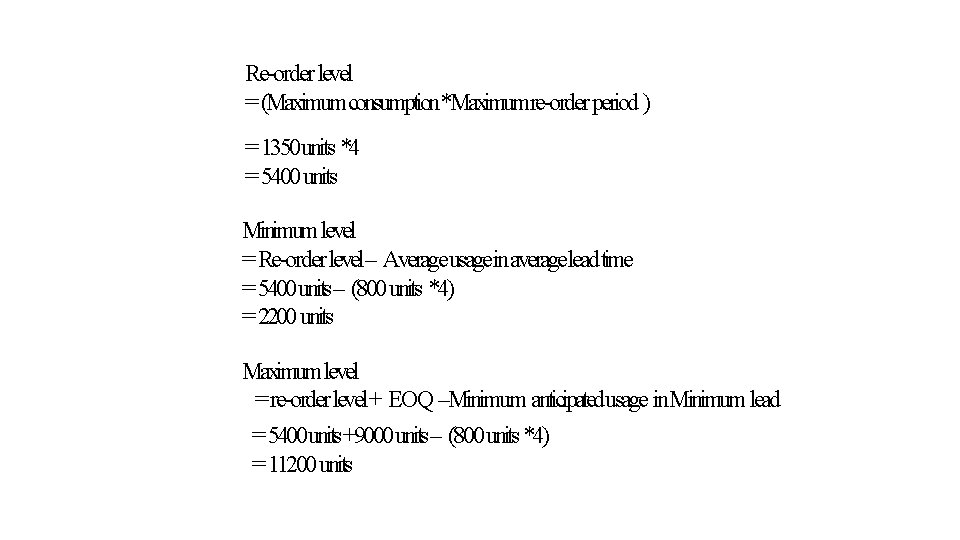

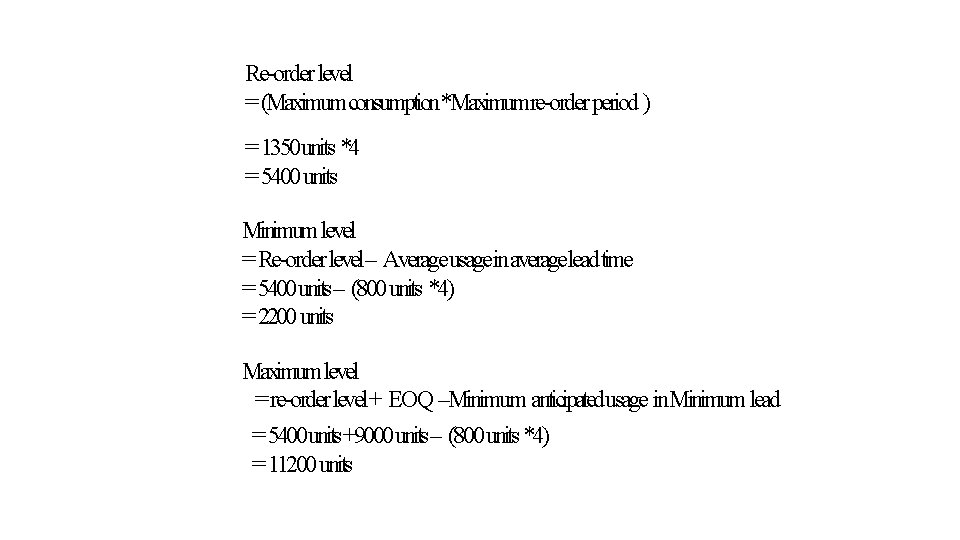

Re-order level = (Maximumconsumption*Maximumre-order period ) = 1350 units *4 = 5400 units Minimum level = Re-order level– Averageusagein averageleadtime = 5400 units– (800 units *4) = 2200 units Maximum level = re-order level+ EOQ –Minimum anticipatedusage in. Minimum lead = 5400 units+9000 units– (800 units *4) = 11200 units

THANK YOU