Completing the Tests in the Sales and Collection

- Slides: 41

Completing the Tests in the Sales and Collection Cycle: Accounts Receivable

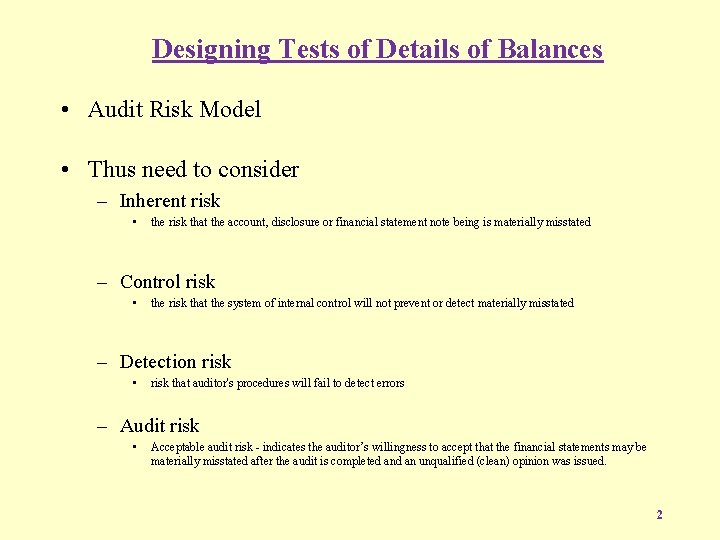

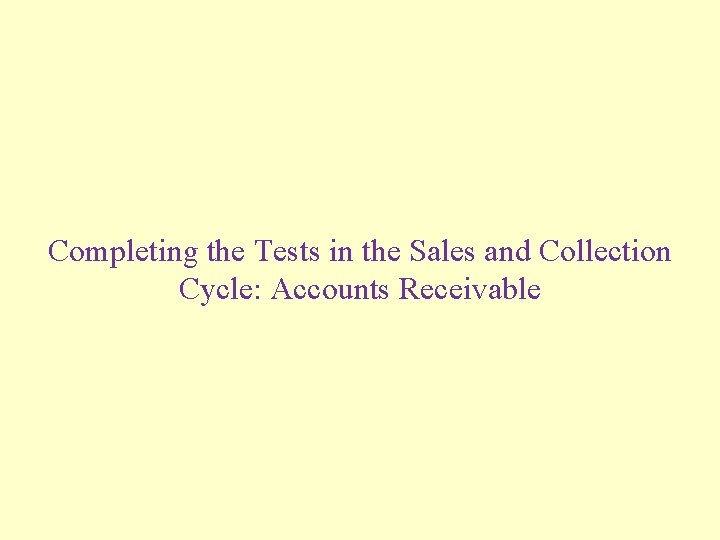

Designing Tests of Details of Balances • Audit Risk Model • Thus need to consider – Inherent risk • the risk that the account, disclosure or financial statement note being is materially misstated – Control risk • the risk that the system of internal control will not prevent or detect materially misstated – Detection risk • risk that auditor's procedures will fail to detect errors – Audit risk • Acceptable audit risk - indicates the auditor’s willingness to accept that the financial statements may be materially misstated after the audit is completed an unqualified (clean) opinion was issued. 2

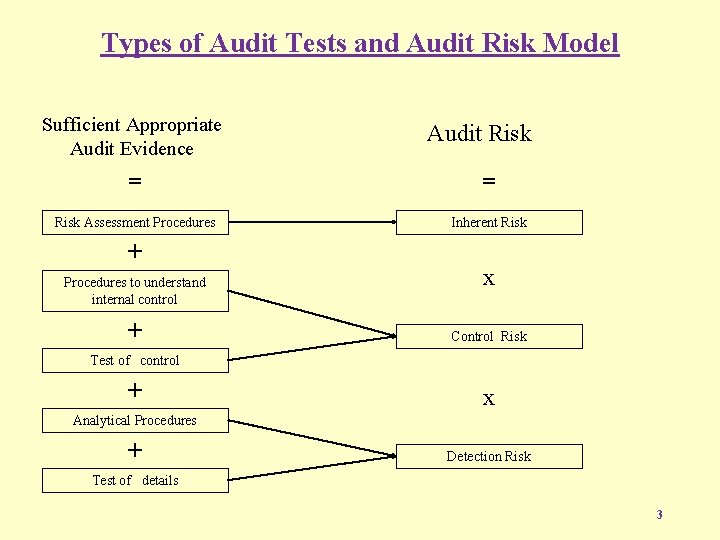

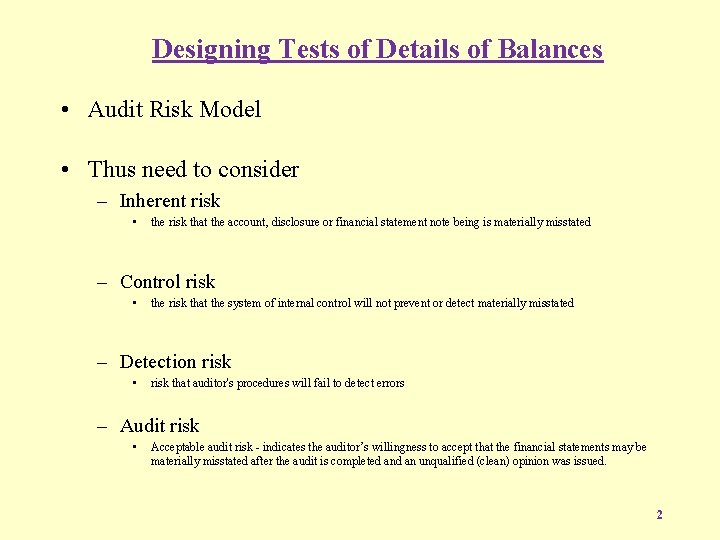

Types of Audit Tests and Audit Risk Model Sufficient Appropriate Audit Evidence Audit Risk = = Risk Assessment Procedures Inherent Risk + Procedures to understand internal control + x Control Risk Test of control + x Analytical Procedures + Detection Risk Test of details 3

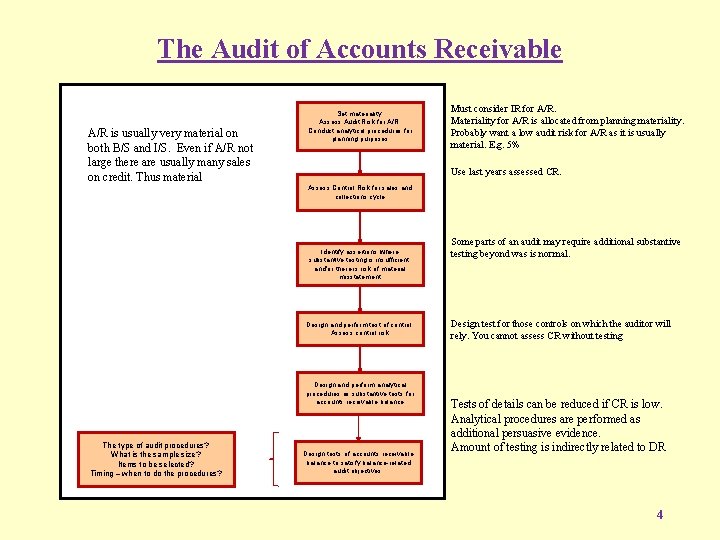

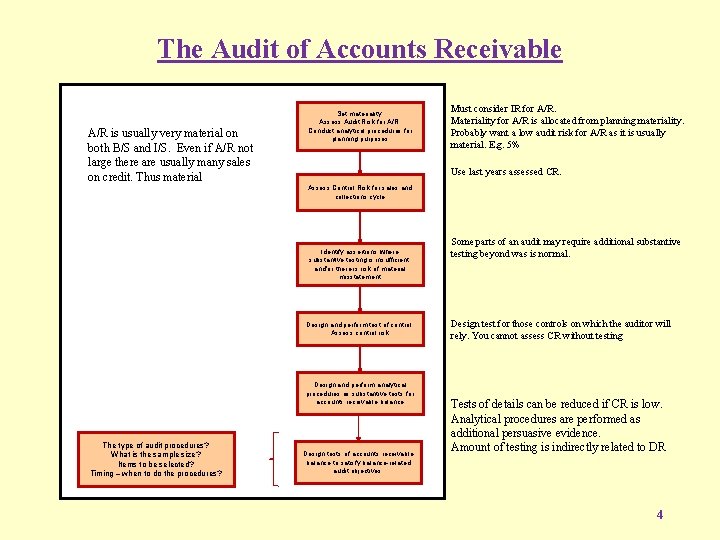

The Audit of Accounts Receivable A/R is usually very material on both B/S and I/S. Even if A/R not large there are usually many sales on credit. Thus material Set materiality. Assess Audit Risk for A/R. Conduct analytical procedures for planning purposes Must consider IR for A/R. Materiality for A/R is allocated from planning materiality. Probably want a low audit risk for A/R as it is usually material. E. g. 5% Use last years assessed CR. Assess Control Risk for sales and collections cycle Identify assertions where substantive testing is insufficient, and/or there is risk of material misstatement Design and perform test of control. Assess control risk Design and perform analytical procedures as substantive tests for accounts receivable balance The type of audit procedures? What is the sample size? Items to be selected? Timing – when to do the procedures? Design tests of accounts receivable balance to satisfy balance-related audit objectives. Some parts of an audit may require additional substantive testing beyond was is normal. Design test for those controls on which the auditor will rely. You cannot assess CR without testing Tests of details can be reduced if CR is low. Analytical procedures are performed as additional persuasive evidence. Amount of testing is indirectly related to DR 4

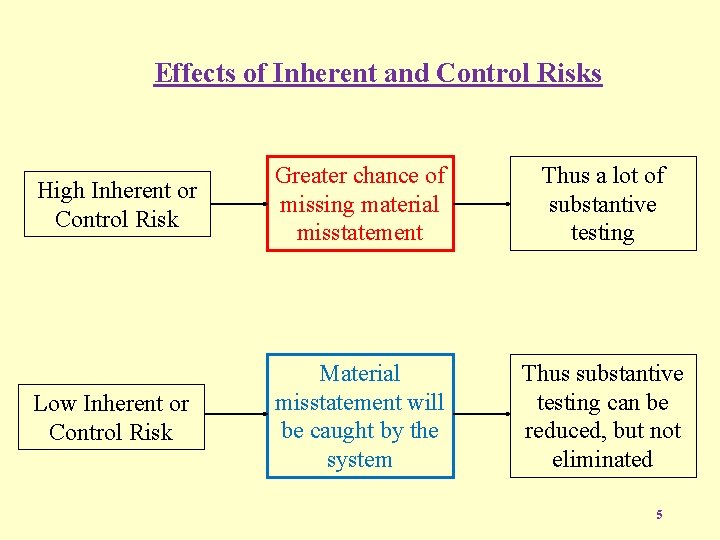

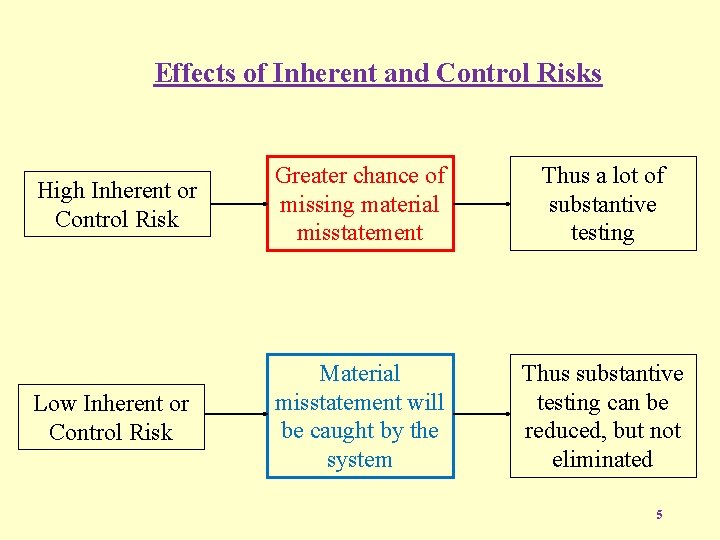

Effects of Inherent and Control Risks High Inherent or Control Risk Greater chance of missing material misstatement Thus a lot of substantive testing Low Inherent or Control Risk Material misstatement will be caught by the system Thus substantive testing can be reduced, but not eliminated 5

Materiality Considerations • Accounts receivable may be one of the largest amounts on the balance sheet. • Sales and accounts receivable balances are normally significant. 6

Inherent Risk Considerations • Inherent risk tends to be moderate to low for all assertions – What are the risk associated with Accounts Receivable? – High risk areas: • Realizable value • Cut-off for sales returns or allowances 7

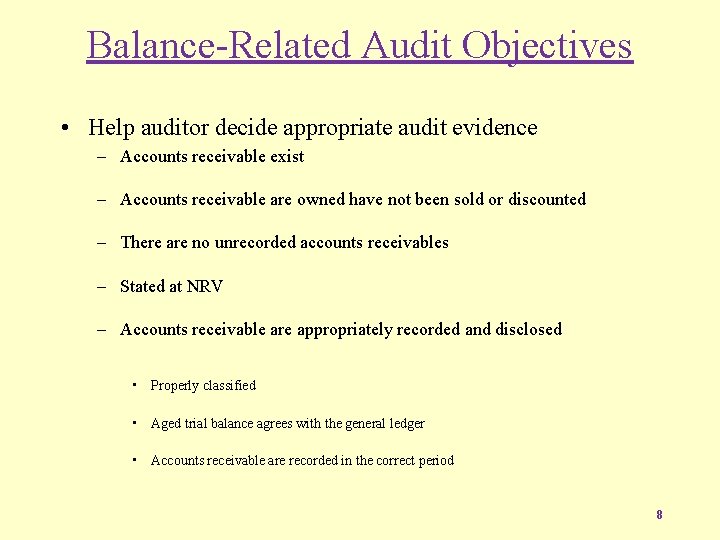

Balance-Related Audit Objectives • Help auditor decide appropriate audit evidence – Accounts receivable exist – Accounts receivable are owned have not been sold or discounted – There are no unrecorded accounts receivables – Stated at NRV – Accounts receivable are appropriately recorded and disclosed • Properly classified • Aged trial balance agrees with the general ledger • Accounts receivable are recorded in the correct period 8

Disclosure-Related Audit Objectives • Presentation and disclosure in the financial statements – Accounts receivable transactions actually occurred – Accounts receivable are amounts collectible by the client – Disclosures for accounts receivables are fully included – Accounts receivable in the financial statements are materially correct – Shown at amounts that are collectible – Correctly shown as current and long-term – Both financial and non-financial is clearly disclosed 9

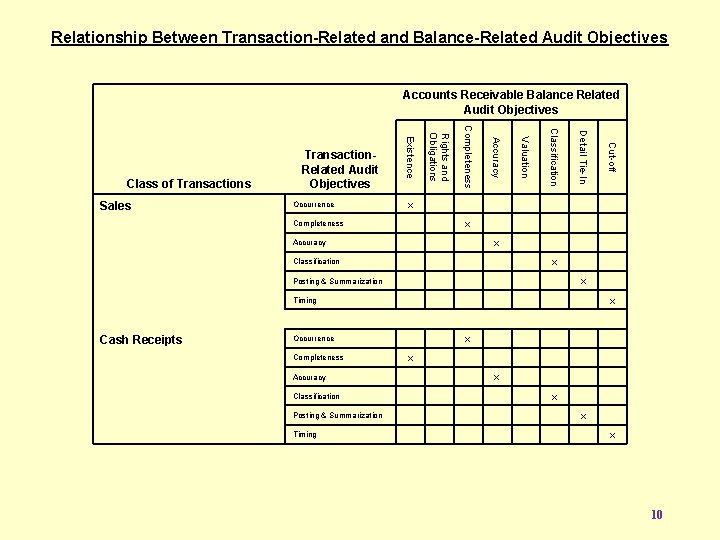

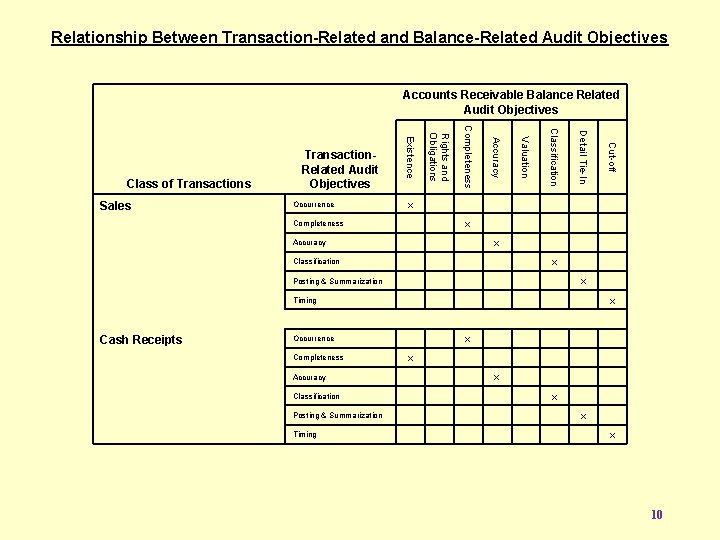

Relationship Between Transaction-Related and Balance-Related Audit Objectives Accounts Receivable Balance Related Audit Objectives x x Completeness x Accuracy x Classification x Posting & Summarization x Timing Cash Receipts x Occurrence Completeness Accuracy Classification Posting & Summarization Timing Cut-off Detail Tie-In Classification Valuation Accuracy Completeness Occurrence Rights and Obligations Sales Existence Class of Transactions Transaction. Related Audit Objectives x x x 10

• Occurrence transaction-related audit objective for sales and the Existence balance-related audit objective – For sales, the audit objective occurrence shows that – For accounts receivable, the audit object of existence shows that – From the point of control risk • If auditor concludes that control risk over sales is low – Also, by performing accounts receivable confirmations 11

• Completeness transaction-related audit objective for cash receipts and the Existence balance-related audit objective – For cash receipts the audit objective completeness shows that – For accounts receivable the audit object shows that – From the point of control risk • If auditor concludes that control risk over cash receipts is low – Thus by performing subsequent payments 12

Analytical Procedures • Analytical procedures are important • But remember that analytical procedures are used during three main phases of the audit: 1. Planning 2. As part of substantive testing 3. As part of completing the audit engagement 13

Using Analytical Review to Target Detailed Tests • Helpful analyses could include comparing: – – – – Sales by month Sales returns and allowances Individual customer balances Bad debt expense to gross sales Number of days in A/R Aging categories Allowance for uncollectible accounts • To what would these items be compared? • What is the auditor looking for? 14

The Audit Objective and the Audit Procedure • Existence and accuracy: – Confirm accounts receivable balances – performing alternative procedures for discrepancies and nonreplies. 15

• Rights and obligations: – Could also say the ownership of the asset – But what is done about pledged or factored accounts receivable? 16

• Valuation: – What is the important valuation account in relation to accounts receivable? – Thus pertinent procedures for valuation? 17

• Completeness: • Classification: 18

• Cut-off: – Select the last 40 sales transactions from the current year’s sales journal and the first 40 from the subsequent year’s • Detail tie-in: – Foot the customer master file • Presentation and disclosure: – Ensure full and complete disclosure in the financial statements 19

The Power of Confirmations • A very important audit procedure – Mc. Kesson & Robbins 1937 • Useful for existence • A/R confirmations come in two forms: – Negative – Positive 20

Positive vs. Negative Confirmations • Positive confirmations – A more reliable form of evidence for A/R – if not answered • When are they used? – Individual balances are – And/or 21

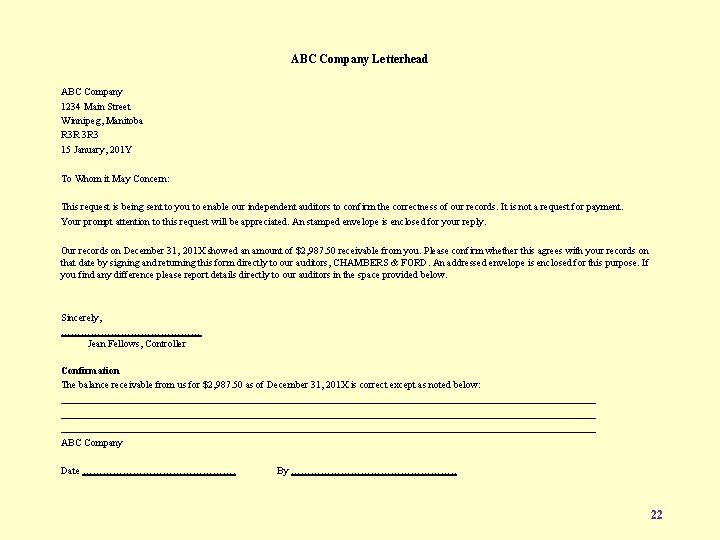

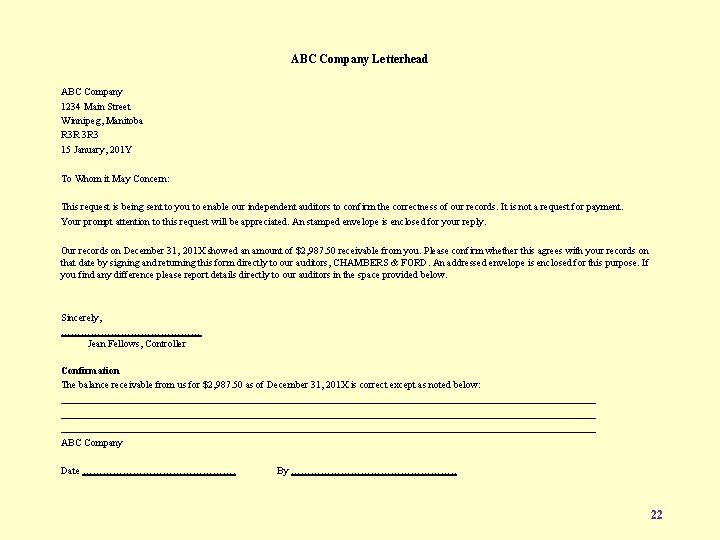

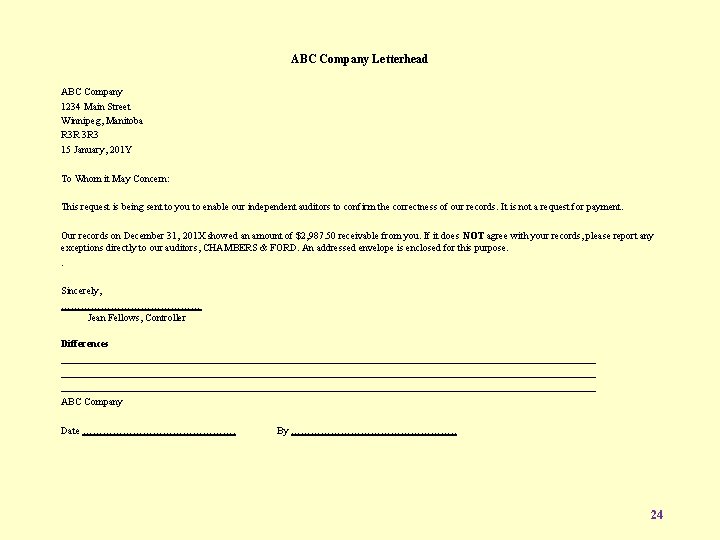

ABC Company Letterhead ABC Company 1234 Main Street Winnipeg, Manitoba R 3 R 3 R 3 15 January, 201 Y To Whom it May Concern: This request is being sent to you to enable our independent auditors to confirm the correctness of our records. It is not a request for payment. Your prompt attention to this request will be appreciated. An stamped envelope is enclosed for your reply. Our records on December 31, 201 X showed an amount of $2, 987. 50 receivable from you. Please confirm whether this agrees with your records on that date by signing and returning this form directly to our auditors, CHAMBERS & FORD. An addressed envelope is enclosed for this purpose. If you find any difference please report details directly to our auditors in the space provided below. Sincerely, ………………… Jean Fellows, Controller Confirmation The balance receivable from us for $2, 987. 50 as of December 31, 201 X is correct except as noted below: ___________________________________________________________________________________________________________ ABC Company Date ……………………. By ……………………. . 22

• Negative confirmations – Failure to reply • Negative confirmation requires a response only if there is a discrepancy. • When are they used? 23

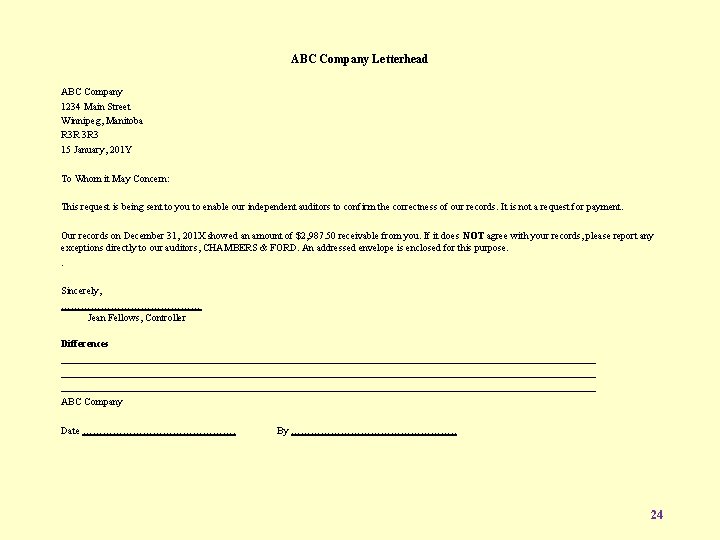

ABC Company Letterhead ABC Company 1234 Main Street Winnipeg, Manitoba R 3 R 3 R 3 15 January, 201 Y To Whom it May Concern: This request is being sent to you to enable our independent auditors to confirm the correctness of our records. It is not a request for payment. Our records on December 31, 201 X showed an amount of $2, 987. 50 receivable from you. If it does NOT agree with your records, please report any exceptions directly to our auditors, CHAMBERS & FORD. An addressed envelope is enclosed for this purpose. . Sincerely, ………………… Jean Fellows, Controller Differences ___________________________________________________________________________________________________________ ABC Company Date ……………………. By ……………………. . 24

Controlling and Managing the Confirmation Process Look at the following points: 1. 2. 3. 4. • Controlling the sending of confirmations Procedures for those accounts the client does not want confirmed Handling returned confirmations Timing of alternative procedures and second requests Auditor must also decide 25

1. Controlling the Sending of Confirmations • The client may assist in preparing the confirmations • If the client stuffs and stamps the envelopes • Return envelopes 26

2. Procedures for those Accounts the Client does not want Confirmed • If it has been selected by the auditor • The auditor will apply alternative procedures to the amount 27

3. Handling Returned Confirmations • Confirmations should be returned directly • Differences between the client’s records and the confirmation reply – Need to determine if the difference is an error 28

Types of differences between client and customer • Differences between the client records and the confirmation could be due to: 1. Payment already made by the client • 2. A timing difference Goods were not received • A timing difference 3. Goods were returned • 4. Could be a timing difference Amounts are in dispute 29

4. Timing of alternative procedures and second requests • Second requests can be sent • Control of such follow-up requests • Alternative procedures – designed to provide adequate evidence with respect to existence, accuracy and cut-off 30

Nature of Alternative Procedures • Review of subsequent cash receipts • Examination of duplicate sales invoices • Examination of shipping documentation • Review of correspondence between the client and the customer 31

Sampling and Accounts Receivable • Sampling is always used to determine which accounts receivable will be selected • Statistical sampling could be used to select accounts receivable for confirmation • Or directed sampling 32

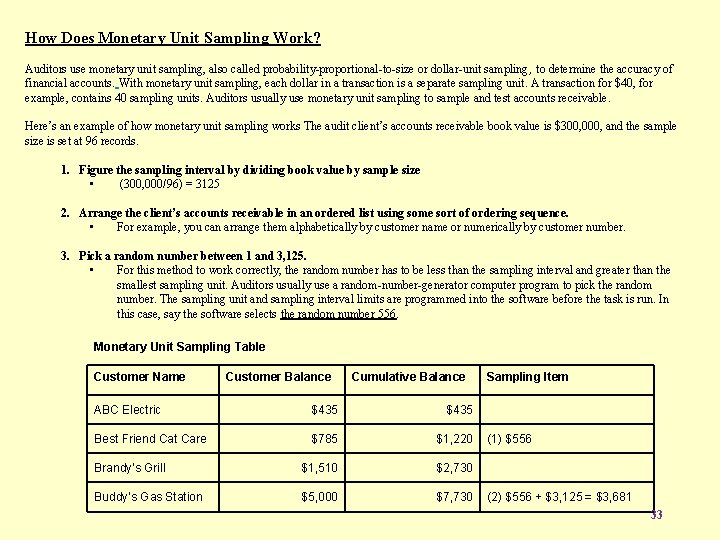

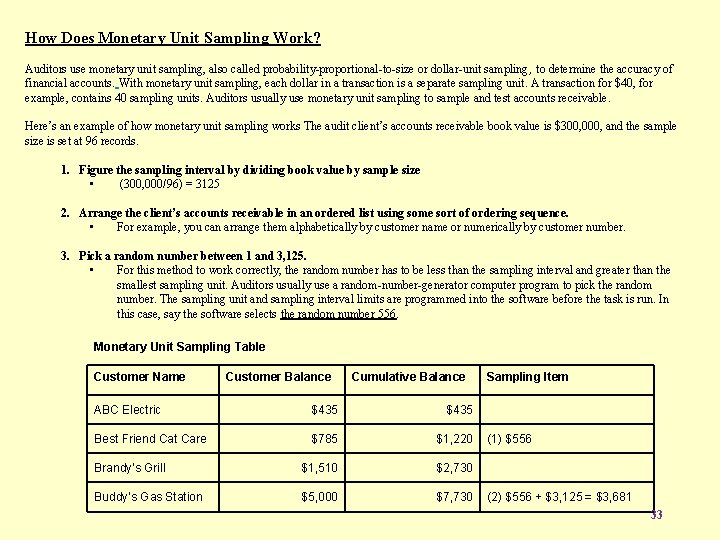

How Does Monetary Unit Sampling Work? Auditors use monetary unit sampling, also called probability-proportional-to-size or dollar-unit sampling , to determine the accuracy of financial accounts. With monetary unit sampling, each dollar in a transaction is a separate sampling unit. A transaction for $40, for example, contains 40 sampling units. Auditors usually use monetary unit sampling to sample and test accounts receivable. Here’s an example of how monetary unit sampling works The audit client’s accounts receivable book value is $300, 000, and the sample size is set at 96 records. 1. Figure the sampling interval by dividing book value by sample size • (300, 000/96) = 3125 2. Arrange the client’s accounts receivable in an ordered list using some sort of ordering sequence. • For example, you can arrange them alphabetically by customer name or numerically by customer number. 3. Pick a random number between 1 and 3, 125. • For this method to work correctly, the random number has to be less than the sampling interval and greater than the smallest sampling unit. Auditors usually use a random-number-generator computer program to pick the random number. The sampling unit and sampling interval limits are programmed into the software before the task is run. In this case, say the software selects the random number 556. Monetary Unit Sampling Table Customer Name Customer Balance Cumulative Balance ABC Electric $435 Best Friend Cat Care $785 $1, 220 Brandy’s Grill $1, 510 $2, 730 Buddy’s Gas Station $5, 000 $7, 730 Sampling Item (1) $556 (2) $556 + $3, 125 = $3, 681 33

First, pick the records to test: Take the alphabetically ordered list shown in the Customer Name column, which lists every customer balance by dollar amount, and count each dollar until getting to $556. The random number generator gives the number 556 in Step 3 in the previous slide. The cumulative dollar amount for ABC Electric is under $556. That shows that the first sampling item is Best Friend Cat Care, which at a cumulative total of $1, 220 is the first customer in the list with a cumulative balance over $556. Best Friend Cat Care becomes the first customer in the sample. Secondly, select the next invoice to sample: Add the sampling interval of $3, 125 to the random number of $556. This equals $3, 681, which is the next sampled item dollar amount. Brandy’s Grill at $2, 730 cumulatively is under $3, 681, thus Brandy’s is skipped. Buddy’s Gas Station has the 3, 681 st dollar. To pick the next sampling item: Add the sampling interval of $3, 125 to the prior sampling item of $3, 681, which equals $6, 806, and so on until the last name in the customer list is reached. This will give the total sample size of 96. When sampling, misstatements are being looked for. If a selected customers invoice should have been entered for $986, for example, and it was entered as $896, there is a misstatement. If the total misstatements exceed the tolerable level, there may be a material misstatement. 34

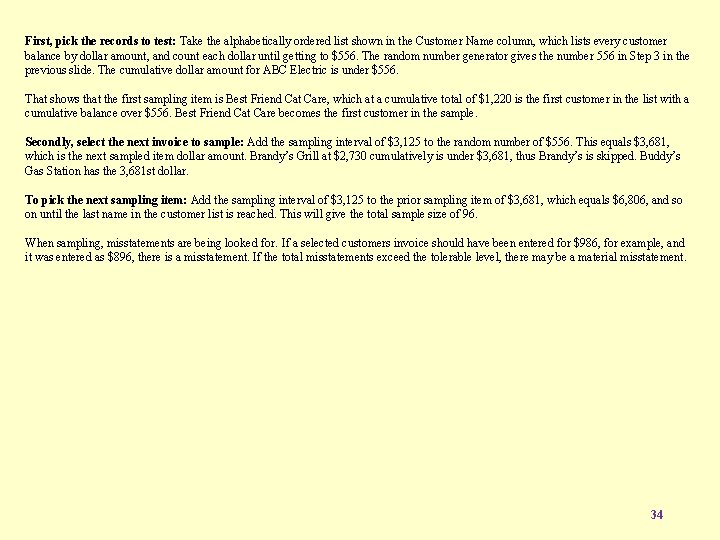

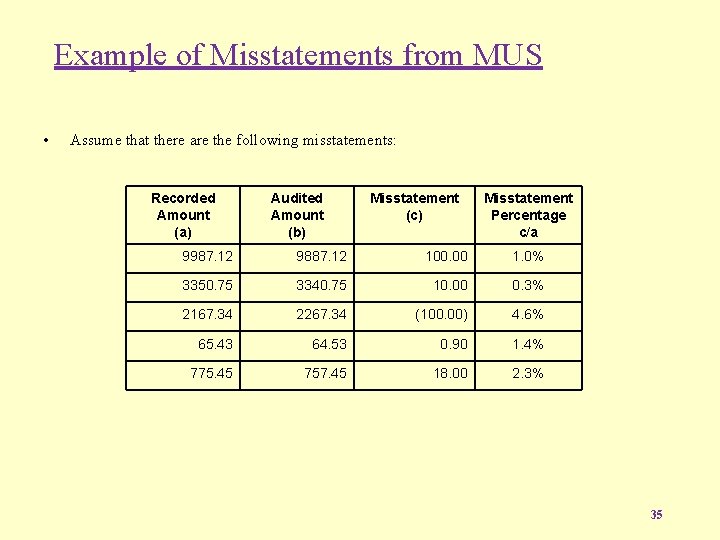

Example of Misstatements from MUS • Assume that there are the following misstatements: Recorded Amount (a) Audited Amount (b) Misstatement (c) Misstatement Percentage c/a 9987. 12 9887. 12 100. 00 1. 0% 3350. 75 3340. 75 10. 00 0. 3% 2167. 34 2267. 34 (100. 00) 4. 6% 65. 43 64. 53 0. 90 1. 4% 775. 45 757. 45 18. 00 2. 3% 35

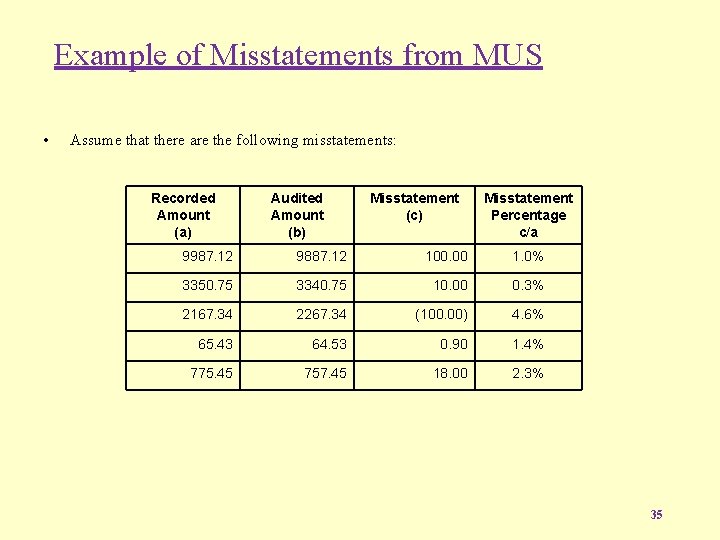

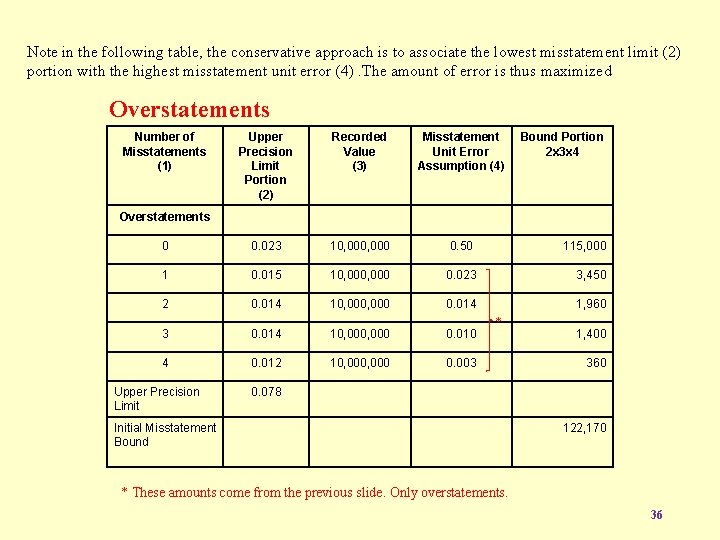

Note in the following table, the conservative approach is to associate the lowest misstatement limit (2) portion with the highest misstatement unit error (4). The amount of error is thus maximized Overstatements Number of Misstatements (1) Upper Precision Limit Portion (2) Recorded Value (3) Misstatement Unit Error Assumption (4) Bound Portion 2 x 3 x 4 0 0. 023 10, 000 0. 50 115, 000 1 0. 015 10, 000 0. 023 3, 450 2 0. 014 10, 000 0. 014 1, 960 3 0. 014 10, 000 0. 010 4 0. 012 10, 000 0. 003 Overstatements Upper Precision Limit * 1, 400 360 0. 078 Initial Misstatement Bound 122, 170 * These amounts come from the previous slide. Only overstatements. 36

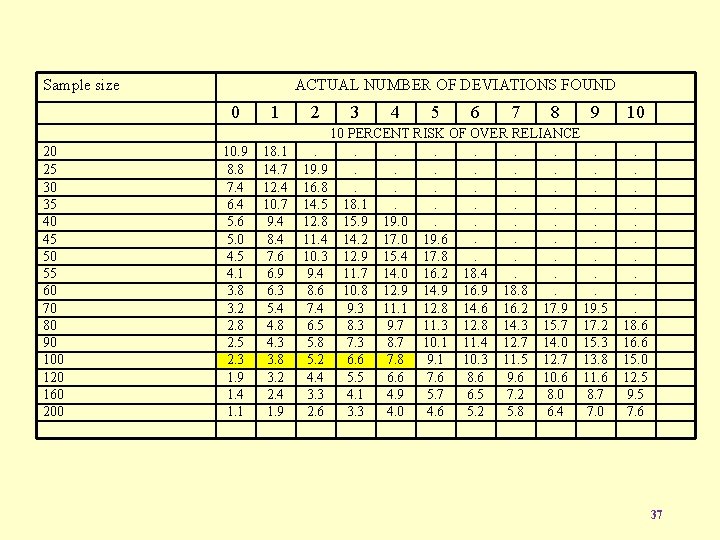

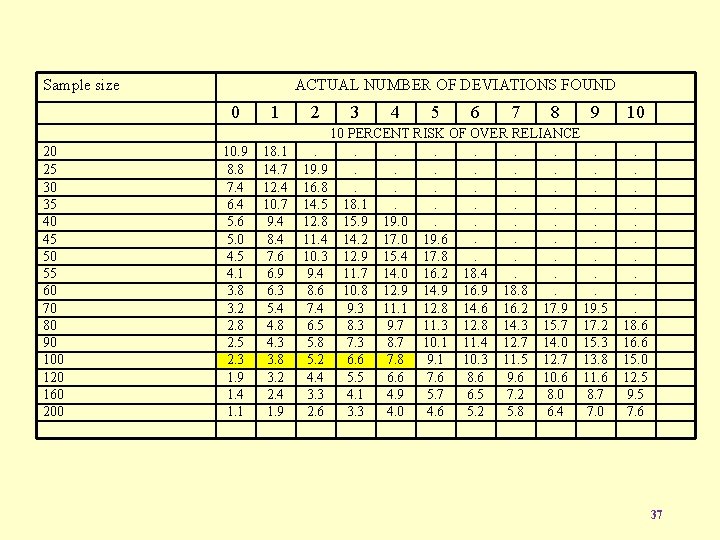

Sample size ACTUAL NUMBER OF DEVIATIONS FOUND 0 1 2 3 4 5 6 7 8 9 10 . . . . 17. 9 15. 7 14. 0 12. 7 10. 6 8. 0 6. 4 19. 5 17. 2 15. 3 13. 8 11. 6 8. 7 7. 0 . . 10 PERCENT RISK OF OVER RELIANCE 20 25 30 35 40 45 50 55 60 70 80 90 100 120 160 200 10. 9 8. 8 7. 4 6. 4 5. 6 5. 0 4. 5 4. 1 3. 8 3. 2 2. 8 2. 5 2. 3 1. 9 1. 4 1. 1 18. 1 14. 7 12. 4 10. 7 9. 4 8. 4 7. 6 6. 9 6. 3 5. 4 4. 8 4. 3 3. 8 3. 2 2. 4 1. 9 . 19. 9 16. 8 14. 5 12. 8 11. 4 10. 3 9. 4 8. 6 7. 4 6. 5 5. 8 5. 2 4. 4 3. 3 2. 6 . . . 18. 1 15. 9 14. 2 12. 9 11. 7 10. 8 9. 3 8. 3 7. 3 6. 6 5. 5 4. 1 3. 3 . . 19. 0 17. 0 15. 4 14. 0 12. 9 11. 1 9. 7 8. 7 7. 8 6. 6 4. 9 4. 0 . . . 19. 6 17. 8 16. 2 14. 9 12. 8 11. 3 10. 1 9. 1 7. 6 5. 7 4. 6 . . . . 18. 4 16. 9 14. 6 12. 8 11. 4 10. 3 8. 6 6. 5 5. 2 . . . . 18. 8 16. 2 14. 3 12. 7 11. 5 9. 6 7. 2 5. 8 18. 6 16. 6 15. 0 12. 5 9. 5 7. 6 37

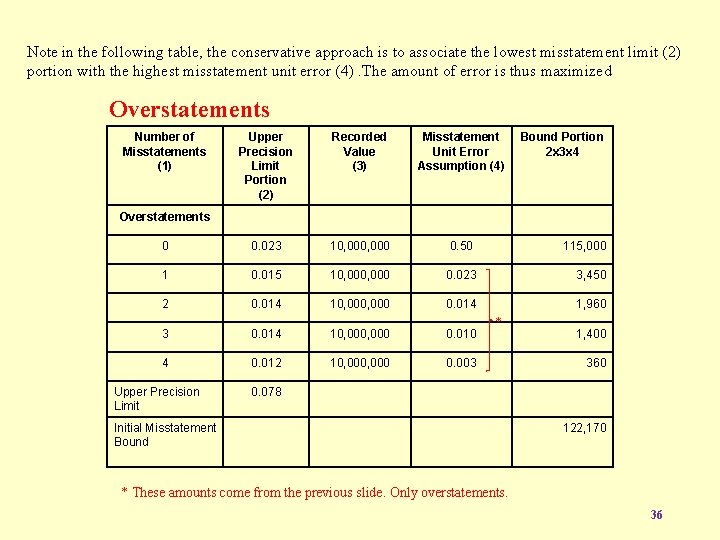

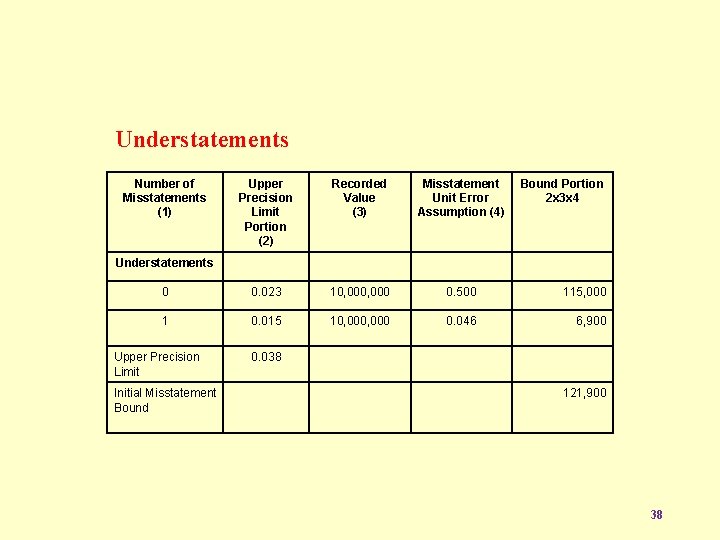

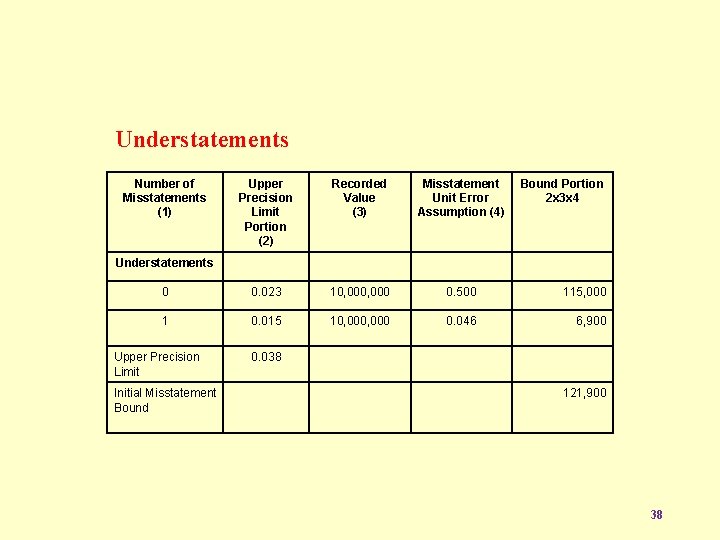

Understatements Number of Misstatements (1) Upper Precision Limit Portion (2) Recorded Value (3) Misstatement Unit Error Assumption (4) Bound Portion 2 x 3 x 4 0 0. 023 10, 000 0. 500 115, 000 1 0. 015 10, 000 0. 046 6, 900 Understatements Upper Precision Limit Initial Misstatement Bound 0. 038 121, 900 38

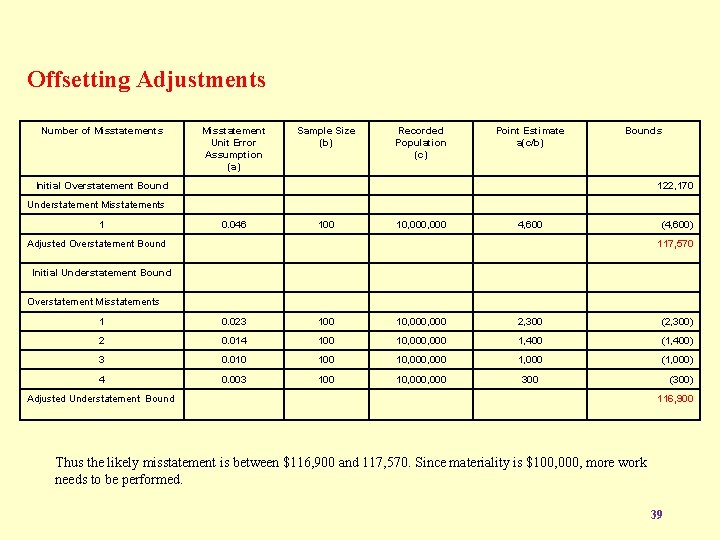

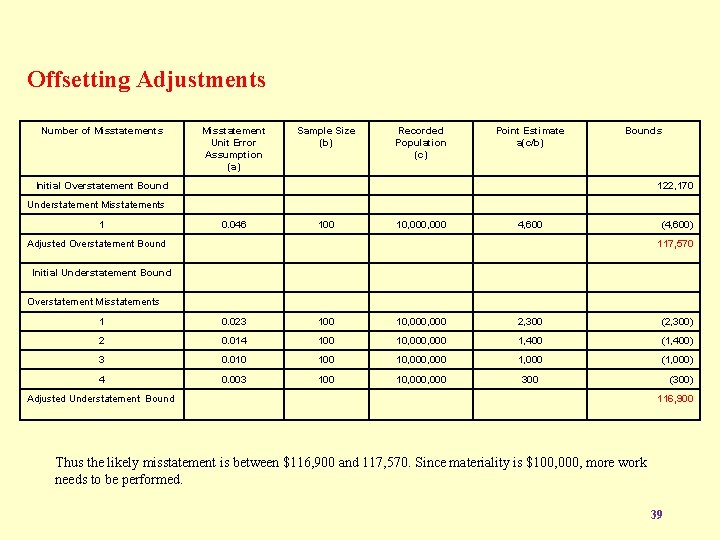

Offsetting Adjustments Number of Misstatements Misstatement Unit Error Assumption (a) Sample Size (b) Recorded Population (c) Point Estimate a(c/b) Bounds Initial Overstatement Bound 122, 170 Understatement Misstatements 1 0. 046 100 10, 000 4, 600 Adjusted Overstatement Bound (4, 600) 117, 570 Initial Understatement Bound Overstatement Misstatements 1 0. 023 100 10, 000 2, 300 (2, 300) 2 0. 014 100 10, 000 1, 400 (1, 400) 3 0. 010 10, 000 1, 000 (1, 000) 4 0. 003 100 10, 000 300 Adjusted Understatement Bound (300) 116, 900 Thus the likely misstatement is between $116, 900 and 117, 570. Since materiality is $100, 000, more work needs to be performed. 39

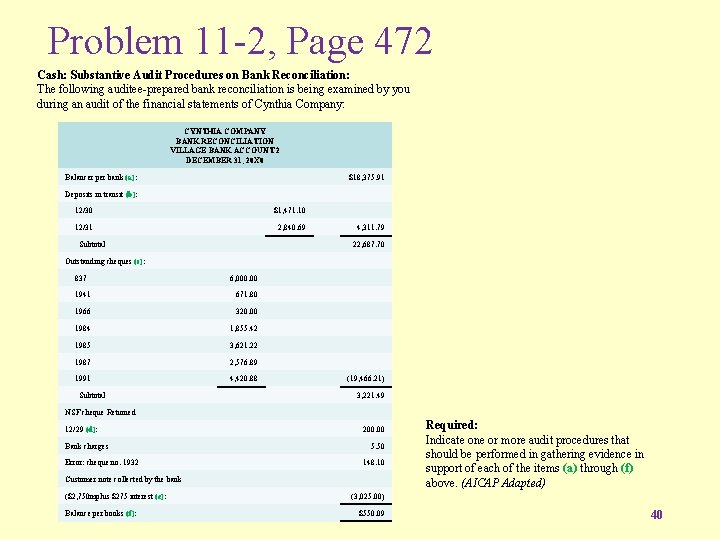

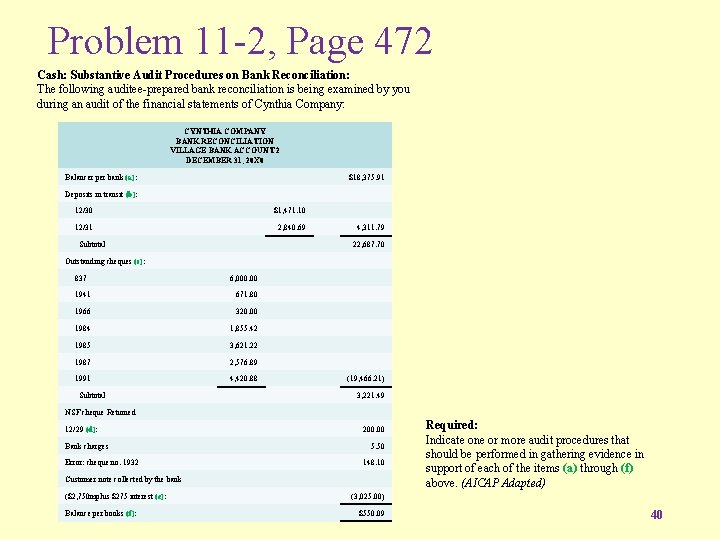

Problem 11 -2, Page 472 Cash: Substantive Audit Procedures on Bank Reconciliation: The following auditee-prepared bank reconciliation is being examined by you during an audit of the financial statements of Cynthia Company: CYNTHIA COMPANY BANK RECONCILIATION VILLAGE BANK ACCOUNT 2 DECEMBER 31, 20 X 0 Balancer per bank (a): $18, 375. 91 Deposits in transit (b): 12/30 $1, 471. 10 12/31 2, 840. 69 Subtotal 4, 311. 79 22, 687. 70 Outstanding cheques (c): 837 6, 000. 00 1941 671. 80 1966 320. 00 1984 1, 855. 42 1985 3, 621. 22 1987 2, 576. 89 1991 4, 420. 88 Subtotal (19, 466. 21) 3, 221. 49 NSF cheque Returned 12/29 (d): Bank charges Error: cheque no. 1932 200. 00 5. 50 148. 10 Customer note collected by the bank ($2, 750 mplus $275 interest (e): Balance per books (f): Required: Indicate one or more audit procedures that should be performed in gathering evidence in support of each of the items (a) through (f) above. (AICAP Adapted) (3, 025. 00) $550. 09 40

Problem 11 -4, Page 473 Alternative Accounts Receivable Procedures. Several accounts receivable confirmations have been returned with the notation “verification of vendor statements is no longer possible because our data processing system does not accumulate each vendor’s invoices. ” Required: What alternative auditing procedures could be used to audit these accounts receivable? (AICPA Adapted) 41