COST ACCOUNTING ACC 501 Accounting for Managers Dr

- Slides: 31

COST ACCOUNTING ACC 501 - Accounting for Managers Dr. ARPIT SIDHU (Ph. D, UGC-NET, HP-SET, MBA, MCOM, BCOM)

Poll from the last lecture • Which of the following cost is also known as overhead cost or on cost: • a. Cost of direct labour • b. Cost of indirect labour • c. Direct expenses • d. Indirect expenses

Learning Outcomes • To understand the Preparation of cost sheet and • estimated cost sheet

Cost of Product • The fundamental element of cost accounting system is cost which is defined as the amount of expenditure (actual or notional) incurred on or attributable to a produced item or a service unit • Cost represents an expenditure made to secure an economic benefit, generally on the uses of resources that promise to produce revenue. • The resources may have tangible substance (e. g. manpower, material, machine, etc. ), or they may take the form of services (e. g. wages, rent, power, etc. ).

Cost, Expense, and Loss • The term ‘cost’ is denoted by expense which is incurred after deriving the benefit. • Expenses are defined as ‘all explicit costs which are deductible from revenue. ’ • When the cost is incurred before deriving the benefit, it is termed as deferred cost, • When no benefit is derived by the incurrence of cost, it is termed as loss,

Cost Accounting Cost accounting is concerned with recording, classifying and summarizing costs for determination of costs of products or services, planning, controlling and reducing such costs and furnishing of information to management for decision making. Cost Accounting = Costing + Cost Reporting + Cost Control.

MCQS Which of the following calculate the actual cost of product: • a. Cost estimation • b. Costing • c. Both a and b • d. None of these

Cost Unit and Cost centre • Cost unit is defined as a quantitative unit of a product, a service, or an item, in relation to which costs are measured. • A cost unit, simply stated, is a unit of finished product, service or time, or a combination of these in relation to which cost is ascertained and expressed. • A cost centre is a location, a person, or an item of equipment (or a group of these) for which costs may be ascertained and used for the purpose of cost control.

Objectives of Cost Accounting Ø Ascertainment of costs Ø Estimation of costs Ø Cost control and Cost reduction Ø Determining selling price Ø Facilitating preparation of financial and other statement

Difference BASIS OF DIFFERENCE PURPOSE STATUTORY REQUIREMENTS ANALYSIS OF COST & PROFIT FREQUENCY OF REPORTING CONTROL ASPECT FINANCIAL ACCOUNTING COST ACCOUNTING Financial & Profitability position. Detailed Cost information to Management. Compulsory For all Companies It is compulsory for selected companies as notified by Government from time to time. Deals with position of business as Provides detailed cost and profit a whole. data for each product, department, process, service etc. On Annual Basis. Continuous Process. No importance to control aspect. It provides detailed system of cost control.

Difference HISTORICAL COST FORMAT OF PRESENTATING INFORMATION Deals with Historical Cost. Deals with both Historical and Pre-Determined Costs. It has uniformat as prescribed by The Companies Act, 1956. It can be tailor-made. TYPE OF TRANSACTION External Transactions like RECORDED Sale, Purchase, Receipts, Payments etc with outside parties. TYPE OF STATEMENT PREPARED Records both External and Internal (inter departmental) Transactions. Income Statement, Balance Special purpose report like Sheet. Report on Loss of Material, Idle Time Report, Variance Report etc.

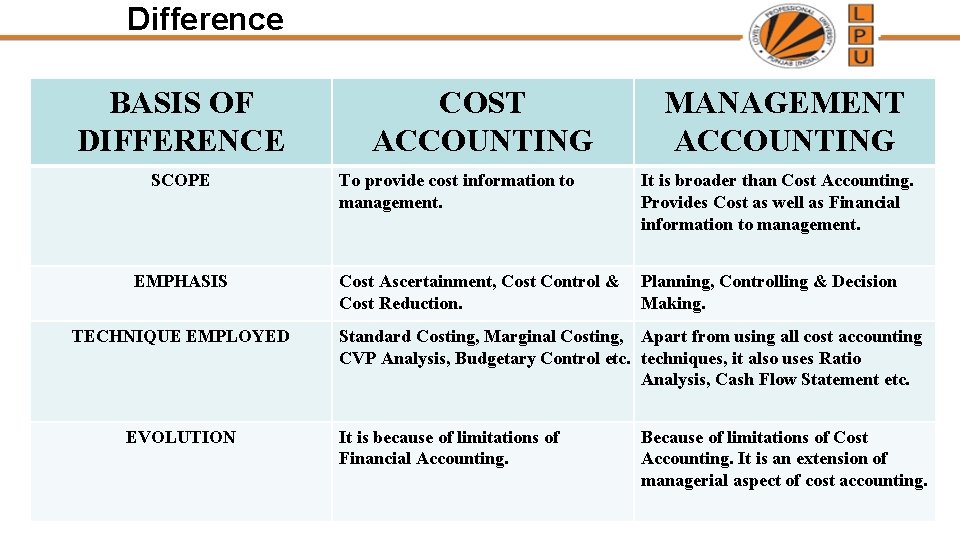

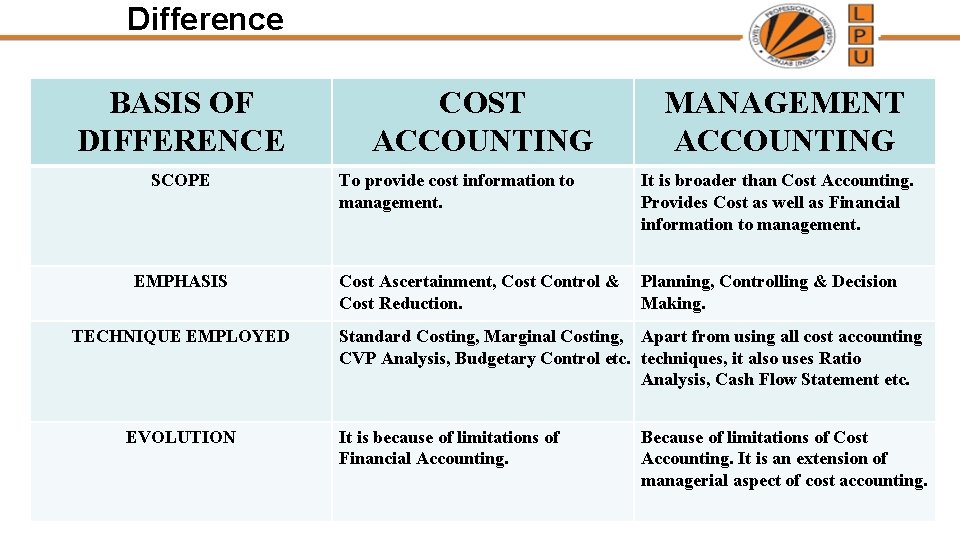

Difference BASIS OF DIFFERENCE SCOPE EMPHASIS TECHNIQUE EMPLOYED EVOLUTION COST ACCOUNTING MANAGEMENT ACCOUNTING To provide cost information to management. It is broader than Cost Accounting. Provides Cost as well as Financial information to management. Cost Ascertainment, Cost Control & Cost Reduction. Planning, Controlling & Decision Making. Standard Costing, Marginal Costing, Apart from using all cost accounting CVP Analysis, Budgetary Control etc. techniques, it also uses Ratio Analysis, Cash Flow Statement etc. It is because of limitations of Financial Accounting. Because of limitations of Cost Accounting. It is an extension of managerial aspect of cost accounting.

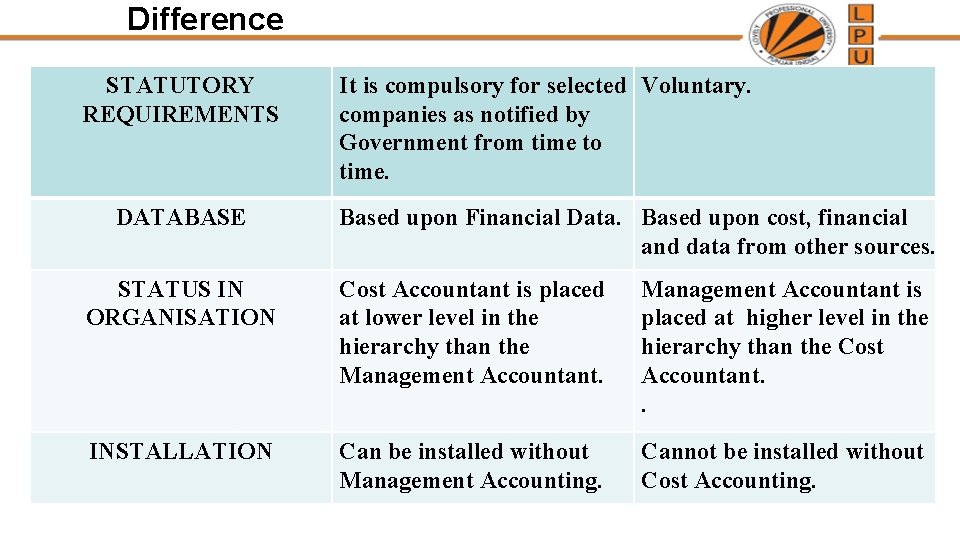

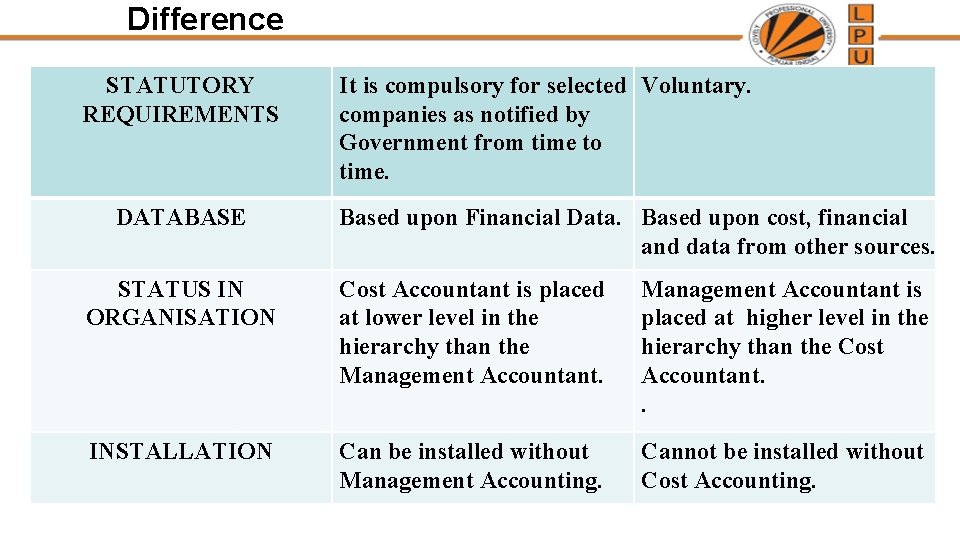

Difference STATUTORY REQUIREMENTS DATABASE It is compulsory for selected Voluntary. companies as notified by Government from time to time. Based upon Financial Data. Based upon cost, financial and data from other sources. STATUS IN ORGANISATION Cost Accountant is placed at lower level in the hierarchy than the Management Accountant is placed at higher level in the hierarchy than the Cost Accountant. . INSTALLATION Can be installed without Management Accounting. Cannot be installed without Cost Accounting.

• • • Which factor that cause change in cost of activity: a. Activity cost b. Driver rates c. Cost pool d. Cost drivers

Limitations of Cost Accounting �Complex �Expensive �Inconsistency �Not applicable to small scale business

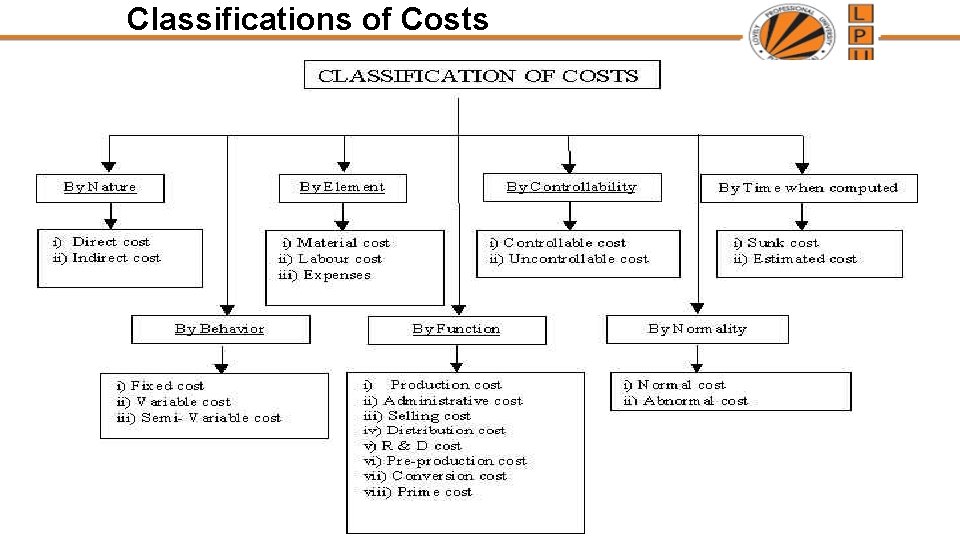

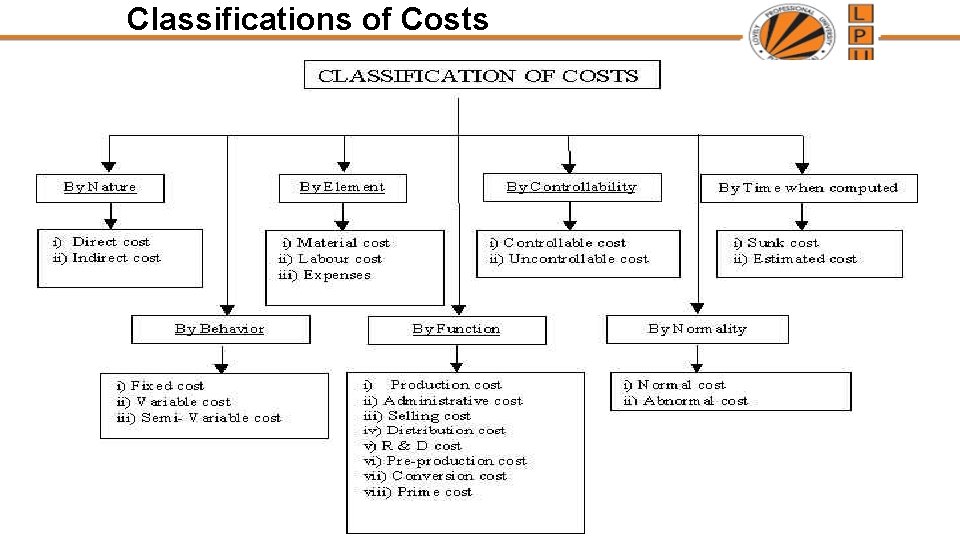

Classifications of Costs

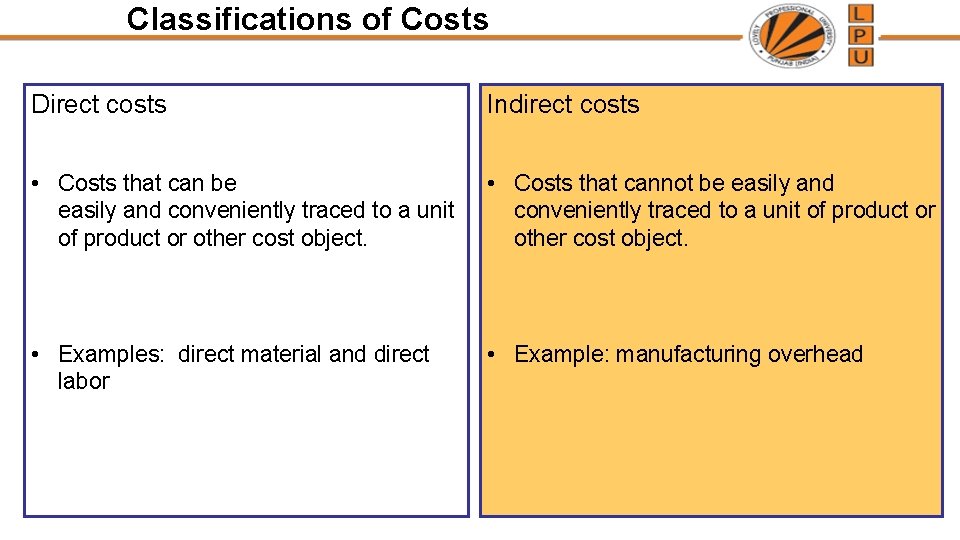

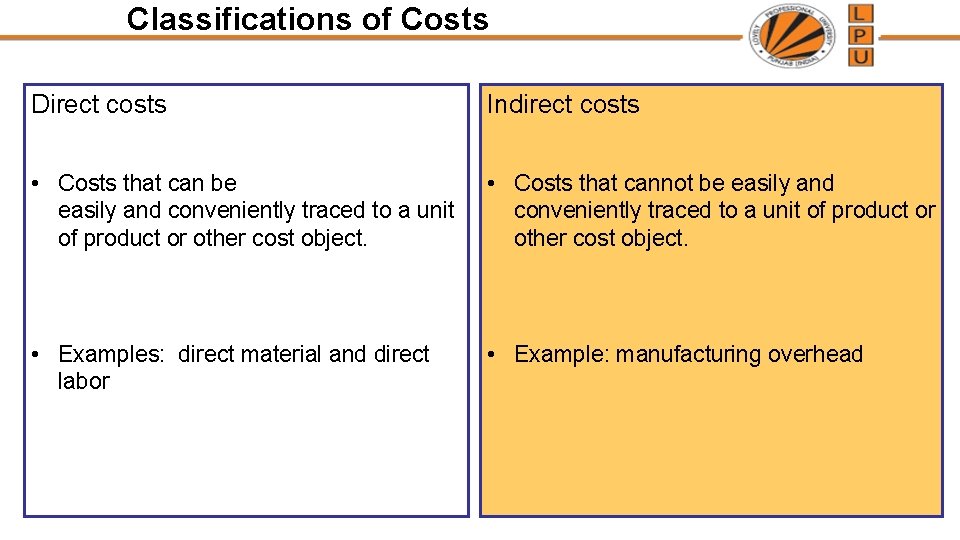

Classifications of Costs Direct costs Indirect costs • Costs that can be easily and conveniently traced to a unit of product or other cost object. • Costs that cannot be easily and conveniently traced to a unit of product or other cost object. • Examples: direct material and direct labor • Example: manufacturing overhead

Classifications of Costs • Manufacturing Costs – Direct Raw Materials – Direct Labor – Manufacturing Overhead • Nonmanufacturing Costs – Overhead – Marketing – Administrative Functions

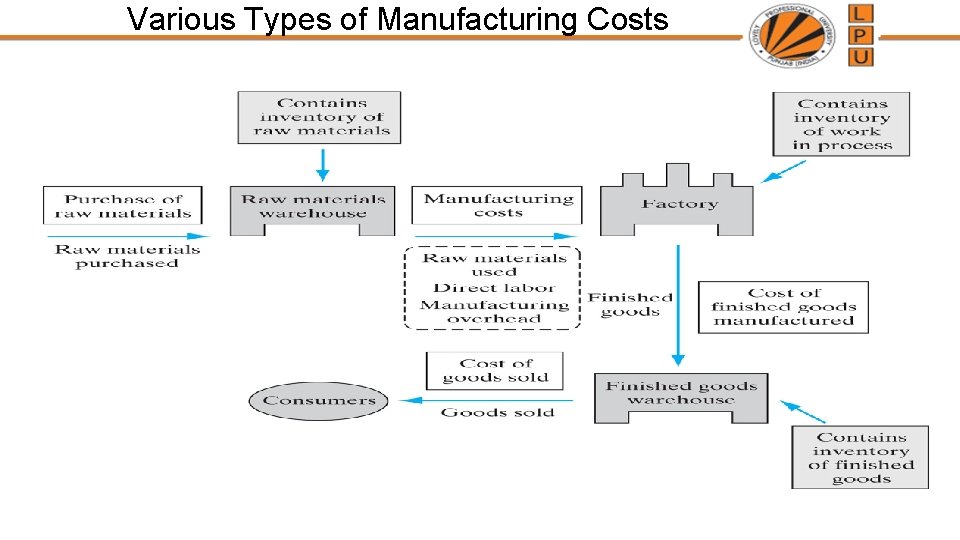

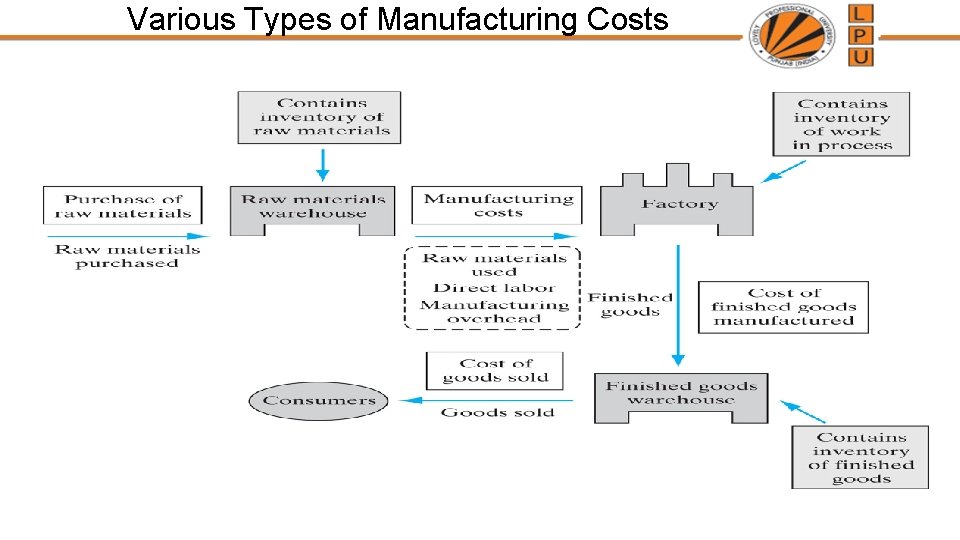

Various Types of Manufacturing Costs

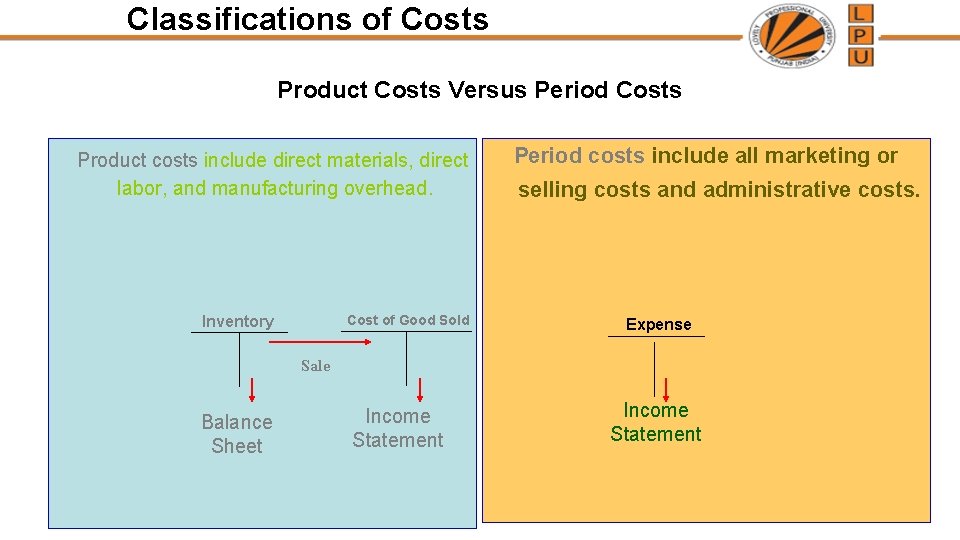

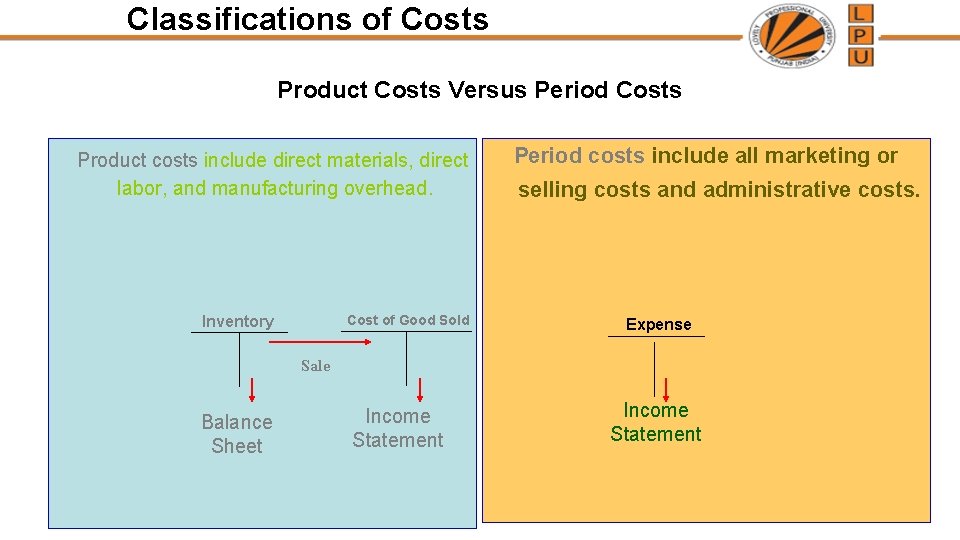

Classifications of Costs Product Costs Versus Period Costs Product costs include direct materials, direct labor, and manufacturing overhead. Cost of Good Sold Inventory Period costs include all marketing or selling costs and administrative costs. Expense Sale Balance Sheet Income Statement

Classifications of Costs

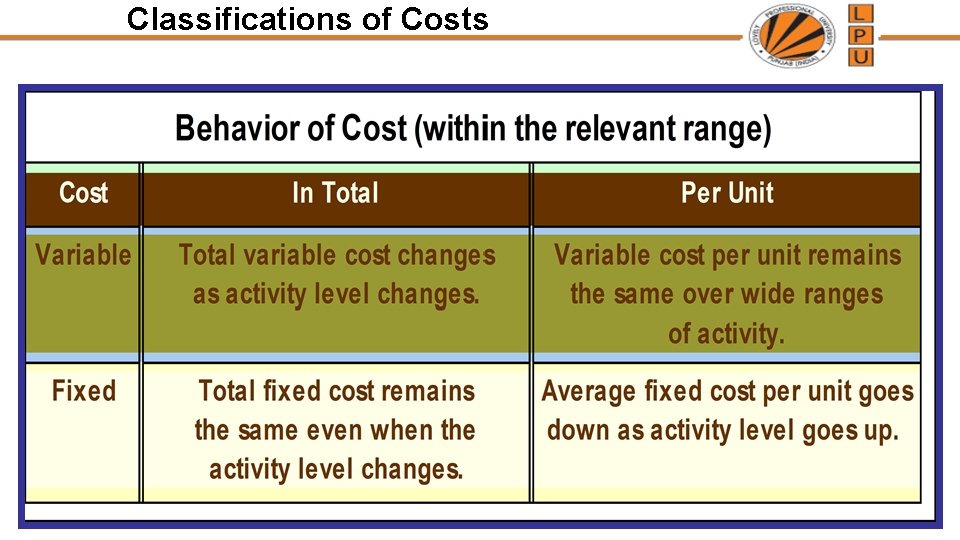

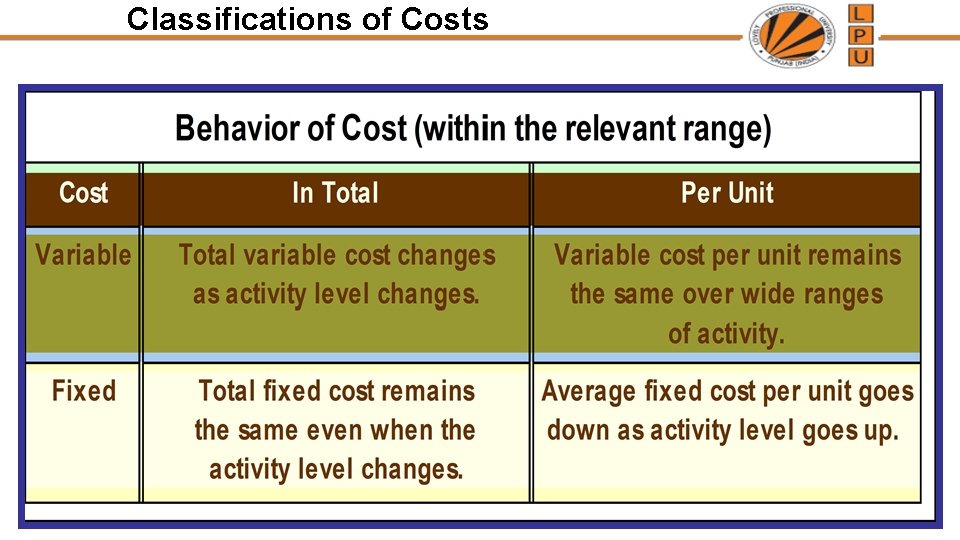

Classifications of Costs Fixed Costs • Def: The costs of providing a company’s basic operating capacity • Cost behavior: Remain constant over the relevant range

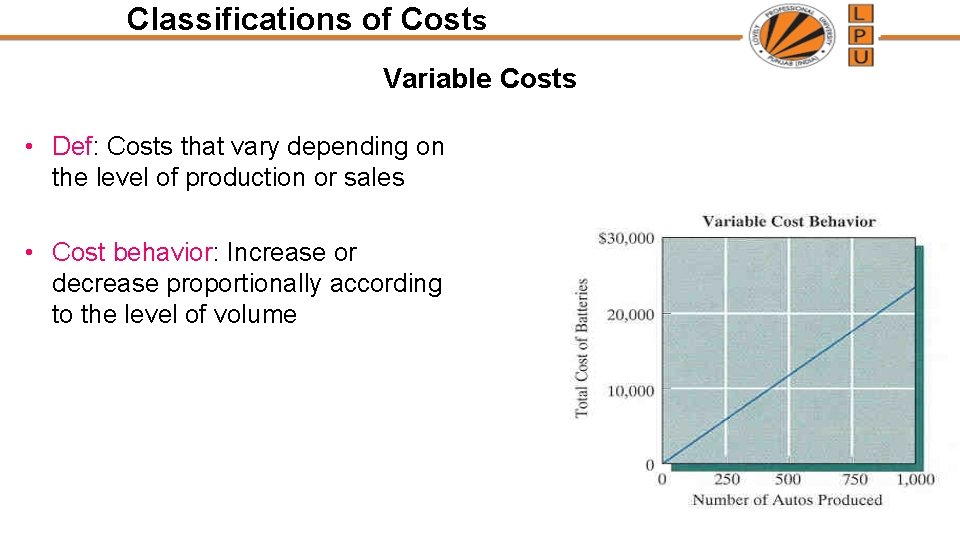

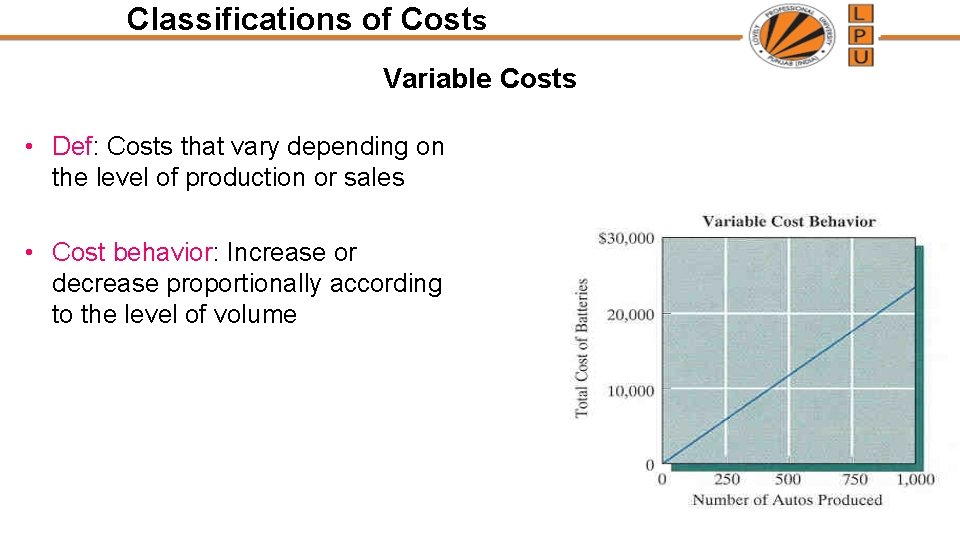

Classifications of Costs Variable Costs • Def: Costs that vary depending on the level of production or sales • Cost behavior: Increase or decrease proportionally according to the level of volume

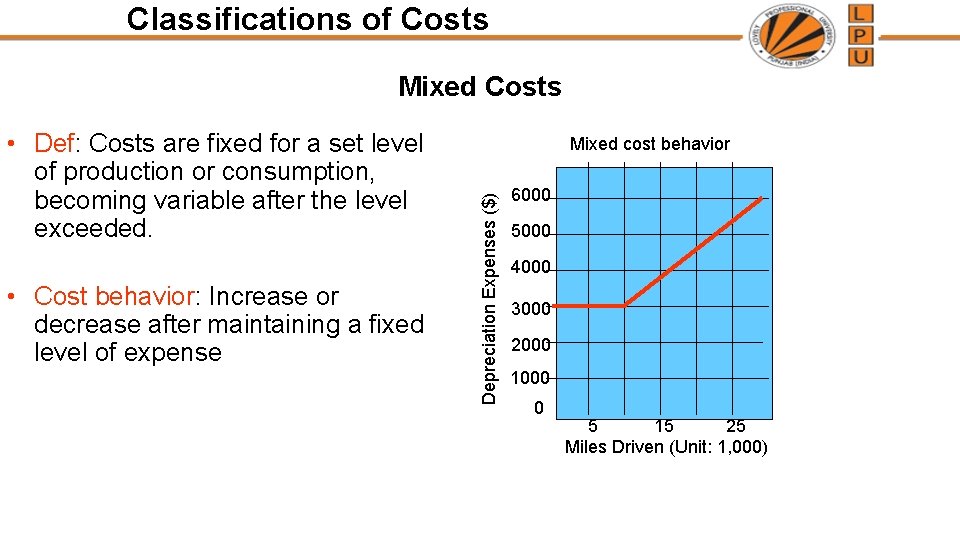

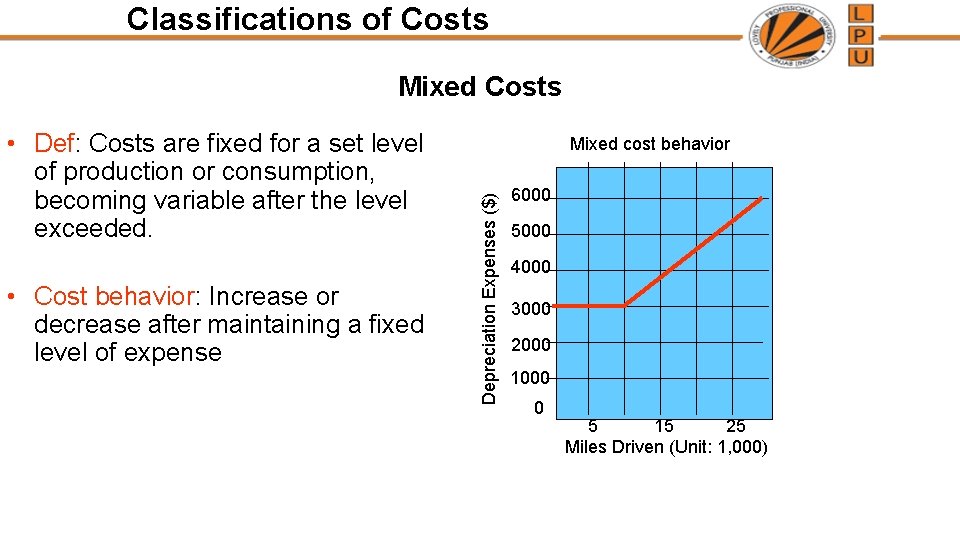

Classifications of Costs Mixed Costs • Cost behavior: Increase or decrease after maintaining a fixed level of expense Mixed cost behavior Depreciation Expenses ($) • Def: Costs are fixed for a set level of production or consumption, becoming variable after the level exceeded. 6000 5000 4000 3000 2000 1000 0 5 15 25 Miles Driven (Unit: 1, 000)

Classifications of Costs Opportunity Costs The potential benefit that is given up when one alternative is selected over another. Example: When you decide to pursue a college degree, your opportunity cost would include a 4 -year’s potential earnings foregone.

Classifications of Costs Sunk costs have already been incurred and cannot be changed now or in the future. They should be ignored when making decisions. Example: You bought an automobile that cost Rs. 10, 000 two years ago. The Rs. 10, 000 cost is sunk because whether you drive it, park it, trade it, or sell it, you cannot change the Rs. 10, 000 cost.

Classifications of Costs Marginal Costs • The increase or decrease in the total cost of a production run for making one additional unit of an item.

THANK YOU 11