Contrarian investing and why it works What is

- Slides: 21

Contrarian investing and why it works

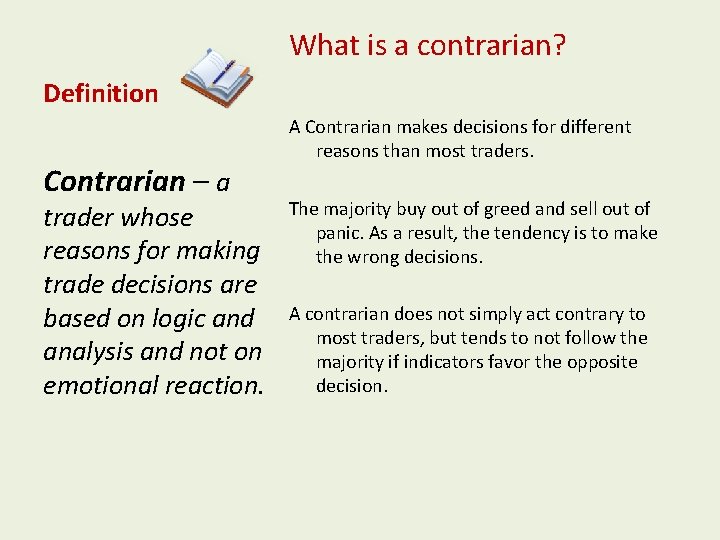

What is a contrarian? Definition Contrarian – a trader whose reasons for making trade decisions are based on logic and analysis and not on emotional reaction. A Contrarian makes decisions for different reasons than most traders. The majority buy out of greed and sell out of panic. As a result, the tendency is to make the wrong decisions. A contrarian does not simply act contrary to most traders, but tends to not follow the majority if indicators favor the opposite decision.

Trading tendencies and market behavior

How most traders trade Everyone has heard the advice to “Buy low and sell high. ” This sounds easy, and most traders do exactly the opposite. They buy high (greed) and sell low (panic). A contrarian attempts to “buy low and sell high” by observing how market prices over-react to news.

The contrarian observation A contrarian will observe that: - most traders follow the majority - the majority is often wrong - as prices rise, a growing number of people tend to buy, and the higher the price, the more buyers - as prices fall, a growing number of people tend to sell, and the lower the price, the more sellers

The contrarian ideal A contrarian will attempt to: - make decisions in spite of what the majority does - make a wise decision more often than not, based on analysis and reading of signals - buy when prices are depressed, especially if reversal signals indicate a coming uptrend - sell when prices rise to new heights, especially if reversal signals indicate a coming downtrend

Timing a buy or sell decision A contrarian not only employs logic and analysis, but also times trades based on: - strong reversal signals found in price patterns, candlestick indicators, volume spikes and momentum oscillators - confirmation of reversals, using the same signals and indicators as reversals; and the stronger the confirmation, the more confidence the contrarian has - avoiding placing too much capital into any single trade, to minimize losses and to avoid large losses - risk reduction methods through hedging and diversification

Price reversal signals A contrarian will watch trends and look for reversals in the following indicators: - traditional price reversal patterns like the head and shoulders, double tops or bottoms, and price gaps – especially when these appear at or near resistance or support - volume indicators as well as volume spikes, a one-day or two-day exceptionally high number of trades - momentum oscillators, indicators designed to reveal how quickly trends develop, when they begin to slow down, and when a stock is overbought (a bearish signal) or oversold (a bullish signal)

Contrarians and the efficient market hypothesis

The efficient market hypothesis Definition Contrarians believe that prices can be predicted to a degree, based on the Efficient market logical and analytical study of market hypothesis – the belief that all current prices behavior and of the news. are based on the accumulation of all This idea is disputed by EMH, which known facts and news assumes that the market is efficient about the company, and that all information is factored meaning that all prices into the price of a stock. are currently fair and efficient.

Problems with EMH If markets were efficient, prices would react in the same manner to all news, such as earnings or merger announcements. Based on EMH, reaction to earnings surprises should be measured and precise, and not subject to correction. EMH fails to recognize the elements of market behavior, which may be the most influential aspect of stock market investing and trading.

A view contrary to EMH A contrarian has observed how irrationally price behaves, and how price tends to overreact to all unexpected news. In these conditions, contrarians believe the market is quite inefficient. If that is true, then exaggerated one-day price movement presents an opportunity to exploit inefficiency.

Contrarians and the random walk theory

The random walk theory Definition Contrarians also reject the random walk theory, because the contrarian believes that price movement can be predicted – based on market behavior and on fundamental analysis. If the random walk theory is true, then all forms of analysis are useless. The contrarian rejects theory for that reason. Random walk theory – a theory about the market stating that it is impossible to predict the direction of price movement, and that any price today has a 50% chance of rising or falling.

Problems with the random walk theory If all prices were 50/50 bets, it would not matter which stock was selected; half would rise and half would fall. Under the random walk, you must reject the effects of high revenue and earnings in one company, versus low results in an other. You also would have to reject reputation, competitive success, and exceptional management. None of this would matter because price movement would occur apart from these influences.

Contrarians and the Dow Theory

The Dow Theory Contrarians accept the basis of the Dow Theory over the long term, while also recognizing that shortterm price behavior tends to be chaotic and irrational. The contrarian views the Dow Theory as an organizing principle of technical analysis, while also observing how volatile short-term price movement and market behavior present trading opportunities. Definition Dow Theory – a series of “rules” about market trends and how they are set and reversed. The theory is based on the teachings of Charles Dow, one of the two founders of the Dow Jones Company.

The tenets of the Dow Theory 1. The market consists of three movements: primary, secondary and short-term. 2. Trends consist of three phases: accumulation, public participation, and distribution. 3. The market tends to discount all news very quickly.

The tenets of the Dow Theory 4. Stock averages must confirm each other before a reversal is recognized. 5. Volume confirms trends. 6. Trends continue until a contrary signal is recognized and confirmed.

Is the Dow Theory in conflict with contrarian investing? Many have pointed to the tenet that the market discounts news, to support the efficient market hypothesis. It is true that the market behaves in this manner, but it often takes several days for the discounting to go into effect. Contrarians are strong proponents of the Dow Theory over the long term, and recognize that the core of trend analysis rests with recognition of reversal and confirmation.

Conclusion Contrarians do not act opposite the majority, but make decisions for different reasons than most – employing logic and analysis rather than emotion. The efficient market hypothesis assumes that all prices are correct because they contain all known news. The random walk theory assumes that prices cannot be predicted, and that all analysis is useless because of the random nature of markets. The Dow Theory is the basis for technical analysis, and contrarians are strong proponents of its tenets.

Define contrarian investing

Define contrarian investing Contrarian value investing

Contrarian value investing Direct investing vs indirect investing

Direct investing vs indirect investing Why why why why

Why why why why Safety at street works and road works

Safety at street works and road works Dont ask

Dont ask The purpose of explanation

The purpose of explanation Lesson twelve saving and investing

Lesson twelve saving and investing Finance and investment cycle

Finance and investment cycle Chapter 10 basics of saving and investing

Chapter 10 basics of saving and investing Holding a variety of investments to reduce risk

Holding a variety of investments to reduce risk Format of indirect method of cash flow statement

Format of indirect method of cash flow statement Operating activities indirect method

Operating activities indirect method Guided reading activity 6 1 why save economics answers

Guided reading activity 6 1 why save economics answers Chapter 6 saving and investing

Chapter 6 saving and investing Sephora case study harvard

Sephora case study harvard Similarities between saving and investing

Similarities between saving and investing Describe the difference between saving and investing.

Describe the difference between saving and investing. Kosaraju algorithm strongly connected components

Kosaraju algorithm strongly connected components Operating activities vs investing activities

Operating activities vs investing activities Fundamentals of investment notes

Fundamentals of investment notes The basic rule of a risk-to-return relationship is that

The basic rule of a risk-to-return relationship is that