CLIENT PERCEPTIONS OF CONSULTING STUDY 2019 Independent research

- Slides: 15

CLIENT PERCEPTIONS OF CONSULTING STUDY 2019 Independent research by Viga

Summary of Findings Key Objectives • To understand client perceptions of consulting and what value it creates • To understand how consulting is benefiting the private and public sector • To gather feedback on future needs for external consulting support Survey • The Management Consultancies Association, in conjunction with Market Research Agency, VIGA, polled a total of 250 industry decision makers for consulting services across the UK. Conclusions Respondents were qualified on the basis of their company size, industry, experience, and relative decision-making authority. • The survey was carried out in September 2018. • Consultants are valued most when they deliver transformational support, knowledge transfer, efficiency and support with digital challenges. • 81% of respondents stated consultants had met or exceeded their expectation • The companies most using consulting services are in private health and life sciences firms followed by digital and technology and manufacturing companies.

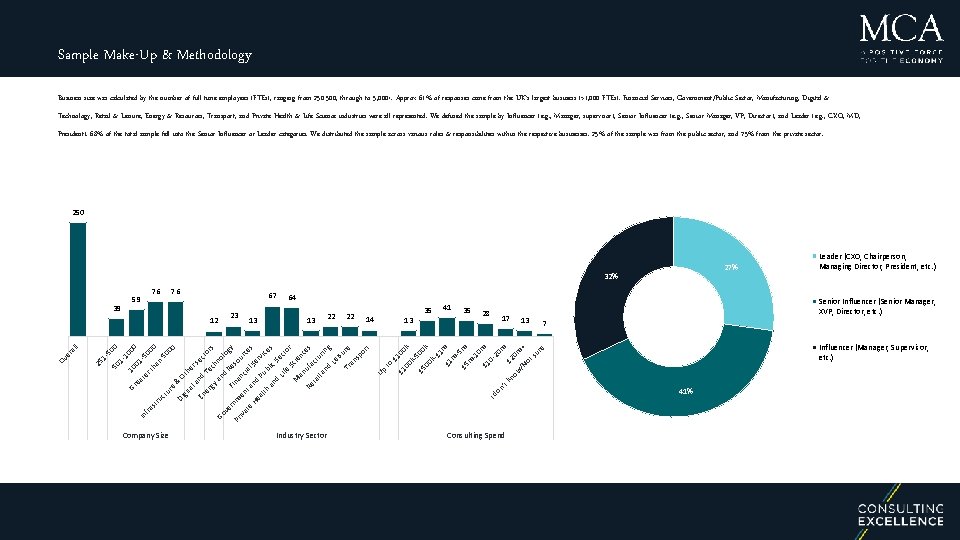

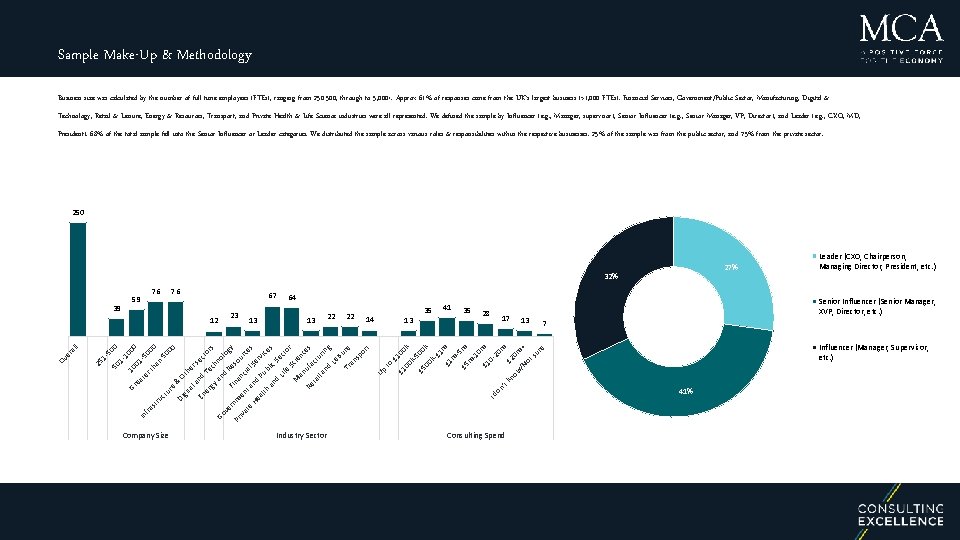

Sample Make-Up & Methodology Business size was calculated by the number of full time employees (FTEs), ranging from 250 -500, through to 5, 000+. Approx 61% of responses came from the UK’s largest business (>1, 000 FTEs). Financial Services, Government/Public Sector, Manufacturing, Digital & Technology, Retail & Leisure, Energy & Resources, Transport, and Private Health & Life Science industries were all represented. We defined the sample by Influencer (e. g. , Manager, supervisor), Senior Influencer (e. g. , Senior Manager, VP, Director), and Leader (e. g. , CXO, MD, President). 68% of the total sample fell into the Senior Influencer or Leader categories. We distributed the sample across various roles & responsibilities within the respective businesses. 25% of the sample was from the public sector, and 75% from the private sector. 250 27% 32% 59 39 76 76 67 14 13 35 41 35 28 17 13 Senior Influencer (Senior Manager, XVP, Director, etc. ) 7 1 0 Gr ea 001 0 t 5 er fra th 000 st an ru ct 50 ur 00 e & Di O git t al her an se En d c Te tor er s gy ch no an Go lo d ve gy Re F r s Pr nm ina nc our iva en ce ia t te He and l Se s r al th Pub vice li s an d c Se Lif ct or e Sc M ie nc an Re ufa es ct ta il a ur nd ing Le isu re Tr an sp or t Up to £ £ 1 100 k 5 0 £ 5 00 0 k k£ 1 m m -5 £ 5 m m -1 0 £ 1 m 0 Id -2 on 0 m ’t kn £ 2 ow 0 /N m+ ot su re 13 22 Influencer (Manager, Supervisor, etc. ) 10 50 13 22 In 1 - 1 - 50 25 Ov er al l 0 12 23 64 Company Size Industry Sector Consulting Spend Leader (CXO, Chairperson, Managing Director, President, etc. ) 41%

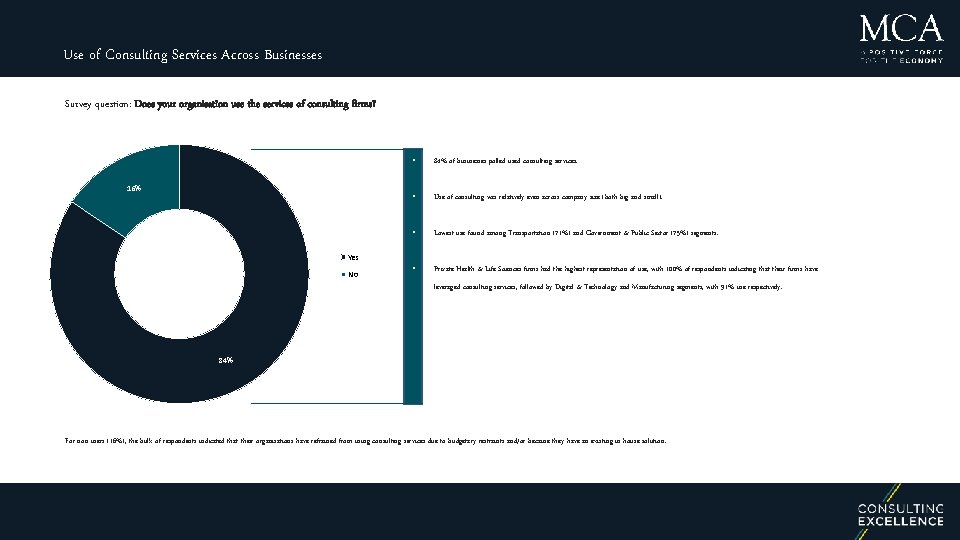

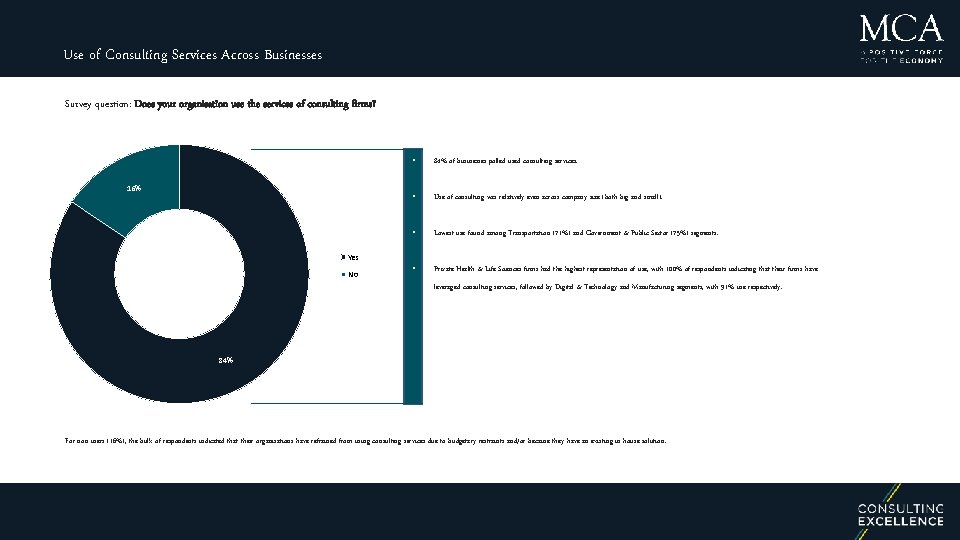

Use of Consulting Services Across Businesses Survey question: Does your organisation use the services of consulting firms? 16% Yes No • 84% of businesses polled used consulting services. • Use of consulting was relatively even across company size (both big and small). • Lowest use found among Transportation (71%) and Government & Public Sector (75%) segments. • Private Health & Life Sciences firms had the highest representation of use, with 100% of respondents indicating that their firms have leveraged consulting services, followed by Digital & Technology and Manufacturing segments, with 91% use respectively. 84% For non-users (16%), the bulk of respondents indicated that their organisations have refrained from using consulting services due to budgetary restraints and/or because they have an existing in-house solution.

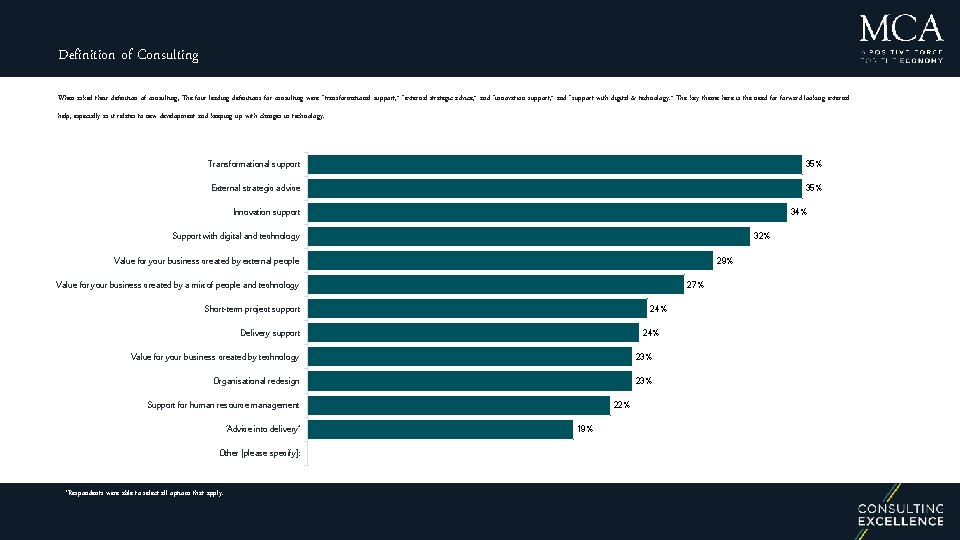

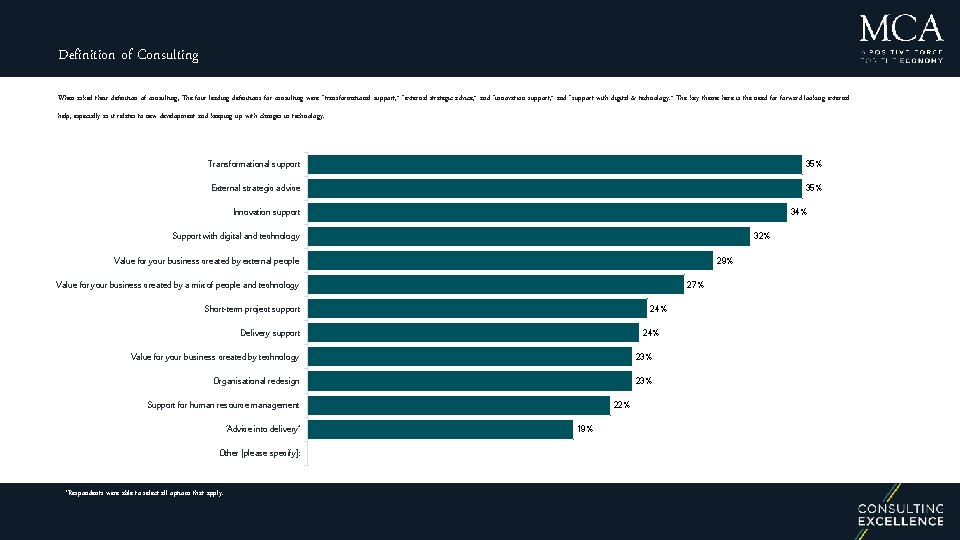

Definition of Consulting When asked their definition of consulting, The four leading definitions for consulting were “transformational support, ” “external strategic advice, ” and “innovation support, ” and “support with digital & technology. ” The key theme here is the need forward-looking external help, especially as it relates to new development and keeping up with changes in technology. Transformational support 35% External strategic advice 35% Innovation support 34% 32% Support with digital and technology Value for your business created by external people 29% Value for your business created by a mix of people and technology 27% Short-term project support 24% Delivery support 24% Value for your business created by technology 23% Organisational redesign 23% Support for human resource management ‘Advice into delivery’ Other [please specify]: *Respondents were able to select all options that apply. 22% 19%

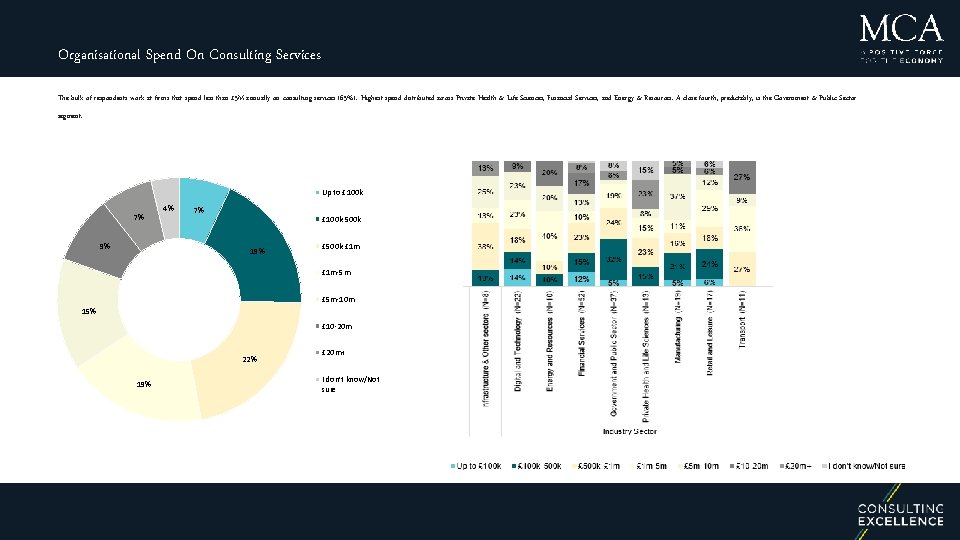

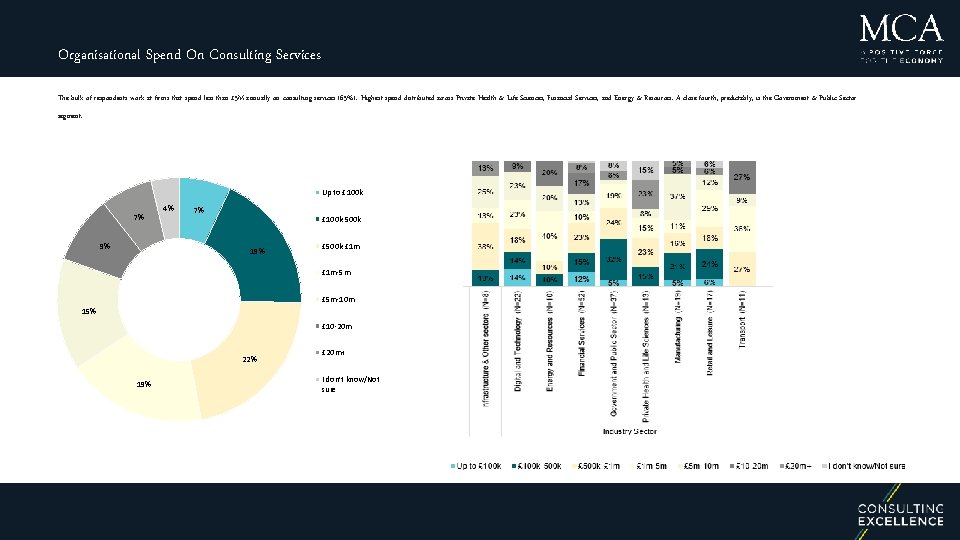

Organisational Spend On Consulting Services The bulk of respondents work at firms that spend less than £ 5 M annually on consulting services (65%). Highest spend distributed across Private Health & Life Sciences, Financial Services, and Energy & Resources. A close fourth, predictably, is the Government & Public Sector segment. Up to £ 100 k 7% 9% 4% 7% £ 100 k-500 k 19% £ 500 k-£ 1 m-5 m £ 5 m-10 m 15% £ 10 -20 m 22% 19% £ 20 m+ I don’t know/Not sure

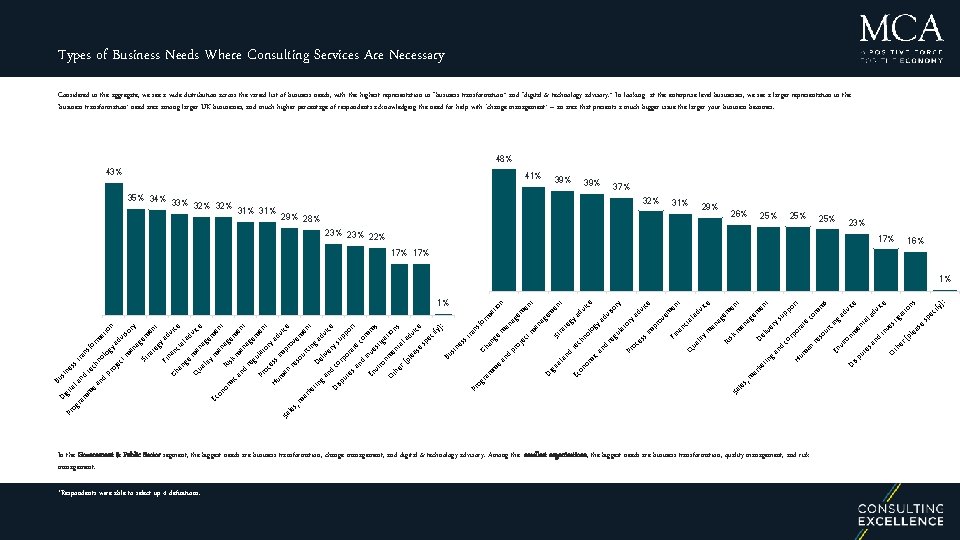

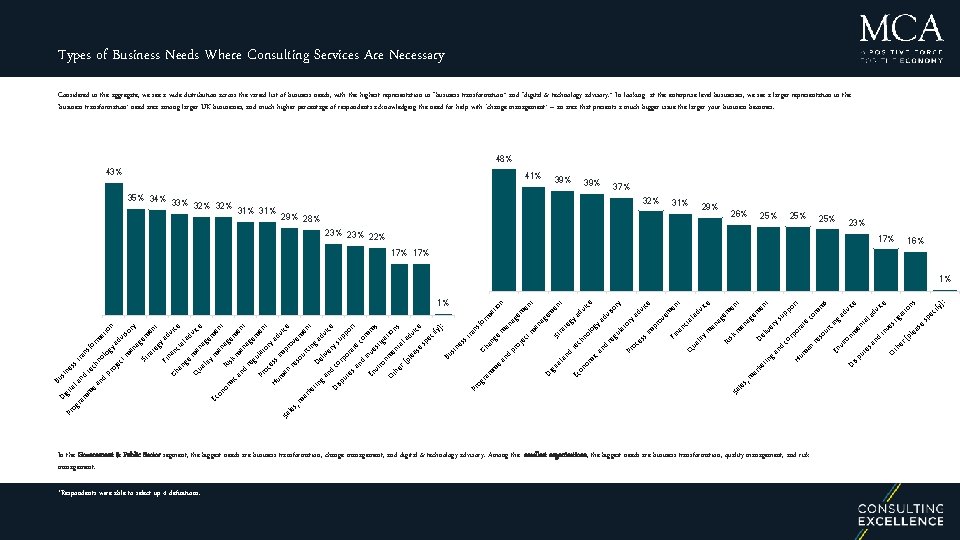

Types of Business Needs Where Consulting Services Are Necessary Considered in the aggregate, we see a wide distribution across the varied list of business needs, with the highest representation in “business transformation” and “digital & technology advisory. ” In looking at the enterprise level businesses, we see a larger representation in the ‘business transformation’ need area among larger UK businesses, and much higher percentage of respondents acknowledging the need for help with ‘change management’ – an area that presents a much bigger issue the larger your business becomes. 48% 43% 41% 35% 34% 33% 32% 39% 37% 32% 31% 29% 28% 31% 29% 26% 25% 23% 22% 25% 23% 17% 16% 17% 1% m e ad gy an d pr oj ec lo no ch te nd la am Pr o gr Di git a Bu sin es st ra n sfo rm at io n vis tm or an y ag e St m ra en te t gy Fin ad v an Ch ice ci an ge al a d Qu man vice ag al ity em Ec m en an on t ag om Ri s e km ic m en an an t d ag re em gu l en Pr at oc or t ya Hu ess d i vic m m an Sa pr e ov le re s, e s m o m ur ar cin ent ke ga tin De dv ga liv ice nd er y Di c s o u sp rp pp ut or or es at t e an co d m i nv En m es vir tig s on at m io Ot en ns he t al r[ ad pl ea vic se e sp ec ify ]: Bu sin es st ra Pr ns og fo C ra rm h an m at m g io e e n m an a d n ag pr em oj ec en tm t an ag em Di git en St al t ra an t eg d ya te Ec ch dv on no ice om lo ic gy an ad d vis re or gu y la to Pr ry oc ad es vic si e m pr ov em en Fin t an c ia Qu la al dv ity ice m an ag em Ri s en km Sa t le a na s, m g em ar De ke en tin liv t er ga ys nd up co po rp rt or Hu a m te an co re m so m s ur cin En g vir ad on vic Di m e sp en ut ta es la an dv d ice in ve Ot st iga he r[ tio pl ns ea se sp ec ify ]: 1% In the Government & Public Sector segment, the biggest needs are business transformation, change management, and digital & technology advisory. Among the smallest organisations, the biggest needs are business transformation, quality management, and risk management. *Respondents were able to select up 4 definitions.

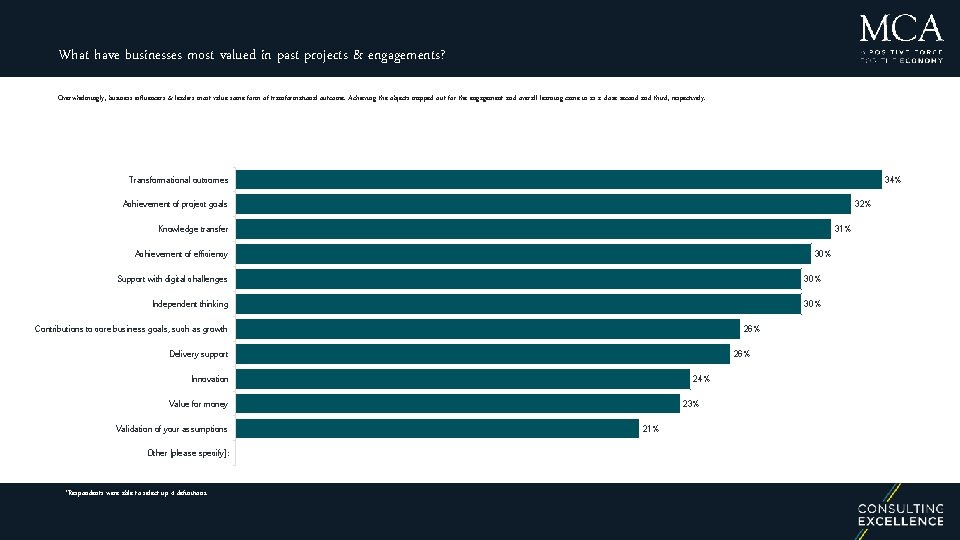

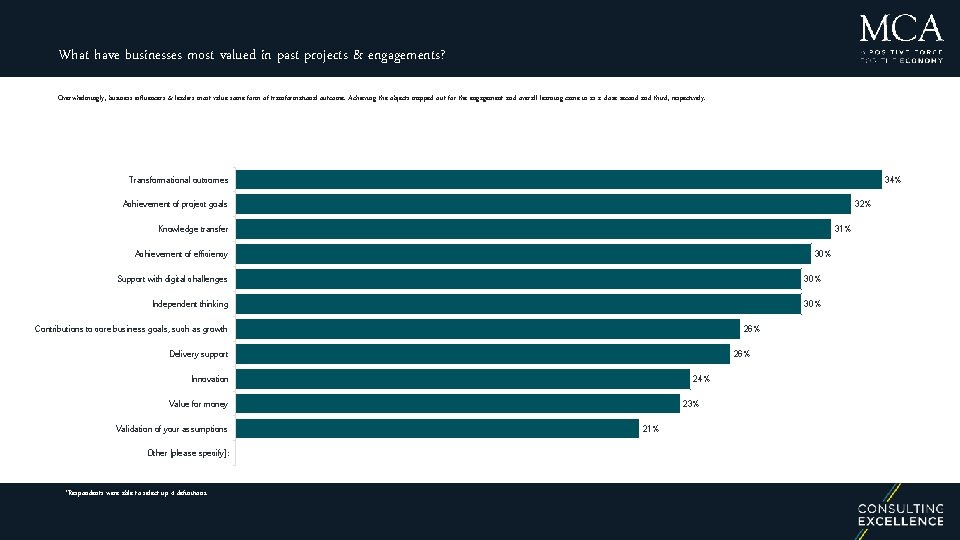

What have businesses most valued in past projects & engagements? Overwhelmingly, business influencers & leaders most value some form of transformational outcome. Achieving the objects mapped out for the engagement and overall learning came in as a close second and third, respectively. 34% Transformational outcomes Achievement of project goals 32% Knowledge transfer 31% Achievement of efficiency 30% Support with digital challenges 30% Independent thinking 30% Contributions to core business goals, such as growth 26% Delivery support 26% Innovation 24% Value for money Validation of your assumptions Other [please specify]: *Respondents were able to select up 4 definitions. 23% 21%

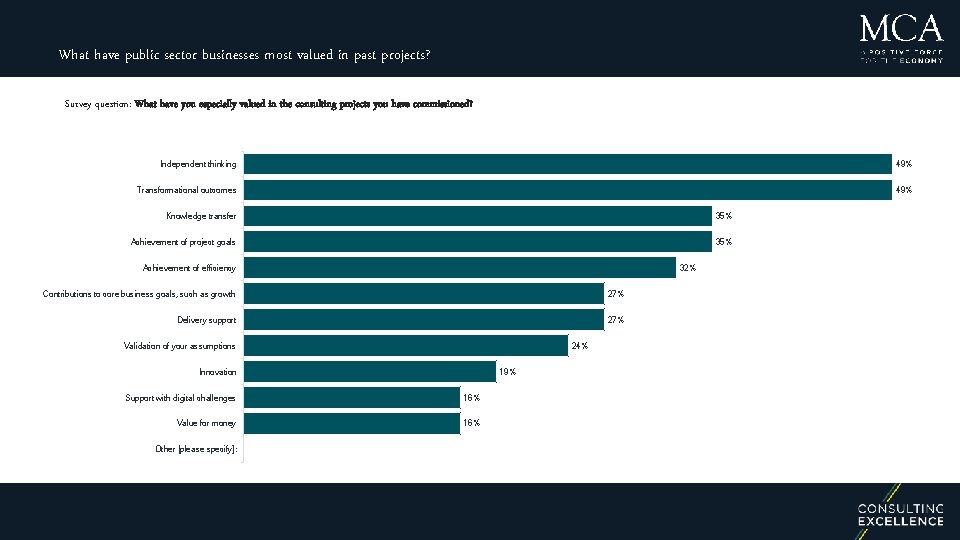

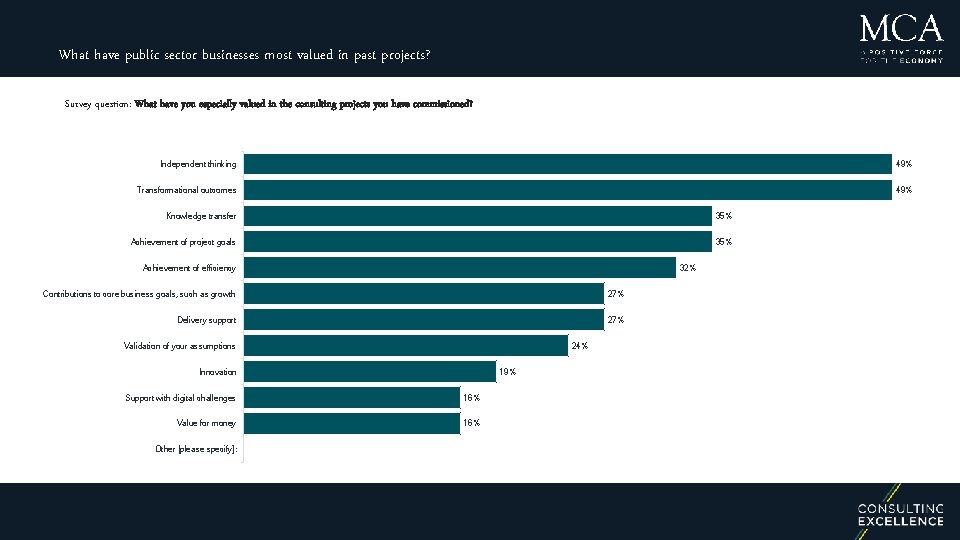

What have public sector businesses most valued in past projects? Survey question: What have you especially valued in the consulting projects you have commissioned? Independent thinking 49% Transformational outcomes 49% Knowledge transfer 35% Achievement of project goals 35% Achievement of efficiency 32% Contributions to core business goals, such as growth 27% Delivery support 27% Validation of your assumptions 24% Innovation 19% Support with digital challenges 16% Value for money 16% Other [please specify]:

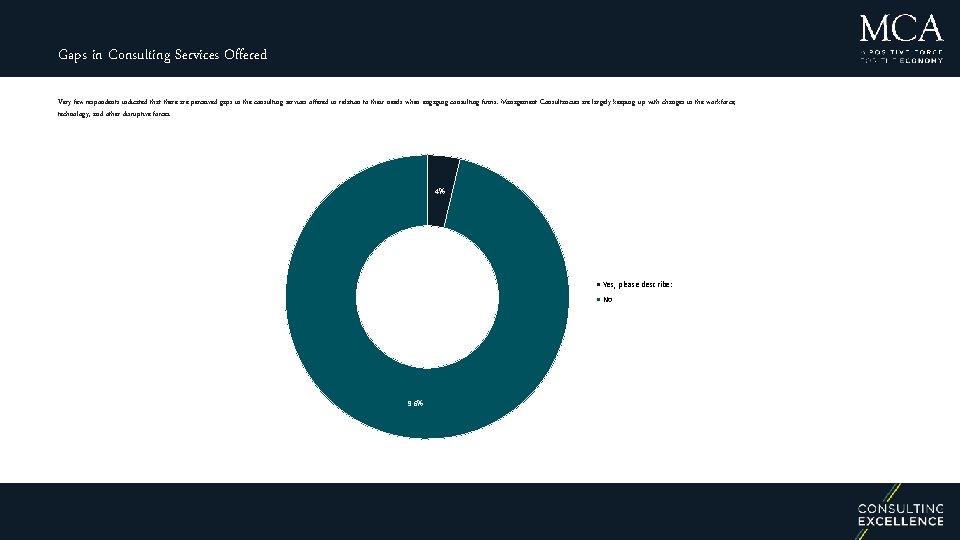

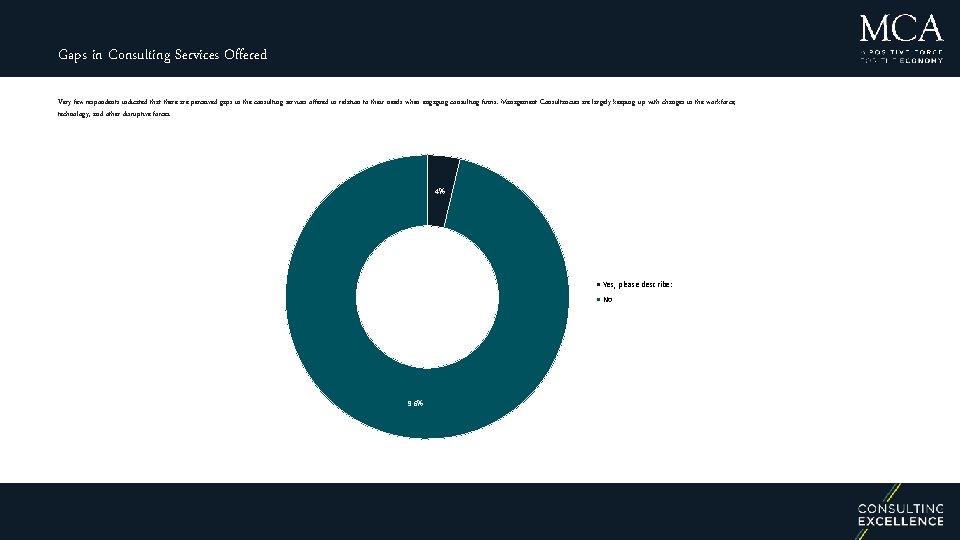

Gaps in Consulting Services Offered Very few respondents indicated that there are perceived gaps in the consulting services offered in relation to their needs when engaging consulting firms. Management Consultancies are largely keeping up with changes in the workforce, technology, and other disruptive forces. 4% Yes, please describe: No 96%

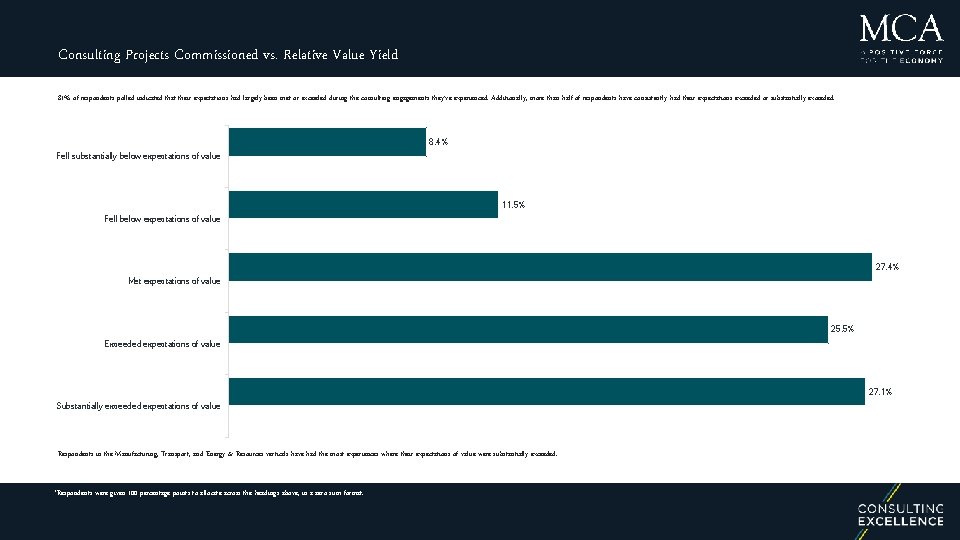

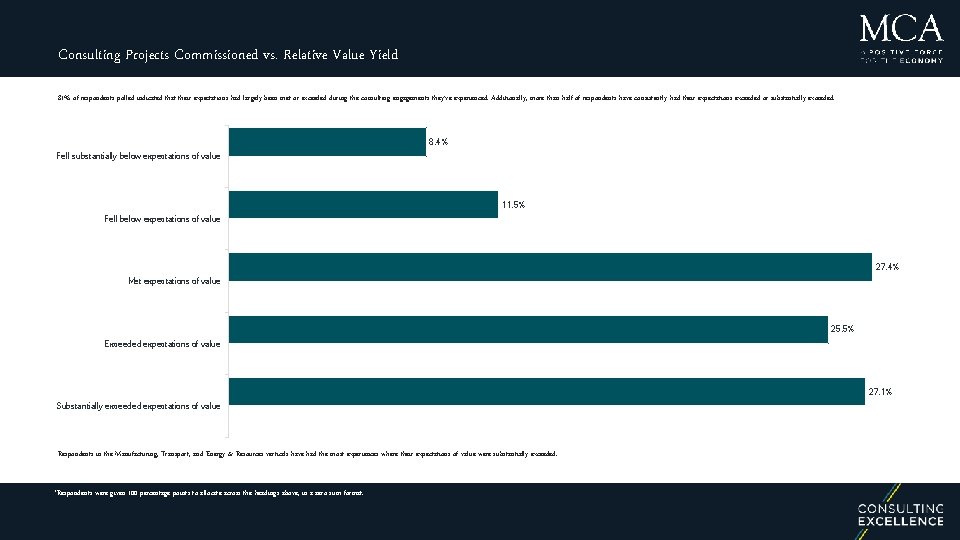

Consulting Projects Commissioned vs. Relative Value Yield 81% of respondents polled indicated that their expectations had largely been met or exceeded during the consulting engagements they’ve experienced. Additionally, more than half of respondents have consistently had their expectations exceeded or substantially exceeded. 8. 4% Fell substantially below expectations of value 11. 5% Fell below expectations of value 27. 4% Met expectations of value 25. 5% Exceeded expectations of value 27. 1% Substantially exceeded expectations of value Respondents in the Manufacturing, Transport, and Energy & Resources verticals have had the most experiences where their expectations of value were substantially exceeded. *Respondents were given 100 percentage points to allocate across the headings above, in a zero-sum format.

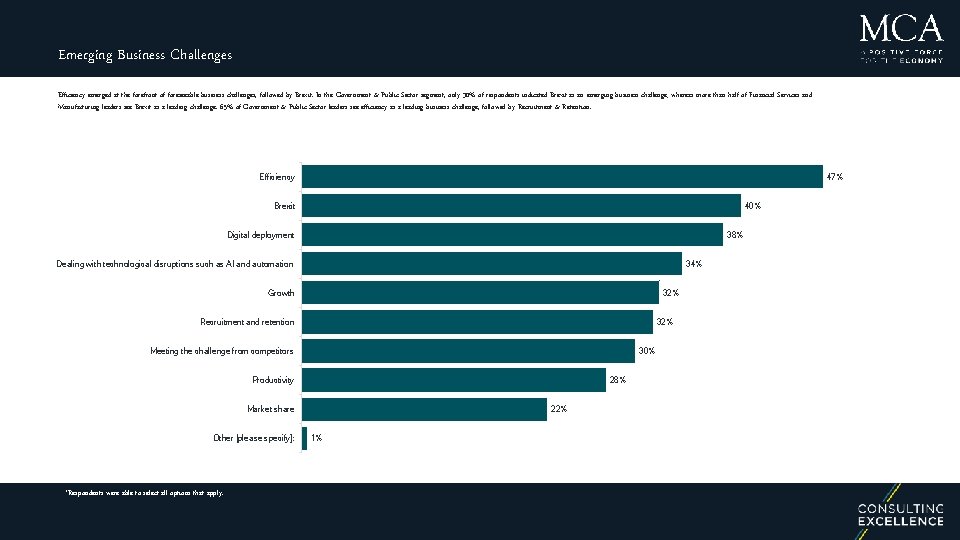

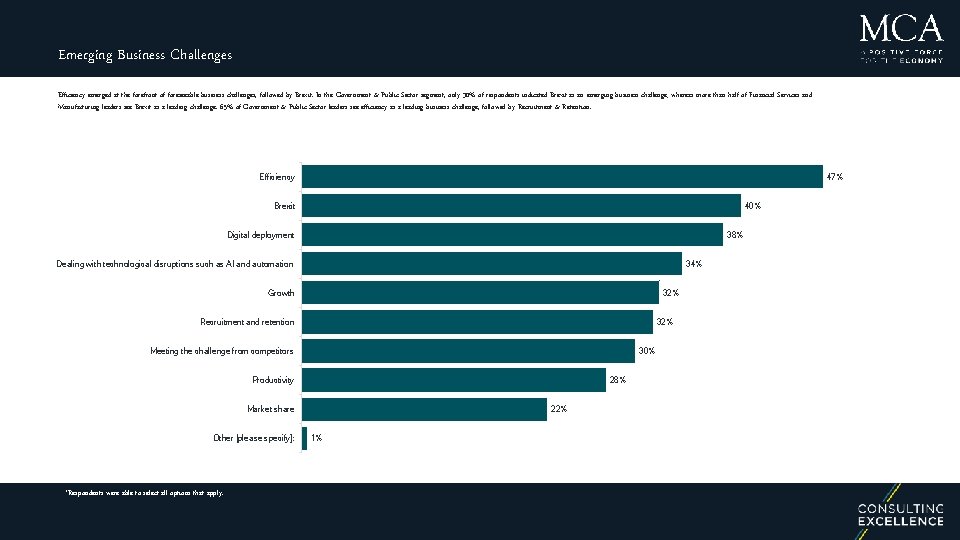

Emerging Business Challenges Efficiency emerged at the forefront of foreseeable business challenges, followed by Brexit. In the Government & Public Sector segment, only 30% of respondents indicated Brexit as an emerging business challenge; whereas more than half of Financial Services and Manufacturing leaders see Brexit as a leading challenge. 65% of Government & Public Sector leaders see efficiency as a leading business challenge, followed by Recruitment & Retention. Efficiency 47% Brexit 40% Digital deployment 38% Dealing with technological disruptions such as AI and automation 34% Growth 32% Recruitment and retention 32% Meeting the challenge from competitors 30% Productivity 28% Market share Other [please specify]: *Respondents were able to select all options that apply. 22% 1%

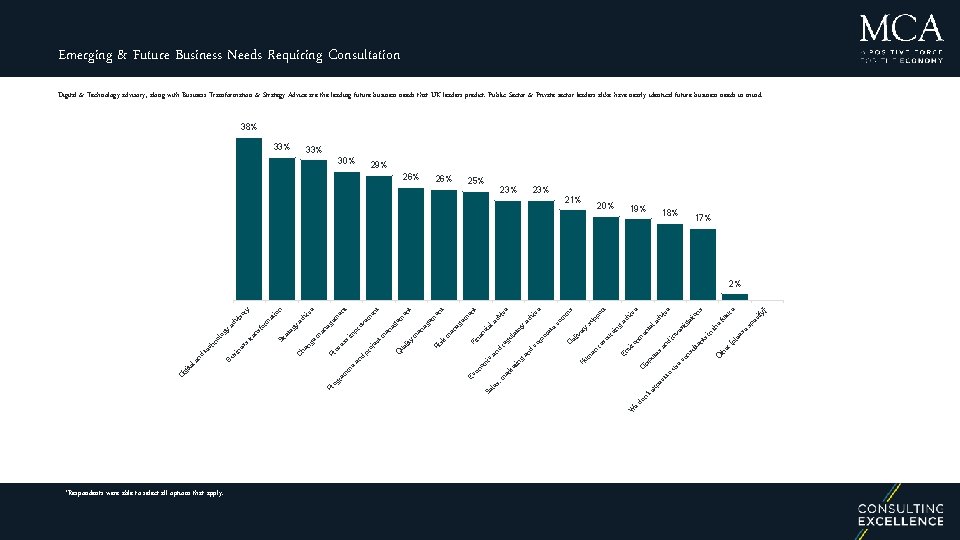

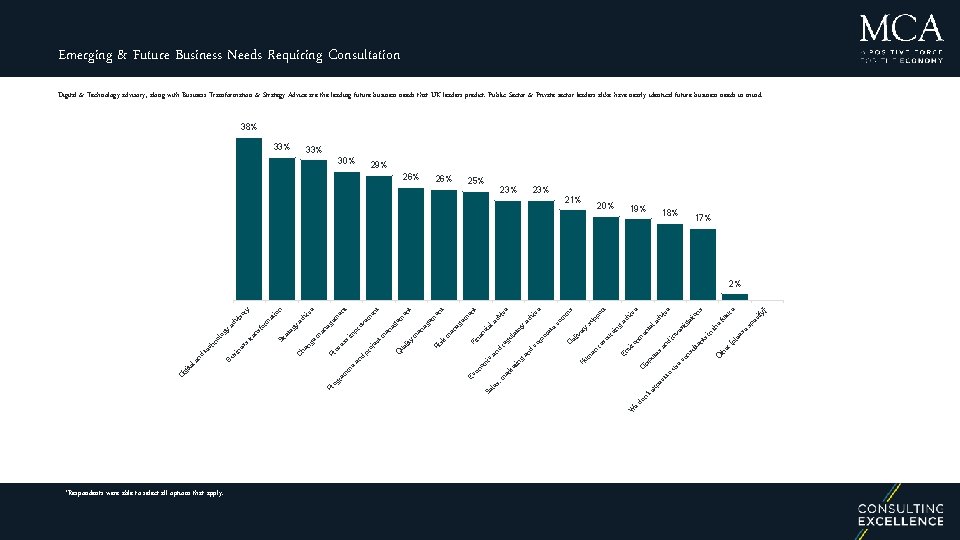

Emerging & Future Business Needs Requiring Consultation Digital & Technology advisory, along with Business Transformation & Strategy Advice are the leading future business needs that UK leaders predict. Public Sector & Private sector leaders alike have nearly identical future business needs in mind. 38% 33% 30% 29% 26% 25% 23% 21% 20% 19% 18% 17% ]: ify sp se ea pl nt s O th er [ ta ul co ns e us to ec t xp te ec tu r e th in ve in s te pu is D do n’ e fu at ig st ta an d ro En vi s, le Sa e ns io ic la dv vi ad nm en ng ci ur so re um an H ke m ar Ec o W *Respondents were able to select all options that apply. e ce rt pp o y er el iv D co an d g tin su co e at rp or la gu re an d m ic no m m s ce to ry la ia na nc Fi an m k ad vi ic dv m ag e em is R an e m m ra og Pr e t en en t t m lit y ua d Q pr an ag ag e tm an ec oj es oc Pr m en en em ov im pr s m ng e ha C t t em en e an ag gy te St ra fo r ns tra es s in Bu s ad v io m at vi ad y og ol hn te c nd D ig ita la ic n so ry 2%

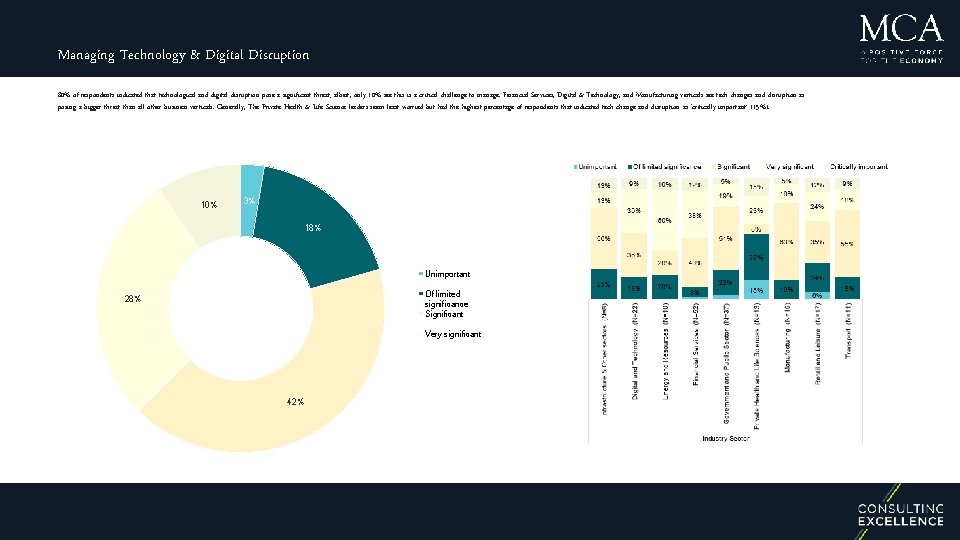

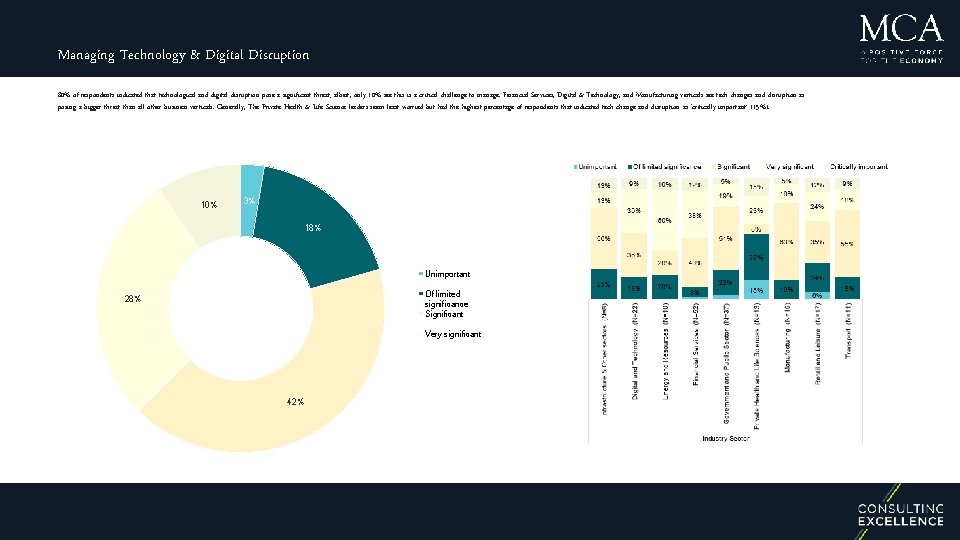

Managing Technology & Digital Disruption 80% of respondents indicated that technological and digital disruption pose a significant threat; albeit, only 10% see this is a critical challenge to manage. Financial Services, Digital & Technology, and Manufacturing verticals see tech changes and disruption as posing a bigger threat than all other business verticals. Generally, The Private Health & Life Science leaders seem least worried but had the highest percentage of respondents that indicated tech change and disruption as ‘critically important’ (15%). 10% 3% 18% Unimportant Of limited significance Significant 28% Very significant 42%

This Report was prepared for the Management Consultancies Association by VIGA is a research & data collection consultancy headquartered in London. With a global audience access of 100 M+ profiled respondents, we connect our clients with B 2 C, B 2 B, Healthcare, and key opinion leading populations around the world. Our clients leverage our proprietary survey tool, audience access hub, and dynamic data resources to solve sophisticated business challenges, conduct commercial & operational due-diligence, and garner insights on markets of interest. Our global team across the US & UK supports top tier management consultancies, leading financial institutions, corporate firms, and market research agencies. VIGA is a proud member of the Next 15 Communications family, a publicly traded holding company based in the UK. To learn more, please contact Steven Scott (steven. scott@VIGA. com). Independent research by Viga