Convenience Fees Solving the Puzzle Copyright 2011 Vantiv

- Slides: 17

Convenience Fees Solving the Puzzle © Copyright 2011 Vantiv, LLC. All rights reserved. Vantiv, the Vantiv logo, and all other product or service names and logos are registered trademarks or trademarks of Vantiv, LLC in the USA and other countries. ®indicates USA registration.

Agenda • Convenience Fee Definition • Typical Industry Segments • How Convenience Fees Work • Compliance Rules by Network • Third Party Processors • Questions and Discussion 2

Understanding Convenience Fees Solving the Puzzle 3

Convenience Fees Definition • A Convenience Fee is an additional charges to the cardholder over and above the cost of goods or services. Use • Convenience Fees are typically used to recoup the cost of processing in an e. Commerce or telephone payment channel. • In some cases a Convenience Fee can be assessed in a face-to-face environment. 4

Solving the Puzzle Some implementations are not fully compliant 5

Industry Segments Typical segments include: • Government Tax › Federal and State Income Taxes › Property Taxes • Government Non-Tax › Licenses, Fines, Court Costs • Utilities › Water, Electric, Gas • Education › Higher Education › K-12 Lunch Programs 6

Processing Methods • Single Transaction Method › One authorization for the entire amount including the Convenience Fee › One transaction appears on the cardholder statement • Two Transaction Method › Separate transactions for the Principal Amount and the Convenience Fee Amount › Two transactions appear on the cardholder’s statement 7

Card Network Compliance • Network rules are confusing and not consistent across the card brands • Rules also vary by industry within a Network • Consistent rules: › Cardholders must be notified prior to finalization with an opportunity to opt out › Cannot characterize fee as an assessment to cover interchange 8

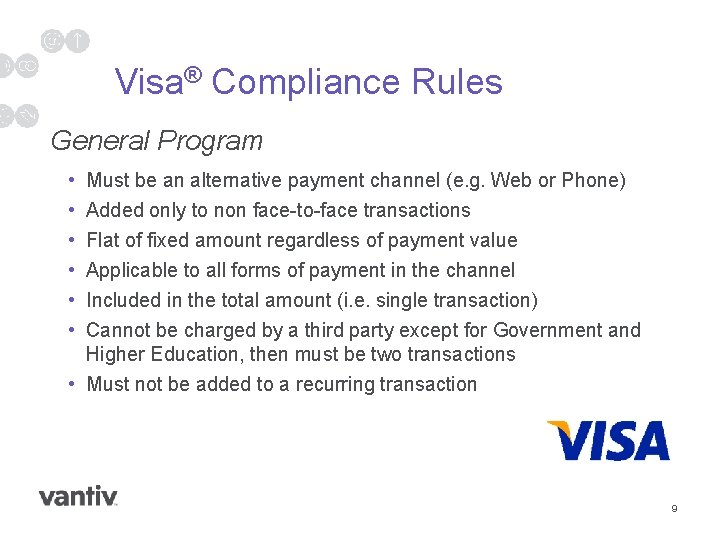

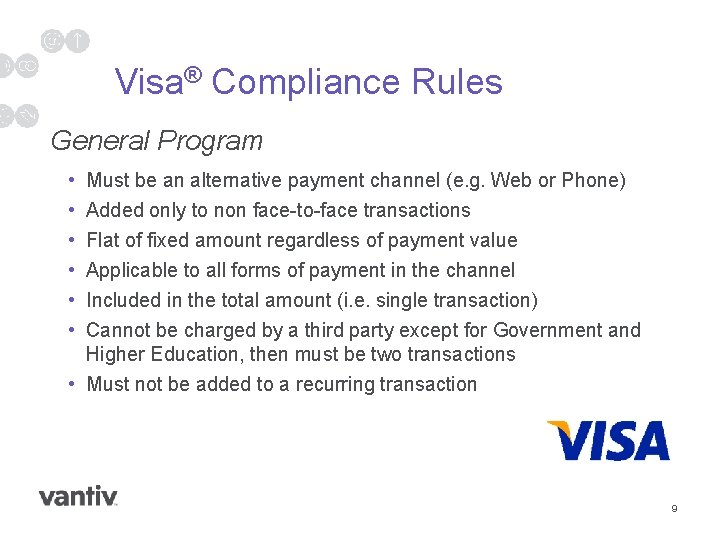

Visa® Compliance Rules General Program • • • Must be an alternative payment channel (e. g. Web or Phone) Added only to non face-to-face transactions Flat of fixed amount regardless of payment value Applicable to all forms of payment in the channel Included in the total amount (i. e. single transaction) Cannot be charged by a third party except for Government and Higher Education, then must be two transactions • Must not be added to a recurring transaction 9

Visa Compliance Rules Government Tax Program • • • Tax Program rules override general program Fee must be processed as a separate transaction Fee allowed in any channel, including face-to-face Fees may vary across channels Registration is required 10

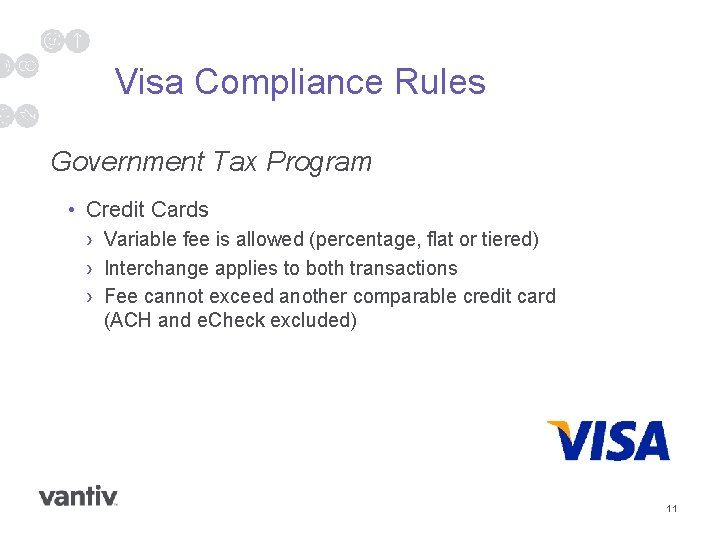

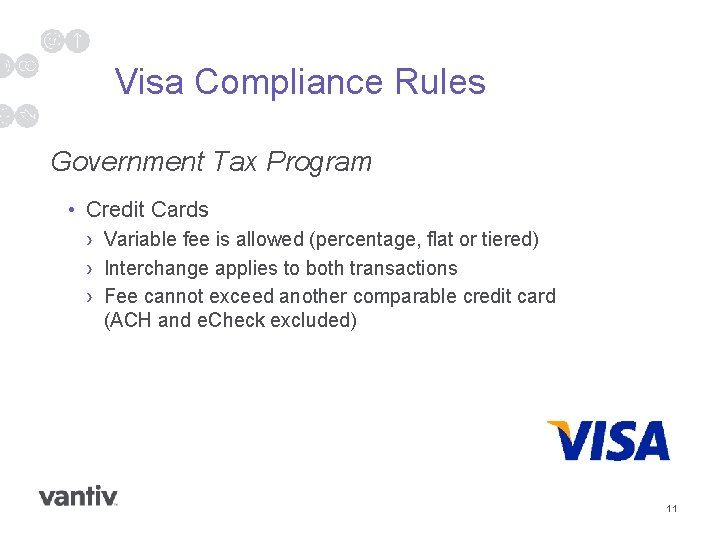

Visa Compliance Rules Government Tax Program • Credit Cards › Variable fee is allowed (percentage, flat or tiered) › Interchange applies to both transactions › Fee cannot exceed another comparable credit card (ACH and e. Check excluded) 11

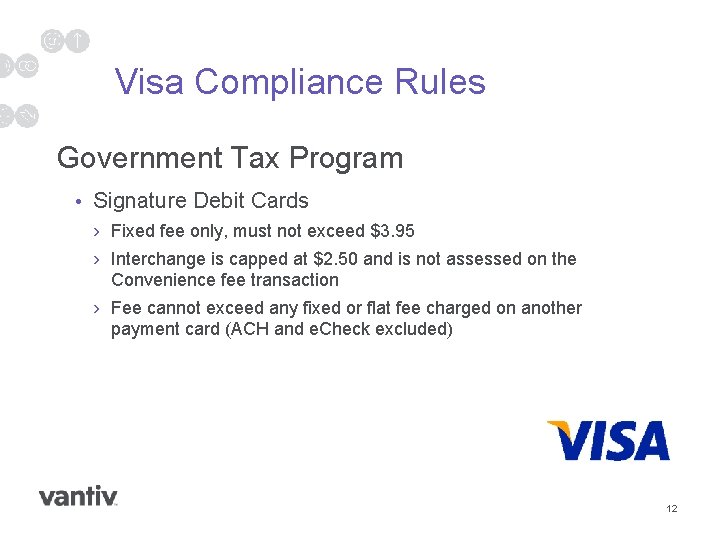

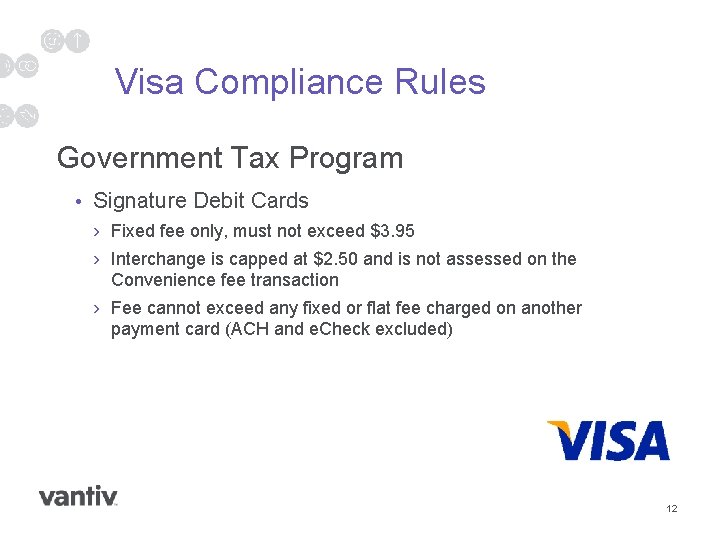

Visa Compliance Rules Government Tax Program • Signature Debit Cards › Fixed fee only, must not exceed $3. 95 › Interchange is capped at $2. 50 and is not assessed on the Convenience fee transaction › Fee cannot exceed any fixed or flat fee charged on another payment card (ACH and e. Check excluded) 12

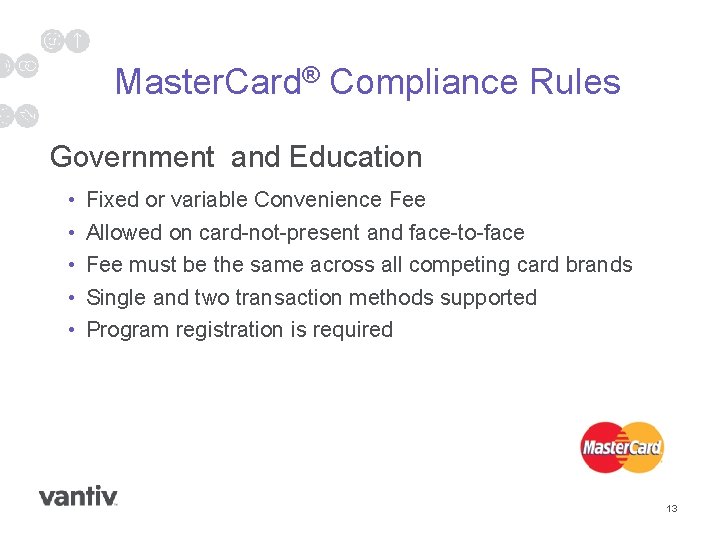

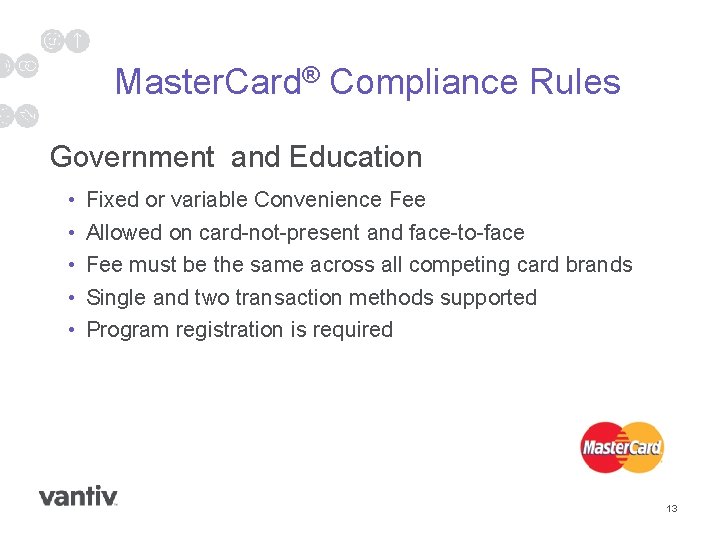

Master. Card® Compliance Rules Government and Education • • • Fixed or variable Convenience Fee Allowed on card-not-present and face-to-face Fee must be the same across all competing card brands Single and two transaction methods supported Program registration is required 13

Discover® Compliance Rules • • • Fixed or variable Convenience Fee Allowed on card-not-present and face-to-face Fee must be the same across all competing card brands Single and two transaction methods supported Cannot be assessed on a Cash Advance • For Discover Retained merchants: › Fee cannot exceed the merchant’s discount rate 14

American Express® Compliance Rules • Convenience Fees are allowed in Government, Utilities and Higher Education › Education: Only allowed for tuition, room & board and other mandatory fees • Fixed or variable fee • Allowed on card-not-present and face-to-face • Fee must be the same across all competing payment types 15

Card Network Compliance • Due to conflicting rules, some merchants exclude one or more card type • Education tends to accept Master. Card because Visa does not allow: › Variable fees › Fees on face-to-face transactions • Government tax payments may exclude Visa due to the debit flat rate rule 16

Third Party Processors Enables Convenience Fees for Merchants • Handles payment transactions › Integrates to Web for e. Commerce › Provides IVR services for phone payments › Supplies Virtual Terminal for face-to-face transactions • Collects Convenience Fee • Pays interchange and other processing costs • Allows merchant to collect the exact amount of payment 17