Constantine Partners Competition Law Enforcement And The MediaTelecommunications

- Slides: 34

Constantine & Partners Competition Law Enforcement And The Media/Telecommunications Industry By Matthew L. Cantor Constantine & Partners, PC 1 4/23/02

Constantine & Partners Why Is This Interesting? 2 4/23/02

Constantine & Partners Why Is This Interesting? • Affects manner in which ideas are relayed to persons. • Cannot underestimate the importance of media to our culture for all persons regardless of race, creed or age. – News – Educational – Entertainment Options 3 4/23/02

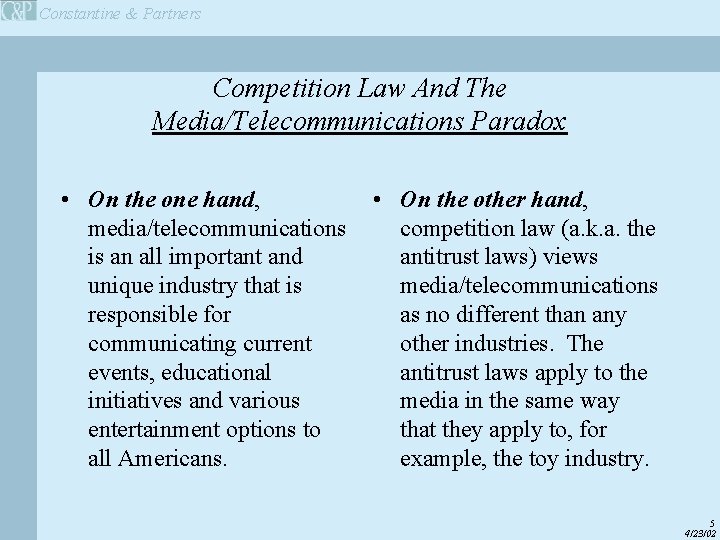

Constantine & Partners Competition Law And The Media/Telecommunications Paradox 4 4/23/02

Constantine & Partners Competition Law And The Media/Telecommunications Paradox • On the one hand, media/telecommunications is an all important and unique industry that is responsible for communicating current events, educational initiatives and various entertainment options to all Americans. • On the other hand, competition law (a. k. a. the antitrust laws) views media/telecommunications as no different than any other industries. The antitrust laws apply to the media in the same way that they apply to, for example, the toy industry. 5 4/23/02

Constantine & Partners The Federal Communications Commission: The Answer To The Paradox 6 4/23/02

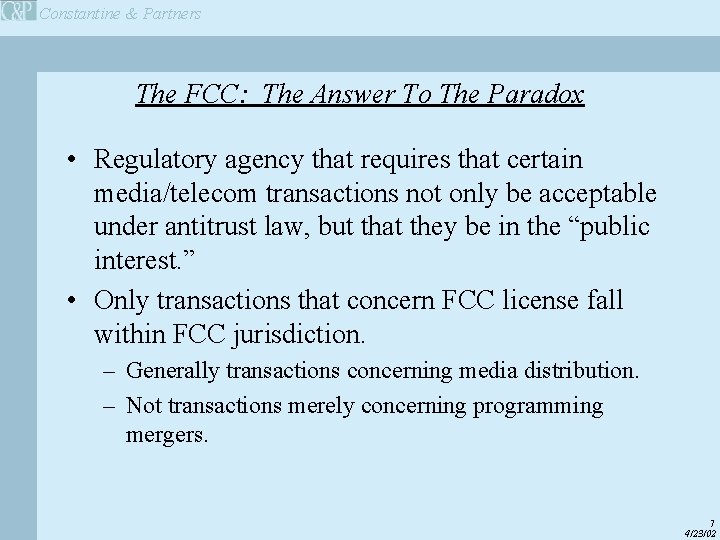

Constantine & Partners The FCC: The Answer To The Paradox • Regulatory agency that requires that certain media/telecom transactions not only be acceptable under antitrust law, but that they be in the “public interest. ” • Only transactions that concern FCC license fall within FCC jurisdiction. – Generally transactions concerning media distribution. – Not transactions merely concerning programming mergers. 7 4/23/02

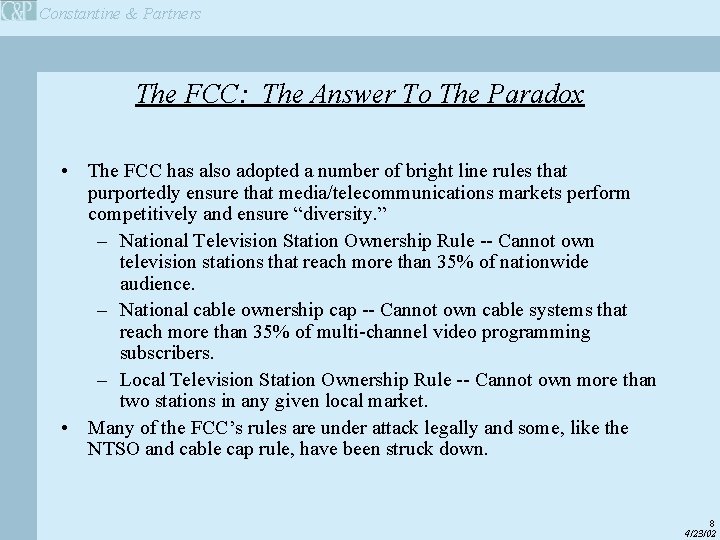

Constantine & Partners The FCC: The Answer To The Paradox • The FCC has also adopted a number of bright line rules that purportedly ensure that media/telecommunications markets perform competitively and ensure “diversity. ” – National Television Station Ownership Rule -- Cannot own television stations that reach more than 35% of nationwide audience. – National cable ownership cap -- Cannot own cable systems that reach more than 35% of multi-channel video programming subscribers. – Local Television Station Ownership Rule -- Cannot own more than two stations in any given local market. • Many of the FCC’s rules are under attack legally and some, like the NTSO and cable cap rule, have been struck down. 8 4/23/02

Constantine & Partners Review Of Media/Telecom Mergers 9 4/23/02

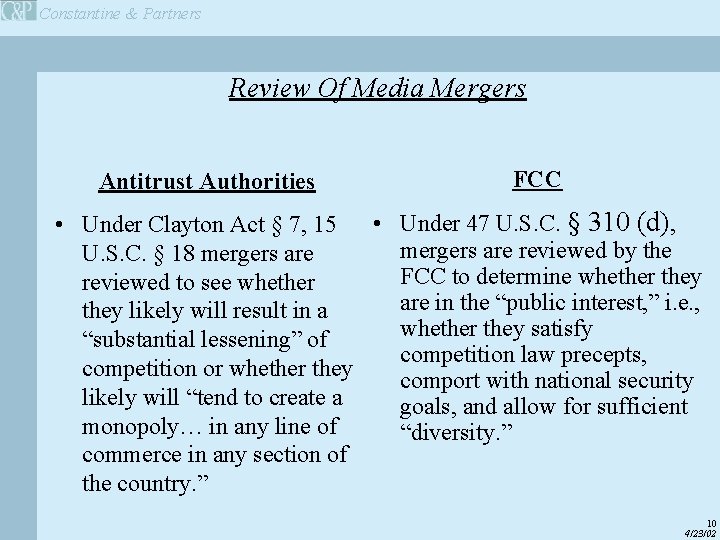

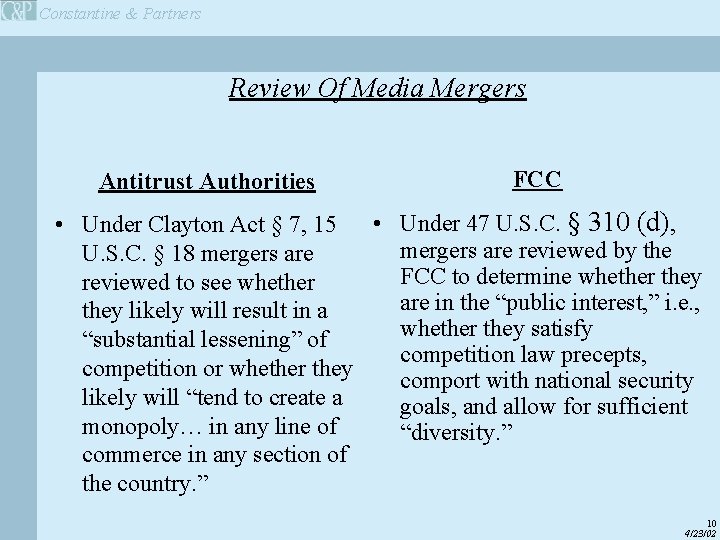

Constantine & Partners Review Of Media Mergers Antitrust Authorities FCC • Under Clayton Act § 7, 15 • Under 47 U. S. C. § 310 (d), mergers are reviewed by the U. S. C. § 18 mergers are FCC to determine whether they reviewed to see whether are in the “public interest, ” i. e. , they likely will result in a whether they satisfy “substantial lessening” of competition law precepts, competition or whether they comport with national security likely will “tend to create a goals, and allow for sufficient monopoly… in any line of “diversity. ” commerce in any section of the country. ” 10 4/23/02

Constantine & Partners Clayton Act Section 7 Standard 11 4/23/02

Constantine & Partners Clayton Act Section 7 Standard • Determine whether merger will likely lead to the acquisition of market power. – Market power is defined as “the power to control market prices or exclude competition. ” U. S. v. E. I. Du Pont de Nemours & Co. , 351 U. S. 377, 391 (1956) • In order to make determination, enforcers follow 1992 Federal Trade Commission/Department Of Justice Guidelines, as amended in 1997. Guidelines are to inform prosecutorial discretion of enforcers, although certain courts have relied on them as law. 12 4/23/02

Constantine & Partners Section 7 Standard: Evaluation Under Merger Guidelines 13 4/23/02

Constantine & Partners Section 7 Standard: Evaluation Under Merger Guidelines • Market definition -- test for deciding scope of particular relevant market, which is prerequisite to determining whether power will be acquired by the merged entity. • HHI Calculations -- Mathematical calculation that determines whether the merger is presumptively illegal. – Utilizes market share information • Analysis of Efficiencies -- Where mergers do not lead to extreme consolidation may benefit consumers by gaining cost reductions. Can rebut presumption of illegal merger. – E. g. , increased economies of scale can lead to reduced cost of product. 14 4/23/02

Constantine & Partners Procedure For Review Of Media Transactions 15 4/23/02

Constantine & Partners Procedure For Review Of Media/Telecom Transactions • Pre-merger notification must be filed with FTC/DOJ. Agencies have thirty days to review merger. Thirty day period can be extended if requests for additional information and documentation are made. • Application for transfer of FCC license must be filed with FCC has selfimposed 180 day period to rule on transaction, but FCC review has not been historically dictated by this deadline. 16 4/23/02

Constantine & Partners Summary of Recent Reviews of Major Media/Telecom Transactions By Antitrust Authorities 17 4/23/02

Constantine & Partners Radio Station Mergers 18 4/23/02

Constantine & Partners Radio Station Mergers • Westinghouse Electric (CBS)/Infinity Broadcasting (1996) – Deal: CBS station ownership group seeks to acquire additional station group. – Issue: Would ownership of stations constituting 40% of Boston radio “market” and 45% in Philadelphia radio “market” lead to increase for radio advertising rates? • DOJ alleges that it is especially concerned because many of the radio stations that would be owned by merged entity competed for the ears of same demographic group (males 18 -54)? – Conclusion/Enforcement Action Taken: Divestiture of major station in Philadelphia and Boston. 19 4/23/02

Constantine & Partners Radio Station Mergers • Clear Channel Communications/AMFM (2000) • Clear Channel Communications/Jacor Communications (1999) – Same issues as in Westinghouse/Infinity. – Both deals led to divestitures. – Question on market definition: Is market broad (advertising on all radio stations) or is it more narrow (advertising on radio stations that appeal to same demographic. ) • DOJ alleges the former. 20 4/23/02

Constantine & Partners Television Station Mergers 21 4/23/02

Constantine & Partners Television Station Mergers • Chris-Craft/Fox (2001) – Deal: Fox attempts to acquire second television broadcast station in NY (UPN affiliate), LA (UPN affiliate), PHO (UPN affiliate) and SLC (ABC affiliate). – Issue: Would merger cause hike in local spot advertising rates charged by television stations, where Fox would was acquiring second television station in a particular regional market? – Conclusion/Enforcement Action: DOJ concluded that a market for local broadcast programming, separate and apart from cable programming, exists. Because Fox was to own both Fox and ABC affiliate in Salt Lake City, which would have given Fox about a 40% share of the ad revenues in that market, DOJ required divestiture of Salt Lake City station. (FCC rule mandated this divestiture in any event. ) In all other respects, deal cleared by DOJ. 22 4/23/02

Constantine & Partners Television Programming 23 4/23/02

Constantine & Partners Television Programming • CBS/Viacom (1998) – Deal: Viacom, 50% owner of UPN network, attempts to acquire second television network. – Issue: Does the acquisition of second network give Viacom market power in sale of advertisements for network programming? – Conclusion/Enforcement Action: Deal is cleared. Viacom is not forced to sell its stake in UPN. 24 4/23/02

Constantine & Partners Television Programming • Fox Family/Disney (2001) – Deal: Disney, owner of Disney channel and tremendous amount of family programming, acquires cable network and all of its distribution rights. – Conclusion/Enforcement Action: Deal clears in 30 day waiting period. • Time Warner/Turner (1996) – Deal: Vertically-integrated programmer/cable provider (second largest cable provider) acquirers largest cable programmer. – Conclusion/Enforcement Action: Deal approved on horizontal aspects. In other words, no divestiture caused as a result of deal. 25 4/23/02

Constantine & Partners Cable 26 4/23/02

Constantine & Partners Cable • Turner/Time Warner (1996) – Deal: Cable provider (Second largest) acquiring largest programmer. – Issues: • By acquisition, will Time Warner be able to foreclose competition (reduce output) in programming market by denying access to its cable pipes. • By acquisition, will Time Warner foreclose competition in cable/multi-channel video programming distribution (“MVPD”) markets by refusing to grant competitors access to its programming. – Conclusions/Enforcement Action: Time Warner agrees to must carry on competitive programming, e. g. , it agrees to distribute Fox News and MSNBC which is competitive with CNN. Also, Time Warner agrees to provide its programming to competitive MVPDs. 27 4/23/02

Constantine & Partners Cable • AOL/Time Warner (2000) – Deal: Largest Internet Service Provider acquires second largest cable distributor. – Issue: Can Time Warner foreclose competition in the ISP market by refusing to grant access to competitive ISPs who will need cable pipes for distribution? – Conclusion/Enforcement Action: FTC requires that AOL/Time Warner provide access to its cable pipes on fair and reasonable terms to at least three ISP competitors, including Earthlink. 28 4/23/02

Constantine & Partners Cable Horizontal Deals 29 4/23/02

Constantine & Partners Cable - Horizontal Deals • AT&T/TCI (1999) • AT&T/Media. One (1999) • Numerous Time Warner Cable Acquisitions – clustering: attempts to increase scope of monopoly in specific regions has led to swaps among cable systems. • Concern about creation of monopsonies – e. g. entities with massive buying, rather than selling, power. Could lead to reduction in output if programming bought at sub-competitive rates. 30 4/23/02

Constantine & Partners DBS 31 4/23/02

Constantine & Partners DBS • Prime. Star attempted acquisition of News Corporation satellite assets. – Deal: News Corp. attempts to sell license to orbital slot to Prime. Star, which is owned by cable companies. – Issue: Will Prime. Star use DBS assets aggressively to compete with cable? – Conclusion: DOJ sues and deal folds. 32 4/23/02

Constantine & Partners Current Deals 33 4/23/02

Constantine & Partners Current Deals • Echo. Star/Direc. TV – Deal: Only two DBS providers attempting to merge. – Issue: Will merger lead to an increase in market power in MVPD markets? • AT&T/Comcast – Deal: Third largest cable monopoly seeking to buy largest cable monopoly. – Issue: Will deal result in monopsony or entity with substantial buying power of programming? If so, is there a likelihood that programming output will be decreased due to dealing with entity that will only purchase programming at sub-competitive rates. 34 4/23/02