COMPANY PRESENTATION INVESTOR PRESENTATION January 2016 DISCLAIMER Disclaimer

- Slides: 41

COMPANY PRESENTATION INVESTOR PRESENTATION January 2016

DISCLAIMER Disclaimer – TRANSATLANTIC Mining Corp (“TRANSATLANTIC” or “The Company”) has prepared this presentation based on the information available to it. No representation or warranty, expressed or implied, is made as to the fairness, accuracy, completeness or correctness of the information, opinions and conclusions contained in this presentation. To the maximum extent permitted by law, none of TRANSATLANTIC, its directors, employees or agents, advisers, nor any other person accepts liability, including, without limitation, any liability arising from fault or negligence on the part of any of them or any other person, for any loss arising from the use of this presentation or its contents or otherwise arising in connection with it. This presentation contains general and background information about TRANSATLANTIC’s activities current as at the date of the presentation and should not be considered to be comprehensive or to comprise all the information that an investor should consider when making an investment decision. The information is provided in summary form, has not been independently verified, and should not be considered to be comprehensive or complete. It should be read solely in conjunction with the oral briefing provided by Transatlantic and all other documents provided to you by TRANSATLANTIC. All dollar terms expressed in this presentation are in US Dollars unless otherwise stated. Certain historical and technical information provided herein is given in reliance on outside sources that Transatlantic considers to be reliable. However, no guarantee is given as to the accuracy of any such information. No Offer – This presentation is not an offer, invitation, solicitation or other recommendation with respect to the subscription for, purchase or sale of any security, and neither this presentation nor anything in it shall form the basis of any contract of commitment whatsoever. Forward looking statements – This presentation may contain forward looking statements that are subject to risk factors associated with mining and production businesses. Forward-looking statements, including projections, forecasts and estimates, are provided as a general guide only and should not be relied on as an indication or guarantee of future performance and involve known and unknown risks, uncertainties and other factors, many of which are outside the control of TRANSATLANTIC. No investment advice - This presentation is not a financial product, investment advice or a recommendation to acquire TRANSATLANTIC securities and has been prepared without taking into account the objectives, financial situation or needs of individuals. Before making and investment decision prospective investors should consider the appropriateness of the information having regard to their own objectives, financial situation and needs, and seek legal, taxation and financial advice appropriate to their jurisdiction and circumstances. Transatlantic is not licensed to provide financial product advice in respect of its securities or any other financial products. Information in this Presentation remains subject to change without notice. 2 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

PRESENTATION CONTENT 1. COMPANY OVERVIEW 2. MONITOR COPPER – GOLD PROJECT 3. US GRANT GOLD PROJECT 4. GNAWEEDA SALE AGREEMENT 3 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

1. COMPANY OVERVIEW Transatlantic Mining Corp. v Transatlantic is an emerging metals miner focused on high margin metal deposits v Shareholder value is driven through development and efficient expansion of assets into a safe and profitable mining case 4 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

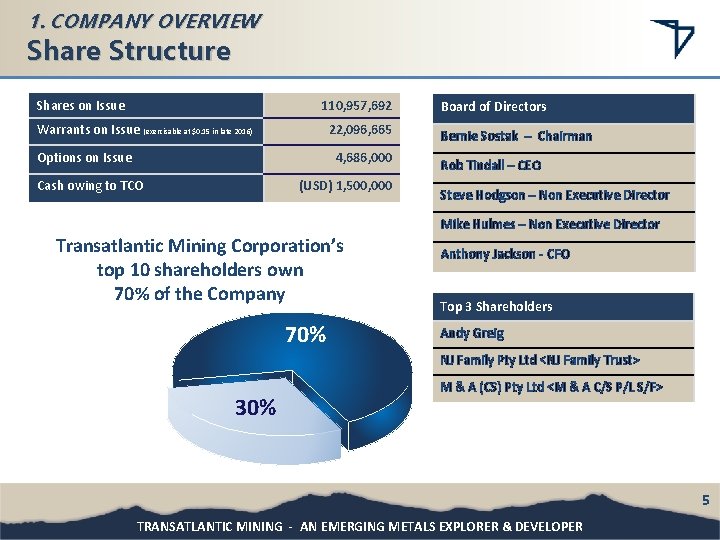

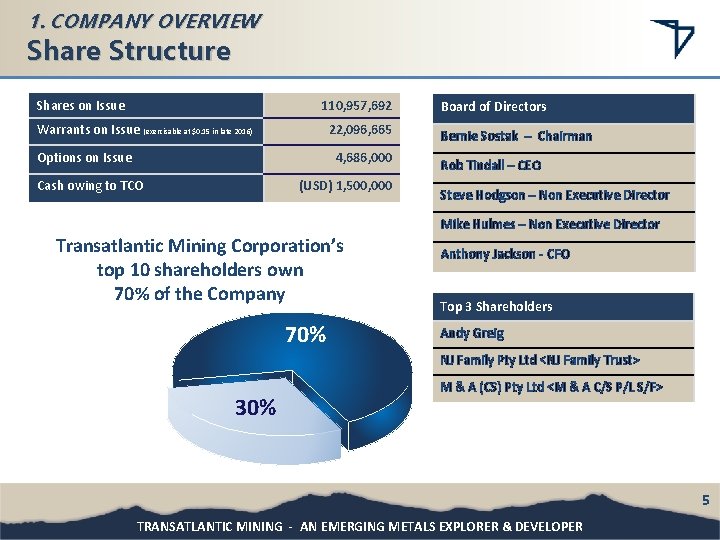

1. COMPANY OVERVIEW Share Structure Shares on Issue 110, 957, 692 Warrants on Issue (exercisable at $0. 15 in late 2016) 22, 096, 665 Options on Issue 4, 686, 000 Cash owing to TCO (USD) 1, 500, 000 Board of Directors Bernie Sostak – Chairman Rob Tindall – CEO Steve Hodgson – Non Executive Director Mike Hulmes – Non Executive Director Transatlantic Mining Corporation’s top 10 shareholders own 70% of the Company 70% Anthony Jackson - CFO 80% Top 3 Shareholders Andy Greig NJ Family Pty Ltd <NJ Family Trust> 30% M & A (CS) Pty Ltd <M & A C/S P/L S/F> 5 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

1. COMPANY OVERVIEW Board of Directors Bernie Sostak – Chairman is a geologist and mining professional with over 25 years experience in the mining industry. Mr. Sostak was formerly the General Manager of Business Development and Technical Services for ASX listed Northern Star Resources. During that time was responsible for growing the company to acquire and integrate 4 new mines. Prior to this role, he was the Director of Resource and Reserve Strategy for Barrick Gold Corporation for 28 mines and 12 projects globally. His experience includes exploration, mine geology, resource estimations, mine planning, feasibilities, mine development, operations and executive management. Rob Tindall – CEO has over 20 years of experience in the finance industry. Having held senior advisory roles Rob has helped fund mining and energy projects globally. Rob holds a Bachelor of Arts degree and a Master of Taxation degree. Rob is Head of Corporate, and director of GTG Capital Partners. Rob is currently involved in mining and petroleum companies including Chairman and CEO of Kengaku Petroleum, with Petroleum Prospecting Licenses in the Onshore Papuan Basin. Steve Hodgson – Non Executive Director Steve is currently the Director for Sales and Marketing at UC RUSAL, responsible for the company's commercial strategy, pricing and worldwide sales. He is a member of the company’s management board and also chairs RUSAL's Chinese base metals trading company, North United Aluminium. Mr Hodgson serves on the marketing committee of Norilsk Nickel, advising the company on its commercial strategy. In his previous role, he was CEO and President of the Bauxite and Alumina Division of Rio Tinto and during this period held the post of President of the Australian Aluminium Council. Prior to this Steve was the Managing Director of Rio Tinto's Diamond Division. Mike Hulmes is a mining engineer with over 30 years experience in mining operations and projects in Australia, Papua New Guinea, Portugal, Spain, Saudi Arabia and Tanzania. Mr Hulmes was formerly the Managing Director of Somincor and was responsible for the Neves-Corvo and Aguablanca Mines in Portugal and Spain respectively. Prior to that his roles included General Manager Operations at the Ok Tedi Mine in Papua New Guinea, COO for Citadel Resources during the development of the Jabal Sayid deposit in Saudi Arabia, Mike was also the General Manager Australian Operations for Barrick Australia with responsibility for five mines and prior General Manager of Plutonic Gold Mine in Western Australia. 6 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

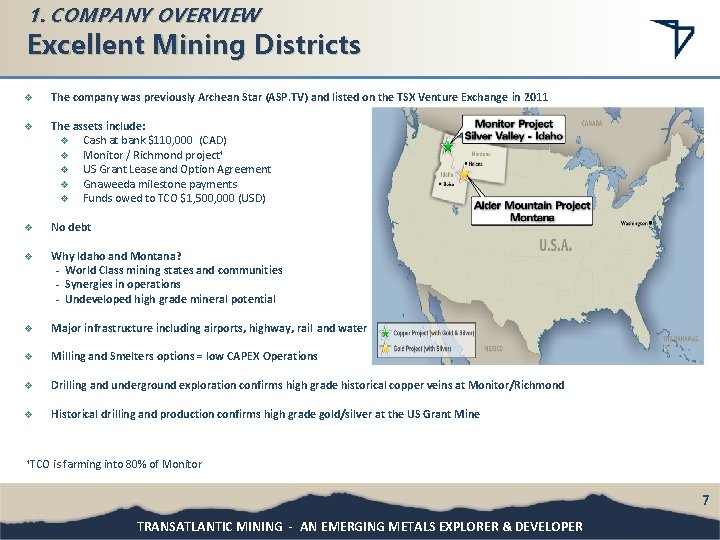

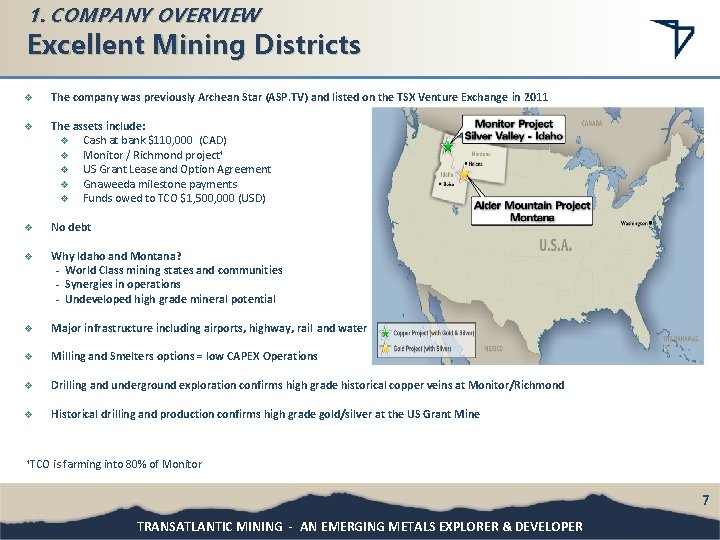

1. COMPANY OVERVIEW Excellent Mining Districts v The company was previously Archean Star (ASP. TV) and listed on the TSX Venture Exchange in 2011 v The assets include: v Cash at bank $110, 000 (CAD) v Monitor / Richmond project¹ v US Grant Lease and Option Agreement v Gnaweeda milestone payments v Funds owed to TCO $1, 500, 000 (USD) v No debt v Why Idaho and Montana? - World Class mining states and communities - Synergies in operations - Undeveloped high grade mineral potential v Major infrastructure including airports, highway, rail and water v Milling and Smelters options = low CAPEX Operations v Drilling and underground exploration confirms high grade historical copper veins at Monitor/Richmond v Historical drilling and production confirms high grade gold/silver at the US Grant Mine ¹TCO is farming into 80% of Monitor 7 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

PRESENTATION CONTENT 1. COMPANY OVERVIEW 2. MONITOR COPPER – GOLD PROJECT 3. US GRANT GOLD PROJECT 4. GNAWEEDA GOLD PROJECT 8 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

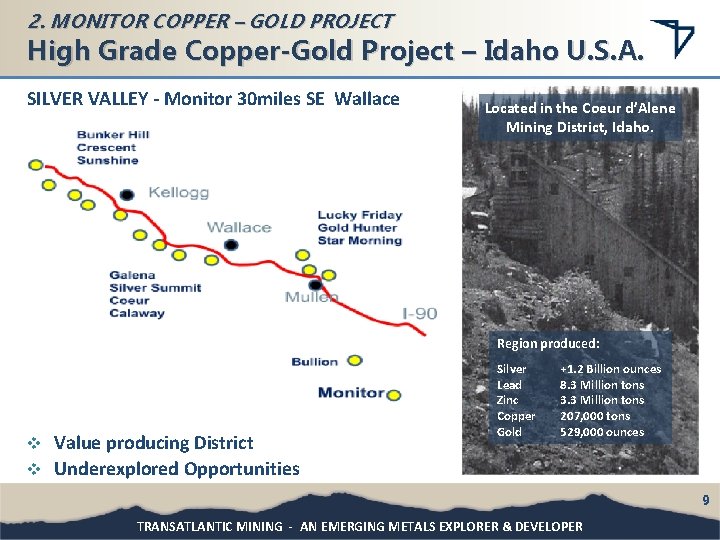

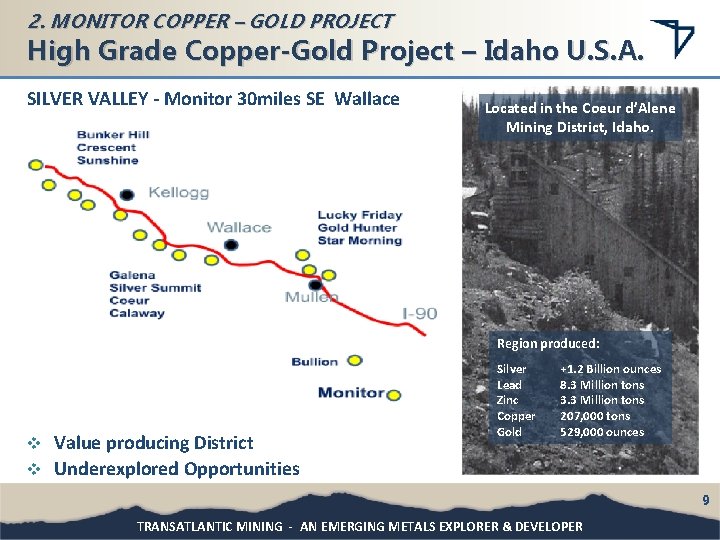

2. MONITOR COPPER – GOLD PROJECT High Grade Copper-Gold Project – Idaho U. S. A. SILVER VALLEY - Monitor 30 miles SE Wallace Located in the Coeur d’Alene Mining District, Idaho. Region produced: Value producing District v Underexplored Opportunities v Silver Lead Zinc Copper Gold +1. 2 Billion ounces 8. 3 Million tons 3. 3 Million tons 207, 000 tons 529, 000 ounces 9 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

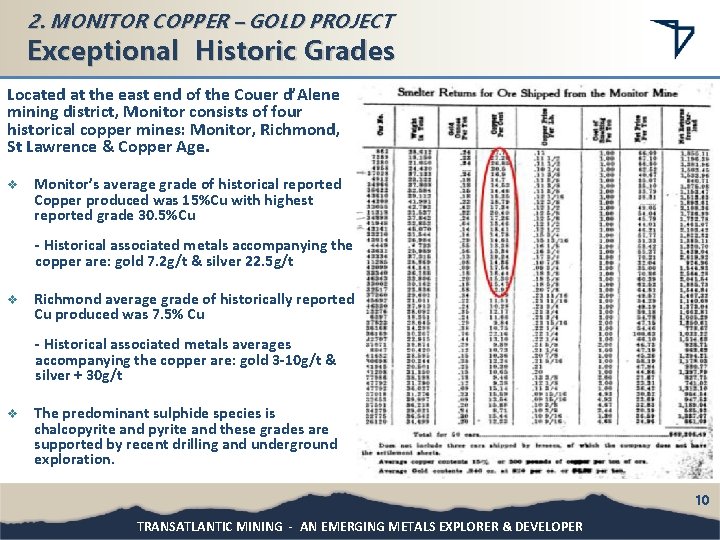

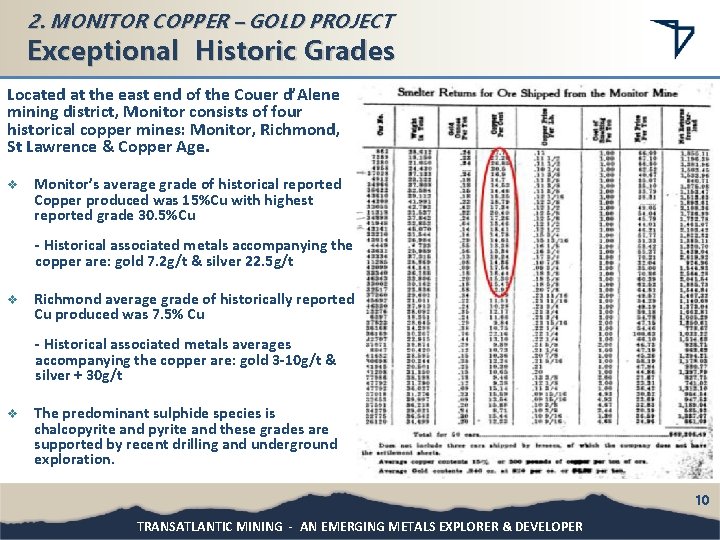

2. MONITOR COPPER – GOLD PROJECT Exceptional Historic Grades Located at the east end of the Couer d’Alene mining district, Monitor consists of four historical copper mines: Monitor, Richmond, St Lawrence & Copper Age. v Monitor’s average grade of historical reported Copper produced was 15%Cu with highest reported grade 30. 5%Cu - Historical associated metals accompanying the copper are: gold 7. 2 g/t & silver 22. 5 g/t v Richmond average grade of historically reported Cu produced was 7. 5% Cu - Historical associated metals averages accompanying the copper are: gold 3 -10 g/t & silver + 30 g/t v The predominant sulphide species is chalcopyrite and these grades are supported by recent drilling and underground exploration. 10 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

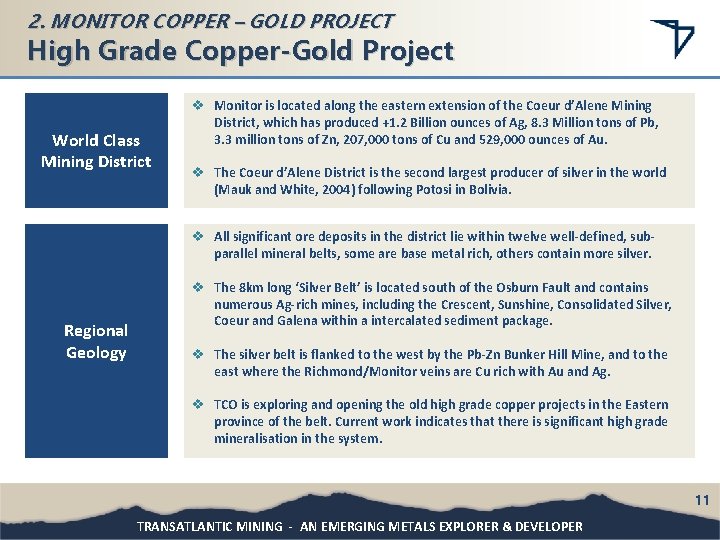

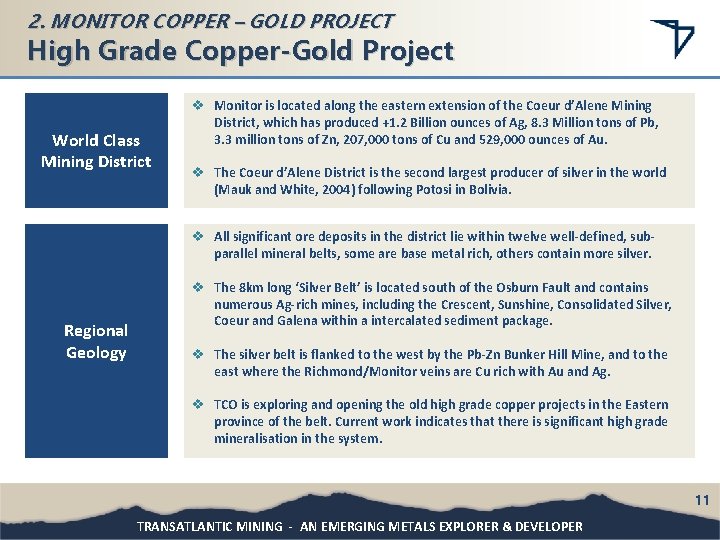

2. MONITOR COPPER – GOLD PROJECT High Grade Copper-Gold Project World Class Mining District v Monitor is located along the eastern extension of the Coeur d’Alene Mining District, which has produced +1. 2 Billion ounces of Ag, 8. 3 Million tons of Pb, 3. 3 million tons of Zn, 207, 000 tons of Cu and 529, 000 ounces of Au. v The Coeur d’Alene District is the second largest producer of silver in the world (Mauk and White, 2004) following Potosi in Bolivia. v All significant ore deposits in the district lie within twelve well-defined, subparallel mineral belts, some are base metal rich, others contain more silver. Regional Geology v The 8 km long ‘Silver Belt’ is located south of the Osburn Fault and contains numerous Ag-rich mines, including the Crescent, Sunshine, Consolidated Silver, Coeur and Galena within a intercalated sediment package. v The silver belt is flanked to the west by the Pb-Zn Bunker Hill Mine, and to the east where the Richmond/Monitor veins are Cu rich with Au and Ag. v TCO is exploring and opening the old high grade copper projects in the Eastern province of the belt. Current work indicates that there is significant high grade mineralisation in the system. 11 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

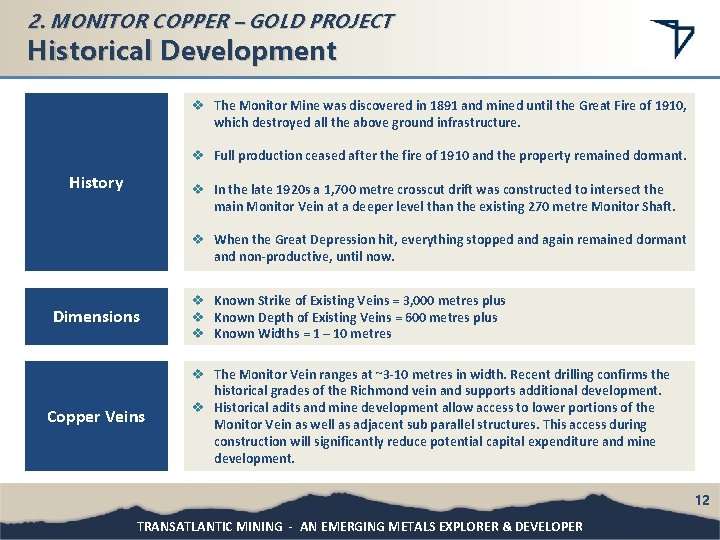

2. MONITOR COPPER – GOLD PROJECT Historical Development v The Monitor Mine was discovered in 1891 and mined until the Great Fire of 1910, which destroyed all the above ground infrastructure. v Full production ceased after the fire of 1910 and the property remained dormant. History v In the late 1920 s a 1, 700 metre crosscut drift was constructed to intersect the main Monitor Vein at a deeper level than the existing 270 metre Monitor Shaft. v When the Great Depression hit, everything stopped and again remained dormant and non-productive, until now. Dimensions Copper Veins v Known Strike of Existing Veins = 3, 000 metres plus v Known Depth of Existing Veins = 600 metres plus v Known Widths = 1 – 10 metres v The Monitor Vein ranges at ~3 -10 metres in width. Recent drilling confirms the historical grades of the Richmond vein and supports additional development. v Historical adits and mine development allow access to lower portions of the Monitor Vein as well as adjacent sub parallel structures. This access during construction will significantly reduce potential capital expenditure and mine development. 12 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

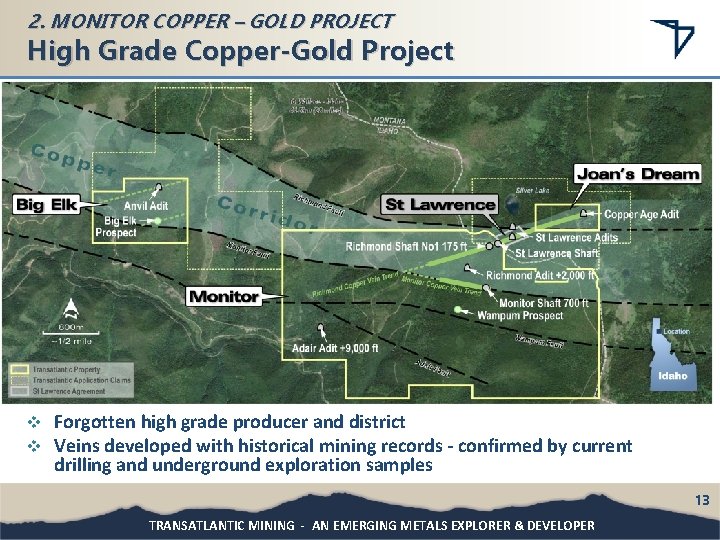

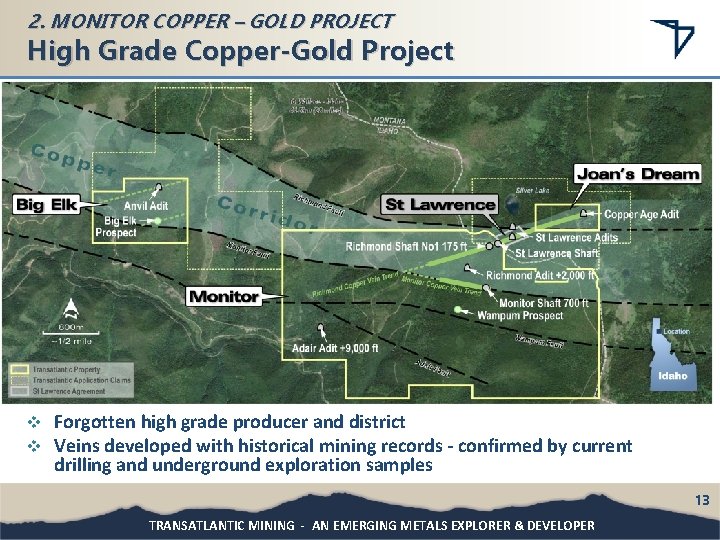

2. MONITOR COPPER – GOLD PROJECT High Grade Copper-Gold Project v v Forgotten high grade producer and district Veins developed with historical mining records - confirmed by current drilling and underground exploration samples 13 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

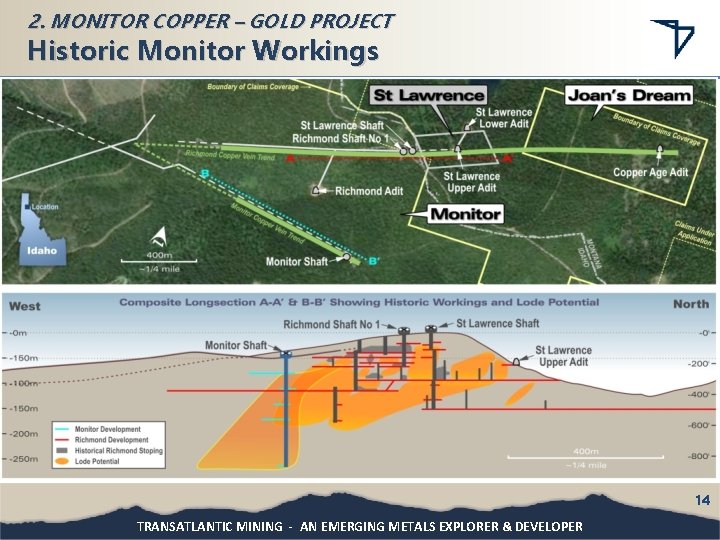

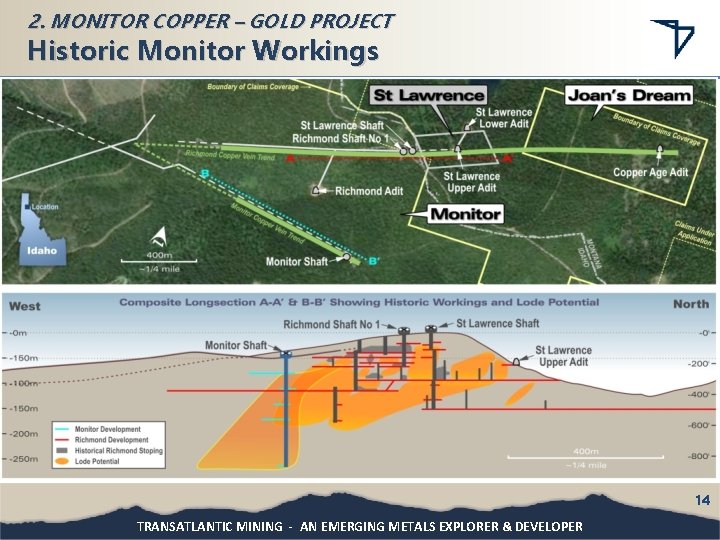

2. MONITOR COPPER – GOLD PROJECT Historic Monitor Workings 14 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

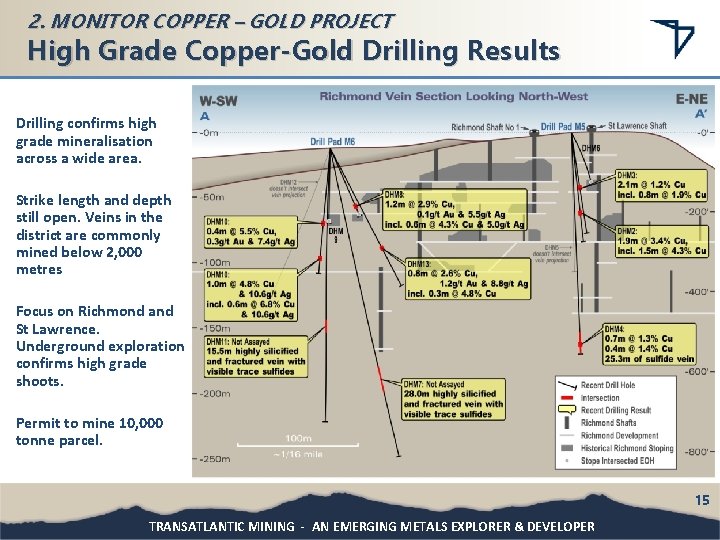

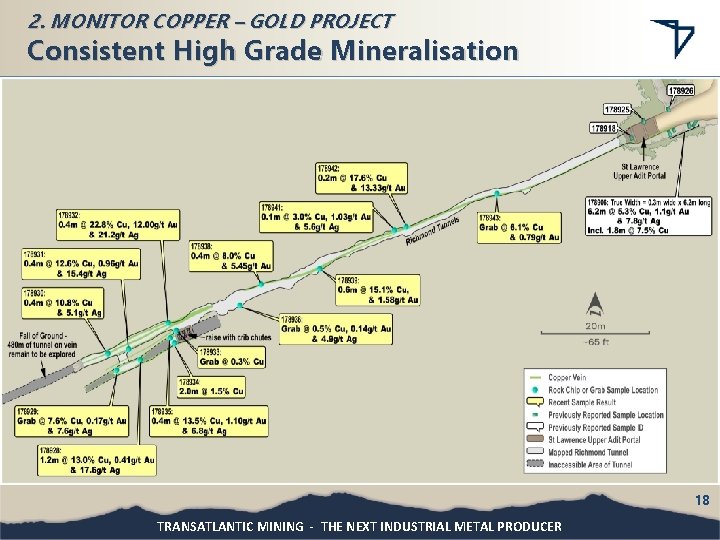

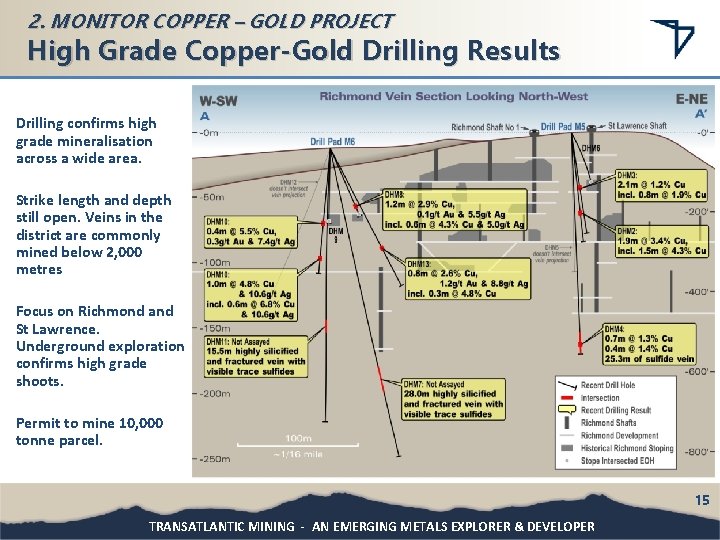

2. MONITOR COPPER – GOLD PROJECT High Grade Copper-Gold Drilling Results Drilling confirms high grade mineralisation across a wide area. Strike length and depth still open. Veins in the district are commonly mined below 2, 000 metres Focus on Richmond and St Lawrence. Underground exploration confirms high grade shoots. Permit to mine 10, 000 tonne parcel. 15 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

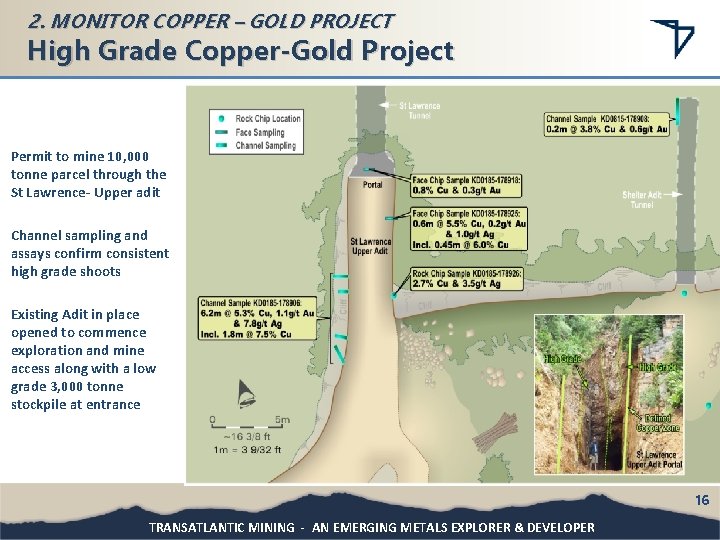

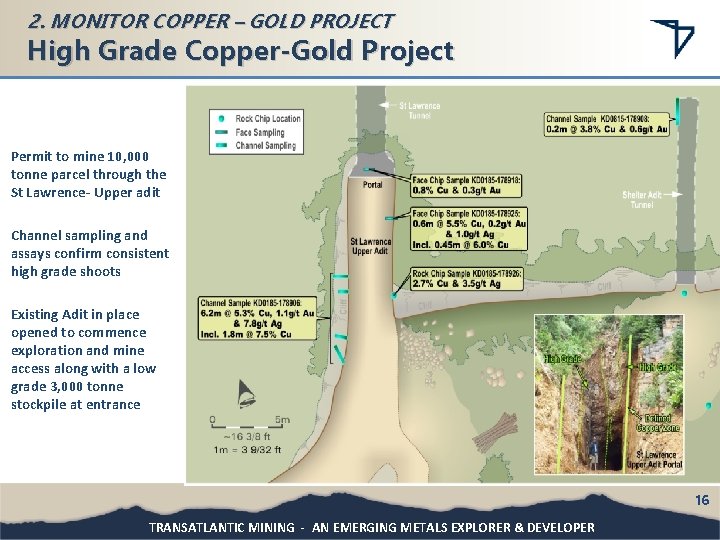

2. MONITOR COPPER – GOLD PROJECT High Grade Copper-Gold Project Permit to mine 10, 000 tonne parcel through the St Lawrence- Upper adit Channel sampling and assays confirm consistent high grade shoots Existing Adit in place opened to commence exploration and mine access along with a low grade 3, 000 tonne stockpile at entrance 16 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

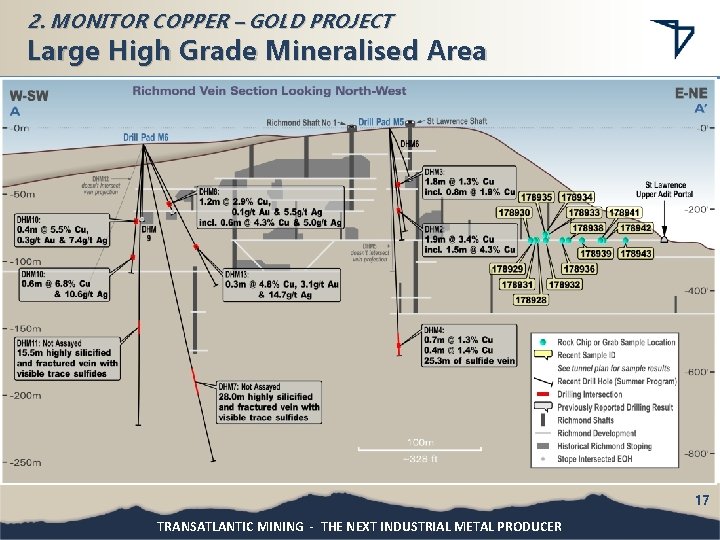

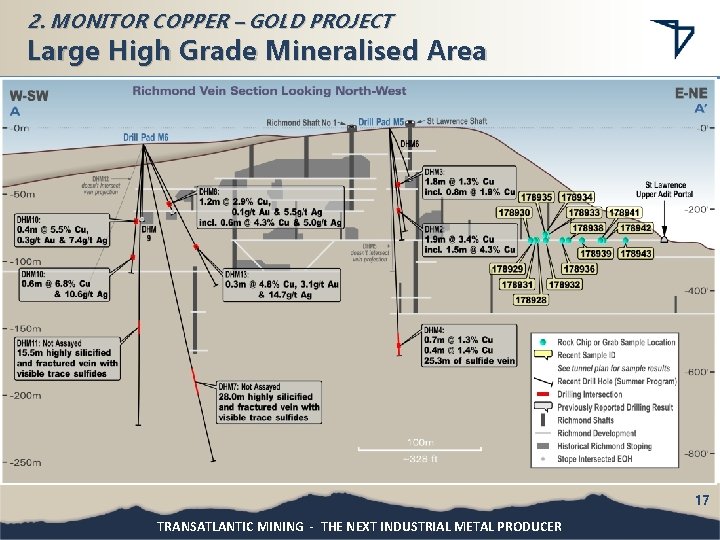

2. MONITOR COPPER – GOLD PROJECT Large High Grade Mineralised Area 17 TRANSATLANTIC MINING - THE NEXT INDUSTRIAL METAL PRODUCER

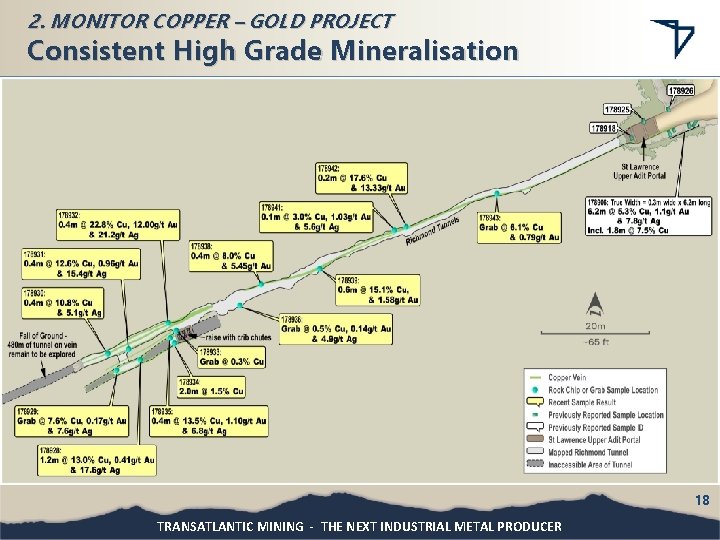

2. MONITOR COPPER – GOLD PROJECT Consistent High Grade Mineralisation 18 TRANSATLANTIC MINING - THE NEXT INDUSTRIAL METAL PRODUCER

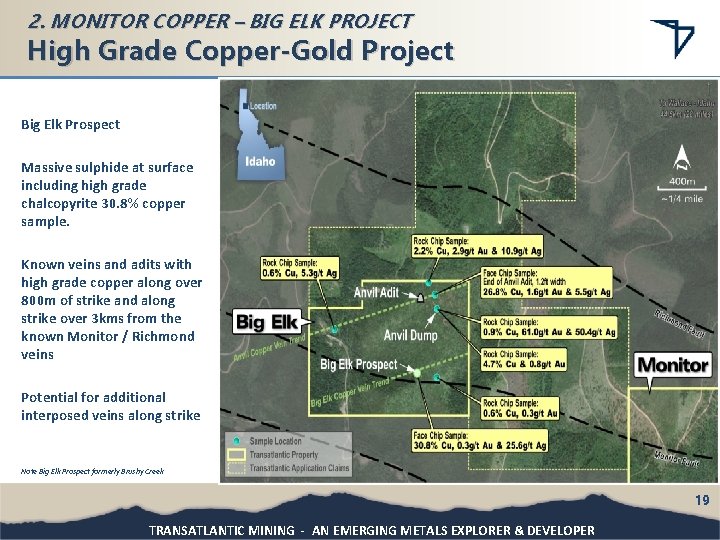

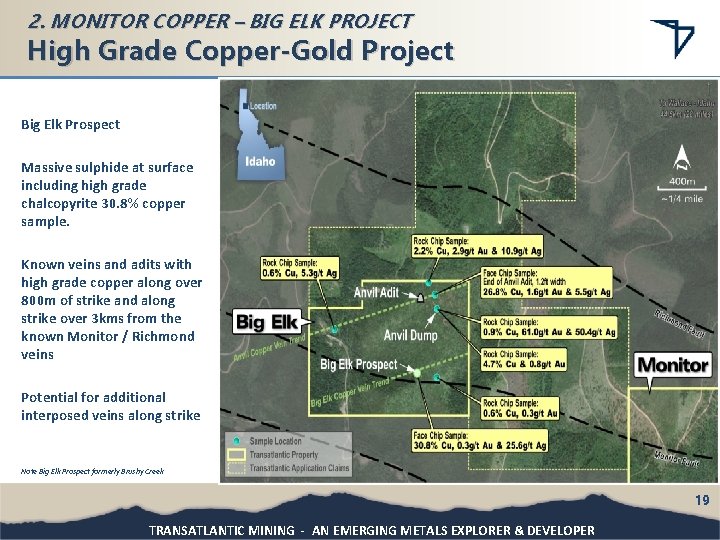

2. MONITOR COPPER – BIG ELK PROJECT High Grade Copper-Gold Project Big Elk Prospect Massive sulphide at surface including high grade chalcopyrite 30. 8% copper sample. Known veins and adits with high grade copper along over 800 m of strike and along strike over 3 kms from the known Monitor / Richmond veins Potential for additional interposed veins along strike Note Big Elk Prospect formerly Brushy Creek 19 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

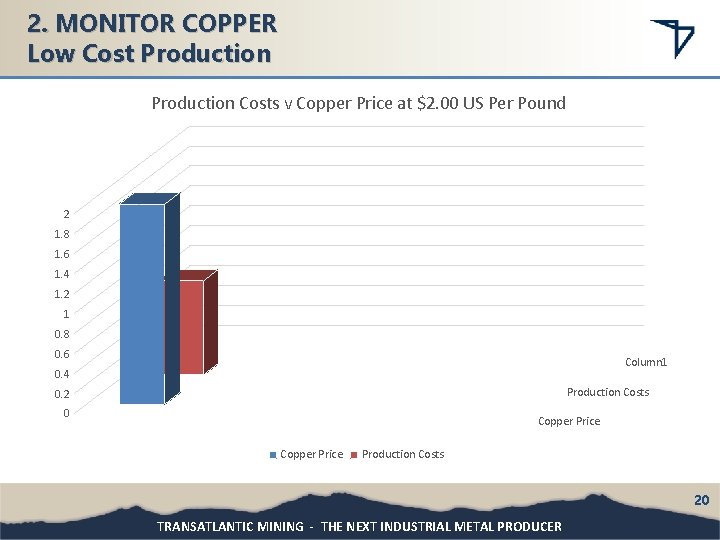

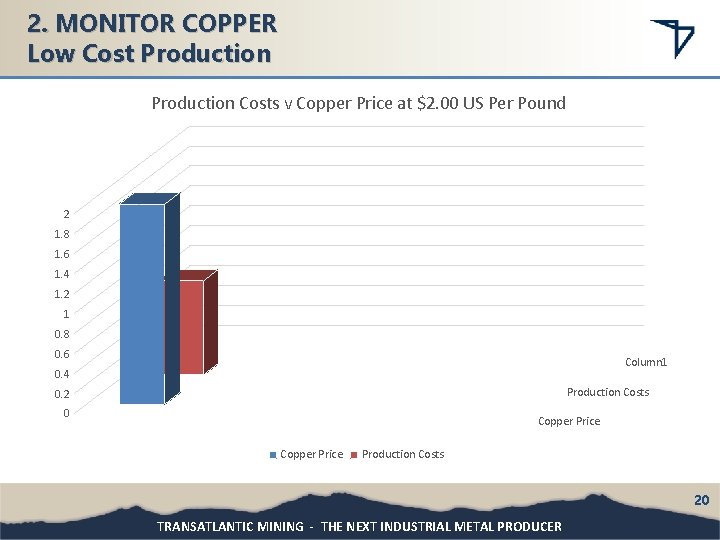

2. MONITOR COPPER Low Cost Production Costs v Copper Price at $2. 00 US Per Pound 2 1. 8 1. 6 1. 4 1. 2 1 0. 8 0. 6 Column 1 0. 4 Production Costs 0. 2 0 Copper Price Production Costs 20 TRANSATLANTIC MINING - THE NEXT INDUSTRIAL METAL PRODUCER

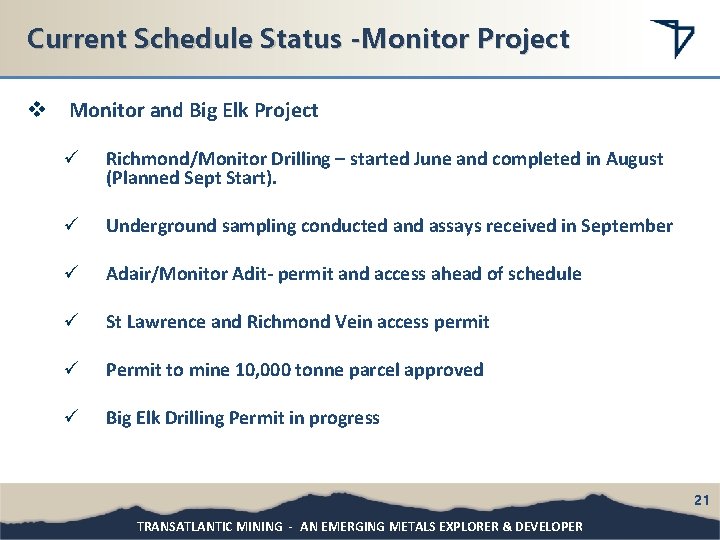

Current Schedule Status -Monitor Project v Monitor and Big Elk Project ü Richmond/Monitor Drilling – started June and completed in August (Planned Sept Start). ü Underground sampling conducted and assays received in September ü Adair/Monitor Adit- permit and access ahead of schedule ü St Lawrence and Richmond Vein access permit ü Permit to mine 10, 000 tonne parcel approved ü Big Elk Drilling Permit in progress 21 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

PRESENTATION CONTENT 1. COMPANY OVERVIEW 2. MONITOR COPPER – GOLD PROJECT 3. US GRANT GOLD PROJECT 4. GNAWEEDA GOLD PROJECT 22 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

3. US GRANT GOLD PROJECT – MONTANA USA LEASE AND OPTION AGREEMENT TCO has entered into an agreement to lease the US Grant Mine and Mill with an exclusive option to Purchase for $6 M USD. v Initial 4 month DD period for $50, 000 USD. Option to extend lease for 12 months at $25, 000 USD per month. Full rights to all production and toll treating proceeds. Option to purchase for $6 M USD less any lease payments. Purchase is paid in annual instalments. v - $2 M (less lease payments) immediately following 16 mth lease v -$2 M one year after the first payment v -$2 M one year after the 2 nd payment v 23 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

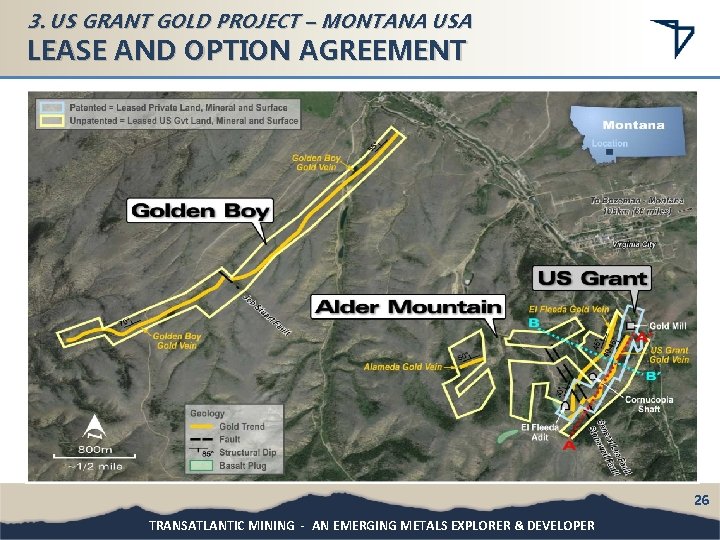

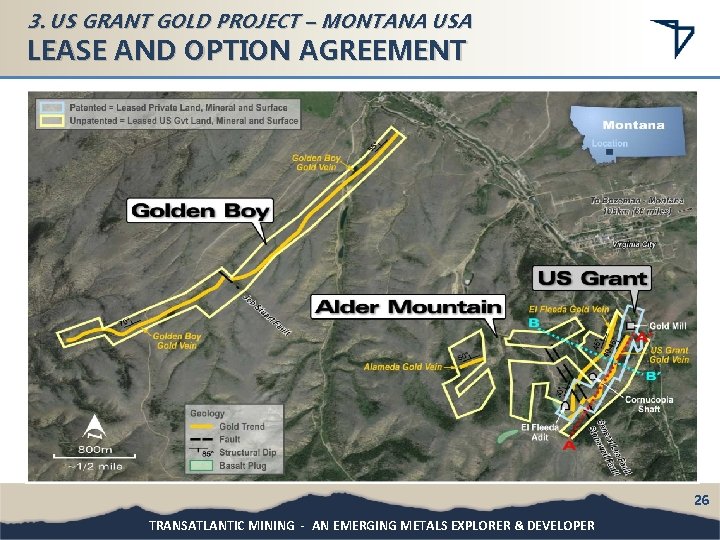

3. US GRANT GOLD PROJECT – MONTANA USA LEASE AND OPTION AGREEMENT World Class Mining District v The US Grant is located in Virginia City Montana. The first discovery of gold in Montana was on the US Grant Property. v The district has produced over 9 million ounces of gold from predominantly from alluvial mining techniques and high grade veins. v Quartz veining hosted in a pre-Cambrian biotite schist of the Tobacco Root Field. v Quartz fissures strike N 40 W and dipping 45 degrees and vary in width from 0. 5 m to 7 m in width. Regional Geology v US Grant Vein has been mapped over 1200 m of surface outcrop on the current land position, with only 600 m partially having any historical development or production. v El Fleeda vein is parallel and only 180 m in the hangingwall of the US grant vein with an unexplored strike length of 1250 m. v Golden Boy vein sets (2) have a total 7, 900 m of unexplored strike length. 24 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

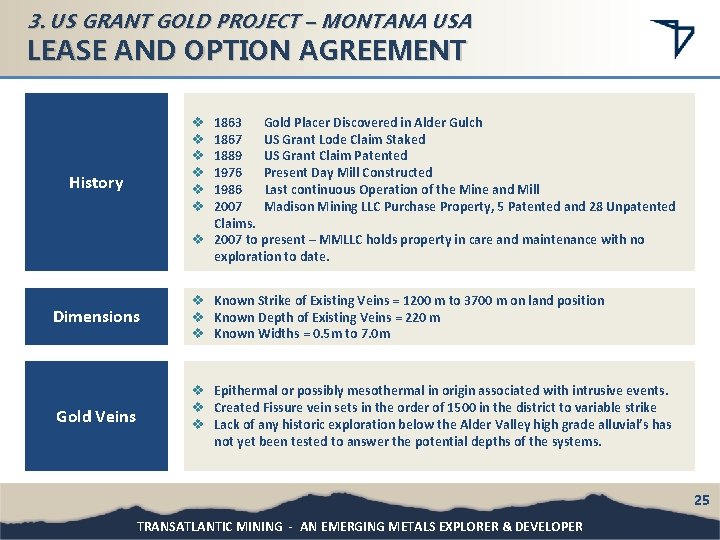

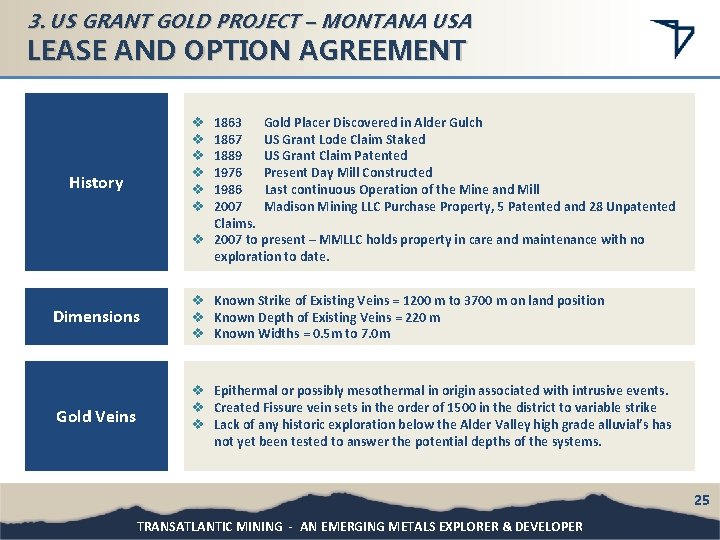

3. US GRANT GOLD PROJECT – MONTANA USA LEASE AND OPTION AGREEMENT 1863 Gold Placer Discovered in Alder Gulch 1867 US Grant Lode Claim Staked 1889 US Grant Claim Patented 1976 Present Day Mill Constructed 1986 Last continuous Operation of the Mine and Mill 2007 Madison Mining LLC Purchase Property, 5 Patented and 28 Unpatented Claims. v 2007 to present – MMLLC holds property in care and maintenance with no exploration to date. v v v History Dimensions v Known Strike of Existing Veins = 1200 m to 3700 m on land position v Known Depth of Existing Veins = 220 m v Known Widths = 0. 5 m to 7. 0 m Gold Veins v Epithermal or possibly mesothermal in origin associated with intrusive events. v Created Fissure vein sets in the order of 1500 in the district to variable strike v Lack of any historic exploration below the Alder Valley high grade alluvial’s has not yet been tested to answer the potential depths of the systems. 25 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

3. US GRANT GOLD PROJECT – MONTANA USA LEASE AND OPTION AGREEMENT 26 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

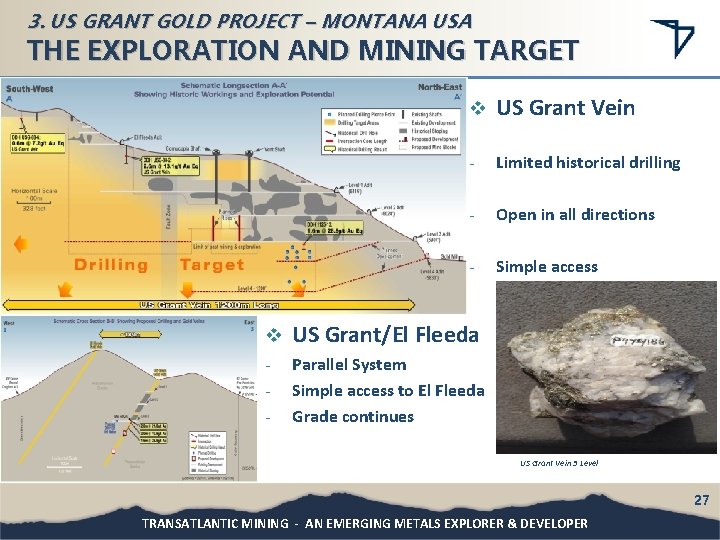

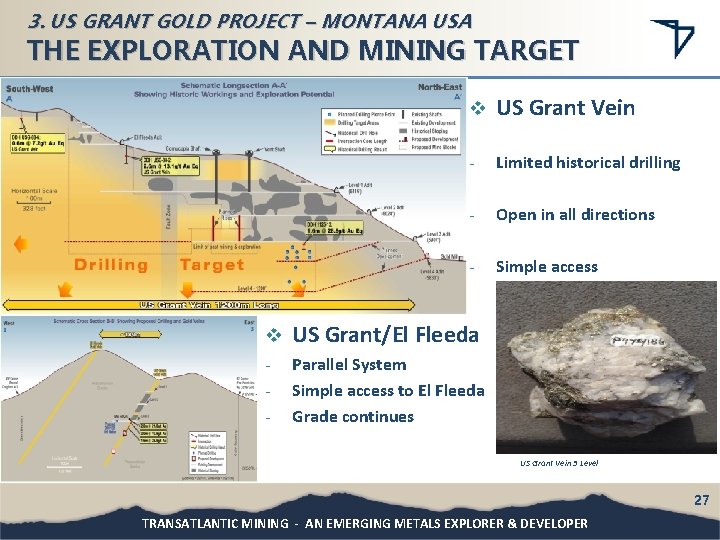

3. US GRANT GOLD PROJECT – MONTANA USA THE EXPLORATION AND MINING TARGET v US Grant Vein - Limited historical drilling - Open in all directions - Simple access v US Grant/El Fleeda - Parallel System Simple access to El Fleeda Grade continues - US Grant Vein 3 Level 27 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

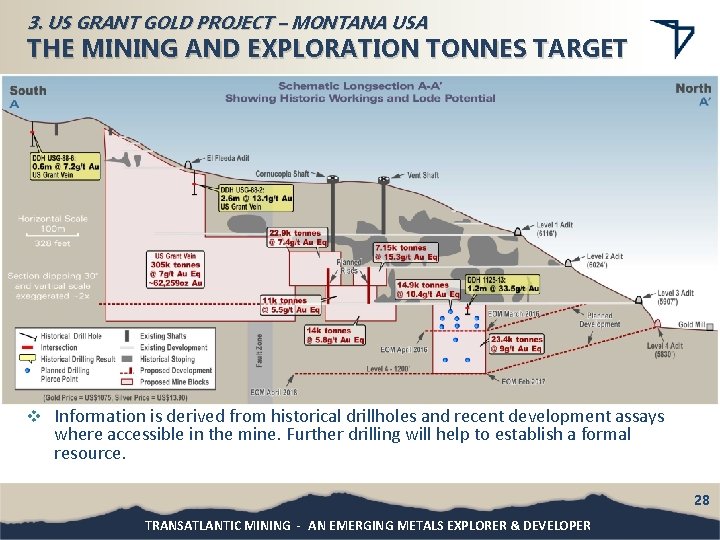

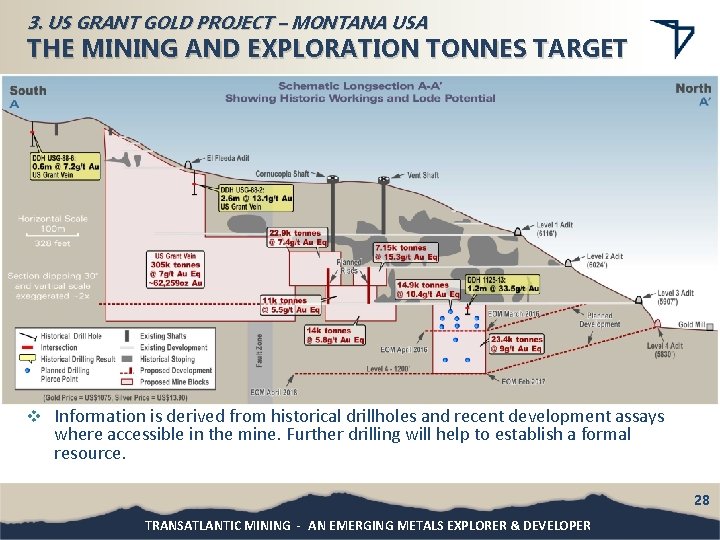

3. US GRANT GOLD PROJECT – MONTANA USA THE MINING AND EXPLORATION TONNES TARGET v Information is derived from historical drillholes and recent development assays where accessible in the mine. Further drilling will help to establish a formal resource. 28 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

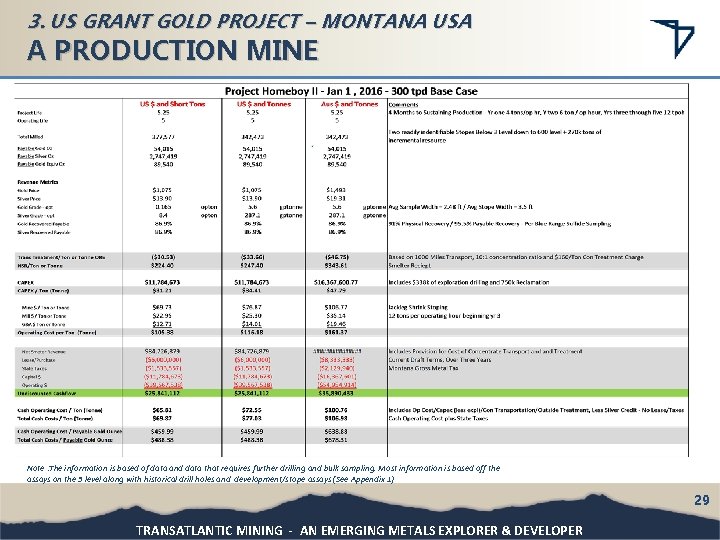

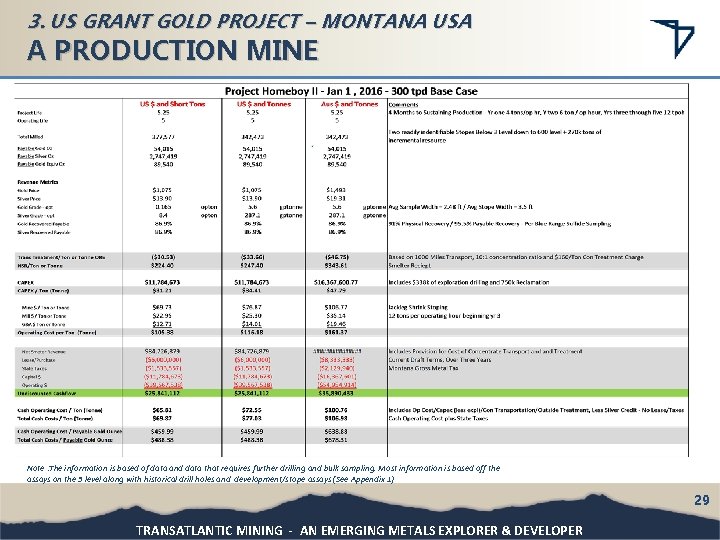

3. US GRANT GOLD PROJECT – MONTANA USA A PRODUCTION MINE Note : The information is based of data and data that requires further drilling and bulk sampling. Most information is based off the assays on the 3 level along with historical drill holes and development/stope assays (See Appendix 1) 29 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

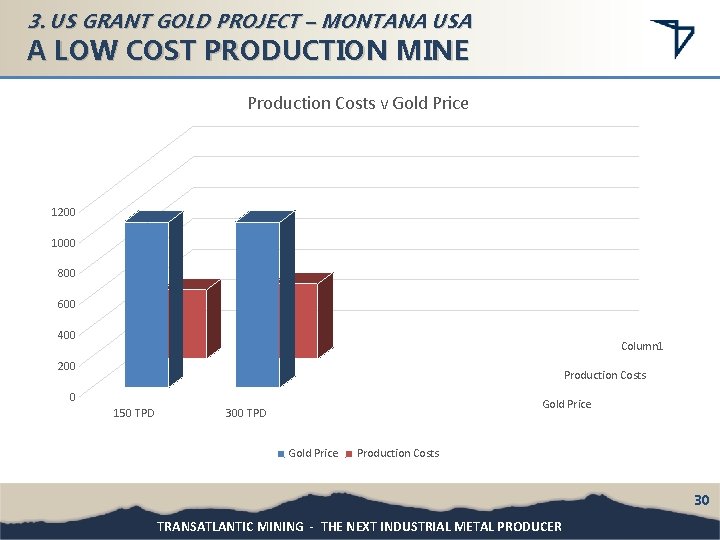

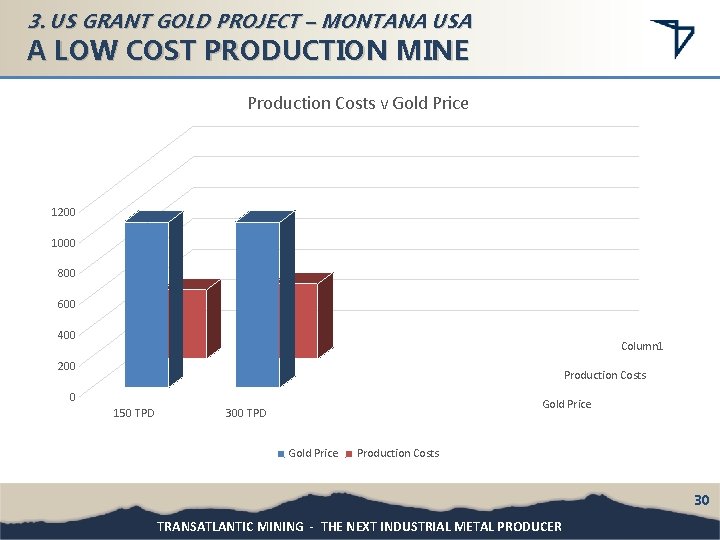

3. US GRANT GOLD PROJECT – MONTANA USA A LOW COST PRODUCTION MINE Production Costs v Gold Price 1200 1000 800 600 400 Column 1 200 Production Costs 0 150 TPD Gold Price 300 TPD Gold Price Production Costs 30 TRANSATLANTIC MINING - THE NEXT INDUSTRIAL METAL PRODUCER

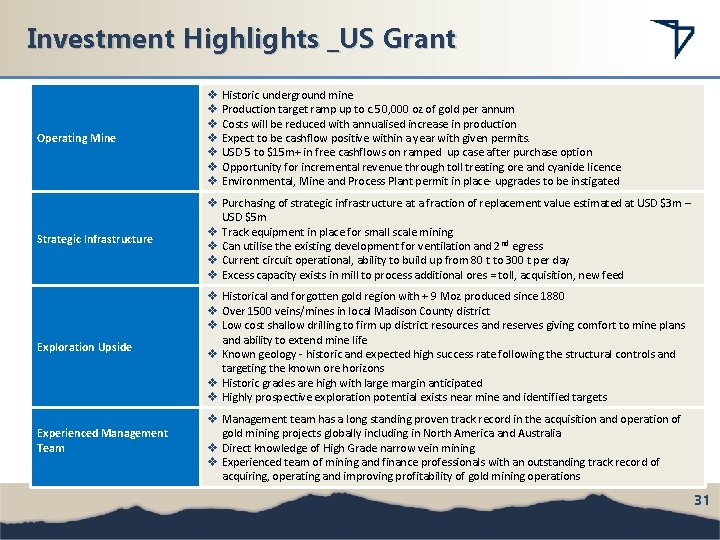

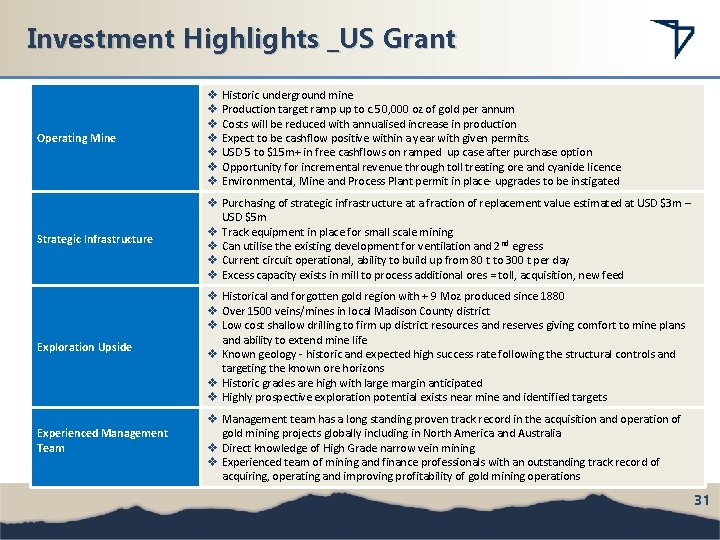

Investment Highlights _US Grant Operating Mine v Historic underground mine v Production target ramp up to c. 50, 000 oz of gold per annum v Costs will be reduced with annualised increase in production v Expect to be cashflow positive within a year with given permits. v USD 5 to $15 m+ in free cashflows on ramped up case after purchase option v Opportunity for incremental revenue through toll treating ore and cyanide licence v Environmental, Mine and Process Plant permit in place- upgrades to be instigated Strategic Infrastructure v Purchasing of strategic infrastructure at a fraction of replacement value estimated at USD $3 m – USD $5 m v Track equipment in place for small scale mining v Can utilise the existing development for ventilation and 2 nd egress v Current circuit operational, ability to build up from 80 t to 300 t per day v Excess capacity exists in mill to process additional ores = toll, acquisition, new feed Exploration Upside v Historical and forgotten gold region with + 9 Moz produced since 1880 v Over 1500 veins/mines in local Madison County district v Low cost shallow drilling to firm up district resources and reserves giving comfort to mine plans and ability to extend mine life v Known geology - historic and expected high success rate following the structural controls and targeting the known ore horizons v Historic grades are high with large margin anticipated v Highly prospective exploration potential exists near mine and identified targets Experienced Management Team v Management team has a long standing proven track record in the acquisition and operation of gold mining projects globally including in North America and Australia v Direct knowledge of High Grade narrow vein mining v Experienced team of mining and finance professionals with an outstanding track record of acquiring, operating and improving profitability of gold mining operations 31

PRESENTATION CONTENT 1. COMPANY OVERVIEW 2. MONITOR COPPER – GOLD PROJECT 3. US GRANT GOLD PROJECT 4. GNAWEEDA GOLD PROJECT 32 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

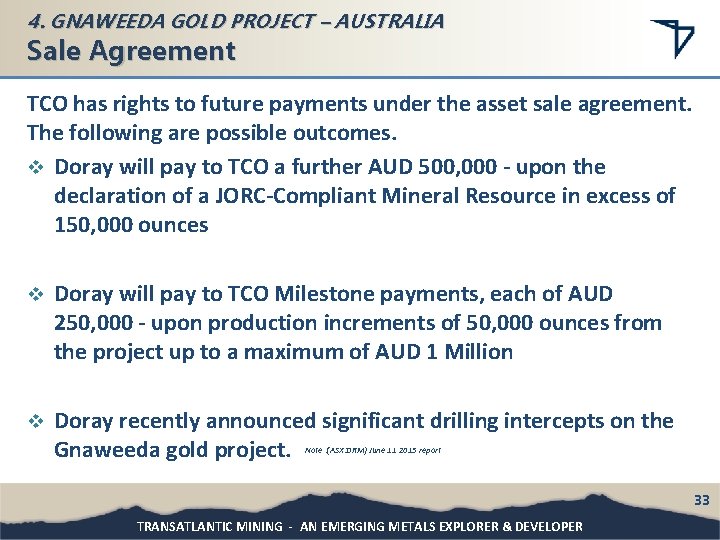

4. GNAWEEDA GOLD PROJECT – AUSTRALIA Sale Agreement TCO has rights to future payments under the asset sale agreement. The following are possible outcomes. v Doray will pay to TCO a further AUD 500, 000 - upon the declaration of a JORC-Compliant Mineral Resource in excess of 150, 000 ounces v Doray will pay to TCO Milestone payments, each of AUD 250, 000 - upon production increments of 50, 000 ounces from the project up to a maximum of AUD 1 Million v Doray recently announced significant drilling intercepts on the Gnaweeda gold project. Note : (ASX: DRM) June 11 2015 report 33 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

PRESENTATION CONTENT SUMMARY 34 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

Summary TCO is moving ahead on its focus to become a producer with focus on the high grade gold at the US Grant Project and the copper- gold deposits at the Monitor and Big Elk Projects: v Moving from explorer and developer into a production mining company in 2016 with two projects. v Drilling, field samples and underground exploration exhibit high grade mineralisation to confirm the geological model for both the Monitor and to a limited program over the US Grant Mine. v A strong team has developed and are committed to operating efficient mines in underground and open pit environments v Establishing resources and reserves for future mining opportunities. v Focused on new projects for earning accretive cash flow. Thank you 35 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

800 -1199 West Hastings Street Vancouver BC V 6 E 3 T 5 T: 604 -424 8257 F: 604 -357 1139 www: transatlanticminingcorp. com E-mail: info@transatlanticminingcorp. com 36 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

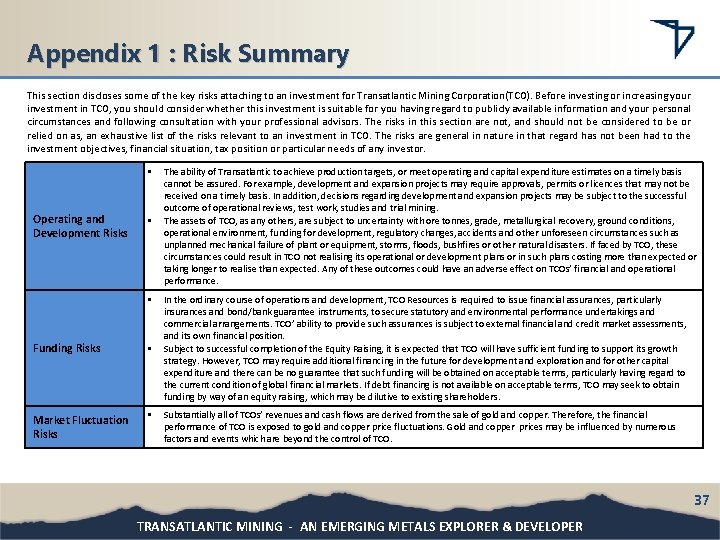

Appendix 1 : Risk Summary This section discloses some of the key risks attaching to an investment for Transatlantic Mining Corporation(TCO). Before investing or increasing your investment in TCO, you should consider whether this investment is suitable for you having regard to publicly available information and your personal circumstances and following consultation with your professional advisors. The risks in this section are not, and should not be considered to be or relied on as, an exhaustive list of the risks relevant to an investment in TCO. The risks are general in nature in that regard has not been had to the investment objectives, financial situation, tax position or particular needs of any investor. • Operating and Development Risks • • Funding Risks • Market Fluctuation Risks • The ability of Transatlantic to achieve production targets, or meet operating and capital expenditure estimates on a timely basis cannot be assured. For example, development and expansion projects may require approvals, permits or licences that may not be received on a timely basis. In addition, decisions regarding development and expansion projects may be subject to the successful outcome of operational reviews, test work, studies and trial mining. The assets of TCO, as any others, are subject to uncertainty with ore tonnes, grade, metallurgical recovery, ground conditions, operational environment, funding for development, regulatory changes, accidents and other unforeseen circumstances such as unplanned mechanical failure of plant or equipment, storms, floods, bushfires or other natural disasters. If faced by TCO, these circumstances could result in TCO not realising its operational or development plans or in such plans costing more than expected or taking longer to realise than expected. Any of these outcomes could have an adverse effect on TCOs’ financial and operational performance. In the ordinary course of operations and development, TCO Resources is required to issue financial assurances, particularly insurances and bond/bank guarantee instruments, to secure statutory and environmental performance undertakings and commercial arrangements. TCO’ ability to provide such assurances is subject to external financial and credit market assessments, and its own financial position. Subject to successful completion of the Equity Raising, it is expected that TCO will have sufficient funding to support its growth strategy. However, TCO may require additional financing in the future for development and exploration and for other capital expenditure and there can be no guarantee that such funding will be obtained on acceptable terms, particularly having regard to the current condition of global financial markets. If debt financing is not available on acceptable terms, TCO may seek to obtain funding by way of an equity raising, which may be dilutive to existing shareholders. Substantially all of TCOs’ revenues and cash flows are derived from the sale of gold and copper. Therefore, the financial performance of TCO is exposed to gold and copper price fluctuations. Gold and copper prices may be influenced by numerous factors and events which are beyond the control of TCO. 37 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

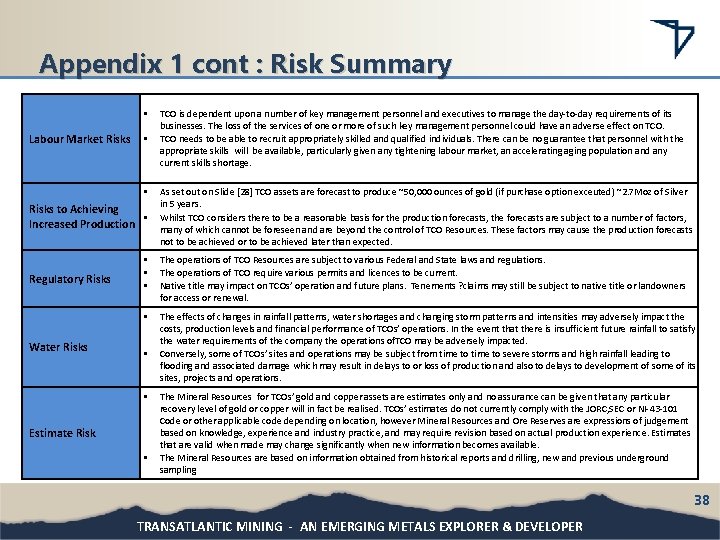

Appendix 1 cont : Risk Summary • Labour Market Risks • • Risks to Achieving • Increased Production Regulatory Risks Water Risks TCO is dependent upon a number of key management personnel and executives to manage the day-to-day requirements of its businesses. The loss of the services of one or more of such key management personnel could have an adverse effect on TCO needs to be able to recruit appropriately skilled and qualified individuals. There can be no guarantee that personnel with the appropriate skills will be available, particularly given any tightening labour market, an accelerating aging population and any current skills shortage. As set out on Slide [28] TCO assets are forecast to produce ~50, 000 ounces of gold (if purchase option exceuted) ~2. 7 Moz of Silver in 5 years. Whilst TCO considers there to be a reasonable basis for the production forecasts, the forecasts are subject to a number of factors, many of which cannot be foreseen and are beyond the control of TCO Resources. These factors may cause the production forecasts not to be achieved or to be achieved later than expected. SUMMARY • • • The operations of TCO Resources are subject to various Federal and State laws and regulations. The operations of TCO require various permits and licences to be current. Native title may impact on TCOs’ operation and future plans. Tenements ? claims may still be subject to native title or landowners for access or renewal. • The effects of changes in rainfall patterns, water shortages and changing storm patterns and intensities may adversely impact the costs, production levels and financial performance of TCOs’ operations. In the event that there is insufficient future rainfall to satisfy the water requirements of the company the operations of. TCO may be adversely impacted. Conversely, some of TCOs’ sites and operations may be subject from time to severe storms and high rainfall leading to flooding and associated damage which may result in delays to or loss of production and also to delays to development of some of its sites, projects and operations. • • Estimate Risk • The Mineral Resources for TCOs’ gold and copper assets are estimates only and no assurance can be given that any particular recovery level of gold or copper will in fact be realised. TCOs’ estimates do not currently comply with the JORC, SEC or NI-43 -101 Code or other applicable code depending on location, however Mineral Resources and Ore Reserves are expressions of judgement based on knowledge, experience and industry practice, and may require revision based on actual production experience. Estimates that are valid when made may change significantly when new information becomes available. The Mineral Resources are based on information obtained from historical reports and drilling, new and previous underground sampling 38 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

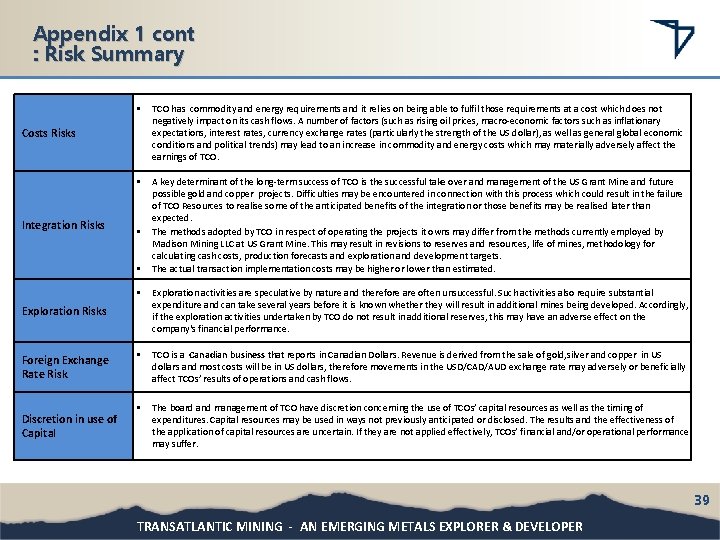

Appendix 1 cont : Risk Summary • TCO has commodity and energy requirements and it relies on being able to fulfil those requirements at a cost which does not negatively impact on its cash flows. A number of factors (such as rising oil prices, macro-economic factors such as inflationary expectations, interest rates, currency exchange rates (particularly the strength of the US dollar), as well as general global economic conditions and political trends) may lead to an increase in commodity and energy costs which may materially adversely affect the earnings of TCO. • A key determinant of the long-term success of TCO is the successful take over and management of the US Grant Mine and future possible gold and copper projects. Difficulties may be encountered in connection with this process which could result in the failure of TCO Resources to realise some of the anticipated benefits of the integration or those benefits may be realised later than expected. The methods adopted by TCO in respect of operating the projects it owns may differ from the methods currently employed by Madison Mining LLC at US Grant Mine. This may result in revisions to reserves and resources, life of mines, methodology for calculating cash costs, production forecasts and exploration and development targets. The actual transaction implementation costs may be higher or lower than estimated. Summary Costs Risks Integration Risks • • • Exploration activities are speculative by nature and therefore are often unsuccessful. Such activities also require substantial expenditure and can take several years before it is known whether they will result in additional mines being developed. Accordingly, if the exploration activities undertaken by TCO do not result in additional reserves, this may have an adverse effect on the company's financial performance. • TCO is a Canadian business that reports in Canadian Dollars. Revenue is derived from the sale of gold, silver and copper in US dollars and most costs will be in US dollars, therefore movements in the USD/CAD/AUD exchange rate may adversely or beneficially affect TCOs’ results of operations and cash flows. • The board and management of TCO have discretion concerning the use of TCOs’ capital resources as well as the timing of expenditures. Capital resources may be used in ways not previously anticipated or disclosed. The results and the effectiveness of the application of capital resources are uncertain. If they are not applied effectively, TCOs’ financial and/or operational performance may suffer. Exploration Risks Foreign Exchange Rate Risk Discretion in use of Capital 39 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

Appendix 2: Foreign Selling Restrictions Australia This document refers to shares that are being offered by TCO in a Private Placement Offering Memorandum (“Offering Memorandum”). The Offering memorandum is available from the issuer and anyone who wants to acquire shares will need to complete the application form that will accompany the Offering Memorandum. Investors should consider the prospectus in deciding whether to acquire shares. Hong Kong WARNING: This document has not been, and will not be, registered as a prospectus under the Companies Ordinance (Cap. 32) of Hong Kong (the "Companies Ordinance"), nor has it been authorised by the Securities and Futures Commission in Hong Kong pursuant to the Securities and Futures Ordinance (Cap. 571) of the Laws of Hong Kong (the "SFO"). No action has been taken in Hong Kong to authorise or register this document or to permit the distribution of this document or any documents issued in connection with it. Accordingly, the shares have not been and will not be offered or sold in Hong Kong by means of any document, other than: to "professional investors" (as defined in the SFO); or in other circumstances that do not result in this document being a "prospectus" (as defined in the Companies Ordinance) or that do not constitute an offer to the public within the meaning of that ordinance. No advertisement, invitation or document relating to the shares has been or will be issued, or has been or will be in the possession of any person for the purpose of issue, in Hong Kong or elsewhere that is directed at, or the contents of which are likely to be accessed or read by, the public of Hong Kong (except if permitted to do so under the securities laws of Hong Kong) other than with respect to shares that are or are intended to be disposed of only to persons outside Hong Kong or only to professional investors (as defined in the SFO and any rules made under that ordinance). No person allotted shares may sell, or offer to sell, such shares in circumstances that amount to an offer to the public in Hong Kong within six months following the date of issue of such shares. The contents of this document have not been reviewed by any Hong Kong regulatory authority. You are advised to exercise caution in relation to the offer. If you are in doubt about any contents of this document, you should obtain independent professional advice. Singapore This document and any other materials relating to the shares have not been, and will not be, lodged or registered as a prospectus in Singapore with the Monetary Authority of Singapore. Accordingly, this document and any other document or materials in connection with the offer or sale, or invitation for subscription or purchase, of shares may not be issued, circulated or distributed, nor may the shares be offered or sold, or be made the subject of an invitation for subscription or purchase, whether directly or indirectly, to persons in Singapore except pursuant to and in accordance with exemptions in Subdivision (4) Division 1, Part XIII of the Securities and Futures Act, Chapter 289 of Singapore (the "SFA"), or as otherwise pursuant to, and in accordance with the conditions of any other applicable provisions of the SFA. This document has been given to you on the basis that you are (i) an "institutional investor" (as defined under the SFA) or (ii) a "relevant person" (as defined under section 275(2) of the SFA). In the event that you are not an investor falling within any of the categories set out above, please return this document immediately. You may not forward or circulate this document to any other person in Singapore. Any offer is not made to you with a view to the shares being subsequently offered for sale to any other party. There are on-sale restrictions in Singapore that may be applicable to investors who acquire shares. As such, investors are advised to acquaint themselves with the SFA provisions relating to on-sale restrictions in Singapore and comply accordingly. 40 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER

Appendix 2 cont: Foreign Selling Restrictions United Kingdom Neither the information in this document nor any other document relating to the offer has been delivered for approval to the Financial Services Authority in the United Kingdom and no prospectus (within the meaning of section 85 of the Financial Services and Markets Act 2000, as amended ("FSMA")) has been published or is intended to be published in respect of the shares. This document is issued on a confidential basis to "qualified investors” (within the meaning of section 86(7) of FSMA). This document should not be distributed, published or reproduced, in whole or in part, nor may its contents be disclosed by recipients to any other person in the United Kingdom. Any invitation or inducement to engage in investment activity (within the meaning of s. 21 FSMA) received in connection with the issue or sale of the shares has only been communicated, and will only be communicated, in the United Kingdom in circumstances in which s. 21(1) FSMA does not apply to the Company. In the United Kingdom, this document is being distributed only to, and is directed at, persons (i) who have professional experience in matters relating to investments falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotions) Order 2005 ("FPO"), (ii) who fall within the categories of persons referred to in Article 49(2)(a) to (d) (high net worth companies, unincorporated associations, etc. ) of the FPO or (iii) to whom it may otherwise be lawfully communicated (together "relevant persons"). The investments to which this document relates are available only to, and any invitation, offer or agreement to purchase will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents. United States This document does not constitute an offer to sell, or a solicitation of an offer to buy, securities in the United States. Any securities described in this document have not been, and will not be, registered under the US Securities Act of 1933 (as amended) and may not be offered or sold in the United States except in transactions exempt from, or not subject to, registration under the US Securities Act and applicable US state securities laws. Other jurisdictions The shares may not be offered or sold in any other jurisdiction except to persons to whom such offer or sale is permitted under applicable law. 41 TRANSATLANTIC MINING - AN EMERGING METALS EXPLORER & DEVELOPER